When submitting tax reports to the relevant authorities, your report may be returned with the error “Code: 0400400011” and the description “The condition of equality of the value of the amount of insurance premiums for the payer of insurance premiums to the total amount of insurance premiums for the insured persons has been violated.” Typically, this error occurs due to a mismatch of reporting checksums (the accountant did not take into account some pennies), but there are also situations when the Pension Fund of the Russian Federation does not transmit data to the tax authorities on time, therefore the report contains various errors and inaccuracies. In this article I will tell you what this error is, when it occurs, and how to fix it on your PC.

Reconciliation of checksums: the error will not slip through?

The control ratio in tax reporting is the correspondence of the figures reflected in one part (line, field, column) of the report to the figures shown in another part of the document (and sometimes in a completely different report).

The control ratios for the previous form of calculation were enshrined in the letter of the Federal Tax Service of Russia dated December 29, 2017 No. GD-4-11 / [email protected] Their non-compliance was one of the most common errors when submitting calculations for insurance premiums.

Note! In 2021, a new form for calculating insurance premiums was approved, so the specified letter from the Federal Tax Service is no longer relevant. New control ratios are given in the letter of the Federal Tax Service of Russia dated 02/07/2020 No. BS-4-11/ [email protected]

If the calculation is filled out electronically, for example, using a special module included in the software for tax or accounting reporting, these errors, as a rule, are recorded automatically. And it is almost impossible that they will slip into the report.

If the DAM is submitted on paper and filled out manually, then the opposite scenario is possible, since it is extremely difficult to maintain official control ratios, relatively speaking, with a calculator in hand. Therefore, it is better to automate the process of filling out the form in terms of checking checksums.

If an employer does not have the opportunity to use specialized programs for filling out reports, then a free solution will come to his rescue - the “Legal Taxpayer” program (despite the name, it is suitable for both legal entities and individual entrepreneurs). You can read its description and get a download link on the Federal Tax Service website.

Compliance with the control ratios in the DAM does not guarantee its acceptance by tax authorities, since they will then carry out format and logical control of the document.

How to get a 1C program update

You can obtain information on your contracts and terms of service in your personal account on the official 1C website. To check whether you can receive updates, go to https://1c.ru/rus/support/support.htm and enter your registration number in the form.

Form for filling out registration number

If you do not have the rights to receive updated versions of programs, contact official 1C partners in your region. To select a service package and calculate its full cost in advance for your purposes, please visit https://portal.1c.ru/applications/calculation on this page.

To get 1C updates:

- Contact official partners. A list of them can be found on the page https://its.1c.ru/db/aboutits#content:23:hdoc;

- Purchase special software that will automatically update your product over the Internet.

It can also be found on the official website; Program for automatic updating of 1C products - Download the update package yourself from the 1C website.

Receiving service packs for the user's product is included in the Information Technology Support group. For those who have basic versions of 1C software systems, they can receive updates on the portal without information technology support. Clients who use the rental version of the program from 1C partners pay for the update service as part of others according to the rental terms. The partner sets the price.

Format-logical control: error 400400011 and others

On the one hand, format-logical control (FLC) includes checking the control relationships of specific numbers. On the other hand, it involves a much more in-depth analysis of various indicators in the report. For example, in order to identify errors in the numbers themselves (which may correlate quite correctly). This control is also carried out automatically - using special departmental programs of the Federal Tax Service.

The peculiarity of format-logical control is that it is carried out entirely by the Federal Tax Service. The user cannot participate in it. But knowing the basic criteria used by tax authorities is useful in any case.

These criteria are prescribed mainly at the level of internal departmental documentation and are not published in regulations such as the administrative regulations of the Federal Tax Service.

Among the main current documents that reflect the current criteria for the FLC, one can include the classifier of errors in files accepted under the TKS, developed by the State Research Center of the Federal Tax Service of Russia. It says, for example, that the common error code 0400400011 in the calculation of insurance premiums means that the equality of the value of the amount of insurance premiums for the employer with the total amount of contributions for the insured persons is violated.

Let's look at examples of some common errors in the DAM that can be detected both when checking control ratios and in the process of carrying out physical exercises.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

Errors when submitting the DAM: incorrect reflection of state data

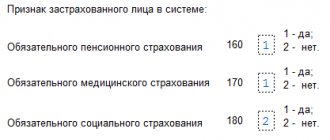

There are errors associated with incorrect reflection of certain personal information about employees in the DAM. Examples of such errors:

- Failure to reflect in section 3 information about employees who are on maternity leave. Despite the fact that such employees do not actually carry out labor activities and contributions are not accrued for the benefits paid to them, they should be classified as insured persons and shown in the DAM.

