A company faced with temporary disability of an employee is obliged to pay him sick leave due by law. These expenses are subject to compensation from the Social Insurance Fund.

The accounting department of the enterprise must collect documents on the basis of which the fund will reimburse the expenses incurred. Their list has changed since 2021. This is due to the transfer of control functions related to the payment of contributions to tax inspectorates. Let's figure out what documents are needed to apply for sick leave and receive compensation from the Social Insurance Fund.

As in previous years, their composition was established by order of the Ministry of Health and Social Development dated December 4, 2009 N 951n. The employer must be guided by the version that takes into account the changes dated October 28, 2016 (Order of the Ministry of Labor N 585n). The list of documents for compensation for sick leave in the Social Insurance Fund is indicated in the appendix to Order No. 951n.

What is a pilot project

A pilot project is an experiment in which the Russian Social Insurance Fund directly pays social benefits without the participation of employers. Also, as part of the pilot project, the foundation, at its own expense, finances expenses for the prevention of injuries and occupational diseases. Contributions for “injuries” are not included in the financing.

For 2021, the experiment of the social insurance fund is being tested on itself (see table).

| Type of region of the Russian Federation | Participants in the FSS experiment |

| Republic | Crimea |

| Karachay-Cherkessia | |

| Tatarstan | |

| edge | Khabarovsk |

| Regions | Astrakhan |

| Belgorodskaya | |

| Kurganskaya | |

| Nizhny Novgorod | |

| Novgorodskaya | |

| Novosibirsk | |

| Rostov | |

| Samara | |

| Tambovskaya | |

| Sevastopol | |

| From July 1, 2021 | |

| Republic | Mordovia |

| Regions | Bryansk |

| Kaliningradskaya | |

| Kaluzhskaya | |

| Lipetskaya | |

| Ulyanovskaya | |

Sequence of work with the gateway

The procedure for working with the gateway is simple and accessible. Before starting to send electronic documents, the organization takes a number of sequential actions:

- Registration on the FSS website.

- Applying to the FSS body for an assignment of expanded rights to use the portal and obtaining such rights.

- Download the necessary software on the FSS website.

- Installation of the Foundation certification authority certificate.

- Installing a certificate from the organization's certification authority.

- Preparation of calculations in an accounting program or on the Social Insurance Fund website.

- Using digital signature to sign a file.

- Sending a report through the gateway.

- Receipt of receipts and FSS protocols until the successful acceptance of the report by the Fund. Correcting errors - if necessary.

Let us remind you! The deadline for submitting electronic reports is until the 25th day of the month following the reporting quarter, and on paper – similarly until the 20th day.

How sick leave is assigned as part of a pilot project

In order for an employee to receive the sick leave benefits due to him as part of the pilot project, he still submits all the necessary documents to his employer. If the employee’s disability is not related to an industrial accident, he submits to the employer:

Articles on the topic (click to view)

- Is sick leave considered income?

- What to do if you have extended sick leave for pregnancy and childbirth

- What to do if your employer does not accept electronic sick leave

- What to do if you are not given sick leave

- How many days does it take for sick leave to arrive from the Social Insurance Fund?

- What to do if the place of work is not indicated on the sick leave

- Are sick leave taken into account when calculating maternity leave?

- application for payment of benefits in the form approved by order of the Federal Social Insurance Fund of Russia dated September 17, 2012 No. 335;

- certificate of incapacity for work;

- certificates of earnings from previous places of work for the pay period, if they have not been submitted previously.

The employer must submit the received documents within five calendar days to the branch of the Federal Social Insurance Fund of Russia at the place of his registration. Attached to them is an inventory of the documents being transferred in accordance with the form from the order of the Federal Social Insurance Fund of Russia dated September 17, 2012 No. 335.

The FSS branch of Russia reviews the documents within 10 calendar days and makes a decision on payment of benefits or refusal. If the decision has a “plus” sign, then the money is sent to the employee’s bank account using the details that he noted in his application.

It is worth keeping in mind that the Social Insurance Fund pays disability benefits in the usual manner. That is, starting from the fourth day of sick leave, benefits are paid to the employee for the period of his temporary illness not by the employer, but directly by the Social Insurance Fund. In this case, the employer must pay the subordinate for the first three days at his own expense.

