There are not only arrears in contributions to the Social Insurance Fund, but also overpayments. Having overpaid insurance premiums to the Social Insurance Fund, you can offset them against the payment of future contributions or towards the repayment of debt on fines and penalties (Article 26 of the Law of July 24, 2009 No. 212-FZ). The FSS itself offsets overpayments against future payments, but payers of contributions can also send an application for offset to the fund in Form 22-FSS (Appendix No. 2 to the order of the FSS of the Russian Federation dated February 17, 2015 No. 49). Let's take a closer look at Form 22 of the FSS of the Russian Federation, a sample of which will be filled out in this article.

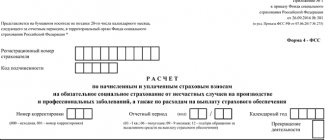

The procedure for drawing up a 4-FSS report by a budget organization

The report form was approved by Order of the Federal Social Insurance Fund of the Russian Federation dated September 26, 2016 No. 381, and it has already been changed twice. The first time - from 01/01/2017 due to the transfer of administration rights for insurance coverage to the Federal Tax Service and the exclusion of calculations for temporary disability and maternity from reporting. And the second - from 06/07/2017 due to the new FSS Order No. 275. In 2021 and 2021, no changes were approved.

The report consists of a title page and five tables, as in the previous version of the document. The title page and tables No. 1, 2 and 5 remain mandatory. Table parts No. 1.1, 3 and 4 are filled out only if the relevant information is available, otherwise dashes are added.

Let us remind you that in 2021, officials added new fields to the form. The changes also affected the procedure for filling out the reporting document. For example, the value of the field “Average number of employees” should now be calculated not for the previous reporting period, but from the beginning of the year. That is, to fill out the Social Insurance Fund form for 2021 (2nd quarter), we now calculate the average payroll for employees for the past 6 months of this year.

To fill out the calculation, you must follow the procedure given in Appendix No. 2 of Order No. 381 of the FSS of the Russian Federation with clarifications of Order No. 275 of the FSS of the Russian Federation dated June 7, 2021. When filling out a paper version of the calculation, you must use a blue or black pen, using block letters. You can fill out the form on your computer.

On each page, the policyholder must indicate his registration number and subordination code. These data are indicated in the notice issued when registering the policyholder with the social insurance fund. The policyholder's signature and the date of signing the document are indicated at the bottom of the page.

The adjustment number “000” is indicated on the title page if the third quarter form is submitted for the first time. In the future, if a revised calculation is submitted, then “001” is entered, subsequent clarifications of the same report are given “002”, etc. The updated calculation must be submitted according to the reporting form that was in effect during the period for which errors were identified.

The reporting periods are the first quarter, half a year, and nine months of the calendar year, which are respectively designated “03,” “06,” and “09.” The billing period is the calendar year, which is designated by the number “12”.

The pages of the form must be numbered and their number, as well as the number of pages of attachments (if any), are indicated on the title page.

Cash amounts in calculations are not subject to rounding, i.e. are indicated in rubles and kopecks. If the indicator is zero, then a dash is placed in the corresponding column.

Table 1 - it reflects the calculation of the base for calculating contributions for “injuries”. Indicators are indicated on a cumulative basis from the beginning of the year, and are broken down by month of the last quarter of the reporting period.

Table 1.1 is filled out by policyholders if their employees, on the basis of a contract, were sent to work for other employers. (clause 2.1 of article 22 of the law of July 24, 1998 No. 125-FZ).

Table 2 - the calculation is filled out according to the policyholder’s accounting data on the status of settlements for contributions and expenses.

Table 3 - is filled in when there are expenses for “injuries”, that is, payments for temporary disability certificates for industrial accidents or injuries, payment for leave for the treatment of occupational diseases at resorts and sanatoriums.

Table 4 - it indicates the number of people affected by occupational diseases and industrial accidents. The data is indicated on the basis of the relevant acts. This table is located on the same page as Table 3.

Table 5 - information on the results of a special assessment of working conditions and medical examinations of workers performed. The table reflects the number of jobs subject to assessment, the number of workers in hazardous production conditions and, accordingly, the number of jobs assessed and the number of workers who underwent medical examinations at the beginning of the year.

