By expanding its activities, a company may decide to open its branches and representative offices. The Tax Code of the Russian Federation also classifies other departments as separate, even if this is the only stationary workplace. Structural units can be created in the same area where the “head” is located, or in other regions. Registration of a separate division is the responsibility of the parent organization. Let's look at what forms are submitted to the Federal Tax Service for this, and provide a sample of filling out notification 1-6-Accounting.

New right

If an organization has several separate divisions on one municipal territory or its location with separate divisions together on this territory, starting from 2021, you can pay personal income tax and submit reports on it in one of 2 ways:

- at the location of one of these sections;

- at the location of the parent organization.

This is regulated by the new paragraph of paragraph 7 of Art. 226 of the Tax Code of the Russian Federation from January 1, 2020 (introduced by Law No. 325-FZ of September 29, 2019).

The tax agent himself chooses a separate office or head office (this is his right , not an obligation), taking into account the procedure established by clause 2 of Art. 230 Tax Code of the Russian Federation.

Let us note that until 2021, such tax agents paid personal income tax and submitted reports at the place of registration of both the parent organization and each separate division.

Filling example

Let’s assume that Guru LLC has 2 separate divisions on the territory of one municipality. They are registered with the Federal Tax Service of Russia No. 19 and 21 in Moscow (let’s agree that these two tax authorities supervise one municipality, each in its own part of the territory).

The company wants to pay personal income tax and submit reports on this tax for these divisions in 2021 through the Federal Tax Service of Russia No. 19 for Moscow (clause 7 of article 226, clause 2 of article 230 of the Tax Code of the Russian Federation).

This means that she notifies Inspectorate No. 19 of her choice.

The following shows a sample of filling out the 2021 notification of choosing a tax authority for personal income tax by separate divisions.

NOTICE OF SELECTION OF TAX AUTHORITY 2021 SAMPLE COMPLETION

Read also

03.01.2020

Submission deadline

As a general rule, the company must notify the Federal Tax Service of its choice no later than January 1 (clause 2 of Article 230 of the Tax Code of the Russian Federation).

Taking into account the New Year holidays from January 1 to 8, this document had to be sent to the inspection no later than January 9 .

cannot be changed during the year . Exceptions:

- the number of sections has changed;

- There are other changes that affect the procedure for submitting information about the income of individuals and personal income tax amounts.

However, due to the rather late approval of the notification form in 2021, the Federal Tax Service issued a special clarification. According to it, tax agent organizations planning to apply the new procedure for transferring personal income tax and submitting reports from 2021 can submit to the inspectorate a notification about the choice of a tax authority until January 31, 2021 (Friday).

If the tax agent plans to submit a notification after the transfer of personal income tax, then in order to avoid arrears and overpayments, these tax amounts should be transferred from January 1, 2021 according to the payment details of the selected separate division .

At the same time, the tax agent has the right to submit an application for clarification of the payment if it is necessary to adjust certain details (payer’s checkpoint, tax identification number, checkpoint and name of the payee).

“Salary” prepayment: sample in 6-NDFL

When filling out 6-NDFL, it is necessary to take into account all income of individuals subject to personal income tax. A “salary” advance is such income for each employee. However, for the purpose of calculating personal income tax, it has the following distinctive features:

- an advance is a part of “salary” income paid in advance, personal income tax on which is not separately determined, withheld or transferred to the budget;

- the advance in 6-NDFL is not reflected separately, but is included in the total earnings accrued for the entire past month (advance + final payment) - this total amount is reflected in the report;

- the date of reflection of the advance in 6-NDFL is the day of accrual of earnings - according to clause 2 of Art. 223 of the Tax Code of the Russian Federation, it falls on the last day of the month for which salaries are calculated.

See also: “How to correctly reflect an advance in form 6-NDFL (nuances)?”

Let's look at the features of reflecting an advance in 6-NDFL (filling example).

Rustrans LLC employs 38 people: drivers, couriers, dispatchers. The monthly total earnings of all employees of the company is 912,000 rubles, for 12 months - 10,944,000 rubles.

The advance is issued in a fixed amount (each employee 10,000 rubles), and the final payment is made personally in accordance with the time worked and the tariff rate (salary).

The issuance of earned money is carried out within the time limits established by the Regulations on the remuneration of Rustrans LLC:

- advance payment - on the 20th of each month;

- final payment is made on the 5th day of the month following the month worked.

To simplify the example, we will assume that employees of Rustrans LLC do not have rights to deductions and, apart from the advance payment and final payment, did not receive any other income in the current period.

