Starting from 2021, KUDiR (Income and Expense Accounting Books) must be used. This type of reporting is not required for all forms of taxation.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

KUDiR is used for each reporting period and has a number of features when filling out that all persons with a simplified tax system need to know.

What it is

The book of income and expenses (KUDiR) is used for accounting. In fact, it is a form on which all amounts and contributions are entered. A new book must be opened for each reporting period, which includes the current year from 01/01 to 31/12.

If taxation systems are combined, for example, a combination of simplified taxation system and patent is used, then each option has its own book. This point must be taken into account, since in the absence of a book for at least one of the taxation options it will lead to fines that range from 10,000 rubles.

This clause does not depend on who is engaged in entrepreneurial activity - an individual entrepreneur or an organization.

The book does not need to be certified by the tax authority. In this case, each section must be correctly formatted. Each column must contain valid and up-to-date data, since the books are checked, like other reports, by the tax authorities.

The integrity of the book should not be compromised. For this purpose, blank sections are also printed and stapled. Any book must be submitted in its entirety for inspection at the request of the tax authorities and their employees.

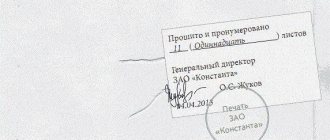

KUDiR is carried out in two versions. The first is electronic. It is worth considering that it must be printed in the second version - paper. This occurs at the end of the reporting period. Then the book is completely bound and the pages are numbered.

After all operations, the paper version is certified personally by the entrepreneur or the management of the organization. It is worth noting that all pages that have been certified must be present. Otherwise, the tax authority can conduct a full audit of all reports.

Conclusions and forms for downloading

So, let’s summarize all the changes in the book of income and expenses (KUDiR) from 2021 in the table:

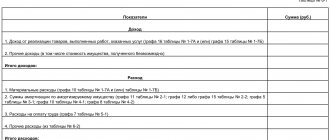

| Change | A comment |

| New section for trade fee | If you are using a simplified approach with the “income” object, then the trade fee by which you are reducing the tax will need to be indicated in a separate section V. |

| There is no need to certify the book | The book will not have to be stamped by those companies and entrepreneurs who have refused the stamp. This rule was clearly written down for the book. |

| There is no need to show excess profit | In Column 4 “Income” of Section I there will be no need to indicate the profits of controlled foreign companies. This is clearly stated in the order of completion. |

| Individual entrepreneurs can reflect insurance premiums | Individual entrepreneurs using the simplified tax system will be able to easily list in the book all their deductions for compulsory insurance: both from the minimum wage and 1 percent of income above the specified level. |

As a result, the book of accounting for income and expenses, used since 2021, consists of a title page and five sections:

- Section I “Income and Expenses”;

- Section II “Calculation of expenses for the acquisition (construction, production) of fixed assets and for the acquisition (creation by the taxpayer himself) of intangible assets taken into account when calculating the tax base for the tax for the reporting (tax) period”;

- Section III “Calculation of the amount of loss that reduces the tax base for the tax paid in connection with the application of the simplified taxation system for the tax period”;

- Section IV “Expenses provided for in paragraph 3.1 of Article 346.21 of the Tax Code of the Russian Federation, reducing the amount of tax paid in connection with the application of the simplified taxation system (advance tax payments) for the reporting (tax) period”;

- Section V “The amount of the trade fee that reduces the amount of tax paid in connection with the application of the simplified taxation system (advance tax payments) calculated for the object of taxation from the type of business activity in respect of which the trade fee is established for the 20__ reporting (tax) period” .

Next, you can download new book forms in various formats:

;

;

.

Who should lead

Almost all entrepreneurs are required to keep a book to record income and expenses. Exceptions are individual entrepreneurs who use UTII. If an entrepreneur combines this tax regime with others, then he is obliged to use and maintain KUDiR.

At the same time, it is mandatory to separate the maintenance of the UTII book from the other taxation system, which ensures separate accounting of assets and all transactions.

If during the course of the company’s activities the entrepreneur decides to use a different regime, then maintaining KUDiR is mandatory.

When maintained by an accountant, the book refers to tax documents, not reporting. In this case, organizations must still maintain and correctly fill out such documents.

The book of income and expenses of the simplified tax system in soft cover can be laminated.