Help-calculation

Documents for sick leave compensation in the Social Insurance Fund since 2021 have been supplemented with a calculation certificate. It is an appendix to the application and its form is also approved by the FSS letter N 02-09-11/04-03-27029 dated December 7, 2016. An enterprise applying for reimbursement of expenses must indicate the following in the document:

- data on the enterprise’s debt to the Social Insurance Fund at the beginning and end of the billing period;

- information on calculated insurance premiums for the previous 3 months;

- information on the amount of additional charges made;

- data on the amount of expenses that were not accepted;

- information on the amount of compensation received from the Social Insurance Fund;

- the amount of overpayments on contributions that were returned and (or) offset in subsequent periods;

- expenses for compulsory social insurance, including payments for the previous 3 months;

- information about debt that has been written off.

This document is drawn up if it is necessary to reimburse expenses incurred in periods starting from January 1, 2021.

For information on new documents when applying to the Social Insurance Fund for compensation, see the following video

How to fill out sick leave for a pilot project

The organization whose employee received sick leave fills out only the continuation of the form - its second part. Registration of the first is the responsibility of the specialist of the medical institution that issued the document.

This is important to know: Hiring while on sick leave

Also see “How to fill out sick leave for an employer: sample.” So, first, the form contains information about the company - its name. Then they note whether this is the person’s main place of work or whether he is employed here part-time. Below on the form of the certificate of incapacity for work indicate the tax registration number and subordination code. After this comes information about the employee such as TIN and SNILS.

Next, you will need to indicate the person’s work experience. Below are the start and end dates of the employee’s period of disability. To calculate the amount of benefits, his average and daily earnings are also indicated.

Expert opinion

Lebedev Sergey Fedorovich

Practitioner lawyer with 7 years of experience. Specialization: civil law. Extensive experience in defense in court.

After this, the amounts that should be accrued to the sick person by his employer and the Social Insurance Fund are given. Below they are summed up and the total amount of benefits that will be paid to the person for the period of his illness is displayed.

Be sure to indicate the surnames and initials of the head of the company, as well as the accountant or HR employee who filled out the sick leave. These persons put their signatures in the lower right corner.

How to provide documents electronically

The procedure for electronic data exchange is established in the Specification approved by the Foundation on October 19, 2017. Data exchange occurs through the FSS Gateway of the Russian Federation https://docs.fss.ru.

To provide documents in electronic format, an electronic digital signature (EDS) of an authorized person of the organization is required. An electronic digital signature used for signing and sending reports to the Federal Tax Service is suitable.

Registries are transmitted in XML format. You can prepare electronic documents using free software developed by the Foundation’s specialists or third-party software. You can download the free software here: https://fss.ru/ru/fund/download/index.shtml.

Once the registry is prepared, it must be signed and encrypted before it can be sent. If the Foundation’s free software is used or the organization’s software does not provide for signing an electronic digital signature, then additionally download and install the “Signing and Encryption of Documents” program from https://fss.ru/ru/fund/download/index.shtml.

The generated, signed and encrypted register, as well as other documents, are sent to the Social Insurance Fund through the “Send Document” Gateway service.

Once the download of the necessary files is completed, the system will display the message “Download successful.”

After sending is completed, information about further processing can be tracked on the Gateway service “Information about transmitted documents.” To do this, just fill out the registration number of the organization in the Social Insurance Fund and the period of interest.

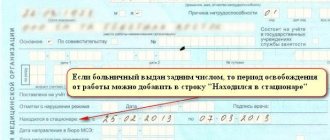

Nuances of entering data

As has already become clear from the above, the pilot project does not affect the filling out of sick leave by the employer . However, it will be useful for employees who are delegated to issue temporary disability certificates in the organization to refresh their memory of some of the nuances associated with this professional task.

Pen and ink

According to paragraph 65 of the Procedure, approved by order of the Ministry of Health and Social Development of Russia No. 624n, filling must be done exclusively with a gel, fountain or capillary pen. It is prohibited to use ballpoint pens for these purposes. Ink can only be black.

High tech

Letters

Information about the organization and the employee is entered into the sick leave form exclusively in capital Russian letters. If the company name contains foreign elements, their combinations, as well as abbreviations, they should not be changed into Russian.

Cells

Filling should occur exclusively where the appropriate fields and cells are allocated for this. It is prohibited to go beyond their limits.

Seal

It is important to note that a seal is affixed to a sick leave certificate only if it is provided for in the company’s charter. There is a place on the right for her. You can go beyond its limits, but the print should not overlap part of the data in the cells.