Section 1 of the 6-NDFL declaration will look like this:

- line 010 - “salary” tax rate (13%);

- line 020 - total amount of accrued earnings 10,944,000 rubles. (RUB 912,000 × 12 months);

- line 040 and line 070 - calculated and withheld “salary” personal income tax = 1,422,720 rubles. (RUB 10,944,000 × 13%).

A sample of filling out 6-NDFL for 2021 (section 1) is presented below:

We will explain how to place data in the second section of 6-NDFL (filling procedure) in the next section.

Which form to use

For this purpose, the form for notification of the selection of a tax authority, the procedure for filling it out and the electronic format for submission were approved by Order of the Federal Tax Service of Russia dated December 6, 2019 No. ММВ-7-11/622.

According to the order, the new form of notification of the selection of a tax authority for a separate division comes into force on January 1, 2020. Her KND is 1150097.

The notification form consists of 2 sheets - a standard title page and a sheet with a list of the organization/its divisions entered by the checkpoint and the corresponding Federal Tax Service codes.

Further, you can use the direct link for free notifications 2021:

We submit a message about the creation of a separate division

Your organization opens a separate division.

You have already decided for sure that you will have just a division, and not a branch or representative office. You also know the date of its creation. Do I need to submit a notification about the creation of a separate division? Should I register it at its location? What documents, when and where to submit? How to fill out a notification correctly so that you don’t have to redo it? Now we will look at everything in detail.

Notice of the creation of a separate division

So, the first thing we have to do is notify the tax office at the location of the organization. This obligation is established by clause 3, clause 2, article 23 of the Tax Code.

The notice period is one month from the date of creation of a separate division. Let's immediately see what threatens you if the deadline is missed (Article 116, Article 117 of the Tax Code, Article 15.3 of the Administrative Code).

The fines are quite significant, so it is very important not to miss the deadlines.

Sample message filling

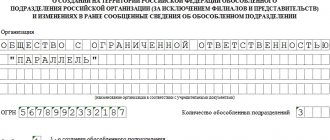

Form No. S-09-3-1 of the message was approved by order of the Federal Tax Service dated 06/09/2011. No. ММВ-7-6/ [email protected] (Appendix 3). You can download the form in pdf format using this link, or search for it yourself in one of the ATPs. Let's use a practical example to analyze the filling step by step.

Filling out the title page is very simple and usually does not raise any questions. At the top you will write the INN and KPP of the parent organization, then the code of the tax authority where the parent organization is registered, the name of the organization in full (without abbreviations), OGRN.

Next, you need to indicate the number of separate divisions that you are creating. This is due to the fact that several units can be registered with one message at once. In this case, there will be as many second sheets as there are sections to be registered - each with its own sheet. The title is common to everyone.

Notification of registration of a separate division (form 1-6-Accounting)

Related publications

By expanding its activities, a company may decide to open its branches and representative offices. The Tax Code of the Russian Federation also classifies other departments as separate, even if this is the only stationary workplace. Structural units can be created in the same area where the “head” is located, or in other regions. Registration of a separate division is the responsibility of the parent organization. Let's look at what forms are submitted to the Federal Tax Service for this, and provide a sample of filling out notification 1-6-Accounting.

Who are reservists and reserved ones?

Let us explain the basic concepts for those new to military registration.

Reservist (or liable for military service) is a citizen who, if necessary (mobilization), will be called up for military service. All persons liable for military service are divided into two categories:

- Citizens who served in the Armed Forces of the Russian Federation and retired to the reserve (reserve). They have a military ID and can be called up to perform military duty all the time until they reach the age limit. The age limit varies depending on the type of military service and the rank of reservist. A detailed table of ages and ranks is given in Art. 53 of the Law of March 28, 1998 No. 53-FZ “On Military Duty”.

- Young men of pre-conscription and conscription age who are subject to military registration.

Reserved citizens are reservists working in positions that will be necessary for the employing company to perform tasks in wartime. In order not to leave such jobs empty, the employer can issue a reservation from general conscription for workers liable for military service in these places.

Reservation is an independent process of military registration. As a rule, if the employer has the right to make a reservation, then this process is supervised by a separate specialist who understands it. Then, when preparing Form 6 for reserved persons, it is best to contact such a specialist for data.

Registration of a separate division

Neither branches nor representative offices of the company, like other divisions, are independent legal entities. They cannot be located at the same address as the parent company; they must have stationary workplaces for work for at least one month. The “head” endows them with property, appoints managers, issues powers of attorney to them, and also develops regulations on the basis of which they act (Article 11 of the Tax Code of the Russian Federation, Article 55 of the Civil Code of the Russian Federation).

