All individual entrepreneurs operating legally are required to make timely insurance contributions. If an entrepreneur has employees on a contractual basis, he is already the policyholder and pays insurance premiums for them. If the entrepreneur does not have employees, then he makes contributions, thus insuring himself. Contributions can be general or fixed. It is in the second case that fixed contributions take place. What role does KBK 39210202140062100160 play here, we will look into it below.

Insurance premiums for individual entrepreneurs for themselves in 2021 are fixed

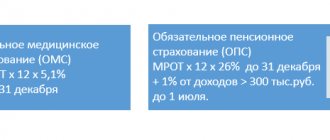

Throughout the year (last day December 31, 2021), each individual entrepreneur registered in this status before 01/01/2016 is required to pay the following fixed insurance premiums for 2021:

- Fixed insurance contributions to the Pension Fund: 19,356.48

- Fixed insurance contributions to the Federal Compulsory Compulsory Medical Insurance Fund: 3,796.85

- not paid for 2021

The amounts of contributions are calculated based on the minimum wage applied from January 1, 2016, equal to 6,204 rubles.

Pension Fund: 6204 * 26% * 12 months. = 19,356.48 rubles.

FFOMS: 6204 * 5.1% * 12 months. = 3,796.85 rubles.

Contributions in the above amounts can be paid immediately, that is, in a lump sum, or they can be transferred every month or once a quarter.

In the latter case, the amounts paid during the reporting (USN 6%) or tax (UNDV) period can significantly reduce the amount of tax under special regimes, if the individual entrepreneur does not have employees. For these purposes, you can take the required amounts from the table below. Amounts of fixed insurance premiums for individual entrepreneurs for themselves in 2021

| Type of insurance premiums | In year | Per quarter | Per month | In a day |

| Fixed contributions to the Pension Fund | 19356,48 | 4839,12 | 1613,04 | 53,03 |

| Fixed contributions to the FFOMS | 3796,85 | 949,21 | 316,404 | 10,40233 |

Throughout the year, you can transfer any amounts in parts, even less than indicated in the table for a month or quarter. You will not be charged any penalties or fines for this. The main thing is that when you pay the last payments of the year, first add up all the previously transferred amounts. Subtract the contributions already paid from the amounts of fixed contributions for the year, and indicate on the payment slip or receipt exactly the remaining amount for both the Pension Fund and the Federal Compulsory Medical Insurance Fund.

To the Pension Fund of the Russian Federation, the entire amount of fixed contributions must be transferred in one payment using the KBK for payment of the insurance part of the labor pension (calculated from the amount of the payer’s income, not exceeding the income limit of 300,000 rubles).

Even in the case where an individual entrepreneur has submitted an application to the Pension Fund for dividing insurance contributions into an insurance and funded part or for transferring the funded part of contributions to a non-state pension fund.

KBK 18210202140061200160 in 2021 and 2021 for individual entrepreneurs

The article covers the topic of KBK 18210202140061200160 for the payment of insurance premiums for compulsory pension insurance by individual entrepreneurs until 2021, as well as in 2021 and 2021.

The text provides for individual entrepreneurs a decoding of KBK 18210202140061200160 for 2018 and 2021. Let us analyze what tax individual entrepreneurs will be able to pay under KBK 18210202140061200160 in 2021 and 2021, and what name of payment should be indicated.

In determining the scope of application in 2021 and 2021, KBK 18210202140061200160 will be helped by deciphering the code, which will tell you what tax and for what period the individual entrepreneur can pay under this KBK.

Insurance premiums of individual entrepreneurs for themselves for 2015 in the amount of 1% over 300,000 rubles

If the total income (total for all types of activities and all tax regimes) of an individual entrepreneur for 2015 exceeded 300 thousand rubles, from the amount of income minus 300,000 rubles it will be necessary to transfer 1% of insurance contributions to the Pension Fund no later than April 1, 2021. However, there is an upper limit on the amount of such contributions.

The maximum amount of all fixed contributions to the Pension Fund for 2015: 148,886.40 rubles.

From this amount you need to subtract fixed contributions for all individual entrepreneurs (in 2015) - 18,610.80 rubles.

The maximum contribution amount of 1% to the Pension Fund for 2015: 130 275,60

rubles

If your 1% for 2015 from an amount of income over 300 thousand rubles turned out to be more than 130,275 rubles. 60 kopecks, then by April 1, 2021 you in any case must pay only 130,275.60 rubles and not a penny more! If you have already overpaid, you should write to the Pension Fund an application to offset the amount of overpayment against insurance premiums in 2021 (the application form has changed).

