Returnable (reusable) packaging is used in circulation many times and must be returned to the supplier, unless the contract provides for other conditions. The contract may also provide for the collection of a deposit by the supplier from the buyer as a guarantee of the return of the container within a specified period and in an undamaged condition.

Containers are accepted on the basis of invoices or other accompanying documents. If the actual quantity of containers and its quality characteristics do not correspond to the documents, then the discrepancies are documented in a document.

Rice. 1. Container movement

Which accounts account for returnable packaging?

Organizations engaged in trade and public catering keep records of returnable containers on account 41.03.

All other organizations account for returnable packaging on account 10.04.

Technological (necessary for the production process) and inventory containers (used for production or household needs) are accounted for in all organizations on accounts 01.01 or 10.01, depending on the service life and cost of such containers.

In addition, based on the decision of the management of the enterprise, it is possible to establish in the accounting policy the keeping of records of returnable packaging on off-balance sheet account 002, since such packaging does not become the property of the buyer.

Accounting for containers

A company can obtain containers in two ways: buy or make them themselves. Regardless of the method of receipt, it is taken into account in the amount of the actual cost, which includes the amounts paid for its purchase and transportation by transport, or all the costs spent on its production.

Accounting uses to account for packaging:

- account 10, containers are considered as a type of materials (subaccount “Containers and container materials”);

- account 41, containers are considered as a type of goods (sub-account “Containers under goods and empty”);

- account 01, packaging is considered as one of the types of fixed assets.

The second option is practiced by trading companies, as well as companies operating in the catering industry.

On account 01, containers of a technological nature and used for economic purposes are reflected if the service period is more than 12 months, otherwise account 10 is used.

In the same way, container equipment that must be returned by the buyer to the counterparty’s warehouse is taken into account.

Unusable containers are written off according to an act approved by an authorized employee.

Postings for write-off of containers

D91 K10, 41 – write-off due to natural wear and tear;

D94 K10, 41 – write-off due to damage.

The transfer of containers for disposal is issued with an invoice.

How to reflect the posting of containers in postings

Receipt of containers from the supplier is reflected at the prices established in the contract.

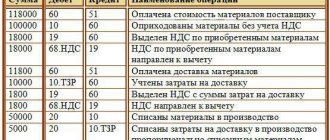

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 10.04 (41.03) | 60.01 | The packaging received from the supplier has been capitalized | 2500 | Invoice, agreement, certificate |

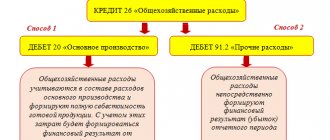

Typical transactions for account 41

In accordance with PBU, account 41 is an active accounting account, therefore, receipts of commodity assets will be reflected as a debit, and disposals as a credit. The movement of goods is reflected in correspondence with the accounting account of the company’s working plan of accounts, approved in the accounting policy. Let's look at typical postings for goods accounting:

- Debit 41 - Credit 60 - reflects the receipt of goods from the supplier. If an organization maintains separate accounting for a warehouse, then detailed account 41-01 will be used in the accounting records.

In addition to the purchase price of goods, an organization may also include in the accounting value of products purchased for sale some expenses associated with the acquisition of goods.

For example, the services of a third-party company for the delivery and unloading of goods to a warehouse. In this case, the wiring

- Debit 41 - Credit 15 - the cost of goods is formed through accounting account 15 “Procurement and acquisition of inventory items”.

In retail trade, the unit price of a product includes a trade margin. To form it, use the following entry:

- Debit 41 - Credit 42 “Trade margin”.

After the sale of goods, the trade margin is subject to write-off to account 90 “Sales” using the reversal method. Read more about this in the article “Revenue from the sale of goods is reflected: posting.”

Upon the sale of goods, a record is made of the write-off of the cost (accounting price) of material assets. Wiring:

- Debit 90 - Credit 41.

The write-off of shortages or damage to goods based on the results of an inventory carried out by the company must be reflected in the following entry:

- Debit 94 - Credit 41.

If errors are detected in accounting, special account 41-k “Adjustment of goods of the previous period” is used to correct them. This accounting account is used to make corrective entries after the closing of the reporting period.

How to reflect the return of packaging in transactions

The return of packaging to the supplier is processed by return posting. If the delivery of containers is carried out at the expense of the buyer, then he attributes these costs to the cost of the product (goods).

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 60.01 | 10.04 (41.03) | The container was returned to the supplier | 2000 | Invoice, agreement, certificate |

Combination of OSNO and UTII

If an organization combines the general taxation system and UTII for packaging, which is used both in activities transferred to UTII and in activities on the general taxation system, it is necessary to organize separate accounting for income tax and VAT (clause 9 of article 274, clause 4 and 4.1 Article 170 of the Tax Code of the Russian Federation). The cost of packaging, which relates to activities on the general taxation system, should be taken into account as part of material or non-operating expenses for income tax (subclause 2, clause 1, article 254, subclause 12, clause 1, article 265 of the Tax Code of the Russian Federation). You can use it to deduct VAT (Article 171 of the Tax Code of the Russian Federation). Do not take into account containers used in activities on UTII for tax purposes (clause 1 of Article 346.29 of the Tax Code of the Russian Federation).

