Attention! From November 25, 2021, an application for amendments to an LLC must be submitted using the new unified form P13014. The information in this article applies to older forms that are no longer in use.

An application in form P14001 is an official form approved by the Federal Tax Service. After the initial registration, information about the organization is entered into the state register of the Unified State Register of Legal Entities. If this information changes during the activities of the LLC, then this must be reported to the registering tax office by submitting an application ().

Using the form

Form P14001 is intended to record changes in the composition or other data of a legal entity and transfer them to the Unified State Register of Legal Entities. These may include:

- change of company name (sheet A),

- change of director of the enterprise (sheet K),

- change of legal address (sheet B),

- emergence of new types of activities (sheet N)

- change of founders,

- the appearance of a new participant, including a foreign citizen (sheet D),

- change in passport data, including registration address (sheet D),

- change of OKVED codes,

- transfer of a share as collateral (sheet B),

- the emergence of a new branch or the closure of an old one (sheet O),

- changes that entailed the sale or distribution of shares,

- correction of errors in the Unified State Register of Legal Entities.

Please note that for some of these cases Form P13001 is filed. To check which document to prepare, go below by clicking on the link “When form P14001 is not needed.”

Depending on the situation, we will fill out different pages of the form. Unnecessary pages are not printed and submitted to the tax office. The responsible persons filing the declaration will also differ.

Several changes can be made to one form P14001 at the same time: for example, data on the sale of a share and the withdrawal of a participant. Exception: cases when it is necessary to correct an error in the Unified State Register of Legal Entities - the documents can only contain corrected data. For this purpose, use sheets E, B, D, D, L, P.

In 2021 (more precisely, in July), the P14001 form was updated, so if you used documents from 2013, they will need to be replaced.

Preparatory stage

Before making changes to form P14001, you must:

- Finally make a decision and approve at a meeting of the owners of the enterprise a protocol on adding new types of activities. Here it is worth raising the question of which code will become the main one;

- make adjustments to the statutory documents and approve them in the presence of a notary;

- determine, according to the classifier of types of economic activity, the codes that now determine the employment of the enterprise;

- from the website of the Federal Tax Service application form No. P14001.

Features of filling out form P14001

The form can be filled out either by hand (in black pen with block letters) or electronically. In the second case, if you download a document from official sources, the Excel form file automatically sets the only correct solution: Courier New font size 18. Cells with descriptions are protected from deleting information. However, you can still enter multiple numbers into an empty cell, so make sure you only have 1 character in each cell.

Please note that the applicant’s full name (sheet P) is entered into the form only by hand. Use only a black pen for this.

Filling and numbering

In form P14001, pages are designated by letters. When filling out, they are numbered, and all cells must be filled in, so 3 turns into 003. All pages do not need to be filled out and numbered: put numbers only on those forms where you are making changes. For example, to change the director, this will be page K. Accordingly, designate it with number 002 (second after the title page).

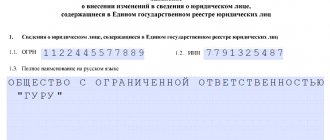

Front page

On the title page, as can be seen from the illustration below, you should indicate the TIN, OGRN and the full name of the organization in large block letters. Please remember that the form is machine readable.

A common mistake is missing spaces in a complex business name.

If the name does not fit completely on the line, move it to the next one. Transfer is strictly prohibited.

Data correction

Using the example of sheet G (information about the mutual fund, which includes the enterprise’s share), we will consider the procedure for replacing data in the Unified State Register of Legal Entities.

At the top of the sheet, you must select a numeric value that explains the reason for filing. In this case, 1 will indicate a new participant whose data is entered below, 2 will mean the exit of an old participant, and 3 will mean making changes to existing data in the State Register.

After that, on page 1 we note the data that appears in the registry at the moment. According to the conditions of the problem, they are incorrect. On page 2 we indicate the correct data as it should be.

4.Numeric values

On sheet D and other pages where you need to indicate, for example, the cost of a share, numerical values are entered as close as possible to the separator sign.

If the number is an integer, then there is no need to indicate zeros after the dot.

Operations with shares

On sheet C, D, D or E (depending on whether the applicant is a resident of the Russian Federation or a foreign citizen) information is provided: - about the former owner of the share (indicate the numerical value 2), - about the new owner of the share, including heirs (value 1 ).

Let's say Mr. Goren transferred his share in favor of Mrs. Osa. Using the example of illustration 4, we see how to fill out a page about a participant who sold or inherited a share. There is no need to enter new information about it into the Unified State Register of Legal Entities.

