Every commercial enterprise strives to make money in its activities. Two terms are inextricably linked with the desire to work “plus” - “income accounting” and “expense accounting”. Today we will talk about accounting accounts for these terms.

If you look through the entire chart of accounts, you can find accounts that collect information about the activities of the enterprise for the concepts of Income and Expenses.

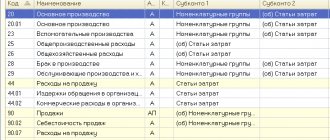

I suggest you complete this task yourself. We will need a chart of accounts. We will take the chart of accounts from the 1C Accounting programs. We will get used to how it looks, since we will practice our skills using 1C programs. .

Review the chart of accounts and write down all the accounts that you could attribute:

- to Revenue

- to Expenses

From the chart of accounts, select only group accounts; you do not need specific subaccounts. Once you complete this task, read on. Compare with what I chose.

Income and expenses

All facts of the economic life of an enterprise reflected in accounting are made up of two groups - income and expenses.

Income and expenses are those facts of economic life that affect the financial result of the economic activity of an enterprise. They can be considered and interpreted from economic, legal and purely accounting points of view.

Economic interpretation

From an economic point of view, income is the receipt of funds at the disposal (economic turnover) of an enterprise.

Funds are what in accounting is included in the concept of assets - property that can participate in the business operations of an enterprise, bringing it profit, which is interpreted as an increase in the volume of funds of the company. The ability to dispose of funds in this case does not mean a real right of disposal, which creates the right of ownership, but the ability to use funds in one’s economic activity (economic turnover). Thus, by receiving equipment for rent, an enterprise can produce products on it in the same way as on equipment owned by it. Hence, from this point of view, rented equipment is completely equivalent to own equipment. In other words, from an economic point of view, income is any fact that an asset increases. And the first income that an enterprise receives is the founders’ contributions to its authorized capital.

Further, from an economic point of view, any increase in an asset associated with an increase in accounts payable is recognized as income. It is no coincidence that Eugen Schmalenbach (1873-1955) defined accounts payable as the income of an enterprise that has not yet become expenses. And even earlier - F.V. Yezersky (1836-1916) fully included all accounts payable in the credit of the Capital account, interpreting the occurrence of debt as an increase in the funds at the disposal of the company.

An expense, in an economic interpretation, is any disposal of funds (assets) from the disposal of an enterprise, i.e. an expense is a decrease in an asset.

At the same time, it is absolutely not important here as a result of what operations such a decrease occurs. Funds are withdrawn from economic circulation and this is already enough to recognize this fact as an expense. Thus, from an economic point of view, the sale of goods, works or services of an enterprise and the incurrence of buyer debt before payment is nothing more than an expense. The enterprise transfers goods into the ownership of the buyer (the volume of the enterprise's funds decreases), but does not receive money in return until a certain time. Hence, in this situation, from an economic point of view, this is an expense (goods are given), but there is no income (no money is received).

Legal interpretation

From a legal point of view, income is recognized as the receipt of tangible assets or intangible property (intellectual property), as well as the occurrence of obligations of debtors that are not related to the occurrence of obligations to creditors.

In other words, from a legal point of view, income is the emergence of an enterprise’s rights to something that is not associated with the loss of similar rights or the emergence of obligations.

This definition is based primarily on two concepts: property and liabilities. Property should be understood as objects of civil rights, which include things, including money and securities, other objects, including property rights; works and services, information; results of intellectual activity, including exclusive rights to them (intellectual property); intangible benefits (Article 128 of the Civil Code of the Russian Federation).

By analogy, from a legal point of view, expenses are defined as the disposal of tangible assets or intangible property (intellectual property), as well as the occurrence of obligations to creditors, not related to the occurrence of obligations of debtors to the enterprise.

Thus, from a legal point of view, what matters is not the actual movement of funds in the economic circulation of an enterprise, but the dynamics of its rights and obligations associated with these funds.

Hence, if from an economic point of view, the sale of goods before receiving payment from buyers is an expense - a diversion of funds from economic turnover, then from a legal point of view this fact means receiving income in the form of the buyer’s obligation to pay money.

