Due to numerous changes in legislation, the issue of receiving a pension from the state is becoming increasingly relevant. Therefore, citizens are beginning to think about making independent contributions to the Pension Fund in order to obtain additional guarantees for its appointment. Such payments can add missing service and pension points, thereby making it possible to receive monthly payments upon reaching a certain age.

What it is

Each employer must calculate and transfer contributions for workers to the Pension Fund on a monthly basis. In addition to the Pension Fund, it is also worth making contributions to the Social Insurance Fund and the Federal Compulsory Medical Insurance Fund.

The meaning of these payments is that the employer makes certain payments and, in the event of insured events, the fund to which payments are made makes a reverse withdrawal of funds in favor of the employee.

For example, when a person takes sick leave, the Social Insurance Fund pays benefits that should be transferred in case of temporary disability. The Russian Pension Fund does the same thing when it is necessary to pay a pension upon reaching a certain age.

It is worth remembering here that the employer must make pension and other types of contributions from his own funds, and he does not have the right to deduct these amounts from the employee’s salary. As for pension contributions, they are divided into two categories: insurance pension and funded pension.

It is worth noting that since 2014, payments have not been made in favor of the formation of the funded part, since all funds are used to replenish the insurance part.

Payment via Sberbank Online

Payment by details

After this, you need to log into the Sberbank Online service using your username and password. Next, look for the “Payments and Transfers” tab, and then select the Federal Tax Service. Here you will need the previously received receipt - it is from it that you need to take the index for payment by index. First you need to indicate the write-off card, and then enter the index. No commission will be charged with this payment method. Based on the index you entered, the system will find the desired address, after which a payment document will be generated and you will see the form. Let's see if the invoiced amount matches what is indicated on your receipt - if so, then everything is in order and you can continue.

Let us note this: when the payment is just being generated, it may contain different recipient details than in the receipt you received from the Federal Tax Service. You shouldn’t stop there; if you continue, the discrepancy will be eliminated and the payment will go to the required details.

By TIN

If you are not concerned about receiving the payment, then you will still be able to make a pension contribution, but in a different way. Instead of paying by index, you need to select a search by TIN, then enter it - and you will see all your debts. All you have to do from the list is select the one you need and pay for it.

When everything is done, you will only need to confirm the payment via SMS - which is the first time. what with the second method. After that, it will be done, and you will be given a receipt stamped “Completed.” This receipt will be saved in the system, and if you wish, you can always print it to confirm that you deposited the required amount.

When is it produced?

Payments that should go to replenish each person's pension savings must be made on the 15th of each month. At this time, the employer pays contributions for the previous month.

In other words, if the employer makes contributions on October 15, then these contributions are made for the month worked in September.

It is definitely worth remembering the timing of deductions, so that subsequently employees at the enterprise do not have disagreements with employees of the Pension Fund.

How to pay online

If you have already made payments via the Internet using the Sberbank Online service, then pension contributions should not cause you any difficulties. Anyone who has a Sberbank card can use the service, but they must be registered with it. Most often, the user is registered when the card is issued, but if this does not happen, you need to register using an ATM. There is nothing complicated about this, just insert the desired card into the ATM and find the “Connect Sberbank Online” item, and then use it. After this, you will receive a login and password in the system, which you will need to use - and you can always change them using the phone number specified during registration.

Who pays insurance premiums

Contributions to the Pension Fund of the Russian Federation are required to be made by the following categories of persons and enterprises:

- Organizations making payments under any agreements in favor of individuals.

- Individual entrepreneur: for persons in whose favor payments were made for work or services under contracts of any kind, as well as for themselves.

- Notaries, lawyers and other categories of self-employed citizens.

- Individuals, in situations where they make payments under any agreements, and in situations where they do not act as individual entrepreneurs.

How to return to the state pension fund?

A person has the right to return accumulated funds to the state pension fund at his own request or when circumstances arise. The regulatory framework in this case is: Federal Law No. 75, 111. The transfer is made at the request of the citizen. If desired, in the future he will be able to redirect funds again to the management company or non-state pension fund.

Example of an application for transfer of funds to a pension fund

It is mandatory for savings to be sent from NPFs to PFs when:

- death of a citizen;

- deprivation of the NPF license;

- expiration of the contract period;

- declaring the NPF insolvent and opening bankruptcy proceedings.

The return of savings to the Pension Fund is carried out in April of the year following the date of filing the application.

Video - How to return from NPF to PF?

Tariffs in 2021

Despite the fact that changes are constantly being made to the legislative framework in the pension sector, the general tariff for contributions to the Pension Fund does not change. For 2021, it is the same 22% of wages, provided that payments cannot exceed the annual limit.

If it is exceeded, then deductions amount to 10% of earnings.

Those individuals who pay contributions on their own will also pay fixed contributions to the Pension Fund, which amount to 26% of the minimum wage. In this case, this amount is multiplied by 12 months.

It turns out that based on the actual minimum wage, which is 7,500 rubles, the total amount of the fixed contribution for the year will be 23,400 rubles.

