Exchange differences when conducting export-import transactions

All Russian organizations are required to keep accounting records in rubles. If they settle with the counterparty in foreign currency, then the transaction amount must be converted into rubles.

In general, recalculation should be made at the current exchange rate of the Central Bank of the Russian Federation. But if the contract specifies a different procedure for determining the exchange rate (currency clause), then the terms of the contract must be used (clause 5 of PBU 3/2006).

But transactions, especially export-import transactions, rarely take place in one day, so the exchange rate will change during the validity of the contract. This is one of the reasons for exchange rate differences.

If a company purchased goods from a foreign counterparty on a deferred payment basis, then on the delivery date the accountant must register it, reflecting the amount in rubles at the current Central Bank exchange rate.

But on the date of payment for the goods, the rate will most likely be different. Therefore, the company will pay the foreign supplier an amount different from the one at which the goods were registered.

If the exchange rate increases, a negative exchange rate difference arises - an additional expense. The company will need a larger amount in rubles for payment than the initial assessment of the goods. If the exchange rate decreases by the time of payment, the exchange rate difference will be positive - the company will save ruble funds.

In such cases, exchange rate differences in accounting should be reflected in account 91 “Other income and expenses”: negative - on debit, and positive - on credit.

Features of accounting under the simplified tax system

For companies using the simplified tax system, exchange rate differences from transactions related to the purchase and sale of foreign currency are subject to accounting. But only on condition that it is positive.

The basis for such accounting is the explanation of the Ministry of Finance that transactions in the non-banking sector for foreign currency exchange are not the sale of goods. They become such only for banking institutions. For them, foreign currency is property for sale, and therefore a commodity.

For companies using the simplified tax system, the purchase of foreign currency and its sale for domestic currency are operations that:

- related to foreign currency circulation;

- do not apply to its sale.

Exchange differences with plus or minus arising from foreign currency purchase and sale transactions should be taken into account in non-operating income. When the foreign currency was sold above the official quotation, a positive exchange rate difference appears. It is this that should be included in non-operating income.

Example 1

Alpha LLC purchased goods from a foreign supplier in the amount of 1,000 euros with deferred payment. On the date of delivery, the euro exchange rate was 75 rubles, and on the date of payment – 78 rubles. Thus, the goods were registered at a cost of 75 x 1000 = 75,000 rubles, and when paying, the company spent 78 x 1000 = 78,000 rubles on the purchase of currency. A deviation of 3,000 rubles is a negative exchange rate difference.

DT 41 – KT 60 (RUB 75,000) – goods purchased and registered at the exchange rate on the date of purchase

DT 60 – CT 52 (RUB 78,000) – goods paid at the exchange rate on the date of payment

DT 91.2 – KT 60 (3000 rub.) – negative exchange rate difference

Exchange rate differences are determined similarly if the company itself supplies goods to foreign buyers with deferred payment. Sales proceeds must be determined at the Central Bank exchange rate on the date of shipment, and exchange rate differences must be calculated based on the exchange rate on the date of payment.

VAT from the buyer

In any case, the buyer accepts VAT for deduction in the amount in which the tax is indicated in the invoice. And if exchange rate differences arise, it takes them into account in non-operating income or expenses (clause 1 of Article 172 of the Tax Code of the Russian Federation).

EXAMPLE The price of a product is USD 23,600, including VAT at a rate of 18% (USD 3,600).

The cost of the goods without VAT is USD 20,000 (USD 23,600 – USD 3,600). The goods are paid for in rubles at the Central Bank exchange rate established on the date of payment. An advance in the amount of 50% of the price of the goods under the contract was transferred on April 25. The item was shipped on May 25th. The final payment was made on June 8. The US dollar exchange rate set by the Central Bank was: – as of April 25 – 66.2 rubles/dollar; – as of May 25 – 67 rubles/dollar; – as of May 31 – 65.5 rubles/dollar;– as of 06/08 – 66 rubles/dollar. The amount of the transferred advance amounted to 781,160 rubles. ($23,600 × 50% × 66.2 RUR/USD). The amount transferred in the final settlement is RUB 778,800. ($23,600 × 50% × 66 RUR/USD). Accounting with the seller

Upon receipt of an advance, the seller will calculate VAT in the amount of 119,160 rubles.

(RUB 781,160 × 18 / 118). Upon shipment, the seller: – recognizes revenue in tax accounting (less VAT) in the amount of RUB 1,332,000. ($20,000 × 50% × 67 rubles/dollars + 781,160 rubles – 119,160 rubles); – recognizes revenue in accounting (including VAT) in the amount of 1,571,760 rubles. ($23,600 × 50% ×67 rub./dollar + $781,160); – will charge VAT in the amount of 239,760 rub. ($20,000 × 50% × 67 rubles/dollars × 18% + 119,160 rubles); – will deduct VAT calculated on the advance in the amount of 119,160 rubles. On the last day of May, the seller recognizes expenses in accounting and tax accounting negative exchange rate difference in the amount of 17,700 rubles. (USD 23,600 × 50% × (65.5 RUR/USD – 67 RUR/USD). Since due to this difference the accounts receivable decreased, it is negative for the seller. On the date of final settlement, the seller recognizes it in income in accounting and tax accounting, a positive exchange rate difference in the amount of 5,900 rubles (23,600 dollars × 50% × (66 rubles/dollar – 65.5 rubles/dollar)). Since due to this difference, accounts receivable increased , then for the seller it is positive. In accounting, the entries will be as follows: as of April 25: DEBIT 51 CREDIT 62-advance