- Incorrect full name. and SNILS of employees. Incorrect full name. may be due to the fact that the employee got married, and her last name was not changed in personnel records (and ended up in the same form in the accounting program for compiling the DAM). An error in SNILS is rare. It usually occurs when you inattentively fill out the calculation manually.

- Failure to reflect in the DAM information about the director - the only founder who does not have an employment contract with the business company. Despite the fact that the director in the case under consideration does not receive taxable payments (contributions are not accrued on dividends), data about him must be recorded in the calculation. Moreover, if the company does not have employees working under employment contracts at all, then it is necessary to submit a zero DAM, which will contain information only about the manager (letter of the Ministry of Finance of Russia dated March 24, 2017 No. 03-15-07/17273).

Write to 1C technical support

In order to solve any problems related to the 1C software product, you can write to the email address [email protected] In the subject line of the letter, write “Internet support” so that operators can determine the nature of the letter and respond to it faster.

If you have identified errors in the test version of the product, then you need to contact:

- for Ukraine -;

- for Kazakhstan –;

- for the Russian Federation –

Support for test releases of the program is provided only for partners within the framework of the conference. If you are using the standard version of the product and you have an error 0400300003 “Violation of the conditions for the mandatory presence of an element, depending on the value of another element,” write to the official address of the 1C company.

Errors in numbers

There are also various errors associated with incorrect reflection of numbers in the RSV. For example:

- Failure to reflect in the report payments that are not subject to contributions. It is unacceptable to ignore such payments. The error in question will give the Federal Tax Service a reason not only to initiate sanctions for its commission, but also to accuse the employer of a gross violation of tax accounting (which provides for fines under Article 120 of the Tax Code of the Russian Federation).

- Exclusion from the report of wages accrued in the current reporting period, but paid in the next one. Exactly when the employee’s taxable income is actually paid does not matter when filling out the DAM: the accrual period is important. For example, the salary accrued for September must be included in the DAM in full, even if its main part was transferred at the end of the month - in October. A special case is vacation pay. They are paid no later than 3 days before the vacation and are considered accrued income in the month in which they are actually paid. If a person must go on vacation from October 1, then vacation pay is issued in September. They must be included in the RSV 9 months in advance.

- Errors in reflecting data on foreigners. For example:

- reflection of excess contributions to the income of temporarily staying foreigners with high qualifications (contributions reflected in the DAM are not accrued on their salaries);

- reflection of excess medical contributions on the income of other temporary workers.

Errors are possible in the form of unlawful non-reflection of pension and social contributions on the income of other temporarily staying foreigners. It is important that foreign citizens draw up an employment contract on the territory of the Russian Federation.

Directories

Correspondence between tariff codes, categories and tariffs for calculating contributions

| Code | Tariff name | Category code | Reporting year | Pension Fund tariff | FFOMS tariff | Tariff FSSpp | ||

| Fear. Part | from amounts exceeding the maximum base amount | for all | for VP** | |||||

| 01 | Payers who are on OSNO and apply the basic tariff of insurance premiums | NR, VPNR, VZHNR | 2017 | 22.0% | 10.0% | 5.1% | 2.9% | 1.8% |

| 2018 | ||||||||

| 2019 | ||||||||

| 02 | Payers who are on the simplified tax system and apply the basic tariff of insurance premiums | NR, VPNR, VZHNR | 2017 | 22.0% | 10.0% | 5.1% | 2.9% | 1.8% |

| 2018 | ||||||||

| 2019 | ||||||||

| 03 | Payers paying UTII for certain types of activities and applying the basic tariff of insurance premiums | NR, VPNR, VZHNR | 2017 | 22.0% | 10.0% | 5.1% | 2.9% | 1.8% |

| 2018 | ||||||||

| 2019 | ||||||||

| 04 | Payers are business companies and business partnerships, whose activities consist of the practical application (implementation) of the results of intellectual activity, the exclusive rights to which belong to the founders of such business companies, participants of such business partnerships | HO, VPHO, VZHHO | 2017 | 8.0% | — | 4.0% | 2.0% | 1.8% |

