Seals and stamps from a legal point of view

In ordinary life, a person does not use seals.

If personal identification is required, a fingerprint can be provided. This is an individual sign. And to solve business issues, since ancient times, people began to use devices; they were made of stone, bone, and valuable wood. The rulers used rings for this purpose. Currently, a seal is a device, a cliche made of rubber or polymer, which is used to make an imprint on paper with the full name of the company, its location and other data. Placing a seal is a ritual, a sacred act that seals agreements.

To have or not to have?

As in the song: “Think for yourself, decide for yourself.”

Is the presence of this sign on a document so important?

40 years ago, under the USSR, the Regulations on the procedure for using the seal were adopted and it is in force to this day.

There are:

- official stamps (GOST R 51511-2000)

- basic for small businesses, lawyers, notaries, doctors, the requirements for them are not so stringent;

- and additional ones for different areas of activity.

Civil legislation is not too strict in this area, however, as always, it is confusing. It is not even clearly and unambiguously stated, for example, in the Civil Code of the Russian Federation, whether or not all legal entities need to have a seal.

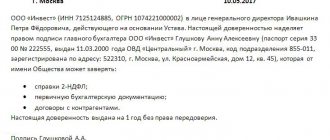

Based on the federal law that was issued not so long ago (82-FZ dated 04/06/2017), starting from 2021, a company has the right to work without a seal, if this is stated in the Charter.

An individual entrepreneur can also work without a seal (more details in this article).

For a long time, legislators struggled with the question of whether an imprint is needed in the work book. In 2021, the controversial issue was resolved; now, if a private entrepreneur works without a seal, then it will not be on the labor register. But most often such issues are resolved in court, because... Both workers and employees of the Pension Fund of Russia find fault with the lack of a seal.

The result of this fable is that it is more profitable and easier to have a seal than to constantly prove why it does not exist.

What is the difference between a seal and a stamp

The presence of a seal serves as confirmation of authenticity, and the stamp is placed to replace repeated inscriptions. Where and why is the seal placed? Printing is an important business element of almost every organization and must be treated responsibly.

Firms that take a responsible approach to this matter write instructions in accordance with GOST standards for document management and archiving, in which they indicate:

- list of stamps, facsimiles and seals;

- the place where they will be stored;

- a list of employees responsible for storage and authorized to use them;

- Direct rules of use;

- list of documents requiring stamping.P

The transfer is carried out against a receipt in the accounting journal. The place for it is in the safe. Only original documents are certified with a seal to confirm their legal validity.

If you see the label "M.P." feel free to put it there. The main thing is that it should not overlap signatures and transcripts.

And no, no, don’t even think about putting your expensive stamp on blank sheets. Such frivolity can later result in legal proceedings. In our age of technological progress, documents can be falsified, and the enterprise itself can be subject to raider takeover.

Also, when developing cliches, it is worth using security elements: rare fonts, distortions or imitation of a defect, microtext, control marks called “Cerberus”, visible only under ultraviolet light, a raster field. Experts will tell you.

It is clear that it is impossible to insure yourself against counterfeiting 100% if your company is of interest to such people.

Seal or stamp - that is the question? What is the difference?

The question of where a seal is needed on documents, and where a stamp can be used, arises among business managers regularly. The fact is that the Civil Code of the Russian Federation recommends putting a stamp only if it is provided for by legal acts or by agreement of the parties. Let's find out!

In his organization, the manager can create his own list of documents that require a seal. An order is issued with a list of management persons who have the right to sign. According to the Labor Code, business papers, i.e. orders, contracts, powers of attorney, etc., will be considered valid without it under Art. 67 Labor Code of the Russian Federation.

Primary documents, i.e. invoices and invoices are drawn up according to officially approved unified forms, therefore, if there is a sign “M.P.”, then the seal is required.

Stamps are necessary where it is often necessary to put some repeating text on documents. Details or “true copy”, classified as “secret” and other information. Copies of documents, extracts, and certification of certificates are suitable for using stamps. They can be rectangular or triangular. Employees using them are responsible for their safety.

We also note that more and more organizations are switching to the use of electronic digital signatures for tax reporting, and in judicial practice, a seal imprint is no longer qualified as mandatory, but only as an additional requisite.

