See the beginning:

CFA - Long-term (non-current) assets CFA - Acquisition of fixed assets CFA - Acquisition of intangible assets

This section discusses the financial reporting implications and implications of cost capitalization rates versus expensing costs in the period in which they are incurred.

We first consider the overall impact of capitalization and write-off costs on financial statements and two related analytical issues—the impact on individual company trend analysis and on company comparability.

If costs are capitalized , then in the period they are incurred they increase the amount of assets on the balance sheet and are shown as a cash outflow from investing activities on the statement of cash flows.

After initial recognition, the company writes off the capitalized amount gradually over the asset's useful life as depreciation and amortization expense (except for assets that do not depreciate, such as land, or are not amortized, such as indefinite-lived intangible assets).

Depreciation expense reduces net income on the income statement and reduces the value of an asset on the balance sheet.

Depreciation and amortization are non-cash (accrued) expenses and therefore, in addition to their impact on taxable income and tax payments, do not affect the statement of cash flows.

In the section of the cash flow statement that compares net income to operating cash flow, depreciation expense is added to net income.

If costs are written off as expenses , this reduces net profit for the period in which they were incurred. However, they are not reflected on the balance sheet as assets, and therefore are not depreciated in subsequent periods.

The lower amount of net income is reflected in lower retained earnings on the balance sheet.

Expenses written off to expenses are shown as cash outflows from operating activities in the period in which they were incurred. They do not have an impact on the financial statements of subsequent periods.

See also:

- IAS 16 - Capitalization of costs in the original cost of fixed assets.

- IFRS - How to determine and apply the asset capitalization threshold in IFRS accounting?

- What costs can be capitalized in the cost of fixed assets?

- Is it possible to capitalize assets located on the client's territory?

- IAS 16 - Can land rental costs be capitalized?

Example 4 illustrates the impact on financial statements of capitalizing costs versus expensing them.

What is account 20 “Main production” intended for?

To summarize the amounts of company expenses that are associated with the main activity, the 20th account (“Main production”) is used in accounting.

This refers to the costs incurred by the organization in the production process, when selling services or carrying out work. In the future, we will use the abbreviation TRU to designate goods, works and services. In accordance with the accounting rules, the debit of the 20th account collects direct costs incurred by the enterprise in the production of products, losses resulting from defects, expenses of auxiliary and service production. To the credit of this account, the cost of goods and services is written off.

For a list of costs that form the cost of production, see the tax guide from ConsultantPlus. Study the material by getting trial access to the K+ system for free.

A description of the 20th account, as well as an example of accounting for the expenses of an organization carrying out work for a customer, can be found in the material “Account 20 in accounting (nuances)”.

Let's consider the process of writing off the 20th account under various circumstances.

Is it possible to deduct VAT in the absence of calculated tax?

Deductions reduce the total amount of calculated tax (Clause 1, Article 171 of the Tax Code of the Russian Federation). Therefore, regulatory authorities believe that if there is no calculated tax, then there is nothing to deduct the input tax from. As soon as the calculated tax appears (that is, sales), it will be possible to reduce it by tax deductions (Letters of the Ministry of Finance of Russia dated December 8, 2010 N 03-07-11/479, dated July 29, 2010 N 03-07-11/317, dated June 22 .2010 N 03-07-11/260). However, the courts in this matter side with organizations, allowing tax deduction even when there is no sale (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 05/03/2006 N 14996/05; Resolution of the Federal Antimonopoly Service dated 12/15/2010 in case N A55-3486/2010). Moreover, there are court decisions that clarify that the calculated tax in the absence of sales exists, it is simply equal to zero (Resolutions of the Ninth Arbitration Court of Appeal dated December 11, 2008 N 09AP-15622/2008-AK; Seventeenth Arbitration Court of Appeal dated June 22, 2007 N 17AP-3945/07-AK). But if the prospect of disputes with tax authorities does not appeal to you and you do not intend to return taxes from the budget, then it is easier, of course, to postpone deductions for the period when your sales begin (realization appears).

