Accountants whose organizations are on the simplified tax system periodically complain that KUDiR in 1C Accounting 3.0 is filled out incorrectly. It happens that entries from the balance sheet do not end up in the book of income and expenses as expected. The publication will discuss the most common errors that arise when maintaining a simplified taxation system in 1C Accounting 3.0 and propose 1C processing for correcting simplified taxation accounting errors.

When studying user complaints about the simplified tax system accounting in 1C Enterprise 8, that, for example, KUDiR in 1C Accounting 3.0 is filled out incorrectly, the algorithm for identifying errors and searching for corrections took a fairly standardized form. I want to share my experiences in this publication.

In order to connect the terminology of accountants and programmers to communicate in a common language, I will make a few clarifications:

- The 1C platform object “Accounting Register” stores accounting entries, the main report using accounting entries is the “Turnover Balance Sheet”. Therefore, the terms “ accounting register data ” and “ balance sheet data ” reflect the same essence.

- KUDiR is an abbreviation for “ Book of Accounting for Income and Expenses ,” which is maintained by organizations and entrepreneurs with a simplified taxation system for calculating the tax base. According to the Book, taxes are paid in accordance with the tariff: 6% of the tax base (Income Only) or 15% of the tax base (Revenue - Expenses).

To clearly understand the problem, let’s look at the reasons for the occurrence of simplified tax system errors in 1C Accounting 3.0.

Book sections

The income and expense accounting book consists of a title page and four sections:

- Section I “Income and Expenses”;

- Section II “Calculation of expenses for the acquisition (construction, production) of fixed assets and for the acquisition (creation by the taxpayer himself) of intangible assets taken into account when calculating the tax base for the tax for the reporting (tax) period”;

- Section III “Calculation of the amount of loss that reduces the tax base for the tax paid in connection with the application of the simplified taxation system for the tax period”;

- Section IV “Expenses provided for in paragraph 3.1 of Article 346.21 of the Tax Code of the Russian Federation, reducing the amount of tax paid in connection with the application of the simplified taxation system (advance tax payments) for the reporting (tax) period.”

Those who pay tax on the difference between income and expenses, in addition to Section I, also fill out a certificate with a breakdown of individual indicators. Inspectors will be able to check the selected taxation object using the title page of the book of income and expenses.

This is stated in Section II of the Procedure, approved by Order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n.

When filling out Section III, read the article about writing off losses of previous years under the simplified tax system “income minus expenses.”

Setting up accounting policies according to the simplified tax system in 1C Accounting 3.0

The accounting policy settings according to the simplified tax system are set before the start of accounting and, in theory, do not change during the year.

To correctly change the accounting policy under the simplified tax system in the middle of the year, after the change, it is necessary to re-post all documents from the beginning of the year.

To study the method of correcting accounting under the simplified tax system, when KUDiR in 1C Accounting 3.0 is filled out incorrectly, we will create a new organization in the “Organizations” directory - individual entrepreneur - with a simplified tax system of 15%. In the card, we will fill in the basic details manually or using the TIN if the 1C Counterparty service is connected. After filling out, we proceed to setting up the taxation system, indicating that the organization has a Simplified taxation system (income minus expenses)

.

The most important settings of the simplified taxation system in 1C Accounting 3.0 are located on the second tab “STS”.

In this tab, for each type of simplified tax system expense, you can set the recognition order. Events of recognition of expenses enshrined in law are specified by check marks, without the possibility of removal. Each organization decides whether or not to take into account events with the possibility of change when recognizing expenses by checking or unchecking the appropriate boxes. That's why,

in the absence of expenses in KUDiR, when the necessary conditions for recognizing expenses are met, see the settings for recognizing expenses of the simplified tax system

for the presence of additional expense recognition events.

How to fill in by selecting the “income” object

Those who pay a single income tax are required to fill out only section I and only in the part relating to income. There are only two exceptions to this rule.

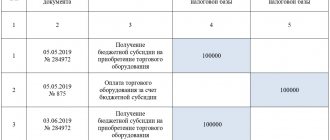

Firstly, expenses for measures aimed at reducing unemployment and paid for from budget funds will have to be reflected in the book. And secondly, expenses from subsidies received to support small and medium-sized businesses in accordance with Law of July 24, 2007 No. 209-FZ. Show such amounts in column 5, as provided for in paragraph 1 of Article 346.17 of the Tax Code of the Russian Federation.

In particular, reflect the amount of the subsidy received in column 4 of section I, and in column 5 indicate the amount of expenses that the organization incurred using these funds. The difference between these indicators should be zero.

