I recently registered an individual entrepreneur. The process does not take much time. Everything is quite simple. As a result, I received an official notification of registration with the tax office. It is this notification that will be discussed in this article. Here I will answer the following questions:

- Who must register?

- What is the document?

- What does the notification look like externally and structurally?

- Application for registration and receipt of TIN;

- Readiness of the document.

Businessman

Who carries out tax registration and how?

In accordance with Articles 32, 83 of the Tax Code of the Russian Federation, this work is done by the tax authorities on the basis of information from the Unified State Register of Legal Entities (USRIP), information from the bodies specified in Article 85 of the Tax Code of the Russian Federation or statements (messages) of taxpayers.

Abbreviations used:

OP - another separate division (warehouse, stationary workplace, etc.).

F/P - branch, representative office.

Table 1 Registration

| Event | What is regulated | Input documents | Registration deadline | Output forms |

| 1 | 2 | 3 | 4 | 5 |

| Creation of an organization | Art. 12 Federal Law No. 129-FZ “On state registration of legal entities..”, Order of the Ministry of Taxes of the Russian Federation dated March 3, 2004 No. BG-3-09/178 | Application on form No. P11001; | 3 days from the date of submission of documents for state registration | Certificate of registration with the tax authority |

| decision to create an organization in the form of a protocol, agreement or other document; | ||||

| charter in 2 copies; | ||||

| receipt or payment order for payment of state duty. | ||||

| Creation of a separate division (SU) | Order of the Ministry of Finance of the Russian Federation dated November 5, 2009 No. 114n, Letter of the Federal Tax Service of the Russian Federation dated September 3, 2010 N MN-37-6/ [email protected] | The creation of an EP is confirmed, for example, by: a lease agreement for the premises where a stationary workplace is created; employment contract with the OP employee; order of appointment to a position; order from the head of the organization to create an OP. | 5 working days from the date of receipt of the message | Notification of registration. Read more in the article |

| Creation of a branch or representative office (F/P) | Art. 17 Federal Law No. 129-FZ “On state registration of legal entities..”, Order of the Ministry of Finance of the Russian Federation dated November 5, 2009 No. 114n, Letter of the Federal Tax Service of the Russian Federation dated September 3, 2010 N MN-37-6/ [email protected] | Application on form No. P13001 (or notification P13002) | 5 days from the date of receipt of information about the branch (representative office) | Notification of registration. Read more in the article |

Now about some nuances for each basis for registration and deregistration.

Receiving a document

Issuance of a TIN or notification is carried out only upon presentation of an identification document. On average, it takes about five working days to process the application after submitting the application. You can receive a notification more than once.

If the taxpayer has lost the certificate or his passport details have changed, he can request the paper again. The TIN remains the same. If paper is restored due to loss, you will have to pay a fee of 300 rubles. If the document changes due to a change in passport data, you do not need to pay anything.

Tax registration when creating an organization

Registration and registration are carried out by the tax office simultaneously. You only submit documents for creation, and already on the sixth day from the date of their submission, your organization will be able to fully begin business activities.

After state registration, the inspection will assign you a primary state registration number (OGRN), a taxpayer identification number (TIN) and a reason for registration code (KPP).

Please note that criminal liability is established for carrying out activities without state registration - Art. 171 of the Criminal Code of the Russian Federation “Illegal entrepreneurship”.

Trade activity type code for trade fee

The notification indicates the required code for the type of trading activity.

| Trade activity type code | Types of trading activities |

| 01 | Trade through stationary retail chain facilities without trading floors (except for gas stations) |

| 02 | Trade through objects of a non-stationary trading network (also used for delivery and distribution trade) |

| 03 | Trade through stationary retail chain facilities with trading floors |

| 04 | Trade from a warehouse |

| 05 | Organization of retail markets |

Tax registration when creating an OP

The Tax Code of the Russian Federation distinguishes three types of separate divisions: branch, representative office, and other separate division. For clarity, here is a brief table of tax law terms.

table 2

| Separate division (SU) | Any territorially separate division from it, at the location of which stationary workplaces are equipped. Recognition of a separate division of an organization as such is carried out regardless of whether its creation is reflected or not reflected in the constituent or other organizational and administrative documents of the organization, and on the powers vested in the specified division. In this case, a workplace is considered stationary if it is created for a period of more than one month. | Art. 11 Tax Code of the Russian Federation |

| Workplace | A place where an employee is required to be or arrive in connection with his work and which is directly or indirectly under the control of the employer. | S. 209 Labor Code of the Russian Federation |

| Branch (F) | A separate division of a legal entity located outside its location and performing all or part of its functions, including the functions of a representative office. | S. 55 Civil Code of the Russian Federation |

| Representation (P) | A separate division of a legal entity, located outside its location, which represents the interests of the legal entity and protects them. | Art. 55 Civil Code of the Russian Federation |

You report the creation of an OP to the tax office at the legal address of the organization within a month from the date of creation. If there is a change in the information, you submit a message to the same inspectorate within three days (see Article 23 of the Tax Code of the Russian Federation). For violation of deadlines - liability under Art. 116 of the Tax Code of the Russian Federation and Art. 15.3 of the Code of Administrative Offenses of the Russian Federation, but not always. If the organization is already registered with the tax authority on one of the grounds specified in Art. 83 of the Tax Code of the Russian Federation, then liability for failure to submit an application for registration on another basis mentioned in this article does not apply to her (see paragraph 39 of the Resolution of the Plenum of the Russian Federation dated February 28, 2001 No. 5).