* * *

Expenses, of course, need to be reflected in a timely manner both in accounting and tax. You should not follow the lead of the tax authorities. After all, the responsibility of an accountant is to properly keep records of his activities. The tax authorities' arguments about the unjustification of such expenses have no legal basis. So take your tax loss easy. And over the next 10 years, you can reduce the income tax base by its amount (Paragraph 2, paragraph 8, Article 274, Article 283 of the Tax Code of the Russian Federation). If you apply the simplified tax system with the object “income minus expenses,” then you can take into account your expenses (except for expenses for the purchase of goods) after payment, even in the absence of income. The amount of loss generated in this case can also be written off over the next 10 years (Clause 7 of Article 346.18 of the Tax Code of the Russian Federation; Letter of the Ministry of Finance of Russia dated January 23, 2009 N 03-11-06/2/5). And if in a few years you have the opposite task - to reduce profits in order to pay less tax - these same losses from previous periods will be very useful to you.

VAT, Revenue

Home — Articles

Writing off costs from account 20 during production

In order to write off manufacturing expenses, the taxpayer must first select the method by which finished goods (FP) will be accounted for. The chosen method should then be approved in the text of the accounting policy (AP). Let us describe the possible methods from which an enterprise can choose.

In accordance with PBU 5/01 “Accounting for inventories”, approved. By order of the Ministry of Finance of Russia dated 06/09/2001 No. 44n, finished products are classified as that part of the inventory that is intended for sale.

IMPORTANT! From 2021, PBU 5/01 will no longer be in force. It was replaced by FSBU 5/2019 “Reserves”.

ConsultantPlus experts explained what will change in inventory accounting when applying FAS 5/2019. Get free demo access to K+ and go to the Ready Solution to find out all the details of the innovations.

What are the main provisions of PBU 5/01, the procedure for assessing inventories and what the regulations for maintaining records on inventories look like can be found out from the material “PBU 5/01 - accounting for inventories”.

In the Guidelines for accounting of inventories, approved. By order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, it is recommended to use 1 of the following methods for assessing GP:

- Based on the actual cost (actual).

- Planned cost, that is, formed on the basis of standards.

- Negotiable price.

Here there are clarifications under what circumstances it is worth using one or another method. Thus, the first method is recommended to be used if we are talking about the production of goods in small batches, the second - with large batch production, the third - with stable, unchangeable prices. It is clear that constant prices for market relations are impossible. For this reason, the third method has currently lost its relevance and is not used.

Expenses without income: will there be problems?

It happens that during the reporting period an organization incurs current expenses (for example, rent payments, employee salaries, etc.), but does not receive any income. This situation is most typical for companies that are just starting their business. Not so long ago, financiers noted that such firms have the right to take such expenses into account when taxing profits"1. In this article we will try to answer the most difficult questions that arise for companies in the absence of income.

There are 2 main cases when a company has expenses but no income.

Case one: the company is already conducting its main activities, but the lack of revenue is caused by objective reasons (no demand for products, difficulties in finding orders, etc.). Case two: the company carries out work on the preparation and development of production and plans to receive revenue after the completion of this work. (Read about optimal revenue accounting in the journal “Actual Accounting” No. 6, 2008) Our further conversation will take place in the context of these 2 situations.

If the company is already operating

Let's assume that the company is already conducting normal business, but it did not have any revenues during the reporting period. Let's see how the expenses incurred will be reflected by the company in accounting and tax accounting. The accounting procedure for expenses incurred by the company is regulated by the Accounting Regulations “Expenses of the Organization” (PBU 10/99)”2″. At the same time, paragraph 17 of this PBU clearly states that “expenses are subject to recognition in accounting, regardless of the intention to receive revenue, other or other income and the form of the expense (cash, in kind and other).”

In other words, if the company has already started its activities, all emerging expenses should be recorded in a timely manner on the appropriate cost accounting accounts - 20, 23, 25, 26, 29, 44.

Let's take a manufacturing company for example. As you know, direct expenses related directly to the production of products are reflected in the debit of account 20 “Main production”3″.

But when writing off general business expenses, options are possible (the chosen method must be fixed in the company’s accounting policy).

Let's say the company generates the full production cost. Then general business expenses at the end of the month are debited to account 20 (or distributed between accounts 20, 23 and 29, if auxiliary and service production performed work or provided services to the outside).

