Cancel the round seal

The abolition of the seal for legal entities has caused a lot of unrest and misunderstanding in the business industry. First of all, managers and representatives of the economic sector of the organization asked the question: “Has the use of seals been canceled for all procedures, or are there documents that are not valid without certification?” The answers were provided by the law on the abolition of seals No. 82-FZ of 04/06/2015. It describes in detail how an organization should operate from the moment the law is adopted, whether it is necessary to put a stamp on the contract, as well as on tax, accounting and primary reporting documents. Also, the law on the abolition of seals explains the procedure for placing such marks on powers of attorney, allowing the interests of a legal entity to be represented in court.

Seal of an individual entrepreneur - sample

The seal, first of all, has the task of quickly identifying its owner, so it must indicate:

- Form of doing business. Example: “Individual entrepreneur Ivan Ivanovich Ivanov”;

- State registration number of an individual entrepreneur. Example: “OGRNIP 321718700000000”;

- Individual number of the individual entrepreneur as a taxpayer. Example: “TIN 87345500000”;

- Location of the individual entrepreneur (most often the city is indicated). Example: “Chelyabinsk” or “Moscow”.

From the picture below you can get an idea of how the print should look:

Sample of IP seal

The individual entrepreneur also has the right to indicate the scope of activity (for example, “cleaning services”) and insert a logo or emblem.

Some issues related to the use of the IP seal are covered in this video:

Should a society have a seal?

The need for the company to use such requisites is prescribed in its charter. Organizations such as LLCs and JSCs are not required to have a round seal based on Federal Law No. 82-FZ of 04/06/2015. Also, from April 7, 2015, enterprises have an obligation to indicate in the charter the fact of having a stamp. If it is absent, it is considered that the legal entity is not obliged to certify documents in this way. Therefore, after the law has come into force, companies that have a mark in their charter indicating the presence of a round seal do not need to make any amendments. As for organizations that were created before April 7, 2015 and do not have the corresponding mark in their documentation, they are recommended to supplement the charter with the required information. The need for this addition is justified by the possible need to put a mark on the papers required by law. As for companies formed after April 7, 2015, they have the right to have a stamp, but this is not obligatory for them.

