Home >> Questions about 1C >> 6-NDFL is not filled out automatically in 1C

Let's look at the algorithm for finding the reasons why form 6-NDFL is not filled out correctly automatically in 1C Accounting 8.3 and 1C ZUP 8.3 .

As a rule, Section 1 of Form 6-NDFL is filled out correctly by most accountants, which is understandable, since this section is filled out for the most part on the basis of income accruals for individuals. And income accruals, for obvious reasons, are under the constant and vigilant control of an accountant. The main problems arise with Section 2 of form 6-NDFL .

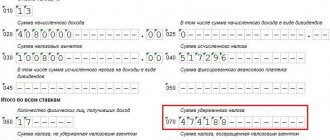

After creating the 6-NDFL report and clicking the “Fill” button, we go to Section 2 of the report and see that the amount of tax withheld (line 140 6-NDFL) taking into account tax deductions does not correspond to the amount of income actually received (line 130 6-NDFL) , or the tax withholding dates (line 110 6-NDFL) do not correspond to reality, or the taxable income is completely missing in the 6-NDFL declaration.

Line 130 in 6-NDFL may not be filled out at all or not completely filled out. If line 130 in 6-NDFL is not completely filled out, then the first thing we need to do is find the entry in which there is a discrepancy and identify the specific individual (persons) for whom there is a discrepancy.

Having found the required entry, go to the cell for the amount of income actually received and click the “Decrypt” button.

We find an employee who is missing from the list or an employee for whom the amount does not correspond to the amount paid. Further steps to find the reason why line 130 in 6-NDFL is not filled out (is not completely filled out) are described in the section Analysis of pay slips (click to go).

Manual recalculation of the amount of withheld personal income tax (line 140 in 6-NDFL) in relation to the amount of income received (line 130 in 6-NDFL) will allow you to identify an entry in which the amount of withheld tax is incorrectly filled out. (Line 130 X 13% = line 140). Do not forget to take into account tax deductions, if any.

Next, we “decipher” the amount of tax withheld. And we find an individual with a discrepancy between the amount of income received and the tax withheld.

And we move on to the analysis of the payroll with which the payment of income was made, the personal income tax for which is incorrectly reflected in line 140 in 6-personal income tax.

The 1C program “pulls up” most of the data for filling out Section 2 of form 6-NDFL from the documents of Payroll statements , namely “Statement to the bank”, “Statement to the cash desk” (for 1C Accounting 8.3), as well as “Statement to accounts” (additionally for 1C ZUP 8.3).

Therefore, to correctly fill out Section 2 of Form 6-NDFL, it is necessary to correctly fill out the Payroll Slips.

We found a discrepancy in the amounts of income paid (line 130 in 6-NDFL) or personal income tax withheld (line 140 in 6-NDFL) for a specific individual for a specific period. Now we need to open the Payroll for this period. If line 130 in 6-NDFL is filled out incorrectly, you need to check the amount “Payable” with the employee found earlier.

Then you need to go to the “NDFL” cell of the desired employee.

This is where the “wrong” amount of tax withheld will be located. It is necessary to check that all cells in each line of the list are filled in correctly (in this case we have one line). First of all, pay attention to the “Date of receipt of income”, “Tax amount”, “Base document”.

The reason for incorrectly filling out information on the withholding of personal income tax in the Payroll in most cases lies in a violation of the procedure for filling out and processing documents, which in turn occurs in the event of changes to the documents involved in the accrual of income of an individual “retroactively”, without subsequent reformation of the Payroll.

If in the Payroll statements an error in the amounts of paid income and (or) withheld personal income tax for an employee is repeated from month to month, then you should cancel all statements in which this employee is present, starting with the one in which the error appeared for the first time. Then refill and post the first statement in which the error occurred and all subsequent ones. At each stage it is necessary to control the result of the re-conduct. It is necessary to achieve correct automatic filling of pay slips. And of course, before making any changes, do not forget to make a backup copy of the 1C information base.

After correctly generating the Payrolls, fill out 6-NDFL again.