If desired, of course, you can reflect in column 5 any other expenses that are associated with generating income. But this data will not affect the calculation of the single tax.

This is stated in paragraph 2.5 of the Procedure, approved by order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n.

Situation: is a simplified organization with the object “income” obliged to store primary documents confirming its expenses?

Answer: yes, primary materials must be stored in a general manner for at least five years.

This rule is established by Article 29 of the Law of December 6, 2011 No. 402-FZ. Organizations using the simplification must keep accounting records in full (Article 2 of the Law of December 6, 2011 No. 402-FZ). Therefore, they are also subject to the requirements of accounting legislation, including the requirement for storage periods for primary documents. These requirements must be met regardless of the chosen object of taxation. At the same time, if an organization pays a single tax on income, it is not required to reflect the expenses incurred in the book of income and expenses (with some exceptions).

Why are salary expenses not included in the Income and Expense Accounting Book (KUDiR)?

Published 05.10.2014 17:23 From organizations working on the simplified taxation system (STS) with the object income minus expenses, I very often hear questions about why some information does not fall into the KUDiR. I already talked about the costs of goods and materials in one of the training videos, but in this article we will talk about wages that do not fall into the book of income and expenses.

In reality, it doesn't take much for the costs to show up on the ledger. First of all, you need to make sure that the documents are processed in the correct chronological sequence - accrual and payment of salaries. And in this situation, it doesn’t even matter which document comes first. Both actions must be performed, and only after completing the second will the data enter the KUDiR. Problems may arise when the salary was first paid, the documents were processed, and then accrued retroactively. But this can all be solved by simply redoing the documents, which must be completed before each month’s closure.

Another common situation is when the type of transaction is incorrectly selected in the salary payment documents. There you must indicate “Payment of wages according to statements” or “Payment of wages to an employee.”

But some users choose the “Other expense” type, while the amounts for KUDiR can only be specified manually, which many people forget to do, and the content of the operation will not be entirely correct. In addition, this is incorrect from the point of view of the accounting methodology in 1C programs and leads to incorrect reporting.

Also, payroll expenses may not be included in the income and expenses book due to incorrect accrual settings. Let's look at the example of the 1C program: Enterprise Accounting 8 edition 3.0. Open the “Payroll” document and go to the “Accruals” tab. The tabular section shows the types of payments that employees receive (salary, etc.). You need to look at the settings for each of these accruals; you can open them directly from the payroll document.

In the settings form, pay attention to the details “Relation to UTII” and “Method of reflection”.

With regard to UTII, I think everything is clear. If you have several organizations in your database, one of which is entirely on UTII, another is on the simplified tax system, and the third combines both modes, then you will have to make different accruals for them with different settings.

Now open the selected reflection method.

The field “Reflection in the simplified tax system” must be filled out correctly, and the cost item for activities with a special taxation procedure is not selected if your entire salary is included in the simplified tax system.

You also need to go to the cost item for the main tax system and check its settings.

After changing any accrual settings, it is necessary to re-post all documents related to wages.

Thus, if expenses do not fall into KUDiR, you need

- retransmit documents

— check the types of transactions in cash settlement services and debits from the current account

— understand the accrual settings and, if necessary, adjust them.

In 90% of cases, these simple steps will help you find and fix errors. If the method did not work in your situation, or you have questions about combining the simplified tax system + UTII modes, which was not discussed in this article, then you can write about it in the comments or in the “Q&A” section.

Author of the article: Olga Shulova

Let's be friends on Facebook

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 #17 Irina Plotnikova 10.29.2020 08:50 I quote Irina:

My situation is a little different. There is an organization on the simplified tax system, in 1C BP it is indicated that the PO is carried out in it, but in fact in the ZUP, there were about 6 accountants who changed, who either made empty accruals, then carried out the PO on the “list of employees”, then on specific employees, then did operation entered manually. As a result, for two years now my “List of Employees” has been receiving a salary, but there are no accruals. From time to time there are no accruals, specific employees receive either a salary or a report... distortions in all places that I did not know about before. But all months are closed and at the end of the year everything is covered by the accounting certificate. I look at this nonsense and don’t know which end to spin it from. I am considering options: 1) completely restore the bay from the beginning of 2021. accounting and duplicate all accruals and resubmit all reports. 2) cut off on 12/31/2019, adjust the balance and restore from 01/01/2020 3) mark everything related to the salary for deletion, indicate that it is maintained in another program, enter reflections and statements for people, and not for the ephemeral “list of employees” , hook it up to the bank, re-close the months, redo the reporting for 19 and start doing it for 20. Now I feel like I’m falling down a rabbit hole... please advise me on what to take on.