Legal regulation of the use of the seal

REQUIREMENTS FOR SEALS The civil legislation of the Russian Federation, as such, does not contain a definition of the seal of a legal entity. In clause 2.1. GOST R 51511–2001 (adopted and put into effect by Decree of the State Standard of the Russian Federation dated December 25, 2001 No. 573-st https://russia.bestpravo.ru/fed2001/data01/tex10472.htm) the following descriptions are given: • printing - device , containing a printing cliché for making impressions on paper; • seal cliché - a print element containing a mirror image of a seal impression. It is necessary to distinguish between the concept of printing as a mechanism and as an image on paper. A seal on documents is a seal impression made using a cliche. Currently, a legal entity must have a seal in accordance with the requirements of the law on the relevant types of legal entities, for example: Clause 5 of Article 2 of the Federal Law “On Limited Liability Companies” dated 02/08/98 N 14-FZ (https://www.consultant.ru /popular/ooo/): “The company has the right to have a seal, stamps and forms with its name, its own emblem, as well as a trademark registered in the prescribed manner and other means of individualization. Federal law may provide for the obligation of a company to use a seal. Information about the presence of a seal must be contained in the company’s charter.” Clause 7 of Article 2 of the Federal Law “On Joint Stock Companies” dated December 12, 1995 N 208-FZ (https://www.consultant.ru/popular/stockcomp/): “The company has the right to have a seal, stamps and forms with its name, its own emblem, as well as a duly registered trademark and other means of individualization. Federal law may provide for the obligation of a company to use a seal. Information about the presence of a seal must be contained in the company’s charter.” Clause 4 of Article 3 of the Federal Law “On Non-Profit Organizations” dated January 12, 1996 No. 12-FZ (https://www.consultant.ru/popular/nekomerz/): “A non-profit organization has a seal with the full name of this non-profit organization on Russian language. A non-profit organization has the right to have stamps and forms with its name,” etc. These laws do not impose any other requirements for the seal of a legal entity. The main purpose of using a seal is to distinguish a particular subject from many similar ones, and, therefore, the print should contain the maximum amount of information about this subject.” The fact that an organization may, at its discretion, have a seal is mentioned in regulations next to provisions on other means of individualizing a legal entity. At the federal level, the following mandatory seal requirements have been established: • a legal entity must have a round seal; • the press must reflect the full corporate name of the organization; • indication of the location of this legal entity; • an indication of the possibility of including a name in a foreign language or in the language of the peoples of Russia. Such general requirements do not allow a third party to reliably establish the identity of a particular entity with an already known counterparty, partner, etc. The following questions arise: • about the size of the seal, • about the font size on the cliché, • about the possibility of indicating an abbreviated company name, • about the legality of indicating the OGRN (main state registration number), TIN (taxpayer identification number) on the seals, • about the legality of producing several printing cliches (for example, on different equipment, with additional words like “for documents”, “for invoices”, etc. • Having analyzed the wording of legal norms at the federal level, we can conclude that these issues are left to the discretion of legal entities and manufacturers themselves stamps. The law only establishes a requirement for a legal entity to have a seal, but does not stipulate the possibility of making several seals. Since there is no direct prohibition, it is possible to make several seals with both identical and different cliches, each of which will be original when used for the corresponding documents For example, it is possible to produce several seals for one organization: one with the full company name and two or more for separate categories of documents (general “for documents”, “for references”, etc.). At the same time, it would be unlawful to produce simultaneously a seal containing the full company name and a seal containing the full and abbreviated name, since this would be misleading as to which company the seal belongs to. In relation to documents certified by impressions of different seals, questions may arise regarding their origin. The law also provides for the mandatory inclusion of the full company name in Russian in the seal cliché, so the production of a seal containing the name only in a foreign language will also be unlawful. About seals with the reproduction of the coat of arms The right to use images of state symbols in seals is stipulated in the relevant legal norms of the appropriate level (RF, constituent entities of the Russian Federation). Until a certain time, it was practiced to make seals with the image of the State Emblem of the Russian Federation. The reason for uncontrolled use was the lack of legal regulation in this matter. On December 25, 2000, Federal Constitutional Law No. 2-FKZ “On the State Emblem of the Russian Federation” was adopted (https://www.consultant.ru/document/cons_doc_LAW_29674/). He established the methods and procedure for the reproduction and use of this state symbols. According to the Law, the State Emblem of the Russian Federation is placed only on the seals of: - federal government bodies, - other government bodies, organizations and institutions, - bodies, organizations and institutions, regardless of the form of ownership, vested with individual government powers, - as well as bodies, carrying out state registration of acts of civil status. On December 27, 2000, the law was published and came into force. From this moment on, the use of the State Emblem of the Russian Federation on the seals of legal entities not endowed with state authority is illegal. The coat of arms is a state symbol, an attribute of state power, therefore its use is possible only by those organizations that act on behalf of the state or on its behalf. Art. 19.11 of the Code of Administrative Offenses of the Russian Federation (https://www.consultant.ru/popular/koap/) establishes liability for violation of the procedure for the production, use, storage or destruction of forms, seals or other carriers of the image of the State Emblem of the Russian Federation in the form of an administrative fine in the amount of five up to ten minimum wages. In this case, employees of internal affairs bodies are authorized to draw up a protocol on an administrative offense, and cases on this issue are considered in court. With regard to seals depicting the coat of arms of the Russian Federation, GOST R 51511–2001 (adopted and put into effect by Decree of the State Standard of the Russian Federation dated December 25, 2001 No. 573-st) (https://zakonbase.ru/content/base/13551) establishes the sizes of seals and fonts, a sample image of the coat of arms, etc. The production of such seals is carried out only by organizations with special permission. Use of coats of arms of the constituent entities of the Russian Federation Subjects of the Russian Federation independently establish rules for the use of their state symbols on seal impressions. Use of trademarks, logos and other graphic means of individualization. The use of means of individualization is lawful to the extent that they do not violate the rights and legitimate interests of other persons. That is, their use should not mislead the person presenting them, and thereby be a method of unfair competition. It is necessary to remember the following points: Rights to use a trademark arise from the moment of its registration; The concepts of “logo” and “trademark” are not used in Russian legislation, therefore, protection of the rights to protect them from use by third parties can only be carried out within the framework of the trademark registration procedure or by proving the fact of unfair competition; Registration of a trademark only means the acquisition of the right to its protection by the state, the fact of the emergence of rights to use a particular image is not associated with it, and secondly, there is a presumption of the legality of a person’s actions until proven otherwise, therefore it is assumed that the use of that or other object does not violate the rights of third parties. You can make a stamp with a logo at any company that produces stamps. It is also possible to produce counterfeit-proof seals, for example, by applying visible or invisible design lines to the cliches. Making a new seal may be required in the following cases: • loss of the old seal; • wear and tear of the old seal; • change of name or address of location (from one subject of the Russian Federation to another). DOCUMENTS REQUIRED FOR THE PRODUCTION OF THE SEAL: Official stamp in accordance with GOST 51511-2001: 1. Letter of application in free form from the head of the enterprise with a request to produce a seal in accordance with GOST 51511-2001 in N quantity. 2. Copy of the Certificate of state registration of legal entities (on assignment of OGRN) 3. Copy of the Certificate of registration with the tax authority of a legal entity (on assignment of TIN). 4. A copy of the Charter, namely the “General Provisions” section, which states the right to use the State Emblem of the Russian Federation in the press. 5. For educational institutions - a copy of the Certificate of State Accreditation.