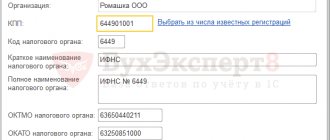

In 1C Accounting 8.3, the tax withholding date (line 110) in form 6-NDFL is formed on the basis of the date of the bank statement , which confirms the transfer of funds to the employee according to the Sheet to the bank or the date of the cash receipt order on the basis of which the income was paid to the individual.

Accordingly, the tax withholding date in Form 6-NDFL will be incorrect if an incorrect date is indicated in these documents.

The situation is different in 1C ZUP 8.3. In this configuration, the tax withholding date in Form 6-NDFL is formed on the basis of documents Confirmation of payment of income.

generate a Confirmation of payment of income from the documents Statement of Bank, Statement of Accounts by clicking the “Create on the basis” button

and from the “Payments” menu section

In the document Confirmation of payment of income, you must indicate the date of actual payment of income.

If the payment is made not according to the salary project, but in separate payments to the accounts of employees, and for some reason the transfer of funds to the employees indicated in the Statement of Accounts did not occur on the same day, then the Statement of Accounts must be divided in accordance with the number of days of payment.

Also, the date of actual transfer of income (that is, the date of withholding of personal income tax) in 1C ZUP can be confirmed by the document Confirmation of payment of wages . This document is filled out on the basis of a response file from the bank after execution by the bank, uploaded through the client-bank Vedomosti to the bank .

If 1C ZUP does not use the documents

Confirmation of payment of income and Confirmation of payment of wages , then the date of tax withholding (personal income tax) when auto-filling out form 6-NDFL will be set to the date of the Sheet .

How to fill out dividends in 6-NDFL?

If dividends in 6-NDFL are not filled out in 1C or are filled out incorrectly, then it is necessary to check the correctness of the formation of the documents on the basis of which dividends are reflected in 6-NDFL.

Payment method

1. When paying interpayment accruals before the advance, vacations and sick leave. We indicate that the document is Payment of salaries for the current month and the Fill button should fill in the correct amount.

2.When paying vacation or sick pay after an advance payment, you must explicitly add an employee and remove the line associated with the payment of the advance payment.

3. Remember the sequence of conducting and filling out documents Accrual (salary, vacation, sick leave) - Statement for payment - Statement or cash settlement.

4. When paying in advance the entire amount accrued for the current month, we manually enter the payroll document and tax into the payment statement.

5. When simultaneously paying one employee for a month through a bank and a cash desk, the tax amounts must be adjusted manually, since the program will not see the correct distribution of amounts.

7. Do not copy payment documents, but create new ones.

8. If in the document Payment of wages in advance the dot is on advance payment, but errors still appear, then move the dot to Payment of wages, remove the personal income tax (it should be withheld only when paying wages), remove the link to the payroll document and then return full stop on "advance".

9. First, the payment statement, then the Bank Statement or Cash Order. If you want to change it, cancel the write-off, then fill out the Payment Statement.

10. If you are correcting the previous period, cancel all payment documents up to today. And run consistently, even for the entire past year, a payment statement, a money write-off document, a payment statement, a money write-off document, etc.

11. The accrued personal income tax is formed by the salary accrual document and if everything has been calculated correctly, then there is no need to retransmit it when making corrections. Check how personal income tax is calculated on bonuses - if the bonus is calculated in two lines, adjust it so that it is one line.

12. Withheld personal income tax is generated using the document Statement for payment + Statement or cash settlement

13. The transferred personal income tax is generated using the document Write-off from a current account with the transaction type Transfer tax and with the selected tax “Personal income tax when performing the duties of a tax agent”. This tax needs to be automatically installed in the program; you don’t need to create it yourself. Otherwise there will be errors. The picture below will show you how to find out that you are completing the Personal Income Tax Transfer correctly. In the document, you can manually indicate whose tax is being transferred or automatically when posting.

14. If no tax has been accrued, then when personal income tax is transferred to the budget, the distribution to employees will NOT automatically work. Correct manually via the “Split by Employee” hyperlink.