Registration of separate divisions of a company is carried out by the Federal Tax Service at their location. After the decision to create is made, no more than a month is allotted for this (clause 1 of Article 83 of the Tax Code of the Russian Federation):

- If a company opens a representative office or branch (Article 55 of the Civil Code of the Russian Federation), the Federal Tax Service, along with a package of necessary documents, submits an application for registration of a separate division - Application for state registration of changes in the constituent documents of a legal entity (form No. P13001) and Notification of amendments (Form P13002), for entering divisions into the Unified State Register of Legal Entities;

- When creating other separate divisions, the “head” sends only one document to its Federal Tax Service - Message in form No. S-09-3-1 (approved by Order of the Federal Tax Service of the Russian Federation dated 06/09/2011 No. ММВ-7-6/362);

- Notification in form No. 1-6-Accounting (Order of the Federal Tax Service of the Russian Federation dated August 11, 2011 No. YAK-7-6/488) is submitted along with the notification of establishment if the organization opens several divisions on the same territory - in one city or municipality, but at the same time they fall under the jurisdiction of different Federal Tax Service Inspectors. There is an exception for such cases: when a new branch, representative office, etc. opens in an area where the company has already registered a previously created division, it can be registered with the same inspection; also, when opening several divisions in one city at once, all of them can be registered at the location of one of them (clause 4 of Article 83 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of the Russian Federation dated September 28, 2011 No. PA-4-6/15886).

Having received the documents, the inspectorate within five days sends the legal entity a notice of registration of a separate division indicating the checkpoint assigned to it. Not being separate legal entities, the divisions use the TIN of the parent organization, so it is not assigned to them.

How to keep military records in an organization

ConsultantPlus experts have prepared a detailed guide to military registration of employees. It contains instructions on what to do and how to do it, how to fill out documents and what will follow for violations. Follow the link below to get free access to this and other instructions.

Get free access to all ConsultantPlus materials

Form No. 1-6-Accounting - sample filling

The Notification of the selection of the Federal Tax Service should be filled out in the form and in the manner approved by Order of the Federal Tax Service of the Russian Federation No. YAK-7-6/488 (Appendices 4 and 15).

Notification in form No. 1-6-Accounting consists of a title page and pages with information about separate divisions. The form can be filled out manually or on a computer. The Notification is submitted to the Federal Tax Service in person, by mail, or electronically.

All necessary codes for filling out the Notification are contained in the appendices to the Completion Procedure.

The number of pages with information about separate structures corresponds to the number of these divisions indicated on the title page. The names of departments are indicated only if they exist: for example, if a remote workplace is created that does not have its own name, then the “Name” field remains blank. In our example, the Notification is filled out for the case of creating two divisions at once: a branch and a separate workplace.

The field with information about the Unified State Register of Legal Entities is filled in exclusively for branches and representative offices.

Submitting form No. 1-6-Accounting allows you not only to register, but also to deregister a separate division, since, when it is sent to a new inspection (at the location of one of the separate divisions), the division will be deregistered automatically by the previous Federal Tax Service Inspectorate .

Attracting specialists

If you act wisely, in this case you will have to turn to specialized organizations.

A prerequisite is that they have a license issued by Roshydromet, which gives them the right to carry out hydrological work.

The algorithm of actions is as follows:

- Search for such organizations, check for license availability;

- Discussion and conclusion of an agreement for hydrological work;

- Carrying out these works by the organization, drawing up a report on their results;

- Receipt by the Customer of reports along with completed forms 6.1-6.3.

The advantage of this approach is the fast and high-quality preparation of reports. Disadvantage - the cost of work will cost 70-100 tr. provided that the width of the survey object is no more than 200 m, and it is located near populated areas. Otherwise the cost will be higher. The cost of work is indicated for one water outlet/water intake/transition.

Who submits Form C-1 and when?

Legal entities involved in the construction and commissioning of capital construction projects, that is, developer organizations, report according to the form. The form is also submitted by organizations that have unfinished construction on their balance sheet.

Find out which statistical forms you should take on the Rosstat website.

Submit Form C-1 monthly and quarterly. The deadline for submitting the monthly form is the 3rd day of the month after the reporting month, for the annual deadline it is February 1 of the following year. Submit the form to the territorial statistics office if you commissioned capital construction projects. That is, there is no need to submit a zero declaration.