Stamp of a legal entity, individual entrepreneur: 1. Copy of the Certificate of State Registration of Legal Entities. 2. If desired, a copy of the Certificate of registration with the tax authority of a legal entity (about the assignment of a TIN), if it is necessary to indicate the TIN in the press.

Doctor's stamp: 1. A copy of the diploma of higher medical education.

RESPONSIBILITY For forgery Responsibility for forgery, production or sale of counterfeit documents, state awards, stamps, seals, forms is established in accordance with Article 327 of the Criminal Code of the Russian Federation of June 13, 1996 N 63-FZ (https://www.consultant.ru /popular/ukrf/10_43.html#p6201): 1. Forgery of a certificate or other official document granting rights or exempting from obligations for the purpose of its use or sale of such a document, as well as production for the same purposes or sale of counterfeit state awards of the Russian Federation Federation, RSFSR, USSR, stamps, seals, forms are punishable by restriction of liberty for a term of up to three years, or by arrest for a term of four to six months, or by imprisonment for a term of up to two years. 2. The same acts committed with the aim of concealing another crime or facilitating its commission are punishable by imprisonment for a term of up to four years. 3. The use of a knowingly forged document is punishable by a fine in the amount of up to eighty thousand rubles or in the amount of the wages or other income of the convicted person for a period of up to six months, or by compulsory labor for a period of one hundred eighty to two hundred and forty hours, or by corrective labor for a term of up to two years. , or arrest for a period of three to six months.

For the use of the coat of arms of the Russian Federation, the Federal Law “On the State Emblem of the Russian Federation” dated December 25, 2002 N 2-FKZ (https://base.consultant.ru/cons/cgi/online.cgi?req=doc;base=LAW;n= 160114;fld=134;dst=1000000001,0;rnd.... Article 11. The use of the State Emblem of the Russian Federation in violation of this Federal Constitutional Law, as well as desecration of the State Emblem of the Russian Federation entails liability in accordance with the legislation of the Russian Federation. for the use of the image of the State Emblem of the Russian Federation is established in accordance with Article 19.11 of the Code of the Russian Federation on Administrative Offenses (CAO RF) dated December 30, 2001 N 195-FZ (https://base.consultant.ru/cons/cgi/online.cgi? req=doc;base=LAW;n=183981;fld=134;dst=101638,0;rnd=0.9…: Violation of the procedure for production, use, storage or destruction of forms, seals or other carriers of the image of the State Emblem of the Russian Federation Violation of the procedure for production , use, storage or destruction of forms, seals or other carriers of the image of the State Emblem of the Russian Federation - shall entail the imposition of an administrative fine in the amount of from five to ten times the minimum wage.