In this situation, even if the company has no revenue in the reporting period, there should not be any problems. Amounts recorded during the month in the debit of account 26 “General business expenses” will be reflected at the end of the month as part of work in progress (debit of account 20) or finished goods (debit of account 43).

If the company forms a reduced cost price, then at the end of the reporting month, general business expenses are written off to the debit of account 90 “Sales”, subaccount 2 “Cost of sales” as semi-fixed ones.

But what if the company forming the reduced cost price did not have any income during the month (that is, there was no turnover on the credit of accounts 90 “Sales” subaccount 1 “Revenue” and 91 “Other income and expenses” subaccount 1 “Other” income")? Is it possible to write off general business expenses as a debit to account 90-2? The same question arises with sales expenses accumulated in account 44 of the same name. After all, sales expenses that are not subject to distribution should also be written off as a debit to account 90-2 at the end of the month.

Regulatory documents on accounting do not prohibit such write-offs (they do not make it dependent on whether the company had any income during the month or not). In oral presentations (for example, at accounting seminars), specialists from the Russian Ministry of Finance also allow this. Moreover, in their opinion, in such a situation, general business expenses can be written off both to the debit of account 90-2 and to the debit of account 91-2 “Other expenses” (the company’s choice should be fixed in its accounting policy).

In our opinion, in this case it is better to use the option of writing off expenses as a debit to account 91-2. The fact is that another option may cause claims from tax inspectors. Of course, tax authorities do not directly control accounting, but at the end of the reporting period it is still necessary to submit a profit and loss report (Form No. 2) to the tax office. Some local inspectors do not accept Form No. 2, in which lines 020 “Cost of goods, products, works sold”, 040 “Administrative expenses” are filled in, and there is no data on line 010 “Revenue...”.

Example

The company, registered in December 2007, began operations but failed to receive any orders in January 2008. Accordingly, there were no revenues during this period. Meanwhile, in January 2008 the company had the following expenses:

- salaries of management personnel, as well as unified social tax accrued on it, pension and injury contributions - 260,000 rubles;

- rent (including utilities) – 118,000 rubles. (including VAT – 18,000 rubles);

- costs of payment for communication services - 7080 rubles. (including VAT - 1080 rubles).

The company's accountant will make the following entries in January 2008:

Debit 26 Credit 70 (69)

– 260,000 rub. – salaries of management personnel, as well as unified social tax and contributions have been accrued;

Debit 26 Credit 60

– 100,000 rub. (118,000 – 18,000) – reflects the amount of rent for January 2008;

Debit 19 Credit 60

– 18,000 rub. – “input” VAT on the rental amount is taken into account (based on the lessor’s invoice);

Debit 26 Credit 60

– 6000 rub. (7080 – 1080) – reflects the costs of paying for communication services in January 2008;

Debit 19 Credit 60

– 1080 rub. – “input” VAT on costs for communication services is taken into account (based on the invoice of the telecom operator).

The company's accounting policy states that general business expenses at the end of the month are written off from account 26 as semi-fixed expenses. But since the organization did not have any income in January, the accountant wrote down:

Debit 91-2 Credit 26

– 366,000 rub. (260,000 + 100,000 + 6000) – general business expenses are written off.

The procedure for accounting for expenses in tax accounting depends on which method of calculating taxable profit the company uses - cash or accrual.

If a company uses the accrual method, it must divide all its costs into direct and indirect."4". At the same time, the company has the right to determine the list of direct expenses independently, recording its choice in its accounting policies.

Thus, those direct expenses that relate to work in progress, balances of finished products and shipped but unsold goods are not taken into account when calculating income tax. It turns out that if the company did not have any income, then no direct expenses can be written off in tax accounting.

As for indirect expenses, they are in no way tied to the revenue received and are fully taken into account in the current period”5. Financiers also agree with this. In their recent letter, they considered the situation where a newly created organization, after registration, incurs costs associated with organizing work. However, the company is not yet making a profit.

From the document

Letter of the Ministry of Finance of Russia dated April 10, 2008 No. 03-03-06/1/265

<…> In our opinion, expenses in the form of rent and utility payments, transport costs and other similar expenses incurred by an organization from the moment of its state registration can be taken into account in the organization’s expenses for tax purposes of corporate profits.