| 2018 | 13,0% | — | 5,1% | 2,9% | 1.8% | |||

| 2019 | 20,0% | — | 5,1% | 2,9% | 1.8% | |||

| 05 | Payers who have entered into agreements with the management bodies of special economic zones on the implementation of technology-innovation activities and make payments to individuals working in a technology-innovation special economic zone or industrial-production special economic zone, as well as payers of insurance premiums who have entered into agreements on the implementation of tourism- recreational activities and making payments to individuals working in tourist and recreational special economic zones, united by a decision of the Government of the Russian Federation into a cluster | TVEZ, VPTZ, VZhTZ | 2017 | 8.0% | — | 4.0% | 2.0% | 1.8% |

| 2018 | 13,0% | — | 5,1% | 2,9% | 1.8% | |||

| 2019 | 20,0% | — | 5,1% | 2,9% | 1.8% | |||

| 06 | Payers operating in the field of information technology | ODIT, UPIT, UPIT | 2017 | 8.0% | — | 4.0% | 2.0% | 1.8% |

| 2018 | ||||||||

| 2019 | ||||||||

| 07 | Payers making payments and other remuneration to crew members of ships registered in the Russian International Register of Ships, | BSEC, VPES, VZhES | 2017 | 0% | — | 0% | 0% | 0% |

| 2018 | ||||||||

| 2019 | ||||||||

| 08 | Payers who apply the simplified tax system and whose main type of economic activity is specified in subparagraph 5 of paragraph 1 of Article 427 of the Code | PNED, VPED, VZhED | 2017 | 20.0% | — | 0% | 0% | 0% |

| 2018 | ||||||||

| 2019 | does not apply (clause 3, clause 2, article 427 of the Tax Code of the Russian Federation) | |||||||

| 09 | Payers who pay UTII and have a license for pharmaceutical activities - in relation to payments and rewards made to individuals who have the right to engage in pharmaceutical activities or are allowed to engage in it (Pharmacies) | ASB, VPSB, VZHSB | 2017 | 20.0% | — | 0% | 0% | 0% |

| 2018 | ||||||||

| 2019 | does not apply (clause 3, clause 2, article 427 of the Tax Code of the Russian Federation) | |||||||

| 10 | Payers are non-profit organizations that apply the simplified tax system and carry out, in accordance with the constituent documents, activities in the field of social services to the population, scientific research and development, education, healthcare, culture and art (the activities of theaters, libraries, museums and archives) and mass sports (with the exception of professional ) | ASB, VPSB, VZHSB | 2017 | 20.0% | — | 0% | 0% | 0% |

| 2018 | ||||||||

| 2019 | ||||||||

| 11 | Payers of insurance premiums are charitable organizations registered in accordance with the procedure established by the legislation of the Russian Federation and applying the simplified tax system | ASB, VPSB, VZHSB | 2017 | 20.0% | — | 0% | 0% | 0% |

| 2018 | ||||||||

| 2019 | ||||||||

| 12 | Payers are individual entrepreneurs applying the patent taxation system in relation to payments and rewards accrued in favor of individuals engaged in the type of economic activity specified in the patent, with the exception of the types of business activities specified in subparagraphs 19, 45 - 47 of paragraph 2 of Article 346.43 of the Tax Code of the Russian Federation | PNED, VPED, VZhED | 2017 | 20.0% | — | 0% | 0% | 0% |

| 2018 | ||||||||

| 2019 | does not apply (clause 3, clause 2, article 427 of the Tax Code of the Russian Federation) | |||||||

| 13 | Payers who have received the status of participants in the Skolkovo | ICS, VPTS, VZhTS | 2017 | 14.0% | — | 0% | 0% | 0% |

| 2018 | ||||||||

| 2019 | ||||||||

| 14 | Payers who have received the status of participant in a free economic zone in the territories of the Republic of Crimea and the federal city of Sevastopol | KRS, VPKS, VZhKS | 2017 | 6.0% | — | 0.1% | 1.5% | 1.5% |

| 2018 | ||||||||

| 2019 | ||||||||

| 15 | Payers who have received the status of resident of the territory of rapid socio-economic development | TOR, VPTR, VZhTR | 2017 | 6.0% | — | 0.1% | 1.5% | 1.5% |

| 2018 | ||||||||

| 2019 | ||||||||

| 16 | Payers of insurance premiums who have received resident status of the free port of Vladivostok | SPVL, VPVL, VZHVL | 2017 | 6.0% | — | 0.1% | 1.5% | 1.5% |