Irina, good afternoon.

Oh, you're out of luck. Difficult situation. Only you can decide. If you have the strength, opportunity and time, you can redo it for 2 years. Again, you need to look at the ZUP to see if wages were processed correctly there. What reports were submitted? Can the moratorium on on-site tax audits take advantage of this? Redo everything, gradually retake all the reports, pay additional taxes, penalties... Quote 0 #16 Irina 10/28/2020 11:07 I have a slightly different situation. There is an organization on the simplified tax system, in 1C BP it is indicated that the PO is carried out in it, but in fact in the ZUP, there were about 6 accountants who changed, who either made empty accruals, then carried out the PO on the “list of employees”, then on specific employees, then did operation entered manually. As a result, for two years now my “List of Employees” has been receiving a salary, but there are no accruals. From time to time there are no accruals, specific employees receive either a salary or a report... distortions in all places that I did not know about before. But all months are closed and at the end of the year everything is covered by the accounting certificate. I look at this nonsense and don’t know which end to spin it from. I am considering options: 1) completely restore the bay from the beginning of 2021. accounting and duplicate all accruals and resubmit all reports. 2) cut off on 12/31/2019, adjust the balance and restore from 01/01/2020 3) mark everything related to the PO for deletion, indicate that it is maintained in another program, enter reflections and statements for people, and not for the ephemeral “list of employees” ", hook it up to the bank, re-close the months, redo the reporting for 19 and start doing it for 20. Now I feel like I’m falling down a rabbit hole... advise me on what to take on.

Quote

+6 #15 Svetlana 07/19/2019 18:59 Hello, please tell me the salary is kept in an external program, we upload it to the accounting department separately and salary payments do not end up in the accounting book. Why, can you tell me?

Quote

0 #14 Maria 03/30/2019 20:44 I quote Maria:

Hello! Tell me, I didn’t get to Kudir for a whole month, payment for wages, taxes and gas costs, the rest of the months are normal as expected, what could be the reason?

Moreover, just yesterday everything was fine Quote

0 #13 Maria 03/30/2019 17:19 Hello! Tell me, I didn’t get to Kudir for a whole month, payment for wages, taxes and gas costs, the rest of the months are normal as expected, what could be the reason?

Quote

+1 #12 Ukhova Natalya 11/17/2017 01:44 I quote Zina:

Hello! For some reason, my salary doesn’t all go to KUDiR. I pay 4 people 20,000 each according to the consolidated payroll. It should be 80,000. It should be 60,000. The salary of one employee is not included every month, the same employee is not included. What is the reason? Please tell me what is the reason

Hello! Perhaps the salary accounting for this employee is incorrectly configured, look at the “Employees” directory, “Payments and salary accounting” tab.

Quote +2 #11 Zina 11/16/2017 02:29 Hello! For some reason, my salary doesn’t all go to KUDiR. I pay 4 people 20,000 each according to the consolidated statement. Should get 80,000 get 60,000. The salary of one employee doesn’t get included every month, the same employee doesn’t get included. what is the reason? Please tell me what is the reason

Quote

0 #10 Natalya 08/22/2017 18:25 Hello! For some reason, my salary doesn’t go entirely to KUDiR. Paid from the cash register salary 35,659.33 and included in expenses 33,973.95? Is it possible to fix this manually?

Quote

+3 Leah 06/24/2016 19:57 Hello, please tell me what operation needs to be carried out in order for expenses to be entered into KuDIR in 1 C Enterprise 8.3

Quote

+2 Yu l and I 05.25.2016 17:09 Very good site, useful tips. Bookmarked the page. Thanks a lot.

Quote

0 Olga Shulova 04/09/2015 12:18 I quote Buttercup:

Good afternoon We upload without details.

Good afternoon

In this case, the salary will not be automatically received. This is only possible with detailed uploading of employees. It is also very important that when making a payment, the appropriate type of transaction is selected in the documents, and not others. Quote 0 Buttercup 04/09/2015 09:38 Good afternoon! We upload without details.

Quote

0 Olga Shulova 04/01/2015 11:29 I quote Buttercup:

Good afternoon And according to 1s 8.2 Accounting, you can suggest the order of operations for getting the salary into KUDIR. We accrue wages to ZUP and upload them to the accounting department.

Hello!

Do you upload summarized or detailed by employee? Quote +3 Buttercup 03/31/2015 14:56 And we pay wages through the cash register and on cards through the bank, now we make payments through other transactions, we enter them into KUDIR manually

Quote

+3 Buttercup 03/31/2015 14:01 Good afternoon! And according to 1s 8.2 Accounting, you can suggest the order of operations for getting the salary into KUDIR. We accrue wages to ZUP and upload them to the accounting department.

