The DAM for the 4th quarter of 2021 (the “new” form) was developed and approved by the Federal Tax Service by order dated September 18, 2019 No. ММВ-7-11/ [email protected] as amended by the order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected] . In accordance with it, the new DAM form is used starting from the submission of reports for 2021. Order No. ED-7-11/ [email protected] made changes to the Calculation form, as well as the procedure for filling it out and the format for submitting the calculation in electronic form.

The name of the form has not changed, as before it is called “Calculation of insurance premiums” (form according to KND 1151111)

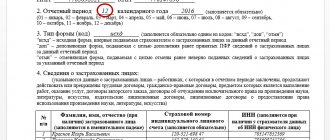

Current calculation form

Fill out and submit the calculation of insurance premiums on the 2018 form, which is fixed by order of the Federal Tax Service of Russia dated October 10, 2021 No. ММВ-7-11/551 (Appendix No. 1):

By the way, the same order sets out the procedure and rules for filling out a unified calculation of insurance premiums (ERSV).

As you can see, the official name of this form is “Calculation of Insurance Premiums”. And the prefix “single” appeared by itself. It is usually used by accountants.

Let us remind you that this type of reporting on insurance premiums has been introduced since 2021 for all individual entrepreneurs and companies acting as policyholders. It is submitted to the tax office, and not to the Pension Fund, as before. This is due to the transfer of the administration function of most of the contributions to the tax authorities. The only exception is contributions for injuries. They remained under the control of the Social Insurance Fund.

From our website you can freely calculate insurance premiums for 2021 using the direct link here.

Main changes to RSV-1 in 2021

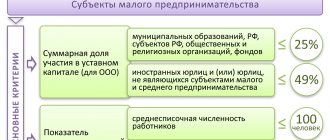

Most of the innovations approved by this order of the Federal Tax Service concern amendments made to the current Tax Code. Changes affecting the calculation of insurance premiums (DAM) should help tax services provide more complete control over the correct use of reduced and zero tariffs by small businesses. They were introduced in the spring of this year in connection with the COVID-19 pandemic.

Rules for filling out the title page

In the coming year, accountants will no longer be required to provide separate data on the average number of employees of a business. According to the adopted adjustments, from now on this information is reflected in the DAM. A separate column appears on the title page of the Calculation in which it is necessary to indicate the average number of employees for the past year.

New application 5.1

Especially for companies engaged in the IT field, Appendix 5.1 appears. It is intended for calculating compliance with the conditions for applying the reduced tariff of insurance premiums by taxpayers specified in paragraph 3 of paragraph 1. Art. No. 427 NKRF. This application was introduced in connection with the reduction of rates to 7.6% , instead of the previously used 14%.

The accounting department of IT companies must fill out a new application with information from section No. 1 of the DAM starting from the reporting period for the first quarter. 2021 In the reporting for 2021 You do not need to fill out this application.

New codes for insured persons

Other changes expected by accountants in the coming year include updating insurance coding. The following codings are introduced for insured persons, depending on their categories:

- KB – employees whose insurance contributions from their income are calculated at a zero rate, in accordance with Federal Law No. 172.

- MC – employees of the organization, insurance contributions from the cash payments they receive are calculated by payers classified as SMEs.

- EKB - employees whose insurance contributions from their income are calculated by enterprises specializing in the field of high technology. These are designers and developers of computer databases and radio-electronic products.

What does the calculation form consist of?

The form under consideration for a single calculation of insurance premiums for 2018 consists of:

- from the title page;

- a sheet with information about an individual who does not have the status of an individual entrepreneur;

- Section 1 (summary data on the obligations of the contribution payer) + 10 appendices to it;

- Section 2 (summary data on obligations for insurance contributions of heads of peasant farms) + 1 appendix;

- Section 3 (information about insured persons).