At the same time, we inform you that the above expenses are taken into account for the purposes of taxing the profits of organizations in the manner established by the Tax Code of the Russian Federation for specific types of expenses.

Thus, in the situation under consideration, at the end of the reporting period, the company will have a loss in the amount of indirect costs.

If a company calculates income tax using the cash method, then all paid expenses are taken into account in the current period and form a loss. (An article in the journal “Actual Accounting” No. 6, 2008 was devoted to the problems of reporting with a loss)

However, in practice, in the absence of any income, tax inspectors sometimes deny the company the right to take into account any expenses incurred during this period. In such a case, controllers consider such expenses to be economically unjustified.

In our opinion, such a position is not based on the law. Fortunately, she does not find support from the judges either. In their opinion, the costs associated with the company's business activities are reasonable and economically justified. As defined in Article 2 of the Civil Code, entrepreneurial activity is an independent activity carried out at one’s own risk, aimed at systematically obtaining profit from the use of property, the sale of goods, the performance of work or the provision of services. That is, if expenses are incurred by an organization within the framework of entrepreneurial (economic, production) activities and are aimed at generating income, then such expenses are justified.

In addition, the judges emphasize that when deciding on the possibility of taking into account certain expenses for profit tax purposes, it is necessary to proceed solely from whether the expenses incurred are documented or not. To include costs in tax expenses, you need to know for sure that they were actually incurred. This can only be done on the basis of relevant documents”6″.

Representatives of the Constitutional Court of the Russian Federation also spoke on this matter”7″. They noted that tax legislation does not decipher the concept of economic feasibility and does not regulate the procedure and conditions for conducting financial and economic activities. Therefore, the validity of expenses cannot be assessed from the point of view of their expediency, rationality, efficiency or the result obtained. Due to the principle of freedom of economic activity, the taxpayer carries out it independently at his own risk and has the right to independently and solely assess its effectiveness and expediency. Federal judges take this position into account when making decisions. For example, some time ago a case was considered regarding the recognition by an organization of expenses of rent for premises intended for sublease. Moreover, the organization received such income only in the next tax period. The expenses in the form of rent incurred by the company before transferring the premises for rent for the purpose of generating income were recognized by the tax authorities as economically unjustified. However, the judges did not agree with this statement."8". (A number of situations related to leasing were discussed in the journal “Actual Accounting” No. 5, 2008)

Thus, the courts agree that the economic justification of expenses incurred by an organization is determined not by the actual receipt of income in a specific tax (reporting) period, but by the target orientation towards generating income as a result of all economic activities of the organization (including in the future).

K.V. Novoselov, adviser to the state civil service of the Russian Federation, II class, Ph.D.

In letter dated December 8, 2006 No. 03-03-04/1/821, the financial department explained that Chapter 25 of the Tax Code does not make the procedure for recognizing expenses dependent on whether the organization had income or not. Therefore, the company takes into account expenses for profit tax purposes both in the period when it receives income and in the period in which it does not receive income, provided that the activities carried out are generally aimed at generating income.

The same conclusion follows from the Determination of the Constitutional Court of the Russian Federation dated July 4, 2007 No. 320-O-P, which emphasizes that the validity of expenses taken into account when calculating the tax base should be assessed taking into account the circumstances indicating the taxpayer’s intentions to obtain an economic benefit in as a result of real business or other economic activity. Please note: in this case we are talking specifically about the intentions and goals (direction) of this activity, and not about its result.

Therefore, taxpayers, if there is no income from sales in a particular period, should primarily focus on documentary proof of the activity as such (for example, searching for potential buyers, conducting negotiations, concluding contracts, etc.).

N.I. Simdyanova , Deputy Head of the Desk Inspections Department, III Class Advisor to the State Civil Service of the Russian Federation

To recognize costs as economically unjustified, tax authorities in their control work use the provisions of Article 252 of the Tax Code. The Constitutional Court of the Russian Federation believes that the norms of paragraphs 2 and 3 of paragraph 1 of this article cannot be interpreted arbitrarily (Determination of the Constitutional Court of the Russian Federation dated 04.06.2004 No. 320-O-P). On June 25, 2007, publicly available criteria for self-assessment of risks for taxpayers were published, used by inspectors in the process of selecting objects for conducting on-site tax audits (prepared on the basis of the Concept of a planning system for on-site tax audits, approved by order of the Federal Tax Service of Russia dated May 30, 2007 No. MM-3-06 / [email protected] ). Companies should consider these criteria when making decisions in their activities.

The company carries out preparatory work

Costs for preparation and development of production are, as a rule, incurred by manufacturing enterprises. This is a situation when the company does not yet produce finished products, but is only preparing for production activities. In accounting, such expenses are taken into account in account 97 “Deferred expenses””9″. Moreover, in this case, the company itself decides what to classify as the costs of preparatory work. This is regulated by internal documents of the enterprise.

The company, as a rule, begins to attribute deferred expenses to the cost of production from the moment when income from new activities appears. In this case, the management of the company must issue an order (instruction) establishing the period for writing off such costs and the method of writing off - evenly or in proportion to some indicator (for example, the volume of output).

As for general business expenses, they are taken into account in exactly the same way as in the previous case. That is, those companies that, according to accounting policies, write off these expenses at the end of the month from account 26 to account 20, form work in progress. Well, if the accounting policy states that amounts from account 26 at the end of the month are transferred to the debit of account 90-2, the accounting department has the right to write them off at a time as conditionally constant.

Example

In January, the company began launching a new production line. This month the company has not yet started production, but has incurred the following expenses:

- salary of management and administrative personnel, as well as unified social tax accrued on it, pension and injury contributions - 70,000 rubles;

- the salary of workers involved in testing the new production, as well as the unified social tax, pension and injury contributions accrued on it - 200,000 rubles;

- materials consumed when starting production - 50,000 rubles;

- depreciation of equipment - 80,000 rubles.

According to the order of the company's management, prepared on the basis of a memorandum from the accounting department, costs in the amount of 330,000 rubles. (200,000 + 50,000 + 80,000) are classified as production development costs. They are expected to be written off evenly over six months, starting from the month in which the first revenues from the new production are received.

The company's accounting policy states that general business expenses at the end of the month are written off from account 26 at a time as semi-fixed expenses.

In January, the company's accountant made the following entries:

Debit 97 Credit 10

– 50,000 rub. – the cost of consumed materials is written off;

Debit 97 Credit 02

– 80,000 rub. – depreciation has been accrued on production equipment;

Debit 97 Credit 70 (69)

– 200,000 rub. – workers’ salaries, as well as unified social tax and contributions have been accrued;

Debit 26 Credit 70 (69)

– 70,000 rub. – salaries of management and administrative personnel, as well as unified social tax and contributions have been accrued;

Debit 91-2 Credit 26

– 70,000 rub. – general business expenses are written off as semi-fixed.

In tax accounting, expenses for the development and preparation of new production facilities are considered other”10″. This means that their entire amount relates to indirect expenses and is written off in tax accounting as expenses in the current period, forming a loss. If we return to the conditions of the last example, the company’s tax accounting took into account the entire amount of expenses - 400,000 rubles. (70,000 + 200,000 + 50,000 + 80,000) – in January 2008.

Is it possible to offset VAT?

Another question that will certainly arise when writing off expenses in the absence of any income: can “input” VAT be deducted?

Officials are against this. They justify their position by the fact that the company has the right to offset VAT only if during the quarter it carried out transactions from which tax was charged for payment to the budget. If there were no such transactions and, as a result, the VAT tax base is zero, the input tax cannot be deducted. In such a situation, officials advise using the deduction in the next period, when the company will have tax to pay to the budget"11".

In our opinion, this position is not entirely justified. After all, the Tax Code does not provide grounds for refusing a VAT deduction if there were no taxable transactions in the tax period. “Input” VAT is deductible if the following conditions are simultaneously met:

the tax is presented by the supplier (performer); property (work, services) was acquired to carry out transactions subject to VAT or for resale; an invoice has been received from the supplier; the acquired property (work, services) is registered.

If all these conditions are met, then, in our opinion, regardless of whether the company had calculated VAT amounts in the current tax period or not, input tax can be deducted.

The validity of what was said is also confirmed by the Supreme Arbitration Court of the Russian Federation"12". Arbitration practice on this issue is also in favor.

Keep in mind: if the company is guided by this point of view, it will be possible to reimburse or return (offset against the payment of other taxes) the VAT claimed for deduction in such a situation only after a desk audit”14″.

- letter of the Ministry of Finance of Russia dated April 10, 2008 No. 03-03-06/1/265

- approved by order of the Ministry of Finance of Russia dated 05/06/1999 No. 33n

- instructions for using the chart of accounts, approved. by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n

- Art. 318 Tax Code of the Russian Federation

- clause 2 art. 318 Tax Code of the Russian Federation

- Fast. FAS NWO dated December 26, 2006 No. A13-5759/2005-05, dated October 17, 2006 No. A05-4649/2006-19

- Determination of the Constitutional Court of the Russian Federation dated June 4, 2007 No. 320-O-P

- Fast. FAS NWO dated September 21, 2007 No. A56-39141/2006

- instructions for using the chart of accounts, approved. by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n

- subp. 34 clause 1 art. 264 Tax Code of the Russian Federation

- letters of the Ministry of Finance of Russia dated 02/08/2006 No. 03-04-08/35, dated 07/29/2005 No. 03-04-11/189, dated 02/08/2005 No. 03-04-11/23

- Fast. Presidium of the Supreme Arbitration Court of the Russian Federation dated May 3, 2006 No. 14996/05

- Fast. FAS VVO dated June 28, 2006 No. A82-13134/2005-37, FAS PO dated February 3, 2006 No. A65-13539/2005-SA2-8

- Art. 176 Tax Code of the Russian Federation

Source: “Actual Accounting” magazine

Write-off of costs at actual cost

Having organized the accounting of GPs at actual cost, the accountant in charge of production must make the following entry: Dt 43 Kt 20.

The essence of this entry is that the cost price is written off directly and in the actual amount generated from the account that records expenses to the account in which GP records are kept.

Despite the simplicity and attractiveness of this method, there are limitations in its use. The point is that the actual cost can only be calculated at the end of the reporting period. In circumstances where products are shipped continuously, it is better to take the planned cost as a basis.

There are 2 options for organizing accounting: write off expenses using account 40 ( “ Release of finished products”), or do without it.

Preparation and development of production

Expenses for the preparation and development of new production facilities, workshops and units in Art. 264 of the Tax Code of the Russian Federation are listed as other expenses. They represent indirect expenses that are subject to one-time accounting during the period of their occurrence. But do not confuse and generalize when it comes to depreciable expenses. If the costs of preparation and development of new production facilities, workshops and units are associated with the creation of operating systems, then such costs are subject to capitalization.

It is worth paying attention to the fact that the tax base for income tax is determined as a whole for the enterprise, and not in the context of the types of activities carried out (provided that they are taxed at a single tax rate). It’s just that some local tax authorities sometimes still try to assess expenses in relation to specific types of activities, which is unreasonable.

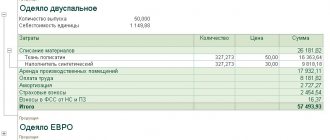

Example 3. LLC “Universal” carries out trading activities and received income in the amount of 14,115,200 rubles, expenses amounted to 11,115,600 rubles.

The management of the enterprise decided to start producing plastic products. For these purposes, the company rented the appropriate premises and carried out the necessary preparatory work. The cost of work on the development of the new workshop amounted to 1,910,100 rubles.

The tax base of the enterprise will be formed from all indicators of the enterprise’s activities and will amount to 1,089,500 rubles. (14,115,200 - 11,115,600 - 1,910,100).

Write-off of costs at planned cost through account 40

If the 40th account is used, then the entire difference between the actual and planned cost amounts appears here.

The debit of the 40th account reflects the actual generated cost of the GP: Dt 40 Kt 20.

On the credit of this account, the cost calculated according to the standards is written off: Dt 43 Kt 40.

At the end of the month, a balance may form on the 40th account, which is nothing more than the difference between the actual and planned cost. Using the resulting amount, the cost of sales is adjusted on the 90th account:

- if the actual indicator is greater than the planned one, an entry is made: Dt 90.2 Kt 40;

- if the planned indicator turns out to be more than the actual one - reversal Dt 90.2 Kt 40.

Check whether you are accounting for production costs correctly using the Typical Situation from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Write-off of costs at planned cost without using account 40

This method of accounting implies that the planned cost should be reflected on the 43rd account immediately after the GP is entered into the incoming documents: Dt 43 Kt 20.

When the GP is shipped, the same amount is reflected on the 90th account: Dt 90.2 Kt 43.

As soon as the reporting period ends, the actual cost of the GP and the difference in the actual and planned cost indicators will appear on the 20th account. You will need to make adjustments to account 43 for the amount received:

- upward, if the actual indicator is greater than the planned one, with the following entry: Dt 43 Kt 20.

- downward if the planned indicator turns out to be greater than the actual one: reversal Dt 43 Kt 20.

You can learn more about accounting for SOEs from the material “How are finished products reflected in the balance sheet?”

Postings

In an organization's accounting, revenue is reflected at the time of its recognition - that is, at the time of transfer or shipment of products. The exception is transactions under contracts that specify the specifics of the transfer of property rights. When selling products to wholesale customers, the following transactions are recorded:

- D 62 K 90.1 – revenue from sales of goods or provision of services was reflected;

- D 90.2 K 41 – the cost of goods sold or services provided is written off;

- D 90.3 K 68 – VAT is charged on the cost of goods sold or services provided;

- D 51/52 K 62 – payment received from the buyer to a current/currency account.

Posting to retail revenue at the cash register can be done directly with account 90 “Sales”, since there is no need to keep records of settlements with retail customers on account 62 “Settlements with buyers and customers”, since payment and shipment are made simultaneously: D 50 K 90.1 – revenue from retail sales was taken into account.

According to the Instructions for using the Chart of Accounts, to reflect cash transferred for collection, posting to account 57 “Transfers in transit” is used:

- D 57 K 50 – cash was issued to the bank’s collection service (you can learn about the procedure for accounting entries when depositing proceeds with the bank here).

- D 51 K 57 – cash was credited to the company’s current account.

Other operations affecting the credit of the 20th account

Here are a few more situations when the 20th account credit entry is used:

- A company engaged in the sale of services or production of work writes off the expenses collected on the 20th account to the sales account as soon as the customer has accepted the results. To reflect revenue and write off costs, the following entries are made:

- Dt 62 Kt 90.1;

- Dt 90.3 “VAT on sales” Kt 68;

- Dt 90.2 Kt 20.

- If a company uses its own products for its own purposes, the entry will look like this: Dt 10 “Materials” Kt 20.

- Large industries with large volumes of output prefer to account for semi-finished products produced by themselves in a separate account. The posting of such materials must be accompanied by the following entry: Dt 21 “Semi-finished products of own production” Kt 20.

- When recording defective products, the corresponding amounts are reflected as follows: Dt 28 “Defects in production” Kt 20.

- If a shortage is identified during the inventory process of the main production, the following entry is made: Dt 94 “Shortages and losses from damage to valuables” Kt 20.

- When terminating a contract under which products have already been produced, expenses are incurred, reflected as follows: Dt 91.2 “Other expenses” Kt 20.

VAT in the absence of income

This issue is initially controversial. In practice, there are two options for action in a situation where there is no income, but there are costs and “input” VAT on them. Let's comment on possible actions using an example.

Example 4. LLC “Orel” and LLC “Rix” in the current tax period incurred expenses aimed at making a profit, but the enterprise did not have any revenue. At the same time, the companies paid “input” VAT to their counterparties for the expenses incurred. At the same time, the heads of the organizations approved the following procedure.

Orel LLC. The amount of VAT paid was deducted in settlements with the budget in the current tax period.

LLC "Rix" The amount of VAT paid was not reflected in the purchase book of the current tax period, but was left for the following tax periods until the sale occurred.

Please note: whatever method the company chooses, it is necessary not to forget to register it in the accounting policy. This will help you defend the correctness of your position before the tax authority and, if events develop further, in court.

