KND form 1152028, or property tax calculation, is a special unified form of fiscal reporting that all payers of this tax obligation are required to submit. We'll tell you how to fill out the calculation correctly using a specific example.

Organizations that own property recognized as the object of taxation are payers of property tax. Let us note that not only Russian companies, but also foreign companies that own property in Russia are obligated to pay these obligations to the budget of our state.

Enterprises that have switched to simplified tax regimes are exempt from payment. So, for example, a company that has chosen UNSO, UTII or Unified Agricultural Tax does not have to calculate and pay a fee for property.

Important! The procedure for calculating property tax for organizations has changed significantly since 01/01/2019. Now only real estate is considered taxable. Movable assets are completely excluded from the calculation of the fiscal payment.

This fiscal obligation is regional, that is, the key norms and rules of taxation are established by the authorities of the constituent entity of the Russian Federation. For example, regional officials have the right to provide for advance payments for the property tax of organizations. You can check which regulations apply in your region on the official website of the Federal Tax Service.

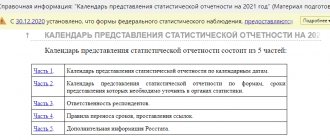

What's changing in 2021

The Federal Tax Service has adjusted the current legislation and made the following changes:

- Property tax assessments have been cancelled. There is no longer a need to send quarterly advance reports to the Federal Tax Service.

- Taxpayers submit only an annual report—the final property tax return. The form is submitted annually, no later than March 30 of the next reporting period - year (clause 3 of Article 386 of the Tax Code of the Russian Federation).

- The obligation to pay quarterly advances on property taxes remains. But only for those taxpayers who need to transfer an advance according to the decision of the regional authorities. But the rules for calculating advance payments have changed. From 2020, the contribution to the budget is calculated according to the changed cadastral value of real estate. Let us remind you that until January 1, 2020, a different rule was in effect - the calculation was carried out according to the cadastral value determined as of January 1 of the reporting year.

When to submit the calculation

The obligation to prepare tax calculations for advance payments of corporate property tax is fixed at the regional level. This fiscal obligation is classified as regional taxes; therefore, the legislative authorities of the subject have the right to provide for advance payments for taxpayers.

If advance payments are provided in your region, then payments to the budget are made quarterly: for 1 quarter, half a year and 9 months. But when KND form 1152028 is submitted, the deadlines are identical for all regions - before the 30th day of the month following the reporting quarter. At the same time, the terms of advance payment are approved individually for each region separately.

Current information by region, payment deadlines and tax rates, table:

The declaration must be submitted by March 30 of the year following the reporting year. Moreover, all taxpayers will have to submit a final declaration, regardless of the availability of advance payments.

Who is renting in 2021

Calculation of property tax refers to mandatory periodic reports. It is rented out by legal entities and individual entrepreneurs who pay property fees.

The obligation to provide a tax calculation for advance payment of property tax 1152028 arises for all payer organizations without exception. Submit the register of enterprises and individual entrepreneurs to OSNO, USN, UTII, Unified Agricultural Tax. But there is a nuance. Property tax is a tax of regional jurisdiction. And only local legislators decide what the frequency of reporting and payment of contributions is. If any subject of the Russian Federation does not define the obligation to provide calculations and advances for property tax, then there is no need to submit them to the regulatory authorities.

Which form to use

If your region has established advance payments to the Federal Tax Service for property taxes, you will have to prepare additional tax reports.

Important! Due to changes in legislation, the KND calculation form 1152028 was updated by Order of the Federal Tax Service of Russia dated October 4, 2018 N ММВ-7-21/ [email protected]

When preparing reports for past reporting periods, it was possible to use the old unified form KND 1152028 (dated 2013). However, in 2021, using an outdated report is unacceptable. It is necessary to use the updated form, which is approved by a separate Order of the Federal Tax Service of Russia dated March 31, 2017 No. ММВ-7-21/ [email protected] (as amended on October 4, 2018).

The current form for KND 1152028: you can download it at the end of the article.

Let us note that officials also approved a new property tax declaration form for companies, which will have to be filled out for the 2019 calendar year. Read more about this in the special article “Property Tax Declaration”.

Due dates

IMPORTANT!

The report has been canceled since 2021! There is no need to fill out and submit form 1152028 for the 1st quarter of 2021!

Calculation of property assessment payments is a periodic report. It is sent once a quarter according to the scheme “in the current quarter we report for the previous one.” See the main deadlines in the table.

| Billing period | Deadline for submission | Period code |

| 1st quarter | Until April 30 | 21 |

| 2nd quarter - half year | Until July 30 | 17 |

| 3rd quarter - nine months | Until October 30 | 18 |

We will separately present the dates for reorganized enterprises:

| Billing period | Deadline for submission | Period code |

| 1st quarter | Until April 30 | 51 |

| 2nd quarter - half year | Until July 30 | 47 |

| 3rd quarter - nine months | Until October 30 | 48 |

KND form 1151111 for the 4th quarter of 2021: sample filling with reduced tariffs

The cover page, mandatory for all policyholders, indicates the billing period code. In reporting for 2021, code “34” is indicated in this field. It also contains information about the average number of employees. All policyholders are required to include in the report:

- section 1;

- subsections 1.1 and 1.2 of Appendix 1 to Section 1, Appendix 2 to Section 1;

- section 3.

