Many accountants have already heard that from October 1, 2021, a new report on employees who are not pensioners must be submitted to the employment service. Is it necessary to take it? If yes, then in what form? Where is the new report? Will the employment service accept a paper or electronic form? What is the deadline for submitting a new report? We will answer your questions and provide you with a sample of how to fill out the new report.

Where did the new report come from?

Starting with data for the third quarter of 2021, employers must submit a new employee report. This follows from the Letter of Rostrud of Russia dated July 25, 2021 No. 858-PR “On conducting quarterly monitoring of information about organizations (employers) and the number of employees of organizations that are not pensioners, as well as monthly monitoring of the implementation of measures to promote the employment of citizens of pre-retirement age.”

Thus, Rostrud begins to collect information about workers of pre-retirement age.

Also see “Responsibility is being introduced for refusal to hire people of pre-retirement age.”

Which employers should I report to?

In general, employment centers (PECs) have a specific list of those organizations and individual entrepreneurs from whom a report should be requested. Some employment centers send targeted letters to employers asking them to fill out the appropriate form. Thus, the employment service in St. Petersburg notified employers of the need to submit a report using e-mail distribution and through electronic document management operators. If an employer with employees of pre-retirement age has not received a notification for some reason, he should contact the employment center (agency) himself, they clarify in the northern capital.

Submit information about the average number of employees via the Internet Submit for free

At the same time, in many regions it is recognized that the central control center does not always have the opportunity to send the report form to all respondents from the sample. In this regard, employment services ask employers whose staff includes the above categories of workers to send information without waiting for notification from the employment center. A notice of the need to send a report is usually published on the website of the employment service (see, for example, Moscow, Bryansk region, Vladimir region).

Messages from accountants about how information is collected in their cities can be read on the Bukhonline forum: “Discussion of the news “Rostrud will collect data on workers of pre-retirement age”.”

Is this a mandatory report or not?

There are no provisions in Russian legislation regarding such a report. Therefore, this report cannot be regarded as mandatory.

However, the Federal Service for Labor and Employment reports that it must be submitted on the basis of decisions of the Government of the Russian Federation (clause 3 of section III of the protocol of the meeting of the Government of the Russian Federation dated June 14, 2021 No. 16, as well as for the purpose of executing the protocol decisions of the meeting in the Federal Labor Service and employment with the heads of executive authorities of the constituent entities of the Russian Federation exercising powers in the field of employment (protocol dated July 10, 2021 No. 1).

Submit a new report to Rostrud in October

Letter No. 858-PR states that information must be sent to a specific email address, but let us clarify that this address is indicated not for employers, but for employment services - CZN specialists will send systematized data on all reported employers to it.

Employers submit this form to their regional employment service structures. A new report to Rostrud from October 1 is submitted by sending it to the email addresses of service employment centers or in another way (it is possible to submit it to the Employment Center in the form of scanned copies, you can submit the report in person or in paper form by mail).

The general deadline for submitting information is as of October 1, 2018. is set until October 15, but some employment services are shortening the period for receiving reports so that they have time to summarize the data (for example, in Moscow the deadline is set until October 3).

In the future, a new report should be submitted to Rostrud at the end of each quarter, before the 15th day of the month following the reporting period, or within other deadlines established in the region.

Rostrud introduces a new report on employees in its letter; no other regulatory act provides for the introduction of an additional reporting form. On this basis, we can conclude that submitting the document is not mandatory, and there should not be a fine for late submission or failure to submit. At the same time, employment services insist on the obligation to submit a report, including a zero report, and the above letter from the Ministry of Labor directly refers to the government decision (clause 3 of section III of the minutes of the meeting of the Government of the Russian Federation dated June 14, 2018 No. 16) and to the protocol decision of the meeting in Rostrud (protocol dated July 10, 2018 No. 1). In addition, Art. 19.7 of the Code of Administrative Offenses of the Russian Federation provides for liability for failure to provide information, including employment service - fine up to 500 rubles. for officials and up to 5000 rubles. for organizations.

What are the deadlines?

A new report will need to be submitted quarterly, starting with data as of 10/01/2018, no later than the 15th day of the month following the reporting one. It turns out that the first report must be submitted before October 15 .

