An employee sent on a business trip must be provided with the main travel document - a travel certificate. It confirms the fact that an employee of the organization was sent on a business trip, and also indicates arrival at the destination, and after performing the assigned functions, timely departure back.

This document is filled out according to the standard unified form T-10 and is a required document for all employees sent on business trips. Based on them, an enterprise accountant can write off travel expenses, including daily allowances, and use them to reduce the tax base when calculating income tax.

Attention! Since 2015, issuing a business travel certificate has ceased to be mandatory (Resolution of the Government of the Russian Federation dated December 29, 2014), but is still recommended for use.

What is the document for?

A travel document (travel certificate) is issued to an employee sent on a trip for the purpose of performing official duties.

The certificate is filled out on a unified form according to form T-10 (Resolution of the State Statistics Committee of Russia No. 1 of 01/05/2004).

At the same time, current legislation allows the employer to draw up a form of travel sheet independently, including the necessary points and provisions. In this case, the developed format must be consolidated in the accounting policies and other local regulations of the organization.

Purpose of the trip and its examples

Since a business trip involves the completion of some task from the employer outside the boundaries of the permanent place of work, there is always a purpose for the assignment, which, among other things, is indicated in the travel certificate.

Here are examples of goals:

- representing the interests of the employing company in courts;

- participation in negotiations with product suppliers;

- carrying out on-site inspections to monitor the activities of separate representative offices, branches, etc.;

- taking part in seminars, conferences;

- presentation of products, goods, services of the employing company to potential clients or investors;

- staff training, exchange of experience;

- carrying out marketing research, studying market conditions;

- acquisition of raw materials, supplies and other supplies necessary for production;

- other goals.

If local regulations provide for the preparation of a business trip plan, then the goals are also indicated in it (see sample below).

Is it necessary to compile

Previously, this document was required to be completed when employees were leaving on a business trip. According to labor legislation, the purpose and duration of the trip had to be stated in the certificate.

In 2015, the obligation to draw up a travel certificate was removed from institutions (RF RF No. 1595 dated December 29, 2014). Since January 2015, the employer himself decides whether to fill out a special certificate for business trips or not. If the organization accepts its completion, this must also be specified in the internal regulations of the institution.

How to confirm the fact of travel without a certificate

Based on clause 7 of the current edition of the Resolution, now the length of stay of a worker on a business trip is determined on the basis of travel documents, that is, plane, train, bus, etc. tickets. These documents are provided upon return from the trip.

If there are no transport tickets, then confirmation is carried out on the basis of contracts for the rental of residential premises at the place of business trip (for example, a receipt or certificate confirming the conclusion of an agreement for the provision of hotel services).

If all this is missing, then confirmation will be a memo from the responsible person of the company where the posted worker was sent. Such a note should contain information about the dates of arrival and departure.

So, since 2015, after the introduction of appropriate amendments to the Resolution, travel certificates are no longer mandatory for use, but employers can still use them at work.

Now travel documents, accommodation agreements or official notes serve as confirmation of being on a business trip.

Front part

Key information must be entered on the title side. Here the details of the organization itself are indicated: its name and OKPO code, as well as the parameters of the certificate itself (number and date).

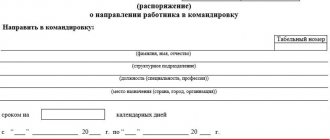

Next, you need to fill out information about the employee sent on a business trip and the work purpose of the trip. The following information is indicated on the front:

- Full name, personnel number and passport details (if necessary) of the employee;

- structural unit and position of the person sent on a business trip;

- information about the receiving party (city, name of organization);

- purpose of the trip;

- duration of the trip, indicating the start and end dates of the trip and the total number of days.

The front side of the sheet is certified by the manager’s signature and seal (if available).

Rules for changing and canceling a travel certificate

Since a travel certificate is issued on the basis of an order, all changes must first of all be made to the order. Further, depending on the situation, either a new certificate can be issued or the old one can be corrected.

Changes to the travel order can be made by another, new order, which will indicate which words should be read in a new way.

Corrections to the certificate are made by crossing out incorrect information and adding new ones with the obligatory “certification” inscription - “Corrected from ... to ... believe.” The inscription is certified by the signature of the official and the seal of the organization.

