In the course of commercial activities of a legal entity or individual entrepreneur, such an unpleasant event often occurs as the suspension of account transactions or, in simpler terms, the blocking of a current account. This event, one might say, paralyzes the activities of the Company or the Entrepreneur. If an account is blocked, then you cannot carry out debit transactions on it: for example, you cannot transfer funds from it in favor of a counterparty or withdraw cash using a checkbook.

In what cases does the tax office block an account?

There are four grounds for blocking a company account:

- Based on the results of the tax audit, additional taxes were assessed and a decision was made to impose tax liability. If there is reason to believe that the company will not pay additional taxes, the inspectorate may take interim measures in the form of suspending transactions on bank accounts.

- The company did not submit a tax return within 10 days after the last deadline.

- Within 10 days, the company did not provide the opportunity to receive tax documents in electronic form.

- The inspection sent the company a request to provide documents or explanations, but the company did not send a receipt to the inspection for acceptance of this request within 10 days.

Results

Thus, the application to unblock the account is drawn up in free form. To contact the Federal Tax Service with a request to remove the blocking, you can use the proposed sample application, adapting its text to a specific situation.

Sources:

- Tax Code of the Russian Federation

- Law “On Enforcement Proceedings” dated October 2, 2007 No. 229-FZ

- Law “On Banks and Banking Activities” dated December 2, 1990 No. 395-1

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Reasons for blocking a current account

The legislation allows you to suspend (block) transactions on the account of a company or entrepreneur. In this situation, spending funds from the account becomes virtually impossible, although the flow of money into it is not limited. Blocks are mainly imposed by the tax office, but can also come from the bank itself.

Let's consider what most often becomes the reason for blocking the account of an organization or individual entrepreneur:

- failure to file tax returns;

- various arrears of taxes, fees, unpaid fines or penalties;

- lack of organization at a legal address;

- failure to provide documents requested during a desk audit;

- carrying out transactions with signs of cashing out funds, terrorist financing, etc.

What is needed to remove the blocking

Blocking an account practically paralyzes a business, and the situation needs to be resolved as quickly as possible. To do this, the first step is to clarify who made the decision to suspend operations. If the blocking occurred at the initiative of the bank, then you must provide all the requested documents to prove the legality of the origin of the funds and the legality of their expenditure.

In a situation where the suspension of the operation occurred by decision of the tax service, it will be necessary to deal with it. First you need to find out the reason for the blocking. The tax inspectorate sends a copy of the blocking decision to organizations via electronic communication channels and regular mail, but not everyone responds to it in a timely manner. To unblock the account, you will need to find out and eliminate the reason for the restriction, and in some cases write a letter asking to unblock the current account.

If the suspension of operations is due to the lack of tax returns on time, then they need to be prepared and sent, and if it was due to unpaid taxes, then they will have to be paid.

In a number of cases, the tax service goes far beyond its powers and freezes an account for far-fetched or invalid reasons. In this case, you can and should challenge its decision by filing a corresponding complaint and attaching documents confirming that you are right.

For example , if the declarations were submitted, but due to a failure, the tax office considers them not sent within the prescribed period, then you will need to draw up a complaint and attach to it a receipt from the EDF operator about sending the documents.

The company does not have revenue all year round

Companies with seasonal activities have constant income to their account in one period, and none at all in another. For example, among agricultural producers. Unstable revenue may attract the bank's attention. In this case, there is a risk that the work of the Client-Bank will be suspended (Methodological recommendations of the Bank of Russia dated April 13, 2016 No. 10-MR).

How to unblock Client-Bank. Write to the bank explaining that unstable revenue is related to the specifics of the company’s activities. Attach documents confirming this fact (agreements with buyers, an extract from the Unified State Register of Legal Entities with “seasonal” OKVED codes, a copy of the confirmation of the main type of activity that you submitted to the Social Insurance Fund). The law does not have a time frame for renewing the program. But the likelihood of a quick resolution of the issue will be higher if the explanations are as detailed as possible.

When is it illegal to block an account?

Judicial practice knows cases where companies managed to prove that blocking an account was illegal.

The company did not submit the declaration, despite the fact that there was no obligation to submit it

The company was registered. Along with the registration documents, a notice of the transition to a simplified system was submitted. However, in fact, the company did not switch to a simplified system. During the year, she provided tax reporting under the general taxation system, including VAT returns.

The tax office accepted these reports without any questions, but at the end of the year, when the company did not submit a declaration under the simplified tax system, it blocked its current account.

The company went to court to challenge the decision to block the account. The court supported this requirement, since the company, despite the fact that it submitted a notice of transition to a simplified taxation system, did not actually switch to it and worked on the general taxation system.

