Who submits form 1-nature-BM

This static form is submitted by legal entities.

Areas of activity of the reporting companies:

- manufacturing of products from mining and manufacturing industries;

- production and distribution of electricity, gas and steam;

- logging;

- fishing.

Even non-profit organizations will have to submit the form if they are engaged in the above areas and sell products to other organizations and individuals.

Rosstat is waiting for forms from branches, representative offices and divisions of foreign organizations.

A Russian company submits a form for each separate division and for the company as a whole, excluding these divisions.

Where and when to submit the form

Submit the form to the territorial office of Rosstat at the location of the legal entity. If the legal entity does not conduct business at its location, submit a report at the place of business. If the company has divisions, fill out the form for each division and legal entity separately and also submit a report at the location or place of business.

The deadline for submitting the form is February 10 of the year following the reporting year. For 2021, submit the report by February 10, 2021, for 2021 - by February 10, 2021.

The head of a legal entity appoints officials authorized to present primary statistical data on behalf of the legal entity.

Submit the form in paper form - in person at the branch or by mail with an inventory. Or submit the form electronically via the Internet - for example, using the Kontur.Accounting service.

Procedure for filling out form 1-natura-BM

The current form was approved by Rosstat Order No. 419 dated July 22, 2019, OKUD code - 0610035. This regulatory act provides detailed instructions for filling out the 1-nature-BM.

The form consists of a title page and three sections. Repair factories, specialized repair shops, consumer cooperatives, and logging enterprises do not fill out the third section.

The title page traditionally contains information about reporting deadlines and reporting persons. You need to enter the name of the organization and address with a zip code. If the legal address is different from the actual location, you must indicate the actual address.

Section 1

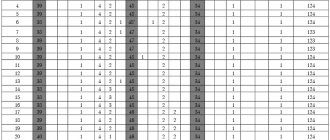

This section does not limit the user in the number of completed lines. The number of lines will be equal to the types of manufactured products (according to the OKPD2 directory). The name of the product is entered in column A, and its code in column B. In column B you must indicate the unit of measurement.

The quantity of products produced is indicated in columns 1 and 2. In column 1 you need to reflect all products made both from your own raw materials and from customer-supplied ones. It doesn’t matter where the products will be used next - absolutely all products need to be reflected.

Column 2 indicates manufactured products aimed at processing and other production needs of the company. It is important to note that only the products of the reporting year are shown here. Remains of products (even those used in the reporting period) at the beginning of the reporting period are not taken into account in column 2. Manufactured products transferred to departments are also not taken into account.

Column 3 reflects products sold/transferred and products that went towards paying employees. The shipment volume is shown here in physical terms.

In columns 4 and 5, from the total shipment, the products of their own production (excluding customer-supplied raw materials), sold/transferred or issued to employees, are distinguished. The data is presented in physical and monetary terms. The price is indicated without VAT.

Remains of products by type are recorded in columns 6 and 7.

Product accounting in the first section is carried out at cost or at discount prices. Products made from customer-supplied raw materials are reflected at full cost, taking into account the cost of customer-supplied raw materials.

Section 2

This section is filled out based on the information from section 1. The volume of products produced should be indicated by type by month.

The second section contains background information. This plate is filled out by certain categories of respondents: budgetary organizations, autonomous and government institutions that produce goods (work, services) for sale to legal entities and individuals.

In column A of the reference section you need to write down the type of economic activity, and in column B - the appropriate OKVED2 code. Column 1 records the volume of shipment in thousands of rubles. The cost is reflected without VAT and excise taxes. In column 1, you should take into account only goods (work, services) of your own production, transferred to organizations or individuals (including employees for wages).

Section 3

This section includes information about production capacity. When calculating capacity, all main production equipment is taken into account, including non-operational equipment due to breakdown, repair, or modernization. The equipment of auxiliary workshops is also taken into account.

The calculation of production capacity does not include the equipment of pilot production (in the manufacture of one or two prototypes), reserve equipment, and equipment of specialized areas for vocational training.

The names of products and units of measurement should not differ from those specified in section I. An exception is several categories of food products, for which capacities are determined per day or per shift.

In column A you need to enter the types of products manufactured in the reporting year. The codes of the unit of measurement and type of activity should be noted in columns B and C. The initial and final capacity should be written down in columns 1 and 14, respectively.

All changes in capacity for the reporting period are recorded in columns 3 - 13. Columns 8 and 13 reflect the increase and decrease in production capacity due to other factors: sales, purchases, bankruptcy, liquidation, mergers, etc.

