The current form of the VAT return for 2021 was approved by Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected] as amended by Order of the Federal Tax Service of Russia dated December 28, 2018 N SA-7-3/ [email protected]

The 2021 VAT return is submitted on the same form as last year. In our publication today we will talk about the composition of this document, the deadlines for its submission, and the rules for filling it out. The article also discusses changes in working with VAT introduced in 2020.

At the bottom of the page you can find the 2021 VAT returns.

Who should take it?

VAT returns must be prepared by organizations and entrepreneurs, including intermediaries, who:

- are recognized as VAT payers;

- are tax agents for VAT.

This follows from paragraph 5 of Article 174 and subparagraph 1 of paragraph 5 of Article 173 of the Tax Code of the Russian Federation.

A detailed list of organizations and the conditions under which they are required to submit a VAT return are given in the table.

If in any tax period the organization did not carry out any transactions that should be reflected in the VAT return, the declaration is allowed not to be drawn up. Instead, you can submit a single simplified declaration, the form of which was approved by Order of the Ministry of Finance of Russia dated July 10, 2007 No. 62n. This was stated in the letter of the Ministry of Finance of Russia dated March 10, 2010 No. 03-07-08/64. However, when applying these clarifications, it must be taken into account that in order to file a single simplified declaration, a number of additional conditions must be met. If these conditions are not met, the organization must draw up and submit a zero VAT return. For late submission of a declaration (including a zero declaration), the organization faces a fine.

As part of the zero declaration, you must submit the title page and section 1 (paragraph 2, clause 3 of the Procedure approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558).

Situation: should organizations that are exempt from taxpayer obligations under Article 145 of the Tax Code of the Russian Federation submit VAT returns?

As a rule, they shouldn't.

Organizations that enjoy VAT exemption do not fulfill the obligations of taxpayers (clause 1 of Article 145 of the Tax Code of the Russian Federation). However, they are required to submit returns for this tax in two cases.

First: if the organization issues an invoice to the buyer with the allocated amount of tax (subclause 1, clause 5, article 173, clause 5, article 174 of the Tax Code of the Russian Federation). Then the declaration must include a title page, section 1 and section 12.

Second: the organization acts as a tax agent (clause 5 of Article 174 of the Tax Code of the Russian Federation). In this case, the declaration must include a title page and section 2.

This is stated in paragraphs 6 and 9 of paragraph 3 of section I and paragraph 51 of section XIV of the Procedure, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

In other cases, it is not necessary to prepare VAT returns during the period of using the exemption under Article 145 of the Tax Code of the Russian Federation. Similar clarifications are contained in the letter of the Federal Tax Service of Russia dated July 31, 2012 No. ED-3-3/2683. This is also confirmed by arbitration practice (see, for example, decision of the Supreme Arbitration Court of the Russian Federation dated February 13, 2003 No. 10462/02, determination of the Supreme Arbitration Court of the Russian Federation dated June 17, 2009 No. VAS-7414/09, resolution of the Federal Antimonopoly Service of the North-Western District dated February 24 2009 No. A26-3353/2008).

If an organization is exempt from paying VAT, but sells excisable goods, it will have to submit a tax return (in terms of proceeds from the sale of excisable goods) in full (clause 2 of Article 145 of the Tax Code of the Russian Federation).

Responsibility

If the VAT return is not submitted on time, the organization faces tax and administrative liability.

An example of determining the amount of a fine for late submission of a VAT return

Organization "Alpha" applies a general taxation system. The Alpha accountant submitted the VAT return for the third quarter of 2015 on February 28, 2021. On the same day, the tax amount was transferred to the budget. The amount of tax to be paid additionally on this declaration was 120,000 rubles.

Since October 25, 2015 is a Sunday, the deadline for filing the declaration is October 26, 2015. The period of delay is five months: October, November and December 2015, as well as January and February 2021.

The amount of the fine under Article 119 of the Tax Code of the Russian Federation is 30,000 rubles. (5% × RUB 120,000 × 5 months).

There is no special penalty for filing a return with errors. If an error in the declaration did not lead to an understatement of tax liabilities, then no sanctions will be imposed on the taxpayer. Having discovered inconsistencies during a desk audit, the inspectorate will inform the taxpayer about this and offer to provide the necessary explanations or correct errors in the initial declaration. This procedure is provided for in paragraph 3 of Article 88 of the Tax Code of the Russian Federation. If the organization has complied with the requirements of the inspection, there is no need to submit an updated declaration.

