Fixed insurance premiums for individual entrepreneurs in 2021

To calculate fixed payments for an individual entrepreneur in 2021, a minimum wage of 7,500 rubles is applied.

per month. Thus, the cost of an insurance year in a fixed amount for compulsory health insurance is 4590.00 rubles. (minimum wage x 5.1% x 12). Insurance premiums for the FFOMS must be paid before January 9, 2021 (December 31, 2021 is a day off).

Please note that insurance contributions to the Federal Compulsory Compulsory Medical Insurance Fund (FFOMS) are administered by the Tax Service from January 1, 2017. Therefore, insurance premiums must be transferred to the account of the Federal Tax Service at the place of residence of the individual entrepreneur. KBK for transferring insurance premiums of individual entrepreneurs for themselves to the FFOMS 18210202103081013160.

How much should I pay?

In 2021, the fixed payment for yourself is calculated based on the minimum wage in force on January 1, i.e. 7500 rubles. The increase in the minimum wage from July 1 to 7,800 rubles did not affect the calculation of contributions.

IP contributions in 2021 for their insurance were:

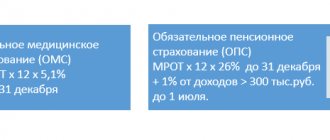

- For retirement according to the formula (minimum wage * 12 * 26%) = 23,400 rubles ;

- For health insurance according to the formula (minimum wage * 12 * 5.1%) = 4,590 rubles .

In total, if an entrepreneur works for the full year 2021, then the mandatory amount to be paid will be 27,990 rubles . If the year is incomplete, then the amounts are recalculated accordingly, taking into account full months and calendar days of an incomplete month (letter of the Federal Tax Service dated February 7, 2021 No. BS-3-11 / [email protected] ).

As of January 1, 2021, the individual was already registered as an individual entrepreneur. He was removed from tax registration on July 5, 2021, having worked a full six months plus five days. The income received this year did not exceed 300,000 rubles.

The amount of contributions for an incomplete year in this case will be 12,014.52 rubles for pension insurance and 2,356.69 rubles for medical insurance, for a total of 14,371.21 rubles.

The entrepreneur was registered on July 3, 2021. How many contributions will he need to pay if the individual entrepreneur plans to work until the end of the year, and the expected income is 380,000 rubles? It turns out that the work period in 2021 will be five full months and 29 calendar days.

Based on the income received, the entrepreneur will have to pay:

- 11,574.19 rubles for pension insurance;

- 2,270.32 rubles for health insurance;

- 800 rubles additional contribution of 1% on income over 300,000 rubles.

Total, 14,644.51 rubles.

Insurance contributions in a fixed amount for 2021 for compulsory pension insurance.

Until January 9, 2021 (December 31, 2021 is a day off), individual entrepreneurs and heads of peasant farms and members of peasant farms must pay fixed insurance premiums in the amount of 23,400 rubles. (RUB 7,500 *26% *12 months).

Please note that insurance contributions to the Pension Fund of Russia are administered by the Tax Service from January 1, 2017. Therefore, insurance premiums must be transferred to the account of the Federal Tax Service at the place of residence of the individual entrepreneur. KBK for transferring insurance premiums of individual entrepreneurs for themselves to the Pension Fund of Russia 18210202140061110160.

Those individual entrepreneurs who received income in 2021 above 300,000 rubles. must pay additional fixed insurance premiums to the Federal Tax Service in the amount of 1% of revenue, but not more than 187,200 rubles. taking into account a fixed payment payable until December 31, 2021 (RUB 23,400). Such payment must be paid to the Federal Tax Service no later than July 2, 2021. KBK for transferring insurance premiums of individual entrepreneurs for themselves to the Pension Fund of Russia 18210202140061110160.