| 2018 | ||||||||

| 2019 | ||||||||

| 17 | Payers who have received resident status of the Special Economic Zone in the Kaliningrad Region | KLN, VPKL, VZHKL | 2017 | not applicable | ||||

| 2018 | 6.0% | — | 0.1% | 1.5% | 1.5% | |||

| 2019 | ||||||||

| 18 | Payers engaged in the production of animated audiovisual products and (or) provision of services for the creation of animated audiovisual products | ANM, VPAN, VZHAN | 2017 | not applicable | ||||

| 2018 | 8.0% | — | 4,0 % | 2,0 % | 1,8 % | |||

| 2019 | ||||||||

Tariff codes for calculating additional fees. tariffs

| Tariff code | Name | Rate |

| 21 | Payers of insurance premiums paying insurance premiums at additional rates established by paragraph 1 of Article 428 of the Code | 9.0% |

| 22 | Payers of insurance premiums paying insurance premiums at additional rates established by paragraph 2 of Article 428 of the Code | 6.0% |

| 23 | Payers of insurance premiums paying insurance premiums at additional rates established by paragraph 3 of Article 428 of the Code when establishing the class of working conditions - dangerous, subclass of working conditions - 4 | 8.0% |

| 24 | Payers of insurance premiums who pay insurance premiums at additional rates established by paragraph 3 of Article 428 of the Code when establishing the class of working conditions - harmful, subclass of working conditions - 3.4 | 7.0% |

| 25 | Payers of insurance premiums paying insurance premiums at additional rates established by paragraph 3 of Article 428 of the Code when establishing the class of working conditions - harmful, subclass of working conditions - 3.3 | 6.0% |

| 26 | Payers of insurance premiums paying insurance premiums at additional rates established by paragraph 3 of Article 428 of the Code when establishing the class of working conditions - harmful, subclass of working conditions - 3.2 | 4.0% |

| 27 | Payers of insurance premiums paying insurance premiums at additional rates established by paragraph 3 of Article 428 of the Code when establishing the class of working conditions - harmful, subclass of working conditions - 3.1 | 2.0% |

| 28 | Payers of insurance premiums paying insurance premiums for additional social security specified in paragraph 1 of Article 429 of the Code | 14.0% |

| 29 | Payers of insurance premiums paying insurance premiums for additional social security specified in paragraph 2 of Article 429 of the Code | 6.7% |

Control ratios

| Field to be checked | Check condition | Error text |

| Verification of Subsection 1.1 Section 1 | ||

| reporting period 21 or 51: | ||

| 061 (3) Subsection 1.1 Appendix 1 Section 1 | ∑lines 061 (3) of Subsection 1.1 of Appendix 1 of Section 1 ≠ ∑lines 1 of column 240 of Subsection 3.2.1 of Section 3 month = 01 | If there is one Appendix 1: The value of “Section 1.Appendix 1.Subsection 1.1 line 061 column 3” must be equal to the sum of the values “Section 3 column 240 line 1” If several: The sum of the values “Section 1.Appendix 1.Subsection 1.1 line 061 column 3" must be equal to the sum of the values "Section 3 column 240 line 1" |

| 061 (4) Subsection 1.1 Appendix 1 Section 1 | ∑lines 061 (4) Subsection 1.1 Appendix 1 Section 1 ≠ ∑lines 2 columns 240 Subsection 3.2.1 Section 3 month = 02 | If one Appendix 1: The value of “Section 1.Appendix 1.Subsection 1.1 line 061 column 4” must be equal to the sum of the values “Section 3 column 240 line 2” If several: The sum of the values “Section 1.Appendix 1.Subsection 1.1 line 061 column 4" must be equal to the sum of the values "Section 3 column 240 line 2" |

| 061 (5) Subsection 1.1 Appendix 1 Section 1 | ∑lines 061 (5) Subsection 1.1 Appendix 1 Section 1 ≠ ∑lines 3 columns 240 Subsection 3.2.1 Section 3 month = 03 | If there is one Appendix 1: The value of “Section 1.Appendix 1.Subsection 1.1 line 061 column 5” must be equal to the sum of the values “Section 3 column 240 line 3” If several: The sum of the values “Section 1.Appendix 1.Subsection 1.1 line 061 column 5" must be equal to the sum of the values "Section 3 column 240 line 3" |

