When checking a VAT return and discovering errors, inconsistencies or contradictions in the information provided, inspectors will send a request for clarification. From April 25, the Federal Tax Service sends requests for clarifications to the new VAT return, effective from reporting for the first quarter of 2021, in a new format. The need for amendments is caused, in particular, by the entry into force in 2021 of regulations on increasing the VAT rate from 18 to 20%. The composition of error codes has also been expanded. In the article, 1C experts tell, using the example of “1C: Accounting 8” edition 3.0, how to respond to the tax authority’s requirement and provide explanations for the VAT return.

When the tax office asks for clarification on the submitted VAT report

The conditions regarding the provision of explanations to the tax authorities for the VAT return are set out in paragraph 3 of Art.

88 Tax Code of the Russian Federation. After the VAT payer has submitted a declaration to his Federal Tax Service, tax officials must carry out a desk audit of the document. And if during the process they have questions, the payer who filed the declaration is sent a request for clarification of points that are unclear to the tax authorities. The main cases when a request for clarification on a declaration will definitely be sent to the payer are:

- if errors are found in the declaration (for example, inconsistency of control values);

- if the declaration data does not coincide with the information available to the tax authority for a given payer (for example, the tax authorities have data from counter audits with the payer’s counterparties, according to which one amount of turnover is obtained, but the calculation submitted by the payer indicates another);

- based on the results of the submitted declaration, the amount of VAT to be deducted (refunded) from the budget is obtained;

- when submitting an adjusted declaration, the adjusted amount of VAT payable to the budget is less than it was in the original calculation.

There are other options available besides those listed. However, they are all combined into logical groups that are assigned a specific code.

How to compose a document

When drawing up a document, we are guided by the following rules:

- We compose a response on the organization’s letterhead. If there is no such form, in the header of the document we indicate the full name of the institution, INN, KPP, OGRN and address.

- We indicate the number and date of the requirement for which the explanatory note is being drawn up. It is permissible to write a response to several tax requests at once.

- If there are errors or inconsistencies in the report, double-check the report to eliminate typos or typos.

- In the descriptive part, we reveal in detail and consistently the circumstances of the situation that needs to be explained.

- When answering a request, rely on the facts and document the circumstances. Attach copies of documents to the answer, if any.

What is an error code in a Federal Tax Service request?

We present the coding and breakdown of groups of possible errors in the table.

| Code | The essence of the comment | Example situation |

| 1 | Discrepancy between the data in the payer’s declaration and the data in the declaration of his counterparty | The counterparty, the settlements with which are included in your declaration, submitted a zero report for the same period or did not submit it at all |

| 2 | Discrepancies between data from tax registers - purchase books (section and sales books (section 9) and sales books (section 9) | A typical situation is the deduction of VAT on advances received for which tax was paid in earlier periods |

| 3 | Discrepancies between data from the journals of invoices received (section 11) and issued (section 10) | The intermediary has an invoice for the entire amount of the intermediary transaction |

| 4 | Other discrepancies and inaccuracies | For example, inconsistencies in indicators in the declaration columns. In this case, as a rule, when indicating code 4, the coordinates of the place of declaration in which there is ambiguity are indicated next to it in brackets |

| 5 | Errors in invoice dates in sections 8–12 | The invoice date is not specified or the invoice date specified exceeds the reporting period for which the declaration is submitted |

| 6 | VAT deduction is overdue | You claimed a deduction beyond three years |

| 7 | You have claimed a VAT deduction based on an invoice drawn up before the date of state registration | — |

| 8 | Incorrect indication in sections 8–12 of the transaction type code | More information about the codes can be found here. |

| 9 | Errors were made when canceling entries in section 9 | The VAT amount indicated with a negative value exceeds the VAT amount indicated in the invoice entry subject to cancellation, or there is no invoice entry subject to cancellation |

Indicating the error code should help the payer understand what exactly the tax office did not like in his return, as well as provide the most appropriate explanations for the situation.

