Who should fill out KUDiR

There are several types of Books:

- For a simplified taxation system.

The book is filled out by individual entrepreneurs and LLCs using the simplified tax system. The form of the document is the same for all simplifiers, regardless of what object of taxation they apply. The only difference is that under the 6% simplified tax system, only income is entered into KUDiR, and under the 15% simplified tax system, both income and expenses are entered.

- For the patent tax system.

It is filled out by entrepreneurs using the PSN, and only income is entered there. In this taxation system, actual income does not affect the amount of tax, i.e. for the cost of the patent. But the Income Accounting Book is needed in order to track compliance with the income limit, because PSN can only be used for incomes up to 60 million rubles.

- For the general taxation system. It is filled out only by individual entrepreneurs on OSNO to calculate personal income tax.

- For individual entrepreneurs using the Unified Agricultural Tax.

Why do you need to conduct and do you need to take KUDiR

The ledger for accounting income and expenses is a special register where taxpayers using the simplified taxation system (STS) enter business transactions for subsequent calculation of the tax base for the STS tax. The obligation to keep a book of income and expenses, or KUDiR, as accountants often call it, is established by Article 346.24 of the Tax Code of the Russian Federation. Both organizations and entrepreneurs have it.

Errors or refusal to maintain KUDiR can lead to fines from 10,000 to 30,000 rubles. And if violations lead to an underestimation of the tax base - a fine of 20% of the amount of unpaid tax, but not less than 40,000 rubles. This is enshrined in Article 120 of the Tax Code of the Russian Federation.

At the same time, there is no obligation to submit KUDiR to the tax office. If the tax authorities require you to provide the Book of Income and Expenses during an on-site audit, then you are required to provide the Book in paper form, bound, numbered and signed (Article , Tax Code of the Russian Federation). Also, KUDiR may be needed to show the expenditure of targeted financing, or to show the Pension Fund of Russia income to determine the rate of insurance premiums for individual entrepreneurs, or in a bank for a loan.

How to conduct KUDiR

The general rules for maintaining KUDIR are as follows:

- The book is kept for one year.

- Records of business transactions are entered in chronological order.

- Each entry must be supported by a primary document.

- KUDiR can be maintained manually and electronically, but even in this case, at the end of the year it needs to be printed, stapled, numbered page by page, signed and stamped (if any).

- The absence of business transactions does not relieve the need to form a KUDiR. If no activity was carried out, you need to create a Book with zero indicators.

- There is no need to submit the KUDiR to the tax office, but you must be ready at any time to provide it for inspection at the request of tax officials. The tax inspectorate will fine you for the absence of KUDiR.

The rules for filling out the KUDiR for each taxation system are contained in the regulatory documents that approved the corresponding form:

- The book is kept for one year.

- Records of business transactions are entered in chronological order.

- Each entry must be supported by a primary document.

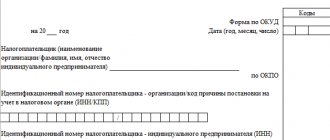

In what form should KUDiR be maintained and when to create it?

A new book must be opened for each tax period - calendar year. If an organization is created within a year, the book is opened from the day of creation until the end of the year. It can be maintained in paper and electronic form. The order of execution depends on the choice of format:

- In a paper book, before starting entries, you need to fill out the title page, sew and number the pages, indicate the number of pages on the last page, certify the KUDiR with a signature and seal (if any);

- the e-book must be printed, bound, pages numbered and their quantity indicated, certified with a signature and seal (if any).

The chosen method of maintaining the book can be established by order of the manager or fixed in the accounting policy. Many accounting programs and web services (such as Kontur.Accounting or Elba) allow you to maintain a ledger in electronic form with varying degrees of ease. At the end of the year or if the tax office requires it, you can print it out.

KUDiR is issued in one copy. If there are separate divisions, the head office forms the ledger. There is no need to separately highlight the data of the departments (Article 346.24 of the Tax Code of the Russian Federation).

Features of filling out KUDiR on the simplified tax system

The form consists of 5 sections.

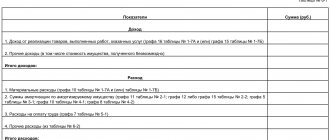

Section I “Income and Expenses”

All business transactions are entered into this part in chronological order, indicating:

- dates and numbers of the primary document (z-report, payment order, sales receipt, act, invoice, etc.);

- contents of the operation. For example, “Receipt of payment for goods shipped by Gamma LLC”;

- amounts.

If the operation is profitable, then the amount is entered in column 4, if it is expenditure, in column 5.

On the simplified tax system 6%, column 5 is not filled in.

You only need to record those amounts of income and expenses that are included in the tax calculation. For example, receipt and repayment of loans, payment of authorized capital, and contribution of own funds - all this is not considered taxable income, so there is no need to enter such transactions into KUDIR.

A complete list of income and expenses that affect the amount of tax is given in Articles 346.15 and 346.16 of the Tax Code of the Russian Federation, and the recognition procedure is in Article 346.17.

When to enter income

The simplified tax system uses the cash method, which means that all receipts are deposited into KUDiR at the moment the money is received in the current account or at the cash desk.