Accounting treatment

The accounting definition of income and expenses is aimed at revealing the ways they are reflected in accounting and demonstrating data about them in the financial statements of the enterprise. It is based on a synthesis of economic and legal interpretations of income and expenses. The procedure for their official accounting is currently determined by PBU 9/99 “Income of the organization” and PBU 10/99 “Expenses of the organization.”

The central point of the definitions of income and expenses in PBU is their impact on the amount of the company’s capital (own sources of funds). The change in the capital of an enterprise as a result of accounting for the facts of economic life, defined as income and expenses, is determined by the amount of profit or loss reflected in the accounting (the difference between income and expenses). Hence, one way or another, the accounting of income and expenses of an enterprise is subordinated to the goal of determining the financial result of its activities (profit or loss). This makes it possible to give accounting definitions of income and expenses that are somewhat more simplified than those given by PBU, according to which income is understood as an accounting assessment of the facts of economic life that increase the financial result of the enterprise, and expenses reduce its financial result.

The main task of accounting for income and expenses is to determine their values, which should be presented in the financial statements. But this particular task is considered one of the most difficult in economics. Its solution goes through three stages: selection of facts of economic life, identified as income and expenses, i.e. determining the moment of occurrence (recognition) of income and expenses; assignment of income and expenses to the reporting periods for which the financial result is calculated; assessment of income and expenses.

Cost classification

The main accounting costs are grouped by economic content in accordance with the following elements:

- material costs;

- salary expenses;

- accrual of extrabudgetary funds;

- depreciation;

- other expenses.

Other costs include:

- salary costs for managers;

- operation of machines and areas;

- travel expenses of employees;

- expenses for communications, audit, information services, security services;

- entertainment expenses;

- costs of selling goods;

- taxes.

Expenses incurred by an enterprise in connection with the production of goods, provision of services or performance of work are reflected and included in the cost of goods, services or work of the reporting period to which they relate, regardless of the time of their payment.

In terms of cost, the following types of costs exist:

- Direct costs that are directly associated with the production of a specific product.

- Indirect - costs for administrative salaries, general production and general business. Costs of this type are associated with the production of several types of goods and must be distributed between product positions in proportion to a certain indicator.

Regarding the process:

- basic;

- invoices.

Regarding production volume:

- permanent;

- variables.

Determining the moment of occurrence (recognition) of income and expenses

Solving the first problem involves answering the question: at what point can we say that the enterprise has received income or incurred expenses?

Example

On February 20, the company enters into an agreement with the client to carry out repair work; on March 18, the completed work is handed over, and an act of acceptance by the client is signed. On April 19, the client transfers money to the company’s current account. The question arises: at what point does income arise, that is, at what point can it be considered received? The answer to this is that any of the three named dates has a reason to be chosen.

Origination (recognition) of income at the time of conclusion of the contract . We can say that income arises from the moment the enterprise enters into an agreement with the client. Firstly, the very fact of concluding a contract generally shows that the likelihood of performing work in the future and receiving revenue is much greater than the likelihood of terminating the transaction. The prices of concluded contracts actually form the sales plan of the enterprise for the periods specified in them. Moreover, the implementation of such a plan, in contrast to purely economic targets, is ensured by established legal liability for failure to fulfill the contract. Moreover, the amount of such liability may exceed the transaction price.

The occurrence (recognition) of income at the time of execution of the contract . We can recognize income from the performance of work as received at the time of signing the act, i.e. at the time of execution of the concluded contract by the contractor. In fact, from the moment the customer signs the act, he formally acknowledges that the work was completed by the contractor in full and in accordance with the contract. Thus, his obligation takes on the nature of a debt, i.e. an unconditional obligation to pay the contractor the transaction price. Until the work was accepted, the customer's obligation to pay money was made conditional on the contractor's fulfillment of the obligation to complete the work. Now that this condition has been fulfilled, payment of the debt by the customer depends only on his will regarding compliance with the terms of the transaction. Failure by the customer to fulfill his obligation will entail his liability, which in general is much more serious than for termination of a contract that has not yet begun to be executed. This is where the right of claim of the contractor against the buyer of the work arises, the amount of which there is every reason to consider as income received.