However, we note that some employment centers ask you to submit your report earlier. For example, the Zlatoust employment center asks for a report to be submitted quarterly by the 1st day of the month following the reporting month.

In what form should the report be submitted?

In most regions, employment centers ask for reports to be submitted by email, fax or paper. In a similar way, reporting is accepted in the Moscow, Sverdlovsk, Chelyabinsk, Rostov, Vladimir, and Omsk regions. However, it is possible that in the near future data collection will be carried out automatically through a personal account on the employment service portal, as is already organized in some constituent entities of the Russian Federation. For example, in St. Petersburg and the Stavropol Territory. The report form is contained in your personal account on the portal. Accordingly, it does not need to be downloaded or downloaded additionally. To register and activate a personal account, you will need the employer’s tax identification number and a unique access code, which can be obtained from the nearest employment agency in person or by proxy, St. Petersburg clarified.

What to include in the report and how to fill it out: sample

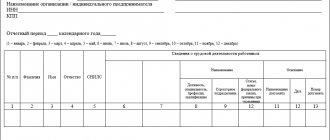

The new report must indicate information about the number of employees:

- men born in 1959;

- women born in 1964.

Moreover, we note that the report will need to indicate both those working on the reporting date and those who ceased their working activities during the reporting period.

Also, in addition to the number of employees, the report must indicate the name of the company, its tax identification number and checkpoint.

The new report exclusively includes information on the number of employees. That is, you need to indicate the number of people. Personal data of employees (for example, full name and year of birth) does not need to be included in the report.

Let's assume that the company employs two men born in 1959 and one woman born in 1964. They operated during the 3rd quarter of 2018. Then a sample of filling out a new report will look like this:

Protection of personal information

All of the information listed above constitutes the personal data of employees, the processing (receipt, transfer, storage) of which is carried out exclusively with the consent of the employees (Article 3 and Article 4 of the Federal Law of July 27, 2006 No. 152-FZ “On Personal Data”).

As a rule, when concluding an employment contract with employers, employees simultaneously sign an agreement with them on the processing of personal data. However, this does not mean that employers have the right to transmit new reports without obtaining consent from employees, although the names of employees are not included in the new report and the mayor’s office believes that the information it receives is not personal data.

Let us recall that, as a general rule, employers can request and process only that information about employees that is required in connection with the performance of their job duties. Employers usually simply do not have information about employees’ license plate numbers and social card numbers, since they previously did not need them. And the collection and processing of unnecessary personal information is a gross violation and entails administrative liability in accordance with Part 1 of Art. 13.11 Code of Administrative Offenses of the Russian Federation. This provision provides for fines for individual entrepreneurs in the amount of 5,000 to 10,000 rubles, and for organizations - from 30,000 to 50,000 rubles. Therefore, previously employers tried not to ask employees for unnecessary information.

Now, in accordance with clause 2.1. Decree of the Moscow City Hall dated October 6, 2020 No. 97-UM, this information is necessary for the further continuation of the activities of Moscow employers. Consequently, employers now have the right to request relevant information from employees without the threat of being held accountable under Part 1 of Art. 13.11 Code of Administrative Offenses of the Russian Federation.

At the same time, in order to exclude the possibility of being held liable for unauthorized processing of personal data, employers must enter into an agreement with each employee on the processing of newly received information.

Eight changes in working with employees in 2021

Depending on the number of employees, reporting is submitted electronically

From 2021, if the number of employees in a company exceeds 10 people, employers submit calculations for insurance premiums and personal income tax reporting electronically.

If it so happens that the number of staff has increased during the year, it is still impossible to submit reports on paper.

From January 1, 2021, a progressive personal income tax rate is in effect.

Currently there is a flat personal income tax rate of 13%, which does not depend on income. This has been the case for 20 years.

But at the end of June 2021, the president announced plans to introduce a progressive personal income tax rate and increase it to 15% for those with large salaries - more than 5 million rubles. in year. Moreover, the increased rate should not be applied to all income, but only to that part of it that exceeds the “limit” of 5 million, the president clarified.

Income over 5 million rubles. per year is approximately 416,600 rubles. per month. Therefore, apparently, the increase in the personal income tax rate will be felt primarily by small businesses.