At what point should you enter expenses (only for simplified tax system 15%)

It all depends on the nature of the expenses.

- Material costs are incurred when the materials are both shipped and paid for. That is, the latest date will appear in KUDiR. If the materials have already been paid for, but not yet received, or vice versa, the amount of expenses is not yet included in taxation and an entry is not made in the KUDiR.

- Expenses for fixed assets (purchase, construction, manufacturing) and intangible assets are paid on the last day of the quarter based on calculations from Section II.

- Expenses for the purchase of goods intended for resale are paid only as they are sold. That is, the purchase price of goods that have not yet been sold and are in storage cannot be taken into account as tax expenses.

In the certificate at the end of section I on the simplified tax system 6%, fill out only line 010.

Based on the final data of KUDiR by quarter and year, advance payments and annual tax are calculated, and a tax return is filled out according to the simplified tax system.

Section II “Calculation of expenses for the acquisition of fixed assets and intangible assets”

This section is intended only for simplifiers with the “Income minus expenses” object.

Data is entered into it only for those fixed assets that have already been put into operation and only within the limits of paid amounts.

Costs must be distributed evenly across the quarters remaining until the end of the calendar year.

For example, if a fixed asset was purchased in February, that is, in the first quarter, for 200 thousand rubles, then the costs will be written off in 50 thousand increments on the last date of the first, second, third and fourth quarters. And if the purchase was made in July, that is, in the third quarter, for 300 thousand, then 150 thousand each must be written off in the third and fourth quarters. Expenses for OS purchased in the fourth quarter will be written off in one amount on the last date of the fourth quarter.

The calculated amount to be written off for the current quarter from column 12 of section II is entered into column 5 of section I on the last day of the quarter.

Columns 7, 8, 14 and 15 are intended for those cases where the fixed asset was purchased before the transition to the simplified taxation system.

Section III “Calculation of amounts of losses from previous periods that reduce the tax base”

This part is also intended only for those who apply the simplified tax system of 15%, had losses in previous periods and can reduce the tax base by the amount of these losses.

Section IV “Expenses that reduce the amount of tax”

This section is filled out by those who apply the simplified tax system of 6%.

It includes the amount of insurance premiums, sick leave paid at the expense of the employer, contributions for voluntary insurance of employees, i.e. those amounts by which the simplified tax system (USN) tax will then be reduced to 6%.

Section V “Calculation of amounts of trade duty that reduces tax”

This part is filled out by those who apply the simplified tax system “Income” and pay a trading fee.

Become a user of the “My Business” service, and you will not have to fill out the Income and Expense Account Book yourself. You will enter data on revenue and expenses, and the service itself will generate a KUDiR and tax return.

If all receipts and expenses go only through a current account, then creating a KUDiR in our service is even easier - you just need to upload a bank statement.

Our service will help you calculate taxes and contributions, report to regulatory authorities and pay taxes. The system accompanies all actions with step-by-step instructions and tips, so the chances of making mistakes are reduced to zero.

How to reflect income in KUDiR

As a general rule, income is reflected on a cash basis: on the date of receipt to the current account, to the cash desk or in another way.

For money, everything is clear: there is the date of the payment order or cash receipt order and the amount. But if the income came in the form of property: a computer, for example?

How to take into account natural income in KUDiR

Income in kind in the form of property, materials and other things is accounted for at market value. How to determine it can be found in Article 40 of the Tax Code of the Russian Federation. Receipts must be reflected in money on the date of transfer of property. The supporting document will be an invoice or transfer certificate.

An example of reflecting natural income in KUDiR:

Income and expenses

| Registration | Sum | |||

| No. | Date and number of the primary document | Contents of operation | Income taken into account when calculating the tax base | Expenses taken into account when calculating the tax base |

| 1 | 2 | 3 | 4 | 5 |

| 1 | 15.11.2020 Transfer and Acceptance Certificate No. 5 | Receipt of goods from LLC "Ai-ai-ka" under contract No. 11/2 dated November 10, 2020 | 25 000 | |

Income in foreign currency

Take into account foreign currency receipts along with those received in rubles. Their amount must be converted into rubles at the Central Bank exchange rate in effect on the date of recognition of income (clause 3 of Article 346.18 of the Tax Code of the Russian Federation).

In accounting, property and debt in foreign currency need to be revalued, but the resulting exchange rate differences are not reflected in KUDiR. But this rule does not include exchange rate differences that arise when the currency exchange rate changes at the time of sale or purchase. Positive exchange rate differences between the official and commercial rates of the currency being sold should be included in income and reflected in the accounting book

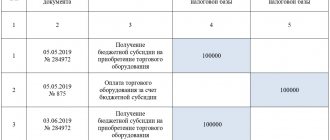

Subsidies for business development

This is the case when a simplified income earner can enter something in column 5 “Expenses” and take these expenses into account when calculating the tax. Reflect the amount of the subsidy received in column 4 of section 1, and in column 5 indicate the expenses paid from these funds.

Thus, if you spend the entire subsidy in one year, your income in the amount of the subsidy will be compensated by the amounts of expenses incurred - the difference between the indicators will be zero.