Organizational seal: is it necessary to put it on? Documents that must be stamped. Previously, before April 2015, if there was no stamp on the documents, the consequences in this case could be dire. If a dispute arises with a counterparty or with a regulatory authority, a document executed without a seal could be declared invalid. Therefore, some accountants put a seal on all documents, even those that do not need a seal. Is the organization's seal required in contracts with counterparties or not? In general, contracts with counterparties may not be sealed if the text of the agreement itself does not oblige the parties to seal it. Or this is not directly required by law. This conclusion follows from paragraph 1 of Article 160 of the Civil Code of the Russian Federation (https://www.consultant.ru/popular/gkrf1/). For example, stamps must be placed on the double warehouse receipt and the pledge agreement if the pledged item remains with the pledgor. Because this is stated in Articles 913 and 338 of the Civil Code of the Russian Federation (https://www.consultant.ru/popular/gkrf1/). If there are no special requirements for the agreement in the law or the text of the agreement, the seal does not need to be affixed. Because the courts, for example, conclude: in the general case, the company’s seal is just an additional, and not a mandatory, requisite of the contract. Therefore, even without an imprint, the contract is considered concluded. And such a deal cannot be declared invalid. Therefore, if there is not a word in the text of the agreement about printing, then the agreement will be valid without it. The main thing is that the document bears the signatures of the parties to the transaction. Those who want to be on the safe side and want mandatory seals of both parties can write the following wording in them: “This agreement and amendments to it are valid only if they are made in writing, signed by authorized representatives and sealed by the parties.” Then you definitely can’t do without printing.

When printing is required Document requiring printing Grounds Financial documents Receipt for cash receipt order (form No. KO-1), last page of the cash book (form No. KO-4) Unified forms of primary accounting documentation for accounting cash transactions, approved by the Decree of the State Statistics Committee of Russia dated 18 August 1998 No. 88, paragraph 13 of the Procedure for conducting cash transactions in the Russian Federation, approved by letter of the Central Bank of the Russian Federation dated October 4, 1993 No. 18 https://www.consultant.ru/popular/uchetnaja-dokumentacija-kassy-inventarizacii/259_1. html Payment documents by which the organization transfers funds Clause 5.1 of the Directive of the Central Bank of the Russian Federation No. 3210-U on the procedure for conducting cash transactions dated March 11, 2014 https://www.consultant.ru/document/cons_doc_LAW _163618/ Strict reporting forms . An exception is documents without the “seal” requisite, approved by federal executive authorities. Clauses 3, 5 and 6 of the Regulations on the implementation of cash payments and (or) settlements using payment cards without the use of cash registers, approved by Decree of the Government of the Russian Federation of May 6, 2008 No. 359 https://www.consultant.ru/document/cons_doc_LAW_76841/

Journal of the cashier-operator (form No. KM-4), log of registration of readings of summing cash and control counters of KKM, operating without a cashier-operator (form No. KM-5) Unified forms of primary accounting documentation for recording cash settlements with the population when carrying out trade operations using cash registers, approved by Decree of the State Statistics Committee of Russia dated December 25, 1998 No. 132 https://www.consultant.ru/document/cons_doc_LAW_24274/

Consignment note (form No. TORG-12), commodity journal of a small retail trade employee (form No. TORG-23) Unified forms of primary accounting documentation for recording trade operations, approved by Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132 https://www. consultant.ru/document/cons_doc_LAW_24274/

Certificate for the purchase of goods on credit (Form No. KR-1), order-obligation (Form No. KR-2) Unified forms of primary accounting documentation for recording trade operations when selling goods on credit and for accounting trade operations in commission trade, approved by a resolution of the State Statistics Committee Russia dated December 25, 1998 No. 132 https://www.consultant.ru/document/cons_doc_LAW_24274/

Certificate of acceptance of completed work (Form No. KS-2), certificate of cost of work performed and expenses (Form No. KS-3), general log of work (Form No. KS-6), act of commissioning of a temporary (non-title) structure ( form No. KS-8), act on suspension of construction (form No. KS-17), act on suspension of design and survey work for uncompleted construction (form No. KS-18) Unified forms of primary accounting documentation for accounting for work in capital construction and repairs construction work, approved by Decree of the State Statistics Committee of Russia dated November 11, 1999 No. 100, unified forms of primary accounting documentation approved by Decree of the State Statistics Committee of Russia dated October 30, 1997 No. 71a https://www.consultant.ru/document/cons_doc_LAW_26273/

Certificate for payments for work (services) performed (form No. ESM-7) Clause 5 of Article 185 of the Civil Code of the Russian Federation, unified forms of primary accounting documentation, approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a https://www.consultant. ru/document/cons_doc_LAW_26273/

