Electronic interaction with tax authorities has become widespread. The possibility of paperless exchange becomes especially important during a pandemic. 1C experts tell you how you can submit documents in response to the requirements of the Federal Tax Service directly from 1C: Accounting 8, edition 3.0, using the 1C-Reporting service.

The tax authority has the right to request documents (information) from the taxpayer both when conducting a tax audit (Article 93 of the Tax Code of the Russian Federation) and when conducting a tax audit of the taxpayer’s counterparty - the so-called “counter audit”. In addition, the Federal Tax Service inspection may request documents outside of inspections, for example, information on a specific transaction in which the taxpayer participated or about which he has information (Article 93.1 of the Tax Code of the Russian Federation).

As a rule, in all these cases, the taxpayer receives a requirement to submit documents (information), drawn up in a certain form (approved by order of the Federal Tax Service of Russia dated November 7, 2018 No. ММВ-7-2/ [ email protected] - see Appendix No. 17 to the order ).

Taxpayers submitting tax returns (calculations) to the tax authority in electronic form are required to ensure receipt of documents from the tax authority in electronic form via telecommunication channels (TCC) through an electronic document management operator (EDF) (clause 5.1 of Article 23 of the Tax Code of the Russian Federation).

The taxpayer’s obligation is considered fulfilled if he has:

- an agreement with an EDF operator for the provision of services to ensure electronic document management with the tax authority at the taxpayer’s place of registration;

- qualified electronic signature verification key certificate.

Thus, if an organization uses electronic document management with the tax authority, then requests for the submission of documents (information), as well as letters, notifications and other documents are received by the organization via telecommunication channels in accordance with the procedure approved by order of the Federal Tax Service of Russia dated July 16, 2020 No. ED- 7-2/ [email protected]

The requested documents can be submitted to the Federal Tax Service both in paper and electronic form (clause 2 of Article 93 of the Tax Code of the Russian Federation). It is obvious that paperless exchange has undeniable advantages: speed, technology and security. Let's look at how in "1C: Accounting 8" edition 3.0 you can submit documents electronically in response to the requirements of the Federal Tax Service.

Document submission methods

If various documents were required during the desk audit, they can be provided to the tax office in the following ways (subclause 1, clause 2, article 93 of the Tax Code of the Russian Federation):

- paper certified photocopies are transferred personally by the taxpayer or through a representative to the tax office or by registered mail by mail (subclause 2, clause 2, article 93 of the Tax Code of the Russian Federation);

- in electronic form in a special format and in accordance with the procedure approved by order of the Federal Tax Service of Russia dated February 17, 2011 No. ММВ-7-2/ [email protected] ;

- in electronic form through the taxpayer’s personal account;

- in the form of scanned images via TKS or through the taxpayer’s personal account.

The taxpayer himself has the right to choose which method to transfer documents to him at the requests and requirements of tax authorities (letter of the Federal Tax Service of Russia dated November 25, 2014 No. ED-4-2/24315).

NOTE! Taxpayers who are required to submit reports only electronically do not have the right to send notifications about the impossibility of submitting the documents requested by the Federal Tax Service by mail.

See here for details.

IMPORTANT! Explanations for VAT can only be submitted in electronic format. See this article for details.

Find out what opportunities electronic personal accounts provide from the following materials:

- “The procedure for filling out the 3-NDFL declaration in your personal account”;

- “Plato system - user’s personal account (nuances)”.

The list of documents that the Federal Tax Service may require depends on the type of event carried out by the tax authorities. What documents to prepare as part of inspections (on-site or office), outside inspections, during counter inspections, ConsultantPlus experts tell in detail. Get trial access and start exploring the Ready Solution for free.

Request for documents under Article 93 of the Tax Code of the Russian Federation

Request for documents is used within the framework of a desk or field audit, outside the scope of inspections, and during additional tax control activities.

The list of cases when the tax authority has the right to request documents is constantly expanding. At the same time, for the taxpayer, fulfilling the requirement is a rather expensive procedure: it is necessary to find original documents, make copies, certify them, and send them to the tax authority. An interview with an expert is devoted to obtaining documents from the taxpayer. How is a demand for production of documents served on a taxpayer?

The requirement can be transferred to the person to whom it is addressed, or his representative directly against receipt, sent by registered mail or transmitted electronically via telecommunication channels (hereinafter referred to as TCS) through an electronic document management operator (clause 4 of Article 31 of the Tax Code of the Russian Federation).

When a request is delivered to the taxpayer against receipt, the date of delivery is indicated directly in the request.

In what sequence are the specified options for submitting a claim applied?

Persons charged by the Tax Code of the Russian Federation with the obligation to submit a tax return (calculation) in electronic form must ensure that they receive the request from the tax authority in electronic form via the TKS through an electronic document management operator.

The procedure for sending a request for the submission of documents (information) in electronic form (hereinafter referred to as the Procedure) was approved by Order of the Federal Tax Service of Russia No. ММВ-7-2 / [email protected] dated February 17, 2011.

Based on the specified Procedure, if a request is sent electronically, but is not actually opened (not read) by the taxpayer, and an acceptance receipt is not generated and sent to the tax authority, such a request cannot be considered received by the taxpayer.

In such a case, the tax authority, based on paragraph 19 of the Procedure, must send the taxpayer a request in paper form.

A different sequence of methods for transferring documents may be directly provided for by the Tax Code of the Russian Federation. For example, if a tax authority official conducting a tax audit is located on the taxpayer’s territory, the requirement to submit documents is transferred to the head (authorized representative) of the organization personally against signature (clause 1 of Article 93 of the Tax Code of the Russian Federation).