- 781,160 rubles - advance received from the buyer;

DEBIT 62-advance CREDIT 68-VAT

- 119,160 rubles - VAT charged from advance;

as of May 25: DEBIT 62 CREDIT 90

- 1,571,760 rubles - revenue from the sale of goods is recognized;

DEBIT 90 CREDIT 68-VAT

- 239,760 rubles - VAT is charged on shipment;

DEBIT 62-advance CREDIT 62

- 781,160 rubles . - the received advance is credited;

DEBIT 68-VAT CREDIT 62-advance

- 119,160 rubles - accepted for deduction of VAT on the advance;

as of May 31: DEBIT 91 CREDIT 62

- 17,700 rubles - negative exchange rate difference is reflected;

as of 06/08: DEBIT 51 CREDIT 62

– 778,800 rub.

– received money from the buyer for final payment; DEBIT 62 CREDIT 91

5900 rub.

– a positive exchange rate difference is reflected. Accounting with the buyer

Upon receipt of the seller's invoice for the amount of the transferred advance, the buyer will deduct VAT in the amount indicated in the invoice - 119,160 rubles.

(RUB 781,160 × 18/118). After shipment, the buyer will accept the goods for accounting and tax accounting at a cost of RUB 1,332,000. ($20,000 × 50% × 67 RUR/USD + 781,160 RUR – 119,160 RUR). Upon receipt of the seller's invoice for shipment, the buyer will deduct VAT in the amount indicated in the invoice, – 239,760 rub. ($20,000 × 50% × 67 rubles/dollars × 18% + 119,160 rubles), and VAT in the amount of 119,160 rubles, previously accepted for deduction from the advance payment, will be restored. On the last day of May, the buyer recognizes in income in accounting and tax accounting there is a positive exchange rate difference in the amount of 17,700 rubles. (USD 23,600 × 50% × (RUB 65.5/USD – RUB 67/USD). On the date of final settlement, the buyer recognizes a negative exchange rate difference in accounting and tax accounting expenses in the amount of RUB 5,900 ( $23,600 × 50% × (66 rub./dollar – 65.5 rub./dollar)).The accounting entries will be as follows: as of April 25: DEBIT 60-advance CREDIT 51

– 781,160 rub. – transferred advance to the seller;

DEBIT 68-VAT CREDIT 60-advance

- 119,160 rubles - accepted for deduction of VAT on the advance;

as of May 25: DEBIT 41 CREDIT 60

- 1,332,000 rubles - goods accepted for accounting;

DEBIT 19 CREDIT 60

- 239,760 rub. – input VAT is reflected;

DEBIT 60-advance CREDIT 68-VAT

– 119,160 rub. – VAT on the advance is restored;

DEBIT 60 CREDIT 60-advance

– 781,160 rub. – the received advance is offset;

as of 31.05: DEBIT 60 CREDIT 91

– 17,700 rubles - a positive exchange rate difference is reflected;

as of 06/08: DEBIT 60 CREDIT 51

- 778,800 rubles - money was transferred to the seller for final payment;

DEBIT 91 CREDIT 60

- 5900 rubles - a negative exchange rate difference is reflected.

Tax expert

Oksana Dobrova

Practical accounting

This article was published in the closed section of the Practical Accounting portal. Specific accounting questions with examples of solutions and expert opinions - maximum useful and necessary information on one portal. Get access >>

If you have a question, ask it here >>

Example 2

Delta LLC sold goods worth $2,000 with deferred payment to a foreign buyer. On the date of shipment, the dollar exchange rate was 65 rubles, so the company took into account revenue in the amount of 65 x 2000 = 130,000 rubles. On the date of payment, the rate increased to 67 rubles per dollar and the ruble equivalent of the foreign exchange earnings received became equal to 67 x 2000 = 134,000 rubles. A deviation of 4,000 rubles is an additional income for the company, i.e. positive exchange rate difference.

DT 62 – CT 90 (RUB 130,000) – revenue accrued at the exchange rate on the date of shipment

DT 52 – CT 62 (RUB 134,000) – foreign currency earnings are credited to the account at the rate on the date of payment

DT 62 – KT 91.1 (4000 rub.) – positive exchange rate difference

If an organization received or issued an advance in foreign currency, then exchange rate differences do not arise (clause 7 of PBU 3/2006). In this case, revenue or costs are taken into account at the exchange rate on the date of receipt (issue) of the advance. Changes in the exchange rate by the time the advance payment is “closed” by shipment will not affect accounting in any way.

How to take into account exchange rate differences on accountable amounts

You can issue cash foreign currency to employees on account.

Advances issued in foreign currency to an employee who is going on a business trip are recalculated only on the day of issue. In the future, they are not recalculated either on the date of approval of the advance report or on the date of preparation of the financial statements (clauses 7, 9, 10 of PBU 3/2006). Therefore, in the advance report, advances issued in foreign currency are reflected at the rate that was in effect on the date of issue (clause 9 of PBU 3/2006).

If the employee returns unused funds, then they must be reflected at the rate that is in effect on the date of return, since the returned funds are no longer considered as advances issued. As a result, exchange rate differences may arise.

Positive exchange rate differences are reflected by posting:

DEBIT 71 CREDIT 91-1

— reflects the positive exchange rate difference on accountable amounts.