At the same time, repayment of the customer’s debt depends on his expression of will, which also makes in this case the income from the sale of works in money only a probabilistic value. The ability to sell his debt under an assignment transaction also depends on the integrity of the customer. At the same time, even if the assignment takes place, the proceeds from the sale of the debt will be significantly less than its face value. Hence, as a matter of prudence, we cannot recognize the buyer's debt as income. Moreover, from an economic point of view, an enterprise’s receivables are not income, but, on the contrary, diverted funds withdrawn from the company’s turnover and given to its counterparties for use. And if the debt is not repaid, its amount will turn from income into losses of the company.

The occurrence (recognition) of income at the time of receipt of money . The moment of recognition of income from performing work under a contract can also be determined immediately when money is received from the customer. Only after the customer pays off the debt can we reliably say how much the completed transaction increased the amount of funds of the selling company, i.e., what was the income of the enterprise. This approach fully complies with and is justified by the requirement of prudence. Based on this, the very fact of performing work should not be recognized as receiving income. It should be noted that this approach to the interpretation of expenses significantly reduces the ability of the user of accounting information to assess the prospects for the existence of the enterprise. The fact is that in this case, from the accounting data, we cannot see not only the boundaries of the planned development of activities, but even the volumes of future financial flows due to already executed transactions. Here we are faced with the so-called “sealed windshield effect”, when the user of financial statements is likened to the driver of a car whose windshield is sealed and only the rear-view mirrors are left in front of him. In this case, the driver sees what happened “yesterday”, but does not see not only what is supposed to happen “tomorrow”, but also what is happening “now”.

Similarly, the issue of recognizing the fact of economic life as determining the amount of the financial result also applies to accounting for expenses.

The occurrence (recognition) of expenses at the time of conclusion of the contract . For example, an enterprise enters into an agreement for the purchase of goods, the price of which represents its expenses to support its activities. The fact of concluding a contract, as determining the volume of future cash payments to the supplier, can already be recognized as an expense of the organization. At the same time, this approach will significantly expand the time frame of accounting information, since from the accounting data we will be able to find out a legally confirmed cash flow plan.

The occurrence (recognition) of expenses at the time of execution of the contract . Expenses for the purchase of goods can be recorded in accounting after the execution of the contract by the supplier, i.e. from the moment the buyer’s obligation under the contract acquires the nature of an unconditional debt. In this case, no accounting entries are made before the goods arrive.

The occurrence (recognition) of expenses at the time of repayment of obligations . The moment the money is transferred to the supplier can be considered the moment expenses are incurred (recognized). It should be noted here that, from an economic point of view, the latter approach does not make it possible to demonstrate, using accounting data, the amount of credit that the buyer receives from the supplier for the period from the moment of purchase of goods to the moment of payment.

Each of the considered approaches to determining the moment of occurrence (recognition) in accounting for income and expenses contains both positive and negative aspects. Regulatory documents governing accounting practices choose one from all possible options. This does not mean that it is better or worse than others, just that for a certain period of time the legislator makes one of three possible decisions, and it becomes the accounting norm. In management accounting, such a choice should be determined by the information needs of reporting users.

Tax accounting

When it comes to tax accounting, costs include economically justified and expressed costs. They can be expressed in cash. Only funds that were spent on generating income from the operation of the company are taken into account.

Accounting and tax accounting of costs are closely interrelated with each other, but they also have differences. Tax accounting involves a number of points that must be known in advance. An entrepreneur should pay attention to the following nuances in advance:

- features of debt transfer to a third party;

- introduction of the netting procedure;

- settlement using an account;

- calculation of accepted obligations;

- recognition of income when paying the simplified tax system.

In controversial situations, the entrepreneur must be guided by the provisions of the current legislation.

The period during which material costs are reflected in tax accounting for the accrual method is specified in paragraph 2 of Art. 272 of the Tax Code of the Russian Federation. It depends on the type of material costs.

Thus, the cost of raw materials and supplies related to manufactured goods is recognized as an expense on the date such a resource is transferred to production.

In the cash method, in order to recognize material costs, in addition to the supply of materials for production or the signing of an act, such costs must be paid in some way (cash or non-cash).

