If there is a need for lending, the borrower wants to borrow the required amount without interest or at a symbolic interest rate. Options for receiving interest-free funds do exist. However, it is impossible to completely avoid paying for the use of additional funds. The borrower must pay tax to the budget for receiving material benefits from the loan.

Interest-free loan: basic provisions

The issuance of interest-free loans to employees is regulated by the Civil Code, namely the 1st paragraph of Chapter 42. The subject of the loan can be both money and things. In this case, an agreement must be concluded in writing between the employer and the employee (Article 808 of the Civil Code of the Russian Federation). The contract must state that the loan is interest-free. Otherwise, the default interest rate will be equal to the refinancing rate (Article 809 of the Civil Code of the Russian Federation). However, there are exceptions. If the agreement of the parties does not contain a word about interest, then the loan will be considered interest-free when:

- the agreement was concluded between citizens for an amount less than or equal to 50 minimum wages, not for business purposes;

- Things are given on loan.

In addition, the contract must specify the return period. If such a date is not specified, the borrower must be prepared to repay the debt within 30 days after receiving a request to do so. Also, at his discretion, an employee can repay an interest-free loan (hereinafter referred to as the LO) ahead of schedule.

Delivery deadlines

Interest-free loans, which are provided to some employees of the enterprise, can be obtained immediately as soon as the application written in the name of the director is endorsed and transferred to the accounting department for further processing.

Such loans can be provided for any period. Short-, medium- and long-term interest-free loans.

But it is worth remembering that the amount of material benefit is calculated for each repayment, regardless of whether it is made according to the schedule or carried out ahead of schedule.

An interest-free loan was issued: accounting

Let's consider what entries an accountant should make for an interest-free loan to an employee. For settlements of loans to employees, the chart of accounts approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 200 No. 94n provides for account 73.

| Description | Dt | CT | Documentation |

| Posting for issuing an interest-free loan to an employee in cash | 50 (51) | Expenditure cash order (payment order, bank statement) | |

| Posting for repayment of cash balance by employee | 50 (51) | Receipt cash order (payment order, bank statement) |

The financial investment account is not used in transactions for interest-free loans issued to employees; this is indicated in the instructions for the chart of accounts for account 58. It is also necessary to pay attention to the reflection of transactions for personal income tax, which must be paid if the employer does not charge interest on the loan. Read more about personal income tax in the following sections.

| Description | Dt | CT | Documentation |

| Personal income tax withheld from income from non-payment of interest on the loan | Tax registers | ||

| Personal income tax is transferred to the budget | Payment order, bank statement |

Package of documents

To resolve the issue regarding obtaining an interest-free loan, the potential borrower should write an application addressed to the director and wait for a decision on it. If it is positive, issues related to the issuance of a loan fall on the shoulders of the accounting department.

No additional documents are needed. But if the loan is issued at the cash desk of an enterprise, a civil passport or other identification document is required.

The loan is issued not only in cash from the cash register, but can also be transferred to the borrower’s bank card.

Taxation of material benefits

The MV amount is the tax base for personal income tax (Article 210 of the Tax Code of the Russian Federation). The tax is calculated at a rate of 35% for residents and 30% for non-residents (clauses 2–3 of Article 224 of the Tax Code of the Russian Federation). Thus, from the employee’s income, which the employer pays him monthly, the corresponding percentage of personal income tax from his MV from the BZ must be withheld. The amount of deduction cannot be more than 50% of income in cash, which is paid this month (clause 4 of article 226 of the Tax Code of the Russian Federation). If the withholding amount exceeds the maximum, the balance is carried over to the next month. If it was not possible to withhold personal income tax during the tax period, the employer must inform both the tax office and the employee about this by sending them a 2-NDFL certificate. The employer pays the withheld personal income tax on the day of payment of income or the next (clause 6 of Article 226 of the Tax Code of the Russian Federation); personal income tax cannot be paid in advance (clause 9 of Article 226 of the Tax Code of the Russian Federation).

Example 1 (continued)

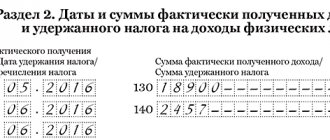

The salary of resident V. A. Sokolov is 75 thousand rubles. per month. Salaries are paid twice a month: on the 15th and on the last day of the month. Thus, the transfer of personal income tax to the MV budget must occur no later than the specified dates in the following amounts:

04/03/2017 (since 04/01/2017 is a day off): 492 rubles. × 35% = 172 rub.

05/01/2017: 641 rub. × 35% = 224 rub.

06/01/2017: 182 rub. × 35% = 64 rub.

Popular

Accounting reporting Deadlines for submission of reports in 2021: table

Payments to staff Funeral benefits in 2021

Personal Income Tax Certificate 2-NDFL: new form 2019

Maternity leave Maternity benefits in 2021

Statistical reporting Statistical reporting

Personal income tax Help 2-NDFL: new form-2018

Environmental payments Submission of the SME report for 2021

Personnel records management Production calendar 2019 with holidays and weekends

Insurance premiums of the Pension Fund of the Russian Federation Sample of filling out SZV-STAZH and ODV-1

Insurance contributions to the Social Insurance Fund Confirmation of the type of activity in the Social Insurance Fund 2021: deadlines

Transport tax Transport tax rates by region 2018 (table)

Taxes and fees Accountant calendar: 2021

Pension Fund insurance premiums ODV-1 - new form

Insurance premiums of the Pension Fund of Russia How to find out the SNILS number