Why might discrepancies arise?

The seller does not keep records in good faith

According to the law, the seller, having issued an invoice, is obliged to register it in the sales book in the period in which the sale occurred, regardless of when it was issued and received by the buyer. However, in practice, situations are possible when the seller does not do this due to negligence or dishonesty. Then the fact of implementation remains undocumented.

The accountant transfers data to the accounting system manually

If a company maintains paper document flow, the accountant has to transfer data from invoices into the accounting system. Most often, confusion arises in document numbers, dates, amounts, and TIN of organizations.

Practice shows that the number of such discrepancies can be very large, and in most cases due to incorrectly indicated TIN. Errors in the TIN are dangerous because when reconciling the data in the Federal Tax Service database, the counterparty may simply not be found. This will lead to discrepancies between the data of the seller and the buyer, and the accountant will have to provide explanations. One or two cases per quarter are not critical, but if at least 15% of counterparties are entered into the accounting system with an error, demands for explanations can paralyze the work of the accounting department.

The counterparty evades taxation

Discrepancies may arise due to the supplier deliberately not fulfilling its tax obligations. You will have to respond to requests from tax authorities even if you unintentionally chose as a partner a “fly-by-night” company or a company in the chain of economic relations of which massive “breaks” are discovered.

How and within what timeframe do you need to send clarifications on VAT at the request of the tax authorities?

In Art. 88 of the Tax Code of the Russian Federation states that clarifications on reporting requested by tax authorities should be submitted no later than 5 working days. However, the tax legislation does not specify what is considered the starting point for counting these 5 days.

ATTENTION! If the request for documents was received during non-working days established by the President of the Russian Federation from 03/30/2020 to 05/11/2020 due to the spread of coronavirus infection, then the deadline for submitting explanations is extended by 10 working days (letter of the Ministry of Finance of Russia dated 04/15/2020 No. 03-02 -08/29938).

ConsultantPlus experts spoke about measures to support businesses during the coronavirus pandemic:

If you do not have access to the system, get trial online access and upgrade to the Ready Solution for free.

According to the norms of paragraph 5 of Art. 174 of the Tax Code of the Russian Federation, almost all VAT payers submit declarations in electronic form.

IMPORTANT! If the declaration is submitted via electronic communication channels, then further interaction between the tax authorities and the payer should occur in the same way. This is stated in the order of the Federal Tax Service dated April 15, 2015 No. ММВ-7-2/ [email protected]

That is, requests for clarifications to declarations must also be sent electronically.

At the same time, in paragraph 5.1 of Art. 23 of the Tax Code of the Russian Federation states that in the case when the tax office sends an electronic document (request) to the payer, the taxpayer confirms receipt by sending a receipt of its acceptance. The receipt must be sent within 6 days from the date of receipt of the document from the tax office.

That is, if we consider the sending of a receipt as confirmation of receipt, we can assume that the period of 5 days begins to run from the moment such a receipt is sent. Otherwise, it turns out that explanations must be submitted before a receipt confirming receipt of the request for these explanations.

At the same time, the letter of the Federal Tax Service dated November 6, 2015 No. ED-4-15/19395 states that 5 days for preparing explanations should be counted from the date of receipt of the request. Let us remind you that in accordance with paragraph 4 of Art. 31 of the Tax Code of the Russian Federation, the day of receipt of the request is considered to be the day following the day the request is posted in electronic access for the payer (for example, in the payer’s personal account on the Federal Tax Service website).

Thus, the question of when to start counting the days for providing explanations after a tax office request is not clearly defined by law. If the request came in electronic form, we recommend that when determining the deadlines, rely on the explanations of the Federal Tax Service, namely: count 5 working days from the working day following the day when the corresponding message from the Federal Tax Service appeared on your electronic resource.

IMPORTANT! In accordance with Art. 129.1 of the Tax Code of the Russian Federation, the fine for explanations not submitted or submitted on time is 5,000 rubles. for the first violation within a year and 20,000 rubles. - if repeated.

