Due to the expansion of the coverage area of the FSS pilot project for direct payment of benefits, and, consequently, with the increased interest in this topic in the context of working with 1C 8.3 ZUP 3, today we will focus on the following issues:

- setup and general mechanism for organizing work in the program within the pilot project;

- we will analyze examples of reflecting the main types of benefits and organizing document flow with the Social Insurance Fund;

- Let's see how the calculation of insurance premiums for organizations is filled out during the pilot project.

From January 1, 2021, all regions switched to direct payments of benefits from the Social Insurance Fund, so the project ceased to be a “pilot” project.

For more details, see the online course “ZUP 3.1 HR and payroll accounting from A to Z”

Project “Direct Social Insurance Payments” in 2021

The FSS pilot project has currently been introduced in 69 regions of the Russian Federation. The full list of participating entities can be found in this article. From January 2021, it is planned to extend the direct payments project to the entire territory of Russia.

The mechanism of the pilot project is as follows:

- The employee provides the employer with sick leave and all related documents confirming the insured event. The deadline for submitting a certificate of incapacity for work and other documents confirming the occurrence of an insured event is 6 months after the end of the sick leave.

- The employer submits a package of documents to the Social Insurance Fund within 5 days.

- Within 10 days, the Social Insurance Fund checks the papers provided by the employer and issues a decision on the appointment or refusal to pay benefits.

- The benefit is transferred to the employee’s current account or transferred by post. If any documents are missing or are drawn up incorrectly, the FSS will send a notice to the employer. Within 5 days, the policyholder is obliged to replace them or provide the missing documents.

This approach allows you to avoid errors in the assignment and payment of benefits, protect the policyholder from paying benefits on a fake sick leave, and guarantee the insured person timely payment of funds.

The following types of benefits are paid in the “direct payments” system:

- for pregnancy and childbirth (B&C);

- for child care;

- at the birth of a child;

- when registering in the early stages of pregnancy;

- in case of injury at work;

- due to illness.

The algorithm for calculating benefits has not changed: benefits for the first 3 days of an employee’s illness are also paid from the employer’s funds. In addition, the employer pays a funeral benefit and 4 additional days of caring for disabled children. The FSS reimburses the employer for the costs of the last two insured events.

Participation in the Direct Payments pilot project is mandatory for all policyholders registered in this region. The exception is separate divisions that do not have a current account and do not pay wages to employees. Provided that the parent organization is located in a region where the pilot project has not yet been introduced.

What is a pilot project and where does it operate?

The pilot project is a new procedure according to which sick leave is paid on the Social Insurance Fund portal (Government Decree No. 294 of 04/21/2011).

How the direct payment mechanism works: when an insured event occurs, the employee submits to the employer a sick leave certificate and an application for the transfer of social benefits. If necessary, these documents are accompanied by certificates of the amount of earnings received in the billing period from other employers and/or an application for changing years in the billing period. The accountant calculates part of the payments at the expense of the organization: according to the pilot project, sick leave for 3 days is paid by the employer, the remaining days are paid directly by the Social Insurance Fund. The organization is obliged to submit documents to the Social Insurance Fund within 5 calendar days after receiving the application from the employee.

IMPORTANT!

Direct payments from social insurance are transferred only in cases of temporary disability. Accidents at work are paid as before.

FSS specialists review the application, check the certificate of incapacity for work and make a decision on payment. The deadline for transferring sick leave to the Social Insurance Fund during the pilot project is 10 days from the date of receipt of documents from the organization (clause 9 of Resolution No. 294).

ConsultantPlus experts sorted out what an accountant should do when making direct payments for sick leave. Use these instructions for free.

The pilot project operates in 77 regions of the Russian Federation. From 01/01/2021 the following will join the program:

- Moscow and Moscow region;

- Saint Petersburg;

- Krasnodar region;

- Perm region;

- Sverdlovsk region;

- Chelyabinsk region;

- Khanty-Mansi Autonomous Okrug.

If a pilot project is operating in the region, the employer is obliged to use the mechanism of direct payments for temporary disability.

What documents are needed for a pilot project?