Negative exchange rate differences are reflected by posting:

DEBIT 91-2 CREDIT 71

— negative exchange rate difference on accountable amounts is reflected.

EXAMPLE 5. ACCOUNTING FOR EXCHANGE DIFFERENCES ON ACCOUNTABLE AMOUNTS

Deputy General Director of Polet LLC A.B.

On February 15 of the reporting year, Ivanov was given $600 on account for travel expenses. According to the advance report approved on February 20 of the reporting year, business trip expenses amounted to $500. The US dollar exchange rate was: - as of February 15 - 24.5 rubles / USD; - as of February 20 - 25 rubles / USD. Accountant " Poleta" will make the following entries: February 15 DEBIT 71 Subaccount "settlements with accountable persons in US dollars" CREDIT 50

- 14,700 rubles.

(600 USD × 24.5 rubles/USD) – cash currency issued for reporting; February 20 DEBIT 26 CREDIT 71 Sub-account “settlements with accountable persons in US dollars”

- 12,250 rubles.

(500 USD × 24.5 rubles/USD) – amounts issued for reporting are included in expenses; DEBIT 50 CREDIT 71 Sub-account “settlements with accountable persons in US dollars”

- 2500 rubles.

(100 USD × 25 rubles/USD) – unused currency previously issued for reporting was returned to the cash desk; DEBIT 71 SUBACCOUNT “Settlements with accountable persons in US dollars” CREDIT 91-1

- 50 rubles. (100 USD × (25 rubles/USD – 24.5 rubles/USD)) – reflects a positive exchange rate difference.

Example 3

Sigma LLC transferred an advance payment to a foreign counterparty for future delivery of goods in the amount of 5,000 euros. The exchange rate on the date of transfer of the advance payment is 80 rubles per euro. At the time of delivery, the euro exchange rate increased to 82 rubles, but the goods were registered at the rate on the date of payment, i.e. in the amount of 80 x 5,000 = 400,000 rubles.

If the advance received or paid covers part of the delivery cost, then the exchange rate difference must be calculated only for that part of the shipment (delivery) that is not covered by the advance payment.

Exchange differences when translating assets denominated in foreign currency

Exchange differences arise when recalculating the balances of foreign currency funds in the cash register and accounts of the organization, as well as securities (except for shares), if their value is determined in foreign currency.

In addition, it is necessary to recalculate current foreign currency settlement debts, except for debts on advances issued and received.

The organization is obliged to recalculate as of the reporting date, but has the right to determine exchange rate differences and more often as the exchange rate changes. Most organizations submit financial statements once a year, i.e. their reporting date will only be December 31st. But over the course of a year, exchange rates can change very significantly, and most of last year’s contracts will already be fulfilled.

On the other hand, it also makes no sense to recalculate debts and account balances every day at the slightest change in exchange rates. Therefore, businessmen usually choose a compromise option and calculate exchange rate differences on balances once a month. This procedure must be reflected in the accounting policies.

Example 5

An organization requires $5,000 to pay for imported goods. The dollar exchange rate set by the Central Bank on the date of purchase is 65 rubles, the bank rate is 67 rubles. Therefore, the organization will have a negative exchange rate difference in the amount of 5,000 x (67 – 65) = 10,000 rubles.

DT 57 – CT 51 (RUB 335,000) – the organization transferred money to purchase currency at the bank rate

DT 52 – CT 57 (325,000) – currency credited to the account at the Central Bank rate

DT 91.2 – KT 57 (10,000) – negative exchange rate difference

Example 6

In accordance with the constituent agreement, a foreign company must contribute 1,000 US dollars to the authorized capital of a Russian organization

On the date of signing the agreement, the dollar exchange rate was 72 rubles, and on the date of payment it became equal to 74 rubles

DT 75 – CT 80 (RUB 72,000) – the founder’s debt on the contribution to the capital company has been accrued

DT 52 – KT 75 (RUB 74,000) – the founder paid the deposit

DT 75 – CT 83 (RUB 2,000) – positive exchange rate difference attributed to additional capital

Cash method

In accordance with paragraph 1 of Article 273 of the Tax Code of the Russian Federation, organizations (with the exception of banks) have the right to determine the date of receipt of income (expenses) using the cash method, provided that the requirements provided for in this paragraph are met.

Paragraphs 2 and 3 of Article 273 of the Tax Code of the Russian Federation establish that if a taxpayer organization determines its income and expenses using the cash method, then the date of receipt of income is the day of receipt of funds into bank accounts and (or) the cash desk, receipt of other property (work, services) ) and (or) property rights, as well as repayment of debt to the taxpayer in another way, and expenses of the taxpayer are recognized as expenses after their actual payment.

These norms of the Tax Code of the Russian Federation, while clearly defining the procedure for recognizing income and expenses from the sale of goods (work, services), leave the issue of recognizing non-operating income and expenses unclear. In particular, this applies to the recognition of exchange rate differences on foreign exchange transactions when determining income and expenses on a cash basis.

To answer the question of whether exchange rate differences are recognized or not recognized as income and expenses when applying the cash method, it is necessary, first of all, to understand what the Tax Code of the Russian Federation generally recognizes as non-operating income and expenses.