Common mistakes when compiling

Below we will look at the most common mistakes made when preparing an explanation for the VAT return.

Mistake #1. The answer is provided on paper.

Before the legislative changes came into force, that is, before 01/01/17, the payer could choose the form of providing a response to the request - electronic or paper. After 01/01/17, the Federal Tax Service accepts only electronic responses; explanations provided on paper are considered invalid.

Mistake #2. The deadline for providing a response expires 5 days after it is sent by the Federal Tax Service.

The reporting point for the response deadline is the day the request was accepted (the day the receipt was sent). That is, from the moment the Federal Tax Service sends the request, the payer is given a maximum of 11 working days to accept it, as well as to draw up and send a response: 6 days - acceptance of the request plus 5 days - sending an explanation.

Mistake #3. The Federal Tax Service sends requests within 30 days from the date of filing the declaration.

Indeed, practice shows that tax authorities send requests within a month after filing a declaration. However, according to current legislation, the period for sending a request is limited to the period of the desk audit (3 months). That is, if you receive a request after 2 months after filing the declaration, then such a request is considered legitimate and requires a response in the prescribed manner.

In what format should explanations be submitted?

Let us immediately clarify that the response to the tax office’s request for clarification on the VAT return can be in 2 options:

- Option 1. If the declaration initially contained an error when filling it out, which affected the amount of VAT payable, then in response to a request from the Federal Tax Service, an updated declaration should be submitted.

Read more about this in the article “How to make an updated VAT return in 2020?”.

- Option 2. If the data in the declaration will not change, but it needs to be deciphered for tax authorities, you need to create explanations and send them to the tax office.

The format of explanations for VAT is electronic only (unlike explanations for other taxes, which can be submitted both electronically and in paper form). The mandatory electronic format of this document is established by order of the Federal Tax Service dated December 16, 2016 No. ММВ-7-15/ [email protected] The document is a set of electronic tables that should be filled out by the payer for each figure in the declaration that raised questions.

Response to the requirements of the Federal Tax Service through electronic reporting

You can attach multiple images to one document.

Note. the Document Type line does not contain the type of document you are sending, then you will need to send such a document by outgoing letter, making sure to notify the Federal Tax Service.

The documents you add must meet the requirements. The list of requirements can be viewed by clicking on the hyperlink File Requirements .

After the document is prepared, click the Save and Close button.

If all the document data for sending is completed, it is displayed in the list of selected documents with the status Ready to send .

If some of the selected documents are not ready for sending, click the Prepare in the Readiness , or the Prepare all .

When all the documents in the Selected Documents are ready to be sent, you can finish document selection by clicking the Transfer button in response to the request.

A small window will appear in which you must select the requirement item to which the prepared document corresponds . Select the requirement item number and click OK .

Generate answers for each point of the requirement, and send a response to the requirement by clicking the Send .

After submitting a response to a requirement, the outgoing file will be displayed on the Request Responses .

Form of explanations for the VAT return: sample

Since VAT explanations must now be submitted strictly via electronic communication channels in the form established by the Federal Tax Service, samples of paper explanations previously presented on professional websites on the Internet have lost their relevance.

The ability to prepare electronic explanations in the required format is implemented in the “Legal Taxpayer” program.

See more details here.

In addition, if you use the services of electronic document management operators, they also allow you to send explanations. For example, if the Federal Tax Service sends a request through “Kontur”, an xml file is attached to the message, using which you can generate a tax response. To clarify how to respond to the tax authorities, please contact the operator through whose system you received the request.

This feature has been implemented in 1C. The form of explanations in 8 should be looked for as follows: Directories - VAT reporting - Clarification of declaration indicators - Submission of explanations at the request of the tax authority.

Sample response to a tax request for clarification

A separate folder is allocated in the memory of the device from which you work with the online service, electronic documents are saved in it:

- a file with a previously submitted value added tax return for which clarification is required; you can download it from the files attached to the declaration on the reports tab, which are in the Completed status;

- file requesting clarification.