It must be said that bills on the introduction of a progressive scale have been introduced into the State Duma at regular intervals since 2013. The last such project was rejected in December 2021. The new bill was introduced in September 2021. And already on October 21, it became known that deputies unanimously adopted in the first reading amendments to Part 2 of the Tax Code regarding the taxation of income of individuals exceeding 5 million rubles. for the tax period. In November, the President signed Federal Law No. 372-FZ dated November 23, 2020.

Additional budget revenues from the increase in personal income tax are planned to be used for the treatment of seriously ill children.

Example

Ivan Ivanov earns 7 million rubles. in year. In 2021, the personal income tax rate is 13%, so the employer must withhold 910,000 rubles from Ivanov’s salary. (7 million * 13%).

In 2021, the personal income tax for Ivanov will be increased to 15%, which means the amount of deductions will increase to 950,000 rubles. (5 million * 13% + 2 million * 15%).

The minimum wage will increase again in 2021

From January 1, 2021, the minimum wage and the cost of living will be calculated using a new methodology, which has already received approval from the Federation Council.

The bottom line is this: the cost of living will now be calculated not from the consumer basket, but from the average per capita income of citizens, and the minimum wage - from the median wage.

The median wage should be understood as the amount relative to which one half of the population has higher wages and the other half has lower wages.

In 2021, the minimum wage, taking into account the new calculation methodology, will be 42% of the specified median, which is 12,792 rubles.

The federal minimum wage is reviewed once a year. Payments for wages and sick leave depend on it. But in the regions the minimum wage may differ from the federal one. For example, the Moscow minimum wage from October 1, 2020 is 20,361 rubles.

It is important for the employer that payments to employees who have worked a full month are not less than the minimum wage.

For some time now, the tax office has been comparing employee salaries, which are indicated in salary reports, not only with the minimum wage, but also with industry averages for the market (Letter of the Federal Tax Service of the Russian Federation dated October 17, 2019 N BS-4-11 / [email protected] ). If these figures are higher than the minimum wage, but much lower than those presented for the industry, the tax office may send a letter to the company demanding explanations.

Since 2021, the updated form 6-NDFL has been in effect.

The new form project contains 3 sections. In the first section, “Data on the obligations of the tax agent,” generalized indicators are indicated for the returned amounts of personal income tax transferred to the budget, indicating the period of transfer.

In the second section “Calculation of calculated, withheld and transferred amounts of personal income tax” the amounts of accrued and actually paid income are entered with a separate indication of the amounts relating to previous periods.

The updated form contains an attachment in the form of a certificate of income and tax amounts of an individual.

There are several differences in the 2021 6-NLFL form compared to the 2021 form:

- Fields have appeared for indicating the amount of tax refunded.

- The dates of actual receipt of income have been eliminated, meaning that only the date of transfer will need to be indicated.

- A separate field has been allocated to indicate information on past tax periods, for example, for cases where wages for December were paid in January.

- There is no need to submit a 2-NDFL certificate based on the results of 2021. At the end of 2021, the 6-NDFL report simultaneously provides annual 6-NDFL information and information on accrued/actually paid income to individuals.

The project to amend the 6-NDFL report is at the stage of preparing a conclusion. But there is a high probability that the new form will be in force from January 1, 2021, as legislators will make a corresponding decision during the fall session.

The transition to electronic work books will continue

On January 1, 2021, the process of creating electronic work books began. The transition to a new format of information about work activity has become voluntary and is carried out only with the consent of the employee. That is, the employee has until December 31, 2021 inclusive, the opportunity to choose whether to keep a paper work report or switch to an electronic one. The employer's further actions depend on this choice.

The employee chooses the electronic option of maintaining a work record book

In this case, the employer hands him a paper work record and continues to enter information into the electronic book.

The employee decides to stay with paper work

In addition to the paper version, the employer maintains an electronic book.

For employees who do not apply during 2020, although they remain employed by the company, the employer will continue to maintain a paper work record.

Transfer information about your work activity using a convenient web service

For those who will be getting a job for the first time in 2021, information about their work activities is initially planned to be maintained only in electronic form.