Requirements of current regulatory documents

Nowadays, in regulatory documents, the recognition of income and expenses is associated with the principle of temporary certainty of the facts of economic life. This principle is defined in paragraph 6 of PBU 1/98, according to which “the facts of the organization’s economic activities relate to the reporting period in which they occurred, regardless of the actual time of receipt or payment of funds associated with these facts.” This is the second option according to our classification. It means that income arises (recognizes) not when the money is received, but when the right to demand it arises; accordingly, an expense is generated not when the money is paid, but when the obligation to pay it arises.

According to paragraph 12 of PBU 9/99, revenue as income from core activities arises (recognizes) in accounting if the following conditions are met:

a) the enterprise has the right to receive this revenue arising from a specific contract or otherwise confirmed in an appropriate manner; b) the amount of revenue can be determined; c) there is certainty that an increase in economic benefits will result, which is the case when the entity received an asset in payment, or there is no uncertainty about its receipt; d) ownership of the product (goods) has passed to the buyer or the work has been accepted by the customer; e) expenses associated with this fact of economic life can be determined.

By analogy with the considered rules for recognizing income, PBU 10/99 defines the criteria for recognizing expenses in accounting. According to paragraph 16 of PBU 10/99, expenses are recognized in accounting if the following conditions are met:

a) the expense arises in accordance with a specific contract, the requirements of legislative and regulatory acts, and business customs; b) the amount of expenditure can be determined; c) there is confidence that as a result there will be a decrease in economic benefits for the payer. This certainty occurs when the payer has transferred the asset, or there is no uncertainty regarding its transfer.

Cost concept

In domestic and foreign scientific journals, the rules often use three concepts, the differences of which are not strictly defined. These are the concepts of costs, expenses and expenses.

Modern theory and practice provide many definitions of costs. Thus, a number of experts present costs as an economic interpretation that expresses the totality of all resources in the field of inventories, labor and finance, the consumption of which is associated with the production process.

M.A. Vakhrushina characterizes costs as a monetary estimate of the volume of resources used for any purpose. Other authors understand the total flow of funds associated with assets if they are capable of generating future income or liabilities. If this does not happen, then the undistributed profit of the enterprise is determined as costs for a specified period.

In the economic encyclopedia, costs are interpreted as the monetary expression of the value of economic resources expended when a business entity performs an activity.

The interpretation of the concept of “costs” is also ambiguous. To understand how accounting systems calculate costs and effectively communicate accounting information to stakeholders, it is necessary to have a clear understanding of what the term “cost” means in each case. It has many meanings and is used differently in different situations.

Costs represent an assessment in monetary terms of all resources in relation to finance, labor and materials, information that are associated with the organization of the production process and sales characteristics over a period of time. The main cost characteristics are as follows:

- monetary valuation of various types of resources, providing a principle for their measurement;

- a target setting that is associated with the production and sale of products in general or at one of its stages;

- the period of time that must be attributed to the production of products.

It should be noted that if costs are not related to production and are not written off (not completely written off) to this product, then they become inventory in warehouses in the form of raw materials, materials, etc.

We can say that costs have the property of reserve capacity; in this regard, they can be attributed to the company’s assets. The main cost features are:

- dynamism;

- manifold;

- difficulties in measurement and evaluation;

- complexity and inconsistency of impact on economic results.

Attribution of income and expenses to reporting periods

The procedure for distributing income and expenses over reporting periods is formed by the accounting principle of compliance, according to which expenses should reduce the profit of the reporting period in which, thanks to these expenses, the enterprise received income.

In each reporting period, there are facts of economic life that are qualified in accounting as income and expenses of the enterprise. But not all of these facts can be defined as expenses and income related to the reporting period in which they occurred. This is explained quite simply using the example of depreciation. So, for example, a factory buys equipment. The fact of purchasing this equipment represents an expense that can be estimated in the amount of the price of the supply contract. This expense will be recognized and reflected in the accounting records of the reporting period in which the equipment becomes the property of the enterprise. However, the enterprise bears the costs of purchasing equipment in order to produce products on it in the future, sell it and receive revenue - income. Consequently, the costs of purchasing equipment should presumably be recouped in the reporting period in which the products made on it will be sold. Further, since the products will be produced over a number of reporting periods, the costs in the amount of the purchase price of the equipment must be distributed in a certain way in relation to the periods during which they will be repaid.