If the error led to an understatement of the tax base, you need to submit an updated declaration (paragraph 1, clause 1, article 81 of the Tax Code of the Russian Federation). If this is not done, then during the inspection the tax inspectorate will charge a penalty and a fine of 20 percent of the amount of unpaid tax on the amount of arrears (Articles 75, 122 of the Tax Code of the Russian Federation).

Situation: can the tax inspectorate fine an organization for failure to submit a VAT return? The organization applies a special regime and issued an invoice to the buyer with allocated VAT

Yes maybe.

As a general rule, the use of special tax regimes exempts organizations from the obligations of VAT payers (except for VAT, which is paid when importing imported goods into Russia). This is stated in paragraph 3 of Article 346.1, paragraph 2 of Article 346.11 and paragraph 3 of paragraph 4 of Article 346.26 of the Tax Code of the Russian Federation.

But if an organization that is not a VAT payer issues an invoice highlighting the amount of VAT, then this amount must be paid to the budget (subclause 1, clause 5, article 173 of the Tax Code of the Russian Federation). In this case, no later than the 25th day of the month following the last month of the expired quarter, you must submit a VAT return to the tax office consisting of the title page and sections 1 and 12. This follows from the provisions of paragraph 5 of Article 174 of the Tax Code of the Russian Federation and paragraph 7 paragraph 3 of section I of the Procedure, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

If you miss submitting your VAT return, you will incur tax and administrative liability. Such liability is established by Article 119 of the Tax Code of the Russian Federation. From January 1, 2014, the category “taxpayer” was excluded from the text of this article (clause 13 of article 10 of the Law of June 28, 2013 No. 134-FZ). Therefore, at present, the tax inspectorate can fine for such an offense any organization that must submit VAT returns, but for any reason has not fulfilled this obligation.

Deadlines for filing VAT returns in 2020

The VAT return is a quarterly return that must be submitted by the 25th day of the month following the reporting quarter. If the deadline for submitting a report falls on a weekend, the deadline for submission is moved to the next working day following that weekend. Thus, according to the tax calendar, the deadlines for filing a VAT return in 2021 are as follows:

- for the 1st quarter - until April 27, 2021;

- for the 2nd quarter - until July 27, 2021;

- for the 3rd quarter - until October 26, 2021;

- for the 4th quarter - until January 25, 2021.

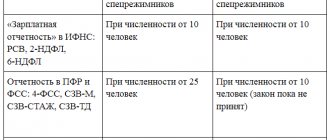

How to pass

VAT returns must be submitted to the inspectorate only in electronic form and only through authorized special operators. This procedure does not depend on the number of employees of the organization and applies to everyone who must prepare VAT returns. Declarations submitted on paper are considered not submitted (letter of the Federal Tax Service of Russia dated January 31, 2015 No. OA-4-17/1350). Therefore, for filing VAT returns on paper, tax inspectorates can fine organizations not under Article 119.1 (violation of the method of submitting declarations - a fine of 200 rubles), but under Article 119 of the Tax Code of the Russian Federation, and also block their bank accounts (clause 3 of Article 76 Tax Code of the Russian Federation).

The only exceptions are tax agents who are not VAT payers and do not conduct intermediary activities with the issuance of invoices on their own behalf. They are allowed to file VAT returns on paper. This follows from the provisions of paragraph 5 of Article 174 and paragraph 3 of Article 80 of the Tax Code of the Russian Federation.

For more information on the composition and methods of submitting VAT reporting to the tax authorities, see the table.

The requirement to submit declarations in electronic form also applies to all updated VAT returns that organizations file (will file) after January 1, 2015 (Clause 7, Article 5 of Law No. 347-FZ of November 4, 2014) .

Who pays VAT on Google and Apple commissions in 2021

Services in electronic form include, among other things, the provision through the Internet of services to provide technical, organizational, information and other opportunities, carried out using information technologies and systems, to establish contacts and conclude transactions between sellers and buyers. It is for these services that Google and Apple charge developers a commission when selling their applications through their platforms.

As we found out above, from 2021, foreign organizations must independently pay VAT when selling services electronically to Russian persons (it does not matter: individuals, legal entities or individual entrepreneurs). Therefore, when purchasing services in electronic form from Google or Apple, Russian organizations and entrepreneurs are exempt from the duties of a tax agent and do not pay VAT.