What is the TIN of a foreign citizen?

TIN of a foreign citizen (taxpayer identification number) is the personal number of each foreign citizen registered with the tax authorities of the Russian Federation.

The assignment of a TIN to a foreign citizen in the Russian Federation, as well as to citizens of the Russian Federation, occurs only once and is forever assigned to an individual, becoming his personal identifier in the tax authorities.

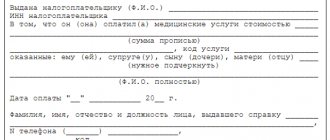

The fact that a foreign citizen has received a TIN is confirmed by the issuance of a certificate of registration of an individual (foreign citizen) with the tax authority. The certificate must include the following information:

- Full name of the foreigner registered with the tax office;

- number of the tax authority that issued the TIN to the foreigner;

- series and document number.

Tax registration when creating a branch

New edition of Art. 23 of the Tax Code of the Russian Federation does not oblige the taxpayer to submit a notification about the creation of a financial entity. This means that in this case liability under paragraph 1 of Art. 116 of the Tax Code of the Russian Federation. As for paragraph 2 of this legal norm, the situation is as follows. After the changes made to the Tax Code of the Russian Federation by Federal Law No. 229-FZ dated July 27, 2010, the obligation to register remained with the organizations creating the OP (except for branches and representative offices); for persons receiving income subject to UTII. Therefore, only these two groups of persons are subject to liability under clause 2 of Art. 116 of the Tax Code of the Russian Federation. As a result, it turns out that organizations conducting activities through a financial institution without registration do not fall under clause 2 of Art. 116 of the Tax Code of the Russian Federation. In general, the situation is ambiguous, and there is no judicial practice yet. We suggest (in order to avoid unnecessary disputes with the tax authorities) to first receive notification of registration, and then start working through F/P. Changes to information about F/P are made in the same order as creation.

According to Art. 5 of the Law on State Registration, a legal entity is obliged to inform the tax authority about changes in information in the Unified State Register of Legal Entities within 3 days. If the change in the information specified in paragraph 1 of Article 5 occurred in connection with amendments to the constituent documents, amendments must be made to the Unified State Register of Legal Entities in accordance with Chapter VI of the law. There is no deadline in this chapter for making changes to the constituent documents. Consequently, the registration law does not establish a time limit for making changes to the constituent documents, including in connection with the creation of a branch (representative office). From Art. 23 of the Tax Code of the Russian Federation eliminates the taxpayer’s obligation to report the creation of a branch or representative office.

In what other cases is Form TS-1 submitted?

A Trading Fee Notice is provided when you begin trading and if you:

- the characteristics of an already registered retail outlet have changed, for example, the area of the hall;

- One of the retail outlets has closed, but you do not stop trading completely. In this case, when indicating the type of notification, you must enter the number “3” - termination of use of the object subject to the levy.

Download the entire procedure for filling out the TS-1 form, as well as a directory of benefit codes for inclusion in the notification below.

Removal from tax registration during reorganization, liquidation, change of address

| Event | What is regulated | Base | Registration deadline | Output forms |

| 1 | 2 | 3 | 4 | 5 |

| Reorganization | Articles 14, 17 No. 129-FZ “On state registration of legal entities”, Order of the Ministry of Taxes and Taxes of the Russian Federation dated March 3, 2004 No. BG-3-09/178 | Application for state registration of a legal entity created through reorganization, according to form No. P12001; | 1 working day from the date of making an entry in the Unified State Register of Legal Entities | Certificate of entry into the Unified State Register of Legal Entities, notice of deregistration |

| constituent documents in 2 copies; | ||||

| decision on reorganization | ||||

| merger agreement in cases established by law; | ||||

| transfer deed or separation balance sheet; | ||||

| receipt or payment order for payment of state duty | ||||

| Liquidation | Article 21 of the Federal Law “On State Registration of Legal Entities and Individual Entrepreneurs”, Order of the Ministry of Taxes and Taxes of the Russian Federation dated March 3, 2004 No. BG-3-09/178 | Application for state registration of liquidation of a legal entity in form P16001 | 1 working day from the date of making an entry in the Unified State Register of Legal Entities | Certificate of entry into the Unified State Register of Legal Entities, notice of deregistration |