In case of illness or leave due to employment and labor regulations, request the following package of documents from the employee:

- sick leave: paper or electronic bulletin number;

- certificates of the amount of earnings received from other policyholders for the 2 years preceding the year of the insured event;

- application for payment of benefits (according to the form from Appendix No. 1 of the Order of the Social Insurance Fund of November 24, 2017 No. 578).

The application is filled out by the employee in block letters and with a black pen. The document can be filled out on a computer and printed. An application from the employee is taken in any case.

Application form to the Social Insurance Fund from an employee (pilot project)

Sample application to the Social Insurance Fund from an employee (pilot project)

In certain insurance cases, the following additional documents may be required:

| Benefit, payment | Documentation |

| One-time benefit when registering in the early stages of pregnancy | Certificate from the medical institution that registered the employee |

| One-time benefit for the birth of a child |

If the parents are divorced, a certificate of divorce and a certificate of cohabitation with the child must be submitted |

| Monthly allowance for child care up to 1.5 years |

|

| Accident or injury at work |

|

| To reimburse benefits | |

| Payment for additional days to care for a disabled child | A copy of the order granting additional days off |

| Funeral benefit | Death certificate |

When filling out a sick leave form, do not fill in the following cells:

- “at the expense of the Social Insurance Fund”;

- “Total accrued.”

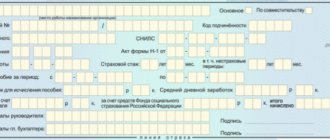

Sample of filling out a sick leave certificate by an employer (pilot project)

How to correct an error in a document

The employer manually fills out a paper sick leave certificate for direct payments according to the rules from Order No. 624n. Entries are made in capital letters. Start filling from the left, from the first cell.

If the contractor made a mistake when filling out, corrections are made to the form. Here's how to fix a sick note error:

- Cross out incorrect information.

- Indicate the correct information on the back of the document - the name of the column and the correct data.

- Indicate next to the correction “Believe Corrected.” Certify the corrections with the signature of the director, chief accountant. Stamp it when using it in an institution.

IMPORTANT!

If several corrections have been made to the certificate of incapacity for work in different columns, the “Corrected to Believe” visa is issued only once.

How to submit documents on direct payments to the Social Insurance Fund

The method of transmitting data to the Social Insurance Fund depends on the average number of employees of the employer:

- 25 people or more - documents, including the register of information, are sent to the FSS in electronic form;

- 24 people or less - documents, including an inventory, can be sent to the FSS both electronically and on paper.

Let's consider each of the methods.

Direct payments: electronic register

The register can be filled out in relation to one or more employees who applied for various types of social benefits during the last 5 calendar days. Data for each employee must be indicated in a separate line of the register. If there is no data to fill out any columns, dashes are placed in them.

Fill out the register taking into account the following features:

- If the employee will receive benefits on the Mir card, the address of residence in column 7 does not need to be filled in.

A number of benefits from the Social Insurance Fund are paid only to the Mir card. You can find out more about this here.

- In column 19 “Cause of disability”, transfer the code from the sick leave certificate.

- When replacing years in the billing period, in column 37 “Calculation period”, indicate the date of the employee’s application on the basis of which the replacement is made.

- In columns 39 and 40 “Amount of average earnings for the billing period,” indicate the larger of the values: the base for calculating benefits or 24 times the minimum wage.

- In column 42 “Other information affecting the right to receive benefits or the calculation of its amount,” indicate the details of certificates in Form 182n from previous employers or the size of the coefficient if the employee works in an area where the regional coefficient is applied.

Within 5 calendar days, submit the originals of the above documents to Social Security. The FSS will return them after checking and assigning benefits (refusal to pay).

Registry form in the Social Insurance Fund (pilot project)

Sample of filling out the register in the Social Insurance Fund (pilot project)

Procedure for filling out the register

Inventory of documents in the Social Insurance Fund: pilot project

If the average number of employees is 24 or less, fill out a list of applications and documents instead of a register. The inventory form is given in Appendix No. 2 to Order No. 578 of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017.

Inventory form in the Social Insurance Fund (pilot project)

Sample of filling out the inventory (pilot project)

Setting up 1C ZUP 3 for benefits of the FSS pilot project

Accounting for benefits from the Social Insurance Fund pilot project is reflected in the Accounting Policy (Settings - Organizations - Accounting Policies and other settings) on the Social Insurance Fund Benefits by checking the box and filling in the date from which the Benefit Payment was transferred to the Social Insurance Fund .

