The new DAM 2021 form comes into force in February 2021 - you must submit a report for 2021 using it. Federal Tax Service Order No. ED-7-11/ [email protected] , which made changes, was published on October 15, 2020 on the official website of the tax service.

The calculation of insurance premiums is now filled out according to new standards: changes affected the title page and codes, and a new application was added. The innovations are primarily relevant for IT companies, especially the added application 5.1.

In this article we will look at the main changes made by the October Order of the Federal Tax Service.

Are there reduced insurance premium rates for SMEs in 2021?

Federal Law No. 102-FZ dated April 1, 2020 not only introduced a reduced tariff for SMEs from April 2021, but also made amendments to the Tax Code of the Russian Federation. The list of insurance premium payers for whom reduced rates apply has been supplemented with a new category (clause 17, clause 1, article 427 of the Tax Code of the Russian Federation):

- For payers of insurance premiums recognized as small or medium-sized businesses in accordance with Federal Law No. 209-FZ dated July 24, 2007 “On the development of small and medium-sized businesses in the Russian Federation” in relation to the portion of payments in favor of an individual determined based on the results of each calendar month as an excess over the minimum wage established by federal law at the beginning of the billing period.

And also, Art. 427 of the Tax Code of the Russian Federation has been supplemented with clause 2.1, according to which for payers specified in clauses. 17, starting from 2021, the following reduced insurance premium rates apply:

1) for compulsory pension insurance:

- within the established limit value of the base for calculating insurance premiums for this type of insurance - 10%;

- above the established maximum base for calculating insurance premiums for this type of insurance - 10%;

2) for compulsory social insurance in case of temporary disability and in connection with maternity - 0%; 3) for compulsory health insurance - 5%.

Thus, SMEs in 2021 and beyond continue to apply a reduced tariff to the part of the base for a calendar month that exceeds the minimum wage.

Calculation according to form 6-NDFL for 9 months of 2021

The calculation in form 6-NDFL for 9 months of 2021 is submitted to the tax authorities in the form approved. by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected]

The change in the form and format of 6-NDFL is planned only from 01/01/2021 (for more details, see the article “The Federal Tax Service will change the form of 6-NDFL”).

Let us recall the basic principles and features of filling out a report in “1C: Salary and Personnel Management 8” edition 3.

Formation of calculations according to form 6-NDFL in the program is carried out automatically.

To correctly generate the calculation, it is necessary that the program contains:

- all income received by individuals during the tax period is reflected;

- information on the right to tax deductions (standard, professional, property, social, advance payments for personal income tax) has been entered and the actual deductions provided have been reflected;

- The amounts of calculated and withheld tax were calculated and taken into account.

Title page

The date of signing the report indicated on the title page affects the automatic completion of the calculation in Form 6-NDFL, namely, the completion of line 080 of Section 1.

Line 080 “Amount of tax not withheld by the tax agent” is filled in according to the program’s accounting data determined as of the date of signing the report.

Thus, the signature date on the title page must be greater than or equal to the date of payment of income for the last month included in the reporting period. If on the date of signature the entire salary has been paid, line 080 will be zero.

Section 1

In Section 1, the indicators are formed on an accrual basis from the beginning of the tax period.

For each tax rate, separate blocks of lines 010–050 are filled in. Lines 020–045 are formed by the date of receipt of income.

In the 1C: Salaries and Personnel Management 8 program, edition 3, the date of receipt of income is determined as follows:

- for income in the form of wages (income codes 2000, 2530) - as the last day of the month for which income was accrued (or the date of dismissal, if the employee was dismissed);

- for other income, the date of receipt of income is according to the payment date specified in the income payment document (Statement to the bank; Statement to the cash desk; Statement through the distributor; Statement to the accounts).

To analyze income by the date of actual receipt of income, use the report Summary certificate 2-NDFL (section Taxes and contributions - Reports on taxes and contributions), fig. 5.

Rice. 5

Section 2

In Section 2 of the 6-NDFL calculation, information about the actual income received and the tax withheld from this income is filled in.

The section is filled out according to the deadline for transferring the tax - in which reporting period (quarter) the deadline for transferring the tax falls (line 120), the operation should be included in the calculation for such a period.

Let us recall that the lines of Section 2 reflect:

- line 100 - date of actual receipt of income;

- line 110 - the tax withholding date is the date of actual payment.

