What is simple

Downtime occurs when a company is forced to stop operations for a while.

Downtime may result from organizational, technical or economic reasons. This may affect the entire company, a specific department, or some employees depending on their positions and job characteristics. In 2021, many businesses were idle due to coronavirus quarantine measures. To formalize downtime, the manager issues an order.

The procedure for paying for downtime is prescribed in Art. 157 Labor Code of the Russian Federation. Apart from the definition of downtime and payment rules, the legislation does not prescribe anything else.

Accounting in 1C

From April 13 to April 30, employee A.P. Vorobyov was issued an order for downtime due to the fault of the employer. PDF

Downtime is paid at the rate of 2/3 of average earnings. Employee working hours are recorded in days.

In the billing period from April 1, 2021 to March 31, 2020, the employee:

- payments accrued: salary - 415,500 rubles;

- vacation pay - 25,000 rubles;

- days worked - 277.

Creating an accrual type

There are two points of view on the issue of reflecting downtime due to the fault of the employer in personal income tax reporting:

- Income code 2000 - in accordance with clause 6 of Art. 255 of the Tax Code of the Russian Federation, this type of payment refers to labor costs. Amounts of payment for idle time are reflected in 6-NDFL in the same way as a regular salary: the date of receipt of income is the last day of the month;

- withholding date—the day of payment.

- Revenue code 4800 — these payments are not listed in Appendix 1 to the Order of the Federal Tax Service of the Russian Federation 09.10.2015 N MMV-7-11/[email protected] (Letter of the Federal Tax Service of the Russian Federation 07/06/2016 N BS-4-11/12127). Amounts of payment for downtime are reflected in 6-NDFL:

date of receipt of income - day of payment;

- withholding date—the day of payment.

In our example, we adhere to the first point of view and use the income code 2000.

Create and configure a new type of accrual - Downtime due to the fault of the employer 2/3 (section Salaries and personnel - Salary settings - Payroll - link Accruals - Create button).

Install:

In the personal income tax :

- switch - taxable , income code - 2000 ;

In the section Insurance premiums :

- Type of income - Income entirely subject to insurance premiums ;

In the Income Tax section, type of expense under Art. 255 Tax Code of the Russian Federation :

- switch - taken into account in labor costs under article : pp. 6 tbsp. 255 Tax Code of the Russian Federation;

In the section Reflection in accounting :

- Reflection method - not filled in (accruals are reflected in the same way as wages for a specific employee).

Calculation of payment for downtime due to the fault of the employer

Step 1. Calculate the amount of payment for downtime outside the program using the formula:

To do this, first calculate your average daily earnings:

- Average earnings;

- How to view accruals for calculating average earnings?

Average daily earnings according to our example:

- 415,500 / 277 = 1,500 rubles.

The amount of downtime payment according to our example:

- 1,500 * 2/3 * 14 = 14,000 rub.

Step 2. Reflect the accrual of payment for downtime in the Payroll document in the Salaries and Personnel section - All accruals - Create button - Payroll.

Fill out the document in the usual manner, then in the Accrued , follow the link, make changes for the employees for whom the downtime was issued:

- using the Add , indicate the previously created accrual of Downtime due to the fault of the employer 2/3 , days, hours and amount from the calculation made outside 1C;

- adjust other accruals for the month according to the hours worked.

Postings according to the document

The document generates transactions:

- Dt Kt - payroll;

- Dt Kt - calculation of payment for downtime due to the fault of the employer;

- Dt Kt 68.01 - calculation of personal income tax from the total amount of salary;

- Dt Kt 69.01 - calculation of contributions to the Social Insurance Fund;

- Dt Kt 69.03.1 - calculation of contributions to the FFOMS;

- Dt Kt 69.11 - calculation of contributions to NS and PZ;

- Dr Kt 69.02.7 - calculation of contributions to the Pension Fund.

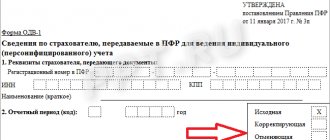

Reporting to the Pension Fund

In the annual report of SZV-STAZH, when filling out information about an employee who has periods of downtime due to the fault of the employer, in the Information about length of service , indicate:

- column Period —downtime period;

- Countable length of service column : Parameter - manually enter the SIMPLE .

See also:

- How to reflect the accrual of downtime due to reasons beyond the control of the parties?

- Calculation of earnings during a business trip based on daily average

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Downtime for reasons beyond the control of the parties Downtime can occur for various reasons: it can be caused by actions...

- Reducing the insurance premium rate from 30% to 15% for SMEs from April 2021 Have you found yourself in the SME register? This means you have the right to reduced...