Accounting Policy settings affect the presence of the following objects in the program:

- tab FSS Pilot Project in the documents Sick Leave (Salary - Sick Leave) and Parental Leave (Salary - Parental Leave and Returns from Leave);

- specialized documents intended for transfer to the Social Insurance Fund. These documents are contained in the document journal Transfer of benefits information to the Social Insurance Fund (section Reporting, certificates );

- workplace Benefits at the expense of the Social Insurance Fund (section Reporting, certificates ). This tool improves the convenience of users in preparing documents to be sent to the Social Insurance Fund.

How to reflect benefits in the calculation of insurance premiums

The calculation of insurance premiums was approved by Order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11/ [email protected] Fill it out as usual. Prepare Appendix No. 2 to Section 1 taking into account the following features:

- in field 001 “Payer tariff code”, enter code “1”;

- enter zeros on pages 070 and 080.

Do not include Schedules 3 and 4 to Section 1 unless the policyholder paid the benefit before participating in the pilot project. For example, if the region in which the employer is registered joins the project in the middle of the year or the company registered in the region participating in the project after moving. In this case, complete Appendices 3 and 4 only for the benefit costs incurred prior to participating in the pilot project.

Useful information from Consultant+

Question: The organization participating in the pilot project of the Federal Social Insurance Fund of the Russian Federation is in the process of liquidation. One of the employees is disabled and will continue to be sick after dismissal and liquidation of the organization. How can such an employee receive temporary disability benefits? How much is this benefit paid? See the answer here.

Which regions are participating?

- Since 2011: Karachay-Cherkess Republic and Nizhny Novgorod region.

- Since 2012: Astrakhan, Novgorod, Novosibirsk, Tambov, Kurgan regions, Khabarovsk Territory.

- Since 2015: Republic of Crimea, Sevastopol, Republic of Tatarstan, Belgorod, Rostov, Samara regions.

- From 2021: Republic of Mordovia, Bryansk, Kaliningrad, Kaluga, Lipetsk and Ulyanovsk regions.

- From 2021: Republic of Adygea, Altai, Buryatia, Kalmykia, Altai and Primorsky Territories, Amur, Vologda, Omsk, Oryol, Magadan, Tomsk and Jewish Autonomous Regions.

- From 2021: Kabardino-Balkarian Republic, Republic of Karelia, North Ossetia, Tyva, Kostroma, Kursk regions.

- From January 1, 2021: Republic of Ingushetia, Mari El, Khakassia, Chechen, Chuvash Republics, Kamchatka Territory, Vladimir, Pskov, Smolensk regions, Nenets and Chukotka Autonomous Okrugs.

Let's sum it up

- In regions that have joined the Direct Payments project, benefits are transferred to the employee directly from the Social Insurance Fund.

- The list of documents submitted by the employer participating in the pilot project to the Social Insurance Fund depends on the insured event.

- If the number of employees is 25 people or more, documents and the register are transferred to the Social Insurance Fund only in electronic form.

- If the average number of employees is 24 people or less, documents and inventory can be submitted to the Social Insurance Fund both on paper and electronically.

If you find an error, please select a piece of text and press Ctrl+Enter.

Algorithm for assigning and paying benefits

We will step by step consider the actions of an accountant to assign and pay benefits to an employee.

Step 1. The employer receives documents from the employee

When the employee brings documents confirming entitlement to benefits, check that they are correct. For example, sick leave must have been issued no earlier than six months ago.

Then prepare an application to the Social Insurance Fund in the form established by Social Insurance Fund Order No. 578 dated November 24, 2017. It is required for all insurance cases, including for periods of temporary disability. The employer can generate and print such a statement for the employee and give it to him for verification. The employee will check the details for transferring funds (bank account, postal address) and personally sign the application.

“The insured person can choose a convenient way to receive benefits: to a bank account, by postal transfer or to a Mir payment card with a 16- or 19-digit number. Benefits can be transferred to the employee either to the salary account or to any other,” says Natalya Vladimirovna Matveeva.