| reporting period 31 or 52: | ||

| 061 (3) Subsection 1.1 Appendix 1 Section 1 | ∑lines 061 (3) Subsection 1.1 Appendix 1 Section 1 ≠ ∑lines 1 column 240 Subsection 3.2.1 Section 3 month = 04 | If there is one Appendix 1: The value of “Section 1.Appendix 1.Subsection 1.1 line 061 column 3” must be equal to the sum of the values “Section 3 column 240 line 1” If several: The sum of the values “Section 1.Appendix 1.Subsection 1.1 line 061 column 3" must be equal to the sum of the values "Section 3 column 240 line 1" |

| 061 (4) Subsection 1.1 Appendix 1 Section 1 | ∑lines 061 (4) Subsection 1.1 Appendix 1 Section 1 ≠ ∑lines 2 columns 240 Subsection 3.2.1 Section 3 month = 05 | If one Appendix 1: The value of “Section 1.Appendix 1.Subsection 1.1 line 061 column 4” must be equal to the sum of the values “Section 3 column 240 line 2” If several: The sum of the values “Section 1.Appendix 1.Subsection 1.1 line 061 column 4" must be equal to the sum of the values "Section 3 column 240 line 2" |

| 061 (5) Subsection 1.1 Appendix 1 Section 1 | ∑lines 061 (5) Subsection 1.1 Appendix 1 Section 1 ≠ ∑lines 3 columns 240 Subsection 3.2.1 Section 3 month = 06 | If there is one Appendix 1: The value of “Section 1.Appendix 1.Subsection 1.1 line 061 column 5” must be equal to the sum of the values “Section 3 column 240 line 3” If several: The sum of the values “Section 1.Appendix 1.Subsection 1.1 line 061 column 5" must be equal to the sum of the values "Section 3 column 240 line 3" |

| reporting period 33 or 53: | ||

| 061 (3) Subsection 1.1 Appendix 1 Section 1 | ∑lines 061 (3) Subsection 1.1 Appendix 1 Section 1 ≠ ∑lines 1 column 240 Subsection 3.2.1 Section 3 month = 07 | If there is one Appendix 1: The value of “Section 1.Appendix 1.Subsection 1.1 line 061 column 3” must be equal to the sum of the values “Section 3 column 240 line 1” If several: The sum of the values “Section 1.Appendix 1.Subsection 1.1 line 061 column 3" must be equal to the sum of the values "Section 3 column 240 line 1" |

| 061 (4) Subsection 1.1 Appendix 1 Section 1 | ∑lines 061 (4) Subsection 1.1 Appendix 1 Section 1 ≠ ∑lines 2 columns 240 Subsection 3.2.1 Section 3 month = 08 | If one Appendix 1: The value of “Section 1.Appendix 1.Subsection 1.1 line 061 column 4” must be equal to the sum of the values “Section 3 column 240 line 2” If several: The sum of the values “Section 1.Appendix 1.Subsection 1.1 line 061 column 4" must be equal to the sum of the values "Section 3 column 240 line 2" |

| 061 (5) Subsection 1.1 Appendix 1 Section 1 | ∑lines 061 (5) Subsection 1.1 Appendix 1 Section 1 ≠ ∑lines 3 columns 240 Subsection 3.2.1 Section 3 month = 09 | If there is one Appendix 1: The value of “Section 1.Appendix 1.Subsection 1.1 line 061 column 5” must be equal to the sum of the values “Section 3 column 240 line 3” If several: The sum of the values “Section 1.Appendix 1.Subsection 1.1 line 061 column 5" must be equal to the sum of the values "Section 3 column 240 line 3" |

| reporting period 34 or 90: | ||

| 061 (3) Subsection 1.1 Appendix 1 Section 1 | ∑lines 061 (3) of Subsection 1.1 of Appendix 1 of Section 1 ≠ ∑lines 1 of column 240 of Subsection 3.2.1 of Section 3 month = 10 | If there is one Appendix 1: The value of “Section 1.Appendix 1.Subsection 1.1 line 061 column 3” must be equal to the sum of the values “Section 3 column 240 line 1” If several: The sum of the values “Section 1.Appendix 1.Subsection 1.1 line 061 column 3" must be equal to the sum of the values "Section 3 column 240 line 1" |

| 061 (4) Subsection 1.1 Appendix 1 Section 1 | ∑lines 061 (4) Subsection 1.1 Appendix 1 Section 1 ≠ ∑lines 2 columns 240 Subsection 3.2.1 Section 3 month = 11 | If one Appendix 1: The value of “Section 1.Appendix 1.Subsection 1.1 line 061 column 4” must be equal to the sum of the values “Section 3 column 240 line 2” If several: The sum of the values “Section 1.Appendix 1.Subsection 1.1 line 061 column 4" must be equal to the sum of the values "Section 3 column 240 line 2" |