Peasants fill out section 2 of the form. The remaining calculation sheets are intended for policyholders who have the appropriate indicators.

The main calculation is given in the appendices; the final indicators are entered in section 1.

Section 3 reflects personalized information about persons who received taxable income.

Application of reduced tariffs

Some organizations need to fill out the calculation for the 4th quarter of 2021 in a new way. This is due to the fact that in connection with the coronavirus, changes have been made to the procedure for calculating insurance premiums - from April 2020, small and medium-sized enterprises listed in the SME register use both 2 tariffs:

- basic - 30% (of which 22% PFR, 5.1% FFOMS and 2.9% FSS) for amounts of payments to insured persons within the minimum wage (RUB 12,130);

- reduced - 15% (10% PFR, 5% FFOMS, 0% FSS) for part of payments exceeding the minimum wage.

The calculation is carried out for each insured person, and the income is compared with the minimum wage at the end of each calendar month.

When filling out the KND form 1151111 for the 4th quarter of 2021. such companies and individual entrepreneurs for the base and accruals above the minimum wage will need to use the new codes listed in the Letter of the Federal Tax Service dated 04/07/2020 No. BS-4-11/ [email protected] : - Basic: 1) payer tariff code “01” (when filling out lines 001 of Appendices 1 and 2 to Section 1);

2) category code of the insured person (Subsection 3.2.1 of Section 3):

- NR - for individuals-Russian citizens;

— Reduced: 1) payer tariff code “20” (when filling out line 001 of Appendices 1 and 2 to Section 1);

2) category code of the insured person (Subsection 3.2.1 of Section 3):

- MS - for individuals-Russian citizens;

- VZHMS - for foreigners or stateless persons temporarily residing in the territory of the Russian Federation or temporarily staying to receive temporary asylum;

- VPMS – temporarily staying foreign citizens.

First, fill out the application with the basic tariff, then with the reduced one.

Here is a sample of filling out the KND form 1151111 for the 4th quarter of 2020 for a SME company applying a reduced tariff of 15%.

How to divide property for calculation

In 2021, the procedure for calculating property taxes has changed significantly. Now the calculation (taxable) base does not include movable property. The calculation reflects information only on immovable fixed assets.

In the new reports, there is no need to divide fixed assets into movable and immovable property. But property assets will still have to be divided, and according to this principle:

- By type of calculation. The advance payment is calculated based on the average annual and cadastral value of the property. For this purpose, the report provides various sections.

- At the location of the real estate. If the assets of the enterprise are located on the territory of various municipalities. They will have to be divided according to OKTMO code, and reports and taxes will have to be sent to various territorial tax departments.

- According to tax rates. The calculation must be carried out for all types of rates applied to the payer’s tax objects.

- By types and amounts of benefits applied. Some property assets are taxed at reduced rates or are completely tax-free. The scope of benefits is set by local legislators. All types of preferential property must be reflected in separate calculation columns.

Before submitting reports, the responsible executor studies regional standards, and only after that he calculates the value of the property.

How to calculate the tax base based on the average annual cost

The average cost is the ratio of the total value for the desired position for a specified amount of time and a similar time period. The average cost is an annual average due to the fact that the reporting period for property tax is a year.

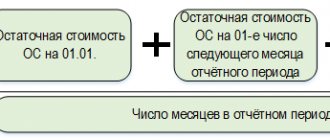

The average annual cost is calculated as follows:

- The frequency is determined. The property advance report is submitted once a quarter. For the first quarter, the required period is 4 months, for the second - 7 months, for the third - 10 months.

- The residual price of the property is determined on the first day of each subsequent month.

- The value of preferential or non-taxable fixed assets is deducted. For the calculation, you only need the price of immovable fixed assets taxed at a specific rate.

The calculation for the first quarter is determined as follows: the total value of the average annual value of property (ASV) as of the 1st day of each subsequent month is divided by 4. AVV is calculated from January 1 to April 1. 4 is a four month period from January to April.

How to calculate the base according to cadastral valuation

Calculation based on cadastral value is even simpler. The regional database records the values of the cadastral value of specific real estate objects. This value is subject to updating, that is, it is periodically recalculated taking into account assessment data. The list of objects whose taxation is based on cadastral value is published annually at the beginning of the reporting period (year).

To calculate the advance, the contractor opens the legislative list, finds the object and identifies the current cadastral value. The value calculated for the current period remains unchanged throughout the year. If the object belongs to preferential property, then all the required benefits are applied to the estimated value. The calculation of the advance payment for cadastral value is differentiated in proportion to the share of ownership (for objects in shared ownership) and location (for assets located in different regions).

How to calculate an advance payment for property taxes

Any tax is calculated according to a single scheme - the base is multiplied by the current rate. Property contributions are no exception. For advance payments, the amount received must be indexed by ¼ - the number of months in the billing period.