- Vacation pay paid on June 25 for vacation from 06/29/2020 to 07/26/2020 are subject to 0% on insurance premiums? Federal Law No. 172-FZ dated 06/08/2020 provides for the tariff of insurance premiums...

- Vacation on non-working days from April 30 to May 11, 2021 Imagine the situation. The employee is scheduled to have an annual...

How to arrange a simple

Step 1. If downtime concerns one employee: for example, his equipment has broken down or he has run out of materials for work, the employee notifies management about this. There is no written form of such notification, so the employee reports in free form: orally or in a memo.

If the downtime affected an entire structural unit, its manager needs to draw up a report and describe in it the reasons for the downtime and its features. There is no special form either; draw up a document in free form.

If the entire company is idle, the manager knows about it without memos.

Step 2. Having learned about the downtime from an employee or independently, the manager issues an order. It describes:

- the reason for the downtime and its type - due to the fault of the employee, employer or for reasons beyond their control;

- downtime;

- employees and departments subject to the downtime order;

- do employees need to be at their workplace during this period or should they not visit the company’s premises;

- payment order.

If the end date of the downtime is unknown, you can indicate this in the order, for example, in the wording “until the order of the regional governor to cancel the high alert regime.”

In an order with an open end date for downtime, you can write:

- conditions for ending downtime;

- method of notifying employees about the resumption of work.

Send the order to employees by email or show them the order against signature.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

Step 3. If the entire company is idle, the manager must inform the employment service within three working days after issuing the order (Clause 2 of Article 25 of the Law of the Russian Federation of April 19, 1991 No. 1032-1 “On Employment of the Population”). There is also no single form for this, although some regions establish one: this is often done on the websites of the Employment Services by filling out an online form. Typically, in a notice of suspension of work, entrepreneurs report:

- reason for downtime;

- start date;

- if the duration is known, the end date;

- number of employees affected by downtime.

If you do not submit information to the Employment Service, you may receive a warning or a fine (Article 19.7 of the Administrative Code). The fine is up to 500 rubles for officials and up to 5,000 rubles for an organization.

Calculation of sick leave during downtime

In order to determine the amount of payments under a certificate of incapacity for work, the accountant will need to determine exactly when the employee fell ill. In this case, the following 3 situations are possible:

- The beginning and end of sick leave occurs during the downtime period. In this case, sick leave benefits will not be accrued.

- The sick leave begins during the period of inactivity, and the certificate of incapacity for work is closed after its end. In this case, sick leave benefits are accrued only for those days that the employee was sick after the end of the downtime. Accrual is made according to the general rules for calculating sick leave.

- The employee fell ill before the start of the downtime, and closed his sick leave either during the downtime or after it ended. The sick leave benefit will then be calculated as follows: for days outside of downtime - according to general rules, and for days of downtime - according to special rules (Article 7, Article 9 of Law 255-FZ).

Important! Such rules apply only in a situation where the employee was not at the workplace during downtime by decision of the employer, since in this case the downtime will be working time.

During the period of inactivity, sick leave benefits are paid in the amount in which the employee's salary is accrued for the period of inactivity. Moreover, the amount of payment cannot be higher than the amount of benefit calculated according to the general rules (

How to pay for downtime

Downtime caused by an employee is not paid. And due to the fault of the company or for reasons beyond the organization’s control (for example, the same coronavirus) you will have to pay.

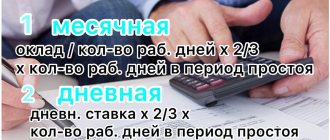

Downtime due to independent reasons is paid in the amount of ⅔ of the employee’s salary. For calculations, not the monthly salary is taken, but the salary calculated from downtime (Part 2 of Article 157 of the Labor Code of the Russian Federation).

Downtime due to reasons beyond the control of the organization and the employee, pay in an amount no less than 2/3 of his tariff rate (salary), calculated in proportion to the downtime. Such rules are established by part 2 of article 157 of the Labor Code.

If an employee works on an hourly basis, the salary for the month in which there was downtime is calculated using the formula:

Salary = Hourly Rate * Normal Hours + ⅔ * Hourly Rate * Idle Hours

If the employee is on a daily wage, calculate the salary using the formula:

Salary = Daily rate * Days of normal work + ⅔ * Daily rate * Days of downtime

If the employee is on a monthly salary, calculate the salary using the formula:

Salary = Salary / Number of working days * Days in normal mode + ⅔ * Salary / Number of working days * Downtime days

If the downtime lasts for the entire month, the first part before the addition sign simply disappears from the formulas.