Consequently, the company had no obligation to file a declaration under the simplified tax system. In this case, the inspectorate blocked the account illegally.

The company did not provide advance income tax calculations; the inspectorate blocked the current account

In this case, the Federal Tax Service relied on subparagraph 1 of paragraph 3 of Article 76 of the Tax Code.

The company had to go all the way to the Supreme Court, which, unlike previous instances, noted that this legal norm does not provide the tax authorities with the opportunity to block an account in case of failure to submit an advance payment calculation.

A tax return and an advance payment calculation are different documents. In case of failure to submit a tax return, the inspectorate may block the account, but for failure to submit an advance payment calculation, it cannot.

The inspectorate assessed additional taxes based on the results of the audit. The value of the company's property exceeded the amount of the arrears, but the tax authorities still took interim measures in the form of suspending transactions on bank accounts. However, by virtue of the law, if the value of the company’s property exceeds the amount of debt, then the inspectorate cannot block the account. She can block the account only for the amount of the difference between additional charges and the value of the assets.

The inspectorate blocked the account due to procedural violations

For example, the inspection revealed tax arrears. After that, she made a demand for payment of arrears. The company has 10 days to make voluntary payment. As long as the period allotted for voluntary payment of the debt has not expired, the tax office cannot block the company’s account. Blocking becomes possible only if the company voluntarily fails to pay the tax.

A statement that will force the inspectorate to fork out money

From January 1 of this year, companies have the right to demand interest from inspectors for unlawful suspension of account transactions (clause

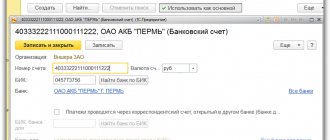

2. Statement of account N 40112818900001000987 in the bank Imperia LLC. 9.2 Art. 76 of the Tax Code of the Russian Federation). In order to receive money from tax authorities for the illegal suspension of account transactions, you need a special statement. From January 1 of this year, companies have the right to demand interest from inspectors for the unlawful suspension of account transactions (clause 9.2 of Article 76 of the Tax Code of the Russian Federation). To receive money from the tax authorities for illegally suspending account transactions, you need a special application. To the head of the Inspectorate LLC "Company" of the Federal Tax Service of Russia No. 1 for Moscow, Petrov Petr Petrovich Limited Liability Company "Company" OGRN 1045012461022, INN 7701025478, KPP 770101001, 127138, Moscow, st. Basmannaya, 25 Ref.

APPLICATION for payment of interest for illegal suspension of transactions on the account Suspension of transactions on the account (from the day the bank received the decision to block the account until the day it received the decision to cancel it) was in effect from February 4 to February 15, 2011 inclusive. Details for transfer: account No. 40702810021400000012, opened with JSCB "ComBank" (TIN 7710105745, KPP 775001001), BIC 044501001. 1. A copy of the confirmation of the special communications operator on 1 sheet in 1 copy.

I. Astakhov

How to unblock an account?

Essentially, there are only two options:

- comply with tax requirements. In this case, you need to take a certified account statement and payment from the bank and submit them to the tax office;

- prove that the tax office blocked the account illegally. To do this, you need to carefully analyze the situation, see what the tax office refers to when blocking, and especially carefully check the deadlines - was the inspectorate too hasty in blocking the account? Maybe the deadline for voluntary repayment of tax debt has not yet expired?

In what cases is it written?

The Tax Service is authorized in special cases (to influence unscrupulous taxpayers) to block their current accounts. These rights are indicated in

What to do if your current account is blocked?

The main reason for blocking taxpayer funds is non-payment of mandatory payments to the budget.

But before freezing, the tax inspector must send a demand for payment of the debt, which must be repaid before a certain date specified in the document.

There are also other reasons for blocking:

- judicial arrest;

- lack of tax return;

- the location of the company does not correspond to the legal address;

- failure to provide documents requested during a desk audit;

- cash withdrawal, terrorist financing.

Seizure is permitted if there is a court decision. This measure is used when large amounts of taxpayer debt arise or to collect a fine.

This method guarantees the execution of a court verdict to confiscate the company’s property if the bailiffs are involved in the collection.

To speed up the procedure for lifting the seizure of bank accounts, submitting a corresponding request to the Federal Tax Service will help.

If operations on the account are stopped due to outstanding debt or violation of reporting deadlines, then the decision is canceled no later than one day from the date of fulfillment of obligations or submission of the declaration, respectively.

How to write to remove the arrest and restriction from the account?

The application to the tax office is drawn up in any form.

