The requirements of the current domestic legislation provide for the obligation of business organizations that accept cash from customers to use cash register equipment (CCT) when paying for goods/work/services.

Each transaction that is recorded through the cash register must be certified by printing a paper cash receipt, which must necessarily contain information about the transaction (amount, essence, date, number).

All settlement transactions performed for a specific time interval and recorded using cash registers are recorded in the cashier-operator’s journal, which is filled out using the standard KM-4 form.

Important features of maintaining this register should be considered in more detail.

Why is it needed and who should have a cashier-operator book (form KM-4)

The cashier-operator's journal was approved by Decree of the State Statistics Committee of December 25, 1998 No. 132 (hereinafter referred to as Decree No. 132), it is also called the unified form KM-4.

The obligation to keep a journal when using cash registers is enshrined in the standard rules contained in the letter of the Ministry of Finance dated August 30, 1993 No. 104. But these rules have lost relevance due to the adoption of a new law on the use of cash registers, according to which most business entities are required to use updated cash register models from July 1, 2017 technology capable of transmitting information to tax authorities about payments to customers online. Read about the use of online cash registers by simplified taxation system payers in this article.

In the new edition of the law “On cash registers” there is no information about the need to use unified forms, and therefore the use of a cashier-operator’s book when working with an online cash register is not necessary. The Ministry of Finance expressed the same opinion in its letter dated June 16, 2017 No. 03-01-15/37692. But companies and individual entrepreneurs have the right to independently maintain this register to account for and control received revenue.

You can find out what documents need to be completed when working with online cash register systems in the Ready-made solution from ConsultantPlus. Trial access to the legal system is free.

Resolution No. 132 provided that the journal is filled out by an employee working at the cash register who serves clients (accepts money from them as payment for goods or services) using a cash register machine (hereinafter referred to as the cash register). The same document stipulated that it should be kept by the manager (manager) or chief (senior) accountant, and given to the cashier before the start of the shift.

You can download the KM-4 log form on our website.

In this register, the cashier had to record the readings taken from the cash register on a daily basis. This journal also served to control the correspondence of the balance in the cash register with what is listed in the car.

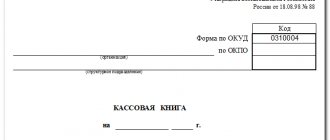

Cash book (form KO-4) in 2021

Title page:

The line “Organization”

indicates the name of the organization in accordance with the constituent documents (for example,

Limited Liability Company “Company”

or

LLC “Company”

).

In the line “according to OKPO”

it is necessary to indicate the OKPO code in accordance with the notification received from Rosstat. If the code has not been assigned, put a dash.

Next, indicate the name of the structural unit

the organization that prepares the cash book (if the organization has no structural divisions, put a dash).

The period is indicated in the middle

, for which a cash book is drawn up (for example,

CASH BOOK for April 2021

).

Cash sheet:

In the line “Cash for”

the day for which the cash book sheet is generated is indicated (for example,

for April 15, 2021

). In the same line you must indicate the serial number of the cash sheet.

Next you need to indicate the balance amount

cash that was in the cash register at the beginning of the working day. It is indicated in the first row of the table in column 4 – “Incoming”.

Rows in a table

are filled out in accordance with incoming (PKO) and outgoing (RKO) cash documents issued during the working day:

In the “Document number”

The serial numbers of incoming or outgoing cash orders are indicated line by line.

In the column “From whom received or issued to”

The full names of individuals or names of organizations (IP) from which cash was received or to which cash was issued in accordance with PKO and RKO are indicated line by line.

In the column “Corresponding account number, subaccount”

It is necessary to indicate line by line the numbers of the corresponding accounts for each PKO and RKO.

In the "Incoming"

The amounts of cash that were received at the cash desk for each cash receipt order are indicated line by line. For RKO, this column is not filled in.

In the "Consumption"

The amounts of cash that were issued from the cash register for each expenditure cash order are indicated line by line. For PKO, this column is not filled in.

In the line “Total for the day”

The amount of cash received and issued per working day is indicated in accordance with incoming and outgoing cash documents.

In the line “Balance at the end of the day”

indicates the amount of cash remaining in the cash register at the end of the working day. If among the balance there is money set aside for the payment of salaries, scholarships and social benefits, then their amount should be indicated in a separate line below.