The response to the requirement is generated in the official software product from the Federal Tax Service (JSC GNIVTs) - Taxpayer Legal Entity. After the response has been generated, it is also better to place it in the folder containing the declaration and requirement files. Next you should proceed to sending.

The response can be sent either from the Requirements section or directly from the tax authority’s notification itself.

When sent from a notification, files requesting clarification will be supported automatically.

You will only need to attach the declaration and the response file.

When sending from the Requirements section, the system will ask you to upload a file with the requirement itself, which was saved in a separate folder at the preparatory stage. The remaining actions are similar to those when sending from a notification.

After clicking on the send field, the entire set of electronic documents will be delivered to the tax authority.

The result of receiving the explanation will be one of the following documents from the tax authorities:

- Confirmation of dispatch date;

- Notification of receipt of an electronic document;

- Receipt of acceptance of an electronic document or Notification of refusal.

What documents must be attached to the explanations?

The form of explanations does not imply the submission of additional documents (copies) along with it. The tables are designed in such a way that if they are filled out correctly, tax authorities will see all the information they need:

- information from primary accounting documents (invoices);

- details of primary documents;

- data from tax registers - sales books and purchase books;

- the amount of identified discrepancies in relation to the primary data and registers;

- the amount of adjustments made;

- Payer comments on discrepancies.

Therefore, there is no need to provide documentation along with explanations. However, it should be borne in mind that in some cases, during the audit, the tax office has the right to request documents.

If you have access to ConsultantPlus, check whether you have correctly compiled and submitted explanations for the VAT return. If you don't have access, get a free trial of online legal access.

There is a lot of interesting information about documentary tax audits here.

How to write explanations when responding to tax requirements

The taxpayer has the right to provide explanations on VAT to the return in free form. Although officials have prudently developed a sample explanation for VAT, which, if desired, can be used. This document consists of several tables in which you can indicate accounting data and document details, as well as explain the reasons for the discrepancies. Each table is dedicated to a specific topic. For example, there are explanations for the high share of VAT. Before filling out a document, you must write an introductory note to it. It indicates by whom and for what tax period the response to the tax office’s VAT explanations was given, and also provides the number of sheets of the document and the correction number.

Advanced training courses for accountants and chief accountants on OSNO and USN. Complete training and confirm your compliance with the professional standard “Accountant”

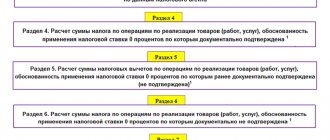

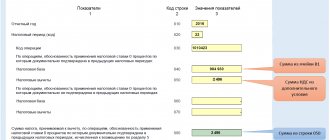

An example of filling out an explanation of control ratios

If you have a violation of the control ratio, then you will indicate the control ratio number and provide an explanation. Please keep your explanation to 1000 characters.

Explanation of discrepancies regarding the Constitutional Code

The discrepancy between the indicators in column 5 of line 110 of section 3 and line 260 of section 9 is due to rounding error.

If, as a result of checking the requirements for control ratios, errors are identified that lead to changes in the value indicators of the tax return, then it will be necessary to provide an updated tax return.

Explanations of information not included in the sales book

Those. the absence in section 9 of a registration entry for the invoice, for which the counterparty reflected the corresponding registration entry in section 8 of the tax return.

Case 1. The transaction is confirmed, i.e. There is no invoice in the seller's declaration. No explanations are provided; an updated declaration must be submitted.

Case 2. The transaction is not confirmed, i.e. The seller did not issue this invoice to the buyer.

Explanations are provided: how to find out about the results

After sending explanations to the Federal Tax Service, taxpayers have questions:

- How to confirm the fact that the tax office has received clarifications?

- How can I find out the results of reviewing the explanations?

The answer to the first question is related to the system for sending explanations via electronic communication channels. Upon receipt of a tax document, the taxpayer receives an electronic notification about this, certified by the electronic signature of an authorized person. Or, if the explanations are not accepted, a refusal will be issued in the same way. Refusal is possible only in one case - if the explanations are sent in the wrong format.