In accordance with the provisions of Articles 247 and 248 of the Tax Code of the Russian Federation, the object of taxation includes income from the sale of goods (work, services), as well as non-sales income. The composition of non-operating income is provided for in Article 250 of the Tax Code of the Russian Federation, however, the given list cannot be considered exhaustive, since the second paragraph of this article, which opens the list of non-operating income, uses the wording that “... non-operating income is recognized, in particular

..."

.

Thus, when determining the composition of income to be included in the tax base for income tax, it is necessary to proceed from the general concept of income given in Article 41 of the Tax Code of the Russian Federation, which is understood as “economic benefit

in cash or in kind, taken into account if it is possible to estimate it and to the extent that such benefit can be estimated"

.

Exchange differences in tax accounting under the general tax system

Exchange differences for income tax must be taken into account according to the same principles as for accounting (clause 11, article 250, subclause 5, clause 1, article 265 of the Tax Code of the Russian Federation). Positive exchange rate differences in tax accounting are attributed to non-operating income, and negative ones - to non-operating expenses.

Exchange rate differences do not affect VAT. The VAT base is determined on the date of shipment or receipt of advance payment. Thus, the accrued VAT is “fixed” at the rate at which the goods were shipped or the advance was received. Any fluctuations in the exchange rate in the future will not be reflected in the calculation of VAT on this transaction.

Accounting for exchange rate differences in accordance with Decree No. 504 dated December 31, 2019

Decree of the President of the Republic of Belarus dated December 31, 2019 No. 504 “On exchange rate differences” (hereinafter referred to as Decree No. 504) established that organizations are required to establish in their accounting policies the procedure for accounting for exchange rate differences for tax accounting purposes (the procedure for accounting for exchange rate differences in accounting Decree No. 504 does not change).

In accordance with Decree No. 504, an organization has the right to take into account exchange rate differences in tax accounting (as part of external income / external expenses):

- or in general - quarterly

- or in December of the calendar year (the last reporting period of the calendar year)

If the procedure for tax accounting of exchange rate differences is not defined in the accounting policy of the organization, exchange rate differences are subject to accounting when calculating income tax on the basis of the provisions of Articles 173 – 175 of the Tax Code (letter of the Ministry of Taxes and Taxes of the Republic of Belarus dated 06/03/2020 No. 2-2-10/01179) .

during the tax period (calendar year) chosen by the organization in accordance with Decree No. 504 is not subject to change (including in 2021).

More precisely, it was not subject to .

Subclause 2.6 of the Decree of the President of the Republic of Belarus dated April 24, 2020 No. 143 “On supporting the economy” gives organizations the right to change the chosen tax accounting procedure for exchange rate differences ONCE in 2021 .

Wherein:

- changes are made to the organization’s accounting policy for 2020 (the corresponding order is issued)

- The new amended procedure is valid throughout 2020

If an organization applies the norms of subclause 2.6 of Decree No. 143, the organization has the right to change its indicators for calculating income tax: (letter of the Ministry of Taxes of the Republic of Belarus dated 06/03/2020 No. 2-2-10/01179):

- or when submitting a tax return for the current (i.e., past) reporting period by filling out Section III “Information on understatement (overstatement) of the amount of tax subject to payment (refund) under a tax return (calculation) in which incomplete information or errors were found” tax return (calculation) for income tax

- or by submitting a tax return (calculation) for income tax with amendments (clarifications) for previous reporting periods.

Note!

If the organization reflects exchange rate differences:

- in tax accounting - only once at the end of the calendar year (in accordance with Decree No. 504),

- and in accounting - monthly (in general order),

then temporary differences arise - which means that deferred tax assets (DTA) and/or deferred tax liabilities (DTL) arise. SHE and/or IT will be reflected in accounting.

To understand, there is a difference between the “conditional” income tax that an organization would have to pay on “accounting” profits, and the income tax actually paid at the end of the reporting period (quarter). For financial reporting purposes, this difference (“deferred” tax asset or liability) between “accounting” income taxes and “actual” income taxes must be recorded in the accounting records.

Exchange rate differences under the simplified tax system

When using the simplified tax system, there is no need to revaluate assets and liabilities expressed in foreign currency (clause 5 of article 346.17 of the Tax Code of the Russian Federation). It turns out that in general, exchange rate differences do not affect the calculation of the “simplified” tax.

But there is one exception here. If a businessman experiences a positive exchange rate difference when selling or buying foreign currency, he must take this income into account when calculating the simplified tax system. Moreover, the “simplified” cannot take into account the negative exchange rate difference in a similar situation. The Ministry of Finance indicated this in a letter dated January 15, 2020 No. 03-11-11/1310 .

The fact is that exchange rate differences when buying and selling currency do not relate to the revaluation of assets and liabilities. For income tax they must be taken into account in accordance with paragraph 2 of Art. 250 Tax Code of the Russian Federation. And the “simplified” ones must take into account non-operating income according to the requirements of Art. 250 Tax Code of the Russian Federation. This is indicated in paragraph 1 of Art. 346.15 Tax Code of the Russian Federation.

On the other hand, in the closed list of expenses for the simplified tax system (Article 346.17 of the Tax Code of the Russian Federation) there are no negative exchange rate differences. This means that they cannot be taken into account in any case.

Therefore, “simplified traders” who buy or sell currency are at a disadvantage compared to companies on OSNO.

Accounting and taxation of exchange rate differences

Alina Margutova

November 26, 2021 574

Business

Exchange rate differences arise when exchange rates fluctuate if an organization is engaged in imports or exports, and all transactions are carried out in foreign currency. Let's talk about how to reflect exchange rate differences in accounting and tax accounting.