Quote

+1 Olga Shulova 03/13/2015 09:58 I quote farsiri:

Good afternoon In 1C 8.3, when forming KUDiR, not all salaries are included, only 4 people (out of 14) during the entire year. I checked all the steps described above. Help me please!

Hello!

Do you work in the 1C: Accounting program (or 1C: Integrated, 1C: UPP)? It’s just that 8.3 is just the number of the 1C platform on which different programs can run. If in Accounting (the article was written based on it), then do you calculate salaries in this program or download them from a special payroll? Do you pay salaries in one document to everyone at once or separately to each person? Quote +3 farsiri 03/12/2015 13:17 Good afternoon! In 1C 8.3, when forming KUDiR, not all salaries are included, only 4 people (out of 14) during the entire year. I checked all the steps described above. Help me please!

Quote

Update list of comments

JComments

How to fill in by selecting the “income minus expenses” object

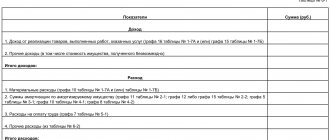

Those who pay tax on the difference between income and expenses fill out all sections of the book, as well as a certificate for section I.

When filling out Section I, please provide the following information:

- in column 1 - the serial number of the registered transaction;

- in column 2 - the date and number of the primary document on the basis of which the income was received or the expense was made;

- in column 3 – the content of the registered transaction;

- in column 4 - income taken into account when calculating the single tax;

- in column 5 - expenses taken into account when calculating the single tax.

- in line 010 - the amount of income received for the year. It can be viewed in the line “Total for the year”, column 4 of section I of the book of accounting for income and expenses;

- in line 020 - the amount of expenses for the year. It is equal to the indicator in the line “Total for the year” in column 5 of section I;

- in line 030 - the amount that can be obtained if you subtract from the amount of the minimum tax that was paid the amount of tax calculated in the general manner;

- in line 040 - the total amount of income. You will get it if you subtract the indicators of lines 020 and 030 from the indicator of line 010;

- in line 041 – the total amount of losses. You will get it if you subtract the sum of line 010 from the sum of lines 020 and 030. Do not indicate a negative value.

Reflection of income

If the organization has switched to a simplified tax system from the general taxation system, then reflect in column 4 as part of its income the advances received before the transition to the special regime. But only if two conditions are met simultaneously. First: the organization previously calculated income tax using the accrual method. And secondly: the organization began to fulfill obligations on such advances, having already switched to a simplified system.

And on the contrary, the money that you received after the transition to the simplified system will not have to be shown as income if two conditions are met. First: previously, the organization calculated income tax using the accrual method. And second: the money was received to pay off accounts receivable, the amount of which was already taken into account as income.

This is stated in paragraph 2.4 of the Procedure, approved by order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n.

Income in foreign currency

Consider receipts in foreign currency in conjunction with those received in rubles. Determine the amount of such income at the Bank of Russia exchange rate in effect on the date of recognition of income (clause 3 of Article 346.18 of the Tax Code of the Russian Federation).

In accounting, property and debt, the value of which is expressed in foreign currency, must be revalued (clause 4 of PBU 3/2006). However, the resulting positive (negative) exchange rate differences do not need to be reflected in the book of income and expenses. This follows from the provisions of paragraph 5 of Article 346.17 of the Tax Code of the Russian Federation. The exchange rate differences specified in paragraph 2 of Article 250 of the Tax Code of the Russian Federation are not subject to this norm. That is, those that arise when the exchange rate of a currency changes when it is sold or purchased. Therefore, the positive difference between the official and commercial rates of the currency being sold must be included in income and reflected in the accounting book.

Manual adjustment

If, after all, KUDiR is not filled out exactly as you wanted, its entries can be corrected manually. To do this, in the “Operations” menu, select “STS Income and Expense Book Entries.”

In the list form that opens, create a new document. In the header of the new document, fill in the organization (if there are several of them in the program).

This document has three tabs. The first tab corrects the entries in section I. The second and third tabs are in section II.

If necessary, make the necessary entries in this document. After this, KUDiR will be formed taking into account these data.

Income from barter transactions

Income received from barter transactions should be reflected in the book of income and expenses at the moment when the counterparty fulfilled its obligations to the organization under the barter (commodity exchange) agreement. That is, when the counterparty transferred the relevant goods (other property) to the organization. This follows from paragraph 1 of Article 346.17 of the Tax Code of the Russian Federation.