The deadline for submitting the SZV-TD has been revised

In 2021, a new report appeared - SZV-TD (Federal Law dated December 16, 2019 No. 436-FZ).

Initially they said that this report should be submitted at the end of the month. However, at the end of April, due to the situation related to the spread of coronavirus, it became necessary for the government to monitor the unemployment rate in the country.

Submit the SZV-TD report in the Kontur.Accounting web service with 24/7 support.

Try for free

As a result, it was decided to introduce temporary rules for registering citizens in order to find suitable work and as unemployed. They oblige employers to submit to the Pension Fund information about hired and dismissed employees the next day after the issuance of the relevant order.

Benefits are paid only to the Mir card

The obligation to pay benefits to the Mir card was supposed to begin on July 1, but due to the pandemic, the Central Bank initiated a postponement until July 1, 2021 (Letter No. IN-04-45/175 dated December 18, 2020). Until this date, there will be no penalties for paying pensions and other social benefits not to Mir cards.

The innovation affected all benefits that are paid from the Social Insurance Fund: benefits for the birth of a child, child care benefits, payments to Chernobyl victims and other budget contributions.

The obligation does not apply to sick leave payments - for the first three days they are credited by the employer to any cards. Salaries, bonuses, vacation pay, and benefits for caring for a sick child are also transferred to any card. These payments are made as usual, and the employee does not need to issue a Mir card.

The exception applies only to those who live abroad. For example, if a company has an employee who receives child care benefits for up to 1.5 years, but she is abroad, then the benefits can be transferred to her on any card.

There is no “World” card or it was not released in time. What to do?

In this case, the money is transferred to the employee to a bank account not linked to any card, by postal order or in cash (Clause 5.4, Article 30.5 of the Law of June 27, 2011 No. 161-FZ).

At the same time, the employer who makes payments not to the Mir card must notify the department that assigned the benefit about this.

To switch to direct payments using the Mir card, you need to notify the employee about this and receive a statement from him with information about the card details.

From January 1, 2021, the remaining regions will switch to direct payments to the Social Insurance Fund

The pilot project to launch direct payments from the Social Insurance Fund started in 2011 and developed in stages - new regions joined it every year.

The project assumes that the employer independently calculates benefits, but transfers only those amounts that are paid at his expense - for example, sick leave for the first three days.

Next, the employer sends an application to the Social Insurance Fund, and the payment of the amount due at the expense of the Social Insurance Fund is paid directly by the fund itself.

The fund will pay benefits directly

From January 1, 2021, the remaining 8 regions will switch to direct payments:

- Krasnodar region;

- Perm region;

- Moscow region;

- Sverdlovsk region;

- Chelyabinsk region;

- Moscow;

- Saint Petersburg;

- Khanty-Mansiysk Autonomous Okrug - Ugra.

Thus, from 2021, all employers without exception will no longer need to pay benefits. This is beneficial - there is no need to reserve funds for payments and withdraw them from circulation.

Algorithm of employer actions for direct payments

- Receives documents from an employee.

- Calculates benefits and pays the amount for the first 3 days.

- Prepares and sends documents to the Social Insurance Fund within 5 days from the date of receipt of documents from the employee.

- The FSS checks and assigns benefits within 10 days. 5. The Social Insurance Fund pays benefits to the employee.

Sick leave is the amount from which personal income tax is withheld. That is, the amount of sick leave paid by the employer is reflected in the accounting records as before.

In relation to amounts paid at the expense of the Social Insurance Fund, the functions of a tax agent are performed by the Social Insurance Fund.

If an employee needs a 2-NDFL certificate regarding payments made by the Social Insurance Fund, he can contact the fund directly.

Calculate sick leave and send an application to the Social Insurance Fund

Sometimes the question arises: what to do with employees who are already receiving benefits? Let’s say an employee is on maternity leave for up to 1.5 years, and accruals have been made to her for a long time. What will change from January 1, 2021? Who will continue to pay her benefits?

For December 2021, benefits are still paid by the employer to the Mir card. And for periods after January 1, 2021, the policyholder sends an application and documents necessary for the calculation and payment of benefits to the Social Insurance Fund office using a special form. And he does this only once. This logic will need to be followed by the regions that will join the FSS pilot project for direct payments from 2021, including Moscow and St. Petersburg.