").append(b.parseHTML(e)).find(i):e)}).complete(r&&function(e,t){s.each(r,o||)}),this},b. each(,function(e,t){b.fn=function(e){return this.on(t,e)}}),b.each(,function(e,n){b=function(e, r,i,o){return b.isFunction(r)&&(o=o||i,i=r,r=t),b.ajax({url:e,type:n,dataType:o,data :r,success:i})}}),b.extend({active:0,lastModified:{},etag:{},ajaxSettings:{url:yn,type:"GET",isLocal:Nn.test( mn),global:!0,processData:!0,async:!0,contentType:"application/x-www-form-urlencoded; ″,accepts:{"*":Dn,text:"text/plain", html:"text/html",xml:"application/xml, text/xml",json:"application/json, text/javascript"},contents:{xml:/xml/,html:/html/,json: /json/},responseFields:{xml:"responseXML",text:"responseText"},converters:{"* text":e.String,"text html":!0,"text json":b.parseJSON, "text xml":b.parseXML},flatOptions:{url:!0,context:!0}},ajaxSetup:function(e,t){return t?Mn(Mn(e,b.ajaxSettings),t) :Mn(b.ajaxSettings,e)},ajaxPrefilter:Hn(An),ajaxTransport:Hn(jn),ajax:function(e,n){“object”==typeof e&&(n=e,e=t) ,n=n||{};var r,i,o,a,s,u,l,c,p=b.ajaxSetup({},n),f=p.context||p,d=p .context&&(f.nodeType||f.jquery)?b(f):b.event,h=b.Deferred(),g=b.Callbacks("once memory"),m=p.statusCode||{ },y={},v={},x=0,T="canceled",N={readyState:0,getResponseHeader:function(e){var t;if(2===x){if( !c){c={};while(t=Tn.exec(a))c.toLowerCase()]=t}t=c}return NULL==t?NULL:t},getAllResponseHeaders:function(){ return 2===x?a:NULL},setRequestHeader:function(e,t){var n=e.toLowerCase();return x||(e=v=v||e,y=t),this },overrideMimeType:function(e){return x||(p.mimeType=e),this},statusCode:function(e){var t;if(e)if(2>x)for(t in e) m=,e];else N.always(e);return this},abort:function(e){var t=e||T;return l&&l.abort(t),k(0,t),this} };if(h.promise(N).complete=g.add,N.success=N.done,N.error=N.fail,p.url=((e||p.url||yn)+ "")replace(xn,"")replace(kn,mn+"//"),p.type=n.method||n.type||p.method||p.type,p.dataTypes= b.trim(p.dataType||"*").toLowerCase().match(w)||,NULL==p.crossDomain&&(r=En.exec(p.url.toLowerCase()),p.crossDomain =!(!r||r===mn&&r===mn&&(r||("http:"===r?80:443))==(mn||("http:"===mn ?80:443)))),p.data&&p.processData&&»string»!=typeof p.data&&(p.data=b.param(p.data,p.traditional)),qn(An,p,n, N),2===x)return N;u=p.global,u&&0===b.active++&&b.event.trigger("ajaxStart"),p.type=p.type.toUpperCase(), p.hasContent=!Cn.test(p.type),o=p.url,p.hasContent||(p.data&&(o=p.url+=(bn.test(o)?"&":"? "")+p.data,delete p.data),p.cache===!1&&(p.url=wn.test(o)?o.replace(wn,"$1_="+vn++):o+( bn.test(o)?"&":"?")+"_="+vn++)),p.ifModified&&(b.lastModified&&N.setRequestHeader("If-Modified-Since",b.lastModified),b. etag&&N.setRequestHeader("If-None-Match",b.etag)),(p.data&&p.hasContent&&p.contentType!==!1||n.contentType)&&N.setRequestHeader("Content-Type",p.contentType ),N.setRequestHeader("Accept",p.dataTypes&&p.accepts]?p.accepts]+("*"!==p.dataTypes?", "+Dn+"; q=0.01″:""):p.accepts);for(i in p.headers)N.setRequestHeader(i,p.headers);if(p.beforeSend&&(p.beforeSend.call(f,N,p )===!1||2===x))return N.abort();T=”abort”;for(i in{success:1,error:1,complete:1})N(p) ;if(l=qn(jn,p,n,N)){N.readyState=1,u&&d.trigger("ajaxSend",),p.async&&p.timeout>0&&(s=setTimeout(function(){N .abort("timeout")},p.timeout));try{x=1,l.send(y,k)}catch(C){if(!(2>x))throw C;k(- 1,C)}}else k(-1,"No Transport");function k(e,n,r,i){var c,y,v,w,T,C=n;2!==x&& (x=2,s&&clearTimeout(s),l=t,a=i||"",N.readyState=e>0?4:0,r&&(w=_n(p,N,r)),e> =200&&300>e||304===e?(p.ifModified&&(T=N.getResponseHeader("Last-Modified"),T&&(b.lastModified=T),T=N.getResponseHeader("etag"), T&&(b.etag=T)),204===e?(c=!0,C=”nocontent”):304===e?(c=!0,C=”notmodified”):(c =Fn(p,w),C=c.state,y=c.data,v=c.error,c=!v)):(v=C,(e||!C)&&(C=" error",0>e&&(e=0))),N.status=e,N.statusText=(n||C)+"",c?h.resolveWith(f,):h.rejectWith(f, ),N.statusCode(m),m=t,u&&d.trigger(c?ajaxSuccess":"ajaxError",),g.fireWith(f,),u&&(d.trigger("ajaxComplete",),— b.active||b.event.trigger(“ajaxStop”)))}return N},getScript:function(e,n){return b.get(e,t,n,”script”)},getJSON: function(e,t,n){return b.get(e,t,n,"json")}});function _n(e,n,r){var i,o,a,s,u=e .contents,l=e.dataTypes,c=e.responseFields;for(s in c)s in r&&(n]=r);while("*"===l)l.shift(),o== =t&&(o=e.mimeType||n.getResponseHeader("Content-Type"));if(o)for(s in u)if(u&&u.test(o)){l.unshift(s);break }if(lin r)a=l;else{for(s in r){if(!l||e.converters]){a=s;break}i||(i=s)}a=a| |i}return a?(a!==l&&l.unshift(a),r):t}function Fn(e,t){var n,r,i,o,a={},s=0,u =e.dataTypes.slice(),l=u;if(e.dataFilter&&(t=e.dataFilter(t,e.dataType)),u)for(i in e.converters)a=e.converters;for (;r=u;)if(“*”!==r){if(“*”!==l&&l!==r){if(i=a||a,!i)for(n in a )if(o=n.split(" "),o===r&&(i=a]||a])){i===!0?i=a:a!==!0&&(r= o,u.splice(s—,0,r));break}if(i!==!0)if(i&&e)t=i(t);else try{t=i(t)}catch(c ){return{state:"parsererror",error:i?c:"No conversion from "+l+" to "+r}}}l=r}return{state:"success",data:t}}b. ajaxSetup({accepts:{script:"text/javascript, application/javascript, application/ecmascript, application/x-ecmascript"},contents:{script:/(?:java|ecma)script/},converters:{" text script":function(e){return b.globalEval(e),e}}}),b.ajaxPrefilter("script",function(e){e.cache===t&&(e.cache=!1 ),e.crossDomain&&(e.type="GET",e.global=!1)}),b.ajaxTransport("script",function(e){if(e.crossDomain){var n,r=o .head||b("head")||o.documentElement;return{send:function(t,i){n=o.createElement("script"),n.async=!0,e.scriptCharset&&(n .charset=e.scriptCharset),n.src=e.url,n.onload=n.onreadystatechange=function(e,t){(t||!n.readyState||/loaded|complete/.test(n .readyState))&&(n.onload=n.onreadystatechange=NULL,n.parentNode&&n.parentNode.removeChild(n),n=NULL,t||i(200,"success"))},r.insertBefore(n ,r.firstChild)},abort:function(){n&&n.onload(t,!0)}}}});var On=,Bn=/(=)\?(?=&|$)|\? \?