A business trip can only be canceled by issuing a special order. The issued certificate must be destroyed.

The order to cancel a business trip is drawn up in any form

Back part

All movements of the employee are recorded on the back. Here the receiving organization puts down the following marks:

- about the date of actual arrival;

- about the day of departure.

Thus, the actual number of travel days is displayed on the back. It is also mandatory to indicate the last name, first name and patronymic of the employee and the place of business trip (city or other locality).

The turnover of the sheet is certified by the head of the receiving organization, and, when used, the seal of the institution is affixed.

How to automate work with documents and not fill out forms manually?

The process of filling out travel forms is accelerated through automation. To automate the process of filling out forms, the CLASS365 program is used.

This utility has many useful features:

- automate filling out standard forms;

- print documents that bear a signature and seal;

- create new forms with the logo and details of your company;

- draw up various commercial proposals;

- send documents by email;

- Upload forms in this format:

- PDF;

- CSV;

- Excel.

The program will help the authorized person save valuable time, which he can spend on other tasks.

Contents and sample

The T-10 form must be filled out in strict accordance with the established rules. Errors in the document are not allowed. If an inaccuracy was made during registration, the erroneous information must be crossed out with one line, and the correct information must be written on top. Corrections must be certified. The specialist responsible for preparing the document must sign and affix a stamp (if available at the institution).

If an employee must visit several cities or host enterprises as part of one trip, then chronology must be strictly observed when making notes.

Rules for registering an employee on a business trip: forms T-10 and T-10a

Since 2015, the use of travel certificates and official assignments is not mandatory (Resolution of the Government of the Russian Federation dated December 29, 2014 No. 1595).

It will be sufficient to formalize the manager’s order (order) to send him on a business trip and provide the employee with an advance report on the business trip, which will confirm the dates of the actual stay on it. For information on how such an order is drawn up, read the material “Unified Form No. T-9 - Business Trip Order” .

However, the organization has the right to issue a travel certificate and official assignment if it considers it necessary.

ConsultantPlus experts have prepared step-by-step instructions for arranging a business trip:

Get trial access to the K+ system and go to the HR Guide for free.

Let's look at the algorithm for preparing a full package of documents for a business trip using an example.

The manager of the purchasing department of Vivat LLC, K.E. Safonov (the company is located in Tambov), is required to be sent on a business trip to Kursk to Yarov LLC to discuss a transaction for the purchase of materials necessary for production. On the spot, he must get to know the supplier, evaluate its capabilities and capacity, so that in the future an uninterrupted supply of the necessary raw materials will be ensured. The assignment for a business trip is also drawn up in the form of a document - for this you can use the unified form T-10a.

The travel arrangements are usually handled by the HR department (or the employee responsible for HR issues). She does this on the basis of an order to be sent on a business trip. The T-10 form is used as a business trip certificate form. The personnel officer fills out the front side of the form, where he indicates the full name of the traveler, his position, place of business trip and the basis document (order) for issuing a travel certificate.

The issued business trip certificate must be handed over to the manager Safonov K.E. and a note on the back of the form must be made about the date of his departure from. The disposal note is certified with a stamp (seal).

As for the reverse side of the form, it will be filled out during the business trip. Upon arrival at Yarov LLC, you will need to make a note: the receiving party will indicate the date of arrival and put a stamp (seal). At the end of the business trip, another mark will be made on the back of the form, indicating the date of departure from Yarov LLC, and this mark will also be certified with a stamp (seal).

If an employee’s business trip certificate includes the task of visiting several organizations, then a note about arrival and departure is made in each of them.

Upon returning from a business trip, manager K.E. Safonov will submit to the accounting service a business trip certificate, a completed work assignment form with a note from the head of the department on its completion, and an advance report with all documents confirming the expenses he incurred.

The travel certificate itself will not be proof of expenses. Read more about this in the material “Travel expenses on a business trip cannot be confirmed with a travel certificate .

Sample route sheet

Many enterprises have business trips that can be permanent and directly related to work.

In such cases, a route sheet must be drawn up, which contains all the information regarding the route developed for the employee.