Columns for filling out the Book of accounting of income and expenses of organizations and individual entrepreneurs using the simplified taxation system :

I. Income and expenses 1. Item No. 2. Date and number of the primary document, payment order details 3. Contents of the transaction 4. Amount—income taken into account when calculating the tax base—expenses taken into account when calculating the tax base

II.Calculation of expenses for the acquisition of fixed assets. accepted when calculating the tax base for the single tax for …………20.. (reporting (tax) period 1. Item No. 2. Name of the item of fixed assets or intangible assets 3. Date of payment for the item of fixed assets or intangible assets 4 .Date of submission of documents for state registration of fixed assets 5. Date of commissioning (acceptance for accounting of fixed assets or intangible assets 6. Initial cost of fixed assets or intangible assets (rub.) 7. Useful life of the fixed asset or intangible assets (number of years) 8. Residual value of the fixed asset or intangible asset 9. Number of quarters of operation of the paid fixed asset or intangible asset in the tax period 10. Proportion of the cost of the fixed asset or intangible asset accepted as expenses for the tax period (%) 11. The share of the cost of an item of fixed assets or intangible assets accepted as expenses for each quarter of the tax period (%) (gr. 10/gr.9) 12.13.The amount of expenses taken into account when calculating the tax base (rubles), including - for each quarter of the tax period (gr. 6 or gr. 8x gr. 11/100) - for the tax period (gr. .12х gr.9) 14.Included in expenses for previous tax periods of application of the simplified tax system (RUB) (Gr.13 Calculations for previous tax periods) 15.The remaining part of the expenses is subject to write-off in subsequent reporting (tax) periods (RUB) ( gr.8-gr.13-gr.14) 16.Date of disposal (sale) of fixed assets or intangible assets

Form and where excel is free

Since 2021, a new form of KUDiR was introduced and approved by Order of the Ministry of Finance No. 135. In particular:

- a new section (No. 5) on the trade tax was introduced, which makes it possible to reduce the tax under the simplified tax system.

- bookkeeping will be simplified for entrepreneurs who do not use hired labor in their activities;

- Only the income of the individual entrepreneur himself is reflected, excluding foreign controlling organizations.

In addition, in 2021, individual entrepreneurs who do not use seals and stamps in their activities may not certify KUDir.

Excel books of income and expenses under the simplified tax system in 2021 can be found here.

If necessary, the form is available on any government portal or legal specialized website.

It is worth considering that the form must refer to the current year, as several amendments have been made. Our website contains a form that is current for 2021.

Book of accounting of income and expenses under the simplified tax system: principles of income reflection

According to Art. 346.24 of the Tax Code of the Russian Federation, the book of income and expenses is intended only for accounting for transactions under the simplified regime. From this it follows that to reflect transactions related to the receipt of funds or property, which, in accordance with Art. 346.15 of the Tax Code of the Russian Federation is not income for tax purposes under the simplified tax system; it is not required to record income and expenses in the book.

Example

The Sisyphus organization applies the simplified tax system with the object “income minus expenses”. In the 1st quarter, the organization had income in the form of revenue from the sale of goods, as well as expenses in the form of payment for the rent of occupied premises and the purchase of goods. In addition, a loan was received from the bank to replenish working capital.

The income generated as a result of the receipt of revenue, as well as expenses, should be reflected in the book of income and expenses on the dates corresponding to the transactions.

The loan amount does not need to be entered into the book, since according to subparagraph. 10 p. 1 art. 251, sub. 1 clause 1.1 art. 346.15 of the Tax Code of the Russian Federation, credit funds do not form an object of taxation.

How to fill out the simplified tax system and its sample

Filling out the book should be carried out taking into account the general rules:

- All entries are made only in Russian with strict regard to chronological sequence and dates;

- information on income and expenses is entered in rubles. The use of other currencies is prohibited;

- The book contains only data on transactions that influenced the final calculation of the tax base and the final amount of tax required to be paid;

- making corrections to the KUDiR is possible only with supporting documents. These include invoices, acts or sales receipts. Any corrections must be certified by the signature of the individual entrepreneur with the date when the changes were made.

The book is filled in sections. Unaffected sections should still be present even if they are empty.

Standard sample:

All other forms will be filled out in the same way, taking into account the requirements for each section. The first sheets should contain basic information about the activities of the entrepreneur or company.

Income

With income, all receipts to accounts, as well as all transactions, are calculated. Most often, next to income there should also be calculations of expenses from each operation, including tax deductions.

Example:

Also, each type of income is divided into sections and fully described.

Example:

Expenses

Expenses include not only the actual expenses of the activity, but also all aspects associated with reducing the tax rate.