Errors in filling out 6-NDFL in 1C ZUP 8.2 (2.5)

Open a Universal report with conditional formatting:

We select error detection section 2 of form 6 – personal income tax:

For the Universal report in 1C, you need to make the appropriate settings. How to correctly make the settings in this report to obtain the necessary data is discussed in the article “How to fill out 6 personal income taxes in 1C ZUP 2.5.”

After setting the appropriate settings, the Universal Report will show errors where the date of receipt of income does not coincide with the date of tax withholding for non-salary income. For salary income, it checks the date of receipt of income whether it refers to the end of the month or not. It will also highlight negative personal income tax withholding.

What to look for in pictures

Listed personal income tax

Statement for payment and withheld personal income tax

Errors without penalties

The Federal Tax Service of the Russian Federation explains that some Reports submitted with errors will not be the basis for the accrual of fines. For example, letters from the Federal Tax Service were published in which it was stated that the Federal Tax Service applies punishment in a mitigating form to those taxpayers who made minor errors that did not cause damage to the rights of the individuals about whom information was submitted. Errors that did not cause underpayments to the budget for personal income tax were also not considered serious violations. That is, minor arithmetic inaccuracies and minor spelling errors will not be a reason for applying penalties to the organization. But experienced entrepreneurs prefer to more carefully check the lines filled in the Report before submitting the Report to the tax office in order to protect themselves from penalties. If, even after submitting the Report, an error is still discovered, the enterprise should immediately provide the inspection with a clarification, having managed to get ahead of the inspectors, then both penalties and additional inspections by state regulatory authorities can be avoided. We will consider below what errors in 6-NDFL will be fined.

The only employee on children's leave

The entrepreneur has only one employee. She was on children's leave throughout the first and second quarters. The entrepreneur paid her a care allowance.

Maternity and child benefits are exempt from personal income tax (clause 1, article 217 of the Tax Code of the Russian Federation). If during 2021 an entrepreneur only provided an allowance to an employee, he is not a tax agent. This means that he has the right not to submit the 6-NDFL calculation (clause 2 of Article 230 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia dated March 23, 2016 No. BS-4-11/4901). A businessman has the right to submit zero reports to the inspectorate (see sample 1) or send a letter stating that he is not a tax agent (see sample 2).

Sample 1. How to fill out the zero calculation 6-NDFL

Top

Accept personal income tax calculated as withheld

Many questions arise regarding the application of the accounting policy setting about “Accept personal income tax in accounting, calculated as withheld.” So, at the beginning of the year, those who used this setting in order to generate 6-NDFL reports had to abandon it and re-post the documents.

However, this setting greatly simplifies accounting for organizations in which salaries and other payments are paid in full on the same day - it can only be used with a new approach. Now, when applying the “Accept personal income tax in accounting calculated as withheld” setting, personal income tax is withheld on the date specified as the date of payment of income in the accrual documents. But when applying this setting, you must remember that if wages are paid in installments, you will need to make adjustments to the 6-NDFL reporting manually.

If an organization does not apply the “simplified personal income tax accounting” setting, then it will be subject to a ban on posting payment documents from past periods. Posting these documents will not be possible if there is a future payment in accounting.

Delayed wages: possible problems for the employer

According to the law, the employing company is required to pay wages twice a month. First, an advance is given, and then the remaining main part of the remuneration. The date of receipt of these funds must be stipulated in the employment contract, as well as in the internal regulations of the company itself, and in collective agreements. A delay of even a day is a direct violation of employee rights.

Untimely distribution of earned funds threatens the employer with questions both from the tax service, if appropriate payments are not made, and from the labor inspectorate.

According to the Labor Code, an employee has the right to refuse to further perform his duties after a prior written warning. An application for this can be submitted 14 days after the date on which the employee should have received his money.

The employer is also obliged to compensate for the delay with compensation at a special rate, which is calculated by the Bank of the Russian Federation. Many employees do not know about this, which business entities use successfully. According to the administrative code, a defaulter may be subject to a penalty under Art. 5.27.