Please note that in the downloaded form in Excel, each table is located on a separate page of the file.

Form 4-FSS for 2021

The form has the following composition:

- Title page

- Table 1 “Calculation of the base for calculating insurance premiums”;

- Table 1.1 “Information required for calculating insurance premiums by policyholders specified in paragraph 2.1 of Article 22 of the Federal Law of July 24, 1998 No. 125-FZ”;

- Table 2 “Calculation of the base for compulsory social insurance against accidents at work and occupational diseases”;

- Table 3 “Expenditures on compulsory social insurance against accidents at work and occupational diseases”;

- Table 4 “Number of victims (insured) in connection with insured events in the reporting period”;

- Table 5 “Information on the results of a special assessment of working conditions (results of certification of workplaces for working conditions) and mandatory preliminary and periodic medical examinations of workers at the beginning of the year.”

The title page and tables 1, 2 and 5 are required to be submitted. They must be submitted in any case, even if the policyholder did not have any accruals for “injuries” during the reporting period. The rest is filled in only in cases where the corresponding indicators exist.

Contributions to the Social Insurance Fund

Starting from January 1, 2021, some changes are being made to the system for regulating relations with the Social Insurance Fund. Thus, the procedure and amount of contributions to be transferred by subjects of economic legal relations in favor of the Social Insurance Fund are regulated by the requirements of the Tax Code of the Russian Federation.

However, these innovations do not concern the procedure for offsetting overpayments of contributions to the Social Insurance Fund. Clause 1 of Article 26 of Federal Law No. 212-FZ of July 24, 2009 provides for the possibility of offsetting overpayment amounts against future deductions.

In 2021, similar provisions will be contained in Article 431 of the Tax Code of the Russian Federation.

In 2021, similar provisions will be contained in Article 431 of the Tax Code of the Russian Federation.

Sample of filling out form 22-FSS of the Russian Federation

The Social Insurance Fund, by its Order No. 49, only approved the application form for offset of overpaid contributions. The procedure and methods for document execution have not been officially approved or developed.

In order to eliminate possible errors when filling out the form, you can use a sample of its design.

In addition, you should also take into account some features of entering information into the document form. As a general rule, applications on the territory of the Russian Federation can be filled out in two ways:

- by hand;

- using typewritten and computer means.

All information must be entered accurately, clearly, without blots, errors, or inaccuracies. Cross-throughs, etching, erasing and painting over the text of the document are unacceptable. If any field is not filled in, then it is advisable to put a dash in it.

Black ink is permitted.

It must be especially emphasized that in order to correctly fill out the application in Form No. 22-FSS of the Russian Federation, the registration number and subordination code assigned to each policyholder upon registration with the Fund should be indicated in the appropriate column of the document. Ignoring this requirement may be grounds for refusal to satisfy the application by the Social Insurance authority.

The Social Insurance Fund of Russia brought the contents of the application in Form No. 22-FSS of the Russian Federation in accordance with the norms of civil legislation. In 2021, a seal should be affixed to the form only if the policyholder has one. If such details are missing, then the signature of an authorized person is sufficient.

As a conclusion, it should be noted that when submitting a request to offset the overpayment of contributions to the relevant enterprise or individual entrepreneur, it is enough to fill out the application form according to the names of the columns and fields. All information entered must be current and reliable.

Strict adherence to the above procedure will give the policyholder a guarantee that the form will be filled out correctly and, as a result, that the Social Insurance Fund of the Russian Federation will not refuse to offset the overpayment amounts to the social insurance entity.

sample of filling out form 22-FSS of the Russian Federation

There are not only arrears in contributions to the Social Insurance Fund, but also overpayments. Having overpaid insurance premiums to the Social Insurance Fund, you can offset them against the payment of future contributions or towards the repayment of debt on fines and penalties (Article 26 of the Law of July 24, 2009 No. 212-FZ). The FSS itself offsets overpayments against future payments, but payers of contributions can also send an application for offset to the fund in Form 22-FSS (Appendix No. 2 to the order of the FSS of the Russian Federation dated February 17, 2015 No. 49). Let's take a closer look at Form 22 of the FSS of the Russian Federation, a sample of which will be filled out in this article.