“The account must have 20 digits, match the bank’s BIC and be registered specifically to the employee. At the same time, it is possible to transfer benefits using only one detail - the Mir payment card number,” adds Julietta Anatolyevna Ustova.

From January 1, 2021, the following will be mandatory transferred to Mir cards:

- maternity benefits;

- a one-time benefit for women who registered with medical organizations in the early stages of pregnancy;

- lump sum benefit for the birth of a child;

- monthly child care allowance;

- payments to citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant,” as a result of the accident at the Mayak production association and the discharge of radioactive waste into the Techa River and as a result of nuclear tests at the Semipalatinsk test site.

After January 1, 2021, banks will check the linking of the Mir card to the account. If it is not available, and the insured person is transferred the benefit, then the bank will receive a notification with an offer to come within 10 working days to receive funds in cash or provide other details for crediting funds. After this period, the funds will be returned to the payer - that is, the Social Insurance Fund.

A medical organization can issue sick leave in paper form or create and post an electronic certificate of incapacity for work (ELN) in the FSS information system.

You can obtain information about electronic sick leave from the Social Insurance Fund database using the employee’s ELN and SNILS number. This is available in the policyholder’s personal account in the unified integrated information system (UIIS), FSS personal account, FSS automated workplace, Kontur Extern, 1C, etc. You can only pay for e-mail with the status “Closed”.

The further procedure depends on the type of certificate of incapacity for work.

If in the “pilot” region the LN is paper

If in the “pilot” region the LN is electronic

Notes:

- LN - certificate of incapacity for work, ELN - electronic certificate of incapacity for work.

- You can fill out and send an application and register with data for payment of benefits (application, LN and ELN) in Kontur.Externe.

Step 2. The employer calculates the benefit and pays the amount for the first three days

In the Direct Payments project, neither the amount of benefits nor the calculation procedure changes:

The benefit for the first three days of temporary disability of the employee is assigned and paid by the employer, withholding personal income tax (clause 1, clause 2, article 3 of the Federal Law of December 29, 2006 No. 255-FZ; Decree of the Government of the Russian Federation of April 21, 2011 No. 294; clause 1 of Art. 217 Tax Code of the Russian Federation). The employee will receive the rest of the benefit from the Social Insurance Fund, so the Fund withholds personal income tax from it.

Step 3. The employer prepares and sends documents to the Social Insurance Fund

An employee can apply for benefits no later than 6 months from the date of termination of the insured event. For example, no later than 6 months from the date of birth of the baby, you can apply for a lump sum benefit for the birth of a child.

Within five calendar days from the date of receipt from the employee of the application and LN, ELN, certificates or certificates, the employer must generate and send to the Social Insurance Fund a set of documents for payment of benefits, including a register of information.

You can fill out and submit to the FSS the electronic register for the “Direct Payments” project in accounting software modified to meet the requirements of the project, in the information systems of specialized telecom operators, as well as in the free automated workplace “Preparation of calculations for the FSS”, which is available for download on the official website of the FSS.

Companies with an average headcount of more than 25 people must submit a register of information in electronic form. Organizations with fewer staff can submit documents both electronically and on paper. The electronic register of information necessary for the assignment and payment of benefits is filled out in xml format, as when submitting pay slips in Form 4-FSS. The register is signed electronically and sent through a single reception point at docs.fss.ru or through the service you use.

It happens that it is necessary to make corrections to the register that has already been sent, for example, the insurance period was calculated incorrectly, preferential conditions that increase the amount of benefits were not indicated, or the amount of average daily earnings changed due to the fact that the employee brought a certificate from a previous place of work. In this case, you need to create a new register with updated data and re-send it to the Social Insurance Fund indicating the reason for the recalculation (clause 3 of Resolution No. 294 dated April 21, 2011).

