April 1, 2021 – this is the deadline set for tax agents to submit reports for 2021. for income tax: 2-NDFL certificates and 6-NDFL calculations. When accepting reports, tax authorities check compliance not only with internal control ratios, but also with external ones, that is, they compare the indicators of these forms with each other. What control ratios should tax agents apply and what should 2-NDFL and 6-NDFL agree on? Our article will help you find answers to these questions.

Interrelation of indicators in 6-NDFL

The letter of the Federal Tax Service No. BS-4–11/3852 dated March 10, 2016 contains control ratios for checking the correctness of filling out indicators within 6-NDFL and interconnection with external forms: 2-NDFL, income tax declaration and DAM report. The explanations from the Federal Tax Service also indicate exactly what inaccuracies accountants make and how tax inspectors should react to them.

Check inside 6-NDFL

Having finished posting indicators from tax accounting registers to section 1 of form 6-NDFL, check the correspondence of the proportions of your indicators with the ratios from the letter from the Federal Tax Service:

- line 020 is greater than or equal to line 030, that is, the amount of tax benefits can be equal to the amount of accrued income, but cannot exceed. If this ratio is not met, the tax agent is given 5 days to provide an explanation or adjust the reporting;

- page 040 = (page 020 - page 030): 100 x page 010. If the ratio is not maintained, the inspector will perform the same actions as in the first case. Slight differences may occur due to rounding. You can check the permissible error by multiplying the “number” from page 060 by 1 ruble. and for the number of lines 100 from section 2;

- p. 040 is greater than or equal to p. 050. The discrepancy must also be explained.

Control ratios for checking the correctness of filling out section 1 of form 6-NDFL

Let's consider the use of control ratios using a specific example of a report from company X, data taken from the figure above:

- the value of line 020 is greater than line 030 – 498,000 rubles. more than 4200 rub.;

- line 040 = (RUB 498,000 on line 020 – 4,200 on line 030) x 13% on line 010 = 64,194;

- tax withheld from employee income (line 070) minus the value, if any, of the amount of excess tax withheld on line 090, in our example it is equal to 0, personal income tax in the amount of 64,194 rubles. subject to transfer to the budget.

Checking the title page

To begin with, it is recommended to perform such a simple operation as checking that 6-NDFL is filled out correctly on the title page, then we check both parts of the report. The first sheet contains basic information about the company (name with explanation, codes, address, telephone, etc.); information about the inspection where the enterprise is registered. A separate report is generated and submitted for each branch of the enterprise, where the codes of the corresponding enterprise are indicated; a personal report is provided for the parent company. In accordance with the new changes made to the rules for filling out the title page of personal income tax-6, two lines have been allocated specifically for assignees and three codes have been added for the place of submission of the report. For the initial version of the report, the adjustment code is indicated as 000, and for adjustments - from 1 and successively further, for example, 003. Some employers mistakenly assign code 001 to the initial report.

Reconciliation of data from reports 2-NDFL and 6-NDFL

At the end of the year, companies are required to prepare a 2-NDFL certificate for each employee with attribute 1, which means how much income the person received, how much tax was withheld from him and whether it was fully transferred to the state budget.

In 6-NDFL, section 1 summarizes the data for the organization as a whole for the entire reporting period. It follows from this that it is possible to compare the amounts of income, withheld and transferred taxes only at the end of the year.

Let us turn again to letter No. BS-4–11/ [email protected] , in which the Federal Tax Service establishes what ratios in the indicators of the two forms must be maintained. All indicators in section 1 of form 6-NDFL for all lines must coincide with the sum of the same indicators in certificates 2-NDFL at the same tax rate.

All relationships between 2-personal income tax and 6-personal income tax can be clearly checked using the indicators given below.