The task of correlating the facts of the economic life of an enterprise with the reporting periods, the financial results of which they form, determines the methodology for accounting income and expenses.

The currently implemented approach to reflecting income and expenses in financial statements originates from the theory of dynamic balance by E. Schmalenbach. The balance sheet here is considered as a consequence of the accounting interpretation of the company's income and expenses. At the same time, the elements of the balance sheet represent a reflection of the stages of capital movement of the enterprise. An asset represents expenses that have not yet taken part in the formation of financial results (expenses that have not yet become income, that is, have not generated income). Liability demonstrates the profit received by the enterprise (income minus expenses) and accounts payable - funds received by the enterprise, credit, that is, income that has not yet become expenses (funds received that will need to be paid back in the future).

Like any scientific theory, the theory of dynamic balance is falsifiable, that is, it has certain boundaries. This logical structure does not include cash and cash equivalents (accounts receivable) reflected in the asset, that is, monetary assets.

Here we are faced with the most important paradox of the content of the balance sheet: it simultaneously reflects the items valued in money and the money itself, that is, it combines what is measured and the meter itself. At the same time, the reflection of income and expenses in the balance sheet represents the transformation of monetary items into non-monetary items and vice versa. Regarding the influence of accounting entries on the contents of the organization’s balance sheet, here we can distinguish three types of entries:

1) capitalization - the primary reflection of the amounts of income and/or expenses in the balance sheet; 2) recapitalization - the formation of new balance sheet items at the expense of previously reflected amounts of income and/or expenses; 3) decapitalization - writing off income and/or expenses from the balance sheet.

This classification creates six types of accounting records, which can be summarized in the following table 1.

Table 1

| Expenses | Income | |

| Capitalization | 1 | 4 |

| Recapitalization | 2 | 5 |

| Decapitalization | 3 | 6 |

Quadrant 1 is the capitalization of expenses. Capitalization of expenses is the transformation of monetary items into non-monetary ones. For example, we buy materials for making products. The purchase of materials is an expense of cash, or real - in this case, the purchase of materials will be reflected in the entry:

Debit 10 “Materials” Credit 51 “Current accounts”

Or potential - in the form of emerging accounts payable:

Debit 10 “Materials” Credit account 60 “Settlements with suppliers and contractors”

The enterprise incurred these expenses in order to generate income, but the expenses for the purchase of materials will bring income to the enterprise and, therefore, will take part in the calculation of the financial result in the reporting period in which the products made from them will be sold. Until this point, expenses are capitalized and reflected as assets on the balance sheet. Consequently, if expenses are capitalized, they do not reduce the financial result of the current reporting period; these are expenses of future periods, in Schmalenbach’s terminology - expenses that have not yet become income.

Quadrant 2 is the recapitalization of expenses. This is the transformation of one non-monetary asset item into another. Recapitalization of expenses is the movement of their amounts across an asset, that is, the formation of new asset items from previously recorded expenses. In our case, reflecting the manufacture and release of products from purchased materials, we form items of work in progress and finished goods in the warehouse using the fixed amounts of expenses for the purchase of materials. Entries are made on the debit of account 20 “Main production” and the credit of account 10 “Materials” and on the debit of account 43 “Finished products” and the credit of account 20 “Main production”.

Recapitalized expense amounts remain in the asset. They do not participate in the calculation of financial results. From here we can draw a general conclusion: while keeping the company's income constant, the greater the amount of expenses capitalized and recapitalized, the greater the financial result (more profit and less loss).

Squares 3 and 4 should be considered together. These are records for decapitalization of expenses, that is, writing them off from the balance sheet, and capitalization of income, that is, reflecting them on the balance sheet. These are facts of transformation of non-monetary items into monetary ones, implying the receipt of a financial result: profit or loss. So, sold products are written off by recording the debit of account 90 “Sales” and the credit of account 43 “Finished products”. With this entry, previously capitalized amounts of expenses for the purchase of materials are written off from the balance sheet and take part in the calculation of the financial result from sales. The amount of income received is capitalized by an entry in the debit of account 51 “Settlements” or account 62 “Settlements with buyers and customers” and the credit of account 90 “Sales”. In this case, the amount of the obtained financial result by entry in the debit of account 90 “Sales” and the credit of account 99 “Profits and losses” is capitalized in the liabilities side of the balance sheet*.

