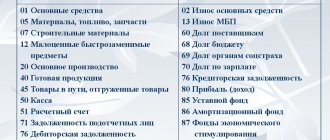

- OTA – deferred tax assets, accounted for in accounting account 09.

- IT – deferred tax liabilities are reflected in accounting account 77.

The procedure for accrual and reflection of these assets and liabilities is regulated in accordance with the Order “Accounting for calculations of corporate income tax” dated November 19, 2002.

Accounting profit - loss can often differ from taxable profit. This is because rules may be applied to determine the amount of income that will take into account permanent and temporary differences. Income recognition occurs through the use of special accounting regulations approved by the legislative system of the Russian Federation on fees and taxes.

Which accounting accounts are involved in the postings?

All operations for calculating taxes are displayed on the credit of account 68. To display the accrual of income tax, a special sub-account is opened for it.

When calculating profit taking into account the norms of PBU 18/02 (approved by order of the Ministry of Finance dated November 19, 2002 No. 114n), reduction to the general value of the desired value calculated in tax and accounting is observed. In order to link the differences that arise (temporary and permanent) when calculating income tax, various accounting entries are used. The appearance of these differences is due to the fact that not all expenses in tax accounting reduce taxable profit, but at the same time they are taken into account in accounting. It is for the purpose of subsequent correction of the profit calculated in accounting that it is necessary to take into account all the differences that arise.

Read more about the differences between accounting and tax accounting here.

Depending on what difference the taxpayer received during the reporting period (deductible or taxable), different entries are applied.

SHE and IT in accounting

Source: United Tax Consultants

Clauses 14, 15 of PBU 18/02 indicate that in the event of a change in income tax rates in accordance with the legislation of the Russian Federation on taxes and fees, the enterprise must recalculate the amount of deferred taxes as of the date of the rate change, and the difference arising during recalculation should be reflected in account 84 " Retained earnings “Uncovered loss.”

The accounting policy of the enterprise stipulates that ONA and ONO are not balanced in the financial statements and are disclosed separately. From 01/01/09 in accordance with Art. 284 of the Tax Code of the Russian Federation, the tax rate for income tax is set at 20%.

In connection with these changes, difficulties have arisen in recalculating deferred taxes when it is not clear what date must be indicated. Based on para. 4 clause 14, para. 3 clause 15 of the Accounting Regulations “Accounting for calculations of income tax of organizations” PBU 18/02 (approved by Order of the Ministry of Finance of the Russian Federation dated November 19, 2002 No. 114n) deferred tax assets and deferred tax liabilities are calculated as the product of the amounts of deductible temporary differences and taxable ones temporary differences, respectively, and the income tax rate established by the legislation of the Russian Federation on taxes and fees, effective as of the reporting date .