How sick leave is paid is established by labor legislation and regulations. We are talking about a simple certificate of incapacity for work; the procedure for paying benefits for BiR, as well as parental leave, are the topics of separate articles.

General information about calculating sick leave and possible changes

In 2021, no major changes are expected in the calculation of sick leave. A certificate of temporary incapacity for work does not have a fixed meaning; it depends, first of all, on length of service and earnings.

General rules for paying sick leave:

- if the work experience is 8 years or more, a benefit is paid in the amount of 100% of the salary;

- from 5 to 8 years - 80%;

- less than 5 years - 60%.

If the average earnings for each year exceed the required limit (815 thousand in 2021, 865 thousand in 2021, 912 rubles in 2021), then the specified maximum amount must be taken into account to pay for sick leave!

In order to correctly calculate sick leave in 2021, you must complete the following sequence of actions:

- Determine the average earnings for the billing period.

- Calculate average daily earnings.

- Calculate the amount of daily allowance.

- Set the amount of benefits to be paid.

First you need to determine your earnings for the previous 2 calendar years. If an employee has recently joined a company, a certificate of the amount of salary and other payments that each employer is required to issue upon dismissal will help in the calculations.

To determine the average daily earnings, the amount received must be divided by 730. Next, you need to calculate the amount of the daily benefit, taking into account the insurance period.

If the employee’s insurance experience is less than 6 months, no more than one minimum wage is paid for each month; from January 1, 2021, the minimum wage is 12,792 rubles.

The final step is to determine the total amount of the temporary disability certificate. You need to multiply the amount of the daily benefit by the number of days in accordance with the sick leave provided.

Please note: starting from 2021, it has become possible to issue electronic sick leave certificates instead of the paper version.

Law on calculation and payment of sick leave

Payment of sick leave is regulated by federal legislation, namely 255-FZ of December 29, 2006 “On compulsory social insurance in case of temporary disability and in connection with maternity”, taking into account all changes and additions.

To pay for temporary disability certificate, the employee must experience one of the following insured events:

- illness or injury of the employee himself;

- caring for a family member who is sick;

- quarantine of an employee, his child under 7 years of age or an incapacitated relative;

- prosthetics, the basis for which is medical indications;

- follow-up treatment in a sanatorium immediately after inpatient medical care.

A mandatory requirement for all of the above situations is the insurance of the employee by his employer by transferring insurance contributions to the Social Insurance Fund of the Russian Federation in the amounts established by law. In practice, every officially registered employee is insured.

How sick leave is paid to an employee who is injured at work or “earns” an occupational disease is established by federal law.

In these situations, the main regulatory document is Law No. 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases” dated July 24, 1998.

Accidents and compensation for occupational diseases are paid from the Social Insurance Fund in the usual manner and are identical to how sick leave is paid in 2021 for other insurance cases.

Funds to pay for sick leave

If an employee took sick leave in 2021, how this sick leave is paid for and from what sources is regulated by regulations.

Any insured event that occurs with the employee himself is paid as follows:

- the first three days – at the expense of the enterprise’s profit;

- the remaining period is subject to compensation from the Social Insurance Fund of the Russian Federation.

Such sick leave payment is established by Article 3, paragraph 2. 1 of the federal law on insurance premiums (No. 255-FZ).

Payment for sick leave for caring for a child or for an incapacitated relative is carried out entirely from the Social Insurance Fund budget. Payment of sick leave after dismissal is carried out in the amount of 60%, regardless of the length of the employee’s insurance period.

Important! A former employee may qualify for such sick leave if he fulfills a number of requirements specified in Article 7, paragraph 2 of Federal Law No. 255-FZ.

Sick leave calculator

For how long is it issued?

A certificate of temporary incapacity for work is issued for a period of ten days, but if the illness becomes more complicated, the doctor has the right to extend it up to one month. The maximum limit of sick days per year per person is 30 days. The following cases are exceptions:

- pregnancy and childbirth without identified complications - 140 days;

- pregnancy and childbirth with complications - 156 days;

- multiple pregnancy - 194 days;

- care for a child due to his illness - 30 - 60 days;

- disability - up to 5 months.

The maximum period of sick leave reaches 12 months if the patient is diagnosed with severe pathologies, complicated fractures and diseases requiring long-term treatment.

Read more: “For how many days is sick leave issued?”

Payment of sick leave to a permanent employee and external part-time worker

The general procedure for calculating sick leave is as follows, established at the legislative level.