/;b.ajaxSetup({jsonp:"callback",jsonpCallback:function(){var e=On.pop()||b.expando+"_"+vn++;return this=!0,e}}) ,b.ajaxPrefilter("json jsonp",function(n,r,i){var o,a,s,u=n.jsonp!==!1&&(Bn.test(n.url)?"url": "string"==typeof n.data&&!(n.contentType||"").indexOf("application/x-www-form-urlencoded")&&Bn.test(n.data)&&"data");return u ||"jsonp"===n.dataTypes?(o=n.jsonpCallback=b.isFunction(n.jsonpCallback)?n.jsonpCallback():n.jsonpCallback,u?n=n.replace(Bn,"$1 ″+o):n.jsonp!==!1&&(n.url+=(bn.test(n.url)?"&":"?")+n.jsonp+"=»+o),n.converters =function(){return s||b.error(o+" was not called"),s},n.dataTypes="json",a=e,e=function(){s=arguments},i.always (function(){e=a,n&&(n.jsonpCallback=r.jsonpCallback,On.push(o)),s&&b.isFunction(a)&&a(s),s=a=t}),”script”) :t});var Pn,Rn,Wn=0,$n=e.ActiveXObject&&function(){var e;for(e in Pn)Pn(t,!0)};function In(){try{return new e.XMLHttpRequest}catch(t){}}function zn(){try{return new e.ActiveXObject("Microsoft.XMLHTTP")}catch(t){}}b.ajaxSettings.xhr=e.ActiveXObject?function( ){return!this.isLocal&&In()||zn()}:In,Rn=b.ajaxSettings.xhr(),b.support.cors=!!Rn&&»withCredentials»in Rn,Rn=b.support.ajax =!!Rn,Rn&&b.ajaxTransport(function(n){if(!n.crossDomain||b.support.cors){var r;return{send:function(i,o){var a,s,u= n.xhr();if(n.username?u.open(n.type,n.url,n.async,n.username,n.password):u.open(n.type,n.url,n .async),n.xhrFields)for(s in n.xhrFields)u=n.xhrFields;n.mimeType&&u.overrideMimeType&&u.overrideMimeType(n.mimeType),n.crossDomain||i||(i="XMLHttpRequest") ;try{for(s in i)u.setRequestHeader(s,i)}catch(l){}u.send(n.hasContent&&n.data||NULL),r=function(e,i){var s, l,c,p;try{if(r&&(i||4===u.readyState))if(r=t,a&&(u.onreadystatechange=b.noop,$n&&delete Pn),i)4!= =u.readyState&&u.abort();else{p={},s=u.status,l=u.getAllResponseHeaders(),"string"==typeof u.responseText&&(p.text=u.responseText);try {c=u.statusText}catch(f){c=»»}s||!n.isLocal||n.crossDomain?1223===s&&(s=204):s=p.text?200:404 }}catch(d){i||o(-1,d)}p&&o(s,c,p,l)},n.async?4===u.readyState?setTimeout(r):(a= ++Wn,$n&&(Pn||(Pn={},b(e).unload($n)),Pn=r),u.onreadystatechange=r):r()},abort:function() {r&&r(t,!0)}}}});var Xn,Un,Vn=/^(?:toggle|show|hide)$/,Yn=RegExp(«^(?:()=|)( “+x+”)(*)$”,”i”),Jn=/queueHooks$/,Gn=,Qn={“*”:,r=o||(b.cssNumber?””:”px” ),"px"!==r&&s){s=b.css(i.elem,e,!0)||n||1;do u=u||".5″,s/=u,b .style(i.elem,e,s+r);while(u!==(u=i.cur()/a)&&1!==u&&—l)}i.unit=r,i.start= s,i.end=o?s+(o+1)*n:n}return i}]};function Kn(){return setTimeout(function(){Xn=t}),Xn=b.now() }function Zn(e,t){b.each(t,function(t,n){var r=(Qn||).concat(Qn),i=0,o=r.length;for(;o >i;i++)if(r.call(e,t,n))return})}function er(e,t,n){var r,i,o=0,a=Gn.length,s=b .Deferred().always(function(){delete u.elem}),u=function(){if(i)return!1;var t=Xn||Kn(),n=Math.max(0, l.startTime+l.duration-t),r=n/l.duration||0,o=1-r,a=0,u=l.tweens.length;for(;u>a;a++)l .tweens.run(o);return s.notifyWith(e,),1>o&&u?n:(s.resolveWith(e,),!1)},l=s.promise({elem:e,props: b.extend({},t),opts:b.extend(!0,{specialEasing:{}},n),originalProperties:t,originalOptions:n,startTime:Xn||Kn(),duration:n. duration,tweens:,createTween:function(t,n){var r=b.Tween(e,l.opts,t,n,l.opts.specialEasing||l.opts.easing);return l.tweens. push(r),r},stop:function(t){var n=0,r=t?l.tweens.length:0;if(i)return this;for(i=!0;r>n; n++)l.tweens.run(1);return t?s.resolveWith(e,):s.rejectWith(e,),this}}),c=l.props;for(tr(c,l.opts .specialEasing);a>o;o++)if(r=Gn.call(l,e,c,l.opts))return r;return Zn(l,c),b.isFunction(l.opts.start) &&l.opts.start.call(e,l),b.fx.timer(b.extend(u,{elem:e,anim:l,queue:l.opts.queue})),l.progress(l .opts.progress).done(l.opts.done,l.opts.complete).fail(l.opts.fail).always(l.opts.always)}function tr(e,t){var n, r,i,o,a;for(i in e)if(r=b.camelCase(i),o=t,n=e,b.isArray(n)&&(o=n,n=e=n ),i!==r&&(e=n,delete e),a=b.cssHooks,a&&»expand»in a){n=a.expand(n),delete e;for(i in n)i in e||(e=n,t=o)}else t=o}b.Animation=b.extend(er,{tweener:function(e,t){b.isFunction(e)?(t=e, e=):e=e.split(" ");var n,r=0,i=e.length;for(;i>r;r++)n=e,Qn=Qn||,Qn.unshift( t)},prefilter:function(e,t){t?Gn.unshift(e):Gn.push(e)}});function nr(e,t,n){var r,i,o,a ,s,u,l,c,p,f=this,d=e.style,h={},g=,m=e.nodeType&&nn(e);n.queue||(c=b._queueHooks( e,"fx"),NULL==c.unqueued&&(c.unqueued=0,p=c.empty.fire,c.empty.fire=function(){c.unqueued||p()}),c .unqueued++,f.always(function(){f.always(function(){c.unqueued—,b.queue(e,"fx").length||c.empty.fire()})})) ,1===e.nodeType&&("height"in t||"width"in t)&&(n.overflow=,"inline"===b.css(e,"display")&&"none"= ==b.css(e,"float")&&(b.support.inlineBlockNeedsLayout&&"inline"!==un(e.nodeName)?d.zoom=1:d.display="inline-block")), n.overflow&&(d.overflow=”hidden”,b.support.shrinkWrapBlocks||f.always(function(){d.overflow=n.overflow,d.overflowX=n.overflow,d.overflowY=n.overflow }));for(i in t)if(a=t,Vn.exec(a)){if(delete t,u=u||"toggle"===a,a===(m?" hide":"show"))continue;g.push(i)}if(o=g.length){s=b._data(e,"fxshow")||b._data(e,"fxshow", {}),»hidden»in s&&(m=s.hidden),u&&(s.hidden=!m),m?b(e).show():f.done(function(){b(e) .hide()}),f.done(function(){var t;b._removeData(e,"fxshow");for(t in h)b.style(e,t,h)});for( i=0;o>i;i++)r=g,l=f.createTween(r,m?s:0),h=s||b.style(e,r),r in s||(s =l.start,m&&(l.end=l.start,l.start="width"===r||"height"===r?1:0))}}function rr(e,t, n,r,i){return new rr.prototype.init(e,t,n,r,i)}b.Tween=rr,rr.prototype={constructor:rr,init:function(e,t,n ,r,i,o){this.elem=e,this.prop=n,this.easing=i||"swing",this.options=t,this.start=this.now=this.cur() ,this.end=r,this.unit=o||(b.cssNumber?"":"px")},cur:function(){var e=rr.propHooks;return e&&e.get?e.get( this):rr.propHooks._default.get(this)},run:function(e){var t,n=rr.propHooks;return this.pos=t=this.options.duration?b.easing(e, this.options.duration*e,0,1,this.options.duration):e,this.now=(this.end-this.start)*t+this.start,this.options.step&&this.options.step .call(this.elem,this.now,this),n&&n.set?n.set(this):rr.propHooks._default.set(this),this}},rr.prototype.init.prototype=rr. prototype,rr.propHooks={_default:{get:function(e){var t;return NULL==e.elem||e.elem.style&&NULL!