Using the example of illustration 5, we see how to enter data about the new owner of the share. There is no information about it in the Unified State Register of Legal Entities yet, so we leave this part of the form blank.

Statements on OKVED

Form 14001 allows you to replace the main type of activity, as well as enter additional ones. According to tax legislation, an enterprise can have only one main type of activity. You can declare its change on sheet N: the new code is indicated on the first page, and the old code is indicated on page 2, which should be excluded from the Unified State Register of Legal Entities.

Deadlines and features for submitting form P14001

The form must be submitted within 3 days of changes being made. Depending on the process that gave rise to the application, the applicant (the person filing P14001) may be:

- director of the enterprise (errors in the Unified State Register of Legal Entities, change of director, change of passport data),

- notary (purchase and sale of shares),

- seller of shares (purchase and sale of shares).

The applicant's data is filled in on sheet R.

When form P14001 is not needed

In short, in cases where changes affect the Charter and they need to be recorded accordingly, form P13001 is submitted. These include:

- adding OKVED codes,

- change of legal address,

- correction of errors simultaneously found in the Unified State Register of Legal Entities and the Charter,

- introduction of a new founder and inclusion of him in the Charter.

Required Documentation

When filling out application p14001 about adding or deleting foreign economic activities, you need to rely on the information indicated:

- in the manager’s passport;

- in his TIN certificate;

- in the postal code directory;

- in the Russian Federation Address Classifier (KLADR);

- in the directory of document type codes;

- in the list of subjects of the Russian Federation with established coding;

- in the current foreign economic activity classifier (since January 2015 this is OKVED2 OK 029-2014);

- in the Unified State Register of Legal Entities.

Form p14001 is certified by a notary , and he may require a decision or minutes of the meeting of LLC participants on the need to change the types of activities.

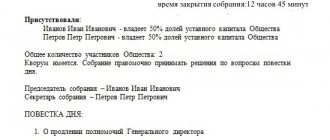

It is better to ask the notary about this document in advance, and if necessary, prepare a protocol (see example below). The date of the protocol must be current, that is, not exceed three days before the application is submitted.

An example of the minutes of a general meeting with a question about the need to change activities.

Good to know

- If you are filing a P14001 on the occasion of a change of director, it is better to have with you the minutes of the participants in the meeting at which the decision to change was made. At the same time, the old director can still submit documents.

- If you are filing a P14001 to declare a change of legal address, you must provide documents for the new address.

- When distributing or buying and selling a share, the responsible person is a notary who submits the form to the State Register.

- If you change your passport details during submission, you must have a copy of your passport with you.

- Documents are usually ready in 6 working days. Please note that you can only receive them in the way that you indicated when filling out the form on sheet P, page 4. Thus, if “issuance to the applicant” is indicated, then the Federal Tax Service will not send them by mail and will not issue them by proxy.

Where can I fill out P13014?

You can download a sample of filling out form P13014 when changing the director in ConsultantPlus. Legal experts have already prepared it. The relevant document is available at the link below. You can get trial access to K+ for free.

It takes into account all the nuances of working with the form that we discussed above. When drawing up your own sample of filling out 13014 when changing the director, you should be guided by the requirements for preparing the document, which are approved by Order of the Federal Tax Service dated August 31, 2020 No. ED-7-14 / [email protected]

The company must submit the change of director form P13014, completed according to the proposed sample, to the Federal Tax Service division at the place of registration.

You can learn more about the specifics of legal relations in which form P13014 can be used in the article “Step-by-step instructions for changing the general director in an LLC .

Prepare P14001 online

If you do not have the time and desire to independently understand the intricacies and nuances of filling out the application P14001, as well as the accompanying documents for making changes to the Unified State Register of Legal Entities information about the LLC, use the online service for preparing documents for state registration. Using this service, you will prepare a package of documents within 15 minutes. The cost of the kit for one company is 1,490 rubles. All documents are checked by qualified lawyers and comply with current legislation. Thanks to the service, possible errors are eliminated that could lead to refusal of state registration if filled out independently.

Registration requirements

The data from the sheets of form p14001 will be read by the machine . Therefore, entries must be made in printed capital letters. If the application will be filled out on a computer, then you must use the Courier New 18-point ; if by hand, then use a pen with black .

One cell is designed for only one character .

Spaces are also considered a sign and must be inserted between words.

If the first of two adjacent words ends in the last cell of the line, then a space before the second word at the beginning of the next line .

Hyphens are not used ; if a word does not fit, it can be continued on another line without adding a space .

OKVED codes are entered not in a column, but line by line , from left to right , starting from the first cell. You need to write down at least 4 digits .