Counting algorithm:

- the employee’s total income base for the last 2 calendar years is taken, for which insurance premiums are calculated;

- the received amount is divided into 730 (seven hundred thirty) days;

- the calculated value is the average daily earnings;

- further, the percentage of payment is determined based on the length of the employee’s insurance experience: insurance experience of 8 or more years – 100%; from 5 to 8 years – 80%; from 3 to 5 years – 60%; less than 6 months – sick leave is calculated based on the minimum wage).

Example: an employee has been working at the company for almost 5 years, his income base for 2 years is equal to RUB 335,200.00. This is his first place of work, i.e. the insurance period is in the interval that assumes 60% payment of average daily earnings: 335,200 / 730 = 459.18 rubles. * 60% = 275.51 rub.

Thus, for each day of sick leave, the employee will receive 275.51 rubles. The employer pays for the first 3 days from his own funds: 826.53 rubles. The remaining days are covered by the insurance fund.

Results

Before calculating sick leave in 2019-2020 from the minimum wage, you need to check whether such a calculation is needed. It is used in situations where the employee has only recently started working or if his earnings are below the established minimum wage.

How to calculate sick leave in 2019-2020 from the minimum wage? You need to take the current minimum wage as of the date of opening of sick leave and substitute it instead of the monthly income in the standard formula for calculating the average daily earnings of an employee. The answer to the question: “How to calculate maternity sick leave in 2019-2020?” will be similar.

Sources: Federal Law dated March 7, 2018 N 41-FZ

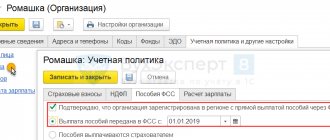

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Rules for paying sick leave to an external part-time worker

When paying a certificate of incapacity for work to an external part-time worker, there are some nuances.

Payment for part-time sick leave in 2021 is carried out as follows.

1. When filling out a certificate of incapacity for work in a medical institution, the patient must say that he has several places of service, and the nurse responsible for issuing sick leave must give several forms - one for each employer. Moreover, on the sick leave, a note is made which place of work is the main one, which (which) is part-time.

2. If an employee has been working part-time for a long time and the income base has developed, all employers will pay for his sick leave.

3. If in the 2 calendar years preceding the year of the insured event, the employee had different employers, then he needs to collect certificates from all of them in form No. 4-n and receive payment from any of the current employers of the employee’s choice, about This is stated in Article 13 No. 255-FZ.

4. If a part-time employee has not worked anywhere for the last 2 years, temporary disability benefits can be paid to him based on the minimum wage and the length of the insurance period.

Who is paid disability benefits?

For every employee who is temporarily disabled, this social security is very important. In essence, this payment is compensation for the income that the employee loses due to his inability to work and not for failure to fulfill his duties due to health problems, both his own and that of a family member if he or she requires care

This benefit is regulated by Order of the Ministry of Health and Social Development No. 91, the Labor Code and Federal Law No. 255.

Insured persons are citizens of the Russian Federation, foreign citizens, and stateless persons who reside in the country temporarily or permanently, except for highly qualified specialists. Insured citizens include:

- Those working under an employment contract, company managers, founders and owners.

- Civilian state and municipal employees.

- Citizens who permanently hold government positions at the federal, regional and municipal levels.

- Participants in production cooperatives in which they personally work.

- Servants in the church.

- People who are guilty in court and deprived of liberty, as well as receiving payment for their work.

In accordance with the employment contract, a person is considered to be working from the moment he begins or is allowed to work. Citizens who are engaged in legal or notarial activities, individual entrepreneurs, members of communities of the peoples of the Far North and farms are insured only if they pay insurance premiums in accordance with Federal Law No. 255.

The procedure for calculating average earnings

As mentioned above, the average daily earnings consists of the amount of income received by the employee in the 2 years preceding the year of application for benefits. In other words, in 2021 the income base is taken for the years 2021 and 2021.

All income received from all employers is counted. The condition is that the contractual relationship must be of a formal nature and all employers transfer insurance contributions from the employees’ wages to the Social Insurance Fund of the Russian Federation.

There are situations when during the specified period the employee does not have an income base. For example, the employee was on leave for employment or childcare. Then, on the basis of Article 14, paragraph 1 of Federal Law No. 255, she has the right to write a statement and choose the previous calendar years (where the income was) to calculate the average daily earnings. The only condition is the fact that the amount of sick leave increases upward (compared to that calculated according to the minimum wage).

When determining average earnings, accounting is guided by Article 14 of Law No. 255-FZ. In this case, the obtained result is compared with the current one at the time of calculating the minimum wage benefit.

Example: an employee has an income base for 2018-2019. 274.7 thousand rubles. We determine the average daily earnings: 274,700 / 730 = 376.3 rubles. Let's calculate the average daily earnings based on the minimum wage: 12,130 (from 01/01/2020) * 24 months = 291,120 / 730 = 398.79 rubles.

