Good afternoon, dear reader.

This article will discuss how to file your taxes online.

The need to file a declaration may arise in different situations: when receiving income (for example, when selling a car) or to receive a tax deduction (for example, for training in a driving school).

The traditional method of filing a return on paper requires time (travel to the tax office and waiting in line) and money (to pay for travel). You can send your tax return online for free and quickly. This article will cover:

- Preparation of documents for filing a declaration. Declaration file in xml format.

- Preparation of copies of additional documents.

Let's get started.

The current declaration form and new requirements for completion have been taken into account

Let us immediately note that the program in question allows you to fill out 3-NDFL for 2017, taking into account all the requirements established by the basic order of the Tax Service of Russia dated December 24, 2014 No. ММВ-7-11/671 (hereinafter referred to as Order No. ММВ-7-11/671 ) in the latest edition – dated 10/25/2017. Let us remind you that they are assigned:

- declaration form 3-NDFL for 2021;

- electronic file format with this report;

- rules for filling out the declaration form.

Thus, in the “Declaration 2017” program, it is almost impossible to fill out 3-NDFL in 2018 in violation of current requirements. After all, it contains:

- The most current declaration form, similar to the paper version.

- The corresponding filling algorithm takes into account the presence of all mandatory details, as well as the latest changes to Order No. ММВ-7-11/671.

Also see "".

Title page design

To fill out the title page, you will need a passport or other identification document.

On the title page you need to fill out:

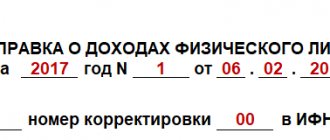

- Correction number. If you are filling out for the first time, enter zero. If the tax office returned the document for revision, indicate which account it is a refund.

- Taxable period. We write "34". This means that the period is equal to a calendar year.

- Reporting year – 2021.

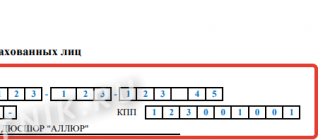

- Tax authority code. Where you are sending the documents. These are 4 numbers that can be found on the Federal Tax Service website, service “Address and payment details of your inspection”: https://service.nalog.ru/addrno.do.

- Code of the country. For Russia – 643.

- Taxpayer category code. 760 – for an individual wishing to receive a tax deduction.

- Write your full name, date and place of birth as indicated in your passport.

- Document code. For a Russian passport – 21.

- Passport series and number, by whom and when issued. Copy the data from your passport.

- Taxpayer status code. 1 – taxpayer, 2 – does not pay taxes.

- Phone number.

- The number of declaration sheets and the number of sheets of the package of documents.

- In the field “I confirm the accuracy and completeness of the information specified on this page,” you must sign and date it. Only if filled out by a legal representative, indicate his full name in the boxes.

What does the application from the Federal Tax Service do?

Before you fill out the 3-NDFL declaration in the program, it is important to understand that it will automatically generate the declaration sheets necessary for your case based on the information you entered.

Simply put, the final version of your 3-NDFL will include as many sheets as needed. The Federal Tax Service will automatically skip any unnecessary applications.

The standard 3-NDFL form from 2021 includes 20 sheets. The final version will include the least of them if you declare only income and do not declare deductions. But with deductions the number of sheets will be greater.

Also see “Download the 3-NDFL declaration for 2021 to fill out.”

After filling out the 3-NDFL through the program, it will generate the sheets itself:

- for all taxable income from domestic and foreign sources;

- by income from business and private practice;

- data for calculating professional deductions for royalties and civil contracts;

- property deductions;

- data for calculating the tax base for transactions with securities, financial instruments of futures transactions and taxable income from participation in investment partnerships;

- for calculating standard, social and investment deductions (+ losses on securities and financial instruments).

Most importantly, the instructions for filling out 3-NDFL through the program assure that the application has built-in:

- control of entered data for their availability (mandatory details);

- checking their correctness.

Also see “Installing the “Declaration” program for filling out 3-NDFL for 2021: instructions.”

Studying legislation

If you work with a Russian broker, then he is your tax agent and he resolves all issues of the Federal Tax Service. You will have to pay the tax yourself only if your sources of income are located outside the Russian Federation, this is stated in Art. 208 Tax Code of the Russian Federation.

These include:

- Coupon payments on bonds.

- Profit received from trading stocks and derivatives on the stock market.

- Dividends.

- Other types of income , for example, interest accrual on the free account balance.