Within the meaning of this norm, when conducting an inspection on the territory (premises) of the taxpayer, and not at the location of the tax authority, the demand must be delivered to the taxpayer personally by the inspector while he is with the taxpayer.

Only if the request for the submission of documents cannot be submitted in the indicated way, it is sent in the manner established by paragraph 4 of Article 31 of the Tax Code of the Russian Federation.

What should you pay attention to when receiving documents from the tax office by mail?

When sending documents by mail, they are sent to the taxpayer - a Russian organization (its branch, representative office) - at the address of its location (location of its branch, representative office), contained in the Unified State Register of Legal Entities (clause 5 of Article 31 of the Tax Code of the Russian Federation).

An organization cannot determine a different address for the purpose of receiving postal correspondence from the tax authority.

On the other hand, the addressee of a legally significant message, who has received and established its content in a timely manner, does not have the right to refer to the fact that the message was sent to the wrong address or in an inappropriate form. This is stated in the Resolution of the Plenum of the Supreme Court of the Russian Federation No. 25 “On the application by courts of certain provisions of Section I of Part One of the Civil Code of the Russian Federation” dated June 23, 2015.

When the tax authority sends a document by registered mail, the date of its receipt is considered to be the sixth day from the date of sending the registered letter.

The fact of acceptance of correspondence for dispatch is confirmed by a list of internal mail accepted for dispatch by the post office, with a stamp of the post office, processed and sent to recipients (Resolution of the Federal Antimonopoly Service of the Central District in case No. A14-8583/2011 dated November 21, 2012, Determination of the Supreme Arbitration Court of the Russian Federation No. VAS-17644/12 dated December 25, 2012 refused to transfer the case for review under supervisory review).

What if the taxpayer did not receive the demand sent by mail?

If the documents are not submitted at the request of the tax authority, the tax authority will draw up an act on the discovery of facts indicating a tax violation.

Messages delivered to the addresses indicated respectively in the Unified State Register of Individual Entrepreneurs (for individual entrepreneurs) or in the Unified State Register of Legal Entities (for organizations) are considered received, even if the relevant person does not actually live (is not located) at the specified address (clause 3 of Article 54 of the Civil Code of the Russian Federation).

A mere statement of non-receipt of a demand will not be enough to conclude that the tax inspector’s decision is illegal.

When considering a dispute, the taxpayer is recommended to indicate valid reasons for not receiving the request for documents (information), circumstances that did not depend on the will of the taxpayer himself.

In what cases can a received claim be appealed?

According to paragraph 1 of Article 93 of the Tax Code of the Russian Federation, the tax authority official conducting the inspection has the right to request from the person being inspected the documents necessary for the inspection.

Please note that in practice, tax authorities request documents about the taxpayer by sending him demands in accordance with Article 93.1 of the Tax Code of the Russian Federation, which indicate the request for documents on a specific transaction as the basis.

The requirement may be left unfulfilled on the merits by sending a corresponding letter to the tax authority:

directional:

- before inspection;

- within the framework of the so-called pre-test analysis;

- during the period of suspension of an on-site tax audit;

- after the end of the tax audit.

about submitting documents:

- not related to the subject or period of the review;

- whose shelf life has expired;

- the preparation of which is not provided for by law (documents in the form of comparative tables that reflect the differences between the tax bases of different taxes, tax and accounting, revenue forecasts, production plans, business correspondence);

- reclaimed;

- the number of which is excessive.

What should be contained in the request for the production of documents?

The form of the request for the submission of documents (information) was approved by Appendix No. 15 to the Order of the Federal Tax Service of Russia No. MMV-7-2 / [email protected] dated May 8, 2015.

The requirement to submit documents must include the name of the documents required for verification, the period to which they relate, and, if available, details and other characteristics that individualize the documents requested.

If the received requirement is not clear to the taxpayer, or there are reasonable difficulties in identifying documents or information, then it is recommended to send a letter to the tax authority stating that fulfillment of the requirement (in full or in the relevant part) is not possible and ask to clarify the content of the requirement, specify the type of document or composition of the requested information.

What will such clarification give the taxpayer?

Such tactics of “executing” the requirement will not allow the tax authority in some cases to send a new requirement due to the lack of grounds (completion of a tax audit, completion of additional tax control measures).

Contacting the tax authority for clarification on the content and number of documents required reduces the risk of being held accountable in the event that the documents are not submitted according to an “unclear” request (they are submitted late).

How is the deadline for fulfilling the requirement to submit documents calculated?

The deadline for fulfilling the requirement, as a general rule, is 10 working days. The calculation of the period begins from the day the request is received. In this case, the period is calculated in working days (clause 6 of Article 6.1 of the Tax Code of the Russian Federation).

If the last day of the term falls on a non-working day, the day of expiration of the term is considered to be the next working day following it.

In law enforcement practice, a certain approach has been developed to the issue of the relationship between the beginning of the calculation of the specified period and the actual date of receipt of the request when it is sent by mail.

If a request is received within the allotted six days, the deadline for submitting documents is calculated from the date of actual receipt of the request (determinations of the Supreme Arbitration Court of the Russian Federation No. VAS-2652/12 dated March 23, 2012 and No. VAS-6232/13 dated May 24, 2013).

If the request is received after the expiration of six days from the date of sending the registered letter, the deadline for submitting the requested documents begins to run from the seventh day of sending the registered letter. Thus, the period for submitting documents is reduced accordingly.

Is it possible to extend the deadline for fulfilling the requirement?

In each case of receiving a request, the taxpayer can be recommended to send a notification to the tax authority about the impossibility of fulfilling the request within the day following the day of its receipt.