In column 15 you need to show the average annual power (power at the beginning of the year + average annual increase in power - average annual decrease in power).

Average annual capacity growth = capacity increase due to each factor x number of full months of capacity operation until the end of the reporting year: 12.

Average annual reduction in capacity = reduction in capacity due to each factor x number of full months remaining until the end of the reporting year from the date of disposal: 12.

Separately, in column 17 it should be noted the production of products at non-core facilities (temporary sites, pilot sites).

Products produced outside the regime are reflected in column 18. In particular, in this column it is necessary to take into account the production of products on equipment that worked above the established standards (on weekends, in several shifts, etc.).

Columns 17 and 18 should not show information about the output of products recorded in column 16.

The amount of data in columns 16-18 for the reporting year must be equal to the data on the production of the corresponding products of the organization in its other reports for the same period.

Order of Rosstat dated August 21, 2017 No. 541

1. Federal statistical observation form No. 1-Natura-BM “Information on production, shipment of products and balance of production capacity” is provided by legal entities of all forms of ownership (except for small businesses) - commercial organizations engaged in the production of products from mining, manufacturing, production and distribution of electricity, gas and steam, logging and fishing, as well as non-profit organizations producing these types of products for sale to other legal entities and individuals.

The federal statistical observation form is also provided by branches, representative offices and divisions of foreign organizations operating on the territory of the Russian Federation in the manner established for legal entities.

Consumer cooperation organizations, repair factories and specialized repair shops, as well as enterprises engaged in the production of logging products, do not fill out this section of the form.

2. A legal entity fills out this form and submits it to the territorial body of Rosstat at its location.

If a legal entity has separate divisions1, this form is filled out both for each separate division and for a legal entity without these separate divisions.

1 Note.

A separate division of an organization is any division territorially isolated from it, at the location of which stationary workplaces are equipped. Recognition of a separate division of an organization as such is carried out regardless of whether its creation is reflected or not reflected in the constituent or other organizational and administrative documents of the organization, and on the powers vested in the specified division. In this case, a workplace is considered stationary if it is created for a period of more than one month (clause 2 of article 11 of the Tax Code of the Russian Federation).

The completed forms are submitted by the legal entity to the territorial bodies of Rosstat at the location of the corresponding separate division (for a separate division) and at the location of the legal entity (without separate divisions). In the event that a legal entity (its separate division) does not carry out activities at its location, the form is provided at the place where it actually carries out activities.

The head of a legal entity appoints officials authorized to provide primary statistical data on behalf of the legal entity.

The address part indicates the full name of the reporting organization in accordance with the constituent documents registered in the prescribed manner, and then its short name in brackets. The form containing information on a separate division of a legal entity indicates the name of the separate division and the legal entity to which it belongs.

The line “Postal address” indicates the name of the subject of the Russian Federation, legal address with postal code; if the actual address does not coincide with the legal address, then the actual location of the respondent (postal address) is indicated. For separate divisions that do not have a legal address, a postal address with a postal code is indicated.

The code part of the title page form contains the code of the reporting organization according to the All-Russian Classifier of Enterprises and Organizations (OKNO) or an identification number (for a territorially separate division of a legal entity) based on the Notification of assignment of the OKPO code (identification number) posted on the Rosstat Internet portal at : https://statreg.gks.ru.

In the case of delegation of authority to provide statistical reporting on behalf of a legal entity to a separate division, the separate division in the code part of the form indicates the OKPO code (for a branch) or identification number (for a separate division that does not have the status of a branch).

Temporarily non-operating organizations where production took place during any period of the reporting year are provided with the form on a general basis.

Bankrupt organizations that have entered into bankruptcy proceedings are not exempt from submitting reports in accordance with this form. Only after the arbitration court has issued a ruling on the completion of bankruptcy proceedings and entry into the unified state register of legal entities of its liquidation (Clause 3 of Article 149 of the Federal Law of October 26, 2002 No. 127-FZ “On Insolvency (Bankruptcy)”) The debtor organization is considered liquidated and is exempt from providing information.

Using the form for the reporting period, it is possible for the respondent to send either a duly signed report that is not filled in with the values of the indicators, or an official letter to the relevant territorial body of Rosstat about the lack of information on the indicators in the reporting period.