Next, the cashier responsible for filling out the cash book must put his signature and a transcript of the signature (last name and initials).

At the end of the cash sheet, the accountant authorized to check the cash book must indicate in words the number of receipts and expenses cash documents received and sign with a transcript.

When and how to fill out the cashier-operator logbook correctly

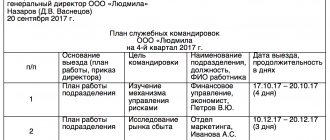

When and how to fill out the 2020 cashier-operator logbook? We believe that organizations and individual entrepreneurs that use online cash registers and have decided to fill out the cashier-operator’s journal can independently establish rules for filling it out. In this case, you can rely on the instructions for filling it out, established by Resolution No. 132. The description for the KM-4 register states that the journal is filled out daily by the responsible employee - the cashier.

Entries in the journal should be made using a blue ballpoint/ink pen without marks. If a correction occurs, the entry made by the cashier is certified by the director and chief accountant.

Before using online cash registers, before starting to operate it, it had to be numbered, laced and registered with the Federal Tax Service. Since, as mentioned above, when using online cash registers, regulatory authorities do not feel the need for a log, then there is no need to register it with the INFS. Organizations and individual entrepreneurs can make the decision on the need to number and lace them independently based on internal rules. According to the instructions for filling out KM-4, the journal should have been filled out by the cashier immediately after the Z-report was taken. In online cash registers, when work is completed, a shift closing report is taken, the data of which can be transferred to KM-4.

For more information about where and how to fill out the cashier-operator’s log, read the article “Unified form No. KM-4 - form and sample” .

Is registration with the tax service required?

The KM-4 journal, like the cash register device itself, must be registered with the tax service. It is noteworthy that even the initial entry is made in this documentary register simultaneously with the registration of the cash register with the state.

The tax inspector independently enters the first check through a registered cash register device for an amount equal to 1 (one) ruble 11 kopecks. The accountant and tax office subsequently do not take this value into account.

In order for the tax registration of a cash register device to be successful, the business entity must provide authorized employees of the Federal Tax Service with the cash register device itself, the KM-4 journal, as well as the following important documents:

- a statement of relevant content (application for registration of a cash register);

- registration documentation of a business entity (registration certificate of an organization/individual entrepreneur);

- passport of the registered cash register device;

- a valid lease agreement for the retail space used (if the business entity does not have its own retail space);

- service agreement for a cash register concluded with a specialized service organization;

- other papers, the full list of which is specified directly in the territorial division of the tax service.

Procedure and rules of conduct

The cashier-operator log form, compiled according to the generally accepted KM-4 standard, can be freely purchased at any office supply store.

The journal is kept only on paper and must be laced. All sheets of this register are marked with serial numbers.

Form KM-4 is signed by the head of a business entity (optionally, an individual entrepreneur), the chief accountant, as well as an authorized tax officer.

If a business entity has a seal, its imprint is also affixed to the KM-4 form as a certification procedure.

It is noteworthy that the electronic format for maintaining and filling out this journal is not provided for by current legislation.

However, currently, as is known, there is a massive transition of business entities that carry out cash transactions and use cash registers to online cash registers.

If an online cash register is used to record cash received from a buyer, all information that was previously entered into the cashier-operator’s journal is now automatically recorded in the taxpayer’s personal account on the tax service website.

Form KM-4 should be maintained separately for each cash register device.

The journal is registered with the local tax department at the same time as the cash register device for which it is created.

The first such log is registered for a specific cash register device by an authorized employee of the Federal Tax Service through two procedures:

- a Z-report is generated for the registered cash register;

- the first entry is made in KM-4.

What to do if it runs out?

The KM-4 register must be filled out while there are free lines in it. When the journal is completely completed, you should create a new form, for registration of which you will need to contact the tax service again.

To register a new KM-4 form, you will need to provide the Federal Tax Service employee with the previous form of this journal, as well as a number of other documents, the current list of which is always checked with the specialists of the local tax office.

Shelf life

A fully completed KM-4 journal should be stored for 5 (five) years in the archives of a business entity using a cash register, since this register, as mentioned earlier, is actually tied to a specific cash register device.