| 061 (5) Subsection 1.1 Appendix 1 Section 1 | ∑lines 061 (5) Subsection 1.1 Appendix 1 Section 1 ≠ ∑lines 3 columns 240 Subsection 3.2.1 Section 3 month = 12 | If there is one Appendix 1: The value of “Section 1.Appendix 1.Subsection 1.1 line 061 column 5” must be equal to the sum of the values “Section 3 column 240 line 3” If several: The sum of the values “Section 1.Appendix 1.Subsection 1.1 line 061 column 5" must be equal to the sum of the values "Section 3 column 240 line 3" |

| Checking Subsection 1.3 Section 1 | ||

| reporting period 21 or 51: | ||

| 050 (3) Subsection 1.3.1 and 050 (3) Subsection 1.3.2 Appendix 1 Section 1 | ∑lines 050 (3) Subsection 1.3.1 + ∑lines 050 (3) Subsection 1.3.2 Appendix 1 Section 1 ≠ ∑lines 1 column 290 Subsection 3.2.2 section 3 month = 01 | The sum of the values “Section 1.Appendix 1.Subsection 1.3.1 line 050 column 3” and “Section 1.Appendix 1.Subsection 1.3.2 line 050 column 3” must be equal to the sum of the values “Section 3 column 290 line 1” |

| 050 (4) Subsection 1.3.1 and 050 (4) Subsection 1.3.2 Appendix 1 Section 1 | ∑lines 050 (4) of Subsection 1.3.1 + ∑lines 050 (4) of Subsection 1.3.2 of Appendix 1 of Section 1 ≠ ∑lines of 1 column 290 of Subsection 3.2.2 of section 3 month = 02 | The sum of the values “Section 1.Appendix 1.Subsection 1.3.1 line 050 column 4” and “Section 1.Appendix 1.Subsection 1.3.2 line 050 column 4” must be equal to the sum of the values “Section 3 column 290 line 2” |

| 050 (5) Subsection 1.3.1 and 050 (5) Subsection 1.3.2 Appendix 1 Section 1 | ∑lines 050 (5) of Subsection 1.3.1 + ∑lines 050 (5) Subsection 1.3.2 of Appendix 1 Section 1 ≠ ∑lines 1 column 290 of Subsection 3.2.2 section 3 month = 03 | The sum of the values “Section 1.Appendix 1.Subsection 1.3.1 line 050 column 5” and “Section 1.Appendix 1.Subsection 1.3.2 line 050 column 5” must be equal to the sum of the values “Section 3 column 290 line 3” |

| reporting period 31 or 52: | ||

| 050 (3) Subsection 1.3.1 and 050 (3) Subsection 1.3.2 Appendix 1 Section 1 | ∑lines 050 (3) of Subsection 1.3.1 + ∑lines 050 (3) of Subsection 1.3.2 of Appendix 1 of Section 1 ≠ ∑lines of 1 column 290 of Subsection 3.2.2 of Section 3 month = 04 | The sum of the values “Section 1.Appendix 1.Subsection 1.3.1 line 050 column 3” and “Section 1.Appendix 1.Subsection 1.3.2 line 050 column 3” must be equal to the sum of the values “Section 3 column 290 line 1” |

| 050 (4) Subsection 1.3.1 and 050 (4) Subsection 1.3.2 Appendix 1 Section 1 | ∑lines 050 (4) of Subsection 1.3.1 + ∑lines 050 (4) Subsection 1.3.2 of Appendix 1 Section 1 ≠ ∑lines 1 column 290 of Subsection 3.2.2 section 3 month = 05 | The sum of the values “Section 1.Appendix 1.Subsection 1.3.1 line 050 column 4” and “Section 1.Appendix 1.Subsection 1.3.2 line 050 column 4” must be equal to the sum of the values “Section 3 column 290 line 2” |

| 050 (5) Subsection 1.3.1 and 050 (5) Subsection 1.3.2 Appendix 1 Section 1 | ∑lines 050 (5) of Subsection 1.3.1 + ∑lines 050 (5) of Subsection 1.3.2 of Appendix 1 of Section 1 ≠ ∑lines of 1 column 290 of Subsection 3.2.2 of Section 3 month = 06 | The sum of the values “Section 1.Appendix 1.Subsection 1.3.1 line 050 column 5” and “Section 1.Appendix 1.Subsection 1.3.2 line 050 column 5” must be equal to the sum of the values “Section 3 column 290 line 3” |