3. On the free lines of Section I, information is indicated for each type of product manufactured in accordance with the All-Russian Classifier of Products by Type of Economic Activity OK 034-2014 (OKPD2), specified in the List (nomenclature) of types of products (indicating units of measurement and their codes according to the All-Russian classifier of units of measurement OK 015-94 (OKEY)). The specified List can be obtained from state statistics bodies or on the official website of Rosstat on the information and telecommunications network “Internet” at the address – www.gks.ru under the headings: Official statistics/Entrepreneurship/Industrial production/Nomenclature of products and services.

In accordance with clause 9 of the Decree of the Government of the Russian Federation of November 10, 2003 No. 677 “On all-Russian classifiers of technical, economic and social information in the socio-economic field,” business entities must assign codes to classification objects (types of products) independently.

4. Data on the production of specific types of products in columns 1 and 2 of Section I include products produced by a legal entity (regardless of the type of main activity) both from its own raw materials and materials, and from unpaid raw materials and materials of the customer (toller), intended for vacation to other legal entities and individuals, to their capital construction and their divisions, included in fixed assets or current assets (for example, work clothes, special equipment), issued to their employees as wages, and also spent on their own production needs.

5. Columns 3 and 4 of Section I provide data on the volumes of products produced by a legal entity during the reporting year, which in the same year were used by it for further processing as raw materials, materials, components or directed to other production needs of this legal entity (except products included in the fixed assets and current assets of this legal entity). Products (for example, dairy products, bread and bakery products) produced by a legal entity and sent by it to its divisions (for example, to kindergartens, nurseries) are not reflected in these columns of the form.

Remains of products produced during the period preceding the reporting year, but used for domestic consumption in the reporting year, are not reflected in columns 3 and 4 of Section I of the form.

6. Column 5 of Section I reflects data in physical terms on products of own production (including those made from customer-supplied raw materials), actually shipped (transferred) in the reporting period to other legal entities and individuals, as well as issued to their employees as payment labor. Products included by a legal entity as part of its own fixed assets are not included in the data on product shipments.

7. In columns 6 and 7 of Section I, from the total volume of shipped products, data in physical and value terms on products of own production (without products made from customer-supplied raw materials) actually shipped (transferred) in the reporting period to other legal entities and individuals, and also issued to its employees as payment for wages.

The valuation of specific types of products shipped to other legal entities and individuals (column 7) is carried out at actual sales prices (excluding VAT, excise taxes and similar mandatory payments). In the case where only ex-wagon prices at the departure station are applied to a specific type of product, the cost of transporting the product from the departure station to the destination station is excluded from its valuation. If only manufacturer's ex-stock prices are applied to a specific type of product, then the cost volume is assessed using these prices.

Products sold under an exchange agreement (barter), transferred to consumers free of charge or provided to their employees as wages, when included in column 7, are valued at the average selling price of the same or similar products.

Products supplied for export are included in column 7 at contract prices, from which value added tax, excise tax, similar mandatory payments and transportation costs from the departure station to the point of export are excluded, and are converted into rubles at the rate established by the Central Bank of the Russian Federation on moment of shipment.

8. In columns 8 and 9 of Section I, for each specific type of product, the balances of finished products of own production (including those produced from customer-supplied raw materials) located in finished product warehouses or other storage places are reflected in physical terms, respectively, at the end of the reporting period and previous year.

9. For types of products accounted for in monetary terms (for example, medicines, furniture), data on production and product balances are provided at actual production costs (or at accounting prices). If the specified products are made from raw materials supplied by customer, then data on its production (columns 1 and 2) and balances (columns 8 and 9) are given at full cost, including the cost of raw materials supplied by customer; for shipment (column 5) - at the cost of services for processing such raw materials, i.e. without taking into account the cost of the customer’s processed raw materials. If all products are produced by a legal entity from customer-supplied raw materials, then zeros are entered in columns 6 and 7. If a legal entity does not produce products from customer-supplied raw materials, then the data in columns 5, 6 and 7 should be the same.

10. In section II of the form, monthly data on the production of the types of products listed in section I of the form are indicated in columns 1–12.

11. The “For reference” section is filled out by budget organizations that produce goods and services for sale to other legal entities and individuals.

Column A indicates the name of the type of economic activity, and column B its OKVED2 code.

Columns 1 and 2 reflect information on the volume of shipped goods of own production, work and services performed in-house in actual selling (sale) prices (excluding VAT, excise taxes and similar mandatory payments). The volume of goods shipped represents the cost of those goods that were produced by a legal entity and actually shipped (transferred) in the reporting period to other legal entities and individuals, as well as provided to their employees as payment for labor, including goods handed over to the customer on the spot according to the act, regardless of whether , whether the money has arrived in the seller’s bank account or not. The volume of work and services performed in-house represents the cost of work and services provided (performed) by the organization to other legal entities and individuals.