There is no point in evading taxes . This is not Forex, where withdrawing a couple of hundred dollars of profit will not interest anyone. Investors operate with large sums, and the Federal Tax Service will not ignore them.

The fines are significant:

- Art. 119 Tax Code of the Russian Federation regulates sanctions for failure to submit a tax return.

- If it is proven that you deliberately evaded paying taxes, fines increase to 20-40%. This is discussed in more detail in Art. 122 Tax Code of the Russian Federation .

- It is also not in your interests to delay time, clause 4 art. 75 Tax Code of the Russian Federation regulates the amount of penalties accrued for each day of delay. It is tied to the refinancing rate of the Central Bank of the Russian Federation. At the time of preparation of the material, it is 7.75%, which means that the fine will increase by 7.75/300 = 0.0258% per day.

In the end, it will all end with you paying tax + a fine. So I recommend not to delay or delay submitting documents to the Federal Tax Service.

Where to begin

Find the following icon on your desktop and launch it:

As a rule, filling out 3-NDFL in the “Declaration 2017” program does not cause much difficulty, since its interface is quite simple and understandable. For example, the main screen you will have to work with looks like this:

To understand how to correctly fill out 3-NDFL in the program, it is important to understand the general principle: first enter individual information, and then this application from the Federal Tax Service will collect it together. It's almost impossible to miss anything. After all, if some required data is missing, the program simply will not generate your 3-NDFL for 2017.

Our instructions on how to fill out 3-NDFL in 2021 in the program from the Federal Tax Service would be incomplete if we did not tell you about the main options that you will have to work with when filling out the report.

Toolbar

It looks like this:

This is access to various main menu functions. You just need to click on the desired button once. If anything, a hint under the mouse arrow will help you figure it out. Essentially, these are step-by-step rules for filling out 3-NDFL in the program.

Main menu

It looks like this:

When you select “File”, a submenu with the following content will appear:

Here the rules for filling out the 3-NDFL declaration in the program from the Federal Tax Service of Russia allow you to:

| Possibilities of the “File” submenu | |

| Option | What gives |

| Create | Generates a new declaration. At the same time, if another declaration is open at the same time and changes are made to it, but not saved, a proposal to save them will appear. According to the instructions, the 3-NDFL program begins each start with the creation of a new declaration. That is, you can enter and change data. |

| Open | Makes it possible to open a file with 3-NDFL, which was previously entered and saved. At the same time, if another declaration is open at the same time and changes are made to it, but not saved, a proposal to save them will appear. |

| Save | Allows you to save the active declaration to a file |

| Save as… | Prompts for the name and location of the file to save |

| Exit | Allows you to leave the program |

Please note: all these options are duplicated on the toolbar.

Important instructions when filling out 3-NDFL in the program: if, after selecting the Create/Open/Save/Exit options, the request to save changes was confirmed, but you did not enter a file name, a dialog will still appear asking for the name and location of the new file. That is, the entered data will not disappear anywhere.

When you select the “Declaration” item, the following submenu will appear:

| Possibilities of the “Declaration” submenu | |

| Option | What gives |

| View | Preview of the generated declaration in the form and volume in which it will be printed if “Print” is selected |

| Seal | Printing the selected 3-NDFL |

| Export | Moves the data of the current declaration to a file in the format approved by the Federal Tax Service (xml) for sending to the Federal Tax Service |

| Check | Analysis of the generated declaration for completeness and compliance of the entered data |

Please note: all these options are duplicated on the toolbar.

When you select “Settings” you will see:

It allows you to enable or disable:

- show toolbar;

- displaying labels under buttons on the toolbar.

When you select Help, a submenu will appear:

Here:

- “Help” – call up comments to the program (can also be opened with the F1 key);

- “About the program” – its version and technical support contacts.

Navigation bar

It shows the topic section you are completing. Just click on it once.

Please note that according to the instructions for the 3-NDFL “Declaration” program, some buttons may not be available. This depends on what conditions you initially set (“Set Conditions”).

Main window

It is here that you need to enter and edit the basic information that will go into the 3-NDFL report:

Please note that compared to last year’s version of this program, in 2021 a field for indicating OKTMO has appeared (see above).

Also see “Which OKTMO to indicate in 3-NDFL”.

The internal instructions for filling out the 3-NDFL declaration in the program indicate that when launched, the application automatically generates an “empty” declaration. And at any time you can:

- save the entered data to disk;

- load a previously saved declaration;

- create a new one.