Many workers are interested in the question: what percentage of sick leave is paid. An employee receives 100% if the insurance period exceeds 8 years. Experience from 5 to 8 years is paid at the rate of 80%, from 3 to 5 years - 60%, less than 6 months. - based on the minimum wage.

Important! For dismissed employees, temporary sick leave is always paid in the amount of 60% of the actual average daily earnings (subject to the conditions necessary for payment being met).

Existing restrictions on sick pay

Payment of sick leave at an enterprise occurs in accordance with the legislation of the Russian Federation, which provides for a number of restrictions.

1) Revenue base for 2020-2021. should not be higher than the maximum permissible value. This provision is spelled out in Article 14, paragraph 3.2 No. 255-FZ. For 2021 – 865,000 rubles, for 2021 – 912 rubles.

Thus, the upper income limit for any employee (for each place of work) who is accrued sick leave in 2021 will be 865,000 +912,000 = 1,777,000 rubles. and average daily earnings - 2,434.25 rubles . (865,000 + 912,000 / 730).

2) The presence on the certificate of incapacity for work of a note about the patient’s violation of the regime. For example, a patient left the hospital without permission. The date of violation of the regime is the moment from which the amount of average daily earnings is calculated from the minimum wage.

3) Limitations in accordance with the length of the insurance period (interests are discussed above).

4) The benefit for caring for sick relatives has a number of restrictions on payment terms in accordance with Article 6, paragraph 5 No. 255-FZ. There is a dependence on the age of the sick relative; the amounts of hospital benefits are presented more clearly in the table.

| Relative | Maximum duration of 1 sick leave in days | Number of paid days during a calendar year |

| Child under 7 years of age | No restrictions | 60 |

| A child under 7 years of age with a disease from the special list of the Social Insurance Fund | No restrictions | 90 |

| Child aged 7-15 years | 15 | 45 |

| A disabled child under 18 years of age | No restrictions | 120 |

| A child under the age of 18 who has HIV and other diseases according to list No. 255-FZ, Article 6, paragraph 5, paragraphs 4,5 | No restrictions | No restrictions |

| Another relative | 7 | 30 |

Outpatient care for a sick child is paid in the following order:

- the first 10 days are paid according to the average daily earnings, adjusted according to the length of the insurance period;

- subsequent (starting from the 11th day) days - 50% of the average daily earnings on the basis of Article 7, paragraph 3 No. 255-FZ.

Deadline for payment of temporary disability certificate

The sick leave accrued in the accounting department is paid to the employee on the day the wages are issued at the enterprise.

There should be 2 such days - advance payment and salary. On the next date, the employee receives the benefit amount (subject to personal income tax).

If the terms of payment of sick leave by the employer are violated, the employee has the right to file a complaint with the labor inspectorate, the prosecutor's office or the court. When drawing up a complaint, you must briefly outline the essence of the case and attach evidence of the unlawfulness of the employer’s actions.

The following documents may be used to confirm that sick leave payment deadlines have been violated:

- a copy of the sick leave certificate;

- a copy of the employment contract;

- a payslip with the accrued amount;

- a copy of the statement or statement from a plastic card account (for non-cash payments to staff);

- other documents.

Terms of payment

Registration and payment of funds expected upon assignment of temporary disability are subject to compliance with the following criteria:

- The citizen regularly made contributions to the social insurance fund;

- You have citizenship of the Russian Federation;

- We have a sick leave certificate, which is proof of temporary disability and the basis for monetary deductions.

Failure to comply with these parameters will result in a refusal from the authorized bodies.

Following the current laws of the Russian Federation, disability benefits can only be assigned to citizens of the Russian Federation.

But, in some situations, this right also applies to foreigners:

- The presence of a minimum period of insurance contributions (one day);

- Official employment;

- Foreigners have citizenship of countries specified in the list of the special treaty of the Russian Federation. These are: Armenia, Belarus, Kazakhstan.

For some time now, the right to receive payment for sick leave has extended to women carrying a child and on maternity leave.

To receive the desired payments, you need to contact your attending physician, who will issue a certificate in the appropriate form.