Situation: when to reflect income from barter transactions in the ledger of income and expenses? Property from the counterparty was received in one month, the organization’s property was transferred in another

Income from barter transactions should be reflected in the book of income and expenses after the ownership of the received property has transferred to the organization.

This is explained by the fact that property obtained not under the right of ownership is not income of the organization (Article 41 of the Tax Code of the Russian Federation).

Paragraph 1 of Article 346.17 of the Tax Code of the Russian Federation states that the date of receipt of income is the moment of receipt of property. From the provisions of this paragraph, we can conclude that income from barter transactions is reflected in the book of income and expenses on the day when the organization receives property from the counterparty.

However, with barter, the parties to the contract receive ownership of the exchanged property at the same time, after fulfilling their obligations to each other.

You can deviate from this rule if the contract specifies a special procedure for transferring ownership. If there are no special clauses in this regard, all received property belongs to the counterparty until the organization transfers its property to him. This is stated in Article 570 of the Civil Code of the Russian Federation.

The above rules also apply to autonomous institutions, since property acquired by the institution under an agreement (other reasons) enters the operational management of the institution in the manner established for the acquisition of property rights (clause 2 of Article 299, Article 570 of the Civil Code of the Russian Federation).

Methodologically, this position seems more justified. However, there are no official explanations from regulatory agencies on this matter.

Income from payments with plastic cards

Situation: at what point should revenue be reflected in the income and expense ledger if customers pay with plastic cards? The organization applies simplification

The amount of revenue received when paying with plastic cards should be reflected at the time the money is received in the current account.

According to the general rules, those who use the simplified method determine income and expenses using the cash method (Article 346.17 of the Tax Code of the Russian Federation). The date of receipt of income under the cash method is the day:

- receipt of money into bank accounts (at the cash desk);

- obtaining other property (works, services, property rights);

- repaying debt to the organization in another way.

This procedure is provided for in paragraph 1 of Article 346.17 of the Tax Code of the Russian Federation.

When making payments using plastic cards, funds are credited to the seller's (performer's) bank account later than they are debited from the buyer's (customer's) card. Nevertheless, the income of the seller (performer) during simplification arises precisely at the moment the funds are received into the current account. On this date, the revenue that was credited to the account must be reflected in the book of income and expenses. Similar clarifications are contained in letters of the Ministry of Finance of Russia dated April 3, 2009 No. 03-11-06/2/58, dated November 21, 2007 No. 03-11-04/2/280, dated May 23, 2007 No. 03- 11-04/2/138.

An example of how sales proceeds are reflected in the book of income and expenses. The organization is engaged in retail trade and accepts plastic cards for payment.

The organization sells goods to the public through a network of retail stores. On April 12 of this year, two buyers presented plastic cards for payment (one purchased goods in the amount of 5,000 rubles, the other – in the amount of 10,000 rubles). The indicated amounts were credited to the bank account on April 14 and 15, respectively.

In column 4 of the book of income and expenses for the second quarter, the accountant reflected these amounts as they were received:

- April 14 – 5000 rub.;

- April 15 – 10,000 rub.

Reflection of received advance payments

In order to understand the process of registering an advance payment, let’s simulate the situation.

For example, you are an individual entrepreneur using the simplified tax system. In February, your buyer transferred an advance of 300 thousand rubles to your current account towards a future transaction, which is scheduled for April of the same year. In March, you received 150 thousand rubles for previously shipped goods. No other funds were deposited into your account during the first quarter.

What we have? 300 thousand rubles in advance, another 150 thousand rubles - profit for the completed transaction. A total of 450 thousand rubles are the results for the first quarter, which must be recorded in the income line and reflected in KUDIR.

This means that advance payments are included in the amount of income, after which:

- in calculating the advance payment and the amount of tax at the end of the current year;

- in calculating the amount allowed for conducting activities under the simplified taxation system.

If due to unforeseen circumstances the transaction cannot be completed, the entrepreneur is obliged to return the advance payment to his client, and the income of the enterprise in this case must be reduced in KUDIR by an amount equal to the returned advance.

Let's change the outcome of the transaction a little and assume that the deal was terminated and you returned the entire amount of the advance payment to the client. In this situation, you will need to note the following in KUDIR:

| No. | Document number and date | Operation | Income | Expenses | |

| 1 | No. 12 dated February 10, 2018 | Receiving an advance from Vostok-Media LLC under agreement No. 4-41 dated January 24, 2018. | 300 t.r. | ||

| 2 | No. 16 of March 6, 2018 | Profit from LLC “Maket” for goods sold under agreement No. 4-14 dated January 12, 2018. | 150 t.r. | ||

| 3 | No. 20 dated March 15, 2018 | Refund of advance payment from Vostok-Media LLC, received under agreement No. 4-41 dated January 24, 2018. | 300 t.r. | ||

| TOTAL for the first quarter | 150 t.r. | ||||

If the deal had been terminated in the second quarter, the transaction would have been reflected in the corresponding month.