12. When filling out section III of the form, all equipment of the main production is included in the calculation of production capacity, with the exception of technologically necessary reserve equipment, equipment of pilot production and areas producing one or two prototypes, specialized areas for vocational training.

Main production equipment that is temporarily inactive due to malfunction, repair, modernization, or insufficient load is taken into account when calculating production capacity.

Equipment installed in auxiliary workshops and areas similar to the equipment of the main workshops should be included in the calculation of the organization’s capacity.

In section III of the form, the names of products and their units of measurement must correspond to those given in section I of the form, with the exception of certain types of products of the activity “Production of food products”, for which the capacity is determined “per day” or “per shift”.

In conditions of multi-product production, when several types of products are produced on the same equipment, when determining production capacity, it is permissible to use the method of reducing the product range to one or several types of homogeneous products taken as a unit, using machine time cost coefficients, as well as other indicators reflecting the specifics of the industry. In this case, the representative product must have the largest share in the production of products of this group.

Data on the availability and use of leased (short-term or long-term) property is included in the report of the organization that rents this property.

13. Column A indicates the name of the types of products produced in the reporting year.

In column B the unit of measurement is given, in columns C and D - product codes in accordance with the All-Russian Classifier of Products by Type of Economic Activities (OKPD2) and the code of the unit of measurement in accordance with the All-Russian Classifier of Units of Measurement (OKEI).

Column D indicates line number 01, 02, 03 or 04, for which the following data is provided.

On line 01 in columns 1 - 16 - data on the availability, movement of capacities in the actual nomenclature and range of products of the reporting year and the output of products at these capacities.

On line 02 in column 16 - in addition, the actual production of products at non-specialized facilities (at temporary sites, pilot sites), if the capacity calculation for them was not carried out, and also if the production capacity of the organization is specialized in the production of one product, and were used during the year to produce other products, heterogeneous with the capacity taken into account.

In the case when re-profiling of capacities occurs, that is, at capacities originally intended for the production of a certain type of product, another type of product is produced, it is necessary to recalculate production capacity (the procedure for recalculation is reflected in industry instructions for calculating production capacity).

In this case, the details of the new type of product are entered in columns A, B, C, D, D of the form, in columns 2 and 7 - the amount of increase in capacity for this type of product, and in columns 9 and 10 - the amount of decrease in capacity for previously produced products .

On line 03 in column 16 - production of products during off-duty hours (working time in excess of the established operating mode for this type of equipment - work in the third (second) shift with the established operating mode in two (one) shifts, work on weekends, increase in operating time equipment by reducing the time for its overhaul, operation of the equipment during its commissioning).

Product output data given in column 16 on lines 02 and 03 should not be included in column 16 on line 01.

On line 04, column 15 provides data on the number of work changes per year according to the regime, in column 16 - the actual number of work changes per year (data on line 04 is filled out only by specialized organizations producing meat, meat, dairy and other food products).

14. Column 1 shows the capacity at the beginning of the reporting year, transferred from column 14 of the production capacity balance for the previous year. Cases of discrepancies between the data in column 1 of the reporting balance sheet and the data in column 14 of the balance sheet for the previous year must be explained in the explanatory note attached to the report.

For organizations and facilities put into operation before the reporting year, whose capacities are in the development stage, column 1 shows their designed capacity. If the nomenclature and range of products differ significantly from the design ones, the power is determined based on the changed nomenclature.

For facilities commissioned in the reporting year, column 1 is not filled in, and the commissioned design capacity is shown in columns 2, 3 and (or) 4, respectively.

Column 2 provides data on the overall increase in capacity in the reporting year.

Columns 3 – 5 reflect data on the increase in production capacity due to the commissioning of new ones, expansion, reconstruction and technical re-equipment of existing enterprises, and the implementation of organizational and technical measures. Data on the commissioning of the specified capacities are provided only for those facilities whose acceptance certificates for operation have been issued in the prescribed manner.

Technical re-equipment and carrying out organizational and technical measures mean the following types of work:

– improvement of labor tools (modernization and replacement of outdated and physically worn-out equipment with new, more productive ones, additional installation of new equipment at existing production facilities);

– improvement of objects of labor (improving the quality of products or the composition of raw materials, materials and fuel for its production);

– improvement of technological processes (improving the parameters of existing technological processes, including through the use of higher speeds, voltages, pressures, temperatures);

– mechanization and automation of production processes;

– improving the organization and management of production (expanding cooperation, increasing the level of specialization, increasing the shift of work of technological equipment, improving the work of general plant facilities and other measures).