The property tax advance is calculated in two ways.

| Method | Description | Formula |

| At average annual cost | The cumulative average price for the selected period is multiplied by the tax rate and by ¼ (or simply divided by 4) | A = (CCi × CH) / 4 |

| According to cadastral value | The cadastre value is multiplied by the tax rate, and the resulting value is multiplied by ¼ | A = (Sk × CH) / 4 |

There are a number of rules for calculating the cadastral value. If legislators have not carried out a cadastral valuation and have not determined the price for the current period, then the advance payment for property tax is calculated based on the average annual cost. The second point is that for organizations that during the reporting period acquired or sold real estate valued according to the cadastre, a special Ki coefficient is used when making calculations. This is an index that determines the number of complete months of ownership of the property. If a real estate transaction took place at the beginning of the month (before the 15th), then this period is taken into account in full. If ownership rights are re-registered after the 15th, this period is excluded from the calculation.

How and where to submit

The calculation is submitted to the territorial office of the Federal Tax Inspectorate. Taxpayers provide reporting data to the Federal Tax Service at the place of registration. Individual divisions send the form to the inspectorate at the address of the structure's registration. If the object is located in several regions (registered in different municipalities), then they report to the Federal Tax Service for each territory of registration of property assets.

The delivery format is determined by the number of taxpayer employees. If the number of employees exceeds 100 people, then the property tax calculation is sent electronically via telecommunication channels. If the enterprise is small, then reporting is submitted on paper.

KND form 1151111 for the 4th quarter of 2021: new form free download

The Federal Tax Service of the Russian Federation has developed and approved a form for calculating insurance premiums (order of the Federal Tax Service dated October 15, 2020 No. ED-7-11 / [email protected] ).

This form, in accordance with the order, must be used when submitting calculations for the 4th quarter of 2021.

Please note that when submitting reports on insurance premiums, the current form is KND 1151111 for the 4th quarter of 2021. The new form can be downloaded for free in Excel here , and in PDF format here .

Deadlines for the DAM in 2021

Due to the coronavirus, reporting deadlines for 2020 have changed.

Read more about this in the article: New reporting deadlines due to coronavirus

The deadline for submitting the calculation for the billing period is the 30th day of the month following the reporting period, regardless of the method of submitting the calculation. Periods are recognized as Ⅰ quarter, half a year, 9 months. (calculated) and 12 months. (reporting).

The deadline for submitting the calculation for the 4th quarter (for the year) 2021 is February 1, 2021 (the first working day after the deadline that falls on weekends or holidays).

If the average number of employees exceeds 10 people, then the company is obliged to submit calculations for insurance premiums electronically. Otherwise, inspectors will impose a fine for violating the format (Article 119.1 of the Tax Code of the Russian Federation).

If the average number of employees of a company is 10 people or less, the calculation of insurance premiums can be submitted either on paper or electronically.

As a general rule, if the deadline for submitting an invoice for the reporting period falls on a holiday or weekend, then the invoice can be submitted on the next working day.

How to fill it out correctly

The rules for filling out reporting forms are the same for all tax registers. Here are brief instructions for filling out advance payment form 1152028:

- All forms must be filled out in the required color only—black block font or handwritten in black, blue, or purple ink.

- Page numbering is continuous.

- The initial registers are numbered with the code “0—”. Correction forms are submitted with correction numbers in the order “1—”, “2—” and so on.

- Corrections using a proofreader are not allowed.

- Stapling paper that damages the integrity of the report is prohibited.

- Duplex printing is not available.

- All calculations are rounded. If the calculated value after the decimal point is less than 50 kopecks, then it is not taken into account. Indicators of 50 kopecks and more are rounded to the nearest sign - the ruble.

Let's imagine filling out the main sections in the form of a table.

| Section number | Section title | Filling procedure |

| — | Title page | All taxpayer registration information is entered. INN and KPP (they will be duplicated on each page of the report), full or short name (as in the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs), telephone number, responsible person. The title page also contains the details of the report itself - the period and year of submission, the adjustment number, the Federal Tax Service code and the coding of the place of registration. Information about the reorganization of the taxpayer is also displayed here. |

| 1 | Advance payment amount to be paid to the budget | In this section, the property tax payer accumulates all reporting data. OKTMO and KBK are indicated, by which the direction of movement of the contribution is determined, and the total value of the advance payment itself for the period. If the taxpayer conducts mutual settlements with various regional budgets, then the OKTMO group - KBK - the advance amount is filled in for each subject payment. |

| 2 | Calculation of the amount of advance tax payment in respect of taxable real estate | This section provides information for calculating the advance (the average annual value as of the 1st day of each subsequent month), sums up the average value of the property for the period, indicates the tax rate and calculates the advance for the reporting quarter. This section provides the coding, amount and cost of the benefit. |

| 2.1 | Information about real estate subject to tax at the average annual value | This block details information about taxable property. The OKOF code and the residual value of property assets at the end of the quarter are also indicated here. |

| 3 | Calculation of the amount of advance tax payment for the reporting period on a real estate property, the tax base for which is determined as the cadastral value | The third section calculates the advance payment based on the cadastral value. The code for the type of property and information, OKTMO, and cadastral details are determined. Then there is a direct calculation of the advance on the assessed value (the assessment value is multiplied by the tax rate). As a result, the calculated advance on the cadastral (page 090 of section 3) and average annual cost (page 180 of section 2) is summed up and entered in line 030 of the first section. |