| liquidation balance | ||||

| receipt or payment order for payment of state duty | ||||

| Change of address (location) | Article 17 of the Federal Law “On State Registration of Legal Entities and Individual Entrepreneurs”, Order of the Ministry of Taxes and Taxes of the Russian Federation dated March 3, 2004 No. BG-3-09/178 | Application for state registration of changes made to the constituent documents, according to form No. P13001 | 1 working day from the date of making an entry in the Unified State Register of Legal Entities | Certificate of entry into the Unified State Register of Legal Entities, notice of deregistration. The tax authority registers at the new address. The organization is issued (sent by mail) a new TIN certificate |

| decision to amend the constituent documents in connection with a change of address | ||||

| changes made to the constituent documents, in 2 copies | ||||

| receipt or payment order for payment of state duty | ||||

| Termination of activities through OP | Order of the Ministry of Finance of the Russian Federation dated November 5, 2009 No. 114n, Letter of the Federal Tax Service of the Russian Federation dated September 3, 2010 N MN-37-6/ [email protected] | Notification of termination of activity through a financial statement in the form approved by Order of the Federal Tax Service of the Russian Federation dated 06/09/2011 No. ММВ76/ [email protected] | 10 days from the date of receipt of the message | Notice of deregistration |

| Termination of activities through the OP is confirmed, for example: an order to dismiss the only employee of the OP, an order to terminate activities through the OP | ||||

| Termination of activities through F/P | Art. 17 of the Federal Law “On State Registration of Legal Entities and Individual Entrepreneurs”, Order of the Ministry of Finance of the Russian Federation dated November 5, 2009 No. 114n, Letter of the Federal Tax Service of the Russian Federation dated September 3, 2010 N MN-37-6/ [email protected] | Application on form No. P13001 (or notification P13002) | 10 days from the date of receipt of an extract from the Unified State Register of Legal Entities or a message | Notice of deregistration |

| Decisions on closing the business entity and amending the constituent documents | ||||

| charter in 2 copies | ||||

| receipt or payment order for payment of state duty | ||||

| Notification of termination of activity through a financial statement in the form approved by Order of the Federal Tax Service of the Russian Federation dated 06/09/2011 No. ММВ76/ [email protected] |

Reorganization. If the reorganization took place in the form of a merger, division, accession or transformation, then the TIN of the liquidated organizations is invalid. The inspectorate notifies other tax authorities related to these organizations about their deregistration. Registration of legal entities formed as a result of reorganization takes place in the same manner as during normal creation. Along with the documents for state registration, a “Certificate of registration of a Russian organization with the tax authority at its location” is issued.

Liquidation. The TIN of the liquidated organization is invalid. A notification is issued about deregistration.

Change of address. Please note that when changing your location, you may encounter two problems. The first is an inspection of the enterprise by the tax inspectorate and extra-budgetary funds. The second is a new address in the tax office’s “black list” as a “multiple registration” address. There is a possibility of a conflict with the new inspection, even leading to legal proceedings to invalidate the state registration. We would like to especially note such a moment as changing the name of the organization. Your procedure is similar to changing your address. Along with the certificate of state registration of changes, you will receive a new TIN certificate.

Termination of activities through OP or F/P. The notice of termination is submitted by the taxpayer to the inspectorate at the legal address of the organization within three days from the date of termination of activity (closing).

Registration when choosing UTII. In accordance with Art. 346.28 of the Tax Code of the Russian Federation, legal entities and individual entrepreneurs carrying out activities subject to a single tax on imputed income are required to register as payers of UTII. After registration, the tax authority issues a notification to the taxpayer.

Does a foreign citizen need a TIN and why does a foreigner need a TIN?

Many people wonder whether foreign citizens receive a TIN in Russia and, if so, which foreign citizens are assigned a TIN in the Russian Federation?

A TIN is needed to record income and taxes paid by a foreign citizen.

In accordance with clause 7 of Article 83 of the Tax Code of the Russian Federation, as well as with clause 7 of Article 13 of Federal Law No. 115 “On the Legal Status of Foreign Citizens in the Russian Federation”, foreign citizens - individuals must register with the tax authorities according to place of residence, at the location of their real estate and vehicle, as well as on other grounds provided for by the legislation of the Russian Federation.

Thus, registration of a foreign citizen with the tax office and obtaining a TIN by a foreigner in the Russian Federation are mandatory if:

- A foreign citizen intends to live and work in the Russian Federation and earn income, and he needs to obtain a work permit or a labor patent to work in the Russian Federation.

- A foreign citizen received a temporary residence permit in the Russian Federation.

- A foreign citizen in Russia owns property that is subject to taxation, including a car or real estate.

- A foreign citizen carries out transactions in the Russian Federation that are subject to taxation.

How to find out the TIN of a foreign citizen? Is it possible to find out the TIN of a foreign citizen online?

Yes, you can find out the TIN of a foreigner online on the official website of the tax authorities of the Russian Federation or on the State Services website.

In order to find out the TIN of a foreign citizen, follow the link https://service.nalog.ru/inn.do

(tax) or https://www.gosuslugi.ru/pgu/fns/findInn

(public services) and fill out the required fields of the form: