Documentation

Employers - organizations and individual entrepreneurs are obliged to timely and correctly calculate sick leave benefits if employees

Invoice and invoice The contract may contain the procedure for payment for goods (work, services): exact deadline, deadline

Statistical form 12-F is used by Rosstat to collect information on expenses and deductions of own funds

Electronic interaction with tax authorities has become widespread. The possibility of paperless exchange is of particular importance

According to Form 6-NDFL, employers - tax agents report accrued income in favor of individuals

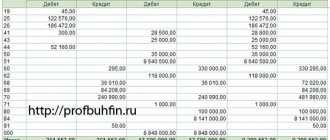

Detailed turnover sheets for synthetic and analytical accounts serve for the purpose of summarizing accounting information

See the beginning: CFA - Long-term (non-current) assets CFA - Acquisition of fixed assets CFA -

Fulfillment of the obligation to pay taxes, fees, insurance premiums (penalties, fines) upon liquidation of an organization is regulated

When submitting tax reports to the relevant authorities, your report may be returned with the found

One of the most important forms of annual reporting is still the “Cash Flow Statement” (CFDS),