Which form to use

Since 2021, the order of the Social Insurance Fund dated November 17, 2016 No. 457 has been in force, which approved several forms of documents necessary for offset or return of overpaid (excessively collected) insurance premiums for injuries.

Also see "".

Please note that this application form does not have an official electronic format, although the law provides for the possibility of submitting it in the form of an electronic document.

If the overpayment was only for contributions, put dashes in the lines “Penalties” and “Fines”. But you can choose what the overpayment will be used for. The amount can be distributed directly to insurance premiums, as well as penalties and fines.

In practice, situations arise not only with arrears of contributions to the insurance budget, but also with overpayments. If this happens, the citizen has the right to offset this extra money to pay subsequent elements or credit it to pay off debts. The insurance service independently records overpayments, however, within the framework of the rights of payers, there is the authority associated with sending an application form 22-FSS. A sample will be reviewed within this material.

Form 22 of the Federal Tax Service of the Russian Federation, a sample for filling out 2021 of which will be presented below, assumes the appearance of several “ticks”.

- Offsetting insurance payments that were made in excess. The offset is carried out between payment types, first the debt is offset, and then the remaining amount goes towards upcoming payments.

- A field associated with crediting insurance premiums at the interregional level. Here, all operations take place between FSS branches, if the transfer occurred within the framework of other details that must be recorded in your fund branch.

The payer was deregistered in one department and registered in another authority. At the same time, erroneous payments were made to the old fund.

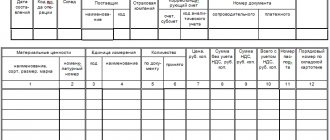

After this point, the process of filling two tables is carried out.

- The first of them indicates the contributions, as well as the accrued amounts of fines and penalties that apply to your situation.

- The second table contains information regarding the scope and in favor of which payments these overpayments will be credited.

If an overpayment occurs after the beginning of 2015, crediting is carried out not only against similar funds, but also under the “injury” category. If overpayments occurred in an earlier period, offsets can be made exclusively within the framework of one type of payment.

Also see "".

Features of filling out an application

Form 22 of the Federal Tax Service of the Russian Federation, a sample for filling out 2021 of which will be presented below, assumes the appearance of several “ticks”.

- Offsetting insurance payments that were made in excess. The offset is carried out between payment types, first the debt is offset, and then the remaining amount goes towards upcoming payments.

- A field associated with crediting insurance premiums at the interregional level. Here, all operations take place between FSS branches, if the transfer occurred within the framework of other details that must be recorded in your fund branch.

Example of the second case

The payer was deregistered in one department and registered in another authority. At the same time, erroneous payments were made to the old fund.

Amounts of FSS benefits in 2021

After this point, the process of filling two tables is carried out.

- The first of them indicates the contributions, as well as the accrued amounts of fines and penalties that apply to your situation.

- The second table contains information regarding the scope and in favor of which payments these overpayments will be credited.

If an overpayment occurs after the beginning of 2015, crediting is carried out not only against similar funds, but also under the “injury” category. If overpayments occurred in an earlier period, offsets can be made exclusively within the framework of one type of payment.

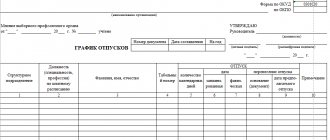

Who rents

The obligation to provide a report to 4-FSS is enshrined in Law No. 125-FZ. In accordance with legislative norms, all legal entities, individual entrepreneurs and private owners who employ the hired labor of insured citizens are required to report. In simple words, all employers who pay social insurance contributions to Social Security for their subordinates are required to submit a unified reporting form.

Insured persons, in accordance with paragraph 1 of Article 5 of Law No. 125-FZ, are recognized as:

- Working citizens with whom an employment contract, agreement or contract has been concluded.

- Citizens forced to work by court decision as part of the execution of a sentence.

- Individuals working under civil contracts, copyright contracts, construction contracts and others, the terms of which provide for social insurance (payment by the employer of contributions for injuries).