Additional tariffs for OPS

Additional tariffs for contributions to the Pension Fund are introduced for those employers who have jobs in hazardous industries. In other words, if they make contributions in favor of those persons who are entitled to receive a preferential pension.

The tariff must be determined in accordance with the given assessment of working conditions, as well as the assigned class.

See when pension payments stop and how to restore them. Will there be an additional payment to the pension after 80 years of age in 2021? Find out in this article.

Exemption from payment of contributions for individual entrepreneurs

For individual entrepreneurs who do not conduct business, but are not excluded from the Unified State Register of Individual Entrepreneurs, Art. 430 of the Tax Code of the Russian Federation provides for exemption from payment of fixed insurance premiums if there are certain grounds.

The main ones:

- conscription into the army;

- being on leave to care for a child up to 1.5 years old;

- when providing care for citizens over 80 years of age, disabled people 1 degree, disabled children;

- if the individual entrepreneur lives abroad together with a spouse working in organizations included in the list approved by the Russian Government;

- if the entrepreneur lives with his spouse, a contract military serviceman, in places where there is no employment opportunity.

To take advantage of the benefit, you must submit applications to the tax office at your place of registration, attaching supporting documents.

Amounts not subject to taxation

It is worth remembering that, unlike the personal income tax, which is taken into account in accordance with bonuses, salaries and the employee’s regional coefficient, the amount according to insurance premiums is not included in the salary. In other words, an employee at an enterprise receives a salary minus personal income tax.

As for the situation with the payment of funds to the Pension Fund, the payer must transfer a certain amount based on income, but not withhold this amount from the salary.

We reduce income tax through contributions

An individual entrepreneur can reduce the tax on income received by the amount of fixed insurance premiums. If an entrepreneur has employees, then the contributions actually paid for them also reduce the tax base, but only by 50% of their amount.

And again an example!

Let’s say that individual entrepreneur Ivan Ivanovich Ivanov paid fixed payments in full - 36,238 rubles.

In addition, Ivan is an employer. He paid for his 3 employees, who worked for a whole year with a salary of 20,000 rubles/month, insurance premiums totaling 20,000 * 3 * 12 * 30.2% = 217,440 rubles.

Income for 2021 amounted to RUB 2,050,000. The tax was calculated as 2,050,000*6%=123,000 rubles.

We can reduce the tax by: 123,000 * 50% = 61,500 rubles, because the deduction cannot be more than 1/2 of the original tax. The total amount of contributions paid is RUB 253,678. This is more than the amount of the allowable reduction, so he will have to pay 61,500 rubles. : (123,000 – (123,000*50%))

Let's change the situation a little:

Initial data:

- fixed payments paid for 2021 - 36,238 rubles.

- employee salary – 37,100 rubles.

- insurance premiums for employees – 11,204 rubles.

- tax for 2021 123,000 rub.

Individual entrepreneur Ivanov will be able to reduce the tax by no more than: 123,000 * 50% = 61,500 rubles,

Let's calculate the tax payable taking into account the benefits: 123,000 – (36,238+11,204) = 75,558 rubles.

In this case, we included in the reduction the full amount of paid insurance premiums, because it is less than 50% of the calculated tax.

How can you find out the amount of contributions to the Pension Fund from your salary?

The amount of deductions should depend on the status of the payer. For those enterprises that operate under the general tax regime, it is 22% of earnings. 10% may also be added in situations where the amount of income is more than 800,000 rubles.

This amount should be calculated based on the total amount of wages for each employee.

Organizations that use the simplified system must pay 20%. Individual entrepreneurs pay the same rate for their employees.

How can I find out where the amount has been transferred?

Sometimes, when an employer centrally registers its employees in a non-state pension fund or for other reasons, a citizen does not know or doubts where his savings are. There are several ways to clarify this information:

- contact your local PF office;

- find out information from the accounting department of the employing enterprise;

- enter SNILS on the State Services resource in your personal account;

- contact the bank with which the Pension Fund cooperates (Sberbank, Bank of Moscow, and so on).

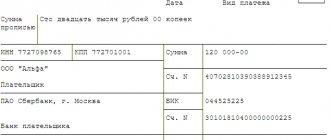

Payment details

It is important to understand that for fruitful cooperation with the Russian Pension Fund, it is necessary to have the details according to which all contributions must be paid. If an employer or self-employed citizen makes a payment using incorrect details, then in this case it will be very difficult to prove that the payment was made on time.

And these deductions will not be easy to credit to the required account.

That is why we provide a list of details for paying various categories of insurance premiums:

- To pay for the formation of the insurance part of the labor pension.

- For payment towards the formation of the funded part of the pension.

- Contributions for compulsory medical insurance, which are credited to the FFOMS budget.

- Contributions for compulsory medical insurance, which are credited to the TFOMS budget.

Budget classification codes

The following list contains budget classification codes for various types of insurance contributions paid by employers and self-employed citizens:

- For payments for the formation of the insurance part of the pension - 39210202010061000160.