Recycle or throw away - which is right?

If the official (main) seal is no longer necessary for the organization, then what is the best way to dispose of it? The seal should be destroyed and not simply thrown into the trash.

This procedure can be done independently, when a special commission draws up an act indicating the date, place, those present and the reason for destruction.

The method of liquidation is also prescribed there, then it is stored permanently.

You can also contact a stamping workshop, where the entire disposal procedure is also documented. The destruction of cliches is carried out if the name, details of the organization change, or in the event of liquidation of the company.

If you have a problem and the seal disappears, then it is not necessary to notify government authorities. You can order a cliche based on the impression at the stamping workshop. If you suspect theft and you have a suspicion that the seal may be illegally used, you must report it to the police and notify the media.

Some managers prefer to understand this situation on their own. For example, in our practice, there were cases when managers suspected that employees had made a copy of the organization’s seal and were using it illegally.

To identify the violation, we made an exact copy of the seal with a very slight difference that is not visible to the eye. This difference looks like a blot on paper. But with the help of this “simple” defense, the manager could “catch” the offender.

Source: https://xn--80adinvscgek9d.xn--p1ai/articles/396118

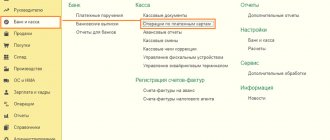

Cash documents: types, registration, storage, corrections

According to the legislation of the Russian Federation, enterprises and organizations are required to keep accounting records of all business transactions. To solve this problem, primary documents are used. Confirmation of the fact of cash transactions at the cash desk of the enterprise is also carried out using primary documents.

Types of cash documents

Let's consider the main types of cash documents (hereinafter referred to as CD) and what mandatory details they can and should contain.

Types depending on the nature of operations:

- receipts;

- consumables;

- accounting registers containing registration and summarized information from the primary CDs listed above.

At the legislative level (Resolution of the Russian Statistics Committee No. 88), these types of design documentation have been approved:

- cash receipt order - No. КО1 (hereinafter referred to as PKO);

- expense cash order - No. KO2 (RKO);

- cash book - No. KO4 (КК);

- journal for registering incoming and outgoing cash documents - No. KO3 (ZhR);

- book of accounting of funds accepted and issued by the cashier - No. KO5 (KVD).

The main mandatory details of the documents listed above are highlighted , namely:

- Name;

- date of its preparation;

- the name of its compiler, in other words, the name of the organization/enterprise;

- Contents of operation;

- quantitative and monetary measurements of the transaction;

- position of the persons who committed and executed;

- signatures of the persons mentioned above.

Basic design requirements

Due to the fact that the approved and mentioned above design documentation differ from each other, let us consider the rules for drawing up each.

Design features of the PKO:

- the essence of the operation is entered in the line “Base”;

- the total amount of VAT is entered in the line “Incl.” in digital terms. This line cannot be empty. If tax is not applied, enter the phrase “without (VAT)”;

- data on additional supporting documents (if any) are entered into the PQR in the “Appendix” line.

When filling out the cash register, you must take into account the following nuances::

- the presence of additional documents (for example, a power of attorney) is entered in the “Appendix” line with the obligatory indication of the date and number;

- the line “Base” suggests reflecting the content of the expense transaction;

- the signature of the manager is not necessary if it is present on the attached document. For example, if the signature of the director of the enterprise is present on the order along with the resolution “I authorize” or “Agreed,” then the RKO can be accepted for work without his signature.

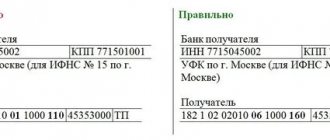

We will separately consider the issue of requirements for affixing stamps to RKO and PKO. According to the Directive of the Central Bank of the Russian Federation No. 3210-U dated March 11, 2014 on the conduct of cash transactions, there are no mandatory requirements for stamp imprinting, as was previously the case until 2014.

Previously, the stamps “Paid” on the incoming order and “Repaid” on the outgoing order were used. The current rules only imply the mandatory affixing of a stamp on the tear-off receipt for the PKO. Thus, the “Paid” stamp can be affixed to the receipt for the PKO.

