What is meant by tax period in Russia?

The tax period in Russia is a period of time after which the final tax base is drawn up, and the tax is calculated and paid from it (Clause 1 of Article 55 of the Tax Code of the Russian Federation). In most cases, this period is equal to a calendar year, but can be a quarter or a month.

In the Tax Code of the Russian Federation, a tax period of less than 1 year is established for a number of taxes. Thus, a quarterly tax period is defined for VAT (Article 163 of the Tax Code of the Russian Federation), water tax (Article 333.11 of the Tax Code of the Russian Federation), UTII (Article 346.30 of the Tax Code of the Russian Federation), and trade tax (Article 414 of the Tax Code of the Russian Federation).

The shortest tax period, lasting only a month, is defined, for example, for taxes such as mineral extraction tax (Article 341 of the Tax Code of the Russian Federation) and excise taxes (Article 192 of the Tax Code of the Russian Federation).

But even the legally established period is not always the same length. Art. 55 of the Tax Code of the Russian Federation considers the following cases of lengthening and shortening the tax period:

- for newly formed companies or individual entrepreneurs, the moment of state registration of which is located between January 1 and December 31 (August 25, for example), the first tax period is shortened and is from 08/25/2017 to 12/31/2017 (paragraph 2, paragraph 2, article 55 Tax Code of the Russian Federation);

- for a company (or individual entrepreneur) registered in December (for example, 12/08/2016), the first tax period becomes longer than usual - from 12/08/2016 to 12/31/2017 (paragraph 3, paragraph 2, article 55 of the Tax Code of the Russian Federation);

- for organizations and individual entrepreneurs who decide to reorganize or even liquidate their business during the year, the last tax period will be shortened compared to the usual one; as a result, its duration will be, for example, from 01/01/2017 until the moment of reorganization or liquidation (paragraph 1, paragraph 3, article 55 of the Tax Code of the Russian Federation);

- if a company or individual entrepreneur was created in 2021 and was liquidated (reorganized) at the same time, then the tax period for them is the time period from the moment of state registration until the moment of liquidation (reorganization) (paragraph 2, paragraph 3, article 55 of the Tax Code of the Russian Federation);

- for a company (or individual entrepreneur) created in December 2021 (for example, 12/20/2016) and ceased operations in 2021 (for example, 12/30/2017), the tax period will be the time period from 12/20/2016 to 12/30/2017 (paragraph 3 clause 3 of article 55 of the Tax Code of the Russian Federation);

- for a foreign company that has recognized itself as a tax resident, the duration of the tax period depends on the date of recognition specified in the statement about this event (clause 6 of Article 55 of the Tax Code of the Russian Federation).

Similar rules apply for a tax period equal to a quarter. However, the time period that allows it to be extended is not equal to 1 month (December), as for a year, but to 10 days remaining until the end of the quarter (paragraph 3, clause 3.1, paragraph 3, clause 3.2, article 55 of the Tax Code of the Russian Federation).

Tax payment schedule for special regimes

| Payment | Characteristics | Period | Payment deadline |

| Unified agricultural tax | All payers | 2017 | Until April 2 |

| 6 months 2021 | Until July 25 | ||

| simplified tax system | When transferring tax by companies | 2017 | April 2 |

| When transferring tax to individual entrepreneurs | 2017 | April 30 | |

| Regardless of the payer category - when making advance payments | 1st reporting quarter, 6 months, 9 months 2021 | The 25th day of the month that follows the period for which the payment is calculated | |

| UTII | Regardless of payer category | 4th quarter of 2021, first 3 reporting quarters of 2018 | 25th day of the month following the period for which the payment is calculated |

| PSA | All payers | Periods are similar to those established by law for mineral extraction tax, income tax, VAT | The same as those defined for mineral extraction tax, income tax, VAT |

| PSN | Payers (only individual entrepreneurs) who have issued a patent for a period of less than 6 months | The validity period of the patent, which can begin in 2021 and end in 2018, or begin and end in 2018 | Patent expiration date |

| Payers with a patent issued for a period of 6 months or more, upon payment of 1/3 of the amount of the patent | 90 days after receiving a registered patent (if registered in 2021) | ||

| Payers with a “long” patent, upon payment of 2/3 of its amount | Patent expiration date |

Now - about the deadlines for paying insurance premiums in 2021.

Under what circumstances can the tax period not be lengthened or shortened?

Taxpayers working for UTII cannot use the rule of changing the length of the tax period (paragraph 2, paragraph 4, article 55 of the Tax Code of the Russian Federation).