| reporting period 33 or 53: | ||

| 050 (3) Subsection 1.3.1 and 050 (3) Subsection 1.3.2 Appendix 1 Section 1 | ∑lines 050 (3) Subsection 1.3.1 + ∑lines 050 (3) Subsection 1.3.2 Appendix 1 Section 1 ≠ ∑lines 1 column 290 Subsection 3.2.2 section 3 month = 07 | The sum of the values “Section 1.Appendix 1.Subsection 1.3.1 line 050 column 3” and “Section 1.Appendix 1.Subsection 1.3.2 line 050 column 3” must be equal to the sum of the values “Section 3 column 290 line 1” |

| 050 (4) Subsection 1.3.1 and 050 (4) Subsection 1.3.2 Appendix 1 Section 1 | ∑lines 050 (4) of Subsection 1.3.1 + ∑lines 050 (4) Subsection 1.3.2 of Appendix 1 Section 1 ≠ ∑lines 1 column 290 of Subsection 3.2.2 section 3 month = 08 | The sum of the values “Section 1.Appendix 1.Subsection 1.3.1 line 050 column 4” and “Section 1.Appendix 1.Subsection 1.3.2 line 050 column 4” must be equal to the sum of the values “Section 3 column 290 line 2” |

| 050 (5) Subsection 1.3.1 and 050 (5) Subsection 1.3.2 Appendix 1 Section 1 | ∑lines 050 (5) of Subsection 1.3.1 + ∑lines 050 (5) Subsection 1.3.2 of Appendix 1 Section 1 ≠ ∑lines 1 column 290 of Subsection 3.2.2 section 3 month = 09 | The sum of the values “Section 1.Appendix 1.Subsection 1.3.1 line 050 column 5” and “Section 1.Appendix 1.Subsection 1.3.2 line 050 column 5” must be equal to the sum of the values “Section 3 column 290 line 3” |

| reporting period 34 or 90: | ||

| 050 (3) Subsection 1.3.1 and 050 (3) Subsection 1.3.2 Appendix 1 Section 1 | ∑lines 050 (3) of Subsection 1.3.1 + ∑lines 050 (3) of Subsection 1.3.2 of Appendix 1 of Section 1 ≠ ∑lines of 1 column 290 of Subsection 3.2.2 of Section 3 month = 10 | The sum of the values “Section 1.Appendix 1.Subsection 1.3.1 line 050 column 3” and “Section 1.Appendix 1.Subsection 1.3.2 line 050 column 3” must be equal to the sum of the values “Section 3 column 290 line 1” |

| 050 (4) Subsection 1.3.1 and 050 (4) Subsection 1.3.2 Appendix 1 Section 1 | ∑lines 050 (4) of Subsection 1.3.1 + ∑lines 050 (4) of Subsection 1.3.2 of Appendix 1 of Section 1 ≠ ∑lines of 1 column 290 of Subsection 3.2.2 of Section 3 month = 11 | The sum of the values “Section 1.Appendix 1.Subsection 1.3.1 line 050 column 4” and “Section 1.Appendix 1.Subsection 1.3.2 line 050 column 4” must be equal to the sum of the values “Section 3 column 290 line 2” |

| 050 (5) Subsection 1.3.1 and 050 (5) Subsection 1.3.2 Appendix 1 Section 1 | ∑lines 050 (5) of Subsection 1.3.1 + ∑lines 050 (5) of Subsection 1.3.2 of Appendix 1 of Section 1 ≠ ∑lines of 1 column 290 of Subsection 3.2.2 of Section 3 month = 12 | The sum of the values “Section 1.Appendix 1.Subsection 1.3.1 line 050 column 5” and “Section 1.Appendix 1.Subsection 1.3.2 line 050 column 5” must be equal to the sum of the values “Section 3 column 290 line 3” |

| Checking compliance of Appendix 3 Section 1 and Appendix 4 Section 1 | ||

| 010 (4) Appendix 3, 250 (4) Appendix 4 | line 010 (4) Appendix 3 ≠ line 250 (4) Appendix 4 | The value of “Section 1.Appendix 3 line 010 column 4” must be equal to the value of “Section 1.Appendix 4 line 250 column 4” |