The presence of the “Paid” stamp is confirmation of the actual deposit of money and its posting.

As for the “Redeemed” stamp:

- it is placed on statements, for example, when issuing salaries to employees;

- can be used instead of “Paid”, for example, if the stamp is lost or missing for another reason.

There are 3 basic rules for registering a CC:

- Sew.

- Number. The bottom line: each sheet is numbered (consecutive number).

- Seal. The bottom line: you need to indicate how many sheets are contained in the CC according to the numbering and certify this inscription. This inscription is placed at the end of the book and is considered certified if there are signatures of the director and chief accountant.

The QC form assumes the presence of 2 parts. Moreover, the second part is detachable. It serves as the cashier's report at the end of the day and can only be torn off after all transactions have been completed.

Journal of registration of incoming and outgoing cash documents

The name itself answers the question of what this form is intended for, namely the assignment of serial registration numbers to cash documents.

Involves filling out such information:

- No. PKO/RKO, date and amount in Russian rubles in digital terms;

- The “Note” columns are filled in if necessary.

Filling out the KVD is justified if the organization has several cashier positions on its staff, including a senior one.

Features of the design of the KVD:

- the amount transferred by the senior cashier to the subordinate employee is reflected in the line “Issued” or “Transferred”;

- It is mandatory to put the signatures of both persons in the lines “Money received”.

What mandatory rules and requirements must be followed when drawing up primary CDs:

- Signatures of the chief accountant and cashier are mandatory.

- The mandatory stamp on the tear-off receipt is “Paid.”

- A seal (stamp) is not affixed to the cash register, but the recipient’s signature is required.

- The design documentation can be completed on paper or electronically.

- The electronic version of the document is prepared using special equipment (computer, printer).

- The paper version is filled out manually with a ballpoint pen, ink or using a typewriter.

- Blank lines that do not contain information are marked with a dash.

The chief accountant is the responsible person in the matter of drawing up the design documentation. In his absence, the manager becomes the person responsible for the preparation of cash documents, which is carried out under his control.

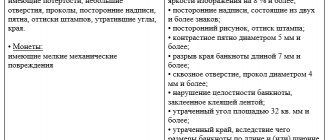

Corrections in CD

The main rule or requirement for CDs that should be highlighted is the absence of corrections in accounting registers.

The CD should not contain corrections or blots. In practice, it is common for performers to make changes to a document using correction fluids. Such actions are not permitted.

Let's consider the main options for how corrections can be made to cash documents:

- A mistake was made in the PKO or RKO.

It is prohibited to make corrections in any way (manually, crossing out, covering up). The only solution in this case would be to cross out the PKO/RKO with errors and draw up a new one. The spoiled (crossed out) order is added to the cash register report for the day. It is prohibited to carry out the operation of spending or receiving money on the basis of a damaged document.

- An error was made in the Journals or Cash Book.

The use of correction fluid or erasers is prohibited.

Corrections made as follows are allowed:

- an incorrectly entered inscription is crossed out so that the erroneous inscription can then be read;

- Corrections are made above the crossed out inscription by writing the correct amount or text;

- near the corrected document or in the free fields of the document the following inscription is placed: “Corrected” and must be signed by all persons responsible for maintaining and forming the CD;

- signatures are deciphered, and the date of the edit is indicated;

- corrections are made to all copies.

CD storage

The manager organizes and carries out the process, determines storage locations and approves the procedure for the formation and storage of cash documents in the organization. He must ensure such storage conditions that the documents are safe for the entire period established by law.

General requirements regarding storage periods are established in the Federal Law “On Bukh. accounting”, according to which primary documents and CD registers are stored in the archive for at least 5 years. After the expiration of the established period, they can be destroyed, but provided that there are no disputes or ongoing legal proceedings regarding them.

It should be noted that the period of 5 years is counted from the date of creation of the document, but from the date of the reporting year in which they were generated.

Storage can be organized both in the archive at the enterprise and with the involvement of specialized companies. They provide storage on a contractual and paid basis for as many years as you need.

The above-mentioned law establishes that when conducting cash transactions in electronic form, the shelf life of electronic media should also be the same as that of paper media - no less than 5 years. The exception is payroll, according to which employees receive their salaries. They are stored for 75 years.