Composition of the declaration

As part of the VAT return, each VAT payer organization must submit to the tax office:

- title page;

- Section 1 “The amount of tax subject to payment to the budget (reimbursement from the budget), according to the taxpayer.”

Include the remaining sections in the declaration only if the organization performed transactions that should be reflected in these sections. For example, sections 4–6 must be completed and submitted if during the tax period the organization carried out transactions subject to VAT at a rate of 0 percent. And section 7 - if the organization performed transactions that were exempt from taxation.

These requirements also apply to those taxpayers whose tax base is zero at the end of the quarter (letter of the Federal Tax Service of Russia dated July 31, 2012 No. ED-3-3/2683).

An example of filling out a VAT return for 2020

When filling out the VAT form, taxpayers often encounter difficulties. As a rule, a rather controversial issue is determining the exact date from which it is necessary to begin calculating the tax burden. According to the law, the tax burden begins at the moment when the organization begins to provide services (within its competence), and at the moment of shipment of the products provided. But you need to pay attention to the fact that if an organization (firm, enterprise) operates on an advance payment basis, then the tax burden is calculated from the moment the funds are received.

We offer you the basic procedure for filling out the 2020 VAT return:

1. If a paper declaration is submitted, it must comply with a single machine-oriented form.

2. The colors of the ballpoint (or fountain) pen used to fill out the declaration must be only black, blue or lilac.

3. Duplex printing cannot be used on document sheets.

4. A declaration with corrected errors (corrections by any corrective means) cannot be accepted for consideration.

Filling procedure

Fill out your VAT return according to the general rules.

In this case, use the data that is reflected:

- in the purchase book and sales book. Please indicate this information separately in sections 8 and 9 of the declaration;

- log of received and issued invoices. This applies to taxpayers (tax agents) who conduct intermediary activities in the interests of other persons. Separately indicate information from the invoice journal in sections 10 and 11 of the declaration;

- issued invoices. This rule applies to those who do not have to pay VAT, but issue invoices with the allocated amount of tax (clause 5 of Article 173 of the Tax Code of the Russian Federation). Please provide separate information about such invoices in section 12 of the declaration;

- accounting and tax registers.

This follows from the provisions of paragraph 5.1 of Article 174 of the Tax Code of the Russian Federation, paragraph 4 of Section I of the Procedure, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

TIN and checkpoint

Please indicate your Taxpayer Identification Number (TIN) at the top of the form.

An entrepreneur can view it in the notice of registration as an entrepreneur, which was issued by the Federal Tax Service upon registration.

Organizations also need to indicate checkpoints. This data can be viewed in the notification of registration of a Russian organization.

The largest taxpayers must indicate the checkpoint assigned to them by the interregional tax office and indicated in the notice of registration as the largest taxpayer. The fifth and sixth checkpoint signs are 50. This is stated in the letter of the Federal Tax Service of Russia dated September 7, 2015 No. GD-4-3/15640.

Entrepreneurs who are required to submit VAT returns put dashes in the “Checkpoint” field.

Taxable period

In the “Tax period” field, indicate the code of the tax period for which the declaration is being submitted. It can be determined in accordance with Appendix 3 to the Procedure approved by Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558. For example, if you are filling out a declaration for the third quarter, enter “23”; if for the fourth quarter, enter the code “24”. Separate codes are also established for the liquidation of an organization (for example, if you fill out a declaration for the fourth quarter, when liquidating an organization, indicate “56”).

Tip 4. Use advance payment discounts - it works

Services that provide access to 1C and 1C-Reporting in particular often give discounts for the first connection and for prepayment. This can and should be used: you will save significantly, fix the cost of services and forget about this expense item for six months, a year or even more.

Please note: in December 2021, new users of the 1C-Reporting service can connect it with a 50% discount at. The service includes support for issuing an electronic digital signature, which again saves your resources and time. Regarding discounts for regular users of 1C rental in the cloud, in ServiceCloud they reach 20% with prepayment for 12 months.

Moreover, until the end of December, if you prepay for 15 months, the discount will be 23%. This is a great way to “freeze” the cost of services, as it announced an increase in prices for 1C rental in 2021. By contacting , the leading cloud 1C provider, you get a reliable partner, 24/7 technical support, financial guarantees of service availability and free consultations on working in 1C.

Inspection - recipient

In the “Submitted to the tax authority” field, enter the code of the tax office at the place of registration.

An individual entrepreneur will find it in the notice of registration as an entrepreneur.