Double-sided filling of the paper sheet is not permitted.

We also recommend reading about how to fill out an application form p14001 when changing the director and when leaving a participant.

What to do next

After changing the surname of the director and founder of the LLC

, as well as the individual entrepreneur will have to notify:

Counterparties

It is enough to send information letters in free form. You do not need to attach a copy of your new passport. Some counterparties require an extract with a new last name. You can order it from the tax office and receive it within 5 working days;

Banks

You can make changes to your last name in a legal file remotely via online banking or at a branch. All you need is a new passport. Sberbank clients can use this instruction.

You do not have to notify government agencies. The tax office itself will transmit the information to the Pension Fund, Social Insurance Fund and other organizations after updating the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs on the next business day.

How to change the last name of a company director

If the director has changed his last name, the procedure is similar. The only difference is that instead of sheet “D” you need to fill out sheet “K”:

- put “3” in line “1. Reason for entering information";

- fill out block “2. Information contained in the Unified State Register of Legal Entities” according to old passport data;

- fill out block “3. Information to be entered into the Unified State Register of Legal Entities for the new passport.

Fill out Sheet “P” using your new passport data.

After changing the surname of the director of the LLC

all corrections must be made to his work book. If the book is paper, simply cross out the old name on the first spread and write a new one. Corrections are certified by the director’s signature and seal. If the book is electronic, then make changes to the labor record through the account of the PFR policyholder.

Procedure for entering data

And so, how to fill out form p14001 when adding OKVED step by step?

Please note the sequence below:

- The first (title) page contains two sections. In the first, the OGRN of the company is written down (clause 1.1.), its INN (clause 1.2.) and the name without abbreviations, including the legal form (clause 1.3.). In the second section, you need to note why the application is being filled out. You need to select “change information” , that is, enter the number 1 in the empty cell.

- The first page of sheet H contains two items. If you just need to add additional OKVED codes, then in paragraph 1.2. you need to enter them in the designated cells. If there is a change in the main type of activity, then in paragraph 1.1 . the code of the new main view is entered. Since an organization can have only one main foreign trade activity, it is necessary not to forget to exclude the previous one by writing it down on sheet N. If the previous main foreign economic activity is left as an additional one, it must be entered in paragraph 1.2 .

- The second page of sheet H looks similar to the first , but the heading indicates that excluded foreign economic activities : in paragraph 2.1. – main, in paragraph 2.2. – additional. If nothing is excluded and the codes do not change one to another, this page is not completed .

- On page 1 of sheet P, indicate who the applicant is. In this case, it will be the director, so the number 01 . Sections 2 and 3 are not completed.

- On page 2 of sheet P to the relevant paragraphs 4.1.-4.4. passport and other data of the applicant, that is, the director, are entered: last name, first name, patronymic, TIN (if it is not there, the item is not filled in), birth information (date, place), identification document code, its details, who issued it and when .

- On page 3 of sheet P in paragraph 4.5. address is recorded in detail : postal code, code of the subject of the Russian Federation, locality in accordance with current directories. The designations of address objects must be entered according to the KLADR (for example, an avenue can be written as “pr-kt”, a block – “kv-l”, a street – “ul”, etc.). The words “house” or “apartment” are not abbreviated . Clause 4.6. provided for the main telephone. If it is a mobile phone, then before the number they write +7 and the code in brackets; if it is a landline, then they write in front of it the number eight and also the code in brackets. There are no hyphens in the phone number .

- Page 4 of sheet P is intended only for filling out by hand in front of a notary . The applicant (director) indicates his full name and signs, the notary notes information about himself. On this page you can also select the desired method for receiving documents confirming changes.

And so, we looked at the step-by-step algorithm for filling out this document in the form of separate pages.

But for convenience, we also provide application p14001 as a sample for filling out when adding OKVED, as an option, with all pages in one file.

All completed pages are folded in accordance with the order of the letter designations and numbered.

The notary is filing the application .

Who fills out Form 14001 when there is a change of director?

This question may naturally arise when filling out an application. Indeed, at the time of its submission to the Federal Tax Service, the powers of the previous director have already been terminated, and the new director has not yet been entered into the Unified State Register of Legal Entities, then who signs Form 14001 when changing the director?

In this situation, it must be taken into account that as soon as the general meeting decided to replace the director, his powers are terminated (this is determined by the Supreme Arbitration Court of the Russian Federation dated September 23, 2013 No. VAS-12966/13). Therefore, he no longer has the right to fill out and sign an application for a change of director, but the new director of the organization must do this.