However, keeping a completed journal lost its practical meaning after the introduction of the EKLZ device, which provides electronic registration of all transactions performed.

From 01/01/2017, so-called fiscal drives began to be installed in all cash register devices, replacing EKLZ devices.

How do I make corrections?

Any errors, inaccuracies, or blots are not allowed when filling out this form. If such inconsistencies are identified, they should be corrected as appropriate.

Each error detected and corrected in the KM-4 register is certified by the signature of the authorized entity responsible for entering information into this journal.

Next to the corrected data there is a standard statement stating that the corrections made can be trusted. The chief accountant and the head of the organization also certify this correction with their personal signatures.

An example of filling out a cashier-operator log

Let's take a step-by-step look at how to fill out the cashier-operator's journal. So, the cashier who passed the shift usually takes a report on the closure of the shift. The data from this document is used when filling out column 4 (report serial number), column 5 (the previous entry is duplicated here), column 6 (counter indicator) and column 10 (daily revenue). Column 9 displays data from the report taken at the end of the shift.

Columns 1–3 indicate: date, department number, cashier’s full name. In columns 7–8, 16–18, the signatures of the cashier, administrator and senior cashier are affixed, if these are 3 different people, and when combining positions, 1 signature is sufficient.

Column 11 displays the amount of cash, column 12 - the number of non-cash payments, column 13 - the non-cash amount, column 14 - the amount minus returns, column 15 - the total value of refunds from the cash register to customers.

It is very easy to check the correctness of the entered data - to do this, compare the readings from the Z-report (column 10 of the register = column 14) and the total values from columns 11–12 minus column 15.

Some more test formulas:

- column 11 = column 10 – column 13 – (column 15);

- column 14 = column 11 + column 13;

- Column 10 = Column 9 – Column 6.

Let's look at a sample of filling out a cashier-operator's book.

The nuances of journaling

When replacing the EKLZ, 3 z-reports are closed, which are reflected in the log: before removal, verification (equal to 1 ruble 11 kopecks) and after replacing the memory.

According to the law, the use of cash registers can occur both when receiving and issuing funds from the cash register (purchasing scrap metal from the population). In this case, it is advisable to buy devices separately for reception and delivery. In this case, the reflection of the latter in the journal occurs in the usual manner; it is simply necessary to reflect in the order that the transactions are expenses.

If an error is made when filling out this register, the correction must be made by crossing out the incorrect entry with one line (so that it can be read) and making a new one. This must be endorsed by the cashier, chief accountant, and head of the company.

Results

Organizations and individual entrepreneurs, when making payments using online cash registers, may not fill out the cashier-operator log.

But if they decided to continue maintaining this register to fulfill internal tasks, then they are recommended to establish the procedure for maintaining it. When using online cash registers, registration of the cashier-operator's journal with the tax authorities is not required. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What is an online cash register

In accordance with changes in tax legislation, in 2021 the vast majority of companies operating in Russian jurisdiction were required to switch to using online cash registers. The main difference between such cash registers and classic cash registers is the direct transmission of information about transactions performed to the servers of the Federal Tax Service via an Internet connection. Otherwise, this cash register has standard functions in the form of printing receipts and storing information about them on a fiscal drive. The operator does not need to undergo special training to use the new option, just access to the Internet and basic skills in using cash register equipment.

The introduction of such innovations in the field of cash register systems was long overdue and was due to the huge volume of the “gray” market for goods and services in the Russian Federation. Many transactions are carried out outside the law, bypassing cash registers, and therefore the tax system, that is, without any control from the state. Now everyone who trades or provides services must have an online cash register. According to the lawmakers, these changes will help regulatory authorities to monitor the volume of the country’s domestic market much more effectively, which will lead to an increase in tax collection and an improvement in the trade climate. In addition, this will bring order to trade via the Internet, as well as protect consumers from unscrupulous entrepreneurs and scammers.

Today, all organizations are required to use such CCP. Until recently, the exceptions were the owners of payment systems and individual entrepreneurs operating under a simplified tax system. For these categories, the obligation to install online cash registers was temporarily postponed, however, from July 1, 2021, they are also required to use cash register equipment with the ability to transmit data online to the Federal Tax Service. By 2021, the last stage of the transition to online cash registers should be completed; they will be used by all categories of entrepreneurs and organizations, including self-employed citizens and individual entrepreneurs without hired employees.