KND form 1152028 “Tax calculation for advance payment of corporate property tax”

General requirements for filling out the Calculation

The calculation is made for the reporting period - the first quarter, half a year (second quarter), nine months (third quarter) of the calendar year in accordance with Article 379 of the Code.

All values of the cost indicators of the Calculation are indicated in full rubles. Indicator values less than 50 kopecks are discarded, and 50 kopecks or more are rounded to the full ruble.

The Calculation pages are numbered consecutively, starting with the Title Page. The serial number of the page is written in the field specified for numbering (“Page”) from left to right, starting from the first (left) space, as follows: for the first page “001”; for the tenth page, respectively, “010”.

Errors may not be corrected by correction or other similar means.

Double-sided printing of the Calculation on paper and binding of Calculation sheets, which leads to damage to the paper, is not permitted.

When filling out the Calculation fields, black, purple or blue ink must be used.

Calculation text fields are filled in with capital printed characters.

Each Calculation indicator in the approved machine-oriented form corresponds to one field, consisting of a certain number of familiar places. Each field contains only one indicator. The exception is for indicators whose values are: date, correct or decimal fraction.

To indicate the date, three fields are used in order: day (field of two characters), month (field of two characters) and year (field of four characters), separated by the sign “.” (dot).

For a proper fraction or decimal in an approved machine-oriented form, there are two fields separated by either a "/" (slash) or a "." (dot) respectively. The first field corresponds to the numerator of the proper fraction (the whole part of the decimal), the second - to the denominator of the proper fraction (the fractional part of the decimal).

Filling out the Calculation fields with the values of text, numeric, code indicators is carried out from left to right, starting from the first (left) familiarity.

When filling out Calculation fields using software, the values of numerical indicators are aligned to the right (last) space.

If any indicator is missing, a dash is placed in all familiar places in the corresponding field. The dash is a straight line drawn in the middle of the familiarity along the entire length of the field.

If to indicate any indicator it is not necessary to fill out all the spaces in the corresponding field, a dash is placed in the unfilled spaces on the right side of the field.

Fractional numeric indicators are filled in similarly to the rules for filling in integer numeric indicators. If there are more acquaintances for indicating the fractional part than numbers, then a dash is placed in the empty acquaintances of the corresponding field. For example, if the indicator has the value “1234356.234”, then it is written in two fields of ten acquaintances each as follows: “1234356—” in the first field, the sign “.” or "/" between fields and "234——-" in the second field.

The correct simple fraction “1234356/234” must be filled in according to the format: 10 acquaintances for the whole part and 10 acquaintances for the fractional part; it is written in the declaration as follows: “1234356—/234——-“. When submitting a Calculation prepared using the software, when printed on a printer, it is allowed that there is no framing of the characters and dashes for empty characters. The location and dimensions must not be changed. Signs must be printed in Courier New font with a height of 16 - 18 points.

When filling out the indicator “Code according to OKCode according to OK12445698—“.

The calculation can be submitted by the taxpayer to the tax authority personally or through his representative, sent in the form of a postal item with a list of attachments, or transmitted in electronic form with an enhanced qualified electronic signature via telecommunication channels in accordance with Article 80 of the Code.

The calculation is submitted by the payer to the tax authority in electronic form via telecommunication channels using an enhanced qualified electronic signature in established formats in accordance with the Procedure for submitting a tax return in electronic form via telecommunication channels, approved by order of the Ministry of the Russian Federation for Taxes and Duties dated 04/02/2002 N BG-3-32/169 “On approval of the Procedure for submitting a tax return in electronic form via telecommunication channels.”

When filling out sections of the Calculation, at the top of each page, indicate the taxpayer identification number (hereinafter referred to as TIN) and the organization’s checkpoint in accordance with clause 3.2 of this Procedure.

When submitting to the tax authority at the place of registration by the successor organization the updated Settlements for the reorganized organization (in the form of merger with another legal entity, merger of several legal entities, division of a legal entity, transformation of one legal entity into another) in the Title Page in the field “at location (accounting) (code)” the code “215” or “216” or 281 is indicated, and in the upper part of it the TIN and KPP of the successor organization are indicated. The name of the reorganized organization is indicated in the “taxpayer” field.

The details “TIN/KPP of the reorganized organization” indicate the TIN and KPP that were assigned to the organization before the reorganization by the tax authority at its location (for taxpayers classified as the largest - by the tax authority at the place of registration as the largest taxpayer).

Sections 1 and 2 of the Calculation indicate the OKTMO code of the municipality in whose territory the reorganized organization (real estate) was located.