How to reflect collateral containers in transactions

The supply agreement may set the price of the container against a deposit (for example, 80%), if it is not returned by the buyer, the amount of the deposit remains with the seller. When the packaging is subsequently returned, the supplier transfers a deposit.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 60.01 | The deposit amount for the packaging was transferred to the supplier | 400 | Agreement | |

| 60.01 | 10.04 (41.03) | Returning containers to the supplier | 500 | Invoice, agreement, certificate |

| 60.01 | Refund of the deposit for packaging by the supplier | 400 | Agreement |

Disposable containers

If the container is manufactured in an organization, then the costs of its production and repair are taken into account depending on the type of activity. In the case when the manufacture and repair of containers are part of the main activity, these costs are taken into account on account 20 “Main production”. In other organizations, such expenses are first collected on account 23 “Auxiliary production” and then written off as a debit to the inventory account.

Since disposable packaging cannot be returned to the supplier, its cost, as a rule, is included in the sales price and is not highlighted as a separate line. The procedure for writing off containers depends on the stage at which the products are packaged. When packaging occurs in production shops, it is written off to the debit of account 20 “Main production”; if packaging of products in containers occurs after they are delivered to the finished goods warehouse, then the cost of the container is written off to the debit of account 44 “Sales expenses”.

The buyer's disposable containers received from suppliers along with the goods are taken into account in accordance with clause 178 of the Methodological Instructions simultaneously with the receipt of goods. If the container is paid to the supplier in excess of the cost of the products packaged in it, then its receipt is reflected in the debit of account 10 or 41.

In trade organizations, accounting for transactions with containers has its own characteristics, since goods can be packaged both during their acquisition and during their sale. If packaging and packaging of goods is carried out upon their acquisition, then the cost of packaging materials is attributed to the increase in the cost of goods (debit to account 41, credit to account 41, sub-account “Container”), since according to clause 6 of PBU 5/01 to the actual costs of purchasing goods include the costs of bringing them to a state in which they are suitable for use for the planned purposes (costs of additional work, sorting, packaging and improving the technical characteristics of the received stocks, not related to the production of products, performance of work and provision of services).

If packaging of goods is carried out during its sale, then such expenses are included in the distribution costs of the trading organization (debit to account 44, credit to account 41, sub-account “Container”).

For the purposes of calculating income tax, expenses for operations with containers in accordance with paragraphs. 12 clause 1 art. 265 of the Tax Code of the Russian Federation are taken into account as part of non-operating expenses.

For the buyer, the cost of non-returnable containers and packaging accepted from the supplier with inventories is included in the amount of expenses for their acquisition (clause 3 of Article 254 of the Tax Code of the Russian Federation).

Example 1

The production association produces bolts, which are packaged at the finished product warehouse in cardboard boxes of 20 pieces. Boxes are purchased separately. The cost of the boxes is included in the price of the finished product and is not allocated as a separate line in the invoices to customers.

The following entries are made in accounting:

From the seller:

- D-t 10, K-t 60 - cardboard boxes were purchased;

- D-t 43, K-t 20 - finished products were received into the warehouse;

- D-t 44, K-t 10 - the cost of the boxes was written off when packaging the bolts.

From the buyer:

- D-t 41(10), K-t 60 - bolts were purchased in boxes.

Write-off of packaging that has become unusable

If part of the container has become unusable, then an inventory commission is created, which draws up an act for writing off the container, indicating the reasons for its damage.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 91, , 73 | 10.04 (41.03) | Containers that have become unusable are written off | 100 | Write-off act |

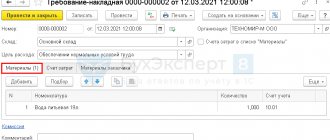

Analytical accounting on account 41

Analytical accounting is carried out in the context of two sub-contos, namely by storage locations (by warehouses) and, of course, by nomenclature. Please note that on all subaccounts 41 accounting by item is mandatory. The exception is subaccount 41.12.

As for accounting for warehouses, it depends on the characteristics of a particular company. In our training database, warehouse records are kept, so in the screenshots above you can see the specified warehouse everywhere. If there is no accounting of goods by warehouse, then only the “Nomenclature” subaccount will remain in the chart of accounts.

You can view the balances and turnover of account 41 and its subaccounts using the balance sheet. Below is an example from our training database.

In the comments after the article, you can share your experience in the field of goods accounting. If possible, give your own examples - this will help other novice accountants better understand the theory of accounting, as well as the 1C: Accounting program.