How to fill out sick leave for direct payments

The period within which sick leave can be filed is limited to 6 months from the date of termination of illness. If the deadlines are not violated, the employer is obliged to pay temporary disability benefits. There is no need to write any special statements.

The basis for calculating benefits will be a certificate of incapacity for work. If the policyholder refuses to accept the document for payment, it makes sense to write a statement in any form demanding payment of benefits. This must be done within the period established by law. As a sample, you can take a form for direct payment to the Social Insurance Fund or use the example below. The last point is to indicate the requirement to issue a written reasoned refusal in case of an unsatisfactory decision. In order to reduce waiting times, you can specify in the document that the employer issues a document related to the work process.

This is important to know: Sick leave report for a contract soldier: sample 2021

The policyholder does not fill in the total accrued. Rationale: In accordance with clause 3 of the Regulations on the specifics of the appointment and payment in 2012, 2013 and 2014 to insured persons of compulsory social insurance in case of temporary disability and in connection with maternity and other payments in the constituent entities of the Russian Federation participating in the implementation of the pilot project approved by Decree of the Government of the Russian Federation dated April 21, 2011 N 294 (hereinafter referred to as the Regulation), the policyholder, no later than five calendar days from the date of submission by the insured person (his authorized representative) of applications and documents, submits the applications received to him to the territorial body of the Fund at the place of registration and documents necessary for the appointment and payment of the relevant types of benefits, as well as a list of submitted applications and documents, drawn up in a form approved by the Fund. If a sheet is issued for part-time work, then the sheet number issued for the main job is indicated - the name of the place of work. Be sure to ask the employer what name of the company is recorded in the Federal Social Insurance Fund of the Russian Federation. This is the name that should be indicated on the sheet. If the patient does not know the full name of the employer, in this case the doctor leaves an empty field that the employer must fill in 6. Next, in the “Exemption from work” table, indicate the start and end dates of sick leave. The doctor's details are entered and his signature is added. When filling out the name of the institution or doctor's specialization, writing an abbreviation is allowed. 7. Under the table, the doctor writes from what date the patient can start working. If the sick leave is extended, then the corresponding code is entered in the “Other” column. And below is written the sick leave number, which is issued in continuation. 8.

Electronic certificate of incapacity for work

A certificate of incapacity for work can be issued both in paper and digital form in accordance with paragraph 5 of Article 13 of the Federal Law of December 29, 2006 No. 255-FZ. Both options have equal legal force starting from 01.07.2017 in accordance with the amendments made by Federal Law dated 01.05.2017 No. 86-FZ. Drawing up a document in a digital version is possible if the medical organization and the insurer (employer) are participants in the information interaction system.

Advantages of electronic certificates of incapacity for work

The undeniable advantages of electronic sick leave certificates over paper versions ensure their widespread use.

Among the advantages:

- lack of expensive production of sick leave forms - strict reporting documents with special protection;

- there is no need to issue a duplicate if the paper form is lost or damaged;

- It’s easy to correct errors/typos;

- there is no need to verify the authenticity and validity of the sick leave certificate;

- there is no need to ensure secure storage of paper documents and their timely transfer to the Social Insurance Fund;

- Filling is not affected by the color of ink and legibility of handwriting;

- The processing time and receipt of documentation is reduced.

Interaction scheme for the ELN project

The interaction of the employee (insured person), employer (policyholder), Social Insurance Fund (insurer) and medical institution in the “ELN” project is as follows (Fig. 1):

- The employee contacts the medical institution, where he expresses written consent to receive an electronic health insurance.

- The medical institution registers an electronic certificate of incapacity for work in the federal state information system - the unified integrated information system “Sotsstrakh”.

- The medical institution receives an ELN number from the FSIS UIIS “Sotsstrakh”.

- The medical institution provides the employee with the ELN number.

- At the end of the period of illness, the employee transfers the personal identification number to the accounting department of the organization in which he works.

- The employer downloads the ENL using the number from the FSIS UIIS “Sotsstrakh”. ELN is filled out in the part supplied from the medical institution. The employer fills out its part of the ENL with information about the employee’s insurance experience and data on average earnings and makes the calculation.

- The employer pays the employee the entire benefit amount.

- The employer submits to the Social Insurance Fund a register of information about personal income tax, downloaded from the FSIS UIIS "Sotsstrakh", supplemented by information about the length of service of employees and data for calculating benefits.