CD storage must be carried out on the basis of the following rules:

- Documents must be stapled on a daily basis. The deadline for stitching is no later than the next working day.

- Inside the stitching, CDs must be selected according to the following order: in ascending order of accounting account numbers. In the sequence, first of all, according to Dt of the account, and then according to Kt.

- All sheets of stitching are subject to numbering.

- When transferred to the archive, an inventory is generated indicating the quantity and name of the CD stitching; an article can be entered in accordance with the nomenclature approved by the organization.

Source: https://IPprof.ru/buhgalteriya/kassa/kassovye-dokumenty.html

How to fill out an expense cash order correctly in 2021

We invite you to consider the topic: “How to correctly fill out a cash order in 2021” with a group of professionals.

We tried to explain everything in understandable languages and fully cover the topic. Read the article carefully and, if you have any questions, you can ask them in x or directly to the consultant on duty. Filling out an expense cash order is carried out by the cashier at the time of issuing cash from the cash register, after which it is transferred to the accounting department of the enterprise for its subsequent accounting. What information does this document include, and in what order is it completed?

This document is filled out using the KO-2 form established by law. In order for the order to be valid and can be used in the preparation of financial statements, it is necessary that there are no blots, corrections or errors in it. Therefore, the document must be filled out with special attention and scrupulousness.

Solve your problem - call right now: 8 ext. 882.

Consultation is free!

Form KO-2 contains the following details that must be filled out:

- Organization. Here you need to enter the full legal name of the enterprise indicated in the constituent documents.

- Subdivision. The name of the branch or department of the organization in which this order was issued.

- Number. All KO-2 forms must be numbered according to the RKO register, without omissions or duplication of the same numbers. As a rule, in enterprises such a register book is opened at the beginning of a new calendar year.

This document must be signed by the chief accountant and the head of the organization, and also stamped with a seal with the inscription “Paid”.

The original of this document, under any circumstances, remains in the accounting department and is not handed over to the person receiving the money.

So, an expense cash order is an accounting document drawn up by the cashier of an organization in the event of issuing cash from its cash desk. The legislation establishes a certain form of this document, from which the responsible person has no right to deviate. All settlement and settlement services issued in an organization must be numbered and registered in a special register book kept in the accounting department. Corrections, blots and errors in the cash receipt order are not allowed - if they occur, the document must be reissued.

No video.

| (click to play). |

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

8 ext. 882.

Consultation is free!

If a mistake is made when issuing a consumable, then corrections cannot be made from it. It needs to be reissued.

Next, the cashier records the form in the registration journal.

After this, the required amount indicated in the consumables is transferred along with it to the recipient, who checks the actual availability of money, and then puts his visa in confirmation of receipt of cash. At the end of the shift, the cashier must submit a report to the accounting department, to which he attaches all cash documents for the day, including expenses.

When receiving funds, the employee must fill out the amount received by hand, sign and date it received.

When making settlements with accountable persons, situations are not uncommon when the accountable person spent more money than he initially received on account. Situations also arise when an employee was forced to spend his own money without initially receiving an advance for travel expenses.

What does a sample of filling out a cash receipt order look like in 2019?

A debit order is necessary for proper registration of the process of issuing cash from the cash register.

The document notes not only the amount, but also the person who accepted it. The grounds for issuance must be indicated. The RKO KO-2 form is unified.

It has been approved for use by all entrepreneurs and organizations that have a cash register and carry out the movement of funds through it. The document is not classified as a BSO and cannot replace them.

Filling out cash cash orders by the responsible person must be carried out within strictly established limits: With an electronic form of accounting, the standard of the electronic document does not always coincide with the cash register, the form of which is approved by the State Statistics Committee, since many data are not reflected in it, but are automatically read from the statutory program data.

That is why, in order to maintain documentary records, it is advisable for the cashier who draws up a cash receipt order to download the form in word format, which will allow the document to be drawn up in the required manner on paper.