Journal order 10

Journal order 10 (a sample of the filling is just below) is intended for recording production costs. The register receives all information from accounts 02, 04, 05, 10, 11, 15 16, 19, 20, 21, 23, 25, 26, 28, 29, 40, 46, 68, 69, 70, 76, 94, 97.

| In D/t accounts | Turnovers on correspondent accounts | total | |||||||

| 02 | 05 | 06 | 10 | 15 | 20 | 26 | etc. | ||

| 01 | 3250 | 215 | 3465 | ||||||

| 08 | |||||||||

| 10 | 145200 | 145200 | |||||||

| 15 | |||||||||

| 50 | |||||||||

| 51 | |||||||||

| 70 | 86230 | 86230 | |||||||

| 76 | 54210 | 54210 | |||||||

| etc. | 3250 | 215 | 285640 | 289105 | |||||

The abundance of information reflected in this register makes it the most informative. The basis for filling out is a variety of forms - production reports and summary statements that form the journal order 10. The form can be downloaded below.

Journal warrant 7

Journal order 7 records the issued accountable amounts in the context of each responsible person. Journal order 7, the form of which combines synthetic accounting with analytical information, is convenient for monitoring the timely submission of employee expense reports.

Introducing journal order 7: sample filling

| No. | Av/report | Full name | Balance at the beginning of the month | Issued on report | according to advance report | ||||

| D/t | K/t | date | cor account | sum | date of presentation | approved amount of expenses | |||

| 1 | 1 | Ivanov I.I. | 0 | 0 | 10.01.2016 | 50 | 16800 | 14.01.2016 | 16800 |

| From the account 71 in d/t accounts | overexpenditure was reimbursed to the employee | unused amounts are withheld | ||||

| 10 | 20 | 26 | cor account | sum | cor account | sum |

| 9600 | 7200 | 0 | 0 | |||

Journal order 7, which can be downloaded below, reflects all accountable amounts and carry-over balances.

Order logs 3, 4, 5

When conducting operations with accounts 54, 55, 56, which take into account capital costs, special accounts and other funds, it is necessary to maintain a register such as journal order 3.

Journal order 4 is provided for recording transactions on credits and borrowings on the account. 66 and 67. Journal order 5 is rarely used by Russian enterprises, since offsets of mutual claims between debtors and creditors are today considered an exclusive operation. However, such a register exists and is used if necessary.

Journal order 2

Journal order 2 takes into account transactions reflected in the credit account. 51. Entries are made on the basis of bank statements and attachments to them - payment orders, letters of credit, etc. On the back of w/o 2, information on the debit of the account is collected in the statement. 51, i.e. according to receipts to the account. Journal order 2 (can be lower ) , is filled out according to the same principle as journal order 1.

Let's look at an example:

| Journal order No. 1 for account loan. 51 from 01/01/2016 to 01/31/2016 to debit accounts | ||||||||

| date | 50 | 60 | 68 | 69 | 76 | Total K | Total D | |

| D s-to 01/01/2016 100000 | ||||||||

| 1 | 04.01.2016 | 124000 | 28000 | 152000 | 168000 | |||

| 3 | 07.01.2016 | 100000 | 100000 | 45800 | ||||

| 4 | 10.01.2016 | 41000 | 12000 | 19000 | 72000 | 65300 | ||

| 5 | 31.01.2016 | 21100 | 21100 | 124300 | ||||

| Total | 100000 | 165000 | 24300 | 28000 | 40100 | 345100 | 403400 | |

| from to 02/01/2016 158300 | ||||||||

Journal warrant 13

Accounting for fixed assets and intangible assets is reflected in journal order 13. The basis for filling it out are depreciation calculations, certificates, and disposal acts. Journal order 13 – sample filling:

| Journal order No. 13 for credit account. 01 to debit accounts | ||||||

| No. | 01 | 02 | 03 | 08 | 76 | Total |

| 1 | 12450 | 12450 | ||||

| 2 | 8954 | 8954 | ||||

| 3 | 4785 | 4785 | ||||

| 4 | 14578 | 8965 | 23543 | |||

| 5 | 4782 | 4782 | ||||

| Total | 12450 | 8954 | 4785 | 19360 | 8965 | 54514 |