Take the organization code from the notice of registration of a Russian organization.

Also, the Federal Tax Service code can be determined by the registration address using the Internet service on the official website of the Federal Tax Service of Russia.

In the field “At location (registration)”, enter the code in accordance with Appendix 3 to the Procedure approved by Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558. For example, when filing a return for the location of an organization that is not the largest taxpayer, indicate code “214.” This follows from paragraph 23 of the Procedure, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

Taxpayer

In the “Taxpayer” field, enter the full name of the organization. It must comply with the constituent documents (for example, charter, constituent agreement).

If the declaration is submitted by an entrepreneur, then you must indicate your last name, first name, patronymic in full, without abbreviations, as in your passport.

This is stated in paragraph 24 of the Procedure, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

In the section “I confirm the accuracy and completeness of the information specified in this declaration,” indicate information about the person who signs the report. There are four options.

Option 1. The declaration is signed by the manager. That is, someone who has the right to represent a company without a power of attorney. Then indicate code 1 and write down the last name, first name and patronymic of the manager in accordance with the data recorded in the Unified State Register of Legal Entities. Even if the manager has changed his last name, information about him must be the same as in the Unified State Register of Legal Entities. Otherwise the declaration will not be accepted. There is no need to indicate information about the power of attorney and the name of the representative organization - put dashes in these fields.

Option 2. The document is signed by an employee or a third-party individual by proxy. Then indicate code 2, last name, first name and patronymic according to the passport and the name of the document certifying the rights of the representative of the power of attorney. Send a copy of the document to the Federal Tax Service of Russia simultaneously with the declaration. In addition, you must fill out and send along with the declaration a statement of power of attorney. This is a separate document and file.

Advice: if the accounting program does not provide the ability to fill out and send a message about the power of attorney, then use the “Legal Taxpayer” application. You can download the program for free on the Federal Tax Service website. Install the application on your computer, generate a power of attorney message file and send it along with your VAT return. The format and procedure for submitting a power of attorney message is prescribed in the order of the Federal Tax Service of Russia dated November 9, 2010 No. ММВ-7-6/534.

Option 3. The declaration is signed by the representative’s employee. This happens when tax reporting services are provided by a representative - a third-party organization (for example, an audit company). In this case, enter code 2, indicate the last name, first name and patronymic of the employee of the representative organization and its name, indicate the data of the power of attorney for the signatory. A copy of the power of attorney and a message about it are sent in the same way as in option 2.

Option 4. The document is signed by an individual entrepreneur for himself. In this case, simply write down code 1. In the fields provided for full name, information about the representative company and the name of the document confirming authority, dashes are placed.

All this follows from paragraph 31 of the Procedure from Appendix 2 to the order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

Tip 1. Choose a service that does not require a lot of resources

In the search for the query “electronic reporting” there are dozens of options - both independent services and those created on the basis of 1C, in particular “1C-Reporting”. To make a choice, answer the question: are you or your accountant ready to spend time learning new services if everything is already implemented in 1C?

If you already use 1C or at least thought about connecting it, consider an important point: the 1C-Reporting service is integrated into most of the developer’s popular products, such as 1C: Accounting, 1C: Salaries and HR Management, 1C: Managing our company”, etc. With its help, you can create, check and send declarations and standard forms in just a couple of clicks.

Please note: the accountant will be able to work in the familiar 1C interface. You won’t have to waste time and resources on training, transferring data from one place to another and their subsequent reconciliation.

OKVED

In the field “Code of the type of economic activity according to the OKVED classifier”, indicate the code of the type of activity. This code can be viewed in the extract from the Unified State Register of Legal Entities (USRIP), which is issued by the Federal Tax Service. If there is no such extract, then the code can be determined independently using OKVED classifiers. In 2021, two OKVEDs are in effect in parallel (approved by Decree of the State Standard of Russia dated November 6, 2001 No. 454-st and approved by Order of Rosstandart dated January 31, 2014 No. 14-st), so you can be guided by any of them.

Information about the reorganization

In the field “Form of reorganization (liquidation)” the reorganization (liquidation) code is indicated in accordance with Appendix 3 to the Procedure approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558. For example, when reorganizing in the form of affiliation, you need to indicate code “5”.

In the “TIN/KPP of the reorganized organization” field, please enter the TIN/KPP that was assigned before the reorganization.

This is stated in paragraphs 26, 27 and 16.5 of the Procedure approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

Situation: how to fill out and submit a VAT return during reorganization in the form of transformation?