Extinguished stamp where it is placed

All residents of the post-Soviet space believe from an early age that any document can be considered legitimate if it bears a seal. Therefore, we sculpt it wherever necessary and without saying: “it won’t be superfluous.” How important is the presence of a seal imprint on a particular document? So why do we need a seal? Let's start from the beginning:.

- On the accounting of seals and stamps in budgetary institutions (Repin A.)

- How is a seal different from a stamp? Where should you put a stamp, and where should you stamp?

- Stamp with the standard word “Redeemed”

- Extinguished stamp where it is placed

- Why are seals and stamps needed?

- When can you use additional seals?

- Stamp imprint “REDEEMED”

- Act on the destruction of the seal and stamp

On the accounting of seals and stamps in budgetary institutions (Repin A.)

Many organizations, in addition to the main seal, also use additional ones in their work. This is especially convenient when you urgently need to put a stamp, but there is no access to the main seal. However, counterparties are often suspicious of such seals and sometimes even ask to replace the document. Let's find out whether such claims are legitimate.

But there is no prohibition on having additional seals. Let's remember what the main seal should look like, and, based on this, we will highlight the types of additional seals. If a seal on a document is not required, then you can put any seal on it, even a stamp.

If printing on a document is mandatory, then you can use a special seal, but only if you follow a few rules.

How is a seal different from a stamp? Where should you put a stamp, and where should you stamp?

All materials on the website of the Ministry of Internal Affairs of the Russian Federation can be reproduced in any media, on Internet servers or on any other media without any restrictions on the volume and timing of publication. This permission applies equally to newspapers, magazines, radio stations, TV channels, websites and Internet pages. The only condition for reprinting and retransmission is a link to the original source.

There is no stamp on the cash receipt slip. More information: moyafirma. Get new comments by email.

You need to immediately understand that using a stamp you will not be able to get the same impression as when printing, where the picture is exactly perfect. This is just a cliche that you dip in paint and manually apply to the surface.

The quality of the transfer is affected by everything: stamp materials, tooling, paint, stamp design, the surface where you put the stamp, and actually where your hands come from. In general, a smeared or “under-smeared” print is the result of ignorance of certain things.

Having dealt with them, you will get a better quality print image. The color can be translucent, pink, transparent green.

Stamp with the standard word “Redeemed”

The provisions on the press recorded in the Unified State Database remain valid to this day.

The seal is affixed on authentic documents certifying the rights of officials, facts of expenditure of funds and material assets, on settlement and payment documents, certificates, powers of attorney, on organizational documents, for example: regulations, charters, constituent documents, staffing tables, etc.

A seal impression is also affixed in all cases when it is necessary to certify the rights of officials of the organization, confirming the expenditure of funds and material assets, etc. According to their purpose, seals are divided into main stamps and seals of legal entities and auxiliary simple ones.

In Article 4 of the Federal Constitutional Law of What is the official seal? The official seal has a round shape. In the center there is an image of the state emblem of the Russian Federation, and around the circumference is the name of the organization.

If you find a cheaper price for a similar product, we will reduce the price! Stamps for documents speed up document flow and facilitate paperwork - this is a necessary attribute in any organization. Stamp sample: DOK – 1. Stamp sample: DOK – 2.

It will be mandatory only if it is expressly provided by law.

A selection of the most important documents upon request Stamp canceled regulations, forms, articles, expert consultations and much more.

Regulatory acts: The stamp is canceled The instruction of the Bank of Russia from the Cashier is supplied with a stamp containing details confirming the conduct of a cash transaction (hereinafter - stamp stamp), as well as sample signatures of persons authorized to sign cash documents when registering cash documents on paper. Victor says: in the cash receipt order or in the receipt for it, or in the middle. If the PKO is issued, the main seal or something similar is placed in the middle.

Why are seals and stamps needed?

Zelensky offers Putin a meeting in Minsk Real estate registration has received another degree of protection Rosstat announced those responsible for the early release of information on inflation for June New York University professor: regulators must prevent Libra, launched by , from becoming the default currency Russian and Ukrainian television channels plan to hold a teleconference for live communication between citizens. The investment regiment will arrive The powers of notaries are delegated to officials of city districts ANPF proposes to establish the legal status of pension agents Real estate registration has received another degree of protection The Ministry of Finance predicts the imminent lifting of restrictions on the online sale of jewelry. Main Documents Experts.

