Article 346.24 of the Tax Code of the Russian Federation obliges firms and individual entrepreneurs who have chosen the simplified tax system to keep tax records through the Book of Income and Expenses (hereinafter referred to as KUDiR, Book). Violation of this requirement threatens the company with a fine of up to 10 thousand rubles per tax period. If the violation affects more than one such period, the fine will be up to 30 thousand rubles (Article 120). The KUDiR matrix, as well as the rules for filling it out, were approved by order of the Federal Tax Service of Russia dated October 22, 2012 No. 135n. If we talk about the 1C: Accounting program, then it allows you to implement the functionality of creating a Book in absolute compliance with the law.

How to configure KUDiR in 1C 8.3

The process of automating accounting based on 1C in terms of setting up the compilation of the Book should begin by checking the tax and reporting settings in the main menu.

Fig.1 Checking tax and reporting settings in the main menu

Next, go to the section “STS” - “Procedure for recognizing income and expenses.”

Fig. 2 Procedure for recognizing income and expenses

If you find that any expenses or income are not reflected in the KUDiR, the problem should be looked for in this section.

You can also check your tax and reporting settings in another way by going through the “Main” menu, then “Accounting Policy”.

Fig.3 Accounting policy

Next, click the “Set up taxes and reports” link.

Fig.4 Setting up taxes and reports

We find ourselves in the “Taxes and Reports Settings” menu.

Fig.5 Tax and reporting settings menu

Here it is necessary to note that there are a number of settings that cannot be edited due to the requirements of current legislation. At the same time, it is possible to make some amendments to the established policy, in particular to the “Transfer of materials to production” in the “Material costs” section. You can also check the box for receiving income (payment from the buyer) in the “Expenses for purchasing goods” section. In the “Input VAT” section, it is possible to accept expenses for purchased goods, works, and services. At the discretion of the taxpayer, it is established that expenses for writing off goods (section “Customs payments”) or inventories (section “Additional expenses included in the cost”) are included in the formation of KUDiR.

Compliance with the requirements of Art. 346.12 Tax Code of the Russian Federation

In this case we are talking about:

- About the number of employees, which should not be more than 100 people. It is necessary to take into account the fact that we mean the average number of employees per year.

- On the residual value of fixed assets. It is determined according to accounting data. The maximum amount is 100 million rubles. For individual entrepreneurs there are no restrictions on the value of assets.

- On the share of legal entities in the authorized capital of the company, which should not exceed 25%. There are exceptions for organizations with authorized capital consisting of contributions from people with disabilities, non-profit organizations, and government scientific institutions.

How to fill out KUDiR in 1C

Like most reports in 1C, KUDiR is generated automatically based on the results of reporting or tax periods. After carrying out routine operations to close the month, the accountant needs to go to “Reports”, to the “STS” section - “STS Book of Income and Expenses”.

Fig.6 Book of income and expenses of the simplified tax system

Further directly into the “Book…” of the organization itself.

Fig.7 In the book

It is possible to select the desired tax period (this is a quarter, six months, 9 months and a year). By clicking the “Generate” button, a printed form of the Book is displayed on the screen.

Fig.8 Printing form of the Book

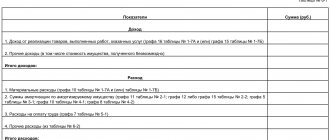

On the left side is a list of sections:

- Section I. “Income and Expenses” shows all business transactions for the period in tabular form in chronological order, indicating the amounts.

- Section II. “Expenses on fixed assets and intangible assets” reflects information on expenses on fixed assets and intangible assets for the period. For organizations that have chosen the simplified tax system - income minus expenses.

- Section III. “Calculation of loss” is filled in if there are losses that reduce the company’s tax base for a number of years.

- Section IV. “Tax reduction” shows amounts that (clause 3.1 of Article 346.21 of the Tax Code) reduce the amount of calculated tax, for example, for insurance contributions to the Pension Fund or other contributions.

- Section V “Trade fee” reflects the amount of the trade fee, which reduces the amount of tax due for payment.

When you click on each line of a section, the corresponding generated report window opens on the right.

Fig.9 Generated report window

When you click the “Show settings” button, the KUDiR form settings open.