| 030 (4) Appendix 3, 260 (4) Appendix 4 | line 030 (4) Appendix 3 ≠ line 260 (4) Appendix 4 | The value of “Section 1.Appendix 3 line 030 column 4” must be equal to the value of “Section 1.Appendix 4 line 260 column 4” |

| 060 (4) Appendix 3, 270 (4) Appendix 4 | line 060 (4) of Appendix 3 ≠ line 270 (4) of Appendix 4 | The value of “Section 1.Appendix 3 line 060 column 4” must be equal to the value of “Section 1.Appendix 4 line 270 column 4” |

| 061 (4) Appendix 3, 280 (4) Appendix 4 | line 061 (4) of Appendix 3 ≠ line 280 (4) of Appendix 4 | The value of “Section 1.Appendix 3 line 061 column 4” must be equal to the value of “Section 1.Appendix 4 line 280 column 4” |

| 062 (4) Appendix 3, 290 (4) Appendix 4 | line 062 (4) of Appendix 3 ≠ line 290 (4) of Appendix 4 | The value of “Section 1.Appendix 3 line 062 column 4” must be equal to the value of “Section 1.Appendix 4 line 290 column 4” |

| 070 (4) Appendix 3, 300 (4) Appendix 4 | line 070 (4) Appendix 3 ≠ line 300 (4) Appendix 4 | The value of “Section 1.Appendix 3 line 070 column 4” must be equal to the value of “Section 1.Appendix 4 line 300 column 4” |

| 080 (4) Appendix 3, 310 (4) Appendix 4 | line 080 (4) of Appendix 3 ≠ line 310 (4) of Appendix 4 | The value of “Section 1.Appendix 3 line 080 column 4” must be equal to the value of “Section 1.Appendix 4 line 310 column 4” |

| 100 (4) Appendix 3, 240 (4) Appendix 4 | line 100 (4) of Appendix 3 ≠ line 240 (4) of Appendix 4 | The value of “Section 1.Appendix 3 line 100 column 4” must be equal to the value of “Section 1.Appendix 4 line 240 column 4” |

Critical and non-critical errors: how to fix them

Errors in the RSV can be divided into:

- The critical ones, namely:

- leading to an underestimation of the amount of contributions (this may be an incorrect indication of the amount of contributions or an unlawfully reduced base for contributions);

- reflecting incomplete information in the calculation (for example, incorrect indication of personal data about the employee - full name, SNILS).

- Non-critical - other errors.

In both cases, you will need to send an updated DAM to the Federal Tax Service (clause 1 of Article 81 of the Tax Code of the Russian Federation).

If they occur, the taxpayer has the right to send an updated calculation to the tax office.

It is advisable to submit the updated DAM before the deadline for its submission (by the 30th day of the month following the reporting period). Also, the consequences can be avoided if you take the RSV later if:

- Submit the calculation before the due date for payment of the contribution, provided that the Federal Tax Service itself does not find the error by that time.

- Submit the payment after the due date for payment of the contribution has expired, provided that:

- By that time, the Federal Tax Service had not found an error and did not order an inspection;

- The arrears in contributions discovered by the employer, as well as penalties on them, have been paid.

If the error in the DAM is not corrected in time, the Federal Tax Service may apply a number of penalties to the employer.

Correction method

Fortunately, there are quite a few ways to answer the question - how to fix this error. Each of them can be effective, so it’s worth familiarizing yourself with all the possible options:

- Once again, scrupulously double-check each amount, figure, and their location in the required lines of the report. If the organization sending such reports to the Tax Service employs several accountants, then it is recommended to assign a similar task to all of them. And then – compare the results obtained;

- Pay special attention to the third section, where data adjustments may be required due to the lack of information on some employees;

- Try using specialized software. “Tester” is used for automatic verification. To do this, you will need to initially download the program and install it on your computer’s hard drive. Very often this method is the most effective, since the automatic search for inconsistencies leads to their visual display on the working screen;

- The last option is to call representatives of the Federal Tax Service and outline the situation. If the circumstances are favorable, the tax officer will point out the existing reasons and tell you how to get rid of them.

Of course, the question arises:

What will happen if, even after making all the changes and amendments, the Federal Tax Service still reports the same unpleasantness with code 0400400017?

There is no need to panic ahead of time. There is more than enough time for the next adjustments - five whole days. During this period, you can double-check literally every symbol, get all the necessary advice, and invite more experienced specialists.

But if the five-day period has expired, and the cause of the non-compliance has not been eliminated, then in this case penalties may be applied against the enterprise - this is worth understanding.