The content of the article

Most often, traveling work is necessary for the purpose of selling a product, studying the state of demand, or, conversely, resolving a purchase issue. Based on this, the route sheet has the following goals:

- a visual report on the work done, how much was accomplished within the set deadline;

- route planning, correct distribution of the sequence of stopping points, spending less time and less fuel;

- a report on how much fuel and lubricants were spent, how far the vehicle traveled, in what quantity and what kind of product was sold.

Based on the purposes of the route sheet, we can conclude that it is necessary in order to properly plan a business trip and make a route. Also, for the driver it is a kind of cheat sheet, which indicates to what address and what needs to be delivered.

In addition, accounting and management require a route sheet as a report of where the funds allocated for fuels and lubricants went.

And in cases of breakdowns or accidents, it can serve as proof that the driver actually made a trip to certain addresses.

If an employee uses his own personal transport for official travel, then upon presentation of a route sheet, he must be reimbursed for the cost of servicing the transport. Although the route sheet is a mandatory document, there is no single unified form for it. Each organization itself develops a form convenient for itself, which it establishes in its accounting policies.

The main thing is that it contains all the necessary data.

Business trip waybill, sample

Contents Waybills are issued to all drivers and other employees of the organization who use freight transport to perform their professional duties. These documents are used to record:

- downtime;

- mileage

- time of active operation;

A correctly completed waybill will provide the truck driver with protection during an inspection by traffic police officers.

If he does not have this document in his hands, he will be issued a fine. In the case when a truck is sent on a business trip to another city or region, a waybill can be issued to the driver for a period of 1 to 30 days. This procedure is regulated by Order of the Ministry of Transport of the Russian Federation No. 152 of September 18, 2008.

In the case where the document was issued for the transportation of special cargo or confirms the severity of the driver’s work, it must be stored for 75 years. Registration of waybills The preparation of waybills is entrusted to the dispatcher of the enterprise or to the one who acts as his representative. Usually the PL is issued in one copy, but if it is lost, a duplicate may be issued (such situations arise extremely rarely).

The validity period (legal force) of the document is limited to the duration of one work shift. If a company practices business trips lasting several days, then one waybill is issued for this entire period.

These are the main elements of the document: Waybill number.

The date when the ticket was opened. Signature of the person who issued the document. Official seal of the company. Quite often, an employee goes on a business trip to another city using personal transport. This is beneficial to both sides: the employee feels comfortable driving his car, and the organization saves on operating a government-owned car.

Upon his return, the management of the enterprise will compensate him for his expenses. It would seem that everything is obvious and simple, but there are a number of nuances in the interpretation of this type of expense for tax purposes and the procedure for reimbursing the spent funds to the employee.

Rules for using waybills in 2021

Good afternoon, dear reader. In this article we will talk about waybills - a document that is primarily needed by drivers of commercial vehicles. Popular questions related to the use of waybills: Let’s consider these questions in more detail. The phrase “waybill” is used only once each year times, in paragraph 2.1.1:2.1.1.

Attention All issues related to journaling must be formalized in a local act of the organization, for example, the Regulations on Business Travel. How to arrange the trips of truck drivers - as business trips or as traveling work.

Carry with you and, upon request, hand over to police officers for verification:.

- in established cases, permission to carry out activities for the transportation of passengers and luggage by passenger taxi, waybill, license card and documents for the transported cargo, and when transporting large, heavy and dangerous goods - documents provided for by the rules for the transportation of these goods;

At the same time, “established cases” are not described in the traffic rules, so you will have to turn to other regulatory legal documents. The waybill is primarily intended for the accounting department of legal entities, as well as for tax inspectorate employees.

It is this primary document that allows you to take into account gasoline costs and deduct them from the tax base. Essentially, a waybill is needed in order to reduce the amount of taxes paid. However, there are situations when a waybill is mandatory. Let's immediately highlight the drivers who do not need a waybill: 1.

If the car belongs to an individual and is used by him for his own purposes or is transferred to another individual under .2.

If the car belongs to a legal entity and accounting for fuel costs does not matter for this legal entity. Let's consider the situation using an example. Let the car belong to an individual entrepreneur who uses the simplified taxation system and has chosen income as the taxable base.

In simple terms, only the income of this legal entity is subject to taxes, regardless of its expenses. In the described example, it doesn’t make much sense to arrange travel vouchers, because

this will only lead to additional costs