With piecework payment, you will have to calculate the average daily or hourly rate of earnings and calculate payment for downtime days, multiplying this amount by ⅔.

Payment for downtime caused by the employer

Downtime that occurs due to the fault of the employer can be caused by completely different reasons. Let's look at them:

- the employer did not carry out timely maintenance of the equipment (used as the main means of production, or as the main tool of the employee), which led to its failure;

- the employee was not allowed to work due to the fact that the necessary medical examination of the employee was not provided and the necessary protective equipment was not provided;

- the employer did not provide safe, comfortable working conditions for the employee.

Payment for downtime caused by the employer is the highest, but for this, documents confirming the downtime must be available.

The employee may draw up a memo, on the basis of which the employer will issue an order for downtime due to the employer’s fault. This order must contain the following:

- reason for downtime (economic, technical or technological, organizational);

- a list of employees who cannot perform their labor functions due to downtime (the entire department in which the downtime occurred can also be indicated);

- start and end of downtime;

- references to legal norms on the basis of which compensation for downtime will be paid.

Payment for downtime due to the employer's fault is paid in the amount of 2/3 of the employee's average salary.

How to take into account downtime during the coronavirus epidemic

In 2021, when registering downtime due to a high-alert regime, justify the suspension of work in the order. If the company cannot send employees to work remotely, the order should prohibit their presence at the workplace. How you write down the justification for the downtime and determine whose fault the downtime is, determines how it will be paid further.

If your company is subject to a presidential decree on non-working days with pay, then it is better not to introduce a simple one - you will have to comply with the rule on maintaining pay. If you introduce downtime, justify it on economic grounds, but be prepared to defend your position in court if disputes arise with employees or the labor inspectorate.

For personnel records, payroll and other payments, and employee reporting, use the Kontur.Accounting service. Here you can easily maintain accounting and tax records, send reports via the Internet, view management reports, use electronic document management and other accounting tools. The first two weeks are free for all new users.

Is compensation for downtime due to independent reasons a salary?

Wages, according to labor legislation, are awarded for the fact that the employee performs his labor function in accordance with his qualifications, as well as the complexity of the work performed. While the downtime lasts, the employee does not perform a work function, sometimes he may even be absent from his workplace.

When calculating vacation pay, the accountant will not take into account the amounts that were paid to the employee during the period of inactivity. That is, it is still impossible to consider compensation for downtime as wages. However, it forms the actual earnings of the employee, therefore, where necessary, it should be supplemented with northern allowances.

Thus, compensation for downtime is not a salary, but nevertheless must be supplemented with northern allowances due to the fact that it forms the actual earnings of the employee.

Downtime announced simultaneously with layoffs without taking into account objective reasons

In accordance with Part 2 of Art. 180 of the Labor Code of the Russian Federation, when terminating an employment contract due to a reduction in numbers or staff, the employer is obliged to notify employees in writing under a personal signature at least two months before dismissal. At the same time, from the day of notification of dismissal until the day of termination of the employment contract, the essence of the labor legal relationship between the employee and the employer does not change. The employer is obliged to provide the employee with work according to the specified labor function, pay wages on time and in full, etc.

Simple in meaning art. 72.2 of the Labor Code of the Russian Federation is a temporary measure due to the occurrence of certain circumstances that do not entail a reduction in the number of employees and termination of the employment contract. As we have repeatedly stated, the employer must have objective circumstances (of an economic, technological, technical or organizational nature) to issue an order for downtime in the organization (individual divisions of the organization).

Thus, carrying out measures to reduce the number or staff of the organization’s employees and notifying them about the upcoming

Dismissal does not constitute idle time in the sense in which this term

Used in Part 3 of Art. 72.2 Labor Code of the Russian Federation. If there are objective circumstances that caused the downtime, and the employer issued a corresponding order for downtime, then employees who were warned about dismissal due to a reduction in numbers or staff may also find themselves in downtime (Clause 2, Part 1, Article 81 of the Labor Code of the Russian Federation).

If a dispute arises, the courts evaluate the circumstances that led to the downtime and find out whether it was caused by a temporary suspension of work.

Arbitrage practice. The Kemerovo Regional Court, in an appeal ruling dated January 30, 2014 in case No. 33-73-2014, confirmed the legality of the announcement of idle time during the period of notice of staff reduction, and indicated that the plaintiff was sent to idle time not because his position was subject to reduction, but due to reasons of an economic nature, about which the employer issued relevant orders.

Arbitrage practice. In turn, the Murmansk Regional Court, in its appeal ruling dated March 5, 2014 No. 33-377-2014, pointed out the illegality of declaring downtime, since the issuance of an order for downtime against the plaintiffs was not caused by a temporary suspension of work. The lack of work for the plaintiffs was permanent, without any signs of temporary suspension.

