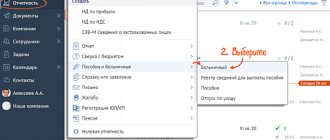

Documentation

Many accountants have already heard that from October 1, 2021, the employment service needs

Let us recall that paragraph 5 of Article 93 of the Tax Code allows organizations to refuse to auditors to re-provide

The nuances of the transition to direct payments from the Social Insurance Fund raise many questions. In this publication we

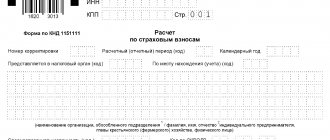

DAM for the 4th quarter of 2021 (the “new” form) was developed and approved by the federal

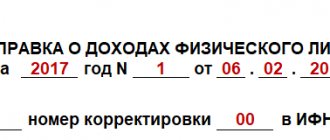

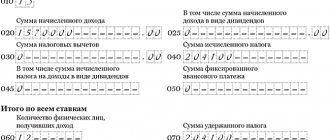

2-NDFL - a certificate of income of an individual, which is used both for tax reporting and

Law No. 149-FZ, dated July 27, 2006, defines the site as a complex of software products and

Reasons for refusing the simplified tax system Why they refuse: Termination of activity. In this case, the liquidation procedure is practically

In what cases may it be necessary to recalculate vacation pay? Calculation of employee's rest pay is based on the amount

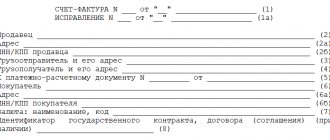

How to issue a duplicate invoice sample We will prepare and provide duplicates and copies of documents

Hello! In this article we will talk about the need to stamp new 2-NDFL certificates