At the legislative level, a unified form of such a form has not been introduced.

The document is generated on the company’s letterhead and contains the following data:

- name of the Federal Tax Service (details, address), to whose address the application is sent;

- Full name of the head of the tax service;

- information about the applicant (name, TIN, location);

- serial number of the letter in accordance with the log of outgoing documentation;

- text part that reflects the essence of the appeal;

- the final block, including a request to restore the ability to carry out transactions on the current account;

- seal, signature of the head of the company.

For faster communication, you can indicate the contact phone number of the chief accountant.

Sample text of the main message:

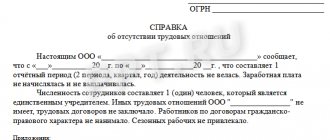

“By decision of the head of the Federal Tax Service No. 8, on August 25, 2021, operations on the current account of Spectr LLC in the bank Vostochny JSCB (account No....) were suspended for failure to submit Form 6-NDFL for the first half of 2021.

In this regard, we report the following. For the period from January 1 to June 30, 2021, no accruals were made in favor of individuals. Accordingly, there were no withholdings or transfers of tax amounts to the budget.

There is no obligation to submit zero tax reporting in Form 6-NDFL ().

In connection with the above, we ask you to unblock the current account No.... Spectr LLC, opened at the Vostochny JSCB. We also remind you that for each calendar day of unlawful blocking, Spectr LLC has the right to demand interest from the Federal Tax Service No. 8 ()"

Arguments may also be made in favor of a partial “unfreezing” of funds. This is possible if the reason for the arrest was non-payment of mandatory payments, and their total amount does not exceed the money available in the company’s current account.

Rules for writing and completing an application to remove seizure from accounts and unblock a bank card

The application is submitted to the reception office of the FSSP branch of your city or district.

It must be written correctly, without errors or corrections.

What to do if the bailiffs have seized the card - can the bailiffs lift the seizure of the card?

When writing an application to cancel the arrest and remove the block from accounts and bank cards, follow these rules:

- Create a “hat”. Find out the name of the head of the department, write it down, and also provide information about yourself - full name, residential address, passport details, telephone number.

- Enter the title of the document. In our case, you must write without quotation marks: “Application to remove the arrest from a current account” or “Application to unblock a bank card.” There is no need to put a period at the end of the sentence. This is a serious mistake, due to which the application may not be accepted.

- The main part of the application must indicate who the applicant is – the debtor or the debtor’s representative.

- If the enforcement proceedings were opened, it was conducted by a bailiff, then the number and date of opening of the enforcement proceedings, as well as the initials of the bailiff are indicated.

- The exact amount that is required to be returned according to the writ of execution is written down.

- It is indicated that the current account under a certain number was seized, which is why the bank card was blocked.

- The request must state that you are asking to lift the arrest, and the reason for your application must also be indicated.

- The name of the banking organization or credit institution is entered when you indicate the current account number.

- At the end of the document, a list should be compiled consisting of the names of documents, certificates confirming the receipt of funds on the card that are not subject to seizure, or proving violations of your rights and interests.

- The date on the application must be entered when you submit the document to the FSSP. The client's signature is required.

It is better to complete the application in two copies. One option is necessary for the applicant to confirm the application and acceptance of the application, the other is necessary for the bailiff.

You can submit the document to the reception and communicate with the bailiff who seized the accounts in person. Then you will know in what period your appeal will be considered and when the arrest will be lifted.

Does the bank have the right to request documents under 115-FZ?

Yes, the bank has the right to request documents under 115-FZ, this right is granted to the bank in clause 14, art. 7, 115-FZ.

information to organizations carrying out transactions with funds or other property

necessary for the specified organizations to fulfill the requirements of this Federal Law, including information about their beneficiaries, founders (participants) and beneficial owners.

How to properly provide documents to the bank?

Documents at the request of the bank must be provided strictly according to the inventory, or the act of acceptance of the transfer of documents

. I’ll explain why to do this, as practice shows, especially since 2021, the bank’s main goal is to withhold from you a commission of 10-25% of the amount in your current account, and after submitting the documents you will receive the standard phrase “That the documents presented do not explain the economic meaning transactions you carry out, we suggest closing the account and transferring funds to another bank, the transfer fee will be 20%"

And the most important thing here is not to make a fatal mistake,

especially if you have not provided all the documents upon request, it will be a fatal mistake if you follow the bank’s lead and transfer money to another account with a commission, this will not solve your problem, because when the funds arrive in another bank, they will not be will be blocked, because when the client’s account is blocked, you end up on the Central Bank of the Russian Federation 550-P list (Black List), it is available to all credit institutions, and when you did not provide documents upon request, but decided to withdraw money with deduction of commission, the bank employee who will carry out the transfer will send the money to another bank with code 6001.