Let us say right away that you do not need to include absolutely all sheets and applications in the generated report. So, in most cases, employers who paid income to individuals should only fill out:

- title page;

- Section 1 (subsections 1.1 and 1.2) + Appendices No. 1 and 2 thereto;

- Section 3.

New additional payer tariff codings

In 2021, due to the coronavirus pandemic, a number of business sectors were, according to the classifier, recognized as affected. As a result, such enterprises were given the opportunity to pay insurance premiums at reduced or zero rates. For the IT industry, a tax maneuver was carried out to reduce the rate to 7.6% .

For the listed organizations that have received the right to preferences, separate codings are introduced:

- For small and medium-sized enterprises (SMEs) - code 20.

- For SME organizations that, according to the OKVED classifier, belong to the industries most affected by restrictions due to COVID-19. They, in accordance with Federal Law No. 172, received the right to apply zero tariffs for insurance contributions from April to June 2021 inclusive - code 21.

- For insurance premium payers employed in the high technology sector - code 22.

There were no changes

Let us immediately note that a new form of calculation for insurance premiums has not been introduced since 2018. Therefore, the previous form applies.

Although initially the Federal Tax Service of Russia planned to adjust it. Moreover, the changes introduced were mostly not related to changes in tax legislation. Officials simply wanted to finalize some sheets and details of the ERSV from 2021, as well as clarify its electronic version. However, this did not happen.

We wrote about this in detail here: “Review of changes in insurance premiums from 2021.”

Thus, there is no need to wait for a new form for calculating insurance premiums in 2018.

ATTENTION

The control ratios of its indicators that need to be taken into account will help you correctly fill out the form for calculating insurance premiums for 2021. They are given in the letter of the Federal Tax Service dated December 29, 2017 No. GD-4-11/27043.

RSV - what is this form? Who should submit the report and when?

RSV is a quarterly report on insurance contributions of all types: pension, social and medical insurance.

The report is submitted by all organizations and entrepreneurs who are policyholders, even if they do not regularly pay contributions for their employees. The type of contract is not important: employees under a contract are accountable for in the same way as employees under an employment contract.

Organizations, separate divisions and branches report to the tax office at the place of business or accounting.

Please note that from January 1, 2021, amendments to the Tax Code introduced by Federal Law No. 325-FZ of September 29, 2019 are in effect. According to the new edition of paragraph 7 of Article 431 of the Tax Code, separate divisions submit calculations at the location of the separate divisions of the organization for which the organization has opened bank accounts and which accrue and make payments and other remuneration in favor of individuals.

Individual entrepreneurs and self-employed citizens submit calculations to the tax office at their registration address.

It is also important to know that from January 1, 2021, insurers with more than 10 people are required to submit calculations electronically (amendments to Article 431 of the Tax Code of the Russian Federation were introduced by Federal Law No. 325-FZ of September 29, 2019).

Even if you did not make contributions for employees during the reporting period, still submit the calculation to the tax office. This is necessary so that you are not considered late and are not charged a fine. To do this, fill out the required sections of the calculation and submit the tax zero form.

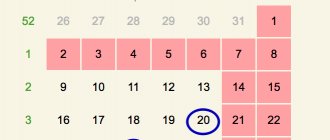

The deadline for submission is established by the Tax Code of the Russian Federation - the 30th day of the month following the reporting period. In 2021, the DAM must be submitted within the following deadlines:

| Reporting period | Deadline for submission (2020) |

| 2019 | January 30 |

| I quarter 2020 | April 30 |

| 6 months 2020 | July 30 |

| 9 months 2020 | October 30 |

On the DAM, general transfer rules apply. Therefore, if the last day of delivery falls on a weekend or holiday, the deadline is extended to the next working day. There will be no such shifts in 2021.

Prepare and send a calculation of insurance premiums via Kontur.Extern.