Consignment note (form No. 1-T), waybills for all types of vehicles. Act on acceptance and transfer of fixed assets (form No. OS-1, OS-1a, OS-1b), on acceptance and delivery of repaired, reconstructed, modernized fixed assets (form No. OS-3), act on acceptance and transfer of equipment to installation (form No. OS-15), act on identified equipment defects (form No. OS-16) Unified forms of primary accounting documentation for accounting of fixed assets, approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7 https://www.consultant .ru/popular/formy-uchetnoj-dokumentacii-po-osnovnym-sredstvam/

Personnel documents Work book. The stamp is placed on the first page, on the inside cover (if the information on the title page changes), after the employee’s dismissal is recorded. Clauses 2.2 and 2.3 of the Instructions approved by Resolution of the Ministry of Labor of Russia dated October 10, 2003 No. 69, paragraph 35 of the Rules approved by Government Resolution RF dated April 16, 2003 No. 225 https://www.rg.ru/2003/11/19/trudovaja-doc.html Letter of Rostrud dated May 15, 2015 N 1168-6-1 https://www. referent.ru/1/254609

Act on the acceptance of work performed under a fixed-term employment contract concluded for the duration of a specific work (form No. T-73) Unified forms of primary accounting documentation for recording labor and its payment, approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1 https: //www.consultant.ru/document/cons_doc_LAW_47274/

Travel certificate (form No. T-10) Tax documents Corrected invoice Clause 29 of the Rules approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137 https://base.consultant.ru/cons/cgi/ online.cgi?req =doc;base=LAW;n=153772;fld=134;from=125462-7;rnd=0.7631839521846068 Tax return. The stamp is placed where it is required by instructions for filling out the form Orders of the Ministry of Finance of Russia on the approval of declaration forms

From January 1, 2013, companies can generally use their own primary accounting forms by stipulating this in their accounting policies. The main thing is that they contain all the mandatory details from Article 9 of the Federal Law of December 6, 2011 No. 402-FZ https://www.rg.ru/2011/12/09/buhuchet-dok.html. Therefore, if the document forms that your company has developed or improved and now uses do not have a stamp field, its imprint on the document is not needed. Feel free to work without it. But if you use standard primary forms, which are marked “M.P.”, you will have to put a stamp. Otherwise, the document will be executed in violation. This means that with its help it will not be possible, for example, to confirm income tax expenses.

We received a bill of lading from a counterparty without a stamp. Should I return the document to have it stamped? It all depends on the shape of this invoice. If your supplier uses standard form No. TORG-12, which is approved by Decree of the State Statistics Committee of Russia dated December 25, 1998 No. 132, a stamp is required. After all, the form itself contains a specially designated place for the imprint. Moreover, the document must have two seals – the seller’s and the buyer’s. If you and the supplier agree to use a self-developed invoice, where there is no “M.P.” field, then printing is not needed. And many companies now use a universal payment document in their work - UPD. This is convenient - with one document you can confirm both VAT deductions and justify expenses. The UPD form is in the letter of the Federal Tax Service of Russia dated October 21, 2013 No. ММВ-20-3/ [email protected] https://www.nalog.ru/rn77/about_fts/about_nalog/4319219/. So, in the form itself there is space for an imprint (the “M.P.” field). Although in the recommendations for filling out individual details of the universal document, tax officials indicated that printing on the form is optional. So a UPD without a stamp can still be accepted for tax accounting. The main thing is that all required primary details are correctly filled out in the document.

There is no seller's seal on the sales receipt. Will such a document be able to confirm expenses? If the document form itself does not have the “MP” field, you will not have any problems. After all, each seller develops the sales receipt form independently. There is no official form. Representatives of the Russian Ministry of Finance emphasized this in a letter dated February 11, 2009 No. 03-11-06/3/28 https://mvf.klerk.ru/rass/r182_11.htm. So if there is no space for an imprint on the sales receipt, then a stamp on the document is not needed.

From now on, the seal is the right of the organization, and not an obligation. It will be mandatory only if it is expressly provided for by law. In other cases, organizations will decide for themselves whether to use a seal or not. For example, a seal will not be required in the audit log, on an industrial accident report, on a judicial power of attorney and a power of attorney for representation during enforcement proceedings, on documents for participation in government procurement, etc. Source: Federal Law No. 82-FZ https: //www.consultant.ru/document/cons_doc_LAW_177588/.