Columns 6 and 12 respectively indicate data on the size of production capacities taken and leased. Rented capacity is reflected by the lessor as a decrease in capacity, and by the lessee as an increase.

Columns 7 and 10, respectively, provide data on the increase and decrease in production capacity as a result of changes in the nomenclature (range) of products (reduction or increase in labor intensity).

Calculation of an increase (decrease) in capacity as a result of a change in the product range (range) is made in cases where the product range of the reporting year taken into account for the calculation of production capacity differs significantly from the product range produced in the previous year.

When determining an increase or decrease in the production capacity of an enterprise due to a change in the product range, the labor intensity of new products is taken into account in calculations according to technical or design standards. A temporary increase in labor intensity compared to standards due to the development of new products is not taken into account in calculations of production capacity.

Columns 8 and 13 reflect data on changes in production capacity due to other factors: purchase, sale, transfer of objects, machinery and equipment to other organizations, bankruptcy, liquidation, merger, division of the organization into a number of small organizations and other factors.

For example. When several organizations merge into one, columns 9 and 13 provide data on a decrease in their capacity, and for the merged organization in columns 2 and 8, data on their increase. The capacity of the organization being closed is reflected in columns 9 and 13 as decreasing, and for the organization that was formed on the basis of these capacities - in columns 2 and 8 - as increasing.

Column 9 indicates data on the general decrease in production capacity.

Column 11 reflects data on the disposal of production capacity due to dilapidation of equipment, depletion of mineral reserves and forest raw materials, deterioration of mining and geological conditions, transition to other types of raw materials, and natural disasters.

Column 14 indicates the size of the organization's production capacity at the end of the reporting year (beginning of the year following the reporting year).

Column 15 shows the value of the average annual capacity operating in the reporting year, which is determined by adding the amount of capacity at the beginning of the year and the amount of its average annual increase minus the amount of its average annual decrease.

The average annual increase in capacity due to the commissioning of new ones, expansion, reconstruction, technical re-equipment of existing organizations and carrying out organizational and technical measures, leasing of equipment, and other factors is calculated by multiplying the amount of increase in capacity due to each of the listed factors by the number of full months of operation of the capacity until the end of the reporting year and dividing the result by 12.

The average annual reduction in capacity due to the disposal of capacity due to dilapidation, depletion of reserves, their rental, and other factors is calculated by multiplying the amount of retired capacity due to each of the listed factors by the number of full months remaining until the end of the reporting year from the moment of its disposal, and dividing the resulting result at 12.

When calculating the average annual capacity, the volume of increase (decrease) in capacity due to changes in the product range (reduction or increase in labor intensity) is taken into account in full.

The data in column 16 (the sum of lines 01, 02 and 03) for the reporting year must be equal to the data on the production of the corresponding products of the organization in its other reporting for the same period.

For certain types of products related to the type of activity “Production of food products”, the production capacity of which is determined “per day” or “per shift” (columns 1 – 14), the average annual capacity operating in the reporting year (column 15), and output products or the amount of processed raw materials (column 16) must be given for the year as a whole.

The operating mode adopted in calculating capacity for each type of product (shifts or hours of work per day) is given for reference.

15. Data controls based on form indicators.

For Section I:

gr. 1 ≥ gr. 3; gr. 2 ≥ gr. 4.

If gr. 1 = gr. 3, then gr. 8 = 0; if gr. 2 = gr. 4, then gr. 9 = 0; if gr. 1 > gr. 5, then gr. 8 ≠ 0.

For Section II:

The sum of the data in columns 1 – 12 of the section for specific types of products should be equal to the data in column 1 of section I of the form and the data in column 16 (sum of lines 01, 02, 03) of section III for the corresponding types of products.

For Section III:

The data in column 1 of the reporting year must correspond to the data in column 14 of the production capacity balance for the previous year.

The data in column 2 must be equal to the sum of the data in columns 3 – 8; and the data in column 9 – the sum of the data in columns 10 – 13.

The data in columns 3 – 5 on line 01 must correspond with the reporting data in Form No. C-1 “Information on the commissioning of buildings and structures.”

The data in column 14 must be equal to the sum of the data in columns 1 and 2 minus the data in column 9.