A reasonable time limit should be given when the requested documents can be submitted. The form and format of the notification are approved by Order of the Federal Tax Service of Russia No. ММВ-7-2 / [email protected] dated January 25, 2021.

The form contains an approximate list of reasons for the impossibility of submitting the requested documents within the prescribed period:

- a large number of required documents;

- location of some documents in separate divisions of the organization, archive;

- simultaneous receipt of several requirements;

- technical and personnel difficulties in making certified copies, etc.

To whom is this notification sent?

If an inspection is carried out on the territory of the taxpayer, a notice of the impossibility of submitting documents may be handed over to the inspecting official against signature.

If the audit is initially carried out at the location of the tax authority or is suspended, that is, the inspectors are not located on the territory of the taxpayer, then a notification about the impossibility of submitting documents is transmitted directly to the tax authority, the head (deputy head) of which made the decision to conduct the audit.

The provisions of Article 93 of the Tax Code of the Russian Federation do not provide for any special features if the requirement to submit documents was signed by an official of a tax authority other than the one that made the decision to conduct the audit included in the inspection group.

In such a situation, if it is impossible to deliver the notice to the inspection official, it should be addressed to the tax authority whose head (deputy head) made the decision to conduct the inspection.

You can also request an extension of the deadline for submitting the requested documents if the fulfillment of the requirement occurs during the period of suspension of the on-site tax audit.

How is notification sent?

Special methods of sending notifications are provided for taxpayers who are obliged, by virtue of paragraph 3 of Article 80 of the Tax Code of the Russian Federation, to submit tax returns in electronic form.

Such persons may submit a notice of the impossibility of submitting documents to the tax authority in person or through a representative, or submit it electronically via TKS.

Notice may be sent by certified mail only to persons who are not required to file a tax return electronically.

At the same time, let us draw attention to the contradiction in paragraph 3 of Article 93 of the Tax Code of the Russian Federation: paragraph two provides for a written notification of the impossibility of submitting documents within the established time frame, which casts doubt on the possibility of transmitting the specified notification in electronic form provided for in the third paragraph.

Let’s assume that the tax authority did not extend the deadline for fulfilling the requirement, and the taxpayer did not meet the allotted deadline. Does liability apply in this case?

The tax authority, within two days, considers the taxpayer’s notification about the impossibility of submitting documents and makes a decision either to extend or refuse to extend the deadline for submission. In practice, the tax authority often does not make any decision.

Sending a notice to extend the deadline for submitting documents does not in itself constitute grounds for failure to comply with the requirement within the originally established period.

Must a taxpayer report the absence of required documents and, if so, within what time frame?

The taxpayer must in any case send a response to the request received. According to the Federal Tax Service of the Russian Federation, reflected in letter No. ED-4-2/ [email protected] dated June 23, 2021, the response about the impossibility of submitting documents within the established time frame due to their absence (lost; not received (not compiled)) should be sent to during the day following the day the request was received.

However, this position seems to be a broad interpretation of the Tax Code of the Russian Federation. The provisions of the Order of the Federal Tax Service of Russia No. ММВ-7-2/ [email protected] dated January 25, 2017, which approved the form and format of the notification about the impossibility of submitting documents (information) within the established time limits, cannot be the basis for holding the taxpayer liable.

A special period for sending a response, which would indicate the absence of the requested documents, as well as the form of such a response, is not provided for by paragraph 3 of Article 93 of the Tax Code of the Russian Federation. In other words, the appropriate response can be sent within 10 days from the date of receipt of the request.

Is it possible to provide original documents in response to a request?

The Tax Code of the Russian Federation does not provide for the fulfillment of the requirement to submit documents through the issuance of original documents.

The seizure of original documents is regulated by Article 94 of the Tax Code of the Russian Federation.

At the same time, if the requested documents are presented in the form of originals within the prescribed period, there are no grounds for holding the taxpayer liable under Article 126 of the Tax Code of the Russian Federation for failure to fulfill the requirement. But there is no need to fulfill the requirement in this way.

It follows from paragraph 5 of Article 93 of the Tax Code of the Russian Federation that documents previously submitted to the tax authority in the form of originals must be returned to the person being inspected. However, the Tax Code of the Russian Federation does not contain a deadline for the return of such documents.

After returning the originals, the tax authority has the right to request them again from the taxpayer - the prohibition on re-requesting documents in this case does not apply.

What does it mean to submit documents as certified copies?

Submission of documents on paper is made in the form of copies certified by the person being verified. A certified copy of a document is a copy of the document, on which, in accordance with the established procedure, the necessary details are affixed, giving it legal force.

According to paragraph 3.26 of GOST R 6.30-2003 “Unified documentation systems. Unified system of organizational and administrative documentation.

Requirements for the preparation of documents" (approved by Decree of the State Standard of Russia No. 65-st dated March 3, 2003), when certifying the conformity of a copy of a document with the original, a certification inscription is affixed below the “Signature” requisite:

- "Right";

- position of the person who certified the copy;

- personal signature;

- decryption of signature (initials, surname);

- date of certification.

In addition to the above, the Ministry of Finance recommends submitting copies of documents with a covering letter and a list of the documents being submitted (letter No. 03-02-РЗ/39142 dated August 7, 2014).

Can documents be certified by facsimile?

No, documents certified in this way will not be considered by the tax authority as proper copies (resolution of the Arbitration Court of the Far Eastern District No. F03-5752/2014 dated January 19, 2015).

Do copies of documents need to be certified with a seal?

According to GOST, it is allowed to certify a copy of a document with a seal determined at the discretion of the organization.