- FSS receives ELN from FSIS UIIS "Sotsstrakh".

- The FSS checks the information received from the employer and sends the employer either an error report or confirmation of receipt of the register within no more than 10 days.

- Having confirmed receipt of the register, the FSS reimburses the employer for part of the benefit in excess of the payment for the first three days.

Rice. 1. Interaction diagram for the ELN project

| 1C:ITS For information about the electronic certificate of incapacity for work and interaction with the Social Insurance Fund, see the section “Instructions for accounting in 1C programs.” |

Support for the ELN project in 1C: Salaries and Personnel Management 8 (rev. 3)

In the program “1C: Salary and Personnel Management 8”, edition 3, a request from the FSIS UIIS “Sotsstrakh” for an electronic certificate of incapacity for work is made by clicking the Receive data from the Social Insurance Fund button when entering the Sick Leave document (Fig. 2). In this case, it is enough to select an employee and indicate the number of the certificate of incapacity received by the employee at the medical institution.

Rice. 2. Document “Sick leave”

All data on the electronic certificate of incapacity for work, including information about the medical organization and special causes of incapacity, are automatically downloaded from the FSIS UIIS “Sotsstrakh”. You can view the download results by following the hyperlink Filled in LN data. The data in the Sick Leave document is automatically supplemented with information from the 1C: Salary and Personnel Management 8 program about the employee’s length of service, his average earnings, previous sick leaves for care, conditions for calculating personal income tax, etc.

Having received the ELN from the FSIS UIIS “Sotsstrakh” and calculated it, the employer pays the employee benefits in the usual manner, and transfers to the FSS a register of electronic certificates of incapacity for work. It is convenient to create a register, send it immediately or upload it to a file in the 1C-Reporting service. The transcript of the ELN registry entry contains detailed information about the certificate of incapacity for work.

If, when sending the ELN register, some of the certificates of incapacity for work are not accepted by the FSS due to any errors, then the corrections of these errors will be taken into account the next time the specified register is sent. To do this, starting from version 3.1.10 of the program, its state is saved separately for each electronic device:

- Accepted by FSS;

- Not accepted by FSS

.

The ENL status is automatically updated when the FSS response is downloaded.

Why does the HR manager need to follow the rules for filling out sick leave?

Issuing sick leave is a procedure strictly regulated by the legislator. This follows from the fact that sick leave must be issued exclusively on a secure form. Its form was approved by order of the Ministry of Health and Social Development of Russia dated April 26, 2011 No. 347n.

In addition, it is important to follow the rules for filling out sick leave in 2021 by the employer, established for him by order of the Ministry of Health and Social Development of the Russian Federation dated June 29, 2011 No. 624n. The document contains a list of general requirements for filling out sick leave, which are still relevant today.

The employer enters information only into some of the items on the sick leave form, which are combined into the “To be completed by the employer” block.

IMPORTANT! The sick leave certificate must correctly indicate the data filled in by both the doctor and the employer.

If the responsible person of the employer, before filling out the sick leave certificate, discovers errors in the block drawn up by the doctor, it makes no sense for the employer to fill out the part. Most likely, the Social Insurance Fund will refuse to reimburse the organization for expenses. It is necessary to request a new document from the medical organization.

Expert opinion

Lebedev Sergey Fedorovich

Practitioner lawyer with 7 years of experience. Specialization: civil law. Extensive experience in defense in court.

The FSS sanction can be just as severe for mistakes made due to ignorance of how the employer fills out sick leave. Let's look at how they can be avoided.

This is important to know: How sick leave is paid in kindergarten

Accounting of transfers

In 2021, the amount paid to an employee from the Fund is not reflected in the employer’s accounting records. The postings should reflect only the accrual of benefits for the first three days of illness. The accounting entries for sick leave in 2021 for the pilot project are as follows:

| Contents of operation | Debit | Credit | Sum |

| Benefit accrued for 3 days of incapacity for work | 20 (25, 26, 44) | 70 | 2054,79 |

| Personal income tax withheld | 70 | 68.01 | 267,00 |

The accounting entries for sick leave payments during the pilot project are as follows:

| Contents of operation | Debit | Credit | Sum |

| Benefit paid from the cash register | 70 | 50 | 1787,79 |

| Benefit paid to bank details | 70 | 51 | 1787,79 |