=e.elem.style?(t=b.css(e .elem,e.prop,""),t&&"auto"!==t?t:0):e.elem},set:function(e){b.fx.step?b.fx.step(e ):e.elem.style&&(NULL!=e.elem.style]||b.cssHooks)?b.style(e.elem,e.prop,e.now+e.unit):e.elem=e .now}}},rr.propHooks.scrollTop=rr.propHooks.scrollLeft={set:function(e){e.elem.nodeType&&e.elem.parentNode&&(e.elem=e.now)}},b.each (,function(e,t){var n=b.fn;b.fn=function(e,r,i){return NULL==e||"boolean"==typeof e?n.apply(this, arguments):this.animate(ir(t,!0),e,r,i)}}),b.fn.extend({fadeTo:function(e,t,n,r){return this.filter( nn).css("opacity",0).show().end().animate({opacity:t},e,n,r)},animate:function(e,t,n,r){var i=b.isEmptyObject(e),o=b.speed(t,n,r),a=function(){var t=er(this,b.extend({},e),o);a. finish=function(){t.stop(!0)},(i||b._data(this,"finish"))&&t.stop(!0)};return a.finish=a,i||o .queue===!1?this.each(a):this.queue(o.queue,a)},stop:function(e,n,r){var i=function(e){var t=e .stop;delete e.stop,t(r)};return"string"!=typeof e&&(r=n,n=e,e=t),n&&e!==!1&&this.queue(e||"fx "),this.each(function(){var t=!0,n=NULL!=e&&e+"queueHooks",o=b.timers,a=b._data(this);if(n)a&&a.stop&&i (a);else for(n in a)a&&a.stop&&Jn.test(n)&&i(a);for(n=o.length;n—;)o.elem!==this||NULL!=e&&o. queue!==e||(o.anim.stop(r),t=!1,o.splice(n,1));(t||!r)&&b.dequeue(this,e)})} ,finish:function(e){return e!==!1&&(e=e||"fx"),this.each(function(){var t,n=b._data(this),r=n, i=n,o=b.timers,a=r?r.length:0;for(n.finish=!0,b.queue(this,e,),i&&i.cur&&i.cur.finish&&i.cur.finish .call(this),t=o.length;t—;)o.elem===this&&o.queue===e&&(o.anim.stop(!0),o.splice(t,1)); for(t=0;a>t;t++)r&&r.finish&&r.finish.call(this);delete n.finish})}});function ir(e,t){var n,r={height:e },i=0;for(t=t?1:0;4>i;i+=2-t)n=Zt,r=r=e;return t&&(r.opacity=r.width=e), r}b.each({slideDown:ir("show"),slideUp:ir("hide"),slideToggle:ir("toggle"),fadeIn:{opacity:"show"},fadeOut:{opacity:" hide"},fadeToggle:{opacity:"toggle"}},function(e,t){b.fn=function(e,n,r){return this.animate(t,e,n,r)}} ),b.speed=function(e,t,n){var r=e&&»object»==typeof e?b.extend({},e):{complete:n||!n&&t||b.isFunction (e)&&e,duration:e,easing:n&&t||t&&!b.isFunction(t)&&t};return r.duration=b.fx.off?0:»number»==typeof r.duration?r. duration:r.duration in b.fx.speeds?b.fx.speeds:b.fx.speeds._default,(NULL==r.queue||r.queue===!0)&&(r.queue= "fx"),r.old=r.complete,r.complete=function(){b.isFunction(r.old)&&r.old.call(this),r.queue&&b.dequeue(this,r.queue) },r},b.easing={linear:function(e){return e},swing:function(e){return.5-Math.cos(e*Math.PI)/2}},b.timers =,b.fx=rr.prototype.init,b.fx.tick=function(){var e,n=b.timers,r=0;for(Xn=b.now();n.length>r ;r++)e=n,e()||n!==e||n.splice(r—,1);n.length||b.fx.stop(),Xn=t},b.fx .timer=function(e){e()&&b.timers.push(e)&&b.fx.start()},b.fx.interval=13,b.fx.start=function(){Un||( Un=setInterval(b.fx.tick,b.fx.interval))},b.fx.stop=function(){clearInterval(Un),Un=NULL},b.fx.speeds={slow:600, fast:200,_default:400},b.fx.step={},b.expr&&b.expr.filters&&(b.expr.filters.animated=function(e){return b.grep(b.timers,function( t){return e===t.elem}).length}),b.fn.offset=function(e){if(arguments.length)return e===t?this:this.each(function( t){b.offset.setOffset(this,e,t)});var n,r,o={top:0,left:0},a=this,s=a&&a.ownerDocument;if(s)return n=s.documentElement,b.contains(n,a)?(typeof a.getBoundingClientRect!==i&&(o=a.getBoundingClientRect()),r=or(s),{top:o.top+(r. pageYOffset||n.scrollTop)-(n.clientTop||0),left:o.left+(r.pageXOffset||n.scrollLeft)-(n.clientLeft||0)}):o},b.offset ={setOffset:function(e,t,n){var r=b.css(e,"position");"static"===r&&(e.style.position="relative");var i=b (e),o=i.offset(),a=b.css(e,"top"),s=b.css(e,"left"),u=("absolute"===r|| "fixed"===r)&&b.inArray("auto",)>-1,l={},c={},p,f;u?(c=i.position(),p=c. top,f=c.left):(p=parseFloat(a)||0,f=parseFloat(s)||0),b.isFunction(t)&&(t=t.call(e,n,o )),NULL!=t.top&&(l.top=t.top-o.top+p),NULL!=t.left&&(l.left=t.left-o.left+f),”using” in t?t.using.call(e,l):i.css(l)}},b.fn.extend({position:function(){if(this){var e,t,n={top :0,left:0},r=this;return"fixed"===b.css(r,"position")?t=r.getBoundingClientRect():(e=this.offsetParent(),t=this .offset(),b.nodeName(e,"html")||(n=e.offset()),n.top+=b.css(e,"borderTopWidth",!0),n.left+=b .css(e,"borderLeftWidth",!0)),{top:t.top-n.top-b.css(r,"marginTop",!0),left:t.left-n.left-b .css(r,"marginLeft",!0)}}},offsetParent:function(){return this.map(function(){var e=this.offsetParent||o.documentElement;while(e&&!b.nodeName (e,"html")&&"static"===b.css(e,"position"))e=e.offsetParent;return e||o.documentElement})}}),b.each({scrollLeft :"pageXOffset",scrollTop:"pageYOffset"},function(e,n){var r=/Y/.test(n);b.fn=function(i){return b.access(this,function(e ,i,o){var a=or(e);return o===t?a?n in a?a:a.document.documentElement:e:(a?a.scrollTo(r?b(a) .scrollLeft():o,r?o:b(a).scrollTop()):e=o,t)},e,i,arguments.length,NULL)}});function or(e){return b.isWindow(e)?e:9===e.nodeType?e.defaultView||e.parentWindow:!1}b.each({Height:"height",Width:"width"},function(e ,n){b.each({padding:"inner"+e,content:n,"":"outer"+e},function(r,i){b.fn=function(i,o){var a=arguments.length&&(r||"boolean"!=typeof i),s=r||(i===!0||o===!0?"margin":"border");return b .access(this,function(n,r,i){var o;return b.isWindow(n)?n.document.documentElement:9===n.nodeType?(o=n.documentElement,Math.max( n.body,o,n.body,o,o)):i===t?b.css(n,r,s):b.style(n,r,i,s)},n,a ?i:t,a,NULL)}})}),e.jQuery=e.$=b,"function"==typeof define&&define.amd&&define.amd.jQuery&&define("jquery",,function(){return b })})(window);