Procedure for filling out the Cover Page of the Calculation

The title page of the Calculation is filled out by the taxpayer, with the exception of the section “To be filled out by a tax authority employee.”

When filling out the Cover Sheet of the Calculation, you must indicate:

For organizations, INN and KPP, which is assigned to the organization by the tax authority to which the Calculation is submitted.

In the “TIN” field for a Russian organization, the TIN is indicated in accordance with the certificate of registration of the Russian organization with the tax authority at its location, for a foreign organization operating on the territory of the Russian Federation through a permanent representative office - in accordance with the certificate of registration at registration of a foreign organization with the tax authority.

In the “KPP” field for a Russian organization, the KPP is indicated in accordance with the certificate of registration of the Russian organization with the tax authority.

In the “KPP” field for a foreign organization operating on the territory of the Russian Federation through a permanent representative office, the KPP is indicated in accordance with the certificate of registration of the foreign organization with the tax authority.

In the “KPP” field for a foreign organization submitting a Settlement at the location of a real estate property that is not related to the activities of the foreign organization through its permanent representative office on the territory of the Russian Federation, the KPP is indicated in accordance with the notice of registration of the foreign organization with the tax authority at the place location of real estate.

For organizations that are the largest taxpayers, the TIN and KPP at the location of the organization are indicated according to the certificate of registration of the Russian organization with the tax authority at the location (5th and 6th category of KPP - “01”).

Correction number.

When submitting the initial Calculation to the tax authority, “0—” is entered in the “Adjustment Number” field; when submitting an updated Calculation, the correction number is indicated (for example, “1—“, “2—” and so on).

The updated Calculation is submitted to the tax authority in the form that was in force during the tax period for which the corresponding changes are made. When recalculating the amount of the advance tax payment, the results of tax audits conducted by the tax authority for the reporting period for which the amount of the advance tax payment is recalculated are not taken into account.

If it is impossible to determine the period of errors (distortions), the tax base and tax amount are recalculated for the tax period in which the errors (distortions) were identified;

In the “Reporting period (code)” field, the code of the reporting period for which the Calculation is presented is indicated, in accordance with Appendix No. 1 to this Procedure.

The “Reporting year” field indicates the current tax period (year);

The code of the tax authority to which the Calculation is submitted is indicated according to the documents on registration with the tax authority.

Codes for submitting the Calculation to the tax authority at the location (registration) are entered in accordance with Appendix No. 3 to this Procedure.

The full name of the organization is indicated in accordance with the name specified in the constituent document of this organization (if there is a Latin transcription in the name, it is indicated);

In the field “Reorganization form (code)” the code is indicated in accordance with Appendix No. 2 to this Procedure.

TIN/KPP of the reorganized organization (separate division) in accordance with clause 2.8 of this Procedure.

The taxpayer's contact telephone number must consist of the country code, locality code, telephone number without characters or spaces. For example, "84950000000".

The number of pages on which the Calculation is compiled.

The number of sheets of supporting documents or their copies, including documents or their copies confirming the authority of the taxpayer’s representative (if the Calculation is submitted by the taxpayer’s representative), attached to the Calculation.

In the section “I confirm the accuracy and completeness of the information specified in this calculation”:

If the accuracy and completeness of the information is confirmed in the Calculation, the head of the taxpayer organization enters “1”; if the accuracy and completeness of the information is confirmed by the taxpayer’s representative, “2” is entered;

When submitting the Calculation by the taxpayer, in the field “last name, first name, patronymic <*> in full,” the full last name, first name, and patronymic name of the head of the organization are indicated line by line. The personal signature of the head of the organization and the date of signing are affixed;

When submitting the Calculation by a taxpayer's representative - an individual, in the field "last name, first name, patronymic <*> in full" the full last name, first name, patronymic of the taxpayer's representative is indicated line by line. The personal signature of the taxpayer’s representative and the date of signing are affixed;

When submitting the Calculation by a representative of a taxpayer - a legal entity, in the field “last name, first name, patronymic <*> in full”, the full surname, first name, patronymic of an individual authorized in accordance with a document confirming the authority of the representative of a taxpayer - legal entity to certify the accuracy and completeness of information is indicated line by line specified in the Calculation.

In the field “name of organization - representative of the taxpayer” the name of the legal entity - representative of the taxpayer is indicated. The signature of the person whose information is indicated in the field “last name, first name, patronymic <*> in full”, a legal entity - a representative of the taxpayer and the date of signing;

The signature of the head of the organization or his representative and the date of signing are entered in the field “I confirm the accuracy and completeness of the information specified in this calculation” of the title page and Section 1 of the Calculation. The date of signing is filled in in accordance with clause 2.4 of this Procedure;

The line “Name and details of the document confirming the authority of the representative” indicates the type of document confirming the authority of the taxpayer’s representative;

The section “To be completed by a tax authority employee” contains information about the presentation of the Calculation:

- 1) method of submitting the Calculation (the code is indicated in accordance with Appendix No. 4 to this Procedure);

- 2) number of Calculation pages;

- 3) the number of sheets of supporting documents or their copies attached to the Calculation;

- 4) date of submission of the Calculation;

- 5) the number under which the Settlement is registered;

- 6) surname and initials of the name and patronymic of the employee of the tax authority who accepted the Calculation;

- 7) signature of the tax authority employee who accepted the Calculation.

