Every year, thousands of Russian taxpayers fill out and submit VAT returns. Unfortunately, this procedure does not always occur without any incidents. Sometimes the sender makes certain mistakes that tax authorities require to be corrected.

Fortunately, in response to an incorrectly completed document, tax authorities send special VAT return error codes. In this article we will look at each of them in detail. We will also tell you what to do if one of the error codes 4 20.21 occurs.

Possible error code 1

Your supplier's reporting does not contain any similar invoice data. This may cause deductions to be taken away. Since the supplier did not reflect an identical invoice, he did not pay the tax. In this case, it is not necessary to submit adjustment reports. It is enough to contact the supplier for clarification. He could simply have made a mistake in the details, which is why the program did not detect the document. If he forgot to report on this implementation, then he should submit a clarification. If the reality of the transaction is documented, the withdrawal of deductions will be unlawful on the part of the tax authority.

Code 000000001 means that errors were made in the declaration or calculation and require clarification, not explanation.

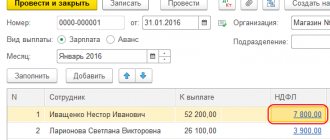

Actions of the taxpayer upon receipt of a request with an error

| Action 1 | Act 2 | Act 3 |

| 1.Send confirmation of receipt of the request to the tax office | Double-check all the data in the declaration, namely registration data, then the purchase and sales book, all invoices, their numbers and dates | 1. Provide a corrective declaration with correct data if it led to an understatement of tax 2. Or provide an explanation of the error made if the tax was not underestimated for this reason |

Possible error code 2

The information inside the declaration contradicts each other. For example, in section 3 and in sections 8 and 9. This also means that the inspectors carried out a detailed reconciliation of the control ratios. This can be done independently before submitting the reports, which will be quite advisable in order to avoid discrepancies and problems with the tax authorities. Error code 2 is possible if the organization erroneously submitted section 2, intended for tax agents, but the program did not detect transactions under code 06 in section 9. This means that the accountant made a mistake.

In this case, an updated declaration is not submitted, since the tax payable is not underestimated, but explanations are provided.

Sometimes errors can occur due to differences in the rules for filling out the form. For example, in section 3 it is necessary to reflect the amounts of deductions and charges in full rubles, and in sections 8 and 9 - in kopecks. There is no need to prepare adjusting statements for such discrepancies; it is enough just to explain that the discrepancies arose due to rounding.

Possible error code 3

There is a discrepancy in sections 10 and 11, intended to be filled out by intermediaries with information from the invoice journal.

Inconsistencies arise if, after selling products on its own behalf, the intermediary company issued an invoice to the buyer, and when checked by the tax service, the program detected inconsistencies. However, errors in the journal cannot affect the basis for calculating tax, so the company can exercise the right not to submit updated reporting. But, due to such errors, inspectors sometimes refuse deductions for the buyer, so explanations along with a table with the correct information still need to be provided in order for the inspector to enter this into his database.

INTRODUCTION

Classifier of errors in format-logical control of tax and accounting reporting files of the Federal Tax Service of Russia (error classifier - KOFO), approved by Order of the Federal Tax Service of Russia dated 01.01.2001 No. MM-3-6 / [email protected] , is an integral part of the system of classification and coding of technical and economic information and developed by the State Scientific Research Center of the Federal Tax Service of Russia in accordance with the Regulations “On a unified system of classification and coding of technical, economic and social information of the Ministry of Taxes of Russia” (Order of the Ministry of Taxes of Russia)

based on the following legislative acts and regulations:

Order of the Ministry of Finance of the Russian Federation dated 01.01.2001 No. 9n “On approval of the Administrative Regulations of the Federal Tax Service for the performance of the state function of free informing (including in writing) taxpayers, payers of fees and tax agents about current taxes and fees, tax legislation and fees and normative legal acts adopted in accordance with it, the procedure for calculating and paying taxes and fees, the rights and obligations of taxpayers, payers of fees and tax agents, the powers of tax authorities and their officials, as well as the provision of tax return forms (calculations) and explanation the order of filling them out";

Format of the notification on clarification of the tax return (calculation) (Version 5.01) Part LXXXVII. Order of the Federal Tax Service of Russia dated January 1, 2001 No. MM-3-6/ [email protected]

Get full text

Order of the Federal Tax Service of Russia dated 01.01.2001 No. MM-7-6/*****@*** “On approval of Methodological recommendations for organizing electronic document management when submitting tax returns (calculations) in electronic form via telecommunication channels”

Order of the Federal Tax Service of Russia dated January 1, 2001 No. MM-7-6/ [email protected] “On approval of the Unified format of a transport container for information interaction with the reception complexes of tax authorities via telecommunication channels using an electronic digital signature”