Insurance premiums for individual entrepreneurs for themselves for 2021 in the amount of 1% on income over 300,000 rubles

The New Year holidays will end, the weekend associated with Defender of the Fatherland Day will be successfully celebrated, International Women's Day in March will also bring a lot of joy, and then the annual reporting period will begin for individual entrepreneurs, which, however, must be completed before the May holidays. Only then, as a rule, individual entrepreneurs will finally calculate their income for 2021 according to all tax regimes that they used.

And if the entrepreneur’s total annual income turns out to be above 300 thousand rubles, then the amount exceeding this threshold must be paid insurance premiums in the amount of 1% by April 1, 2021 So, there is very little time left.

However, you do not necessarily have to transfer the entire amount; the law also sets an upper limit. We will calculate the amount of insurance premiums required for payment.

- Maximum amount of contributions to the Pension Fund for 2021: 154,851.84 rubles (8*12*6204*26%).

- From this amount, you need to subtract fixed contributions to the Pension Fund for 2016 for all individual entrepreneurs - 19,356.48 rubles, which should have already been paid.

- The maximum amount of contributions in the amount of 1% to the Pension Fund for 2021: 135,495.36 rubles.

If your calculated 1% on the amount of income for 2021 over 300,000 rubles turns out to be more than the above amount in bold, then until 04/03/2017 you in any case must pay only 135,495.36 rubles and not a penny more! If you suddenly overpaid, you need to submit an application to offset the amount of overpayment against the payment of fixed contributions in 2021 not to the Pension Fund, but to the tax office. If the overpayment is significant and you need money, you can write an application for a refund of overpaid insurance premiums.

Attention! Contributions in the amount of 1% of the amount of excess income for 2021 are paid only for the payment of the insurance pension, and are transferred to the Federal Tax Service under a separate KBK - only for contributions for 2016! We don’t pay anything to the FFOMS!

From April 23, new BCCs for individual entrepreneur contributions are in effect

| KBK | from 04/23/2018 |

| 182 1 0210 160 | Contributions in a fixed amount (the payment itself, including arrears, for periods starting from January 1, 2021) |

The fixed payment is calculated using the formula:

(Income of individual entrepreneurs - 300,000 rubles)* 1%.

Those. if in 2021 the income of an individual entrepreneur is 10,000,000 rubles, then the amount of the fixed payment to the Pension Fund will be 97,000 rubles. ((10,000,000 - 300,000)*1%). The total amount of fiduciary insurance contributions to the Pension Fund for 2021 for this individual entrepreneur will be 120,400 rubles. (23400 +97 000).

If the income of an individual entrepreneur for 2021 is 19,020,000 rubles. and more, then the amount of fixed insurance contributions to the Pension Fund for 2021 will be 187,200 rubles. ((19,020,000 -300,000)*1%)), which the individual entrepreneur must pay before January 9, 2018 (December 31, 2021 is a day off) in the amount of 23,400 rubles. and until July 2, 2021 in the amount of RUB 163,800.

We recommend that individual entrepreneurs in Uroshchenka pay fixed insurance premiums for 2021 to the Federal Tax Service by December 31, 2021. In this case, the taxes paid can be reduced to 100% or the contributions can be taken into account in expenses.

The amount of insurance premiums for the billing period is determined in proportion to the number of calendar months, starting from the month of beginning (completion) of activity. For an incomplete month of activity, the amount of insurance premiums is determined in proportion to the number of calendar days of this month.

How to calculate income for 2021 under different tax regimes

In 2021 and beyond, the rules for determining the income of individual entrepreneurs for the purpose of calculating fixed insurance premiums in the amount of 1% on an amount exceeding 300 thousand rubles are enshrined in Article 430 of the Tax Code of the Russian Federation. There are significant changes compared to the 2021 rules, when they were defined in Law 212-FZ. The main thing is that for individual entrepreneurs on the ORN (general taxation regime), who pay VAT and personal income tax, tax deductions and/or expenses are also taken into account when determining income . In other words, instead of income amounts, the tax base is now used to calculate the 1% fixed contributions.