Types of exchange rate differences

The exchange rate difference depends on how the exchange rate has changed: if it has increased, then a positive difference is formed, if it has fallen, a negative difference will be formed.

With accounts receivable, a positive exchange rate difference is the organization’s income, because the debtor will pay more than the original amount, and a negative difference is an expense. If the company itself is a debtor, then the opposite is true for it.

Accounting for exchange rate differences

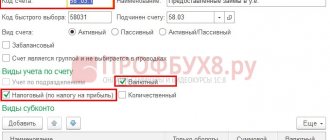

The exchange rate difference is taken into account as part of other income and expenses on account 91 “Other income and expenses”. The exception is settlements with the founders: in this case, exchange rate differences are charged to account 83 “Additional capital”.

A positive exchange rate difference is reflected in account 91.01 for accounts receivable or on account 91.02 for accounts payable.

Negative exchange rate differences are reflected in account 91.02 for accounts receivable and in account 91.01 for accounts payable.

When taking into account exchange rate differences, the following types of postings are made.

Exchange differences and foreign currency account

As the Central Bank exchange rate increases, the ruble equivalent of foreign currency increases. In this case, you need to recognize other income:

- Debit of account 52 “Currency accounts”—Credit of account 91, subaccount “Other expenses”.

- Debit account 91, subaccount “Other expenses” - Credit account 52.

- Debit account 91, subaccount “Other expenses” - Credit account 50 “Cash”;

- Debit of account 50 - Credit of account 91, subaccount “Other income”.

When the exchange rate of the Central Bank decreases, another expense arises, which is reflected in the opposite entry:

Exchange differences in foreign currency at the organization's cash desk are reflected according to the same principle:

Exchange differences when purchasing non-current assets and inventories

The cost of fixed assets, intangible assets and inventories is fixed at the exchange rate of the Central Bank of the Russian Federation on the date of their acceptance for accounting and does not change anymore. Only the outstanding payment to the supplier can be revalued. As a result, positive or negative exchange rate differences arise, which are reflected in the following transactions:

- Debit of account 91 “Other income and expenses”, subaccount “Other expenses” Credit of account 60 “Settlements with suppliers and contractors” - Negative exchange rate difference on settlements with suppliers is reflected;

- Debit of account 60 “Settlements with suppliers and contractors” Credit of account 91 “Other income and expenses”, subaccount “Other income” - Reflects the positive exchange rate difference in settlements with the supplier.

Advances and exchange differences

The amounts of advances received and issued are accounted for at the exchange rate on the date of receipt or transfer of funds, respectively, and are not revalued.

Exchange rate differences when buying and selling currencies

When purchasing currency, the following transactions are required:

| Account Dt | Kt account | Contents of operation | Primary document |

| 57 | 52 | Transferred funds for the purchase of currency | Bank statement for ruble account |

| 52 | 57 | After conversion, the currency arrived at the company’s account | Bank statement for foreign currency account |

| 57 | 91.01 | Positive exchange rate difference reflected | Accounting certificate-calculation |

| 91.02 | 57 | Negative exchange rate difference reflected | Accounting certificate-calculation |

When selling currency, the following transactions are made:

| Account Dt | Kt account | Contents of operation | Primary document |

| 57 | 52 | Selling currency for conversion | Bank statement for foreign currency account |

| 52 | 57 | Ruble funds received after conversion | Bank statement for ruble account |

| 57 | 91.01 | Positive exchange rate difference reflected | Accounting certificate-calculation |

| 91.02 | 57 | Negative exchange rate difference reflected | Accounting certificate-calculation |

Tax accounting of exchange rate differences

VAT

VAT is not calculated on exchange rate differences. The tax base for VAT is determined on the day of shipment of goods, performance of work, provision of services or transfer of property rights, and on the same date the currency is converted into rubles.

Income tax

Taxpayers are required to revaluate currency values. Accounting for exchange rate differences depends on their type and accounting method. Accounting methods and the procedure for their application must be enshrined in the accounting policy.

The positive exchange rate difference arising during revaluation is the organization’s income. It is included in non-operating income.

Under the accrual method, income is recognized on the date when one of the following events occurs first:

- transfer of ownership of currency during transactions with foreign currency;

- the last day of the month has arrived;

- termination or fulfillment of a foreign currency obligation and claim if the date does not coincide with the last day of the month.

With the cash method, exchange rate differences do not arise because the amount of foreign currency debt coincides with the amount that was transferred to the counterparty.

When revaluing currency values in accounts, you can use the same method as with the accrual method.

The following positive exchange rate differences cannot be recognized as income:

- For securities denominated in foreign currency.

- For advances issued and received. But in case of termination of the transaction, you will have to recalculate the obligation to return the money from the date of receipt of the advance until the day of termination of the contract. The resulting positive exchange rate difference must be included in non-operating income, and the negative exchange rate difference must be included in expenses.

- If you received a currency that is not taken into account in the tax base - targeted funds in foreign currency or a contribution to the authorized capital.

The negative difference is taken into account in the organization's expenses.

Under the accrual method, expenses are recognized on the date of the earliest event:

- transfer of ownership of currency when performing transactions with currency;

- on the last day of each month;

- on the date of termination or fulfillment of currency obligations and claims.

Under the cash method, there are no exchange differences, except for the currency in the accounts. In this case, you can determine the date of recognition of expenses in the same way as with the accrual method.