For a tax period defined as a month, its duration is taken according to the actual number of days of the taxpayer’s existence in it, if such existence does not cover the entire period (clauses 3.3 and 3.4 of Article 55 of the Tax Code of the Russian Federation).

There is no provision for extension of the tax period for tax agents. It can only be reduced (clause 3.5 of Article 55 of the Tax Code of the Russian Federation). But for those working on a patent, the rules for lengthening/shortening the tax period do not apply at all (paragraph 1, paragraph 4, article 55 of the Tax Code of the Russian Federation).

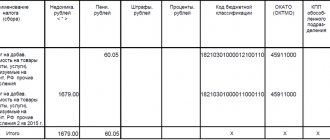

What code will correspond to the year in the payment order?

How to indicate the tax period - year - on a payment slip? According to the same rules that are valid for indicating other payment periods (Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n).

These rules require that the payment period be indicated in a code of 10 characters, the first 2 of which indicate the duration of the period (MS, CV, PL or GD). They are separated by a dot from the next 2 characters corresponding to the period number (01-12, 01-04, 01-02 or 00). Next, the year number consisting of 4 digits is also inserted through a dot (for example, 2017).

For more information on how the payment period code is generated, read the article “Indicating the tax period in the payment order - 2017.”

Thus, the tax period code for the year in a payment order generated in 2021 when paying for 2021 will look like this:

GD.00.2017

Its difference from ciphers of other periods is the impossibility of specifying the period number, which leads to two zeros being placed in the middle part of the code.

What is a reporting period and when is it considered equal to the tax period?

A reporting period is a period of time for which a taxpayer must report on a specific tax or, if necessary, transfer an advance. It is shorter in duration than the tax period.

Typically, one tax period contains several reporting periods, and the law determines their exact number. For example, for land tax paid by organizations, Art. 393 of the Tax Code of the Russian Federation, the calendar year is established as a tax period, and quarters, accordingly, are indicated as reporting periods.

At the same time, the Tax Code provides for the possibility of completely abandoning reporting periods for certain types of taxes. For example, since land tax is classified as local, local governments are given the right not to establish reporting periods for this tax (clause 3 of Article 393 of the Tax Code of the Russian Federation).

In such cases, the tax and reporting periods coincide in length (tax reporting period).

For information on how land tax is paid, read the material “Procedure and deadlines for paying land tax in 2016-2017” .

Arbitrage practice

But judicial practice gives quite clear formulations. Judges consider the concepts “before” and “not later” to be equivalent. Thus, if we take the situation with the 15th, it turns out that the payment deadline will expire on the 15th. This is precisely what the Constitutional Court of the Russian Federation pointed out in its Determination No. 185-O dated 04.07.2002.

The Supreme Court of the Russian Federation, in Resolution No. 304-KG18-7786 dated October 16, 2018, also explained that if the deadline is set until April 30 (we were talking about land tax), then April 30 should be considered as the deadline for fulfilling the obligation to pay the tax.

Where do the judges come from? Is it not because the longer the period for fulfilling the obligation, the better it is for the taxpayer? But, most likely, they simply know how to “read and translate” the Tax Code.

What does the expression “tax payment period” mean?

The period of tax payments is a time period after the end of the tax period, when taxpayers make tax payments to the budget within a legally defined period. The expression “tax payment deadline” is usually used - it, like the duration of the tax period, is determined by the norms of the Tax Code of the Russian Federation.

Payment deadlines, as a rule, remain unchanged from year to year, and the taxpayer prepares for them in advance in order to pay his tax obligations on time and in full. However, under the pressure of circumstances, corrections are still made. For example, for a tax such as VAT, legislators have repeatedly changed the deadline and procedure for payment in recent years. Just a few years ago, quarterly calculated VAT amounts were paid by payers of this tax no later than the 20th day of the month following the reporting quarter. Now the payment deadline has been postponed until the 25th, and the amount of VAT payable at the end of the quarter is divided into 3 parts and paid within 3 months in equal installments.

“How long is the tax and reporting period for VAT in 2021?” will help you understand all the nuances of the tax and reporting periods for VAT, as well as find out the specifics of paying it to the budget. .

Personal income taxes: payment schedule

| Payment | Characteristics | Period | Payment deadline |

| Personal income tax | When transferring tax to individual entrepreneurs (and other business entities in the status of individuals) for themselves | 4th quarter 2021 | January 15 |

| 2017, 1st half of 2018 | July 16 | ||

| 3rd quarter 2021 | October 15 | ||

| When paying tax by agents who paid sick leave and vacation pay to employees | Month | Until the end of the month in which payments were made | |

| When paying tax by agents who paid employees wages | No later than the day following the day of payment of the last part of the salary | ||

| When paying tax by agents in the status of JSC who paid dividends | Within a month after the occurrence of the earliest of the events specified in paragraph 9 of Art. 226.1 Tax Code of the Russian Federation | ||

| When dividends are paid by a company in a status other than JSC | No later than the day following the day of transfer of dividends | ||

| When paying tax on payments under civil contracts | On the day of payment to the contractor |

Now let's study the tax payment schedule that companies using natural resources must adhere to in 2021.