The printing was cancelled. How to work now? From April 7, 2015, commercial organizations can refuse round seals. They acquired this right after Federal Law No. 82-FZ of April 6, 2015 https://www.consultant.ru/document/cons_doc_LAW_177588/ came into force.

Is it necessary to refuse printing? Not at all necessary. The management of the organization, at its own discretion, decides whether to use printing in the future or do without it. The law only provides for the possibility of abandoning the round seal in favor of modern identification methods. But organizations still have the right to produce any number of seals and stamps of any shape, color and degree of protection.

What can replace printing? You can replace the seal, for example, with an electronic signature, special company forms or holographic seals. How to refuse the organization's seal? Make changes to your organization's charter. Information about the presence of a seal must be in this document.

If we refuse the organization’s seal, is it necessary to put it in standard documents where such details are provided, for example, in a cash book? There have been no official clarifications on this issue yet. But the Federal Tax Service of Russia, the Pension Fund of Russia and the Federal Tax Service of Russia explain that immediately after the law comes into force, the company has the right to transfer to them any documents without a seal. My only wish is that if you decide to refuse the seal, notify the inspectors about this by letter. As soon as official clarifications become available, changes will be made to the article.

Is it necessary to put a stamp on the primary product, the forms of which the company has developed itself? No no need. The seal is not listed among the mandatory details of primary documents listed in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ https://www.consultant.ru/document/cons_doc_LAW_122855/. Is it necessary to use a seal in contracts, for example, in a purchase and sale agreement? No, not necessarily. It is necessary to put a stamp in an agreement with counterparties only if this is expressly provided for in the agreement (clause 1 of Article 160 of the Civil Code of the Russian Federation https://www.consultant.ru/document/cons_doc_LAW_5142/95f9ba225766dcfec8461f257ed0b179d032c5b7/). Therefore, if one of the parties refuses the round seal, simply make sure that the requirement to affix it is removed from the contract.

Will banks require stamps on documents? No, they will not do. Representatives of banks report that the signature of the general director on any documents is sufficient for them if the company refuses the seal.

Do you need a stamp on form 4-FSS? According to the FSS Information dated June 10, 2015, the absence of an organization’s round seal on the calculation of insurance premiums cannot serve as a basis for refusal to accept reports https://fss.ru/ru/fund/for_enterprises_and_organisation/50/166349.shtml. In addition, FSS employees do not have the right to require organizations to certify with a seal corrections in the 4-FSS calculation and an application for offset (return) of overpaid (collected) amounts of insurance premiums, penalties and fines.

Organizations are not required to put a stamp on declarations and documents submitted to the inspection. Tax inspectors do not have the right to refuse an organization to accept documents, citing the absence of the taxpayer's stamp in them. This conclusion follows from the letter of the Federal Tax Service of Russia dated 08/05/15 No. BS-4-17/ [email protected] https://base.consultant.ru/cons/cgi/online.cgi?req=doc;base=LAW;n= 183997. The commented letter was sent to lower tax authorities for use in their work. According to the letter, tax inspectors must accept documents submitted by taxpayers, regardless of whether they are certified by a seal or not. This problem (lack of a stamp on the declaration, calculation or other documents submitted to the inspection) does not exist for organizations that submit electronic tax reports via the Internet. After all, to certify the above documents, it is enough for them to sign the sent file with a qualified electronic signature.

Is it now possible not to put stamps in work books? The rules for filling out work books still state that the entry on the title page and records of dismissal in the work book must be certified with a seal (clause 2.2 of the Instructions approved by Resolution of the Ministry of Labor of Russia dated October 10, 2003 No. 69 https://www.consultant .ru/document/cons_doc_LAW_44948/). At the beginning of April, the President of Russia signed Federal Law No. 82-FZ “On amendments to certain legislative acts of the Russian Federation regarding the abolition of the mandatory seal of business companies,” which gives the right to LLCs and JSCs to decide whether they will resort to the use of a seal, or documents will be certified in a different way https://www.consultant.ru/document/cons_doc_LAW_177588/. But Rostrud has its own opinion on this.

05/15/2015 Rostrud issued letter No. 1168-6-1 https://www.referent.ru/1/254609, which reminds that the organization has an obligation under Art. 66 of the Labor Code, namely the obligation to certify with a seal the entries in the work book. Yes, in the article itself there are no instructions on the use of seals for certification, but it refers us to the current “Rules for maintaining and storing work books, producing work book forms and providing them to employers.”