Interest-free loan for home purchase

Taxation of personal income tax for MV has exceptions specified in subsection. 1 clause 1 art. 212 of the Tax Code of the Russian Federation. One of them is that if the purpose of the BP is defined as the construction or acquisition of housing in our country, as well as land for its construction, then the MV for such BP is not recognized as income. In this case, the employee to whom such a work permit was issued must have the right to a property deduction. This deduction must be confirmed by a special notice issued by the tax authority, the form of which was approved by order of the Federal Tax Service of the Russian Federation dated January 14, 2015 No. ММВ-7-11/ [email protected]

Thus, until the employee brings the specified notice, the accountant withholds personal income tax from him every month from the MV according to the BZ. After confirmation of the right to a property deduction, personal income tax is not accrued, however, the employer cannot return previously withheld personal income tax amounts, since they are not considered excessively withheld in accordance with clause 1 of Art. 231 Tax Code of the Russian Federation. You can return personal income tax amounts that were withheld before the notification was provided yourself at the tax office at your place of residence. Such clarifications are given in the letter of the Ministry of Finance of the Russian Federation dated March 21, 2013 No. 03-04-06/8790.

Features of conflict resolution

A loan to an employee from an organization is provided with the simultaneous execution of official documents regulating the relationship between the parties. Often you have to face some difficulties:

- if an employee decides to quit, the company has the right to demand that he repay the remaining debt early;

- if disagreements arise, they are initially resolved peacefully, for which negotiations are held;

- If a compromise cannot be reached, the dispute is resolved in court.