Based on our extensive experience in protecting individual entrepreneurs, in order to avoid disputes with the tax authorities, we strongly recommend that you use to calculate the amount of income not from accounting books for different tax regimes or other tax accounting registers, and especially not from your notes in notebooks, but exclusively from the data of tax returns that are prepared for submission, and better if they have already been submitted to the Federal Tax Service. For the patent tax system, the income of the entrepreneur is indicated in the patent, which is issued by the tax office.

Where to get income to calculate 1% fixed contributions under different taxation regimes

- On ORN (OSNO) - line 060 (clause 6) of Section 2

of Declaration 3-NDFL (Form according to KND 1151020). In this case, only income from business activities must be reflected in the declaration, otherwise the amount of income will have to be determined by calculation in Sheet B. - On the simplified tax system - with the object of taxation Income (USN 6%) line 113 of Section 2.1.1

of the declaration; - On the simplified tax system - with the taxable object Income-expenses (15% simplified tax system), line 213 of Section 2.2

of the declaration; - On UTII - the sum of lines 100 of all Sections 2

of the declarations

for the year

(we add up the amounts for these lines in the declarations for the 1st, 2nd, 3rd and 4th quarters). If declarations were submitted to different Federal Tax Service inspectors during the year, you need to take into account the indicated amounts from all declarations; - On the Unified Agricultural Tax - line 010 of Section 2

of the declaration (Form according to KND 1151059); - On PSN - potential income - tax base (indicated in the patent). If several patents were received, you need to add up the amounts from all patents received in 2021.

If you used several tax regimes simultaneously for different types of activities, then you need to add up the income for all regimes, using the information posted above. The resulting total amount will be the total income, from which you need to subtract 300,000 rubles. Divide the remaining amount by 100 and compare it with the contribution limit for 2021.

If your calculated amount is less than the limit, you have an amount in rubles and kopecks, which you need to transfer to the Federal Tax Service for your insurance pension until April 2, 2021 inclusive (for 2021). Otherwise, pay only the maximum amount 163 800,00

rubles

FOR 2021

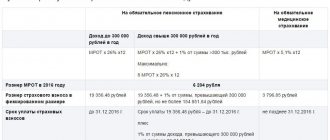

| Individual entrepreneur with an income of up to 300 thousand rubles. in year, Heads of peasant farms and members of peasant farms | Individual entrepreneur with an income of over 300 thousand rubles. in year |

| 1 minimum wage*26%*12 CONTRIBUTION TO THE PFR = RUB 23,400.00 Payment by January 9, 2021 | 1 minimum wage*26%*12+1.0% of the amount>300 thousand rubles. Max.: 8 minimum wage * 26% * 12 = 187,200.00 rub. CONTRIBUTION TO THE PFR = RUB 23,400.00+ + (INCOME-300000)*1% Payment: until January 9, 2021 – 23,400 rubles. |

Fixed contributions IP-2018

In 2021, fixed contributions of individual entrepreneurs will be “unlinked” from the minimum wage . The amount of the fixed part of contributions will be established annually by government decree. The annual amount of contributions must provide the entrepreneur with at least 1 point of the individual pension coefficient.

For 2021, the fixed part of insurance pension contributions will be established by law itself and will amount to 26,545 rubles. per year (i.e. calculated based on the amount of 8,508 rubles per month), you will have to pay 5,840 rubles for health insurance.

That is, 2018 individual entrepreneurs will be paid 32,385 rubles. This is 4395 rubles. more than in 2021.

No changes are provided for contributions in the form of 1% on income over 300 thousand rubles.

until July 2, 2018 - 1% of income.

Amount of insurance premiums for 2018-2020

Starting from 2021, the procedure for calculating fixed contributions for individual entrepreneurs, lawyers, heads and members of peasant farms, etc. is changing. Article 430 of the Tax Code of the Russian Federation provides for the values of fixed contributions that do not depend on the minimum wage, as in 2015-2017.