Attention!

We pay contributions in the amount of 1% of the excess income only to the Pension Fund!

Why do they change the KBK?

Changes in the BCC often accompany general changes and amendments to existing legislation. At the same time, naturally, the entrepreneurs themselves suffer, because it would be much easier to pay fees and taxes. If the codes were set once and were not subject to changes. Naturally, neither the tax services nor the Ministry of Finance comment on the reasons for the changes. But entrepreneurs put forward some assumptions:

- The amounts suspended in uncertainty, transferred “to the wrong address” as a result of incorrectly indicated BCCs, due to the complexity of their return, can be used by the state for a long time for its own purposes

- Formation of additional sources of budget revenue, since late payments generate fines and penalties, and it is quite difficult to prove timely payment when an incorrect BCC was used

- Changes in the structure of legislative documents entail a change in the purpose of payments

Insurance premiums for individual entrepreneurs for themselves for 2021 in the amount of 1% over 300,000 rubles

As soon as the total income of individual entrepreneurs for all types of activities carried out and for all tax regimes exceeds 300,000 rubles from the beginning of 2016, you can begin to pay fixed insurance contributions to the Pension Fund in the amount of 1% of the amount exceeding 300 thousand. But you don’t have to rush. It is enough to pay only the fixed contribution amounts established for all individual entrepreneurs by December 31, 2016. And the amount of 1% will need to be transferred no later than April 1, 2021, immediately or in parts.

Maximum amount of contributions to the Pension Fund for 2021: 154,851.84 rubles.

From this amount you need to subtract fixed contributions to the Pension Fund for all individual entrepreneurs - 19,356.48 rubles.

The maximum contribution amount of 1% to the Pension Fund for 2021: 135 495,36

rubles

If your 1% from the amount of income for 2021 over 300 thousand rubles turned out to be more than the above amount in bold, then until 04/01/2017 you in any case must pay only 135,495.36 rubles and not a penny more! If you suddenly overpaid, submit an application to the Pension Fund to offset the amount of the overpayment against the payment of fixed contributions in 2021. If the overpayment is significant, you can write a request for a refund of overpaid insurance premiums. However, these applications can only be submitted after the end of 2021. Application forms change from time to time, please note.

Attention!

We pay contributions in the amount of 1% of the excess income only to the Pension Fund!

Decoding income items for the estimate

| Decoding of income items for 2018-2019. | ||||||||||||

| Nn/n | Name of income | price (rub, kopecks) per unit area | Amount per month (RUB) | Period | Amount per year (RUB) | |||||||

| 1. | Maintenance of housing per sq.m. | |||||||||||

| * 33341.6 sq.m. x 12.93 rub. | 12,93 | 431 107 | 12 months | 5 173 283 | ||||||||

| 2. | Current repairs with sq.m.. | |||||||||||

| * 33341.6 sq.m. x 5.07 rub. | 5,07 | 169 042 | 12 months | 2 028 503 | ||||||||

| 3. | Payment for HOA services for the maintenance of common property and management of apartment buildings under an agreement with ZAO NZhS-2 (block 5 of the housing section), including: | 94 502 | 12 months | 1 134 027 | ||||||||

| 3.1 | Housing maintenance | 82 744 | 12 months | 992 926 | ||||||||

| 3.2 | Maintenance | 11 758 | 12 months | 141 102 | ||||||||

| 4. | Income from leasing MKD structures for advertising | 500 | 66 600 | 12 months | 796 254 | |||||||

| 5. | Other income | 311 053 | 4 535 428 | |||||||||

| 5.1 | Income from leasing structures and space for placing telecommunications equipment and HVAC: 1) Zap-SibTranstelecom CJSC - 3250.00; 2) JSC "Teleconnect" - 1200.00; 3) MegaCom LLC - 3000.00; 4) Novotelecom LLC - 2200.00; 5) PJSC Rostelecom - 4000.00 | 13 650 | 12 months | 163 800 | ||||||||

| 5.2.1 | 33341.6 sq.m x 2.09 rub. | 2,09 | 69 726 | 12 months | 836 712 | |||||||

| 5.2.2 | Territory control post services paid for by JSC NZhS-2 5 block section - 5682.6 sq.m x 2.09 rub. | 2,09 | 11 877 | 12 months | 142 524 | |||||||

| 5.3 | Maintenance and operation of elevators per sq.m. (33341.6 sq.m. x 1.31 rub.) | 1,31 | 43 677 | 12 months | 524 124 | |||||||