Order of the Federal Tax Service of Russia dated January 1, 2001 No. MM-7-6/*****@*** “On approval of the Unified format of a transport container for information interaction with the receiving complexes of tax authorities via telecommunication channels using an electronic digital signature”

Order of the Federal Tax Service of Russia dated January 1, 2001 No. ММВ-7-6/ [email protected] “On conducting a pilot project to provide information services to the largest taxpayers electronically via telecommunication channels in the “one window” mode”

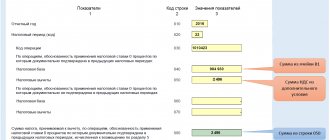

Possible error code 4 [a, b]

Inconsistencies between the details in the invoices of the buyer and supplier. In square brackets, the inspector will reflect the numbers of the columns where incorrect details are entered. It is important to understand that these are columns of invoices or purchase books, namely columns in the tax program table. For example, the Federal Tax Service sent a request with a table for section 8, error code - 4 [19]. This means that the parties to the transaction do not have the same VAT amounts and, possibly, deductions are inflated.

If you do not find an error, please provide an explanation and attach a copy of the invoice. Errors in the TIN/KPP, invoice number or date also mean that there is no need to clarify. Fill out only the table from letter No. AS-4-2/12705 with the correct data so that the tax authorities correct inaccuracies in their database.

Only an underestimated tax means that in response to the requirements it is necessary to submit an amended declaration, and before that pay additional VAT with penalties.

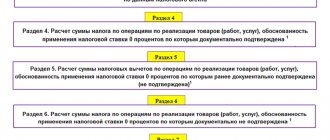

Codes that will tell you about errors in your VAT return

Using the figure below, you can quickly and clearly get acquainted with the coding of errors detected using ASK VAT (automated system for monitoring data from VAT returns):

You can find out what error codes 5 to 9 mean and how to respond to them in ConsultantPlus. You can get trial access to the K+ system for free.

In the following sections we will dwell in more detail on the reasons for the occurrence of errors with individual codes and the subsequent actions of the taxpayer.

What should the taxpayer do?

Receipts

First of all, send an electronic receipt to the tax office, which indicates that you have received a request for clarification.

Error checking

The request will indicate all possible error codes for which contradictions and inconsistencies were found. It is necessary to find out exactly which reflected transactions the inspection found inconsistencies in. It is important to reconcile the invoice records with those shown in the statements. Pay attention to the completed details, especially for any inconsistencies identified: date, number, amounts, calculation of the VAT amount at the correct tax rate and the cost of purchases or sales.

Explanations or subtle declaration

Send explanations if previously discovered errors did not change the VAT amount. Also provide explanations if you have not identified any errors and there are no grounds for correction.

Possible response format to the tax office:

“In response to the request from DT.MM.YYYY No. XX, I inform you that I have not identified any grounds for entering other data into the XXX declaration for the reporting period ... the declaration was drawn up correctly.”

If a self-check shows that you made a mistake (for example, a technical error in the digit of a certain code):

“In response to the request from DT.MM.YYYY No. XX, I inform you that when checking the XXX declaration for the reporting period... an error was discovered in the reflection... The updated declaration is attached.”

After re-checking, submit it to the tax inspector at your location, reflecting the new correct tax calculation indicators (if errors were found that underestimated the amount of tax payable to the state budget).

Changes in tax calculations

Elimination of errors in the calculation of the VAT amount in the updated declaration occurs in the direction of its decrease or increase.

If you have submitted clarifications in order to reduce the VAT payable, such reporting will be followed by a desk audit or an on-site audit, if one has not been carried out for a long time. If the audit confirms the fact of a tax reduction, an overpayment will be created on the company’s personal account: return it to your current account, or use it to offset other taxes. You also need to write an application addressed to the head of the Federal Tax Service inspection for a refund or offset.

If you have submitted clarifications for an increase in tax, which means an additional payment, first pay the amount of the underpayment, and then submit the adjustment declaration. This will help you avoid penalties for non-payment of taxes.

The tax office may impose penalties on the amount of non-payment, which must also be paid before submitting the clarification. If the additional payment amount has already been transferred, you can submit the declaration on that day, but it is usually submitted on the next business day.

A private easement is established by agreement of the parties. How to properly purchase a plot of land and avoid problems? Find out about this by reading our article. When should land tax be paid? You will find the answer here.

Responsibility for late filing of a declaration

To ensure that the tax inspectorate does not assess a fine for late payment of VAT tax and submission of a declaration, it is necessary to comply with the deadlines for payment of VAT tax adopted by the Tax Code of the Russian Federation. But if this happens and the tax is not transferred on time, then you will have to pay a fine of 20% of the tax amount.

If circumstances are discovered in which the report and payment are not listed on purpose, the company may be fined 40%

And also transactions on the current account may be suspended, it will be impossible to pay anything except taxes.