Is it possible to change the tax period

The tax period is one of the mandatory elements of taxation, without which no tax can be established (Clause 1, Article 17 of the Tax Code of the Russian Federation).

For certain types of taxes, adjustment of the duration of the tax period is possible only under one indispensable condition - if changes are made to the Tax Code of the Russian Federation. This also applies to those taxes, individual elements of which are established and adjusted by local or regional authorities (for example, they have the right to set their own tax rates, payment deadlines, etc.).

What are the benefits of a tax calendar for accountants?

The accountant's tax calendar is a special directive developed annually by the Federal Tax Service, which contains all the information about all necessary tax payment items for all business entities.

Being a kind of hint in the work of an accountant, the tax calendar provides all the necessary annually changing information on the deadlines for submitting reports of all types, as well as making various types of mandatory tax payments. The document contains an indication of all specific dates in the year, as well as the current budget classification codes for the transfer of funds.

In addition to its main function - orienting the accountant to the deadlines for submitting the necessary reports, which change annually, the tax calendar also details information regarding regulatory documents, as well as regulatory changes in reporting forms for the current year.

Thus, the tax calendar serves as reinsurance for the accountant in matters of timely submission of reporting documentation, while reducing the risk of committing offenses after inspections by fiscal authorities.

Results

The tax period is a time period established by the Tax Code of the Russian Federation, after which the tax is calculated and paid. For most taxes, it is a calendar year. For certain taxes, a shorter tax period is provided (quarter or month).

The reporting period is the period of time for which the taxpayer must report and advance the budget.

This period is shorter in duration than the tax period. In some circumstances, reporting periods are not established if this is required by regional or local legislation in relation to the relevant types of taxes. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Deadlines for paying basic taxes in 2019

| Type of tax | For what period is it paid? | Payment deadline |

| Income tax (if only quarterly advance payments are made) | For 2021 | No later than 03/28/2019 |

| For the first quarter of 2021 | No later than 04/29/2019 | |

| For the first half of 2021 | No later than 07/29/2019 | |

| For 9 months of 2021 | No later than October 28, 2019 | |

| For 2021 | No later than 30.03.2020 | |

| Income tax (when paying monthly advance payments with additional payment at the end of the quarter) | For 2021 | No later than 03/28/2019 |

| For January 2021 | No later than 01/28/2019 | |

| For February 2021 | No later than 02/28/2019 | |

| For March 2021 | No later than 03/28/2019 | |

| Additional payment for the first quarter of 2021 | No later than 04/29/2019 | |

| For April 2021 | No later than 04/29/2019 | |

| For May 2021 | No later than 05/28/2019 | |

| For June 2021 | No later than 06/28/2019 | |

| Additional payment for the first half of 2021 | No later than 07/29/2019 | |

| For July 2021 | No later than 07/29/2019 | |

| For August 2021 | No later than 08/28/2019 | |

| For September 2021 | No later than September 30, 2019 | |

| Additional payment for 9 months of 2021 | No later than October 28, 2019 | |

| For October 2021 | No later than October 28, 2019 | |

| For November 2021 | No later than November 28, 2019 | |

| For December 2021 | No later than 12/30/2019 | |

| For 2021 | No later than 30.03.2020 | |

| Income tax (for monthly payment of advances based on actual profit) | For 2021 | No later than 03/28/2019 |

| For January 2021 | No later than 02/28/2019 | |

| For February 2021 | No later than 03/28/2019 | |

| For March 2021 | No later than 04/29/2019 | |

| For April 2021 | No later than 05/28/2019 | |

| For May 2021 | No later than 06/28/2019 | |

| For June 2021 | No later than 07/29/2019 | |

| For July 2021 | No later than 08/28/2019 | |

| For August 2021 | No later than September 30, 2019 | |

| For September 2021 | No later than October 28, 2019 | |

| For October 2021 | No later than November 28, 2019 | |

| For November 2021 | No later than 12/30/2019 | |

| For 2021 | No later than 30.03.2020 | |

| VAT | 1st payment for the fourth quarter of 2021 | No later than 01/25/2019 |

| 2nd payment for the fourth quarter of 2021 | No later than 02/25/2019 | |

| 3rd payment for the fourth quarter of 2021 | No later than March 25, 2019 | |

| 1st payment for the first quarter of 2021 | No later than 04/25/2019 | |

| 2nd payment for the first quarter of 2021 | No later than 05/27/2019 | |

| 3rd payment for the first quarter of 2021 | No later than 06/25/2019 | |

| 1st payment for the second quarter of 2021 | No later than July 25, 2019 | |

| 2nd payment for the second quarter of 2021 | No later than 08/26/2019 | |

| 3rd payment for the second quarter of 2021 | No later than September 25, 2019 | |