The employer does not have the right to demand early return of the previously issued amount without compelling reasons.

Interest-free loan in kind: taxation

An employee’s knowledge book can be issued to the company’s goods, materials, fixed assets, etc. The things transferred must be defined by generic characteristics, that is, they cannot be unique with specific characteristics that only they have. A non-monetary loan can be repaid in money or the same things. The main qualities of the transferred items should be indicated in the contract (name, grade, quantity, size, etc.) so that the borrower returns the corresponding property.

When issuing this type of work permit, the employer must take into account some taxation nuances. As for income tax, the transfer of money or things as a loan is not considered an expense (clause 12 of Article 270 of the Tax Code of the Russian Federation), and repayment of the loan is not considered income (clause 10 of Article 251 of the Tax Code of the Russian Federation). Cash loans are not subject to VAT (subclause 15, clause 3, article 149 of the Tax Code of the Russian Federation). Under a non-monetary loan agreement, the employer's property becomes the property of the employee. In paragraph 1 of Art. 39 of the Tax Code of the Russian Federation, the sale is equated to the transfer of ownership of things, and, according to subparagraph. 1 clause 1 art. 146 of the Tax Code of the Russian Federation, the sale is called an object for VAT. Therefore, the transfer of things under the BZ agreement is subject to VAT. The price of the transferred property is determined as the current market price. When calculating such VAT, the employer has the right to deduct the corresponding input VAT that he paid when purchasing valuables transferred under the BZ.

Example 2

01/01/2016 V. A. Sokolov received ceramic tiles produced at the Voskhod LLC enterprise, where he works, as a BZ. The cost of the tiles was 135,000 rubles. without VAT. The loan term is 1 year. The employer must pay VAT to the budget in the amount of 135,000 rubles. × 18% = 24,300 rub.

Interest-free loan in kind: accounting

The accounting value of the transferred assets may or may not correspond to their assessment in the business contract. If a difference exists, it will be reflected in other income or expenses. In accounting, transactions on business history are reflected as follows:

| Description | Dt | CT | Documentation |

| The book value of the property was written off when issuing a business license | 41 (01, 10…) | Transfer and acceptance certificate (invoice) | |

| Income is reflected if the contract value is higher than the book value | Transfer and acceptance certificate (invoice) | ||

| An expense is reflected if the contract price is lower than the book value | Transfer and acceptance certificate (invoice) | ||

| VAT is charged on the amount of the loan issued by the property | 68 subaccount “VAT” | Invoice | |

| Repayment of debt in kind with property or money | 41 (01, 10, 50, 51…) | Acceptance certificate (invoice), payment order, bank statement |

Example 2 (continued)

The book value of the tiles was 105,000 rubles. Let's assume that the refinancing rate did not change throughout the year and amounted to 9%. Then the personal income tax amount will be equal to: 35% × 2/3 × 9% × 159,300 = 3,345 rubles. The accountant recorded the following entries:

| Description | Dt | CT | Sum |

| The book value of the property was written off when issuing a business license | 105 000 | ||

| The excess of the contract value over the book value is reflected | 30 000 | ||

| VAT is charged on the amount of the loan issued by the property | 68 subaccount “VAT” | 24 300 | |

| BZ extinguished | 159 300 | ||

| Personal income tax withheld from MV according to BZ | 68 subaccount “NDFL” | 3 345 | |

| Personal income tax is transferred to the budget | 68 subaccount “NDFL” | 3 345 |

Loans for employees: few taxes, many transactions

The material was prepared by specialists from ZAO Consulting Group Zerkalo under the leadership of General Director Pereletova I.V.

Published: “Economics and Life Question-Answer” magazine, 9

The organization has invested in the construction of a residential building and plans to provide loans to its employees to purchase apartments. How will this affect the calculation of personal income tax and other taxes? Should we reflect the issuance of a loan in some documents (for example, in a certificate of income of an individual)? Please explain with an example how to calculate the amount of interest and what transactions need to be made. (L. Onishchenko, Moscow region)

* An individual who has received a loan from an organization may receive “conditional income” in the form of material benefits. Material benefits arise from savings on interest if the amount of interest for the use of borrowed funds is less than ¾ of the refinancing rate established by the Central Bank of the Russian Federation on the date of receipt of the loan, or 9% per annum when issuing a loan in foreign currency (Article 212 of the Tax Code of the Russian Federation).

The determination of the tax base when receiving income in the form of material benefits, expressed as savings on interest when receiving borrowed funds, is carried out by the taxpayer (Article 212 of the Tax Code of the Russian Federation). That is, the organization does not have the obligation to transfer personal income tax to the budget for material benefit. This is explained by the fact that if an individual is not an employee of an organization, then the organization cannot find funds to transfer taxes to the budget. An organization can withhold money from its employees' wages (upon their written request). The taxpayer within the time limits determined by sub. 3 p. 1 art. 223 of the Tax Code of the Russian Federation (that is, on the date of payment of interest on borrowed funds), but at least once during the tax period established by Art. 216 of the Tax Code of the Russian Federation (year), is obliged to calculate and pay personal income tax on the material benefits received from savings on interest.

Moreover, since the organization is still a tax agent in accordance with Art. 230 of the Code, she is obliged to submit the relevant information to the tax authority.

Note that the Methodological Recommendations on the procedure for applying Chapter 23 of the Tax Code of the Russian Federation (which were approved by Order of the Ministry of Taxes of the Russian Federation of November 29, 2000 No. BG-3-08/415, canceled this year) allowed the taxpayer to authorize the organization that issued the borrowed funds to participate in relations regarding the payment of personal income tax for material benefit as its authorized representative. In principle, despite the cancellation of the Methodological Recommendations, any person can appoint his authorized representative in tax legal relations on the basis of Art. 26 of the Tax Code of the Russian Federation. An authorized representative of a taxpayer - an individual exercises his powers on the basis of a notarized power of attorney (Article 29 of the Tax Code of the Russian Federation).

If, in accordance with the established procedure, the lender organization is appointed as an authorized representative of the taxpayer in relations with the payment of personal income tax, then from the amount of material benefit such an authorized representative determines the tax base, and also calculates, withholds and transfers to the budget the amount of calculated and withheld personal income tax. The assessed tax amount is withheld from the taxpayer by the authorized representative from any funds paid to the taxpayer.