Appeal to the interdepartmental commission of the Central Bank of the Russian Federation.

An interdepartmental commission under the Central Bank of the Russian Federation was created on March 30, 2018, with the aim of rehabilitating legal entities and individuals who were blacklisted by banks (550-P).

In order for the right to appeal to the interdepartmental commission under the Central Bank of the Russian Federation to arise, it is necessary to provide evidence of filing a claim against the bank. That is, in order for you to have the right to appeal, you must exhaust all possible options for communicating with the bank.

The Interdepartmental Commission is provided with an application, evidence of the transfer of documents to the bank upon request, a claim, and the bank’s response is not a claim, the period for consideration of the application is 30 days.

Algorithm of actions to unblock an account:

1) Provide all documents at the bank’s request and hand them over to employees according to the inventory or transfer acceptance certificate;

2) If your access to remote banking services has not been restored, write a written complaint and send it to the bank;

3) If after the claim the RBS was not restored to you, contact the interdepartmental commission created under the Central Bank of the Russian Federation;

4) If appealing to the interdepartmental commission does not help, then you need to file a claim with the Arbitration Court at the location of the bank or its branch.

If your bank card opened for an individual has been blocked. face read how to unlock it in this article.

I hope the information provided will be useful for you, do not forget to subscribe to the channel in order to regularly improve your legal literacy.

Situation No. 1: “We’ll transfer dubious money, but keep 10-20% for ourselves”

The above procedure. But the logic is simple and smacks of nonsense: “You launder proceeds through criminal means and look like a terrorist, but so be it, we will transfer your criminal money to another bank. Just give us 10-20% of the amount.” Sometimes banks don’t even inform you about the “special” tariff. They keep silent... Or they write it in small print in the banking service agreement. Therefore, read the contract carefully. What do the courts think?

- If the bank did not notify the client about special tariffs, did not indicate which transactions it considered suspicious, and did not make a request for explanations and documents, then the bank’s actions in charging a commission are illegal: Resolution of the Moscow District Court of August 24, 2018 in case No. A40 -201153/17. Just read these lines: “The court concluded that, by writing off the disputed funds, the Bank illegally usurped the functions of a government body and established a fee not provided for by law and agreement in the form of a “protective tariff” for conducting banking operations without providing documents, which is contrary the meaning of Federal Law No. 115-FZ “On combating the legalization (laundering) of proceeds from crime and the financing of terrorism .

- Increased commissions are not a form of control, even if this is provided for in the contract: Resolution of the Far Eastern District Court No. F03-3404/2018 dated August 27, 2018 in case No. A73-18762/2017. The enterprising bank, of course, in the fight against terrorism, stipulated in the contract individual conditions for suspicious clients: a commission of 12% when closing an account. The court put the bank in its place, and the businessman returned his honestly earned money: “Law No. 115-FZ, as well as other federal laws, does not contain provisions allowing credit institutions to establish a special commission as an anti-money laundering measure. in an increased size. Collection of a commission for transactions with funds related to the legalization (laundering) of proceeds from crime and the financing of terrorism is not a form of control.”

Situation No. 2: “We will limit access to the Internet bank without requesting documents”

A bank employee calls and says: “We have grounds to block your account under No. 115-FZ . Provide us with documents confirming the legality of the operation.” Or tells you the same thing when you come to the bank. What will you do: run to collect papers or ignore the demand? The bank's requirement in this form is contrary to the law. The bank is obliged to request documents in the following ways:

- “by delivering to the Client or his Representative a request drawn up on paper, certified by the signature of the Authorized Person and the seal of the Bank (branch), containing a list of necessary documents and the period within which the documents must be submitted to the Bank;

- by sending a similar request to the Client via electronic communication channels (if the form of contractual relations with the client involves the exchange of electronic messages)" ( clause 8.2.2. "Model Rules of Internal Control of a Credit Institution", approved by the Regulations of the Bank of Russia dated March 2, 2012 year No. 375-P )

A similar situation occurred in the Resolution of the Moscow District Court of August 13, 2018 in case No. A40-227570/2017. Of course, the businessman won: a telephone request is not a request. Therefore, the bank’s actions to restrict access to the Internet bank are illegal.

Situation No. 3: A “terrorist” is someone who transfers money between his accounts.”

