The SZV-STAZH form was approved by Resolution of the Pension Fund Board of January 11, 2017 No. 3p. At the same time, the following were adopted:

- forms of information on the policyholder submitted to the Pension Fund for maintaining individual (personalized) records (EFV-1);

- data on the adjustment of information recorded on the individual personal account of the insured person (SZV-KORR);

- information on earnings (remuneration), income, amount of payments and other remuneration, accrued and paid insurance premiums, periods of labor and other activities counted in the insurance period of the insured person (SZV-ISH).

The SZV-STAZH report indicates the full name and SNILS of the insured persons, periods of work, and grounds for early assignment of a pension. SZV-STAZH forms (SZV-ISKH, SZV-KORR) for each employee are collected in a package of documents and accompanied by the EDV-1 form. This form contains information on the policyholder as a whole (clause 1.7 of the Procedure for filling out the SZV-STAZH, approved by Resolution of the Pension Fund of the Russian Federation Board of January 11, 2017 No. 3p, hereinafter referred to as the Procedure).

The SZV-KORR form is submitted if it is necessary to clarify (correct) or cancel the data recorded on the individual personal accounts of the insured persons (clause 1.10 of the Procedure).

The SZV-ISH form is filled out by an employer who has violated the reporting deadlines for reporting periods up to and including 2021 (clause 5.1 of the Procedure).

Form and submit SZV-STAZH (SZV-ISKH, SZV-KORR) and EDV-1 via the Internet

To learn more

Procedure for filling out SZV-STAZH

Filling out the information begins by selecting the type of form to be submitted.

Type "Original"

is filled in when submitting primary information for the reporting period for all insured persons.

Type "Complementary"

is submitted to those employees for whom data, presented in the form with the

“Initial”

, was missing or not included in individual personal accounts due to an error contained in them.

Type “Pension assignment”

is presented to insured persons who retire this year.

When the reporting deadline arrives, these individuals must also submit a form with the “Original”

.

Attention! SZV-STAZH with the “Pension Assignment”

is created in the Pension Fund register

“For Retirement”

.

To generate information, you must select an employee using the “+ Employee”

. The employee is selected from the list, and if he is absent, he is added using the “+” button, filling in all his personal data (full name, SNILS, INN, date of birth, passport data, etc.).

Next, click on the “Operation period”

the periods of work of the insured person are indicated.

Moreover, these periods should not extend beyond the reporting period. If the date of dismissal of this employee falls on December 31 of the calendar year for which information is being submitted, then a mark is made in the “Dismissed on December 31”

.

in the “Unemployed”

if it is necessary to indicate the periods that are included in the insurance period for the unemployed.

Individual fields also indicate periods when the employee not only worked, but was also on vacation, sick, etc. To do this, in the “Additional” block.

information and preferential length of service" in the

"Additional" field.

information: sick leave/children/vacation”, select the code for the corresponding period.

Attention! When reflecting several periods of work for a specific employee, each period is indicated separately, incl. and if the employee quit during the year and was rehired.

Attention! For a form with the type “Pension assignment”

The employee's periods of work are indicated up to the date preceding the date of expected retirement.

Attention! The period of work of the insured person within the framework of a civil contract is filled in and reflected in the “Additional” field. information: sick leave/children/vacation"

one of the following codes:

- “AGREEMENT” - if payment under the agreement was made in the reporting period,

- “NEOPLDOG” or “NEOPLAVT” - if payment was not made.

Attention! If in the field “Add. information: sick leave/children/vacation"

If you need to indicate more than one code at the same time, one of which indicates the filling of state or municipal positions, then such information is indicated in two lines. In this case, the first line always indicates the periods with the codes: “ZGDS”, “ZGD”, “ZGGS”, “ZMS”, “ZMD”. The second line reflects the period with a different additional information code, which must be inside the period or equal to the period specified in the first line.

In the "Territorial conditions"

the code of the territorial conditions in which the employee works is indicated.

Attention! If an employee works full-time in a part-time mode, then the period of work is reflected according to the actual working time worked (field “Output in months (hours)”

);

if in part-time mode, then, accordingly, the volume of work is reflected (field “Rate”

) in a given period.

Field "Special working conditions"

is filled out in relation to insured persons working under conditions that give the right to early assignment of a pension.

Attention! This field is filled in only if, during the period of work under conditions that give the right to early assignment of a pension, insurance contributions at an additional rate or contributions in accordance with pension agreements for early non-state pension provision have been paid.

If the employee was employed in work with harmful or difficult working conditions, then the code of the employee’s profession is additionally indicated in the “List Position Code”

.

Fields “Special working conditions”

,

“Early assignment of pension”

are not filled out if:

- special working conditions are not documented;

- the employee’s employment in special conditions does not comply with the requirements of current regulatory documents;

- There is no payment of insurance premiums at an additional tariff or contributions in accordance with pension agreements for early non-state pension provision.

In the field "Insurance experience"

the basis for calculating the insurance period is selected, and the actual time worked is indicated in the corresponding fields - the number of calendar months and days (for divers - the time spent under water in hours and minutes).

Attention! In the field "Insurance experience"

the code “VIRUS” is indicated in relation to medical workers who provided medical care to patients with COVID-19 or suspected of it.

This code is indicated if

codes 27-1, 27-2 and (or)

“Early assignment of pension”

“Special working conditions” - 27-GD, 27-SM, 27-GDHR, 27-SMHR.

It is also necessary to take into account that if the code “VIRUS” is indicated in the “Insurance Experience

, then in the

“Special Working Conditions”

code 27-1 must be indicated in combination with codes 12300000-17541, 12300000-20426, 12300000-24577, 12300000- 24713 or code 27-2 in combination with codes 2260000a, 2260000b, 2260000e, 2260000zh, 22600000-1754v, 22600000-14467.