What you need to do before the end of 2021

In addition to submitting reports on employees’ work activities by the end of 2021, employers need to:

- If necessary, revise local regulations (LNA). For example, if some LNA states that you keep work books in paper form, then it is important to review these acts and bring them into compliance with the law. And if work books are kept electronically, write down this obligation in the documents.

- Put agreements, employment contracts and collective agreements in order. This part of the work is also related to the transition to electronic work books.

- Ensure the technical ability to transfer information about labor activity to the Pension Fund.

- By the end of October 2021, the employer must notify each employee in writing about changes related to the maintenance of work records and the employee’s right to choose between paper or electronic work records. The employee must make his choice before the end of 2021.

- The notification is drawn up in any form. It needs to highlight the essence of the changes, describe what choice the employee can make, what will happen if he does not submit an application for choice (the employer will need to keep both a paper and electronic work record book). It is also worth stating that if you choose the electronic option, the employee will be given his paper book.

employee about changes in labor legislation and the possibility of refusing to maintain a work record book on paper.

Tatyana Evdokimova, leading expert, Kontur.Accounting

Sanctions and fines

There are no penalties for failure to submit a report to the employment center. This is due to the fact that Form No. 1 is not approved by law. A letter from Rostrud cannot oblige companies to submit these reports.

Rostrud has introduced a new report, which is designed to provide separate accounting for employed citizens of pre-retirement age. The need for such a document is due to recent changes in pension legislation: raising the retirement age while simultaneously tightening control over the employment of persons approaching retirement age, introducing additional measures to influence employers who unreasonably dismiss workers who are about to retire.

Timing and frequency of reporting in Form P-4

Since 2021, some companies submit reports monthly, while others submit quarterly reports. The period within which the form must be completed and returned depends on which category the respondent falls into.

Every quarter, the form is submitted by organizations that over the past two years, on average, had no more than 15 employees and 800 million rubles in revenue, not counting companies of those organizational and legal forms that are exempt from submission.

They submit the report by the 15th after each quarter. That is, April 15, July 15, October 15 and January 15.

Every month, all other organizations that are not included in the first group submit the form. Also, regardless of the number of employees and the amount of revenue, companies with a mining license and those registered or reorganized in 2021 and 2021 must submit a monthly form.

They submit the report by the 15th after the end of each month.

If you are not sure which category you fall into, check your obligation to report to the special Rosstat service. There you will see a list of forms that are expected of you and deadlines.

The P-4 report can be submitted on paper by delivering it to the Rosstat office in person, delivering it with an authorized representative or sending it by mail. There is also the opportunity to report electronically - through electronic document management services.

Reporting to the Pension Fund

Report on the form SZV-STAZH

Information about the insurance experience of insured persons in the form SZV-STAZH is a new form of reporting to the Pension Fund of the Russian Federation for employers. It must be completed within a year.

Learn more about the SZV-STAZH report.

Report according to the SZV-M form

The report in the SZV-M form is a new monthly reporting to the Pension Fund for employers. It must be taken starting in April 2021 (including for employees working under civil contract agreements).

More details about the SZV-M report.

Who should be included in the report

When filling out headcount indicators, separately take into account all citizens: both those who work on the basis of open-ended employment contracts and those who perform temporary or seasonal work.

If the founders are themselves employed and receive wages, they should be indicated separately.

Employees registered in an organization for a part-time or weekly basis should be taken into account in 1-T (professional) on a general basis, as whole units.

If the same employee occupies two positions at once, i.e. is an internal part-time worker, then he must be included in the report only on one line, which indicates his main profession.

Who doesn't need to be included

The updated instructions for filling out 1-T (professional) (statistics) consolidate the list of those who need to be included in the report and who are not required to be included. Do not include in the headcount of employees:

- employees who are external part-time workers;

- persons with whom civil law agreements (GPC) have been concluded;

- women who are on maternity or child care leave;

- military personnel called up for service.

To fill out, use the All-Russian Classifier of Occupations - OKZ (OK 010-2014 (MSKZ-08), approved by order of Rosstandart dated December 12, 2014 No. 2020-st. This document contains all data on professions, specialties and positions similar to those included in report.