| 5.4.1 | Payment for services for maintaining a watch - 24753.4 sq.m x 5.80 rubles. | 5,80 | 143 570 | 12 months | 1 722 836 | |||||||

| 5.4.2 | Payment for watch maintenance services (video surveillance) - 4636 sq.m x 2.85 rubles (3rd and 4th entrances) | 2,85 | 13 213 | 12 months | 158 556 | |||||||

| 5.5 | Solid waste removal - 39024.5 sq.m x 1.36 rubles | 1,36 | 53 073 | 12 months | 636 876 | |||||||

| 5.6 | Other income penalties, bank interest, etc. | 29 167 | 12 months | 350 000 | ||||||||

| * area of premises excluding the area of apartments in the 5th block section (6th entrance, property of JSC NZhS-2″) | ||||||||||||

| 13 667 495 | ||||||||||||

| Chief accountant Gustova L.Yu. | ||||||||||||

| 03.09.2018 | ||||||||||||

How to calculate income under different tax regimes in 2021

In order to determine whether you need to pay something else for the past year to the Pension Fund of the Russian Federation or not, you need to calculate the income of the individual entrepreneur for the reporting period. If you apply only one tax regime, then there should be no problems. As a rule, by April individual entrepreneurs submit tax returns for the year, or at least they have already filled them out. In this case, the income of the individual entrepreneur, for the purpose of calculating insurance contributions to the Pension Fund in a fixed amount, is taken from the tax return:

- On OSNO - the amount in line 110 (clause 3.1) minus the amount in line 120 (clause 3.2) of sheet B

of the 3-NDFL declaration;

* - On OSNO - line 030 (clause 2.1) of sheet B of

the 3-NDFL declaration (KND Form 1151020); - On the simplified tax system - with the object of taxation Income (USN 6%) line 113 of Section 2.1.1

of the declaration; - On the simplified tax system - with the taxable object Income-expenses (15% simplified tax system), line 213 of Section 2.2

of the declaration; - On UTII - the sum of lines 100 of all Sections 2

of the declarations

for 2015

(we add up the amounts for these lines in the declarations for the 1st, 2nd, 3rd and 4th quarters); - On the Unified Agricultural Tax - line 010 of Section 2

of the declaration (Form according to KND 1151059); - On PSN - potential income - tax base (indicated in the patent).

if you don’t want disputes, you can use the previous option and pay extra fees:

If you apply the UTII regime in several municipalities at once, you need to add up the calculated income for all UTII declarations for the year in all municipalities.

If an individual entrepreneur has received several patents for different types of activities, or in different regions of Russia, it is necessary to sum up the potential income for all patents received during the year.

If you use several tax regimes simultaneously for different types of activities, then you need to add up the income from them. The resulting amount will be the total income, from which 300 thousand rubles must be subtracted. Compare the remaining amount with the 1% limit for 2015 or 2021. If the balance is less than the maximum contribution amount, divide it by 100. You will get the amount in rubles and kopecks, which must be transferred to the Pension Fund by April 1, 2016 (for 2015) or 2021 (for 2016) inclusive.

*

Taking into account the Resolution of the Constitutional Court of the Russian Federation of November 30, 2021 No. 27-P. Just don’t forget to first calculate the benefits, since you will have to pay additional personal income tax and pay tax penalties, as well as submit updated returns.

Budget classification codes introduced from January 1, 2021

- About Kaluga Yesterday History of the city

- Memorable dates

- Memorable places

- Official symbols

- Strategic initiatives of the President of the Russian Federation

- Page of the City Mayor Information about the City Mayor

- Structure

- General information

- Internal municipal financial control

- Electronic resume

- List of institutions and enterprises

- Projects of legal acts Projects of municipal legal acts

- City Charter

- General information

- Legislation

- Housing and communal services Consumption standards

- Regulatory acts

- Traffic pattern

- Road repair plan

- Improvement and landscaping

- Civil protection General information

- Targeted assistance

- List of TOS of the city of Kaluga

- Children's holidays

- Data bank on orphans

- Heroes among us

- Contact details

- Property complex Municipal property

- Contacts

- General information

- Business news

- Important information

- Restriction and seizure of land Seizure of land plots

- Public hearings and public discussions

- Public hearings and public discussions

- The decision to develop documentation

- Permits for excavation work

- Public discussions

- Heat supply

- Budget and budget process Formation of a draft budget

- Budget execution reports

- UPFR in Kaluga Addresses and contacts

- Addresses and contacts

- The Cadastral Chamber informs

- Clarifications of legislation

- Credit organizations

- General provisions

- General information

- Contacts