Send a request

If the policyholder submits the report later than the due date, he will be fined. The fine is equal to 5% of the contributions reflected in the report. It is charged for each full and partial month of delay. At the same time, you will not be able to pay a fine of less than 1,000 rubles, but you will not be punished for more than 30% of the contributions.

Another trouble that awaits latecomers is the blocking of their current account. The tax office has the right to block it for being late by more than 10 working days.

Electronic calculation format in 2018

For sending calculations of contributions to the tax office electronically, the requirements have also not changed. They are established by Appendix No. 3 to the mentioned order of the Federal Tax Service No. ММВ-7-11/551.

The developer of the software with which the policyholder generates the calculation always takes into account the format of the file with the report regulated by the Federal Tax Service of Russia and the ensuing issues.

Also see “How to fill out the calculation of insurance premiums for the 1st quarter of 2021: sample.”

Read also

28.03.2018

Section 3

The section contains personalized information about the insured . an employment or civil law contract during the last three months of the reporting period . Amounts must be paid in rubles and kopecks. Section 3 consists of several blocks.

A list of employees

When a user logs into Kontur.Extern for the first time, he sees an empty list of employees. Before forming the RSV, you need to add them. There are three ways to do this:

- Manually. If there are few employees, they can be added using the “Add employee” .

- Download the report file in xml format. You need to go to the main page of the service, select the “Federal Tax Service” , then the “Download employees from file” .

- Download the list from form 2-NDFL format 5.04. To do this, you need to be in Section 3, click “Actions” and select “Load employees from file” .

When loading from a file, employees will be added to those who were previously added to the service.

Employee personal card

If an adjustment report , then the number of the adjustment is indicated on the card of the employee who is included in it. An employee is included in the adjustment if some information about him in the primary report needs to be changed.

Note! The adjustment numbers on the title page and on the employee’s card may not match.

Section 3.1

In this section, information about an individual is filled out. For all insured persons the following is indicated:

- TIN (optional, you can click the link “Find out TIN” );

- SNILS;

- last name, first name and patronymic;

- Date of Birth;

- floor;

- citizenship;

- identification document code and its number;

- types of insurance for which the policyholder pays contributions - pension, medical, social (the required types are checked).

When specifying the funds in which a particular employee is insured, the following must be taken into account:

- Social contributions are not paid for persons working under the GPC. Accordingly, there is no need to choose a social fund for such citizens.

- Medical contributions are not paid for persons who are temporarily staying on the territory of Russia, with the exception of citizens of the EAEU (they have the category of permanent residence).

- Pension contributions are not paid for citizens of Korea, China and Vietnam working under international treaties.

Section 3.2

This section is completed for those employees who have “Compulsory pension insurance” . Section 3.2 consists of two subsections:

- Subsection 3.2.1. It contains information about the amount of payments and other remunerations accrued to this Individual. Contributions are calculated monthly in column 240. If they are calculated according to several tariffs, then you need to add them all using the button “Add payout amount for another category code”.

- Subsection 3.2.2. Information on the amount of payments and other remuneration for which contributions are calculated at an additional rate. This is relevant for some cases related to special working conditions. To enter data you need to click “Add payout amount” and enter information based on Articles 428 and 429 of the Tax Code:

- Column 270.The tariff code is selected. The service will tell you which code you need to specify. Codes 21-27 are intended for employees with preferential, harmful or difficult working conditions.

In this case, codes 21 and 22 are used without a special assessment of working conditions or certification, and codes from 23 to 26 are applied according to established classes of working conditions. Codes 28-29 are not included in the directory, since subsection 1.4 should be filled out separately for pilots and miners. - Column 280. It indicates the amount of the base for calculating contributions for the additional tariff, that is, the amount of payments and other remunerations that are subject to such contributions.

- Line 300/column 280. Here the amounts for which contributions are calculated at the additional tariff are calculated. In this case, amounts not subject to contributions are not taken into account.

Title page

This section of the form is filled out in the same way, both in the presence of data and for a “zero” report.