The title will show the name you gave to the file with 3-NDFL.

The best foreign brokers

I.B.

Below I will briefly discuss companies that have proven themselves well and are also suitable for Russians. Let's start with Interactive Brokers:

- Starting deposit from $10,000 – suitable only for experienced investors and traders.

- Thousands of assets available.

- Share fees are 68% lower than direct competitors ($2.24 vs. $8.0).

- There is access to global exchanges , as well as trading platforms in North and South America, Africa, and Europe.

- Thousands of assets available for trading.

Open an account with IB

CapTrader

The company is not popular in Russia, but rather due to the lack of information about it in Russian. In the near future I plan to make a detailed review of this broker:

- In terms of reliability, the company is comparable to InteractiveBrokers; it is its “daughter”.

- Starting capital has been reduced to $2000/€2000 . For the first account with a foreign broker, CapTrader is more suitable than IB.

- There is access to all popular exchanges (America, Europe, Asia, the Pacific region, global platforms).

- There are slightly fewer assets available than IB.

- There is a demo account.

Register an account with CapTrader

Exante

- For individuals, the minimum deposit is €10,000.

- There is a demo account.

- The spreads are not record narrow, slightly inferior to Exness, but remain normal.

- You can work with cryptocurrencies, metals, stock market instruments, futures - not a single area has been ignored.

- A single account has been implemented for all markets.

- The total number of assets available for trading exceeds 50,000.

These are some of the best foreign companies. If you are interested in working on the Russian market, I recommend trying to trade with BCS. A review of the BCS broker was done earlier, the company offers good conditions, plus there are no problems with reliability.

Entering basic information

Now about how to fill out 3-NDFL for 2021 in the program. The instructions suggest starting from the main window (see picture above). Here the main conditions (reason) for filling out this declaration are introduced.

If you are submitting the primary 3-NDFL report, put “0” in the “Adjustment number” field. In the opposite situation, the instructions for the program for filling out 3-NDFL for 2021 require you to enter the number for which you submit the updated declaration.

The OKTMO field was introduced in 2013 instead of the OKATO field. Its meaning can be found in your Federal Tax Service.

The “Income available” panel logically separates the information input. For her, detailed instructions for filling out 3-NDFL in the program are shown in the table below.

| How to fill out “Income available” | |

| Option | Explanation |

| Choose the first option if you have income: • according to 2-NDFL certificates; • under civil contracts; • royalties; • from the sale of property, etc. | This is data on income that is taxed at rates of 13, 9 and 35% (in the case of a non-resident - 13, 15 and 30%). The exceptions are: • income in foreign currency; • income of individual entrepreneurs; • profit from private practice; • income from participation in investment partnerships. |

| If you have income in foreign currency | Check the box next to “In foreign currency” |

| If you have income from business activities | Check the box next to “From business activity” |

| When there are income from participation in investment partnerships | The checkbox next to “Invest. partnership" |

Keep in mind: the step-by-step filling out of 3-NDFL in the program is organized in such a way that each of these points allows or denies access to entering the relevant information. If you have not selected any of the options, you will only be able to enter information about yourself.

Now let’s talk about how to correctly fill out the “Inspection Number” field in the program for 3-NDFL. There shouldn’t be any particular difficulties here either. The current list of all Russian tax inspectorates (at the time of release of your version of the program) is already attached to this field (see the figure below). Just press the “…” button:

However, how to fill out 3-NDFL using the program if your tax authority is suddenly not on this list? The Federal Tax Service assures that it can be edited independently in any text editor.

Inspections reorganize quite often, so they change their code. If a year ago you applied to the Federal Tax Service (conditionally with code 7777), this does not mean that you should add it to the list. First, find out if she has changed the name and code. Perhaps it is already in the directory, but under its new code - conventionally 7778.

The second approach to filling out 3-NDFL through the “Declaration” program in this part is to use the built-in mode for updating the list of inspections. True, it is more complicated: you need to download the archive from the Internet yourself and unpack it to the appropriate location.

Also see “How to correctly indicate the Federal Tax Service in 3-NDFL”.

The following is information about the declarant and his address:

Please note that, unlike last year, it is not necessary to indicate the exact address of residence, including abroad, from 2021.

In general, how to fill out the 3-NDFL declaration through the program using these columns is fully consistent with the design of the title page of this form in paper form.