In some cases, the entrepreneur to whom the advance payment was transferred cannot fulfill all the terms of the transaction, and then the parties agree to transfer the funds from the “advance” status to the “loan” status. In such a situation, the entrepreneur is also obliged to deduct the advance payment from the amount of income, since the loan is not included in the list of payments under the simplified tax system. Instead of recording “Return of advance payment”, you will need to make a note in KUDIR “Additional agreement” or “Novation of obligation”.

Settlement costs

The expenses incurred as a result of the offset of mutual claims should be reflected in the book of income and expenses as of the date of signing the act of offset of mutual claims. It is at the moment of signing the act of offsetting mutual claims that the organization extinguishes its obligation to the seller (Article 410 of the Civil Code of the Russian Federation). The date of expenditure on such operations is the date of termination of the obligation (clause 2 of Article 346.17 of the Tax Code of the Russian Federation). The basis for making entries in the book of income and expenses is the act of offsetting mutual claims.

The main causes of accounting errors of the simplified tax system in 1C Accounting 3.0

In fact, there are not many reasons and they are all related to a misunderstanding of the operation of the 1C cost accounting mechanism. Comrade users, entries in the book of income and expenses are formed not according to the data of the accounting register (turnover balance sheet), but according to data from completely different registers.

Therefore, I want to write in bold letters once again that

the amounts included in KUDiR are not taken from the accounting register or balance sheet, but are formed in separate registers 1C Accounting 3.0

We will look at all these registers below. And I pay so much attention to this issue because

When maintaining the simplified tax system in 1C Accounting 3.0, by introducing a manual operation with adjustments only to the accounting register (amounts in the balance sheet) without adjusting the simplified tax system registers, you are 100% making a mistake!!!

After entering a manual transaction, the data becomes correct in the balance sheet, but the expense offsets are carried out incorrectly! Therefore, if you want to correct something in wages, taxes, goods, consult with people who know how to do it correctly in 1C Accounting 3.0. By doing this, you will ultimately benefit from saving your time and nerves in the future when submitting reports.

The problem is further aggravated by the fact that accounting periods are closed after the reporting period, and correcting errors in the closed period can lead to discrepancies between the submitted reports and 1C data. Therefore, when KUDiR in 1C Accounting 3.0 is filled out incorrectly, the only correct solution is to correct the data at the beginning of the open period and do a general re-posting of documents, as a result of which a correct book of income and expenses should be formed.

I will show you how to do this yourself below in this article. And now we will look at the accounting policy settings according to the simplified tax system, since sometimes KUDiR in 1C Accounting 3.0 is filled out incorrectly due to incorrect accounting policy settings.

Labor costs

Reflect labor costs in the book of income and expenses at the time of repayment of debt to employees (subclause 1, clause 2, article 346.17 of the Tax Code of the Russian Federation).

Situation: how to reflect personal income tax in the book of income and expenses when paying salaries? An organization (autonomous institution) applies a simplification

Reflect personal income tax amounts as they are transferred to the budget.

Under the cash method, expenses reduce the tax base as they are paid. Personal income tax is an integral part of the salary (clause 4 of article 226 of the Tax Code of the Russian Federation). Therefore, in the book of income and expenses, the amount of withheld personal income tax can be reflected as part of labor costs at the time the tax is transferred to the budget (subclause 3, clause 2, article 346.17 of the Tax Code of the Russian Federation). Similar explanations are contained in the letter of the Ministry of Finance of Russia dated June 25, 2009 No. 03-11-09/225.

The basis for making entries is a payment order for the transfer of tax. At the moment when the organization pays salaries, reflect in expenses only the amounts actually paid to employees (subclause 1, clause 2, article 346.17 of the Tax Code of the Russian Federation).

Situation: is it necessary to reflect the amount of salary advance paid in the book of income and expenses? The organization applies simplification

Answer: yes, it is necessary.

Organizations that apply the simplification recognize the amount of the paid salary as expenses at the time of repayment of debt to employees (subclause 1, clause 2, article 346.17 of the Tax Code of the Russian Federation). By paying an advance, the organization repays such debt for the time that employees have already worked in the current month. Therefore, reflect the amount of the advance in the book of income and expenses in the month in which it was paid.