In the program, tax is withheld using payment documents (statements). The amount of tax withheld in the statement is calculated automatically. And in the event of a discrepancy between the planned payment date specified in the accrual document and the actual date in the statement, when posting the Statement document, the date of receipt of income for income accounted for by the payment date is redefined by the date indicated in the statement. For example, in the Vacation document, the planned payment date was indicated as 09/30/2020, but vacation pay was actually paid on 10/01/2020, the date of receipt of income in this case will be 10/01/2020.

To analyze the total amount of withheld personal income tax, use the Withheld personal income tax report (section Taxes and contributions - Reports on taxes and contributions).

Line 120 reflects the date no later than which personal income tax must be transferred. For example, if this is a temporary disability benefit (including a benefit for caring for a sick child), vacation pay, then the transfer period is until the end of the month in which such income was paid. All other income, including wages, is the next day after tax is withheld. If the tax payment deadline falls on a weekend, it is postponed to the next working day.

The actual date of transfer is not reflected anywhere in the report. But it is important to control the actual dates of personal income tax transfer and the dates in line 120, since the data is verified by the Federal Tax Service with the tax agent budget settlement card (CRSB NA). If the date on line 120 is less than the date of actual payment of the tax amount (line 140), then during the inspection the inspection will reflect that the deadline for transferring personal income tax may have been violated, and, most likely, the organization will be charged fines and penalties.

Line 130 reflects the generalized amount of income actually received on the date indicated in line 100. This line is not included in the control ratios of the indicators of the calculation form, i.e. the line is not checked against anything, it is for reference.

Line 140 reflects the generalized amount of tax withheld on the date indicated in line 110. The tax amount is indicated excluding the personal income tax refund amount.

Information about the income actually received and the tax withheld from this income, for which three dates simultaneously coincide (the date of actual receipt of income, the date of tax withholding and the deadline for transferring the tax), are summarized and indicated in one block of lines 100–140.

If at least one of the dates does not match, income and tax withheld from it are reflected separately, i.e., a separate block of lines 100–140 is filled in for them.

To check and analyze the data in Section 2 of the 6-NDFL calculation, use the report Check section. 2 6-NDFL (section Taxes and contributions - Reports on taxes and contributions).

Deadline for submitting the 6-NDFL report

In accordance with the Tax Code, a report in form 6-NDFL for 9 months of 2021 must be submitted no later than November 2, 2020 (clause 2 of Article 230 of the Tax Code of the Russian Federation).

1C:ITS

For more information on preparing calculations using Form 6-NDFL in 1C programs, see the reference book “Reporting on personal income tax” in the “Legislative Consultations” section.

You can submit all necessary regulated reporting to regulatory authorities remotely, without visiting regulatory authorities, using the 1C-Reporting service built into 1C. The service works both in the cloud and through 1C:Link

.

From the editor. What to pay attention to when preparing “salary” reports for 9 months of 2021, see also in the video recording of the lecture dated September 24, 2020 on the 1C:ITS website on the 1C:Lecture Hall page. The video recording is available for everyone to watch.

How to tax contributions above the minimum wage at reduced rates

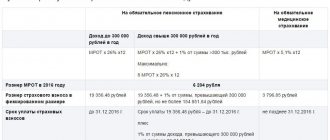

Every month you need to look at whether payments in favor of an individual exceed the minimum wage established at the beginning of the billing period (12,792 rubles in 2021). If they exceed, then reduced insurance premium rates are applied to part of the amount above the minimum wage according to the following scheme:

| Contributions | Bid |

| For compulsory pension insurance | And up to the maximum value of the base (1,465,000 rubles), and above - 10% |

| For compulsory social insurance in case of temporary disability and in connection with maternity | 0 % |

| For compulsory health insurance | 5 % |

When calculating insurance premiums, SMEs must indicate that they apply a reduced tariff. To do this, in Appendices 1 and 2 to Section 1, they must enter the tariff code “20”, and in Section 3, apply the category codes of the insured person: MS, VZHMS, VPMS (Order of the Federal Tax Service of the Russian Federation dated September 18, 2019 No. ММВ-7-11/ [ email protected] as amended on October 15, 2020).

How the DAM will change from 2021: average headcount, new codes and applications

How to apply a reduced tariff - formulas from the Federal Tax Service

After the publication of the law, accountants of small and medium-sized enterprises had many questions. Here are some of them.

How to apply a reduced tariff when calculating contributions if the regulations refer to payments, and contributions are calculated from the base?

How can I distribute amounts across applications with different rate codes?

What to do if the employee’s payments amounted to 16,000 rubles (more than the minimum wage), but 5,000 of them are disability benefits, which are not subject to taxation?