If you were previously able to fill out 3-NDFL using the “Declaration” program of previous versions (2002 - 2016) and there was a file left with information about yourself, you have actually freed yourself from the need to fill out most of the information about yourself. Simply open the old file in the new program: past earnings will be ignored and personal information will be extracted. This will save time filling out the report.

Please provide the country code according to the All-Russian Classifier of Countries of the World (OKSM). If there is no citizenship/nationality at all, then in the “Country Code” field, indicate the state that issued the identity document.

The TIN field must be filled in only for individual entrepreneurs. Other individuals may not do this.

The next main tab is “Income received in the Russian Federation”. There are 4 screens for input. Switching between them occurs using the number buttons with personal income tax rates at the top of the main window (see figure below).

Please note that the screens are divided by rates: 13, 9, 35% (Sheet A of the declaration). At the same time, dividend income, which since 2015 has been at a rate of 13%, is shown on a separate screen (“13” in green).

And for non-residents there is a different set of tax rates: 30, 15 and 13 percent.

Add a payment source using the “+” button, remove “-”, and edit using the lowest button (see figure).

Also see “Sources of payment in 3-NDFL: revealing the cards.”

The “…” button opens the income directory (deductions, if a deduction is allowed for this income, otherwise this button is not available). Selecting a deduction will automatically add the corresponding sheets to 3-NDFL.

The success of how to work with the program for 3-NDFL largely depends on the quality of filling out 2-NDFL certificates. The Federal Tax Service advises not to forget to fill out the total amounts by source of payments (these are points 5.2 – 5.4 of the certificate form). When the source of income did not calculate taxable income and tax, you need to do this yourself.

Also see “What is the difference between 2-NDFL and 3-NDFL”.

Income tax return: reflection of dividends

The receipt of dividends by a company is indicated as part of income when the company financially participates in the activities of third-party companies - that is, invests funds in their development and receives additional income from these investments. In this case, received dividends or interest from investments made are recorded in the total amount of non-operating income on line 100 of Appendix 1 to sheet 02 of the declaration. A more specific breakdown by type of income is not provided in the declaration, since this information is fully provided to users in the explanations to the balance sheet.

If we are talking about the payment of dividends, that is, about the company’s expenses, then these data are indicated in a separate section of the declaration - sheet 03, and in their formation along the lines of this section it is necessary to take into account some nuances.

Features for individual entrepreneurs

Businessmen fill out 3-NDFL for 2021 in the program according to the same principle, but in different windows. According to the principle of Sheet “B” of a paper declaration:

Pay attention to the option “There are documented expenses.” It allows you to enter data on them. There are 2 options:

- Costs supported by documents.

- Calculation of expenses at the standard (20%) rate relative to income.

In addition, individual entrepreneurs must indicate their OKVED code. It is selected from the directory attached to the program. When searching for the required code, some sublevels for a particular type of activity may not be provided.

Read also

10.01.2018

Manually

There are two ways. The first is to print the form and enter the data in the boxes by hand. The second is to fill it out on your computer in PDF or Excel format and then print it out.

In any case, follow the rules:

- Write with a blue or black pen.

- Print the document on one side of the sheet.

- Do not staple the sheets together to avoid damaging the barcode.

- When writing by hand, fill in the fields from left to right. If there are empty cells left, you need to put dashes. For example, the column “OKTMO code” has 11 cells. We enter the eight-digit code like this: “12445698—”

- If filling out on a computer, align to the right. There is no need to put dashes. Use Courier New font size 16-18.

- You cannot correct, cross out or cover up.

- Each page must be signed. To do this, at the bottom there is a field “I confirm the accuracy and completeness of the information indicated on this page.”

- If the declaration is submitted by your representative, please include a notarized copy of the power of attorney in the package of documents.

- The personal income tax amount is indicated in full rubles. Kopecks are rounded (up to 50 - down, equal to or more than 50 - up).

- Convert income in foreign currency into rubles at the Central Bank exchange rate on the date of receipt.

- You need to enter a number in a special field. The cell contains 3 cells. Put 0 in the extra ones. For example, 003 or 011.

How to fill out the first section

Before filling out section 1, you need to calculate the refund amount in section 2.

After calculation, indicate the values:

Line 010. Write 2 - tax refund from the budget. Line 020 – budget classification code. To return personal income tax paid, the code is: 182 1 0100 110. Stoka 030 is the OKTMO code of the locality where the tax is being refunded. You can look here: https://www.consultant.ru/document/cons_doc_LAW_149911/#dst0 Line 040. Put zero. Line 050. Transfer the tax amount from section 2.