- Tax identification codes (TIN and KPP) (the latter is only for legal entities).

- Correction number reflecting the “version” of the report (“0 – -”, “1- -”, “2- -”, etc.)

- The reporting period is determined by two fields: calendar year (2018) and billing period code (Appendix 3 to the Procedure). For 9 months, code “33” is indicated.

- Code of the Federal Tax Service to which the form is submitted.

- The location (registration) code (Appendix 4 to the Procedure) indicates the reason why the form is submitted to this Federal Tax Service (place of residence, registration, etc.)

- Full name of the legal entity or full name of the individual.

- OKVED code.

- When submitting a report, the legal successor uses special fields “Form of reorganization/liquidation (Appendix 2 to the Procedure) and “TIN (KPP) of the reorganized organization”

- The telephone number of the responsible person is indicated with spaces between the number “8”, the area code and the number itself.

- Number of report sheets and supporting documents (if available).

- Signature of the responsible person with transcript and date of filling out the report. If the form is submitted by an authorized person, then you must also indicate the details of the power of attorney.

- Information about submitting the report is filled out by the tax inspector upon receipt.

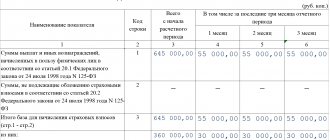

Section 1

This part of the report contains summary information on the amounts of contributions payable by type.

In line 010 you need to indicate the OKTMO code at the place where the report was submitted.

Next, for each type of contribution (except for social insurance), a block of five lines is filled in, including:

- KBK.

- The amount payable for the period as a whole.

- Amounts for the last three months on a monthly basis.

All amounts payable will contain zero indicators.

Two blocks are allocated for “social” contributions, because for them, it is possible that the corresponding expenses of the payer (for example, sick leave) may exceed the accrued contributions. But in this case, all fields will also be zero.

RSV 1 Pension Fund new unified form 2018

The new RSV 1 form for the 1st quarter of 2021 is presented on the Bukhsoft website.

You can download a free sample form here:

The given new form of DAM 1 is valid for the first quarter and half of the year, as well as for three quarters and annual reporting. Each section has a name and must be filled out according to the sample for those who pay the specified fees.

How has the report form changed?

The Consultant Plus website describes best how the new DAM form has changed for the first quarter. For example, changes in the sample appeared due to amendments to Article 58: a rule appeared for the use of reduced tariffs and a reduction in the maximum accrual base in the Federal Compulsory Medical Insurance Fund (medical insurance). Many organizations, on the contrary, have lost the right to reduced rates when paying to the Social Insurance Fund, so the sample has changed for them as well.

Subsection 1.1 of Appendix 1 to Section 1

This part of the DAM form contains the calculation of pension insurance contributions.

When filling it out for a “zero” DAM, the following should be taken into account:

- Line 001 contains the payer's tariff code, selected from Appendix 5 to the Procedure. In the absence of special features (special tax regimes, preferential contribution rates), code 01 is used.

- Line 010 indicates the number of insured persons. The indicator in it should not be zero. Even if there is no activity, the company must have at least one insured person - the director.

- Lines 020 and 021 should already contain zero indicators, because they contain information about individuals who receive payments (including excess payments).

- Lines 030 to 062 reflect information about the amounts of income and accrued contributions (for the period as a whole and the last three months). They are also filled with zeros.

Appendix 2 to section 1

This part of the report reflects information about accrued social contributions and related employer expenses. This section will be longer than the previous ones, because... contains fields for special cases of calculation of contributions and for reflecting “social” payments. However, most lines should also be filled with zeros. Information will only be contained in the following fields:

- Payment attribute (line 001). They can be direct (1) or carried out using a credit system (2).

- Number of insured persons.

- Sign of the relationship between social expenses and accrued contributions in line 090. Because expenses did not exceed contributions (0 is not more than 0), then you need to indicate the attribute “1” here.