Since April 7, 2015, Article 2 of Federal Law No. 14-FZ “On Limited Liability Companies” of February 8, 1998 (as amended by Federal Law No. 82-FZ of April 6, 2015) enshrines the right of a company to have a seal.

The obligation of a company to use a seal may be provided for by federal law. Information about the presence of a seal must be contained in the company's charter.

A similar approach is reflected in Federal Law No. 208-FZ “On Joint Stock Companies” of December 26, 1995.

Thus, if the company has not exercised the right to have a seal, then copies of documents can be made without being certified by a seal.

From April 7, 2015, documents submitted to the tax authorities are accepted regardless of the presence (absence) of a stamp in them (letter of the Federal Tax Service of Russia No. BS-4-17/13706 dated August 5, 2015).

How to certify a document with more than one page?

It is advisable to sew a copy of a multi-page document, number it and certify it as a whole.

To do this, on the reverse side of the last sheet, in addition to other details, you must put the inscription: “Total numbered, laced _____ sheets” (the number of sheets is indicated in words).

You can create a binder from copies of certified documents. At the same time, the ability to freely read the text of the document and the ability to freely copy each individual sheet of a document in a stack should be preserved.

It is recommended to certify a copy of each document rather than a binder. Only in this case is it permissible to use the relevant documents as confirmation of the circumstances in the case of a tax offense (Resolution of the Federal Antimonopoly Service of the Moscow District No. KA-A41/11390-09 dated November 5, 2009).

If uncertified copies are submitted or only the last page of the document file is certified, the taxpayer may be faced with the fact that the tax authority will draw up a report on the detected offense provided for in Article 126 of the Tax Code of the Russian Federation and re-request the documents (especially if they find errors in the submitted uncertified copies).

But we note that the Ministry of Finance issued letter No. 03-02-RZ/62336 dated October 29, 2015, from which we can conclude that it is admissible to submit documents in the form of stitched documents.

In addition, there are examples of judicial acts in which it was recognized that the taxpayer’s actions to timely submit a file of documents do not constitute an offense, since they do not constitute a refusal to submit documents (failure to submit documents).

This approach is reflected, in particular, in the resolution of the FAS Central District in case No. A54-8663/2012 dated November 1, 2013 and the resolution of the FAS West Siberian District in case No. A75-10184/2011 dated August 24, 2012.

In our opinion, the submission of documents in the form of a staple, certified on the last sheet, is possible when fulfilling the requirement in accordance with Article 93.1 of the Tax Code of the Russian Federation.

When submitting documents upon request sent on the basis of Article 93 of the Tax Code of the Russian Federation, it is advisable to certify a copy of each document separately.

How are copies of paper documents submitted?

The methods for submitting the requested documents are personal submission, submission through a representative, or sending documents by registered mail.

If documents are requested during an audit that is carried out on the territory of the taxpayer, can the taxpayer, having made copies, make them available to the tax authority on his territory?

The Tax Code of the Russian Federation does not contain such a method of fulfilling the requirement. Judicial practice is based on a systematic interpretation of Articles 89 and 93 of the Tax Code of the Russian Federation: the requested documents must be presented at the place of inspection.

This condition is met:

- when conducting an inspection on the taxpayer’s territory;

- when submitting documents at the place of inspection, where, according to Article 89 of the Tax Code of the Russian Federation, officials of the tax authority should be located;

- upon receipt by the inspectorate of a letter from the taxpayer indicating the readiness of the requested documents.

If these circumstances exist, the obligation of the person being inspected to ensure that the tax authority has the opportunity to receive documents in a timely manner is fulfilled (resolution of the FAS Volga-Vyatka District in case No. A29-4831/2012 dated February 18, 2013, resolution of the FAS Moscow District No. A40-78313/12-91-433 dated June 5, 2013).

But informing the tax authority about the preparation of copies of documents and their location on the taxpayer’s territory does not constitute proper fulfillment of the requirement to submit documents if the audit is suspended (Decision of the Supreme Court No. 304-KG14-7880 dated February 9, 2015).

The letter of the Federal Tax Service of the Russian Federation No. ED-4-2 / [email protected] dated August 7, 2015 states that during the period of suspension of the audit, the taxpayer must submit documents to the tax authority specified in the request for the submission of documents (information).

Is it necessary to submit on paper documents that were compiled electronically?

If the documents requested from the taxpayer are compiled in electronic form in accordance with the formats established by the Federal Tax Service, the taxpayer has the right to send them to the tax authority according to the TKS in the manner established by Order of the Federal Tax Service of Russia No. ММВ-7-2 / [email protected] dated February 17, 2011.

Submission of documents in electronic form in unspecified formats and (or) on magnetic storage media is not provided for by the Tax Code of the Russian Federation (letter of the Federal Tax Service of Russia No. ED-4-2/15669 dated September 7, 2015).

When the document requested from the taxpayer is compiled in electronic form not in accordance with the formats established by the Federal Tax Service, the document is presented on paper in the form of a copy certified by the taxpayer with a note indicating that the original document was signed with an electronic signature.

The ability to submit documents in xml format is installed for the following documents:

- invoice, adjustment invoice, journal of received and issued invoices, purchase book, additional sheet of the purchase book, sales book, additional sheet of the sales book (formats approved by Orders of the Federal Tax Service of the Russian Federation No. ММВ-7-6 / [email protected] dated March 4, 2015, No. ММВ-7-15/ [email protected] dated April 13, 2016, No. ММВ-7-15/ [email protected] dated March 24, 2021);

- document on the transfer of goods during trade operations (format approved by Order of the Federal Tax Service of Russia No. ММВ-7-10 / [email protected] dated November 30, 2015);

- a document on the transfer of work results, a document on the provision of services (format approved by order of the Federal Tax Service of Russia No. ММВ-7-10 / [email protected] dated November 30, 2015);

- act of acceptance and delivery of work (services), delivery note (TORG-12), invoice and document on the shipment of goods (performance of work), transfer of property rights (document on the provision of services), including an invoice, an adjustment invoice invoice and document confirming changes in the cost of goods shipped (work performed, services rendered), transferred property rights, including an adjustment invoice.