Table: scheme of control relationships between 2-NDFL and 6-NDFL

| Compliance of indicators | 6-NDFL | 2-NDFL |

| By income amount | page 020 (section 1) | page “Total amount of income” (section 5) |

| By dividend amounts | page 025 (section 1) | gr. “Income amount” with code 1010 (section 3) |

| Based on calculated tax amounts | page 040 (section 1) | page “Tax amount calculated” (section 5) |

| By number of individuals | page 060 (section 1) | number of 2-NDFL certificates |

Reporting Differences

The forms for submitting a report on the income of individuals working in an organization or a private entrepreneur and reports on the income of citizens have a number of fundamental differences:

- the frequency of filing a new 6-NDFL document is quarterly, and 2-NDFL forms are submitted once a year;

- the new form reflects summary indicators for the organization, and in the usual 2-NDFL information is submitted individually for each specific employee separately.

The title page

of Tax legislation explains the features of each of the reports and the nuances of possible discrepancies, harmonizing the rules for filling out and calculating several regulations. For example, a separate letter from the fiscal authority, issued in 2021, establishes where 2-personal income tax and 6-personal income tax should converge and indicates the ratios that make it possible to check the indicators for tax deductions of two types of statements.

Monitoring indicators 6-NDFL and Appendix 2 to the DNP

The Federal Tax Service's letter also regulates the compliance of indicators 6-NDFL and Appendix 2 to the income tax return (DNP):

- p. 020 6-personal income tax at the same rate must correspond to the amount of p. 020 appendix 2 to the personal income tax with the same rate;

- p. 025 6-NDFL is equal to the amount of income under the same code in Appendix 2 of the DNP;

- tax amounts at the same rate on line 040 in 6-NDFL = amount on line 030 of Appendix 2 to the DNP;

- the indicators for the amount of unwithheld tax should be equal: page 080 of form 6-NDFL and page 034 of appendix 2 to the DNP;

- The number of individuals according to page 060 6-NDFL must also coincide with the number of attachments 2 (for each person who received income in the form of dividends, a separate application sheet is filled out).

Companies dealing with securities and paying dividends are required to fill out Appendix 2 to the DNP for the reporting year.

Reporting when calculating dividends

Important information about deadlines and filling rules

IMPORTANT!

In 2021, the deadlines for submitting annual income tax reports have been changed: submit information by 03/02/2020.

The forms should indicate all types of income accrued in favor of individuals under employment and civil law contracts. Also reflect income from fixed-term and seasonal contracts.

Step-by-step instructions for compiling 6-NDFL for 2021 are disclosed in a separate article “How to fill out the updated Form 6 NDFL. Complete Guide."

Rules for preparing annual reports on personal income tax are in a separate material “Certificate 2-NDFL: form, codes and due date.”

The completed form 2-NDFL should be submitted to the Federal Tax Service no later than March 1 of the year following the reporting year. In 2021 this is a day off, report by 03/02/2020.

Quarterly report 6-NDFL - until the 30th day of the first month following the reporting quarter. It should be taken into account that if the deadline for provision falls on a weekend or a non-working holiday, then the deadline is transferred to the first working day (Article 6.1 of the Tax Code of the Russian Federation). Submit your year-end calculations by 03/02/2020.

What indicators should be compared in 6-NDFL and RSV?

On March 13, 2021, the Federal Tax Service published letter No. BS-4–11/4371 with requirements for the relationship between DAM reports (calculation of insurance premiums) and 6-NDFL.

DAM is reporting to the Pension Fund of the Russian Federation, which represents a calculation of accrued and paid insurance premiums from the earnings of company employees and workers under civil contracts for compulsory insurance (pension and medical).

It is known that starting from 2021, the Federal Tax Service has been entrusted with the responsibility of administering insurance premiums. To interconnect the indicators of the DAM report and 6-NDFL, the tax inspectorate has developed two positions:

- whoever submits 6-NDFL is required to report according to the RSV;

- income for the company without dividends, that is, the difference between accrued income (line 020) and accrued dividends (line 025) of Form 6-NDFL must be greater than or equal to the amount entered in page 030 of subsection 1.1 of section 1 of the RSV.