Procedure for filling out Section 1 of the Calculation

Section 1 of the Calculation is completed in relation to the amount of the advance tax payment payable at the location of the organization (the place of registration of the permanent representative office of the foreign organization with the tax authority), the location of the real estate, in accordance with paragraph 1.6 of this Procedure.

Each block of lines with codes 010 - 030 indicates:

- 1) on line with code 010 code according to OKTMO, for which the amount of the advance tax payment is payable, indicated on line 030 of this block;

- 2) on line with code 020, the budget classification code (hereinafter referred to as BCC), according to which the amount of the advance tax payment indicated on line with code 030 of this block is to be credited;

- 3) on the line with code 030 - the amount of the advance tax payment payable to the budget at the place of submission of the Calculation according to the corresponding codes for OKTMO and KBK.

The value of the line with code 030 is determined by summing the differences in the values of lines with codes 180 and 200 of all Sections 2 of Calculation with the corresponding codes according to OKTMO and the differences in the values of lines with codes 090 and 110 of all Sections 3 of Calculation with the corresponding codes according to OKTMO.

The information specified in Section 1 of the Calculation is confirmed by the line “I confirm the accuracy and completeness of the information specified on this page”, with the signature of a person from among the persons specified in clause 3.3 of this Procedure, and the date of signing is indicated.

Procedure for filling out Section 2 of Calculation

Section 2 of the Calculation is completed by Russian organizations and foreign organizations operating in the Russian Federation through permanent representative offices.

Section 2 of the Calculation must be completed separately:

in relation to real estate taxed at different tax rates;

in relation to property included in the Unified Gas Supply System in accordance with Federal Law of March 31, 1999 N 69-FZ “On Gas Supply in the Russian Federation”;

in relation to each object of real estate actually located on the territories of different constituent entities of the Russian Federation or on the territory of a constituent entity of the Russian Federation and in the territorial sea of the Russian Federation (on the continental shelf of the Russian Federation or in the exclusive economic zone of the Russian Federation);

in relation to a specific tax benefit (with the exception of tax benefits in the form of a reduction in the entire amount of tax payable to the budget, and a tax benefit established in the form of a reduction in the tax rate) of real estate;

in relation to the real estate of a resident of the Special Economic Zone in the Kaliningrad Region, created or acquired during the implementation of an investment project in accordance with Federal Law dated January 10, 2006 N 16-FZ “On the Special Economic Zone in the Kaliningrad Region and on amendments to certain legislative acts of the Russian Federation "(hereinafter referred to as Federal Law No. 16-FZ of January 10, 2006);

in relation to public railway tracks and structures that are their integral technological part;

in relation to main pipelines, energy transmission lines, as well as structures that are an integral technological part of these facilities;

in relation to main gas pipeline facilities, gas production facilities, helium production and storage facilities; objects provided for by technical projects for the development of mineral deposits and other design documentation for the performance of work related to the use of subsoil areas, or design documentation of capital construction projects, and necessary to ensure the functioning of real estate objects of main gas pipelines, gas production facilities, helium production and storage facilities, subject to the simultaneous fulfillment of the following requirements for such objects:

- objects were first put into operation during tax periods starting from January 1, 2015;

- objects are located wholly or partially within the borders of the Republic of Sakha (Yakutia), Irkutsk or Amur region;

- objects belong during the entire tax period on the right of ownership to the organizations specified in subparagraph 1 of paragraph 5 of Article 342.4 of the Code.

When filling out Section 2 of the Calculation:

1) on the line with code 001, the code of the type of real estate in respect of which Section 2 of the Calculation is being filled out is indicated, in accordance with Appendix No. 5 to this Procedure;

2) on the line with code 010, the OKTMO code is indicated according to which the amount of the advance tax payment is due;

3) the values of lines with codes 020 - 110 are filled in as follows:

when submitting the Calculation for the first quarter, lines with codes 020 - 050 are filled in;

when submitting the Calculation for the half-year (second quarter), lines with codes 020 - 080 are filled in;

When submitting the Calculation for 9 months, lines with codes 020 - 110 are filled in.

In this case, the corresponding lines in columns 3 - 4 reflect information on the residual value of fixed assets for the reporting period as of the corresponding date:

Column 3 indicates the residual value of fixed assets for the reporting period for tax purposes, including:

Column 4 indicates the residual value of the preferential real estate;

If the residual value of real estate includes a monetary assessment of future future costs associated with this real estate, the residual value of the said real estate is indicated without taking into account such costs in accordance with paragraph 3 of Article 375 of the Code.