Therefore, if your organization employs not only full-time employees, but also contract workers, be sure to study the contract that was signed with such a specialist. Pay special attention to the terms of accrual and payment of insurance coverage. If, in addition to mandatory contributions (compulsory health insurance and compulsory medical insurance), contributions for injuries are also indicated, then the amount of remuneration for the work of contract workers will have to be included in the reporting.

Filling example

Entering information into the form in question does not cause any particular difficulties. Moreover, the FSS has not approved a separate procedure for filling out an application for credit.

Please note that at the very beginning of the application form you must correctly indicate the registration number in the Social Insurance Fund and the code of subordination. They are assigned to each policyholder when registering for injury.

Also see “Registration numbers in the Pension Fund of the Russian Federation and the Social Insurance Fund in payment orders for the payment of insurance premiums.”

The link shows a sample of filling out Form 22-FSS of the Russian Federation in 2018.

Also see “Deadlines for submitting 4-FSS in 2021: table.”

If you find an error, please highlight a piece of text and press Ctrl Enter.

Form 22 FSS of the Russian Federation and sample filling: algorithm of actions

Form 22 of the FSS of the Russian Federation, the sample filling out assumes an alternate sequence of performing basic actions.

Registration of an individual entrepreneur with the Social Insurance Fund as an employer

"A cap"

Information about the company name and its identification code values is indicated here.

First table

There are two columns here that reflect information on amounts received for insurance related to:

- Disability, motherhood;

- Occupational diseases, injuries.

Within each direction, the amounts of not only insurance premiums are displayed. Penalties imposed on them are taken into account.

Second table

It provides for similar two directions, associated with the same causal factors of deviations, but here the elements are indicated in payment of which certain business transactions are carried out.

Last stages

As part of the last steps, the details of the insurance authority and the company itself are followed, as well as the signatures of the parties responsible for the fact of concluding these contractual relations. The final result must be signed by a legally authorized employee of the insurance premium payer. The application may be accompanied by some other documents that indicate the applicant’s correctness and help confirm his rights in this matter. This list is determined on a case-by-case basis.

A competent approach to filling out an application guarantees the successful completion of any case.

| Download Application for refund of overpaid amounts for insurance |

Deadlines for submitting 4-FSS

The deadline for submitting the Social Insurance Fund form for the 2nd quarter of 2019 depends on the method of submission. For policyholders generating paper reports, the report must be submitted no later than July 22, 2019. For injury contribution payers reporting electronically, until July 25.

For the 4-FSS report, the same rules apply for determining the type of submission of reports: for policyholders with an average number of up to 25 people, submission is provided on paper, for payers with 25 or more employees - exclusively in electronic form.

News

- 22.05.2019

Beware: scammers!

A resident of the Altai Territory received a letter promising social compensation from the Federal Social Insurance Service of the Russian Federation. Specialists of the Altai regional branch of the FSS of the Russian Federation warn: such letters are fraudulent!

»

- 17.05.2019

FSS maternity payments will be transferred only to the MIR card

The new procedure will affect benefits issued on May 1, 2021 and later, as well as benefits for which the first payment will occur within the specified period. In this case, benefit recipients will have two alternatives.

»

- 08.05.2019

Happy Great Victory Day!

Dear residents of the Altai Territory! Participants and veterans of the Great Patriotic War, members of their families!

On behalf of the team of the Altai regional branch of the Social Insurance Fund of the Russian Federation, I congratulate you on one of the most significant dates in our history - Happy Victory Day!

»

- 16.04.2019

Question and answer: deadlines for submitting calculations in Form 4-FSS for the first quarter of 2021

Who and within what time frame must submit to the Social Insurance Fund of the Russian Federation a calculation in form 4-FSS for the first quarter of 2021? What happens if the accountant does not submit the specified calculation to the Fund on time?