Contributions to the Pension Fund for income exceeding RUB 300,000. will be calculated as 1% of the excess amount, but not more than the maximum permissible value.

Fixed individual entrepreneur contributions for 2018-2020

| Insurance contributions to the Pension Fund, FFOMS | 2018 | 2019 | 2020 |

| Mandatory contribution to the Pension Fund for income not exceeding 300,000 rubles. | RUB 26,545 | RUB 29,354 | RUB 32,448 |

| Maximum allowable amount of contributions to the Pension Fund | RUB 212,360 (RUB 26,545 × | RUB 234,832 (RUB 29,354 × | RUB 259,584 (RUB 32,448 × |

| Contributions to the Compulsory Medical Insurance Fund | RUB 5,840 | RUB 6,884 | RUB 8,426 |

Deadline for payment of “pension” contributions on income exceeding RUB 300,000. starting with reporting for 2021, you must pay no later than July 1 of the following year for the reporting year.

So for 2021, insurance contributions to the Pension Fund for the excess amount must be paid no later than July 2, 2021 (since July 1, 2018 is a day off).

Insurance premiums for the heads of peasant farms and their members are also fixed and correspond to the minimum amount of insurance contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund.

What are fixed individual contributions

Fixed contributions are payments made by individual entrepreneurs “for themselves.” A fixed payment is established annually and is mandatory for all registered individual entrepreneurs.

In 2021, the mandatory payment consists of two parts - the first, which is paid mandatory (contributions to pension insurance (26%) and health insurance (5.1%) from the current minimum wage for each month of the year), the second - upon receipt of income in amount over 300 thousand rubles.

In 2021, the amount of fixed contributions for individual entrepreneurs is RUB 27,990.

And from income exceeding 300,000 rubles. per year, in addition to the fixed payment, the individual entrepreneur pays an additional contribution of 1%.

The income taken into account in the calculation is determined:

- for OSNO, all income of an individual entrepreneur received by him both in cash and in kind, as well as income in the form of material benefits, taking into account professional deductions, are taken into account. In this case, you can reduce income for expenses, i.e. for the calculation, the same base is taken as for calculating personal income tax;

- for the simplified tax system, income is taken into account in accordance with Art. 346.15 Tax Code of the Russian Federation. The ability to reduce income for expenses is not provided, but the courts think otherwise;

- for UTII, the object of taxation is the taxpayer’s imputed income (Article 346.29 of the Tax Code of the Russian Federation);

- for PSN, the object of taxation is the potential income of an individual entrepreneur for the corresponding type of business activity from which the patent is calculated (Article 346.47 of the Tax Code of the Russian Federation);

- For insurance premium payers applying more than one tax regime, insurance premiums are calculated based on the total amount of taxable income received from all types of activities.

Deadlines for payment of fixed payments

There are no monthly or quarterly mandatory payments for entrepreneurs to pay their own contributions. The main thing is to deposit the entire required amount (27,990 rubles) before December 31 of the current year. This can be done in one or several payments. As for the additional 1% contribution, it can be made both during the year and before April 1, 2018.

We recommend that entrepreneurs on UTII and simplified taxation system Income pay part of the fixed contributions in the reporting quarter before the imputed tax or advance payment on the simplified basis is calculated.

In this case, you can immediately reduce the calculated tax or advance by the amount of contributions paid in this quarter. If this is not done, then you will have to return or offset the overpayment of tax through reconciliation with the tax office. If an entrepreneur ceases activity without paying the outstanding contributions in full, he is given only 15 calendar days to do so after deregistration. Closing an individual entrepreneur does not remove arrears of taxes and contributions; they will still be collected from the individual, but with penalties and fines. So, it is better to pay contributions to the Pension Fund in 2021 for individual entrepreneurs on time.