Contour Extern will help you create a register or upload and send a finished document to the Social Insurance Fund. Here are Extern's capabilities:

| Paper documents | Electronic documents |

| Forms a register in accordance with the requirements of the Social Insurance Fund and checks for errors; Generates an application for payment of benefits, which can be printed and given for signature; Automatically fills in the details of the medical institution and the bank of the benefit recipient; Shows the current status of the document: “Queued for sending”, “Sent to the FSS”, “Accepted by the FSS” | Allows you to send several electronic tax records and registers to the FSS at a time; The register and e-number can be sent by the accounting department; Checks the signature certificate for validity so that the FSS is guaranteed to accept the document; Checks the registry for errors. If the FSS does not accept the registry, you can view the error log. Stores data on a secure server that complies with the requirements of Law No. 152-FZ “On Personal Data”. |

Fill out electronic sick notes quickly and without errors and create registers in Externa

Step 4. The Social Insurance Fund checks the documents and assigns benefits

Within 10 calendar days from the date of receipt of the complete set of documents, the regional branch of the Fund makes a decision on the assignment and payment of benefits, says Julietta Anatolyevna Ustova.

During the process of processing documents and transferring benefits, a regional branch or bank may detect an error. Then the documents will be returned to the employer for correction,” adds Natalya Vladimirovna Matveeva.

If a delivery receipt is received in response to the sent set of documents, then everything is in order: the documents have been accepted for consideration. Upon receipt of the error protocol, you need to correct them and send the documents to the FSS again. If the documents were sent on paper, you need to resend them, the required result is a delivery receipt.

Step 5. The Social Insurance Fund pays benefits

The Fund returns paper documents for the assignment and payment of benefits to the policyholder, who stores them in accordance with the procedure and deadlines established by law. Track when the employee receives benefits in order to collect supporting documents from the Social Insurance Fund.

If a company with an average workforce of less than 25 people submits documents in paper form, the accountant will have to visit the Fund’s branch at least twice. If questions arise, errors are found in the documents, clarifications and corrections are required, you will have to go to the FSS again.

You can find out about the benefit paid in the personal account of the recipient of services. You can log in with your login and password from the government services portal,” says Zalina Gatsirovna Aylarova. There, working citizens can view the history of accruals, submit requests and consult with the Fund’s specialists, adds Natalya Vladimirovna Matveeva.

Natalya Vladimirovna Matveeva, and. O. Deputy Manager of the State Institution - RO FSS of the Russian Federation for the Republic of Karelia on the timing of payment of benefits to women on maternity leave

Previously, workers received benefits on payday. Now the monthly child care allowance will be paid by the Fund department from the 1st to the 15th of the month following the month for which it is due. For example, the fund will pay child care benefits for July 2021 from August 1 to August 15, 2021.

In what form should the register be kept?

The same Decree of the Government of the Russian Federation No. 294 dated April 21, 2011 states that the register of electronic sick leave in the Social Insurance Fund (and non-electronic ones too) is approved by the Fund itself. The same government agency is developing the procedure for filling it out.

Current forms and instructions are now contained in Order of the Federal Social Insurance Fund of the Russian Federation No. 579 dated November 24, 2017. It follows from it that there are three forms for transmitting information for the calculation and payment of benefits:

- For temporary disability, labor and registration and for registration in the early stages of pregnancy.

- At the birth of a baby.

- Newborn care.

Organizations and individual entrepreneurs not only need to determine which form to choose. They are required to prepare an electronic register of sick leave in the Social Insurance Fund if there are more than 25 employees. If less, it is acceptable to transmit information on paper.

IMPORTANT!

The Ministry of Labor has prepared amendments to the legislation that will change the rules for submitting registers electronically. It is planned that from 2021 those employers with more than 10 employees will be transferred to the e-format.

Benefit payment procedure

In general, the direct payment system looks like this:

- An employee experiences an insured event and sends an application to the employer for payment of a certain benefit.

- The employee also provides the documents necessary to assign benefits, and the employer sends this package to the Social Insurance Fund.

- With the direct payment system, the employer pays only 3 days of sick leave, and the remaining payments are made by the territorial branch of the Fund.

Direct payments from the Moscow Social Insurance Fund: which card are transferred to?

It was planned that from 01/01/2021, employees will be able to receive certain types of benefits only on the Mir card (B&R benefits, payments for children, some sick leave, etc.). This deadline has once again been changed (information letter of the Bank of Russia dated December 18, 2020 No. IN-04-45/175). It is expected that direct payments from the Moscow Social Insurance Fund will be transferred only to the Mir card from 07/01/2021.