Fig.10 Show settings

It is possible to display transcripts, include the columns “Income of total”, “Expenses of total” and “VAT printing mode”. When you check the box in the line “Include in the report form and fill out” and during the subsequent formation of the KUDiR, columns of all income and expenses are displayed on the screen, including those taken into account when calculating the tax base. This function allows you to visually monitor indicators that are not included in tax accounting.

Fig. 11 Control of indicators not included in tax accounting

Double-clicking on the indicator line allows you to display the primary document that served as the basis for inclusion in KUDiR.

Fig. 12 Primary document that served as the basis for inclusion in KUDiR

The generated KUDiR form can be printed in the context of the sections of interest.

Fig. 13 Printed form KUDiR

Also, KUDiR in 1C Accounting 8.3 can be saved in any of the file formats presented below.

Fig.14 Save KUDiR to file

Minimum tax

As in the previous paragraph, this situation applies exclusively to the object of taxation “Income minus expenses”. The minimum tax is calculated based on 1% of income, and is paid when its amount is greater than the result obtained from subtracting expenses from income. It is also paid in the event that at the end of the year the organization receives a loss from business activities. Please note that the minimum tax is paid only at the end of the year; if the company receives losses quarterly, advance payments are not made.

Manually making changes to KUDiR

For example, during visual inspection of KUDiR it was discovered that for some reason the expense recognized in tax accounting did not fall into the column “Including expenses taken into account when calculating the tax base.”

Fig. 15 Including expenses taken into account when calculating the tax base

Double-click on this line to open the primary document.

Fig. 16 Primary document

We hover the cursor over the fourth button in the panel, the note “Show transactions and other movements of the document” pops up, when clicked, the movement of the document in accounting and tax accounting opens.

Fig. 17 Show postings and other movements of the document

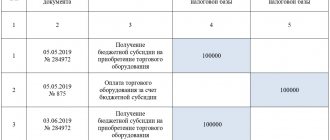

Go to the section “Book of Income and Expenses (Section 1)”.

Fig. 18 Book of income and expenses

At the top of the document, check the “Manual adjustment (allows editing of document movements)” checkbox. Then you can enter the amount of the document in the “Expenses” column.

Fig.19 Manual adjustment

Save your changes, post and close the document.

In the KUDiR menu, press the “Generate” button again. The program will ask you to update the information as changes have been made.

Fig.20 Update information

With the subsequent formation of KUDiR, we see that expenses are reflected in both columns - both in accounting and tax accounting.

Fig. 21 Expenses are reflected in both columns

There is also another way to manually make changes to KUDiR. To do this, you need to select the section “Records of the book of income and expenses of the simplified tax system” in the “Operations” menu.

Fig. 22 Entries in the book of income and expenses of the simplified tax system

In the window that opens, we will generate an arbitrary document for the amount of making the necessary adjustments, in our example - 1.0 million rubles to the supplier for the goods supplied.

Fig.23 Let's create an arbitrary document

After completing this document, we proceed to the formation of KUDiR and see the line with our adjustment.

Fig.24 Line with our adjustment

Step-by-step instruction

The Universal Report will help you understand the situation.

Step 1. Open the Universal report : section Reports – Standard reports – Universal report.

Step 2. In the header of the report to select information, indicate:

- Period – period for compiling the report;

- Accumulation register – type of data source;

- Expenses under the simplified tax system – name of the data source.

Step 3. Open the report settings form using the Show settings .

Step 4. On the Grouping , use the Add to specify the following values:

- Type of consumption;

- Flow element.

Step 5. On the Indicators Add new field button and select values from the list:

- Quantity;

- Sum;

- VAT;

- Reflection in NU;

- Registrar;

- Status of payment of expenses of the simplified tax system;

- Type of movement;

- Payment document details.

Step 6. Generate a report of the required form using the Generate .

To correct an error in the document Write-off from a current account, let’s set up the repayment of debt under the document for the delivery of a Brother Printer:

- Debt repayment - according to the document ;

- Document - Receipt (invoice act) No. 0000-000002 dated January 22, 2018 .

After this, we will generate a report in the Universal Report based on the specified settings.

After correcting the error, the cost of goods Brother Printer (2 pcs.) is included in KUDiR.