Attention! In the event of a malicious violation of Labor legislation and a long delay in wages, the guilty person is brought to criminal liability under Art. 145 of the Criminal Code of the Russian Federation.

Fines for non-payment of personal income tax

- Failure to fulfill the duties of a tax agent to transfer personal income tax to the budget will result in a fine of 20% of the amount of tax not transferred on time.

- In case of violation of the deadlines for submitting reports on 6-NDFL within 10 days after the established deadline for submitting reports, the tax office has the right to block transactions on the organization’s current accounts.

- Providing false information is subject to a fine of 500 rubles. for each 6-NDFL report or 2-NDFL certificate, regardless of the number of errors within one report.

- Failure to submit 2-NDFL certificates entails a fine of 200 rubles. for each document.

Who, where and when submits the report

The Tax Code of the Russian Federation assigns the obligation to fill out and send to the Federal Tax Service at the place of registration of the 6-NDFL report to tax agents - organizations and entrepreneurs who make payments to individuals within the framework of labor relations and under GPC agreements. If there were no payments to individuals in the reporting period, the “zero” report form does not need to be submitted (Articles 24, 226, 230 of the Tax Code of the Russian Federation).

Form 6-NDFL and the procedure for filling it out were approved by order of the Federal Tax Service of the Russian Federation dated October 14, 2015 No. ММВ-7-11/ [email protected]

The report is submitted to the Federal Tax Service using the TKS or on paper. Tax agents paying income to 10 or more individuals must send calculations electronically from 2021; in other situations, a paper form is allowed.

The calculation is submitted by the end of the month following the reporting quarter. In 2021, due to the coronavirus pandemic, 6-EDFL for the 1st quarter was allowed to be submitted until July 30. The deadline for submitting the annual report is March 1 of the reporting year. This is a change for 2020; previously, the report could be submitted until April 1.

The company has only a director - the only founder

The director of the company owns 100 percent of the authorized capital. There are no other employees in the organization.

Submit the calculation if the company issued dividends or salaries to the director. The Ministry of Finance believes that the sole founder does not have the right to enter into an employment contract with himself (letter dated March 15, 2016 No. 03-1111/14234). But labor relations with him arise on the basis of the participant’s decision.

Thus, the director, the only founder, has the right to receive both salary and dividends. If there were no payments or accruals during 2021, the company has the right not to submit the calculation. But to prevent the account from being blocked, you can submit zero reporting (see sample 1) or send a special letter to the inspectorate (see sample 2).

If the director received dividends or a salary, fill out the calculation in the general manner. There are no special rules for an employee who is the sole founder. For all situations with examples of filling, see the following sections of the book.

Sample 1. How to fill out the zero calculation 6-NDFL

Top

Errors in the first section

A common mistake when entering data and calculating indicators in the first section is that the indicators are indicated in the lines without an accrual total. Let's give examples of what other mistakes in 6-NDFL, for which you will be fined, can be made in the first section:

- line “020”: income not subject to personal income tax is included;

- line “070”: the indicator includes a tax deduction, the deduction of which will be made only in the next quarter (personal income tax on wages accrued in the last month of the quarter, and actually issued in the first month of the next quarter);

- line “080”: the indicator takes into account the amount of tax withholdings for which the time of payment has not arrived.

If an employee has been accrued money earned within the quarter, but the period has expired and it has not yet been paid due to the taxpayer’s financial problems, then information about them is entered only in the first section (in line “020” - accrued payment; in line “040” - accrued income tax; in lines “070” and “080” for the rolling payment we set 0 until the moment of actual disbursement of funds). In this case, no accounting is carried out in the second section. Line “070” often contains errors due to the fact that the accountant indicates in it the amount of tax deduction, which is subject to withholding only in the next period (this is especially common for issues related to wages paid in the first month of the next quarter). If such an error occurs, it is important to make and reflect the actual payment in the subsequent report; the Federal Tax Service does not require an updated Report to be provided for this error.