You can submit the form to Rosstat in person or by mail on paper or electronically. If there are separate divisions, report separately for branches and separately for the parent organization.

If your facilities are being built in two or more constituent entities of the Russian Federation, then report on each on a separate form and submit them to the relevant territorial bodies of Rosstat.

How to fill out Form C-1

Rosstat established the reporting form by Order No. 562 dated August 30, 2017. In Appendix No. 8 to Order No. 562, read the sample form and a brief procedure for filling it out. In the instructions, study the control ratios to avoid mistakes when filling out. Rosstat Order No. 9 dated January 18, 2019 approved detailed instructions for filling out C-1.

Form C-1 consists of a title page and five sections. Let's look at them in order.

Title page

The title bar is similar to other statistical forms. Indicate the period for which you are reporting, the full name of the company, postal address and OKPO code. Next, go to section 1.

Section 1. Commissioning of buildings by customers

Columns 3–5 may cause difficulty when filling out. Read all codes in Appendices No. 1 and No. 2 to Rosstat Order No. 9 dated January 18, 2019. In Column 6, indicate the commissioning of the total living space in residential and non-residential premises. The unit of measurement depends on the selected OKEI code. In column 7, indicate the number of buildings entered, in column 8 - their volume, and in column 9 - their area. In column 10, enter the actual cost of the constructed building.

On line 01, indicate residential and apartment buildings, dormitories, shelters, etc. As part of residential buildings, do not take into account objects suitable only for seasonal residence, yurts, trailers, motels, camp sites, mobile homes, residential buildings converted from non-residential buildings, etc.

Using line 02 from line 01, select individual types of residential buildings using codes from Appendix No. 1.

Line 07 is intended for entering information about non-residential buildings. Next, detail line 07 by type of building in lines 08–14.

In line 15, separately indicate residential premises in non-residential buildings.

Section 2. Capacity of commissioned facilities in non-residential buildings and structures

Columns 3–5 are filled out similarly to section 1. In column 6, indicate the commissioning of capacities and facilities in non-residential buildings.

Indicate data on the introduced capacities in line 16. In column 1, enter the name of the capacity, in column 3 - the code of the type of capacity, in column 4 - the nature of construction. Please see Appendix No. 2 for all codes.

Section 3. Residential units in commissioned residential and non-residential buildings

On line 21, indicate the number of apartments in the entered residential and non-residential properties in columns 2 and 3, respectively. On lines 22–25, detail line 21 by the number of rooms in the entered apartments.

Section 4. Distribution of commissioned residential buildings by wall materials and number of storeys

In column 3, indicate the area of the apartments, and in column 4, the number of buildings. On lines 26–32, distribute the areas of apartments and the number of buildings by wall materials. Using lines 33–45, distribute the area of apartments and the number of buildings by number of floors. Please note that on lines 26-45 you open columns 6 and 7 of line 01, so the amount on lines 26-45 must match line 01 under columns 6 or 7.

Section 5. Information on buildings and structures under construction as of the end of the year

Section 5 should only be completed in the annual report. In column 3, indicate the number of unfinished construction projects, in column 4, highlight residential buildings, and in column 5, indicate the total area of apartments in residential buildings.

To save time when submitting a report, use the cloud service Kontur.Accounting: here you can send the form to Rosstat via the Internet, and also easily keep records, pay salaries, pay taxes, and submit reports. All newbies get their first month free.

Procedure for filling out 6-NDFL for 2021

Filling out 6-NDFL is carried out taking into account the following requirements set out in Appendix 2 to the order of the Federal Tax Service:

- the basis for filling out the report is data from tax registers for personal income tax (mandatory for maintaining by each tax agent);

You will find a sample of filling out the tax register for 6-NDFL here.

- the number of report pages is not limited and depends on the amount of data (taking into account the rows and cells provided by the report);

- for each report indicator - 1 field (except for dates and decimal fractions - the order of their reflection is regulated by paragraphs 1.5, 1.6 of the application);

- in the absence of any total indicators, 0 is entered in the cells intended for them, and dashes are inserted in empty familiar spaces;

- direction of filling cells - from left to right;

- When preparing a paper version of the report, it is not allowed: filling it out with multi-colored ink (only black, purple and blue are allowed), correcting erroneous entries with a correction pencil (or other means), double-sided printing, as well as using a method of fastening that leads to damage to report sheets;

- for a report generated using software, it is allowed to have no borders of familiar spaces and to cross out empty cells, print in Courier New font 16–18 points high, and changing the size of the location and size of the details’ values is not allowed.

Read more about the rules for filling out the calculation here.