Such clarifications are provided by the tax service (see, for example, letter of the Federal Tax Service for Moscow dated December 31, 2004 No. 21-14/85240).

Correcting errors when recognizing expenses for goods and materials

Let's consider the mechanism for generating expenses for KUDiR for purchased goods and materials. For a better understanding of the actions to correct the accounting of the simplified tax system, we will create a simple accounting situation.

First of all, we will deposit a founding contribution to the authorized capital of 10,000 rubles into the bank account.

We pay for goods and materials, for this we transfer an advance to the supplier in the amount of 4,720 rubles (of which 720 rubles are VAT). In this case, posting Dt 60.02 Kt 51 will be generated and the entire payment amount falls into column 6 “Total expenses” of KUDiR.

We make the receipt of paid item items, and divide the receipt into goods in the amount of 3 units. and we arrive at account 41.01 for resale and materials in the amount of 1 unit. to the account 10.01. to use for your own purposes. 1C Accounting will generate receipt entries, but only the payment for the purchased material will be included in the income and expense ledger.

The received items of goods were not included in KUDiR, since the settings for the simplified tax system indicate that in order to recognize expenses for purchased goods, events are necessary: purchase of goods, payment for them and sale. To recognize materials as expenses, a sufficient condition is the purchase of materials and payment for them:

Accordingly, the goods will go to KUDiR after sale. We will sell one unit of products out of three purchased, so that we can check the operation of the mechanism for recognizing expenses under the simplified tax system. We draw up a document for the sale of purchased products (by the way, if you need to display gross records in TORG 12, then read the publication Gross in TORG 12 for 1C Accounting 3.0).

Indeed, after registration of the sale, we see records of the consumption of one commodity unit in the entry in the book of income and expenses of the simplified tax system.

The example shows how the initial system settings affect the formation of entries in the book of income and expenses of the simplified tax system. That's why,

If you have not created records in KUDIR, then look at the settings for recognition events of expenses of the simplified tax system and check the entire path of movement of goods or materials - from purchase to sale or consumption in the organization.

This rule will apply if the entries do not appear in the Book at all after the events have been completed. But more often there are situations when expenses are recognized incorrectly.

Expenses for the acquisition of fixed assets and intangible assets

Expenses for the acquisition (creation) of fixed assets and intangible assets are reflected in section II of the book of accounting for income and expenses. This section is a table that consists of 16 columns.

In column 1, reflect the serial number of the operation.

In column 2, indicate the name of the fixed asset or intangible asset. Indicate the name in the same way as in the documents for the corresponding object (for example, in a technical passport, inventory card).

In column 3, enter the date, month and year of payment for the fixed asset or intangible asset. Fill out this column based on primary documents: payment orders or receipts for cash receipt orders.

Fill out Column 4 only if the fixed asset is subject to state registration. Indicate the date of submission of documents for state registration.

In column 5, indicate the day, month and year of commissioning of the fixed asset or intangible asset.

In column 6, reflect the initial cost of the fixed asset that was purchased or manufactured during the period of application of the simplification. In this case, reflect the initial cost of intangible assets that were manufactured during the period of application of the simplification in the reporting (tax) period in which one of the following events most recently occurred:

– acceptance of the object for accounting;

– payment (completion of payment) of expenses for the acquisition of an intangible asset.

Such rules are established in paragraph 3.10 of the Procedure approved by Order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n.

In column 7, indicate the useful life of fixed assets or intangible assets. If the objects were purchased (manufactured) and put into operation during the period of application of the simplification, then do not fill out this column.

In column 8, reflect the residual value of fixed assets and intangible assets before the transition to the simplified procedure.

In column 9, indicate the number of quarters during which the facility is operated in a given tax period.

In column 10, reflect the share of the cost of fixed assets or intangible assets that is accepted as expenses in the tax period.

In column 11, indicate the share of the cost of the object that is included in expenses in each quarter of the reporting (tax) period. It can be determined by dividing the data in column 10 by the data in column 9. Round the value of this indicator to the second decimal place.

In column 12, reflect the amount of expenses that is taken into account when calculating the tax base for the tax for each quarter of the tax period. If a fixed asset or intangible asset was acquired or manufactured during the period of application of the simplification, then this amount can be found by multiplying the values of columns 6 and 11 and dividing by 100.

If the organization acquired the objects before switching to the simplified system, then determine the value for column 12 by multiplying the indicators in columns 8 and 11 and dividing by 100.

In column 13, reflect the amount of expenses that is taken into account when calculating the tax base for the tax for the entire tax period. To do this, you need to multiply the indicator in column 12 by the indicator in column 9.