Attention! For SZV-STAZH with the “Pension Assignment”

information is reflected on insurance premiums accrued for compulsory pension insurance (OPI), incl. at additional rates. If an employee applying for a pension was accrued insurance premiums for the periods of work specified in the information, then marks are made in the appropriate fields.

Section “Information on paid contributions under early non-state pension agreements”

is filled out only in information with the

“Pension Assignment”

and is intended for those policyholders who have an agreement with the Non-State Pension Fund on early pension provision for workers engaged in hazardous work.

To fill out the section, you must click on the “+” button and in the appropriate fields, check whether the contributions have been paid and indicate for what period of the employee’s work.

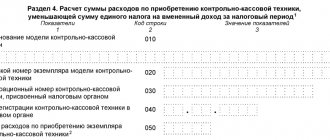

Section 2. Reporting period (code)

This section automatically indicates the code of the reporting period for which the information is provided.

A separate field indicates the type of form being presented.

Type "Original"

filled out to accompany a package of documents with personalized accounting forms.

Attention! The package may include documents of only one name and one type of information, and for a package of SZV-ISH forms - one name, one type of information and for one reporting period.

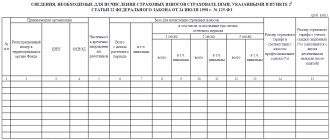

Section 4. Data on the policyholder

The section is completed if EDV-1 is submitted simultaneously with the SZV-ISH forms or with the SZV-KORR form with the “Special”

.

The following indicators are indicated in the corresponding columns:

- debt at the beginning and end of the reporting period;

- the amount of accrued and paid insurance premiums.

Attention! These data are reflected separately in relation to insurance premiums for insurance and funded pensions, as well as according to the tariff. A separate table provides a breakdown of the insurance premiums paid by the periods for which the premiums were paid.

How to reflect vacation periods with the code “DLOTPUSK” in SZV-STAZH?

In the SZV-STAZH form for 2021, the “DLOTPUSK” code is filled in only for periods of employee work under special working conditions, for which insurance premiums were not charged at additional rates. For employees who were on annual paid leave and at the same time working under normal working conditions, this code does not apply.

The code “DLOTPUSK” must also be used in the case when the employee was on regular vacation in January, received vacation pay in December, and quit his job on the last day of vacation, and no contributions were accrued to him in the current calendar year.

Fines

If you do not meet the deadline for submitting the form or submit it with errors or incomplete information, the fine will be 500 rubles for each insured person. An official may also be fined in an amount from 300 to 500 rubles.

For violating the report form, that is, submitting it on paper instead of sending it electronically, the fine will be 1,000 rubles.

So, we reviewed the SZV-STAZH report and told you how to fill out this form. We recommend that you see what the finished report should look like. However, you need to remember about different working conditions and other nuances, so it’s worth looking into Resolution No. 507P.

How to correct mistakes when taking SZV-STAZH?

During the submission of information about experience, various errors may occur, which are indicated in the protocol by certain codes. To correct these errors, you must submit a clarifying report form.

The procedure for correcting errors, depending on their type and whether the report was accepted by the fund, is presented in the following table:

| Error made in the report | How to fix the error |

| Incorrect registration number of the policyholder in the Pension Fund of the Russian Federation, incorrect TIN, etc. (error code – 50) | Resubmit SZV-STAZH with the “Initial” type within 5 working days from the date of receipt of the protocol |

| Inaccurate information regarding insured persons (for example, errors in full name, SNILS, etc.) (error code - 30 and 40) | Submit SZV-STAZH with the “Additional” type for those persons in respect of whom errors were discovered within 5 working days from the date of receipt of the protocol |

| Inaccurate information regarding insured persons for whom the initial report was successfully accepted (data recorded on personal accounts) | Submit SZV-KORR with the “Corrective” type for those persons in respect of whom errors were detected |

| We included in the original report workers who should not have been included in it, for example, those who were laid off last year | Provide SZV-KORR with the type “About employees |

| Forgot to include workers in the report, for example, contractors or maternity leavers | Present SZV-STAZH with the “Additional” type for “forgotten” employees |

Why did you enter the report?

Resolution of the Board of the Pension Fund of the Russian Federation No. 507p dated December 6, 2018 explains in detail what it is and who takes the SZV-STAZH in 2021. A form has been developed in accordance with paragraph 2 of Art. 8 Federal Law of April 1, 1996 No. 27 “On individual (personalized) accounting in the compulsory pension insurance system.” This report is necessary to collect information about length of service and contributions, which will be reflected in the future on the individual personal accounts of the insured persons, on the basis of which an insurance pension is then assigned.

Is it possible to submit SZV-STAZH to a director who is the sole founder?

The founding director is an insured person, regardless of whether a written employment contract has been concluded with him or not and whether he receives a salary. As the Ministry of Labor notes in letter No. 17-4/10/B-1846 dated March 16, 2018, labor relations can arise even when the employment contract is not concluded properly, in particular, on the basis of the actual admission of the employee to work with the knowledge or on behalf of the employer . Thus, if the organization has only one director, who is the sole founder, then it is necessary to fill out a SZV-STAZH for him.

Where are the reports submitted?

According to the developed rules, the new form will need to be submitted:

- Companies, as well as related divisions located in other regions;

- Entrepreneurs, licensed detectives, lawyers, notaries who have employees.

According to the rules, a new report will have to be submitted by:

- All companies, as well as their affiliates in other regions;

- Entrepreneurs, notaries, lawyers and licensed detectives who have employees.

Attention! The report will need to show all registered employees with whom the individual entrepreneur or company has an agreement

labor contract

, or

GPC agreement

, and they receive cash payments, which are used to make payments to social funds.