What documents can be presented as scanned images?

- agreement (agreement, contract), including additions (changes);

- specification (calculation, calculation) of price (cost);

- act of acceptance and delivery of works (services);

- invoice, including adjustment;

- waybill;

- waybill (TORG-12);

- cargo customs declaration/transit declaration, including additional sheets to them.

The list of these documents that can be sent to the tax authority via TKS in the form of scanned images, including using pdf format, is given in Order of the Federal Tax Service of Russia No. ММВ-7-6/ [email protected] dated June 29, 2012.

Both xml files and scanned images can be sent in one set of documents (letter of the Federal Tax Service of Russia No. ED-4-15/24784 dated December 23, 2016).

Documents submitted in electronic form under the TKS must be certified by an enhanced qualified electronic signature.

The taxpayer has no right to send scanned images of other documents to the tax authority in response to a request to submit documents (letter of the Federal Tax Service of Russia No. ED-4-15/21002 dated November 3, 2021).

At the same time, the acceptance of documents submitted under Article 93 of the Tax Code of the Russian Federation can be carried out by the tax inspectorate in the form of scanned images according to the TKS in electronic form using the “Appeal” document flow type.

What is the liability for failure to comply with a requirement?

Failure by a taxpayer (fee payer, insurance premium payer, tax agent) to submit to the tax authorities documents and (or) other information provided for by the Tax Code of the Russian Federation and other acts of legislation on taxes and fees, entails a fine under Article 126 of the Tax Code of the Russian Federation in the amount of 200 rubles for each unsubmitted document.

At the same time, in order to be held accountable in cases of submission of documents in an inappropriate form and (or) in an inappropriate manner, the fact of failure to submit the requested documents may be recorded by the tax authority, subject to the return of the specified documents to the taxpayer.

If facts of non-fulfillment of a requirement by a tax authority official are discovered, within 10 days from the date of discovery of the violation, an act must be drawn up, signed by this official and the person who committed such a violation (clause 1 of Article 101.4 of the Tax Code of the Russian Federation).

How is the fine amount calculated?

The document is considered as separate, regardless of the form of its expression (paper or electronic).

Each unsubmitted document must be separately named in the report on the detected offense and the decision of the tax authority.

When the requirement does not contain a specific list of requested documents and does not indicate their number, then there are no grounds for bringing to liability (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation No. 15333/07 of April 8, 2008).

Within the meaning of paragraph 1 of Article 126 of the Tax Code of the Russian Federation, the fine is collected based on the documents requested (specified in the request) and not submitted (untimely submitted) documents and cannot be determined by calculation.

A taxpayer cannot be held accountable if the number of documents he failed to submit is not reliably determined by the tax authority.

Establishing the amount of the fine based on the taxpayer’s presumable availability of at least one of the requested types of documents is unacceptable (Determination of the Supreme Court of the Russian Federation No. 302-KG15-19180 dated February 4, 2021).

Does failure to indicate in the request the number and details of the requested documents protect the taxpayer from liability?

The lack of quantity and details of documents in the requirement cannot always serve as a basis for exemption from liability, since the specified information is in the possession of the taxpayer himself, and not the tax authority. And, in particular, the taxpayer cannot but know about the number of invoices to be submitted, since he independently maintains a purchase book in which they are reflected (Determination of the Supreme Court of the Russian Federation No. 305-KG17-6715 of June 14, 2021).

In controversial situations, the tax authority can determine the amount of the fine based on the number of unsubmitted documents, united by generic characteristics (Resolution of the Arbitration Court of the East Siberian District No. F02-5551/2015 dated October 9, 2015).

Such groups can be invoices received, invoices issued, contracts with the counterparty, primary documents.

When preparing objections to an act that proposes to bring to liability under Article 126 of the Tax Code of the Russian Federation, and there are no circumstances excluding liability, it is recommended to declare the presence of mitigating circumstances. These include any circumstances that the court or tax authority considering the case may be recognized as mitigating liability (Article 112 of the Tax Code of the Russian Federation).

As mitigating circumstances, you can indicate reasons for extending the deadline for fulfilling the requirement, for example, sending a notice with a request to extend the deadline for submitting documents, as well as a short period of delay in fulfilling the requirement.

Submission of documents in electronic form

You can transfer the required documents to tax authorities in paperless form via telecommunication channels (TCS) using an enhanced qualified electronic signature (ECES) through an electronic document management operator (EDO) or through the website of the Federal Tax Service of Russia (for details about this method, see the link ).

Find out how to obtain an electronic signature from the publication .

Thanks to this opportunity you:

- avoid technical errors by using electronic formats;

- save your resources (no need to print documents and come to the inspection or post office to transfer (send) them);

- You are guaranteed to receive confirmation of document delivery.

To prepare and submit documents you have:

- 5 working days if the tax authorities are waiting for documents (information) from you about a specific transaction or counterparty in respect of which an audit is being carried out;

- 10 working days if documents are requested as part of a desk or on-site inspection of your company.

The deadlines are counted from the date of receipt of the request for the submission of documents.