For a number of years, financiers have been advocating for a more conservative and budget-friendly option (see, for example, Letters of the Ministry of Finance of Russia dated March 30, 2010 N 03-07-11/79, dated December 25, 2007 N 03-07-11/642, dated 02/08/2005 N 03-04-11/23), as well as representatives of the tax department (see Letter of the Federal Tax Service of Russia for Moscow dated 12/23/2009 N 16-15/135777).

The courts do not agree with this approach. You can read about this in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated May 3, 2006 N 14996/05. Regional courts make similar decisions (Resolution of the Federal Antimonopoly Service of the East Siberian District dated 06.08.2007 N A33-1401/07-F02-4901/07, etc.). Therefore, each enterprise must determine for itself the level of risk that it agrees to bear in relations with the state.

But let's return to the original situation and look at it from a different angle. The company has just started its activities or has decided to open a new production facility. Since the organization has no income, it can be financed either from its own accumulated funds or from borrowed funds. If current activities are paid for from own funds, then we have already discussed the possibilities of attributing VAT to reimbursement and the position of controllers above.

But very often the source of financing is borrowed funds, which adds complexity to a difficult situation and leads to refusals on the part of inspectors to accept deductions declared by taxpayers. There are many lawsuits on this matter, which does not prevent tax authorities from again and again denying deductions to taxpayers, constantly suspecting them of dishonesty.

Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated October 30, 2007 N 6399/07 recognized the correctness of the taxpayer and the right to deduct the amounts of tax paid using borrowed funds. In doing so, the judges used the following logic of thinking. The conclusion that the company does not have the right to a refund of value added tax in connection with the payment for goods with borrowed funds does not comply with the law. The acquired property is the property of the company; therefore, if it is impossible to repay loans with cash, it is possible to fulfill loan obligations by selling this property. Attracting additional funds when paying for purchased leased property cannot serve as evidence of the creation of a scheme aimed at illegal reimbursement of value added tax from the budget.

At the same time, the court, in order to distinguish between real and sham transactions, analyzed the reality of the taxpayer’s costs. The court found that the requirement to confirm the reality of the taxpayer's expenses may not be met only if the borrower's debt to the lender is clearly not payable in the future (that is, the parties to the loan agreement initially assumed that the borrowed funds would not be repaid).

Thus, in the absence of income, VAT on expenses incurred, paid both from one’s own and from borrowed funds, is taken as a deduction in settlements with the budget.

Account balance 20 “Main production”

At the end of the reporting period, the organization identifies and writes off the cost of production on account 20 “Main production”. As a result of these activities, a debit balance may be formed. This indicator reflects how high the cost of the work in progress is. The resulting amount on the 20th account should be transferred to the next month.

How to properly organize accounting of work in progress and how its indicators are entered into the balance sheet, you can learn from the material “Main production in the balance sheet (nuances).”

How to write off expenses if there is no revenue

Advice from an Expert - Financial Consultant

Photo on the topic Business, like any other type of activity, has its periods of ups and downs. In addition, it depends on the state of the economy in the country, and in the world as a whole. It also happens that for a certain period of time an enterprise does not generate revenue from its own activities. Such enterprises mainly include trade organizations or companies that produce and sell their goods. Just follow these simple step-by-step tips and you will be on the right track when solving your financial issues.

How to take into account expenses if there is no revenue - accounting, tax accounting, ... 01/04/2012

Results

The credit of the 20th account shows the cost of the finished product, whether it is intended for sale or for one’s own needs, the cost of services sold, work performed.

This amount is transferred to the 40th, 43rd, 90th or other account, as required by the accounting policy of the enterprise and the nature of the transaction performed. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What is accounting policy

An accounting policy (hereinafter referred to as the AP) is a document in which an organization establishes the methods of accounting and tax accounting that it uses in its work.

That is why you need to take into account the specifics of your activities when drawing up the management program. The work of a trading and manufacturing enterprise has its own characteristics and is even regulated differently by law. Therefore, the UP of such organizations will be different.

The UE itself includes two parts: for accounting and tax accounting purposes. They are collected in one document or compiled separately. The chief accountant is usually responsible for drawing up the management program. This can be done by the manager himself, with proper understanding of the issue, or by an outsourcing company.

The head of the organization studies the finished management program and approves it with an order.