Note:

* Currently, according to the regulatory documents in force in Russia, the amount of profit received is capitalized in liabilities only after the reformation procedure (ed.).

The greater the amount of income capitalized in the asset, the greater the financial result. The larger the amount of decapitalized expenses, the lower the financial result.

We looked at squares 3 and 4 together. However, they can also be considered separately. It is possible to decapitalize expenses without capitalizing income (square 3), for example, when reflecting losses of inventory (debit to account 99 “Profits and losses”, credit to account 10 “Materials”). This is also the transformation of non-monetary items into monetary ones only with the sign “0”. It is possible to capitalize income, which does not imply simultaneous decapitalization of expenses, for example, reflecting a trade margin by an entry in the debit of account 41 “Goods” and the credit of account 42 “Trade margin”. In this case, this is also the transformation of a non-monetary item into a monetary one, since the goods account in this case begins to reflect the potential receivables of customers - the future revenue of the enterprise.

Square 5 - recapitalization of income - formation of new balance sheet items at the expense of previously reflected amounts of income - transformation of some monetary balance sheet items into others. Recapitalization of income can take place in both assets and liabilities of the balance sheet. Active recapitalization of income, for example, includes reflecting the repayment of their obligations by debtors. Thus, the receipt of money from buyers of products will be reflected by an entry in the debit of account 51 “Current accounts” and the credit of account 62 “Settlements with buyers and customers.” Recapitalization of liabilities takes place, for example, when accrual of dividends is reflected by an entry in the debit of account 84 “Retained earnings, uncovered loss” and the credit of account 75 “Settlements with founders”.

Square 6 is the recapitalization of income - writing off previously recorded income from the balance sheet. This is a reduction in the volume of monetary items, which does not imply their transformation into non-monetary ones. This, for example, may include paying off accounts payable.

This approach assumes a broader interpretation of the concepts of “income” and “expenses”, within which income is understood as any fact of receiving money, and expense is any fact of paying money.

Reflection of the company's income and expenses at the stages we have identified: capitalization, recapitalization and decapitalization determines the picture of the financial position of the enterprise, reflected in its financial statements. Thus, the greater the volume of decapitalized expenses, the lower the reported profit. On the contrary, an increase in the capitalization of expenses leads to an increase in accounting profit. Recapitalization of expenses from non-current assets to current ones (for example, by charging depreciation) leads to an increase in the company's solvency indicators. In turn, the content of accounting information determines its perception by users of reporting and their adoption of management decisions.

The accountant gets the opportunity to influence the amounts of capitalization, recapitalization and decapitalization of expenses through accounting and contractual policies. Thus, by implementing accounting and contractual policies, we actually model financial statements, influencing the opinions and management decisions of its users. (For more information about this, see the article “Modeling the financial position of an organization.”

Organization of production cost accounting

To collect costs for the production of goods, provision of services or implementation of work, use the “Production Costs” section of the chart of accounts.

Grouping of costs in this section is most often carried out using the following settlement accounts: 20, 23, 25, 26, 28.

Account 20 and production cost accounting is used to collect data on the costs of producing goods, services or work, which, in turn, were the purpose of creating a company.

This account records both direct costs determined by the production process and those included in the cost price, as well as indirect costs associated with managing and maintaining production.

Analytical accounting on this account is carried out for certain types of products.

Indirect costs are associated with several types of products. They are distributed in proportion to the approved indicator. Costs are paid according to standard (planned) or actual production costs.

Account 23 “Auxiliary production” reflects costs that are auxiliary to the main production (maintenance of operating systems, provision of heat, electricity, etc.).

Analytical accounting in this account refers to the type of production. Fees are written off to account 20 or to the cost of a specific product in the form of direct costs or distributed between individual types of goods in proportion to the selected indicator.

Account 25 “General production expenses” groups the costs of servicing main and auxiliary production enterprises. Among the expenses that are taken into account in this account may be payments for insurance of production machines, the cost of servicing these machines, the cost of renting production space and equipment, and others.