It is impossible to take into account the negative differences that arose in expenses:

- for securities in foreign currency, advances and for currency that is not taken into account in the tax base;

- for obligations and claims not related to activities aimed at generating income.

When buying and selling currencies, there may also be income or expense.

Purchasing a currency below the Central Bank rate is non-operating income, above it is non-operating income. When selling, on the contrary, an expense arises if the exchange rate is lower than the Central Bank, and if it is higher, an income occurs.

Under the accrual method, the difference must be recognized on the date of transfer of ownership of the currency.

Under the cash method, income is taken into account on the date of receipt of currency or rubles into the organization’s account.

simplified tax system

Simplified people do not revaluate currency values and liabilities for tax accounting, so no difference arises.

The exception is the sale or purchase of currency: if a positive difference arises, it must be taken into account in non-operating income and tax must be paid. It is impossible to take into account the negative difference in costs, because The simplified list of expenses is closed.

UTII

From January 1, 2021, UTII will cease to operate. But before that, it should be taken into account that if a company only conducts activities on UTII, the exchange rate does not affect the amount of its tax.

Alina Margutova

November 26, 2021 574

Was the article helpful?

67% of readers find the article useful

Thanks for your feedback!

Comments for the site

Cackl e

Products by direction

1C-Reporting

—> Service for transmitting reports to regulatory authorities from 1C:Enterprise programs

Astral Report 5.0

—> Online service for submitting reports to regulatory authorities

Exchange differences with unified agricultural tax, UTII and PSN

The procedure for recognizing income and expenses under the unified agricultural tax is in many ways similar to the simplified tax system. It also does not take into account the revaluation of foreign currency assets and liabilities (clause 5.1 of Article 346.5 of the Tax Code of the Russian Federation), and income in general must be recognized according to the standards established for income tax (clause 1 of Article 346.5 of the Tax Code of the Russian Federation). The list of expenses under the Unified Agricultural Tax, as well as under the simplified tax system, is closed (clause 2 of Article 346.5 of the Tax Code of the Russian Federation).

Therefore, we can conclude that the procedure discussed above for accounting for exchange rate differences during “simplified” applies to the Unified Agricultural Tax, although there is no separate explanation from tax authorities on this topic yet.

With UTII and PSN, the tax does not depend on income and expenses, so exchange rate differences do not affect tax accounting in any way.

However, under the patent system, it is necessary to take into account income to determine the annual limit of 60 million rubles. after exceeding which the taxpayer is deprived of the right to use the PSN. According to the Ministry of Finance, exchange rate differences do not need to be included in revenue to determine the specified limit (letter dated May 25, 2016 No. 03-11-12/30538 ).

Accounting for exchange rate differences in accordance with Decree No. 159 dated May 12, 2020

Decree of the President of the Republic of Belarus dated May 12, 2020 No. 159 “On recalculation of the value of assets and liabilities” (hereinafter referred to as Decree No. 159).

Decree No. 159 comes into force after official publication and applies to relations arising from January 1, 2020.

Decree No. 159 gives commercial organizations the right to assign exchange rate differences arising in accounting when converting the value of assets and liabilities denominated in foreign currency into Belarusian to income/expenses of future periods (and not to other income/expenses of the organization - as provided for in general order).

The following exchange rate differences are included in the income/expenses of organizations (if a decision is made to assign them to “future” periods):

- in the manner and within the time limits established by the head of the organization

- no later than December 31, 2022

In connection with the adoption of Decree No. 159, 2 questions arise immediately:

- Does the application of Decree No. 159 also change the tax accounting of exchange rate differences? After all, both paragraph 3.20 of Article 174 and paragraph 3.26 of Article 175 of the Tax Code of the Republic of Belarus in terms of accounting for exchange rate differences in the composition of an organization’s external income and external expenses refer us to the very concept of exchange rate differences, determined in the manner established by law. But both Decree No. 159 and National Standard No. 69 are the legislation of the Republic of Belarus

- Do the norms of Decree No. 159 apply to exchange rate differences under so-called “pseudo-currency agreements” (agreements in which a monetary obligation is payable in Belarusian rubles in an amount equivalent to a certain amount in foreign currency or conventional monetary units - part 2 of paragraph 1 of Art. 298 of the Civil Code of the Republic of Belarus)? Or can Decree No. 159 be applied only to the value of assets and liabilities expressed directly in foreign currency?

For our part, we note that both issues are controversial. However, there are clarifications from government agencies. Read more

Decree No. 159 and tax accounting

Does an organization’s decision to apply the norms of Decree No. 159 affect the tax accounting of exchange rate differences?

According to the letter of the Ministry of Taxes and Duties of the Republic of Belarus dated May 26, 2020 No. 2-2-10/01117 “On exchange rate differences” - it does not affect .

For our part, we will also agree with the Ministry of Taxes and Duties.

To substantiate my position, in addition to the indicated letter from the Ministry of Taxation, the following can be cited.

Decree of the President of the Republic of Belarus dated February 27, 2015 No. 103 “On recalculation of the value of assets and liabilities” also addressed issues of changes by commercial organizations to the procedure for accounting for exchange rate differences in accounting.