Paragraph 35 of the Rules reads:

“When an employee is dismissed (termination of an employment contract), all entries made in his work book during his time working for this employer are certified by the signature of the employer or the person responsible for maintaining work books, the seal of the employer and the signature of the employee himself.”

In this regard, Rostrud considers it obligatory to certify with a seal the entries in the work book.

When is printing necessary and when is it not?

The company is obliged to affix a seal in the following cases:

- if there is a need to leave the pledge with the pledgor under the protection of the lock and seal of the pledgee,

- when an educational organization certifies education documents,

— if documents are submitted for registration under a lease agreement for a structure or building for a period of more than a year, then they must be certified with a seal, but only on the condition that this method is prescribed in the charter,

— an information message is submitted to the customs authority in a package with other documents on the payment of excise taxes on goods marked by the Customs Union and imported into the territory of Russia from the territory of the union state.

The abolition of the seal for legal entities forced corresponding amendments to be made to a number of laws. Some of the by-laws still presuppose the need for its presence. Cases where by-laws require this mark to be placed on documents should be perceived by a legal entity as optional. But government agencies, banks and other structures may still require stamping on documents.

A little about use and storage

The head of the organizational department usually has the main seal, which has a round shape. A special safe is used to store it. If the head of the organizational department is absent for a long time, the seal can be issued to employees against signature. Or if the device needs to be used on weekends or holidays.

As for auxiliary types, they are given personally to employees of the organization vested with the appropriate powers.

Auxiliary types of seals must be stored inside tables that must be closed. A sealable safe is needed to preserve the main and auxiliary seals, and the address stamp. Only authorized employees responsible for storage should have access to them.

A special journal is kept in order to organize the accounting of devices. This document is maintained according to general rules that relate to strict reporting. Store such a magazine in a cabinet protected from fire to the maximum extent possible.

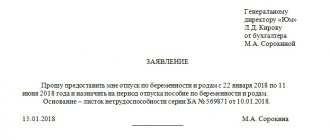

Registration of work books

In accordance with the rules for maintaining a work record book, upon dismissal of an employee, all entries that were made during his work must be certified by a seal. The abolition of the mandatory seal introduced adjustments to this procedure. Now the employee’s information is certified with a stamp belonging to the personnel department. Rostrud believes that replacing a round seal with another is not a violation of the Labor Code and does not infringe on the rights of the employee, since the latter receives confirmation of the fact of working in this organization. It is important to understand that only the mark that contains information about the name and location of the employer is confirmatory.

About the location of the seal imprint

Print location

The rules state that the prints are only on the bottom. Usually - in the same place where the directors put their signature. The seal may partially cover the position designation. The main thing is that it does not end up on the signature along with the transcript.

Documents are sometimes marked with a mark indicating the location where the seal should be placed. This saves specialists a lot of hassle. Letters to designate such a place usually take up space on title pages in work books, accounting documents and certificates.

To bet or not to bet? That is the question!

When preparing documents confirming the involvement of foreign employees, the employer certifies them only if this is provided for in the charter. As for the staffing table, the abolition of the mandatory seal of business companies entailed a complete absence of the need to certify this document. The changes also affected the principle of drawing up an employment contract. The abolition of the organization's seal now implies that there is no need to certify the employment contract with a stamp.

Printing on primary documents

The Tax Code and the Accounting Law do not contain any information about the need to affix a stamp to the organization’s primary documents, even those that indicate income tax expenses. But there are cases when the mandatory certification is established by the procedure for filling out a specific form, or the form itself, or the format for submitting the primary document, developed by the taxpayer. In connection with this subtlety, taxpayers are recommended to warn their counterparties about the need to certify the document, if this is provided for in the form of this document. Also, the abolition of seals for legal entities forces taxpayers to make sure in advance that the counterparty also needs a seal.

Features of affixing

The seal is required to be affixed to all contracts, most personnel documents, as well as to primary documentation. Letters of guarantee and acts have no legal force if they are not stamped. Nothing bad will happen if you put it on a document on which a stamp is not required. However, it should always be placed where its presence may later be needed during legal proceedings.

Some companies develop special provisions or instructions for using the seal. As a rule, it is approved by the manager and contains sections such as a list of stamps used in the organization, their storage location, and the procedure for use.