- For payments to form the funded part of the pension – 39210202020061000160.

- Contributions for compulsory health insurance, which are credited to the FFOMS budget - 39210202100081000160.

- Contributions for compulsory medical insurance, which are credited to the TFOMS budget - 39210202110091000160.

How to pay dues to an entrepreneur - possible options

There are many options for paying fixed insurance premiums.

Here are the most popular ones:

- make payments from your bank card through your personal account (PA) of the bank;

- through the personal account of the taxpayer-individual entrepreneur on the official portal of the tax department;

- by generating a receipt on the Federal Tax Service website in the “Payment of taxes and duties” section and paying it at any bank;

- by debiting the amount from the individual entrepreneur’s current account (if there is one) according to the payment order.

Detailed video instructions on paying contributions on the tax office website:

The individual entrepreneur makes payments from his current account.

Procedure for transferring funds

All contributions are calculated by the accounting department employees, thus, all payments in favor of the employee are multiplied by the amount at the insurance rate. This formula is the same for each enterprise - it cannot depend on the taxation regime.

Accounting for the reporting period accrues 22% of the earnings of workers in the Pension Fund. If the salary reaches a level of more than 624,000 rubles, then the tariff should be 10%. For example, if an employee receives 20,000 rubles every month, the accounting department accrues 4,400 rubles every month.

For some enterprises, preferential rates for insurance premiums are provided. For example, for the field of information technology it should be 8%. As for employee income, employers pay contributions at an increased rate - 6% more.

This applies to those citizens who are employed in heavy production.

Advantages and disadvantages of non-state pension funds

It is believed that leaving savings in a state pension fund is beneficial if the period before retirement is less than 10 years. In other cases, most citizens prefer to use the services of non-state pension funds. There are several types of non-state funds. The citizen decides which of them to contact himself, based on an analysis of financial indicators and ratings.

Table 2. Classification of non-state pension funds

| Type | Description | Examples of funds |

| Captive | Mainly promotes corporate pension plans of founders, while reserves significantly exceed savings | Transneft (related structure - Transneft), Gazfond (Gazprom), Blagostostoyanie (Russian Railways), Neftegarant (Rosneft) |

| Corporate | They also serve programs of founders and related structures, however, the share of savings for retirement grows annually, and a client base is also attracted for this purpose | "Welfare", "Norilsk Nickel" |

| Regional | They are formed with the support of territorial authorities. Operate within specific regions | "Khanty-Mansiysk NPF", "Erel" |

| Universal | They are independent of large financial and industrial organizations and serve citizens and organizations. The assets mainly involve pension savings | "European PF", "Raiffeisen", "KIT Finance" |

The advantages of NPFs include:

- usually higher returns compared to state pension funds. This is due to the flexibility of managing NPF funds;

- the ability to track the status of your account online;

- contractual relations ensure the preservation of uniform provisions of cooperation for the entire period of validity of the document;

- openness - annual provision of financial information on the activities of the fund;

- security - citizens' savings are subject to insurance; in case of bankruptcy or license revocation, they will be returned by the state.

The disadvantages of NPFs include:

- profitability depends on the fund’s investment results and its position in the financial market. Since savings are not subject to indexation by the state, their annual increase is not guaranteed;

- difficulty in choosing a fund. There are about 125 organizations in the Russian Federation, the ratings of which are determined by special agencies. However, to make the right choice, a citizen must independently analyze the indicators and reliability of the NPFs presented. Some of them offer unfavorable conditions, delay payments, make mistakes in charges, and so on. Therefore, it is important for a citizen to collect as much information as possible about the institution to which he intends to entrust his savings.

How to check using SNILS

Contributions to the Pension Fund must be reflected in the individual account of each citizen. In other words, on a personal personal account. It is important to remember that in a situation where a person decides to use his funded pension, he can find out the amount of pension savings by using his SNILS number.

In order to do this, you must contact the Pension Fund employees and provide all the necessary contact information to formulate a request.

Where can I transfer the funded part of my pension?

If a person leaves money in a state pension fund, it is managed by Vnesheconombank. The positive side is the guaranteed return of funds, but you can hardly count on a significant increase in them. Therefore, future retirees prefer to transfer amounts to third-party organizations. Two main options for transferring accumulated funds are presented in the table. Both institutions operate a mechanism for calculating interest on client deposits, that is, on the specified part of the pension.

Table 1. Options for transferring pension savings

| Organization | Description |

| Management Company (Management Company) | The functions of the institution include trust management of clients' benefits. Activities are regulated by Federal Law No. 156 of November 29, 2001 (as amended on December 30, 2015) |

| NPF (Non-state pension fund) | It is mainly created on the basis of an industrial or credit institution. Operation is regulated by Federal Law No. 75 of 05/07/98 (as amended on 12/30/15) |

The options differ in that the citizen enters into an agreement with the NPF, but this is not required with the management company. In the latter case, an application is submitted to the Pension Fund with a request to transfer funds to a financial institution.

Example of an application for transfer of funds to the management company