However, Decree No. 103 dated February 27, 2015 (paragraph 3 of paragraph 1 of Decree No. 103), in contrast to Decree No. 159, clearly indicated that changing the procedure for accounting for exchange rate differences affects not only accounting, but also tax accounting (non-operating income/expenses taken into account for tax purposes).

does not contain such instructions (to change the tax accounting procedure) . Those. if necessary, for tax accounting purposes, exchange rate differences can be applied to Decree No. 504.

Decree No. 159 and accounting for pseudo-currency contracts

The Ministry of Taxes and Duties of the Republic of Belarus, in its letter dated May 26, 2020 No. 2-2-10/01117 “On exchange rate differences” (link above), extremely unexpectedly (at least for us - definitely unexpectedly) touched upon the issue of accounting for exchange rate differences in in accordance with Decree No. 159.

The Ministry of Taxes and Taxes of the Republic of Belarus in the said letter expressed its position that Decree No. 159 applies only to the accounting procedure for exchange rate differences in relation to assets and liabilities denominated in foreign currency.

At the same time, according to the letter of the Ministry of Taxes and Taxes of the Republic of Belarus, Decree No. 159 does not change the procedure for reflecting in accounting exchange rate differences that arise when recalculating the value of assets and liabilities expressed in the official monetary unit of the Republic of Belarus in an amount equivalent to a certain amount in foreign currency.

This indicates the position of the Ministry of Taxes and Taxes that organizations (except banks):

- in terms of exchange rate differences on assets and liabilities denominated in foreign currency - has the right to apply both the norms of National Standard No. 69 and be guided by Decree No. 159,

- in terms of exchange rate differences on assets and liabilities expressed in Belarusian rubles in an amount equivalent to a certain amount in foreign currency (i.e., in terms of exchange rate differences under “pseudo-currency agreements”) - has the right to be guided only by National Standard No. 69.

The position of the Ministry of Taxes and Taxes of the Republic of Belarus on this issue, in our opinion, is controversial

( UPDATED : the position of the Ministry of Taxes and Taxes of the Republic of Belarus was confirmed by a letter from the Ministry of Finance in response to our email

Below we provide the rationale for our position, which, however, should not be followed. You should be guided by the explanations of government agencies. But you can familiarize yourself with our position for a general understanding

And that's why.

Firstly:

In accordance with the Law of the Republic of Belarus “On Accounting and Reporting,” state regulation of accounting and reporting in the Republic of Belarus is carried out:

- President of the Republic of Belarus

- Council of Ministers of the Republic of Belarus

- National Bank of the Republic of Belarus (regarding accounting in banks and non-bank financial institutions)

- Ministry of Finance of the Republic of Belarus (regarding accounting in organizations other than banks)

In particular, the Ministry of Finance approved National Standard No. 69, which determines the procedure for accounting for exchange rate differences:

- and in relation to the value of assets and liabilities denominated in foreign currencies

- and in relation to “pseudo-currency” agreements

using in relation to these different types of legal relations the general concept of “foreign currency”, enshrined in clause 1 of National Standard No. 69.

We have sent an electronic appeal to the Ministry of Finance of the Republic of Belarus on this issue - the procedure for accounting for exchange rate differences under pseudo-currency agreements within the framework of Decree No. 159

Secondly:

Paragraph 1 of Article 298 “Currency of monetary obligations” of the Civil Code of the Republic of Belarus determines that:

- monetary obligations must be expressed in Belarusian rubles - part one, clause 1, article 298 of the Civil Code of the Republic of Belarus

- a monetary obligation may stipulate that it is payable in Belarusian rubles in an amount equivalent to a certain amount in foreign currency or in conventional monetary units (“special drawing rights”, etc.) – part two of paragraph 1 of Article 298 of the Civil Code of the Republic of Belarus

Almost identical wording is contained in part one and part two of Article 11 “Currency of Monetary Obligations” of the Banking Code of the Republic of Belarus.

We are interested in part two, clause 1, article 298 of the Civil Code of the Republic of Belarus and part two of article 11 of the Budget Code of the Republic of Belarus - the so-called “pseudo-currency” agreements.

Paragraph 1 of Decree No. 159 contains the verbatim wording “when recalculating the value of assets and liabilities expressed in foreign currency .

The Ministry of Taxes and Taxes of the Republic of Belarus, in letter dated May 26, 2020 No. 2-2-10/01117 “On exchange rate differences,” expresses its position that Decree No. 159 does not apply to pseudo-currency agreements, believing, apparently (in our opinion), that if the obligation is subject to payment in Belarusian rubles in an amount equivalent to a certain amount in foreign currency (in accordance with Part 2, Clause 1, Article 298 of the Civil Code of the Republic of Belarus, Part 2, Article 11 of the Budget Code of the Republic of Belarus), which means the value of assets and liabilities is expressed in Belarusian rubles

Well.

There is a certain judicial practice on this issue (judicial law in the Republic of Belarus is not precedent, but how can one not take into account the existing judicial practice?)

Let us refer to the following court decisions that have entered into force:

- decision of the Economic Court of Minsk dated 04/30/2009 (case No. 296-26/09) and Resolution of the appeal instance of the Economic Court of Minsk dated 06/02/2009 (case No. 296-26/2009/362a)

- decision of the economic court of the Vitebsk region dated 07/05/2012 (case No. 85-7/2012)

- decision of the Economic Court of the Vitebsk Region dated March 10, 2015 (case 16-13/2015)

All of these court decisions contain the same phrase in their reasoning parts (with reference to the cited articles of the Civil Code of the Republic of Belarus and the Budget Code of the Republic of Belarus):

The current legislation does not contain a ban on the use of foreign currency as a way of expressing a monetary obligation ; restrictions apply to the use of foreign currency when making payments on the territory of the Republic of Belarus

We believe that this means that when using “pseudo-currency” contracts, monetary obligations are expressed in foreign currency, and Belarusian rubles are the currency of settlements between the parties.