As for the results of checking the explanations at the tax office, the current provisions of the law do not provide for the obligation of the Federal Tax Service to specifically inform payers about the results of consideration of their explanations.

So the results can only be learned in indirect ways:

- Conduct a reconciliation with the tax office some time after submitting clarifications and explanations. If the accruals on the personal account coincide with the updated (explained) data, then the explanations have “passed”.

- Receive a repeated request for clarification or a document verification order. From which it can be concluded that the explanations presented “did not pass.”

- There is also the option to contact the contractor who sent the request. However, today this method may not be justified. On the one hand, the operating procedure of the Federal Tax Service Inspectorate itself is aimed at minimizing personal communication between employees of the Federal Tax Service Inspectorate and payers. On the other hand, as we noted above, the employee you contact has the right to refuse to inform you about the results of the check.

Reducing the tax burden

This issue is of particular interest to tax authorities. Thus, representatives of the Federal Tax Service constantly monitor the volume of revenues to the state budget. If they decrease, the reaction is immediate: demands with the provision of an explanatory note, an invitation to the manager to a personal meeting with a representative of the Federal Tax Service, or an on-site desk audit (a last resort).

In such a situation, you cannot hesitate; you must immediately provide explanations to the Federal Tax Service. In the explanatory note, describe all the circumstances and facts that influenced the reduction in tax payments. Confirm the facts with documents or provide economic justification. Otherwise, the Federal Tax Service initiates an on-site inspection, which may take several months.

What to write in an explanatory note:

- Reduction of salary taxes. The reasons may be staff reduction, enterprise restructuring, or reduction in wages.

- A decrease in profits may occur due to termination of contracts with customers. A copy of the additional agreement on termination of the contract should be attached to the explanatory note.

- Increased costs as a result of decreased profits. The justification may be expansion of activities (increasing production volumes, opening a new branch, division, retail outlet), changing suppliers or increasing prices for inventories and raw materials (attach copies of contracts).

There can be quite a few reasons for reducing the tax burden. We will have to look into each specific case.

Results

The procedure for submitting clarifications on VAT is now in effect, established by Order of the Federal Tax Service dated December 16, 2016 No. ММВ-7-15/ [email protected] According to this procedure and the requirements of the Tax Code, clarifications are submitted strictly in electronic form. Explanations are created by filling out tables according to the forms and format established by the Federal Tax Service.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service dated December 16, 2016 No. ММВ-7-15/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What response to the Federal Tax Service’s requirement is considered formalized?

A formalized response to a Federal Tax Service request is considered to be a response containing documents in XML format. Documents can be generated in this format, for example, when using an accounting program.

The list of documents that can be provided to the tax office in xml file format is as follows (Table 4.8 to the Order of the Federal Tax Service dated June 29, 2012 No. ММВ-7-6/ [email protected] ):

- invoice;

- Book of purchases;

- sales book;

- journal of received and issued invoices;

- act of acceptance and delivery of works (services);

- additional sheet of the Purchase Book;

- additional sheet of the Sales Book;

- waybill (TORG-12);

- adjustment invoice;

- document on the transfer of goods during trade operations;

- document on the transfer of work results (on the provision of services);

- invoice and document on the shipment of goods (performance of work), transfer of property rights (document on the provision of services), which includes an invoice;

- an adjustment invoice and a document confirming changes in the cost of goods shipped (work performed, services rendered), transferred property rights, which includes an adjustment invoice;

- response to a request for clarification.

We “recapture” every ruble of VAT refund from controllers

If the act describes many violations, there is no need to despair, much less remain inactive. First, it needs to be carefully studied - usually not all identified violations are justified, and the company still has a chance to defend, if not all, then a significant part of the deductions. The main thing is to present your objections in a timely manner, supporting them with appropriate justifications.