Until this period, benefits can be transferred to any card or bank account specified by the employee, the main thing is that it belongs to the recipient of the funds.

How to fill out forms

Let's look at the general rules on how to make a register of sick leave for the Social Insurance Fund, using appendices 2, 4 and 6 to Order No. 579 of the Social Insurance Fund of the Russian Federation dated November 24, 2017, which provides instructions for filling out each of the three types of forms.

Each form is a table where you enter:

- information about the policyholder and the insured person;

- passport details of the benefit recipient;

- information about sick leave and other documents giving the right to receive payments;

- information about the method of transferring money, bank details.

The most voluminous is a form for transmitting data necessary for the assignment and payment of benefits for illness (injury), labor and accounting and registration. It has 47 columns, and some are not found in other forms. Let's look at a sample of filling out the register of sick leave for the Social Insurance Fund to understand how to fill them out correctly.

ConsultantPlus experts discussed how to verify the authenticity of a sick leave certificate submitted by an employee. Use these instructions for free.

Step 1. Enter information about the policyholder

Step 2. Fill in the data block about the benefit recipient

This will include the following information:

- FULL NAME. employee;

- registration address and place of residence of the insured person. If they match, it is enough to write the address only once;

- TIN and SNILS;

- passport details.

Columns 13, 14 and 15 are completed only if the employee is a foreigner.

IMPORTANT!

Cells are not left empty. If there is no information, put dashes.

Step 3. We clarify the data on the period of temporary disability

Columns 16 to 25 are filled out based on the issued certificate of incapacity for work. FSS is interested in:

- sick leave form - paper or electronic;

- his details;

- reason for disability (code);

- period of release from work;

- date of return to work;

- date of submission of documents for medical examination;

- other details from the sick leave.

If the register is filled out to pay benefits in connection with registration, fill out columns 26–27. If a violation of the regime is recorded - column 28.

Step 4. Provide information for calculating benefits

To determine the payment amount, you will need information about (columns 29–42):

- insurance experience;

- the period for which the payment is due;

- billing periods and amounts received during these years;

- other information.

Step 5. Notify about the method of payment of funds

The last block in the form is filled out taking into account the employee’s application. In columns 43–47 indicate:

- method of payment of benefits;

- Bank details.

Please note: the employer is required to transfer data to the Social Insurance Fund within 5 days from the date of receipt of the employee’s application and documents entitling them to benefits.

What will an accountant need to do in 2021 to pay sick leave and maternity leave?

In order for the employee to receive his payments, the accountant will have to, after receiving an application for sick leave or benefits, no later than 5 calendar days, transfer the necessary package of documents to the regional office of the Social Insurance Fund

.

The Ministry of Labor is considering the possibility of reducing the period for sending documents for the calculation and accrual of direct payments from the Social Insurance Fund from 5 calendar days to 3 working days. However, the draft Federal Law that provides for this change has not yet been submitted to the State Duma of Russia and is at the stage of public discussion.

The list of documents required to calculate direct payment depends on the type of benefit. We will tell you more about the package of documents in the next paragraph of this article.

Information necessary for calculating benefits can be sent to the Social Insurance Fund office on paper only if the average number of employees of the enterprise does not exceed 25 people

. In other cases, a package of documents is sent to the FSS via electronic communication channels.

If an organization plans to reimburse from the Social Insurance Fund the costs of paying for additional days off to care for a disabled child, funeral expenses, or expenses for preventive measures to reduce injuries, the accountant must send a certain package of documents to the Social Insurance Fund.

To reimburse payment for additional days off to care for a disabled child

the package of documents consists of:

- an application, the form of which is approved by Order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578;

- a certified copy of the order to provide additional days off to the employee.

To get money back for funeral benefits

The accountant sends to the Social Insurance Fund:

- an application from a relative of a deceased employee, the form of which was approved by Order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578;

- a copy of the death certificate of the former employee.

To reimburse expenses aimed at minimizing injury incidents

at production, the following documents should be submitted to the Social Insurance Fund:

- an application, the form of which is approved by Order of the Ministry of Health and Social Development of Russia dated July 11, 2011 No. 709n;

- copies of documents confirming payment of the company's expenses (agreement, check, certificate of completion, delivery note or other strictly reporting forms).