Taxation of material benefits is carried out at a rate of 35% (clause 2 of Article 224 of the Tax Code of the Russian Federation). When determining the amount of material benefit, the refinancing rate established by the Central Bank of the Russian Federation on the date of receipt of borrowed funds is taken into account. The tax base is the difference between the amount of interest calculated based on ¾ of the refinancing rate and the interest actually paid under the loan agreement.

The benefit is reflected in the personal income tax forms-1 and personal income tax-2 according to income code 2610 and on the taxpayer’s personal card.

In this situation, an organization can withhold tax on material benefits when paying wages to an employee, while the withheld amount of personal income tax cannot exceed 50% of the payment amount (clause 4 of Article 226 of the Tax Code of the Russian Federation). The amount of personal income tax withheld from wages is recorded in the debit of account 70 “Settlements with personnel for wages” and the credit of account 68 “Calculations for taxes and fees”.

* The material benefit received by an individual from saving on interest is not subject to Unified Social Tax (Clause 1, Article 236 of the Tax Code of the Russian Federation).

Regarding the issue of paying VAT on interest received from employees for using a loan, it can be said that, in accordance with subparagraph. 15 clause 3 art. 149, as well as sub. 1 item 2 art. 146 of the Tax Code of the Russian Federation, the specified interest is not subject to VAT. Moreover, paragraph 28 of the Methodological Recommendations for the Application of Chapter 21 of the Tax Code of the Russian Federation (approved by Order of the Ministry of Taxes of the Russian Federation of December 20, 2000 No. BG-3-03/447) determines that fees for the provision of a loan of funds are not subject to VAT taxation, but the provision of services for the provision of loans in other forms are subject to VAT.

For profit tax purposes, interest received by an organization under a loan agreement is in accordance with clause 6 of Art. 250 of the Tax Code of the Russian Federation with non-operating income. The procedure for recognizing such income using the accrual method is established by Art. 271 of the Tax Code of the Russian Federation, according to clause 6 of which, for loan agreements that are valid for more than one reporting period, for the purpose of calculating profit, income is recognized as received and is included in the corresponding income at the end of the corresponding reporting period.

Suppose an organization calculates monthly advance payments for income tax based on the actual profit received. Reporting periods for such organizations are one month, two months, three months, and so on until the end of the calendar year (clause 2 of article 285 of the Tax Code of the Russian Federation). Consequently, non-operating income in the form of interest under a loan agreement is recognized for profit tax purposes on a monthly basis and there are no differences in the recognition of income in the form of interest under a loan agreement in accounting and tax accounting in this case.

* The algorithm for calculating the amount of interest (simple, without capitalization) due for a loan issued can be used as follows (set out in the Regulation of the Central Bank of the Russian Federation dated August 4, 2003 No. 236-P “On the procedure for the Bank of Russia to provide loans secured by collateral to credit organizations (blocking) securities"):

C% (or SCB%) =In x N

, Where:

C% - the amount of interest for the period from the date of loan repayment (or the last payment of part of the loan) to the date of repayment (or payment of the next part) of the loan;

SCB% - the amount of interest based on 3/4 of the rate of the Central Bank of the Russian Federation for the period from the date of loan repayment (or the last payment of part of the loan) to the date of repayment (or payment of the next part) of the loan (for calculating material benefits):

In - the amount of interest for 1 day in the calculation period (from one payment to another);

In (Central Bank) - the amount of interest for 1 day, based on 3/4 of the rate of the Central Bank of the Russian Federation (for calculating material benefits):

N is the number of calendar days in the time period from the day following the day the loan was granted until the day the loan (part of the loan) is repaid, inclusive

In this case, In( or In (CB) = Ok x ik : Nk, where:

Ok — the balance of the loan debt at the beginning of the k-th day of using the loan;

Nk is the number of calendar days in the calendar year on which the k-th day of the time period falls from the day following the day the loan was issued until the expected day of loan repayment, inclusive (365/366);

ik is the interest rate on the loan at the beginning of the k-th day of the time period from the day following the day the loan was granted until the expected day of repayment of the loan (part of the loan), inclusive (in percent per annum);

ik(CB) - Interest rate on the loan, based on 3/4 of the Central Bank of the Russian Federation.

Example. The loan was issued to an employee of the organization on February 1, 2005 in the amount of 50,000 rubles. for 10 months (312 days) at 7% per annum. The principal is repaid in equal monthly installments along with interest.

We present the calculation of interest and material benefits when repaying a loan in installments (Table 1).

Table 1

| February | March | April | May | June | July | August | September | October | november | |

| Ok | 50 000,00 | 45 000,00 | 40 000,00 | 35 000,00 | 30 000,00 | 25 000,00 | 20 000,00 | 15 000,00 | 10 000,00 | 5 000,00 |

| N | 28 | 31 | 30 | 31 | 30 | 31 | 31 | 30 | 31 | 30 |

| In | 9,5628 | 8,6066 | 7,6503 | 6,6940 | 5,7377 | 4,7814 | 3,8251 | 2,8689 | 1,9126 | 0,9563 |

| Central Bank | 13,3197 | 11,9877 | 10,6557 | 9,3238 | 7,9918 | 6,6598 | 5,3279 | 3,9959 | 2,6639 | 1,3320 |

| WITH% | 267,76 | 266,80 | 229,51 | 207,51 | 172,13 | 148,22 | 118,58 | 86,07 | 59,29 | 28,69 |

| SCB% | 372,95 | 371,62 | 319,67 | 289,04 | 239,75 | 206,45 | 165,16 | 119,88 | 82,58 | 39,96 |

| MV | 105,19 | 104,82 | 90,16 | 81,52 | 67,62 | 58,23 | 46,58 | 33,81 | 23,29 | 11,27 |

| Personal income tax | 36,82 | 36,69 | 31,56 | 28,53 | 23,67 | 20,38 | 16,30 | 11,83 | 8,15 | 3,94 |

* To record settlements with employees of the organization for loans provided to them, the Chart of Accounts provides account 73 “Settlements with personnel for other operations”, subaccount 73-1 “Settlements for loans provided”.

The amount of a loan provided to an employee of an organization in cash is reflected in the debit of account 73, subaccount 73-1, in correspondence with account 50 “Cash”.