Important! 1 month is allotted for written objections to the company’s inspection report (clause 6 of Article 100 of the Tax Code of the Russian Federation).

A sample objection to an office inspection report can be downloaded in this material.

The tax authorities in our example, having considered the company’s arguments, removed some of their comments, and the amount of VAT refund increased significantly. However, now is not the time to relax - not the entire amount that can be defended in a difficult battle with controllers may end up in the company’s account.

This can happen if the company has arrears on VAT or federal taxes (including debts on penalties and fines) - under clause 4 of Art. 176 of the Tax Code of the Russian Federation, tax authorities have the right to independently offset the amount of tax to be reimbursed against the repayment of these debts.

Therefore, the taxpayer should check with inspectors in advance so that by the time the refund is transferred, the entire amount is at his disposal.

For information on the form of the reconciliation report valid in 2021, read the material “Attention - a new form of the reconciliation report with the tax office.”

Submitting documents to controllers

In the process of communication between a company and tax authorities as part of an audit, every detail is important. For example, copies of documents provided must be prepared in a special way - otherwise they will simply not be accepted for verification. Let's look at this in more detail.

Let's continue the example: Hellas LLC collected the necessary documents within the prescribed period according to the request sent by the inspectors.

Important! The documents requested as part of the desk audit must be submitted within 10 working days from the date of delivery of the request (Clause 3 of Article 93 of the Tax Code of the Russian Federation).

Company employees prepared copies of the requested documents and certified them properly.

Important! Since April 2015, companies may not use a round seal in documents drawn up on paper (Law No. 82-FZ dated 04/06/2015).

Hellas LLC stamped the copies. The company proceeded from the following: the term “certified copies” is not defined in the Tax Code, and therefore whether it is now necessary to put the company’s seal on the copy is not completely clear. On this issue, Ministry of Finance officials refer to GOST R 6.30-2003 (clause 3.26), according to which copies of the document should be stamped. To avoid unnecessary nagging from inspectors, the company decided to play it safe and put the seal on anyway.

What to do if controllers ask for unnecessary documents?

The first question after receiving a request: how to collect documents within the deadlines established by the Tax Code and avoid liability for failure to comply with its norms?

Important! For each tax claim document not submitted or submitted late, a fine of 200 rubles is possible. (clause 1 of article 126 of the Tax Code of the Russian Federation).

There is no need to immediately drop everything and collect the entire requested list. It is important to make sure that all the documents listed in the request relate to the declaration being verified and confirm the information reflected in its lines.

Important! During a desk audit, tax officials can request only those documents that directly relate to the subject of the audit (Article 88 of the Tax Code of the Russian Federation).

If the requested information does not relate to the declaration being verified, controllers do not have the right to demand it (clause 7 of Article 88 of the Tax Code of the Russian Federation).

It will be difficult for tax authorities to punish a company for failure to submit such documents - judicial practice is mainly on the side of the taxpayer. For example, the FAS Resolution No. A45-2243 dated October 09, 2013 states that the primary documents confirming the right to deduct VAT do not include balance sheets, account analyzes and other accounting registers.

For details, see the material “The fine for turnover is illegal.”

However, sometimes you can find a different judicial position when judges support the right of the tax authority to independently determine the list of requested documents (Resolution of the Federal Antimonopoly Service of the Moscow District dated October 4, 2006 No. KA-A40/9438-06). The ambiguity of the situation is explained by the fact that the criteria for selecting documents for verification are not defined in the Tax Code of the Russian Federation.

Having found out that some of the documents were requested incorrectly, it is risky to simply reduce their volume - it is better to send a letter to the tax authorities explaining the reason for the non-submission of certain documents. In the text of the letter, you can make a reference to clause 2.8 of the Federal Tax Service letter dated July 16, 2013 No. AS-4-2/12705, in which the tax authorities themselves indicated that the inspector’s right to request documents during desk audits is limited.

Judicial practice on VAT refunds is very extensive. Get trial access to the Consultant and study the Encyclopedia of Controversial Situations for free.