Columns 3 and 4 do not indicate the residual value of the real estate specified in paragraphs one through three of paragraph 24 of Article 381 of the Code;

4) on line with code 120 the average value of real estate for the reporting period is indicated, calculated as follows:

when presenting the Calculation for the first quarter as a quotient of dividing by 4 the sum of values in column 3 lines with codes 020 - 050;

when presenting the Half-Year Calculation as a quotient of dividing by 7 the sum of values in column 3 lines with codes 020 - 080;

when presenting the Calculation of an advance payment of tax for 9 months as the quotient of dividing by 10 the sum of the values in column 3 lines with codes 020 - 110;

5) on the line with code 130, a composite indicator is indicated: in the first part of the indicator, the tax benefit code is indicated in accordance with Appendix No. 6 to this Procedure.

For tax benefits established by the law of a constituent entity of the Russian Federation in the form of a reduction in the tax rate (hereinafter referred to as tax benefit code 2012400) and in the form of a reduction in the amount of tax payable to the budget (hereinafter referred to as tax benefit code 2012500), the line with code 130 is not filled in.

The second part of the indicator on the line with code 130 is filled in only if the first part of the indicator indicates the tax benefit code 2012000 (tax benefits established by the laws of the constituent entities of the Russian Federation, with the exception of tax benefits in the form of a reduction in the rate for a separate category of taxpayers and in the form reducing the amount of tax payable to the budget). In the second part of the indicator, the number, paragraph and subparagraph of the article of the law of the constituent entity of the Russian Federation are sequentially indicated, in accordance with which the corresponding tax benefit is provided (for each of the indicated positions, four familiar places are allocated, while filling out this part of the indicator is carried out from left to right and if the corresponding detail has less than four characters, empty spaces to the left of the value are filled with zeros).

For example, if the corresponding tax benefit is established by subclause 15.1 of clause 3 of Article 2 of the law of a constituent entity of the Russian Federation, then on line with code 130 the following is indicated:

If Section 2 of the Settlement with code 05 is filled out on the line “Property type code (line code 001)” by an organization excluded from the unified register of residents of the Special Economic Zone in the Kaliningrad Region before receiving a certificate of fulfillment of the conditions of the investment declaration, a dash is placed on the line with code 130 ;

6) line code 140 shall indicate the average value of tax-free real estate for the reporting period, calculated as follows:

- when presenting the Calculation for the first quarter as a quotient of dividing by 4 the sum of values in column 4 lines with codes 020 - 050;

- when presenting the Half-Year Calculation as a quotient of dividing by 7 the sum of values in column 4 lines with codes 020 - 080;

- when presenting the Calculation for 9 months as a quotient of dividing by 10 the sum of values in column 4 lines with codes 020 - 110;

7) line with code 150 is filled in only in Section 2 of the Calculation with code 02 on the line “Property type code (line code 001)”.

The line with code 150 indicates the share of the book value of the real estate property on the territory of the corresponding constituent entity of the Russian Federation;

on the line with code 160, filled in only if the law of a constituent entity of the Russian Federation establishes a tax benefit in the form of a rate reduction for a given category of taxpayers for a given property, a composite indicator is indicated: in the first part of the indicator the tax benefit code 2012400 is indicated, and in the second part of the indicator the tax benefit code 2012400 is indicated sequentially number, clause and subclause of the article of the law of the constituent entity of the Russian Federation, in accordance with which the corresponding tax benefit is provided (for each of the indicated positions, four familiar spaces are allocated, while this part of the indicator is filled out from left to right and if the corresponding detail has less than four characters, free familiar spaces to the left of the value are filled with zeros). An example of filling is given in subclause 5 of clause 5.3 of this Procedure.

on the line with code 160, filled in only if the law of a constituent entity of the Russian Federation establishes a tax benefit in the form of a rate reduction for a given category of taxpayers for a given property, a composite indicator is indicated: in the first part of the indicator the tax benefit code 2012400 is indicated, and in the second part of the indicator the tax benefit code 2012400 is indicated sequentially number, clause and subclause of the article of the law of the constituent entity of the Russian Federation, in accordance with which the corresponding tax benefit is provided (for each of the indicated positions, four familiar spaces are allocated, while this part of the indicator is filled out from left to right and if the corresponding detail has less than four characters, free familiar spaces to the left of the value are filled with zeros). An example of filling is given in subclause 5 of clause 5.3 of this Procedure.

If a tax benefit in the form of a rate reduction is not established for a given category of taxpayers for a given property, a dash is placed on the line with code 160;

9) line with code 170 reflects the tax rate established by the law of the constituent entity of the Russian Federation for this category of taxpayers for the relevant property (types of property).

If the law of a constituent entity of the Russian Federation establishes a tax benefit for a given category of taxpayers for a given property in the form of a reduced tax rate, the line with code 170 reflects the tax rate taking into account the tax benefit provided (reduced tax rate).