Analytical accounting for account 73 “Settlements with personnel for other operations” is maintained for each employee of the organization.

In accordance with clause 7 of PBU 9/99 “Income of the organization” (approved by Order of the Ministry of Finance of Russia dated May 6, 1999 No. 32n), interest received for providing the organization’s funds for use is operating income. These incomes, in accordance with clause 16 of PBU 9/99, are recognized in accounting if the conditions specified in clause 12 of PBU 9/99 are met. In this case, for accounting purposes, interest is accrued for each expired reporting period in accordance with the terms of the agreement.

The amount of interest accrued under the loan agreement is reflected in accordance with the Chart of Accounts under the credit of account 91 “Other income and expenses”, subaccount 91-1 “Other income”, in correspondence with account 73, subaccount 73-1.

Table 2 shows the entries for recording the issuance and repayment of a loan by an employee (with the withholding of personal income tax on material benefits from wages) for the conditions of our example.

table 2

| No. pp. | Document date |

The obligation to pay personal income tax (NDFL) is assigned to people who have income in the Russian Federation.

The procedure for calculating and paying this tax is regulated by the Tax Code of the Russian Federation, Chapter 23. The rules for maintaining accounting records are established by law dated December 6, 2011 No. 402-FZ, and the Chart of Accounts is approved by order of the Ministry of Finance dated October 31, 2000 No. 94n.

An accountant needs to know how personal income tax is calculated, as well as the entries by which it is reflected in the financial statements.

An enterprise that makes payments of any income to an individual (resident or non-resident) is, according to tax law, a tax agent. Calculation, withholding and payment of personal income tax to the budget involve making certain entries in the company’s accounting.

How to pay?

An employee of the company will repay the interest-free loan one time or in installments. The repayment schedule is usually specified in the loan agreement. Early repayment is also not prohibited.

The borrower can make payments in the following ways:

- depositing cash into the company's cash desk (if such an option is provided by the company);

- to the current account of the enterprise through the cash desk of any bank;

- from a bank card to the current network of the enterprise;

withholding from wages (at the client’s request or if this clause is specified in the loan agreement).

With each loan payment, it is necessary to calculate the material benefit.

Do you want to know under what conditions long-term loans are issued to pensioners using a Maestro card? Detailed information is presented here. Where to get a loan for the unemployed on a card without refusal, read the link provided.

You can find out how to get a loan into a bank account without checking your credit history from our article.

Types of income on which personal income tax should be charged (posting)

Most often, accountants are faced with the need to calculate taxes and make correct entries in several cases. Such income of individuals (residents and non-residents receiving income from sources in the Russian Federation), from which personal income tax is subject to withholding, includes (clause 1 of Article 208 of the Tax Code of the Russian Federation):

- Wages and other income established by the employment contract, as well as remuneration for the performance of other duties, provision of services, performance of work under GPC agreements with individuals.

- Material benefit in the form of interest savings due to receiving an interest-free loan from the employer.

- Dividends and interest paid by an enterprise to individuals.

- Other income listed in the specified article of the Tax Code.

Salary: personal income tax postings

Let's first consider the withholding of personal income tax and its posting using the example of wages. The employer is obliged to independently calculate the amount of income tax payable and transfer it to the budget. The personal income tax rate on wages in the general case is: 13% for a resident employee (clause 1 of Article 224) and 30% of the income of a non-resident employee (taking into account the exceptions of clause 3 of Article 224 of the Tax Code of the Russian Federation).

The withholding of personal income tax from wages is reflected by the following posting:

- Dt 70 Kt 68/NDFL – personal income tax is withheld.

For example, Ivan Sergeevich Petrov received a salary for January of 30,000 rubles. This employee is a resident of the Russian Federation and has one child aged 5 years.

Personal income tax is calculated as follows: the difference between the employee’s income and the child deduction is multiplied by the tax rate.

- (30,000 – 1400) x 13% = 3718. Thus, personal income tax on wages is 3718 rubles.

The tax withholding transaction will look like this:

- Dt 70 Kt 68/NDFL – 3718.00 personal income tax was accrued from the salary of Petrov I.S.

No later than the next day after payment, the salary tax is transferred by the agent to the budget:

- Dt 68/NDFL Kt 51 – 3718.00 tax is transferred to the budget.

Personal income tax withheld: posting from material benefits

An enterprise can provide an employee with a low-interest or interest-free loan for a short period. In this case, the employee has a kind of profit - material benefit in the form of savings on interest. To account for the loan, account 73/1 “Settlements on loans provided” is used in correspondence with accounts 50 or 51:

- Dt 73/1 Kt 50(51) – loan issued to employee

- Dt 73/1 Kt 91/1 – interest accrued on the loan if the loan is interest-bearing

- Dt 50 (51, 70) Kt 73/1 - the employee returned the loan amount and interest.

On the day the loan is repaid, personal income tax is withheld from the income paid to the employee by the employer at a rate of 35% (for interest-free loans and those where the interest rate is less than 2/3 of the key rate of the Central Bank of the Russian Federation):

- Dt 70 Kt 68/NDFL – personal income tax is charged on material benefits on the loan

- Dt 68/NDFL Kt 51 – tax transferred to the budget

Personal income tax withheld: posting for payment of tax on dividends

Dividends recognize the profit of the founders of the organization. The personal income tax rate is 13%, and for non-residents - 15%.

In the entries when withholding personal income tax from an individual's dividends, Debit indicates account 70 if the founder is an employee of this company, or account 75 if the founder does not work for the organization. Personal income tax is paid to the budget no later than the next day after the payment of dividends to the founder (Article 226 of the Tax Code of the Russian Federation).

- Dt 84 Kt 70 (75) – dividends accrued to the founder

- Dt 70 (75) Kt 68/NDFL – personal income tax withheld from dividends

- Dt 70 (75) Kt 50(51) – dividends paid to the participant

- Dt 68/NDFL Kt 51 – the tax is transferred to the budget.

Where to go?

Typically, such loans are provided to employees of the enterprise. To receive such a loan, an individual must submit a written application to the head of the company and, if a positive response is received, he will receive the money in a promptly short time.

It should be noted that such loans are issued extremely rarely and are often approved only for particularly important employees of the company.

Loans are provided to employees of the enterprise who are residents and non-residents of the country. Loan conditions (amount and term) directly depend on the salary of an employee of the organization and are determined personally.