The primary documents for income are a payment slip. Primary documents for expenses - acts, invoices, etc.

Refund of advance payment to buyer

In KUDiR, indicate the income received, including advances. The return of the advance minus the previously received income in the form of the advance amount. Therefore, we write it down in column 4 “Income” - with a minus. There is no need to reflect the returned advance in column 5; such an expense is not provided for in Art. 346.16 Tax Code of the Russian Federation.

An example of an advance refund to KUDiR:

Income and expenses

| Registration | Sum | |||

| No. | Date and number of the primary document | Contents of operation | Income taken into account when calculating the tax base | Expenses taken into account when calculating the tax base |

| 1 | 2 | 3 | 4 | 5 |

| 1 | 15.11.2020 P/p No. 3452 | Receipt of advance payment from the buyer Ganymed LLC | 25 000 | |

| 2 | 25.11.2020 p/p No. 67 | Refund of advance payment to the buyer Ganymed LLC | – 25 000 | |

RESPONSIBILITY FOR VIOLATION OF MAINTENANCE OF THE INCOME BOOK ON THE PATENT

If an individual entrepreneur applying the patent taxation system does not keep a book of income, he will be subject to tax liability under Article 120 of the Tax Code of the Russian Federation. The fine for the entrepreneur will be:

- 10,000 rub. – if such a violation was committed during one tax period;

- 30,000 rub. – if the violation was committed over several tax periods.

In connection with the abolition of UTII from 2021, a number of new types of business activities have been added that are available when working on PSN.

In the service sector:

- parking for vehicles;

- pet care;

- plowing gardens and cutting firewood for the population.

Repair:

- toys and similar products;

- tourist and sports equipment;

- glasses;

- siphons and autosiphons, including charging gas cartridges for siphons.

Works:

- engraving machines for metal, glass, porcelain, wood, ceramics, except jewelry (by order of the population);

- glasses assembly;

- production and printing of business cards, invitations to family celebrations;

- grain grinding, production of flour and cereals from wheat, rye, oats, corn or other grains;

- production and repair of cooper's utensils and pottery according to individual orders of the population.

In addition to these types of activities approved at the federal level, local authorities are given the right, at their discretion, to allow the use of PSN for other types of activities.

Individual entrepreneurs operating in the field of catering and retail trade, who used UTII before 2021, will be able to painlessly switch to PSN from 2021. An amendment has been made to the Tax Code of the Russian Federation to increase the “threshold” of area for retail trade and catering under PSN.

Previously, shops and cafes with a sales or service area of more than 50 sq. meters could not buy a patent. Now this condition has been changed, and a patent can be issued if the area does not exceed 150 square meters. meters.

This might also be useful:

- Activities of individual entrepreneurs in another city or region

- Patent value calculation

- Patent tax system in 2021

- Changes in individual entrepreneur taxation in 2021

- What taxes does the individual entrepreneur pay?

- Tax system: what to choose?

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Sample of filling out a new book

Below is a sample of filling out the new KUDiR book from 2021. Taxable income of individual entrepreneurs without employees in 2021:

- in the 1st quarter - 120,000 rubles,

- in the 2nd quarter - 150,000 rubles,

- in the 3rd quarter - 140,000 rubles,

- in the 4th quarter – 180,000 rubles.

Quarterly, the individual entrepreneur paid insurance premiums to the Pension Fund of the Russian Federation and compulsory medical insurance “for himself” in the amount of 7,000 rubles, a total of 28,000 rubles were transferred for the year. The quarterly amount of the trading fee is 9,000 rubles, transferred per year is 36,000 rubles.

Read also

26.10.2017

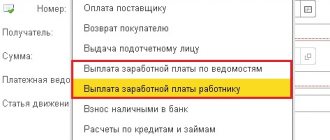

How to configure KUDiR in 1C 8.3

The process of automating accounting based on 1C in terms of setting up the compilation of the Book should begin by checking the tax and reporting settings in the main menu.

Fig.1 Checking tax and reporting settings in the main menu

Next, go to the section “STS” - “Procedure for recognizing income and expenses.”

Fig. 2 Procedure for recognizing income and expenses

If you find that any expenses or income are not reflected in the KUDiR, the problem should be looked for in this section.

You can also check your tax and reporting settings in another way by going through the “Main” menu, then “Accounting Policy”.

Fig.3 Accounting policy

Next, click the “Set up taxes and reports” link.

Fig.4 Setting up taxes and reports

We find ourselves in the “Taxes and Reports Settings” menu.

Fig.5 Tax and reporting settings menu

Here it is necessary to note that there are a number of settings that cannot be edited due to the requirements of current legislation. At the same time, it is possible to make some amendments to the established policy, in particular to the “Transfer of materials to production” in the “Material costs” section. You can also check the box for receiving income (payment from the buyer) in the “Expenses for purchasing goods” section. In the “Input VAT” section, it is possible to accept expenses for purchased goods, works, and services. At the discretion of the taxpayer, it is established that expenses for writing off goods (section “Customs payments”) or inventories (section “Additional expenses included in the cost”) are included in the formation of KUDiR.