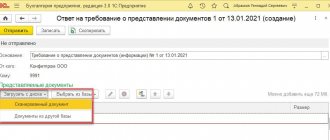

Editing the response to the Federal Tax Service's request to provide documents

Documents to be submitted is filled out in the response form

.

To edit the tabular part, select the line(s) and use the command bar buttons located above the tabular part (Fig. 16):

- Change

– to edit a document line;

- Remove current item

– to delete a document line from a response to a requirement or the entire requirement item with all document lines;

- Change requirement clause –

to change the number of the claim item;

- Move current element...

– to move a document line up or down within a requirement item group. To move a document to another requirement item, simply drag it while holding down the mouse button.

Rice. 16. Ready answer

Scanned images of paper documents: what to look for when presenting them

When submitting scanned images of documents drawn up on paper to tax authorities, be guided by:

- per paragraph 4 p. 2 tbsp. 93 of the Tax Code of the Russian Federation, which allows you to submit paper documents in electronic form in the form of electronic images of documents (documents drawn up on paper, converted into electronic form by scanning while preserving their details);

- Order of the Federal Tax Service of Russia dated January 18, 2017 No. ММВ-7-6/ [email protected] , which approved a universal inventory format for transferring scanned copies of documents to the tax office, allowing you to send scans of any papers to tax authorities;

- Federal Tax Service letter No. ED-4-2/ [email protected] , which notes the possibility of submitting any documents to the Federal Tax Service in electronic form using any software, if they are compiled in accordance with the formats established by the Federal Tax Service.

When deciding on the form in which to submit the requested documents to the tax authorities, do not forget that the tax authorities accept certain documents exclusively in electronic form. Find out more about this by following the link .

The Federal Tax Service requires documents again

On the one hand, the Federal Tax Service has the right to request documents again. On the other hand, the organization has the right not to submit documents that have already been submitted a second time.

If you receive a request to submit documents again, you need to notify the tax office that the documents were submitted earlier. Indicate the details of the first request for the provision of documents, and a list of previously provided documents with details.

Previously on the topic:

Is it prohibited to re-request documents?

However, if the tax authorities lose the documents “due to force majeure circumstances,” you will have to submit the documents a second time.

How to sign photocopies of documents

If documents are submitted in paper form, then a number of rules should be followed.

Photocopies of documents must be certified by the manager or other authorized person. You can also seal them if the organization has one. But this is optional. Tax officials allow not to certify the submitted copies with a seal, even if the company or individual entrepreneur has not abandoned the seal in its activities (letter of the Federal Tax Service of Russia dated 08/05/2015 No. BS-4-17 / [email protected] ).

The authorized person acts on the basis of a power of attorney issued by the manager. The power of attorney must be drawn up in accordance with the requirements of the law (Articles 185-189 of the Civil Code of the Russian Federation and subparagraph 1, paragraph 3, Article 29 of the Tax Code of the Russian Federation).

The signature on the photocopies is affixed in accordance with the registration procedure defined in clause 3.26 of GOST R 6.30-2003 (Resolution of the State Standard of Russia dated 03.03.2003 No. 65-st). This standard specifies the order in which the labels should appear. It looks like this:

Right

Position of the certifier Personal signature Initials, surname

date

It is necessary to take into account that the established procedure is advisory in nature, therefore it is considered optional (subclause 4, clause 1 of GOST R 6.30-2003). Thus, inscriptions can be located anywhere in the document.

For example:

Copy is right.

March 20, 2021

Smirnov

General Director of Orion LLC ———— Smirnov A.P.

M.P.

There is no need to notarize copies of documents (Clause 2, Article 93 of the Tax Code of the Russian Federation). But a situation may arise when you cannot do without a notary. Find out about this in the next section.

Presence of a seal imprint

As a rule, a copy of the document is certified by the seal of the organization. Meanwhile, from 04/07/2015, limited liability companies and joint stock companies are not required to have a seal (clause 5, article 2 of the Federal Law of 02/08/1998 N 14-FZ “On Limited Liability Companies” and clause 7, article 2 of the Federal Law dated December 26, 1995 N 208-FZ “On Joint-Stock Companies”). And its affixing is required on documents only if the company has not abandoned its use.

Despite this, the fiscal authorities issued a Letter in which they explained that documents submitted to the tax office are accepted regardless of the presence (absence) of a stamp in them until appropriate changes are made to the orders of the Federal Tax Service of Russia (Letter of the Federal Tax Service of Russia dated 05.08.2015 N BS- 4-17/ [email protected] ).

Opinion. Maria Smolyaninova, editor-in-chief of the publishing house Business Arsenal LLC

Few people know that GOST R 6.30-2003 is not the only document that establishes the composition of the certification inscription on a copy of a document of an ordinary organization. There is a normative legal act that was adopted back in 1983 and has not yet been officially repealed - Decree of the Presidium of the Supreme Soviet of the USSR dated 08/04/1983 N 9779-X “On the procedure for issuing and certification by enterprises, institutions and organizations of copies of documents relating to rights of citizens” (hereinafter referred to as Decree N 9779-X). Despite such a considerable age, this document is used in a mandatory (and not recommendatory) manner to this day; This is also confirmed by the fact that on December 8, 2003, amendments were made to it by Federal Law No. 169-FZ.

Unlike GOST R 6.30-2003, it does not directly indicate that the certification includes the word “True” (for example, in practice the phrase “Copy is true” is often used), and there are no explanations about what is included in “Signature” detail of the person attesting to the accuracy of the copy. For example, based on the text of Decree No. 9779-X, we can conclude that indicating the initials and surname of the official putting his personal signature is not mandatory. This is confirmed by judicial practice (Resolution of the Federal Arbitration Court of the Moscow District dated November 20, 2006 N KA-A40/11075-06 in case N A40-29722/06-129-219).