»

- 12.04.2019

Falling from a height is the main cause of industrial injuries in Altai

In total, 631 production-related insured events were registered in 2021. The total amount of payments from the Social Insurance Fund budget in this area for the year exceeded 852 million rubles

»

- 11.04.2019

Future managers of Altai got acquainted with the work of the Social Insurance Fund

Altai State Agrarian University students attended another lesson at the School of Social Insurance

»

- 08.04.2019

At the ER reception desk they discussed providing disabled people with technical means of rehabilitation

On April 4, at the regional public reception of the chairman of the United Russia party D.A. Medvedev held a thematic reception on the issue of providing disabled people in the Altai Territory with technical means of rehabilitation

»

To the list "

If activity is suspended

Companies suspend their operations infrequently. In most cases, this situation is familiar to non-profit organizations; public sector employees are “frozen” much less often.

If the activity of the entity is still suspended, there are no taxable charges in favor of employees, what to do with the reporting? Should I pass zero 4-FSS or not?

Definitely pass. Even if in the billing period there was not a single accrual in favor of full-time employees. For example, if a non-profit organization did not make payments throughout 2019, then the report must still be submitted on time. Officials did not provide any exceptions. 4-FSS will issue a fine for failure to pass the zero grade. To avoid penalties, you will have to fill out the title page of the 4-FSS form, as well as tables numbered 1, 2 and 5.

Offset of overpayment to the Social Insurance Fund: fill out an application

In the application on Form 22-FSS, select the desired type of offset by checking the appropriate box:

- “offset of overpaid insurance premiums”, when offset occurs between types of payments, and first, the debt on penalties and fines will be offset against the overpayment, and the remaining amount will be offset against future payments,

- “Interregional offset of insurance contributions” is carried out between regional branches of the Social Insurance Fund, if the contributions were transferred using other details, and now they need to be taken into account in your branch of the fund (for example, if the payer was deregistered in one branch of the Social Insurance Fund and registered in another, and mistakenly continued to pay at the old place of registration).

Next, we fill out two tables of form 22-FSS of the Russian Federation (see below for a sample of filling): in one, indicate for which contributions, penalties, and fines the excess amounts were paid, in the other - against which payments you want to offset them.

Important: if the overpayment of contributions for disability and maternity occurred after January 1, 2015, then it can be offset not only against the same contributions, but also against contributions for “injuries.” And vice versa - “injuries” can be counted towards contributions for “disability and maternity”.

With the completed application, contact your FSS branch where you are registered. This can be done by sending an application by mail, handing it over to the fund branch in person, or sending it electronically. After receiving your application, the fund may:

- propose to carry out mutual reconciliation of settlements with the signing of the act in order to identify the exact amount of overpayments and debts,

- make a decision on offset without reconciliation.

In the first case, the decision on offset will be made by the social insurance fund within 10 days from the date of signing the reconciliation act, and in the second - within 10 days from the date the fund receives your application for offset.

An application for offset of insurance premiums can be submitted to the Social Insurance Fund within three years from the date the overpayment was made.

Further actions

With the completed listed columns contained in Form 22 of the FSS of the Russian Federation (the 2021 form can be downloaded from us), you must contact the FSS address where the registration was previously carried out. The paper can also be sent by postal order or electronically. When interacting with the fund, there are several options for the development of events.

- A proposal to reconcile settlement transactions with the fact of signing the act in order to identify the exact amount of overpayments and debt obligations. In this situation, it takes about 10 days for the authority to make a decision from the moment the reconciliation act is signed.

- Deciding that an offset can be made without the need to carry out corresponding reconciliation operations. In this situation, the decision will be identified with reality within a 10-day period from the day the offset application was received.

The application can be submitted within a three-year period from the date of the overpayment.

Features of filling out 4-FSS

Representatives of the Social Insurance Fund require that basic rules be followed when drawing up a reporting form on injuries:

- It is acceptable to fill out the 4-FSS form by hand. For notes, use only black or blue ink.

- All pages of the paper report must be signed by the head of the organization indicating the date of signing. Also, do not forget to put the page number in the special field at the top.

- Corrections are not allowed. Therefore, if you make a mistake on one of the pages, you will have to rewrite it again.

- The electronic version of 4-FSS must be certified by a qualified signature of an authorized person of the institution. Before sending, the electronic form must be checked in specialized verification programs.

It is not necessary to print out 4-FSS pages that lack information and submit them to Social Security.