Bank “A” offered you more attractive terms of service than bank “B”. And you decided to open a current account in bank “A”. Bank “B” was notified about the termination of the contract and the transfer of money to a new current account. Who are you after this? Of course, it's a "terrorist". Justify “why - why - how” and bring a suitcase of documents. And anyway, how could you do this, you bastard! Or, your company, which has an account in bank “A”, transfers you money to your “physicist” account in the same bank. Or your company has 2 current accounts in different banks. There are definitely “terrorist” notes...

In all the described cases, there is a risk of blocking if you do not justify the economic meaning of the transactions and provide supporting documents. Although, the bank can find 1000 and 1 reasons to still add you to the ranks of dangerous clients... All that remains is the court. And the courts support businessmen. For example, in the Resolution of the Arbitration Court of the North-Western District dated June 13, 2018 in case No. A56-51915/2017, the court stated: “Since, according to the evidence presented in the case, the Company explained to the Bank the economic meaning of the operation being carried out and provided supporting documents, the refusal to carry out the controversial operation on the grounds of paragraph 11 of Article 7 of Law No. 115-FZ, in the absence of evidence of the Bank’s compliance with the requirements of paragraphs 2, 3 of Article 7 of Law No. 115-FZ, the courts rightfully declared illegal and unfounded.” A similar situation occurred in the Resolution of the Moscow District Court of July 25, 2018 in case No. A40-173510/2017.

Former employee of one of the large banks:

- I worked in a large bank in Russia for more than 4 years as a manager of VIP clients, and during this time I saw enough of everything (I mean negative situations with clients).

But the most difficult situations are precisely the blocking of accounts of individuals engaged in entrepreneurial activities. They were not saved even by the fact that they had service packages open for privileged clients, which allowed them to withdraw millions of sums from their accounts and cards.

BUT!!! As soon as funds began to flow on their cards, even within the limit, their accounts were immediately blocked! Naturally, the question arises: why then do banks allow clients to open platinum cards for large amounts if these cards and accounts are immediately blocked? And then clients cannot “get” their money out of their accounts for months, because... For this you need permission from the Rosfinmonitoring service! The financial monitoring service requires supporting documents about the client’s financial activities, the client provides them... But the saddest thing is that the accounts remain frozen.

It's a vicious circle... Once you get there, you can't get out. In my practice, not a single client’s account has ever been unblocked and not a single client has been excluded from the so-called “STOP LIST”, except for one person: a friend of the bank manager (there are still loopholes for such “friends”). It is not surprising that the bank has lost many important clients, but the reality today is what it is...

Situation No. 4: “We will not unblock the current account / we will charge a commission / we will refuse banking services for an incomplete set of documents, or for conflicting information”

If the documents are indeed fakes, contain gross irregularities in their design, and do not fully reflect the essence of the transactions, then you will definitely be denied service. As happened in the Resolution of the Central District Court of August 1, 2018 in case No. A36-14507/2017. The bank conducted a study not only of documents, but also of the activities of the client’s employees. The general director is on maternity leave, but he signed the documents. Is that possible? No, unless there is a corresponding statement. After all, according to Art. 256 of the Labor Code of the Russian Federation , while on maternity leave, a woman can work part-time or at home only upon application.

And the documents are a mess: contracts for the provision of information and consulting services without attachments, identical loan agreements with “physicists” of non-identical content: different conditions and details, changed dates. In addition, the company did not pay taxes and insurance premiums. The bank refused service and terminated the contract. The court agreed: “Transfer of funds between their accounts for subsequent transfer of funds to the accounts of individuals, issuance of loans to individuals, lack of evidence of the return of funds by borrowers within the prescribed period, failure to provide the requested information, documents confirming the payment of personal income tax, insurance premiums, taxes, the presentation of documents containing contradictory information indicates that the client’s transactions fall under the criteria confirming the possible legalization (laundering) of proceeds from crime...”

And the commission will be charged for contradictory documents if the contract stipulated special tariffs and conditions for closing a current account. And in requests for the provision of documents, they will not forget to refer to the corresponding clause of the contract: Resolution of the Moscow District Court of July 17, 2018 in case No. A40-126172/2017.

The commission can also be withheld for an incomplete set of documents: Resolution of the Moscow District Court of August 15, 2018 in case No. A40-215812/2017. The court considered the 20% commission to be completely legal, since it was provided for in the contract.

By the way, sometimes a link to an incomplete set of documents does not work if the client actually provided the set that the bank requested. But the bank, either due to its inattention or harmfulness, still did not retreat. You can’t do this - the client is right. The businessman turned out to be very attentive and meticulous in Resolution of the Eighteenth AAS No. 18AP-10806/2018 dated August 23, 2018 in case No. A76-3461/2018 . Won.