The sequence of arrangement of details for certification of a copy of a document is not fixed in Decree N 9779-X. But a number of additional points are highlighted.

1. Only the manager or another authorized official can certify a copy of the document (that is, only those employees who are officials are on the staff of the organization). In other words, even issuing a power of attorney with the right to certify the accuracy of copies of the organization’s documents to a third party (lawyer, employee of a law firm, specialist of an outsourcing company, etc.) formally does not allow the latter to sign when certifying a copy of the document on behalf of the company.

The authority to certify copies of documents by an employee of an organization who is not its manager should be established:

- in an internal document of the enterprise (such as a separate order or instructions for office work, etc.);

- and in a power of attorney (it is needed to represent the interests of the organization in relations with third parties);

- as well as in the employment contract with the relevant official (or in an amendment to it, and if there is a job description as a separate local regulatory act - and in its new edition), since certification of copies of documents on behalf of the organization is not only the right to sign and an imprint of the company's seal, but also the job responsibility of this employee, which should be performed properly.

The manager has the right to certify the accuracy of copies on the basis of the law (the corresponding provisions are in the Civil Code of the Russian Federation and laws on certain types of legal entities) and by virtue of the charter (or other constituent document) of the organization.

2. A note should be made about the location of the original document in the organization in which its copy is certified. Please note: Decree N 9779-X is based on the fact that an organization can certify copies of its documents. Copies of others can be certified by her only if the originals (for example, a letter received from a counterparty) are in the same organization. Therefore, you cannot certify copies of, for example, constituent and registration documents, local regulations, orders, instructions, etc. at your enterprise. other companies.

3. Finally, Decree N 9779-X clearly states that the accuracy of the copy is evidenced not only by the signature of an authorized person, but also by the seal of the organization. However, now, as was correctly noted above, printing is required only if it is available at the enterprise.

Thus, the mark on the certification of the copy in accordance with Decree N 9779-X should look like this: Correct. The original is located at Zeus LLC Chief Accountant <signature> I.I. Ivanova 11/12/2015 <stamp of Zeus LLC seal>

Does an individual entrepreneur need to have a power of attorney certified by a notary?

If the entrepreneur’s documents for submission to the tax office are certified by an authorized person, then a power of attorney certified by a notary is required (subclause 4, clause 2, article 11, subclause 2, clause 3, article 29 of the Tax Code of the Russian Federation).

The following people share the same opinion:

- judicial authorities (see decision of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57).

- officials of the Ministry of Finance (letters dated 03/24/2014 No. 03-02-08/12763, dated 08/01/2013 No. 03-02-08/30900, dated 11/15/2012 No. 03-02-08/99, dated 08/07/2009 No. 03- 02-08/66);

- tax authorities (letters from the Federal Tax Service of Russia dated August 22, 2014 No. SA-4-7/16692, dated October 16, 2013 No. ED-4-3/ [email protected] ).

How to make copies of documents

If the legislation does not provide for a copy of documents certified by a notary, then tax inspectors do not have the right to demand certified copies (subparagraph 2, paragraph 2, article 93 of the Tax Code of the Russian Federation, additionally letter of the Ministry of Finance of Russia dated December 7, 2009 No. 03-04-05-01/886 ).

Therefore, tax inspectors are provided with copies of documents certified by the manager.

A multi-page copy of the document must be bound and a single certification inscription must be placed on the firmware. The sheets are numbered and the total quantity is indicated on the certification inscription. It is necessary to stitch the sheets in such a way that subsequently there is no embroidering of the bundle, and there is free access for photocopying any sheet. All dates and signatures must be clearly visible on the copy of the document (letter from the Ministry of Finance of Russia dated 08/07/2014 No. 03-02-RZ/39142, Federal Tax Service of Russia dated 09/13/2012 No. AS-4-2 / [email protected] (clause 21) ).

If there are several documents, then the copies are certified separately and a certification inscription is placed on each one. The financial department reports this in its letters dated May 11, 2012 No. 03-02-07/1-122, dated October 24, 2011 No. 03-02-07/1-374, dated November 30, 2010 No. 03-02-07/1 -549 <1>, as well as the tax department in a letter dated 10/02/2012 No. AS-4-2/16459. The judicial authorities adhere to the same position (resolution of the Federal Antimonopoly Service of the Moscow District dated November 5, 2009 No. KA-A41/11390-09).

—————

<1> These letters refer to counter checks. Since the conditions for submitting documents at the request of the tax authorities are the same, they can also be applied to desk audits (clause 2 of Article 93, subclause 3 of clause 5 of Article 93.1 of the Tax Code of the Russian Federation).

You should not use used sheets to copy documents. On the reverse side there is information about the executor of the document - last name, initials and telephone number (letter dated 02/01/2010 No. 03-02-07/1-35).

ConsultantPlus expert M.A. Klimova answers about the specifics of preparing responses to the requirements of the Federal Tax Service. Get free trial access to the system and go to the video lecture.

Receiving a request from the Federal Tax Service and confirming its receipt

1C-Reporting service built into 1C programs

allows you not only to send regulated reports to regulatory authorities, but also ensures the receipt of documents from them in electronic form, and also provides convenient tools for preparing a response to the requirements of the Federal Tax Service, including the requirement to submit documents (information).

1C:ITS

For instructions on using the 1C-Reporting service in 1C programs, see the section “Instructions for accounting in 1C programs,” including on submitting documents as required by the Federal Tax Service.