Example of filling out trading fees:

An example of calculating regular expense items:

Book of income and expenses: form for combining two modes

Some taxpayers combine two regimes: simplified tax system and UTII. In this case, the book of income and expenses according to the simplified tax system should not contain either income corresponding to UTII or expenses for it.

This is confirmed by the letter of the Ministry of Finance of Russia dated October 29, 2004 No. 03-06-05-04/40. The authors of the letter are based on the provisions of paragraph 8 of Art. 346.18 Tax Code of the Russian Federation. Since no changes were made to this paragraph, the conclusions expressed in the letter remain relevant to this day.

In addition to accounting for income and expense transactions, the book calculates the tax base and determines the amount of losses from previous periods that reduce it (Article 346.24 of the Tax Code of the Russian Federation, clauses 2.6–2.11, 4.2-4.7 of the Procedure).

But the tax payable in the book of income and expenses is not calculated - that’s what the tax return is for.

Electronic

The electronic tracking option is used very often. If the book is kept in electronic form, then at the end of the period it should be:

- printed;

- sewn, numbered indicating the number of pages on the last sheet;

- certified by the signature of the manager and the seal of the enterprise, if any.

At the end of the reporting period, the electronic type of book is converted to paper version and sent for storage.

It is worth considering that filling out the electronic version must also be complete and correct, since otherwise a fine and a tax audit are possible.

Do I need to take it?

At the moment, the law does not oblige individual entrepreneurs to submit their accounting books for inspection. This obligation was abolished in 2013, greatly simplifying the reporting system.

In addition, at this stage, entrepreneurs are exempted not only from the need to submit, but also to register information on expenses and income, but this does not exempt them from mandatory reporting in accordance with the chosen taxation system.

When conducting an unscheduled inspection by regulatory authorities, KUDiR must be provided upon request to verify the correctness of data entry and calculations. If there is no accounting book, the entrepreneur will be fined in the amount of 2 thousand rubles.

How to stitch a book

If the reports are stored on separate sheets, then submitting them for inspection by regulatory authorities in this form is prohibited. The sheets must be sewn together. There are no specific rules for stitching sheets.

To knit A4 sheets, it is enough to make 4 holes from the end of the sheet. This procedure can be carried out using a regular awl, and then expanded using a needle file.

It is better to carry out the firmware itself using nylon thread. For greater reliability, the thread must pass through each hole at least 5 times. After which the thread is secured using a regular knot.

It is worth considering that when stitching a large number of sheets, an awl cannot always help. In such situations, it is worth using a drill with a fine nozzle.

Nuances for individual entrepreneurs

For individual entrepreneurs, the main nuance is that the book is required. It is also worth considering that the individual entrepreneur must conduct it independently and fulfill all the requirements.

The book itself reflects all transactions including categories of income and expenses. Any error or inaccuracy may lead to fines or full tax audits.

If there are any transactions that were not reflected in the book, sanctions will be applied to the entrepreneur. This will happen even if the operation has a zero balance, that is, expenses and income together tend to zero.

Keeping a book of accounts is the responsibility of every entrepreneur using the simplified taxation system. Also, KUDiR is used for any tax system, with the exception of UTII.

The book must be filled out correctly, since it is a regulatory accounting document. It is required to use special forms that are filled out according to a standard form. They can be downloaded on our website.

Income book with simplified tax system 6%

If the taxpayer, preferring to work on the simplified tax system, chose the object “income”, the list of transactions should indicate:

- payments that are permitted by clause 3.1 of Art. 346.21 of the Tax Code of the Russian Federation to reduce the amount of tax (clauses 5.1-5.7 of the Procedure);

- expenses in the form of subsidies as part of state support for small and medium-sized businesses;

- expenses in the form of payments to stimulate the employment of unemployed citizens (column 5 of section I, paragraphs 3–6 of clause 2.5 of the Procedure).

According to para. 7 clause 2.5 of the Procedure, taxpayers with the object “income” can enter other expenses into the book of income and expenses on their own initiative. If they are absent, you are allowed not to fill out the certificate for Section. I, sec. II, sec. III, as well as column 5 of section. I (paragraph 2, clause 2.5, clauses 2.6, 3.1, 4.1 of the Procedure).

K+ experts have prepared a sample for filling out an organization’s book of income and expenses on the simplified tax system with the object “income” for 2021. Get free trial access to the ConsultantPlus system and proceed to the sample.