The stamp is placed only next to the signature of the official who has the right to sign this type of documentation. As a rule, this is either the head of the company or a trusted representative.

The legal meaning of this detail is to certify the signature of that official who is part of the management circle of people working in the company whose name is indicated on the seal.

The imprint cannot be placed next to the signature of an ordinary company employee. It is desirable that the seal does not overlap the official’s signature, is readable and makes it possible to distinguish all the information on it.

Submitting reports to the Federal Tax Service

It is the responsibility of each taxpayer to timely submit a declaration in accordance with the form approved by the Federal Tax Service of Russia and agreed upon with the Ministry of Finance of Russia. If an organization submits reports in paper format, then affixing a stamp is mandatory. This rule is regulated by the instructions of the tax department, which include standards for filling out declarations. The abolition of stamps misled many legal entities, which led to the frequent absence of important details on the submitted declaration and, as a consequence, to its rejection.

In connection with the existence of a rule stating that cases requiring the affixing of a seal must be prescribed in federal laws and the provision of this requirement in by-laws, a paradoxical contradiction arises. Legal force is on the side of the law, that is, conflicting by-laws are not taken into account. However, in order not to risk thinking that the abolition of the seal of business entities also applies to this situation, it is recommended to certify the document with a wet seal until clarifications appear from the competent authorities or changes are made to the orders relevant to this situation. At the same time, as a recommendation, a wish is put forward to include information about the presence of a stamp in the organization’s charter.

Reporting for the Pension Fund of Russia

According to the law on insurance contributions, certification of reports submitted to the Pension Fund of the Russian Federation is not required. This provision also applies to filling out forms such as RSV-1 Pension Fund. But, despite this, in the form itself there is a field that requires a stamp. In this regard, the lack of certification on the RSV-1 Pension Fund leads to a refusal by the receiving authority. Also, making corrections during the process of filling out the calculation requires mandatory certification of the corrections with a seal.

How to submit reports to the Social Insurance Fund and not get rejected

If you study the procedure for filling out reports for submission to the social insurance fund in Form 4-FSS, you will understand that there is a need to confirm the correctness of the data with a seal. In the same way as in the case of data that have undergone changes in the RSV-1 form of the Pension Fund of the Russian Federation, mandatory certification requires the corrected information in the document containing calculations for contributions sent to the social insurance fund. As for the documents requested by the Federal Tax Service, according to the form describing the requirements for the provision of documentation, the organization must submit copies of those papers that are required by the inspection, certified by the signature of the head and the corresponding seal, unless otherwise provided by the legislation of the Russian Federation.

Is a stamp required on the information message required to pay excise duty?

As for information messages aimed at paying excise duty on labeled goods included in the Customs Union and imported into the territory of the Russian Federation from the territory of the union state, no changes are introduced here (specifically for payers). In this case, the need to certify the information letter with a seal is established by the Tax Code of the Russian Federation. This fact is consistent with the new requirements, which necessitates the mandatory use of a stamp.

What did the abolition of stamps lead to, and for whom is it relevant?

The abolition of the organization's seal applies exclusively to companies with the form of ownership of JSC or LLC. It must be available to non-profit and government organizations. As for legal entities that have the opportunity not to use a seal, if they wish, they can carry out their activities using it. To do this, you just need to state this fact in the charter, and then the abolition of the company’s seal will not raise any questions. Until various departments and ministries give official clarifications, it is not recommended to destroy this document certification instrument. It is best to constantly certify a certain group of documents with a stamp to avoid the possibility of their rejection by the receiving service.

So is a seal needed for an individual entrepreneur or LLC?

You have the right to work without it, but in some cases the lack of a seal can lead to certain difficulties. It’s better to do it and have it on hand - if you have a seal, be sure to use it when signing any documents.

Key words for this article: is a seal needed for an LLC, is a seal needed for an individual entrepreneur, is it necessary to register the seal of an individual entrepreneur with the tax office, is it necessary to register the seal of an LLC with the tax office, in what cases is a seal affixed, can an individual entrepreneur work without a seal, an individual entrepreneur without a seal basis, what seal is needed for an individual entrepreneur, what seal is needed for an LLC, what documents are needed for an LLC seal, what documents are needed for an IP seal, can an LLC operate without a seal, requirements for an LLC seal, requirements for an individual entrepreneur seal