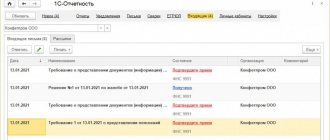

Requirements received from the Federal Tax Service are displayed in a single workplace 1C-Reporting

in

the Inbox

and

New

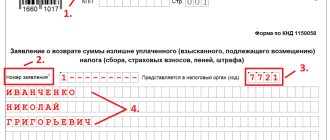

(Fig. 1).

In the list of incoming documents, the newly arrived request is highlighted in bold, and its status is set to Confirm receipt

.

Rice. 1. Receipt of request

If acceptance of the request is not confirmed within 6 business days from the date of sending, then the tax authority has the right to block the organization’s current account (clause 5.1 of Article 23, subclause 2 of clause 3 of Article 76 of the Tax Code of the Russian Federation).

The requirement is considered accepted by the taxpayer if the tax authority has received an acceptance receipt signed with the taxpayer’s electronic signature (clause 10 of Order No. 448).

To confirm receipt of a request from the Inbox

You can immediately follow the link

Confirm your appointment.

Or you can open the request form (Fig. 2) to first familiarize yourself with its contents, and only then confirm acceptance.

Rice. 2. Request form

The essence of the requirement is set out in a separate pdf file, which is attached to the electronic requirement and which can be opened using the link located under the caption Attached files

. The pdf file indicates the requested documents point by point, as well as the deadlines within which these documents must be submitted.

If there are grounds, the taxpayer generates a notice of refusal to accept, signs it with an electronic signature and sends it to the tax authority. To do this, just click on the Refuse

.

A notice of refusal is generated only in the following cases (clause 17 of order No. 448):

- the demand was sent to the taxpayer by mistake (it was intended for another addressee);

- the requirement does not comply with the established format;

- the requirement does not contain (does not correspond to) the electronic signature (ES) of an authorized official of the tax authority.

If there are no grounds for refusing to accept the request, then click on the Confirm Acceptance button.

The requested documents must be sent to the Federal Tax Service within the prescribed period, otherwise the taxpayer may be subject to a fine of 200 rubles. for each document not submitted (clause 1 of Article 126 of the Tax Code of the Russian Federation).

Demanding a scanned version of a document is illegal

The actions of tax inspectors are considered unlawful if, in addition to a certified copy of documents, a scanned version of the document on disk or in electronic form is requested.

Tax legislation does not provide for the presentation of a scanned version of a document on disk or in electronic form if a paper copy was previously provided (Article 93 of the Tax Code of the Russian Federation).

What fines can a company expect if it fails to submit counter-verification documents, see the article “What is the fine for failure to provide counter-verification documents?” .

Find out what time frame it takes to prepare and submit documents to the tax authorities here .

We discussed in this publication when it is possible not to comply with the requirements of the tax authorities.

Results

If the tax authorities have asked you for documents, you can submit them on paper or electronically. Paper copies must be certified by the signature of the manager and sewn in a certain way, and can be brought to the tax office in person (or through a representative) or sent by registered mail.

When transferring documents electronically, you need to take into account the requirements of the order of the Federal Tax Service of Russia dated February 17, 2011 No. ММВ-7-2/ [email protected]

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated February 17, 2011 No. ММВ-7-2/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Step-by-step instructions for filling out

The accompanying note to the power of attorney should look like this:

- In the upper right corner of the sheet, write the Federal Tax Service number, city, initials and surname of the manager, position held. If the letter is not written on letterhead, the sender’s details are also indicated.

- The outgoing number and date of compilation are indicated in the upper left corner. If the letter is a response, then it is necessary to indicate the request number and the date of its preparation.

- The name of the document is indicated in the center of the sheet. The title should express the essence of the letter. In this case, the letter should be called “On the direction of the power of attorney.”

- After departing a few lines from the title, you need to write an explanatory text. The first words should be “We are sending to your address” or “We provide you with a power of attorney.” Next, you need to indicate all the details of the power of attorney and information about the authorized person.

- Departing a few lines from the main text, you need to indicate on the left the position of the authorized person. On the same line in the middle of the sheet it is necessary to put the signature of the person and the seal of the organization. On the right there should be a transcript of the signature.

- Information about the artist is located in the lower left corner of the letter.

Points 1, 2, 5 and 6 are the same for all types of cover letters.

To the declaration

The document should be called “On the direction of the declaration.”

The accompanying text can be written as follows: “We are sending you the 3-NDFL declaration for 2021.”

Application:

Declaration 3-NDFL for 2021 - on 6 sheets in 1 copy.”

We wrote in detail about cover letters for declarations in these materials, and you can find out whether it is necessary to prepare this document for a personal income tax declaration here.

To the updated declaration

The document should be called “On sending an updated declaration.”

The text of the letter can be written as follows: “We are sending to your address an updated 3-NDFL declaration for 2021, drawn up in connection with an arithmetic error contained in the primary declaration (indicate your reason).

Application:

Updated declaration 3-NDFL for 2021 - on 6 sheets in 1 copy.”

To answer the demand

The document should be called “On the direction of documents.”

Example of a letter in response to a request:

“We are sending to your address, in accordance with the request for the provision of documents dated _ No. _, the following documents in order to verify the correctness of calculation of the VAT tax base for the second quarter of 2017:

- Issued invoices – on 5 sheets in 1 copy.

- Received invoices - on 5 sheets in 1 copy.

- Purchase book – on 8 sheets in 1 copy.

- Sales book – on 8 sheets in 1 copy.

- Current account statement – on 3 sheets in 1 copy.”

We wrote about how to correctly fill out such a VAT letter in another article.