Analytical accounting of the account is carried out by individual business units and expense items. At enterprises where homogeneous goods are produced, and expenses are not distributed, they are subject to write-off to the debit of account 20. At enterprises producing different goods, expenses are subject to distribution between the types of goods produced. Expenses are written off to the debit of accounts 20, 23, 29. Account 25 has no balance at the end of the reporting period.

Account 26 “General expenses” groups those expenses that are not directly related to production processes and are not related to management needs. For example, salaries of managers, accounting, depreciation of property that the administration uses in its activities, rental payments in premises for administration, etc.

Analytical accounting is carried out according to budget items and place of origin. Write-off of expenses collected during the month is carried out depending on the chosen method of forming the cost of production. When an accountant chooses the method of accounting for the full cost of production, expenses are written off using accounting entries Dt20-Kt26, Dt23-Kt26, Dt20-Kt26. If you choose to record products at a reduced price, the contents of account 26 are charged directly to account 90-2.

Estimation of income and expenses

The ability to choose methods for assessing income and expenses, first of all, depends on determining the moment of their occurrence (recognition) in accounting. So, for example, a contract for the performance of work is concluded for 100,000 rubles. During the execution of the contract, the scope of work to be performed is specified. As a result, the act is signed for 90,000 rubles. Subsequently, the parties enter into an additional agreement to the contract on the provision of a commercial loan by the customer to the contractor, as a result of which by the time the debt is repaid, its amount increases to 105,000 rubles. Thus, if the timing of recognition of income is determined by the conclusion of the contract, income will be measured at 100,000, and subsequent changes in this amount to 90,000 and 105,000 will be recorded as additional losses (10,000) and profits (15,000). If income is reflected (recognized) in accounting after the contract is executed by the contractor, income is estimated at 90,000, and in the future, a change in its value to 105,000 will be recorded as profit. And finally, in the case where the only basis for recognizing income is the receipt of money from the customer, the amount of income reflected in the accounting records will be 105,000 rubles.

The variety of options existing in theory for assessing income and expenses in the practice of official accounting is limited by the requirements of regulations, which, from the entire range of possible solutions, choose one method or a specified number of them.

Accounting Recommendations

The organization of cost accounting in different industries is characterized by its own characteristics. They are related to the conditions of a specific industry. Ministries have developed sectoral cost accounting guidelines. These recommendations detail and clarify the provisions of federal and industry cost accounting rules for the production of a particular industry.

In recommendations for cost accounting in a specific industry, an economic entity finds its own classification of methods and methods for cost accounting, forms of source documents for their accounting, cost distribution schemes, nomenclature of cost items and principles for calculating the cost of various products.

Results

The procedure for reflecting income and expenses in official accounting is determined by the requirements of regulatory documents. But even here, with the help of accounting policies, the accountant can, reflecting income and expenses using one of the possible methods, model the picture of the company’s financial position presented in external financial statements. In management accounting, the choice of methods for assessing income and expenses, their recognition and distribution over reporting periods should be determined by the information needs of reporting users. Moreover, this choice may not be limited to one of the possible options.

Accounting: optional and desirable

Note that individual entrepreneurs, based on the current requirements of Russian legislation, may not create accounting records. However, in practice, many entrepreneurs do it, since the noted forms of accounting, when compiled correctly, can be an extremely valuable source of data reflecting the effectiveness of the development of the enterprise. In turn, for business companies, the formation of accounting is an obligation predetermined by the provisions of the sources of law. However, the value of such activities, as we noted above, is also significant from the point of view of business development.

Improving accounting

To obtain useful data that allows you to make decisions and plan, production costs should be systematized in several ways:

- expenses for future periods;

- unreimbursable expenses;

- opportunity costs when making alternative decisions;

- incremental and marginal costs;

- dynamic costs in relation to the volume of industrial goods.

In order to improve the accounting of production costs in companies, it is advisable to separate cost accounting in accounting, management and financial accounting. These areas of activity have many differences from each other, although at first glance they concern the same issues.

It is also worth introducing methods for approving the final financial results of “input-output” and the use of foreign classifications of production costs. Foreign classification methods are more accurate and understandable.

When accounting for costs of services, established recommendations should be followed.

It is necessary to use current accounting records when making entries, as well as methods that allow the records to be kept in as simple a form as possible.