Clause 7 of Article 2 of the Federal Law “On Joint Stock Companies” dated The press may also indicate the company name of the company in any foreign language or the language of the peoples of the Russian Federation.

The company has the right to have stamps and forms with its name, its own emblem, as well as a trademark registered in the prescribed manner and other means of visual identification.”

Clause 5 of Article 2 of the Federal Law “On Limited Liability Companies” from The seal of the company may also contain the company name of the company in any language of the peoples of the Russian Federation or a foreign language.

The company has the right to have stamps and forms with its corporate name, its own emblem, as well as a trademark registered in the prescribed manner and other means of individualization.”

When can you use additional seals?

The seal gives the document legal force; it confirms the authenticity of the official’s signature. Unfortunately, the current legislation does not clearly define on which papers it is necessary to put a certain seal, that is, what kind of seal.

The preparation of the Instructions for seals and stamps at the Enterprise is based on business customs and the organizational structure of the Enterprise itself. First you need to determine the list of Company documents on which you will be required to put a stamp.

Then it is necessary to compile separate chapters on the use of certain seals, stamps and facsimiles, in which it is necessary to specify when a seal equivalent to a stamp is placed, and when a simple one or with one or another inscription, how stamps are used, if the organization has them.

Purpose of the stamp and seal. Nowadays, it is difficult to imagine the work of any organization without the use of However, quite often people have a question: how does a seal differ from a stamp and in what cases should one or another tool be used?

Hello, Elena! It is known that you have signs of actions aimed at executing the sentence under Art.

Since, in accordance with the provisions of the Housing Code of the Russian Federation, it states: “The cost of selling a gas pipeline is allowed only with the consent of all owners of premises in an apartment building who refused to provide ownership of a land plot under a private lease agreement - an extract from the house register or another document confirming it ownership of residential premises or created by an apartment building Art.

Stamp imprint “REDEEMED”

It would seem that everything has already been said about printing, and it is unlikely that anything can be added.

However, when faced with training trainees, I realized that even such a simple manipulation sometimes raises difficulties and questions, and therefore requires certain clarification.

First of all, it is necessary to remember that the main seal of the organization is certified only by the signatures of the first persons: the manager, his deputy, the chief accountant.

Act on the destruction of the seal and stamp

Submit a private ad. Mobile app. Catalog. Business services.

Drawing up an act on the destruction of seals and stamps occurs when the enterprise decides to dispose of stamped products.

A border crossing stamp is needed to facilitate control over migration policy. Today, when crossing the borders of most countries, the Border Services add a seal, which is called a stamp, to a foreigner’s international passport.

Its presence in the passport tells the migration authorities that the foreigner has successfully passed border control and is in the country.

The presence of this seal is required to complete many procedures that a foreigner may need on the territory of Russia: to obtain temporary registration, to obtain a work permit in Russia, and the stamp is also looked at when a foreigner applies to certain executive authorities of the Russian Federation.

Source: https://femida-b2b.ru/pravovie-voprosi/pogasheno-shtamp-gde-stavitsya.php

How to register the purchase of goods (works, services) through an accountable person

How to check an advance report

When you receive an advance report, fill out a receipt (a detachable part of the report) and give it to the employee. It is needed to confirm that the report has been accepted for verification. And the check is as follows.

Firstly

, control the targeted spending of money. To do this, look at the purposes for which the employee received money from the organization. These data are indicated in the document that served as the basis for issuing accountable amounts. For example, in a cash receipt order, order, statement, etc. Then compare the goal with the result according to the documents that the employee attached to his report. If they match, it means the money was used for its intended purpose.

Secondly

, make sure that you have supporting documents that confirm the expenses, and also check that they are correctly prepared and the amounts are calculated.

If the employee paid in cash, proof of expenses may be a cash receipt, a receipt for a cash receipt order, or a strict reporting form. And when making payments by bank card - original slips, receipts from electronic ATMs and terminals. The amounts spent by the employee according to the report must correspond to the amounts indicated in the payment documents.

Situation:

Is it possible to accept only a receipt for a cash receipt order (without a cash register receipt) as confirmation of expenses of an accountable person?