This means that the requirements of Decree No. 159 should apply to exchange rate differences under “pseudo-currency agreements”.

But let’s wait for a response to our email from the Ministry of Finance of the Republic of Belarus.

UPDATED:

The Ministry of Finance of the Republic of Belarus, in its letter to our Accounting Center (based on the results of our electronic appeal), confirmed the position that Decree No. 159 “does not establish for commercial organizations the procedure for accounting for differences arising when recalculating an amount expressed in Belarusian rubles in an amount equivalent to a certain amount in foreign currency, the value of assets and liabilities in Belarusian rubles at the official exchange rate of the Belarusian ruble in relation to the corresponding foreign currency, established by the National Bank of the Republic of Belarus.”

As the Ministry of Finance indicates, exchange rate differences under “pseudo-currency” contracts in the accounting of commercial organizations must be reflected in the manner established by paragraph 7 of National Standard No. 69.

Our position (as stated earlier) regarding the wording used in Decree No. 159 and Decree No. 103 has not changed, however, one should be guided not by our position, but by the explanations of government bodies .

Thus, commercial organizations with regard to accounting (Decree No. 159 does not apply to tax accounting) exchange rate differences within the framework of Decree No. 159:

- in terms of exchange rate differences on assets and liabilities denominated in foreign currency - has the right to apply both the norms of National Standard No. 69 and be guided by Decree No. 159

- in terms of exchange rate differences on assets and liabilities expressed in Belarusian rubles in an amount equivalent to a certain amount in foreign currency (i.e., in terms of exchange rate differences under “pseudo-currency agreements”) - has the right to be guided only by National Standard No. 69.

UPDATED:

a letter dated June 17, 2020 No. 15-1-20/42 in June 2021 .

The letter explains the procedure for applying the provisions of Decree No. 159.

We will not dwell separately - the application of the norms of Decree No. 159 in the accounting of non-state commercial organizations is not very widespread.

In addition, this letter is quite detailed - it contains the necessary information for those who decided to apply Decree No. 159.

Decree No. 159 and financial results

In terms of accounting for exchange rate differences, you need to understand the following .

Let's give an example :

- the organization has a short open currency position (liabilities in foreign currency exceed the organization's assets in foreign currency)

- the exchange rate of the Belarusian ruble to foreign currency falls (i.e. the foreign currency strengthens)

- the organization experiences significant negative exchange rate differences

- in general, the organization should have reflected negative exchange differences in accounting as part of other expenses and received a loss

- but the organization uses the right granted by Decree No. 159, attributes negative exchange rate differences to deferred expenses and, instead of receiving a loss in accounting , makes a profit .

How to evaluate the result? After all, we made a profit, more or less a balance.

The situation is controversial.

At a minimum, distortion of financial statements. Maybe it’s time for the organization to think about bankruptcy proceedings. And she has a profit on paper.

With financial reporting according to international standards, this story does not apply.

Conclusion

Exchange rate differences in accounting arise in the following cases:

- Changes in the foreign currency exchange rate during the execution of the transaction.

- Translation of assets and liabilities denominated in foreign currencies, excluding shares and advances.

- Buying or selling foreign currency at a rate different from the Central Bank rate.

To calculate income tax, exchange rate differences are taken into account according to the same rules as in accounting. Exchange rate differences do not affect the calculation of VAT.

For the simplified taxation system and unified agricultural tax, it is necessary to take into account only income in the form of positive exchange rate differences that arose during the purchase and sale of currency.

When calculating UTII and the cost of a patent, exchange rate differences are not used.

VAT from the seller

Exchange differences arising in accounting and tax accounting also include differences in the amount of VAT. But they do not affect the calculation of the tax itself, but are fully taken into account in expenses or income when calculating income tax (clause 4 of Article 153 of the Tax Code of the Russian Federation). In this case, the procedure for calculating VAT is as follows.

Situation 1. The goods are paid in full in advance

In this case, upon receipt of an advance payment, the seller calculates VAT on the entire advance amount in rubles at a calculated rate of 10/110 or 18/118. Based on this advance amount, he will determine the tax base on the date of shipment. As a result, the amount of VAT accrued upon shipment will be equal to the amount of VAT on the advance payment (letter of the Federal Tax Service dated July 21, 2015 No. ED-4-3/12813, Ministry of Finance dated July 6, 2012 No. 03-07-15/70).

Situation 2. The goods are fully paid for after shipment

In this case, the seller calculates the tax base and the amount of tax in rubles according to the Central Bank unit on the day of shipment and does not recalculate any more (letter of the Ministry of Finance dated December 23, 2015 No. 03-07-11/75467).

Situation 3. The goods are partially paid in advance, partially - after shipment

In this case, the tax base and tax are calculated separately in terms of the paid and unpaid cost of the goods. In the paid part - as in situation 1, in the unpaid part - as in situation 2 (letters from the Ministry of Finance dated 12/23/2015 No. 03-07-11/75467, dated 07/06/2012 No. 03-07-15/70, dated 03/06/2012 No. 03-07-09/20).