Downtime is subject to personal income tax

Contents The financial crisis has led to the suspension of the activities of some enterprises, resulting in downtime in organizations.

We recommend reading: Happy birthday greeting form

In this situation, accountants need to pay employees for the downtime period, take these amounts into account for tax purposes and prepare the necessary documents. ConsultantPlus FREE for 3 days Get access We will help you do it right. Please note that this article does not deal with downtime caused by the employee.

Downtime is a temporary suspension of work for reasons of an economic, technological, technical or organizational nature. Moreover, we can talk about suspending the work of both one employee (for example, in case of a breakdown of the machine at which he works), as well as a unit (workshop, department, branch) and even the organization as a whole.

Downtime can be caused by any external (for example, short supply of components by a counterparty) or internal (equipment damage, etc.) factors.

The downtime order does not indicate whether workers should be present at work sites

The Labor Code of the Russian Federation does not contain a requirement for the mandatory presence of workers at workplaces during downtime. But since the downtime period refers to working time (Part 1 of Article 91 of the Labor Code of the Russian Federation), and not to rest time (Article 107 of the Labor Code of the Russian Federation), employees cannot use it at their discretion and leave their workplaces. Their absence from work without the permission of the employer can be regarded as absenteeism. However, a stay-at-home order may allow employees not to report to work. To avoid disputes, the order must clearly indicate whether workers are required to be present at work or not.

Arbitrage practice. The Orenburg Regional Court, in an appeal ruling dated June 27, 2013 in case No. 33-3812/2013, confirmed the legality of the dismissal under subsection. “a” clause 6, part 1, art. 81 of the Labor Code of the Russian Federation in connection with the absence of an employee from the workplace during downtime.

The type of downtime is incorrectly defined

The Labor Code of the Russian Federation distinguishes three types of downtime: due to the fault of the employer, for reasons beyond the control of the employer and employee, and due to the fault of the employee. Depending on the type of downtime, the Labor Code of the Russian Federation provides for different amounts of payment for downtime. In practice, it can be difficult to establish whether the employer is at fault, or whether downtime arose for reasons beyond the control of either party to the employment contract. In case of incorrect determination of the type of downtime and the amount of payment, the employer will be forced, according to the court decision, not only to make additional payments, but also to compensate for moral damages, and if the employee contacts the labor inspectorate, he will also have to pay a fine.

For your information. There is no exhaustive list of reasons for downtime in the Labor Code of the Russian Federation. It can be:

— liquidation, merger or division of the company’s structural divisions (organizational reasons);

— introduction of new or changes in existing methods of production (technological reasons);

— breakdown, replacement or modernization of production equipment (technical reasons);

— financial crisis, difficult financial situation of the company, violation of contractual obligations by counterparties (economic reasons).

The main criterion for downtime due to the employer's fault is that it is caused by the employer's guilty actions or inaction - both intentional and due to inept management and failure to take into account business risk. Moreover, the obligation to prove the existence of these circumstances rests with the employer (clause 17 of the resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 N 2 “On the application by the courts of the Russian Federation of the Labor Code of the Russian Federation”).

Often, employers refer to the introduction of downtime due to the deterioration of the economic situation in the organization, believing that the reason did not depend on any of the parties to the employment contract. However, this opinion is wrong. Judicial practice does not support it.

Arbitrage practice. The Vladimir Regional Court, in its appeal ruling dated October 31, 2013 in case No. 33-3566/2013, noted that the negative financial position of the company (lack of orders) is a financial (commercial) risk in relations between business entities, and therefore relates to the direct fault of the employer.

Arbitrage practice. The Tula Regional Court, in its cassation ruling dated November 10, 2011 in case No. 33-3848, noted that a decrease in demand for manufactured products, the purchase of raw materials at inflated prices, and a decrease in production volumes are the fault of the employer.

Then the question arises: what will relate to reasons independent of the will of the parties? Let us turn to judicial practice and explanations of officials. According to them this is:

— issuance of orders by state bodies (decision of the Moscow City Court dated July 15, 2010 in case No. 4g/2-5685/10);

— extreme weather conditions (see, for example, the recommendations of the Ministry of Health and Social Development on the organization of work and rest regimes in conditions of extreme temperatures and smoke dated 08/06/2010);

- breakdown of the machine of the employee who uses it, but is not to blame for its breakdown. For an employee who breaks a machine, the reason for downtime will be his culpable actions (letter of Rostrud dated May 12, 2011 N 1276-6-1).