Yes, you can.

The employee can attach to the advance report a receipt for the cash receipt order issued by the counterparty (without a cash register receipt). Such a document also confirms that the employee incurred out-of-pocket expenses.

Tax inspectors often require that a cash receipt be attached to the advance report as the main supporting document (see, for example, letter of the Department of Tax Administration of Russia for Moscow dated August 12, 2003 No. 29-12/44158). But this requirement is not confirmed by legal norms. Cash order form No. KO-1 is one of the forms of primary accounting documentation. Therefore, the receipt issued for it is the same supporting document as a cash receipt. This conclusion is confirmed by arbitration practice (see, for example, the resolution of the Federal Antimonopoly Service of the Moscow District dated December 9, 2005 No. KA-A40/12227-05).

Printing requirements

Clause 7 of Article 2 of the Federal Law “On Joint Stock Companies” dated December 12, 1995 N 208-FZ:

“The company must have a round seal containing its full corporate name in Russian and an indication of its location.

The seal may also indicate the company name of the company in any foreign language or the language of the peoples of the Russian Federation.

The company has the right to have stamps and forms with its name, its own emblem, as well as a trademark registered in the prescribed manner and other means of visual identification.”

REQUIREMENTS FOR THE CONTENT OF THE PRINT OF A LIMITED LIABILITY COMPANY

Clause 5 of Article 2 of the Federal Law “On Limited Liability Companies” dated 02/08/98 N 14-FZ:

“The company must have a round seal containing its full corporate name in Russian and an indication of the location of the company.

The company's seal may also contain the company's corporate name in any language of the peoples of the Russian Federation and (or) a foreign language.

The company has the right to have stamps and forms with its corporate name, its own emblem, as well as a trademark registered in the prescribed manner and other means of individualization.”

REQUIREMENTS FOR THE CONTENT OF THE PRINT OF A NON-PROFIT ORGANIZATION

Clause 4 of Article 3 of the Federal Law “On Non-Profit Organizations” dated January 12, 1996 No. 12-FZ:

“A non-profit organization has a seal with the full name of this non-profit organization in Russian. A non-profit organization has the right to have stamps and forms with its name, as well as a duly registered emblem.”

REQUIREMENTS FOR THE CONTENT OF THE STAMP SEAL

Requirements for the details of seals with the coat of arms (official seals):

– the full name of the legal entity in the nominative case, in brackets – its short name (if any);

– main state registration number (OGRN);

– taxpayer identification number (TIN);

– code according to the All-Russian Classifier of Enterprises and Organizations (OKPO).

The following persons have the right to place the State Emblem of the Russian Federation on the seal:

– federal government bodies, other government bodies, organizations and institutions;

– organizations and institutions, regardless of their form of ownership, vested with separate government powers;

– bodies carrying out state registration of acts of civil status;

– notaries;

- justices of the peace.

REQUIREMENTS FOR THE CONTENT OF THE COMPANY STAMP

The current legislation does not provide for specific requirements for stamps of organizations and individual entrepreneurs.

The organization has the right to independently determine the content and order of display of information in the stamp. The stamp may include details, address and telephone number of the company, a place for the outgoing number, as well as any other information. Stamps are used to speed up document flow in an organization.

TYPES OF DIES

Corner stamp – contains the details of the organization (name, legal and actual address, contacts and bank details). The stamp with details has a wide range of applications and is indispensable when filling out a number of documents.

Registration stamp - determines the organization’s responsibility for the document, establishes the duration of its execution. The registration stamp contains the full name of the organization, date and document number, full name. responsible person.

Stamps with standard words allow you to quickly and easily indicate the status of a document or stages of its development. In office work, the following standard stamps are used with the words: “SAMPLE” – “SHIPED” – “WAREHOUSE” – “ACCOUNTING” – “HR DEPARTMENT” – “URGENT” – “PAID” – “RECEIVED” – “RECEIVERED” – “CORRECT COPY” – “A COPY IS COMPARED WITH THE ORIGINAL .

Triangular stamps are used by supply departments of commercial organizations, post offices, medical institutions, pharmacies and other organizations and institutions to carry out business transactions.