The answer to this question depends on who submits the declaration - the successor or predecessor.

After all, the predecessor can submit a declaration only for the period of his activity. That is, from the beginning of the quarter to the date when the reorganization was completed. If for some reason the predecessor did not submit a declaration for the last period of his activity, this responsibility passes to the successor. He must prepare a declaration for the entire quarter as a whole. It must reflect both the transactions performed by the predecessor and its own transactions performed from the date of reorganization until the end of the tax period.

The deadline for filing a declaration is general: no later than the 25th day of the next month after the end of the quarter.

This follows from paragraph 3 of Article 80, Article 163, paragraphs 1 and 5 of Article 173, paragraph 5 of Article 174 of the Tax Code of the Russian Federation and is confirmed in the letter of the Federal Tax Service of Russia for Moscow dated May 13, 2015 No. 24-15/046265.

The predecessor and his successor draw up the declaration differently.

Option 1. The organization that is being transformed independently submits a declaration for the last tax period

The tax period, the last for the predecessor, is indicated in the declaration with the following values:

- 51 – I quarter;

- 54 – II quarter;

- 55 – III quarter;

- 56 – IV quarter.

This procedure is prescribed in paragraph 21 of the Procedure for filling out a VAT return and Appendix 3 to it, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

In the “Form of reorganization” indicator, enter the code “1”. This follows from the provisions of paragraph 26 of the Procedure for filling out a VAT return and Appendix 3 to it, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

Fill in the “TIN/KPP” indicators as follows. At the top of the title page and on the remaining sheets, indicate the details of the organization being converted. In the “TIN/KPP of the reorganized organization” field, put dashes - until the moment of registration, the taxpayer does not have this information. This conclusion follows from paragraphs 16.5 and 18 and the Procedure for filling out a VAT return, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

In the remaining details (name, type of activity code, etc.), provide information about the organization before the transformation.

Option 2. The declaration for the entire quarter is submitted by the legal successor - the transformed organization

In this case, the declaration must indicate:

- on the title page “at the location (registration)” - code “215”, and if the assignee is the largest taxpayer, then code “216”;

- TIN and KPP (in the entire declaration) – data of the legal successor;

- Taxpayer – name of predecessor;

- TIN/KPP of the reorganized organization - codes that were assigned to the organization before the transformation;

- The form of reorganization is code “1”.

In Section 1 of the declaration, in the “OKTMO Code” field, indicate the code of the municipality in which the reorganized organization (predecessor) was located.

Remember, fill out the specified information only in the declaration, which reflects the indicators for the predecessor and successor. In subsequent declarations, follow the general procedure. This procedure is directly provided for in clause 16.5 of section II of appendix 2 to the order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

Tip 3. Prepare for a possible increase in quarantine

Forecasts for the epidemiological situation for 2021 are disappointing, but this is the reality. Your accountant may be working from home due to age restrictions, a child's quarantine at school, isolation as a "contact" or, ultimately, simply being on sick leave. Many companies have already switched to 1C in the cloud - when all data is stored on a secure remote server, and access to the program is possible from anywhere in the world.

Please note: “1C-Reporting” can be connected to both the cloud 1C and the local version of the program. In the case of renting in the cloud, you can submit reports with access from any device connected to the Internet. In this case, the strengthening of quarantine with a general transition to remote work will not take you by surprise.

Section 1

Fill out Section 1 of the declaration in accordance with Section IV of the Procedure approved by Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558. Indicate the date of completion of the declaration and the signatures of the organization’s representatives.

On line 010, indicate the OKTMO code according to the All-Russian Classifier, approved by order of Rosstandart dated June 14, 2013 No. 159-st. Fill in from left to right, put dashes in the cells remaining free.

On line 020, reflect the VAT budget classification code for goods (works, services) sold on the territory of Russia in accordance with Order of the Ministry of Finance of Russia dated July 1, 2013 No. 65n.

On line 030, indicate the amount of VAT accrued in accordance with paragraph 5 of Article 173 of the Tax Code of the Russian Federation. This amount is not reflected in section 3 of the declaration and is not included in the calculation of indicators on lines 040 and 050 of section 1.

In lines 040 and 050 with total indicators, reflect the results of adding the total data transferred from completed sections 3–6.

If there is no tax base and the amount of tax to be paid, put dashes in the corresponding cells of Section 1 (paragraph 4, clause 3 of the Procedure approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558).