Payment terms

The benefits provided are accrued within the time limits specified by law, which are shown in the table below.

| Age category and illnesses of family members | Period for which funds are deducted |

| Less than seven years | Payment is made for the entire period of inpatient treatment or stay with the child in the department. The limit is a period of sixty calendar days per year for all illnesses of the child. |

| Increasing the above-mentioned period to ninety days a year in the event that a child is diagnosed with a disease that is included in the list determined by the Ministry of Health (ACTIVE LINK). | |

| This list includes many types of cancer, insulin-dependent diabetes, autism, schizophrenia, epileptic seizures, etc. | |

| In addition, the list includes injuries (damage to internal organs, head injuries, etc.), as well as frostbite, or burns, etc. | |

| From seven to fifteen years | Compensation is due for a period of fifteen calendar days for each case of illness in which the child is admitted to the hospital. |

| The limit is forty-five calendar days. | |

| A minor child with a disability | For the entire period of outpatient treatment or stay with the child in a hospital. |

| The limit is a period of one hundred and twenty days per calendar year for all illnesses of the child. | |

| A child under the age of eighteen is infected with HIV, has cancer (including malignant tumors), or suffers from complications after vaccination | Compensation is provided for the entire duration of the child’s hospital stay at the clinic. |

| In this case, there are no time limits. | |

| In other situations when caring for a sick family member is required | No more than a seven-day period for each disease, but no more than thirty calendar days in one year. |

Legislative changes in 2021

In 2021, the maximum amount of temporary disability benefits will increase by 4.5 thousand rubles - from 65.4 thousand to almost 70 thousand. Regardless of the length of service, the maximum sick leave cannot be higher than the amount established by law, and in 2021 it will be increased to RUB 69,962

Let us remind you that the restrictions on the maximum amount of sick leave are due to the fact that contributions to the Social Insurance Fund are calculated not from the entire employee’s salary, but from a certain amount. In 2021 it is 865,000 rubles, that is, the monthly “maximum” is 734,520.55 rubles. In 2021, the maximum amount for deduction of insurance premiums will increase to 912 thousand rubles, and the monthly maximum will increase to 36,513.75 rubles. This means that in 2021 you can count on an increase in the maximum amount of sick leave.

Thus, any legislative changes regulating sick pay should be carefully studied by employers. The Federal Tax Service may refuse payment if the documentation is prepared in violation of the established procedure.

How to calculate insurance experience

The insurance period for calculating sick leave benefits is determined by the work book, and in its absence, by the following documents:

- written employment agreements;

- a certificate issued by the head or an authorized institution;

- extract from the order;

- personal account or salary statement.

Employee Sidorov V.P. brought sick leave from May 14 to May 28, 2021 to the accounting department. The following information is recorded in his work record:

- From March 2, 2010 to December 1, 2010, he worked as a plumber at Aquamarine LLC.

- From December 2, 2011 to August 16, 2021, he worked for individual entrepreneur I.Yu. Savelyev.

- From August 17, 2021 to May 14, 2021 he works at Parus LLC.

During the first period, the length of service will be 8 months 30 days.

For the second – 6 years 8 months 16 days.

For the third - 8 months 29 days.

As a result - 8 years 2 months 15 days. The experience has exceeded 8 years, so a payment of 100% is due.

This might also be useful:

- Vacation schedule for 2021

- How to obtain a duplicate work book

- Local regulations in 2021

- Model employment contract in 2021

- Stamps in work books are canceled

- Bonus payment deadlines in 2021

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Sick leave for 3 days at the expense of the employer

If the resulting disability is a consequence of industrial or domestic damage, ordinary illness or poisoning, then the first 3 days are paid by the management from the assets of the enterprise. Compensation for the remaining days of sick leave is assigned to the Fund. For the worker, the division of sources of funds does not have any impact, since all payments are made by the employer.

The manager calculates compensation taking into account current and expected contributions to the Fund. If the amount to be paid is not enough, the Social Insurance Fund will compensate for the expenses.

Managers often have questions about when sick leave must be paid and whether it is possible to transfer funds along with wages. It is the days of advance payment and salary that are the time for calculating compensation. However, the manager has 10 days from the date of receipt of documents from the employee to check them and calculate the amount of compensation.

Final provisions

- The benefit is available only to employed persons and based on the fact of the bulletin provided to the personnel department.

- Legal grounds for obtaining a certificate of incapacity for work are considered to be illness, professional or domestic injury, caring for a seriously ill relative, adoption, and labor and labor.

- The maximum amount of compensation per day is -2150, the minimum is 370.85. In relation to the latter, a regional coefficient may be applied, increasing the total amount.

- All payments are made at the expense of the Social Insurance Fund, except for the first 3 days of incapacity for work - paid by the management.

- The duration of leave is determined by the cause of the disability, whether the person himself is ill or is caring for someone.

- The amount of compensation depends on the person’s earnings, the number of years worked and the allotted days of incapacity for work.

- The benefit cannot exceed the country's maximum benefit limit.

9 questions about sick leave. Elena A. Ponomareva answers:

Form for receiving a question, write yours