| 1st payment for the third quarter of 2021 | No later than October 25, 2019 | |

| 2nd payment for the third quarter of 2021 | No later than November 25, 2019 | |

| 3rd payment for the third quarter of 2021 | No later than December 25, 2019 | |

| 1st payment for the fourth quarter of 2021 | No later than 01/27/2020 | |

| 2nd payment for the fourth quarter of 2021 | No later than 02/25/2020 | |

| 3rd payment for the fourth quarter of 2021 | No later than March 25, 2020 | |

| Tax under the simplified tax system (including advance payments) | For 2021 (only organizations pay) | No later than 04/01/2019 |

| For 2021 (paid only by individual entrepreneurs) | No later than 04/30/2019 | |

| For the first quarter of 2021 | No later than 04/25/2019 | |

| For the first half of 2021 | No later than July 25, 2019 | |

| For 9 months of 2021 | No later than October 25, 2019 | |

| For 2021 (only organizations pay) | No later than 03/31/2020 | |

| For 2021 (paid only by individual entrepreneurs) | No later than 04/30/2020 | |

| Personal income tax on vacation and sick leave benefits | For December 2021 | No later than 01/09/2019 |

| For January 2021 | No later than 01/31/2019 | |

| For February 2021 | No later than 02/28/2019 | |

| For March 2021 | No later than 04/01/2019 | |

| For April 2021 | No later than 04/30/2019 | |

| For May 2021 | No later than 05/31/2019 | |

| For June 2021 | No later than 07/01/2019 | |

| For July 2021 | No later than 07/31/2019 | |

| For August 2021 | No later than 09/02/2019 | |

| For September 2021 | No later than September 30, 2019 | |

| For October 2021 | No later than 10/31/2019 | |

| For November 2021 | No later than 12/02/2019 | |

| For December 2021 | No later than 12/31/2019 | |

| UTII | For the fourth quarter of 2021 | No later than 01/25/2019 |

| For the first quarter of 2021 | No later than 04/25/2019 | |

| For the second quarter of 2021 | No later than July 25, 2019 | |

| For the third quarter of 2021 | No later than October 25, 2019 | |

| For the fourth quarter of 2021 | No later than 01/27/2020 | |

| Unified agricultural tax | For 2021 | No later than 04/01/2019 |

| For the first half of 2021 | No later than July 25, 2019 | |

| For 2021 | No later than 03/31/2020 | |

| Trade tax on the territory of Moscow | For the fourth quarter of 2021 | No later than 01/25/2019 |

| For the first quarter of 2021 | No later than 04/25/2019 | |

| For the second quarter of 2021 | No later than July 25, 2019 | |

| For the third quarter of 2021 | No later than October 25, 2019 | |

| For the fourth quarter of 2021 | No later than 01/25/2020 |

Read more: How sick leave is calculated for pregnancy and childbirth

You will find the deadlines for paying other taxes (for example, VAT paid when importing goods from the EAEU countries) in the Accountant’s Calendar.

Submission of reports by employers

Reporting to the tax authority must be submitted after the tax period for an individual entrepreneur or company is over. At the same time, these tax agents must reflect the income of their employees. Until recently, only the 2-NDFL certificate served for these purposes. It indicates the income tax withheld and transferred to the budget.

If we consider an individual entrepreneur in this context, then if he works under the general regime, he must make advance payments to the budget for personal income tax. And for those individual entrepreneurs who pay income to individuals or use the labor of hired workers, it is mandatory to perform the functions of a tax agent during the personal income tax tax period.

The duties of tax agents imply that when paying income to an employee or other individual during the year, they calculate personal income tax and withhold it. After which it is transferred to the budget. If we are talking about wages, then deductions must go every month - on the next days after the actual receipt of money, receipt on the bank card.

The tax period for personal income tax involves submitting reports to the employee income inspectorate by April 1 of the next year. If the certificates are submitted untimely, then for each unit of document that is overdue, a fine of 200 rubles will be imposed. It is noteworthy that you have the right to choose: submit certificates in paper form or using electronic reporting. The law allows for the first option for small companies if they employ less than 25 people.