What to do if the base limit has been reached? Should non-taxable payments be distributed according to tariffs in proportion to the minimum wage and the part exceeding it?

The Federal Tax Service explained how to apply the norms of 102-FZ, and published the formulas by which SMEs must calculate contributions (letter of the Federal Tax Service dated April 29, 2020 No. BS-4-11 / [email protected] ). If we adapt them to 2021, we get the following formula:

Minimum wage payments from the beginning of the year × 30% + (base from the beginning of the year - minimum wage payments from the beginning of the year) × 15% - contributions accrued from the beginning of the year.

Minimum wage payments are the amount of payments that is less than or equal to the minimum wage at the beginning of the billing period.

For example, to calculate contributions for January, February and March, perform the following calculation:

- for January: minimum wage payments × 30% + (base for January - minimum wage payments) × 15%.

- for February: minimum wage payments for 2 months × 30% + (base for 2 months - minimum wage payments for 2 months) × 15% - contributions calculated for January.

- for March: minimum wage payments for 3 months × 30% + (base for 3 months - minimum wage payments for 3 months) × 15% - contributions calculated for January-February.

Then proceed by analogy.

When the tax base reaches the limit, tax the excess amount at a reduced rate above the limit. To do this, exclude the excess amount from the base from the beginning of the year. The procedure for calculating the taxable base in the month of excess was explained by the Federal Tax Service in a letter dated July 13, 2020 No. BS-4-11/11315.

Responsibility for late submission of a report

If the deadline for submitting the calculation is violated, the tax office may fine the legal entity or individual entrepreneur 5% of the amount of contributions to be transferred. Interest is calculated for each month of delay, including the day the payment is submitted. In this case, the total amount of the fine will be no less than 1000 rubles, but no more than 30% of the amount. The fine is paid in proportion to each type of contribution to individual BCCs. For example, if a company pays pension contributions at a rate of 22%, and the fine is 1,000 rubles, the pension fund needs to pay 733.33 rubles (22%/30% × 1,000 rubles). The remaining amount will be redistributed between the Social Insurance Fund and the Compulsory Medical Insurance Fund.

If contributions are calculated correctly, but personal data is entered incorrectly, a fine cannot be avoided. If the tax inspectorate discovers discrepancies in the amounts, then if a smaller amount is calculated, the fine will be calculated from the difference between the contributions already paid and the arrears. 5% is charged from this difference, which goes towards paying the fine.

Submit RSV using the online accounting service Kontur.Bukhgalteriya. All forms in the service are up to date, the report is generated automatically based on salary data and undergoes a format and logical check before being sent to the tax office. Get rid of routine, easily keep records, pay salaries and send reports using Kontur.Accounting. The first 5 days of using the service are free for all new users.

What control ratios must be met in the DAM

The situation became even clearer after the Federal Tax Service published the control ratios that must be met for this category of payers in the form of the RSV (letter of the Federal Tax Service dated May 29, 2020 No. BS-4-11 / [email protected] ).

These new control ratios complement the previous list of controls for the DAM form (letter of the Federal Tax Service dated 02/07/2020 No. BS-4-11 / [email protected] ). In the list they are listed under numbers 1.193–1.199, 2.8–2.10. Then these control ratios were supplemented once again (letter of the Federal Tax Service dated June 23, 2020 No. BS-4-11/ [email protected] ).

Let us explain what the wording of these control ratios means.

| Control ratio - wording in the letter from the Federal Tax Service | What does it mean |

| If field 001 adj. 1 rub. 1 SV = 20, then the presence of adj. 1 rub. 1 SV with value 01 in field 001 is required | If there is an application with code “20” in the calculation, then there must also be an application with code “01” |

| If in subsection 3.2.1 p. 3 SV according to FL (according to SNILS + full name indicators) field value 130 = MS, then the presence of subsection 3.2.1 r. 3 SV for this FL with a value in the field of 130 = NR required | If in section 3 of an individual there is subsection 3.2.1 with the code “MS”, then subsection 3.2.1 with the code “NR” must be present |

| If in subsection 3.2.1 p. 3 SV according to FL (according to SNILS + full name indicators) field value 130 = MS, then in subsection 3.2.1 p. 3 SV for this FL with a value in field 130 = NR line 150 for each value of field 120 = minimum wage (based on a base not exceeding the limit value) | If in subsection 3.2.1 there is a line with the code “MS”, then in the line with the code “NR” for the same month the amount in column 150 (base) should be equal to the minimum wage. This requirement applies as long as the base does not exceed the limit |

Thus, the right to apply a reduced tariff appears if the base for calculating contributions for the basic tariff is not less than 12,792 rubles. If less, the reduced rate does not apply that month.