In column 14, indicate the amount of expenses that were taken into account for previous tax periods. You can view it in column 13 of the calculation for the previous year. If the objects were purchased (manufactured) and put into operation during the period of application of the simplification, then do not fill out this column.

In column 15, reflect the part of the expenses that are subject to write-off in subsequent tax periods. It can be determined by subtracting the indicators of columns 13 and 14 from the indicator in column 8. If the objects were acquired (manufactured) and put into operation during the period of application of the simplification, then do not fill out this column.

In column 16, indicate the day, month and year of disposal (sale) of the fixed asset or intangible asset.

Fill out the final line in this section only for columns 6, 8, 12–15.

How to fill out Section II is described in Section III of the Procedure, approved by Order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n.

Situation: how to reflect in the book of income and expenses the sale of a fixed asset that was previously written off due to moral (physical) depreciation? The organization applies simplification

In the accounting book, reflect only the proceeds from the sale of fixed assets.

The entire amount that the organization receives from the buyer for the sold fixed asset increases the tax base for the single tax (clause 1 of article 346.15, clause 1 of article 249 of the Tax Code of the Russian Federation). Therefore, it must be reflected in the accounting book as part of income (clause 2.4 of the Procedure approved by order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n).

Since the entire cost of the fixed asset has already been taken into account when calculating the single tax, no expenses arise for such an operation.

There is no need to recalculate the tax base for the single tax in connection with the sale of fixed assets. In this case, the moment of sale of the fixed asset was preceded by the moment of its write-off due to moral (physical) wear and tear. The write-off of a fixed asset due to its moral (physical) wear and tear is not recognized as either a sale or a transfer (Clause 1, Article 39 of the Tax Code of the Russian Federation, Article 224 of the Civil Code of the Russian Federation). Therefore, when selling such an object, do not recalculate the single tax when simplified (paragraph 14, clause 3, article 346.16 of the Tax Code of the Russian Federation).

Losses from previous years

Section III of the book of accounting for income and expenses is filled out by taxpayers who received a loss based on the results of previous tax periods (clause 4.1 of the Procedure approved by Order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n). For more information about transferring losses to the future, see How to write off a loss received during the period of application of the simplified tax system.

Insurance premiums, temporary disability benefits

Organizations that pay a single tax on income can reduce the amount of a single tax (advance payment for the reporting period) when simplified by the amount of a tax deduction, which includes three elements:

1) the amount of insurance premiums paid within the accrued amounts in the period for which the single tax was assessed (advance payment);

2) the amount of contributions under voluntary personal insurance contracts for employees in the event of their temporary disability. Include this type of expense as part of your tax deduction if the following conditions are met:

- contracts are concluded with insurance organizations that have valid licenses;

- the amounts of insurance payments provided for in the contracts do not exceed the amount of temporary disability benefits determined in accordance with Article 7 of the Law of December 29, 2006 No. 255-FZ;

3) the amount of hospital benefits paid at the expense of the organization’s funds for the first three days of incapacity for work. But only to the extent not covered by insurance payments, and under the contracts specified in paragraph 2.

This procedure is provided for in paragraph 3.1 of Article 346.21 of the Tax Code of the Russian Federation.

Section IV is intended for calculating tax deductions in the book of income and expenses. The rules for filling out this section are established in Section V of the Procedure, approved by Order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n.

Compensation for damage

Situation: how to reflect in the book of income and expenses the amount of damage caused as a result of theft, as well as the amount of compensation for damage received from the thieves? The organization applies simplification

Record only the amount of compensation for damage in the accounting book.

The amount of compensation for damage received from the offender is recognized as non-operating income and taken into account when calculating the single tax (clause 1 of Article 346.15, clause 3 of Article 250 of the Tax Code of the Russian Federation). In the book of income and expenses, reflect this amount as part of income on the date of receipt of money to the account or cash desk (clause 1 of Article 346.17 of the Tax Code of the Russian Federation, clause 2.4 of the Procedure approved by order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n).

The cost of stolen property cannot be taken into account when calculating tax, even if you pay a single tax on the difference between income and expenses. This is explained by the fact that the list of expenses that reduce the tax base for the single tax is closed (clause 1 of Article 346.16 of the Tax Code of the Russian Federation). But property damage caused to the organization as a result of theft is not included in this list.

Similar explanations are contained in letters of the Ministry of Finance of Russia dated December 18, 2007 No. 03-11-05/303, Federal Tax Service of Russia for Moscow dated May 30, 2005 No. 18-11/3/38165.