In case of filling out Section 2 of the Calculation with code 05 on the line “Property type code (line code 001)”:

when reflected on line with code 130, tax benefit code 2010401 (tax rate of 0 percent for the first six calendar years, starting from the day the legal entity is included in the unified register of residents of the Special Economic Zone in the Kaliningrad region, in relation to property created or acquired during the implementation of an investment project in accordance with Federal Law dated January 10, 2006 N 16-FZ) in line with code 170 a tax rate of 0 percent is indicated;

when reflected on line with code 130 tax benefit code 2010402 (tax rate for tax in the amount established by the law of the Kaliningrad region and reduced by fifty percent in the period from the seventh to the twelfth calendar year inclusive from the date of inclusion of the legal entity in the unified register of residents of the Special Economic Zone in the Kaliningrad region, in relation to property created or acquired during the implementation of an investment project in accordance with Federal Law of January 10, 2006 N 16-FZ), in line with code 170 the tax rate is indicated in the amount established by the law of the Kaliningrad region, reduced by 50 percent;

10) in case of filling out Section 2 of the Settlement with code 09 on the line “Code of the type of property (line code 001)” in relation to public railway tracks and structures that are their integral technological part, meeting the requirements established by the Government of the Russian Federation, registered for the first time as fixed assets, starting from January 1, 2021, the value of the Kzh coefficient is indicated on line with code 175, the value of which is determined in accordance with paragraph 2 of Article 385.3 of the Code; 11) line with code 180 reflects the amount of advance tax payment for the reporting period, calculated as:

- one fourth of the product of the difference between the values of lines with codes 120 and 140 and the value of line with code 170, divided by 100 - when filling out Section 2 of Calculations with codes 01, 03, 05, 08, 10 on the line “Property type code (line code 001) ";

- one fourth of the product of the difference between the values of lines with codes 120 and 140 and the values of lines with codes 170 and 175, divided by 100 - when filling out Section 2 of the Calculation with code 09 on the line “Property type code (line code 001)”;

- one-fourth of the product of the difference between the values of lines with codes 120 and 140 and the value of the line with code 150 and the value of the line with code 170, divided by 100 - when filling out Section 2 of the Calculation with code 02 on the line “Property type code (line code 001)” ;

12) lines with codes 190 and 200 are filled in only if the law of a constituent entity of the Russian Federation establishes a tax benefit for a certain category of taxpayers in the form of a reduction in the amount of tax payable to the budget.

On the line with code 190, a composite indicator is indicated: in the first part of the indicator, the tax benefit code 2012500 is indicated, and in the second part of the indicator, the number, paragraph and subparagraph of the article of the law of the constituent entity of the Russian Federation are sequentially indicated, in accordance with which the corresponding tax benefit is provided (for each of the specified positions are allocated four spaces each, and this part of the indicator is filled in from left to right, and if the corresponding attribute has less than four characters, the free spaces to the left of the value are filled with zeros). An example of filling is given in subclause 5 of clause 5.3 of this Procedure.

The line with code 200 indicates the amount of the tax benefit, which reduces the amount of the advance tax payment payable to the budget.

For example, if the law of a constituent entity of the Russian Federation establishes a tax benefit for a given category of taxpayers in the form of payment to the budget of 80% of the amount of calculated tax, then the value for the line with code 200 should be calculated as follows: 1/4 of the value for the line with code 180 x (100 - 80) : 100;

Procedure for filling out Section 2.1 Calculation

Section 2.1 of the Calculation is completed by Russian and foreign organizations in relation to real estate objects, the tax base for which is recognized as the average annual cost, the amount of the advance tax payment in respect of which is calculated in Section 2 of the Calculation.

Each block of lines with codes 010 - 050 of Section 2.1 of the Declaration indicates:

1) on the line with code 010, the code of the object number for which Section 2.1 of the Calculation is being filled out is indicated. Wherein:

- if the real estate property has a cadastral number specified in the Unified State Register of Real Estate (hereinafter referred to as the USRN), code “1” is indicated on the line with code 010;

- if the real estate object does not have a cadastral number specified in the Unified State Register of Real Estate, and the real estate object has a conditional number specified in the Unified State Register of Real Estate, code “2” is indicated on the line with code 010;

- if a real estate property does not have a cadastral number and a conditional number specified in the Unified State Register of Real Estate, and has an inventory number, as well as an address assigned to this property on the territory of the Russian Federation indicating the municipality, code “3” is indicated on the line with code 010;

- if a real estate property does not have a cadastral number and a conditional number specified in the Unified State Register of Real Estate, and there is an inventory number in the absence of an address assigned to this object on the territory of the Russian Federation indicating a municipal entity, code “4” is indicated on the line with code 010;

line with code 020 indicates:

- cadastral number specified in the Unified State Register of Real Estate - if the code “1” is indicated in the line with code 010,

- conditional number specified in the Unified State Register of Real Estate - if code “2” is indicated in line with code 010,

- inventory number - if code “3” or code “4” is indicated in line with code 010;

2) on the line with code 030, the address of the real estate property located on the territory of the Russian Federation is indicated, if the address includes an indication of the municipality. Line with code 030 is filled in only if code “3” is filled in line with code 010.

If you fill in the line with code 030, indicate:

- code of the subject of the Russian Federation in accordance with Appendix No. 7 to this Procedure;

- Register to create a review.