Transfer employees from the previous period and check the DAM for free

Rules for filling out line 010 in the calculation

There are several main recommendations issued by tax and other regulatory authorities.

- If a full season has been worked, then the corresponding column is filled out in the document.

- Presence of code The field is required if code 27-6 is present, associated with special working conditions. The main requirement is that the work actually be done in the field.

- Special attention is paid to determining the number of months that are taken into account and the proportion of future length of service is important. To determine the result, the total number of working days is divided by the total number of days in the month, which is calculated as an average for the year. If necessary, the result is rounded to two digits.

- It is necessary to indicate the total number of calendar days and months that were actually worked at the enterprise.

There is also the so-called average number of employees. Here only the payroll composition is taken into account. But not all employees are included in the average headcount.

Records are kept only for full-time employees of the enterprise. This also applies to those who for some reason did not go to the workplace - for example, due to vacation or downtime at the enterprise. The same rule applies to absenteeism and illness, and being in custody due to an investigation.

Other groups of persons are also subject to registration:

- The owners of the enterprise, if they worked, received wages.

- Student interns who had a full-time position.

- Other people's employees from other companies, if their wages remain unchanged.

The following citizens may not be included in the payroll:

- Performers of work with civil contracts.

- Military personnel and prisoners who were involved in duties under the contract.

- Owners who had no wages.

- If a person submitted a resignation letter and stopped working before the notice period expired.

- Those who were sent abroad and to other employers without pay.

- Part-time workers of external order.

How to fill out a calculation: examples

Let's look at an example of how to apply a reduced tariff when calculating pension insurance contributions and filling out the calculation.

Example 1. The base is less than the minimum wage

Let's take the case mentioned above: in February, an employee received 16,000 rubles, 5,000 of which were disability benefits.

Contributions for February need to be calculated only at the basic tariff, since 16,000 - 5,000 = 11,000 (< minimum wage 12,792 rubles).

If we assume that the employee is paid 16,000 rubles every month and only in April there was a non-taxable amount of 5,000 rubles, then in section 3 you need to fill out two subsections 3.2.1.

- Subsection 3.2.1 with category code HP:

- Subsection 3.2.1 with category code MS:

Accordingly, in section 1 in subsection 1.1 of Appendix 1 with tariff code “01” these amounts will be reflected as follows:

And in Appendix 1 with the tariff code “20” - this way:

Example 2. The base is greater than the minimum wage

Let’s say an employee’s monthly payments are 20,000 rubles. In February, part of this amount was an allowance of 5,000 rubles.

In this case, the base for February is greater than the minimum wage:

20 000 — 5 000 = 15 000 > 12 792

This means that there is an excess from which contributions are calculated at a reduced rate. Let's look at the formula that the Federal Tax Service requires to calculate contributions. The payment for compulsory pension provision amounts to 3,035.04 rubles:

12 792 × 2 × 22 % + (35 000 — 12 792 × 2) ×10 % – 3 535,04 = 5 628,48 + 941,6 — 3 535,04 = 3 035,04

In the calculation in section 3 this will be reflected as follows:

Example 3. Base limit reached

The requirement for an amount equal to the minimum wage in line 150 of subsection 3.2.1 with code NR must be fulfilled only on a basis that does not exceed the size of the limit.

Let’s assume that an employee’s monthly payments are 500,000 rubles; there are no non-taxable payments. In March, we will exceed the maximum value of the base for OPS (1,465,000 rubles). The amount exceeding the limit of 35,000 rubles:

1 500 000 — 1 465 000 = 35 000

The base, which does not exceed the limit, in March is 465,000 rubles (500,000 - 35,000 > minimum wage).

Using the formula for calculating contributions using a reduced tariff, the amount payable for compulsory pension insurance for March is obtained:

38,376 × 22% + (1,465,000 - 38,376) ×10% + 35,000 × 10% – 103,070.08 (contributions for January–February) = 51,535.04 rubles.

The personalized information does not reflect the base exceeding the limit and contributions from it. Here's how to fill out subsection 3.2.1 in section 3 of the calculation with the HP category code:

And here is a sample of filling out subsection 3.2.1 with the MS category code:

The base in excess of the limit and contributions from it will be reflected in subsection 1.1 of Appendix 1 with code 20 in lines 051 and 062.