Control relationships between 6-NDFL and DAM: line 030 from the DAM should be equal to line 020 in 6-NDFL

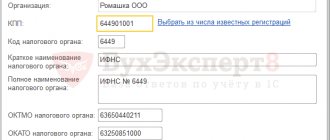

The control ratio between the DAM and 6-NDFL reports for the 1st quarter of 2017 for Romashka LLC must be observed: line 020 in 6-NDFL, equal to 41,574 rubles, must coincide with the indicator on line 030 of subsection 1.1 of section 1 of the DAM report - RUR 41,573 53 kopecks (subject to rounding).

We must remember that discrepancies between the amounts entered into 6-NDFL and the amounts in the DAM do not always indicate an error. For example, payments under civil contracts are always subject to income tax and insurance premiums are not always charged on them. Therefore, it is necessary to carefully analyze each situation.

Letters of explanation from the Federal Tax Service help accountants correctly prepare reports and predict the actions of tax inspectors. Undoubtedly, you can find services on the Internet that help you check the ratios of reporting indicators in electronic form, but you should learn how to carry out such checks yourself. If, before sending forms 6-NDFL and RSV, you check the compliance of the data using the above algorithm, there will be no complaints from the tax authorities.

- Author: ozakone

Rate this article:

- 5

- 4

- 3

- 2

- 1

(3 votes, average: 5 out of 5)

Share with your friends!

Fines

The deadlines for submitting the 6-NDFL report are established by law, and it is not recommended to violate them, otherwise, penalties will be imposed on the company. For failure to submit reports, in addition to a fine of 1,000 rubles for each month of delay, the organization faces the possibility that the company's current account will be completely blocked and unblocked only after the report is submitted. It seems possible to avoid penalties if the organization independently corrects errors and submits clarifications before the inspector identifies the inaccuracies. For submitting a report containing errors, the organization will be fined, and the tax office will require clarification.

Checking the first section

The first section should indicate the totals for all previous tax periods for all individuals to whom the company paid money. If an enterprise paid income taxed at different rates for the past reporting period, it will be required to provide the completed first part of the report for each rate on a separate sheet. If personal income tax was calculated at the rates: 13, 15, 30, 35%, then in lines 10 to 50 the manager or accountant of the enterprise enters information in each section number 1, and lines from 60 to 90 - only on page 1 of this first section. If all payments were made based on the tax rate, for example, 13%, then the organization draws up one first section, filling out all lines from 10 to 90.

Difference in meanings by shape

When preparing reports for the fiscal authority 2-NDFL and 6-NDFL, what is the difference between the information specified in the two documents will allow you to correctly fill out the required declarations. The issue of discrepancy lies in the different meaning of total deductions for income reflected in the reporting documents for personal income tax due to the fact that part of the deductions from the payroll fund in one report is reflected in the reporting year, and in another tax report the amount flows into the new reporting period.

You should understand how 6-NDFL differs from 2-NDFL based on tax calculations for December in order to make the correct calculations:

- Personal income tax for December is not included in the annual report for 6-NDFL;

- 2-NDFL will reflect the amount of tax withheld and transferred, regardless of the fact that the required amount was withheld a month later.

Otherwise, the accountant is recommended to adhere to those published in March 2021. separate explanatory letters from the Tax Service regarding the relationships to monitor the correctness of the information entered in the declaration with a comparison of line-by-line values.

Checking the second section

The design of the second section is more difficult than the first

It is very important not to make mistakes with dates and amounts. The second section consists of identical blocks for placing information on dates and amounts with lines from 100 to 140. To reliably fill out the second section, you must indicate the dates correctly. To accurately enter information, you need to prepare documentation, from which you can highlight:

- Date of actual receipt of income. This date is not the date when money is issued to an individual. This refers to the date of accrual of income (for salary, for example, this is the last day of the month).

- The date of personal income tax withholding from this income. This is the number of tax withholding from income, and not the number of the payment order for the transfer of tax.

- The last day of the period when the organization was obliged to transfer the personal income tax withheld from this income to the budget.

If these three numbers are the same, then the accountant groups the information and indicates it in one block of lines from 100 to 140. If the dates differ, the blocks are filled out individually for each date, and the number of blocks corresponds to the number of date options.