Example

Goods worth 6,000 rubles were transferred to the sales floor as a visual sample, incl. VAT 20%. A month later, the commission declared the goods damaged and decided to write them off. The act reflects the cost excluding VAT. No persons responsible for the damage have been identified; the goods deteriorated due to natural causes.

Postings:

- Dt 94 Kt 41 - 5000 rub.;

- Dt 44 Kt 94 - 5000 rub.

Let's use the conditions of the previous example, but determine that the goods were stored in a warehouse, and as a result of the negligence of the guilty party, they became unfit for use. The guilty person, who entered into a liability agreement with the organization, confirmed in an explanatory note his agreement to compensate for the damage in full.

Postings:

- Dt 94 Kt 41 - 5000 rub.;

- Dt 73 Kt 94 - 5000 rub.;

- Dt 50 Kt 73 - 5000 rub.

Here, the cost of the goods is attributed to the guilty parties, and then the debt is repaid by depositing cash into the cash register.

Is it necessary to restore VAT, previously accepted for deduction, when writing off goods with an expired shelf life or due to shortages, theft (theft), defects, fire, etc.?

Hello student

1.4.5. Accounting for barter transactions.

Barter (commodity exchange) are operations in which one party exchanges a certain amount of property (goods, fixed assets, etc.) for a corresponding amount of property of the other party.

A barter transaction is formalized by a corresponding agreement (contract). In a barter transaction, both parties to the agreement act simultaneously as both the seller and the recipient. A barter agreement by its legal nature is an exchange agreement, provided for by the Civil Code of the Republic of Kazakhstan dated December 27, 1994 in Article 235, paragraph 2, which states that the ownership of property that the owner has can be acquired by another person on the basis of a purchase and sale agreement , exchange, donation or other transaction for the alienation of this property.

In barter transactions, the conditions of equivalence of the exchanged property must be observed, which is achieved through the exchange at negotiated prices.

Mutual claims in barter transactions are regulated, as a rule, by additional supplies or a decrease in the supply of goods.

Resolution of the Cabinet of Ministers of the Republic of Kazakhstan dated July 19, 1995 No. 984 prohibited, from July 20, 1995, all economic entities of the Republic of Kazakhstan from carrying out export-import barter operations for all types of products and goods with countries near and far abroad. In this regard, we will consider the procedure for recording barter transactions carried out in the domestic market of the Republic of Kazakhstan. In accordance with the Law of the Republic of Kazakhstan “On taxes and other obligatory payments to the budget”, barter transactions for the payment of all taxes are considered as the sale of products, goods (works, services) at applicable prices.

The capitalization and write-off of the value of goods under barter transactions is generally carried out in the usual manner. A peculiarity of accounting for barter transactions is the mutual offset of receivables and payables under a barter transaction. The main accounting entries for accounting for barter transactions are presented in Table 9.

Table 9

Accounting for barter transactions

| No. n/n | Contents of business transactions | Document | Account correspondence | |

| Debit | Credit | |||

| 1. | Goods shipped under a barter agreement: | |||

| a) at negotiated prices | Invoice | 1280 | 6010 | |

| b) VAT | Invoice | 1280 | 3130 | |

| 2. | The cost of goods shipped via barter was written off at accounting (purchase) prices | Invoice | 7010 | 1330 |

| 3. | Goods received through barter at negotiated prices were accepted: | |||

| a) a car for business purposes | act of acceptance and transfer of fixed assets | 2410 | 3390 | |

| b) materials | invoice | 1310 | 3390 | |

| c) goods | invoice | 1330 | 3390 | |

| d) intangible assets | act of acceptance - transfer of intangible assets | 2730 | 3390 | |

| e) VAT on values accepted by barter | Invoice | 1420 | 3390 | |

| 4. | Barter payments have been offset | Reference | 3390 | 1280 |

1.5. Accounting for containers in trade

Most goods require packaging, i.e. packaging (stacking, installation) in certain containers, boxes, crates, containers. According to the Resolution of the Cabinet of Ministers of the Republic of Kazakhstan “On approval of the Regulations on the supply of products” dated June 19, 1992 No. 536, containers and packaging of products must comply with the requirements of standards or technical specifications, and contribute to the safety of products and goods during transportation. Suppliers are required to use reusable packaging, packaging equipment, packaging equipment, specialized containers and other types of reusable packaging, which are subject to return to the manufacturer (supplier) or delivery to packaging organizations (Article 470 of the Civil Code of the Republic of Kazakhstan). Thus, the container can be used once or used repeatedly (reusable container).

The cost of containers used to package products in the warehouse is reflected as follows:

Debit 7110 “Expenses for sales of products and provision of services”

Credit 1334 “Containers under goods and empty.”

At enterprises that buy and sell inventories in reusable containers, separate accounting must be provided for containers that:

— capitalized on the basis of shipping documents from suppliers;

— is not included in the supplier’s shipping documents and is capitalized on the basis of an act drawn up by the commission at the price of possible use;

- refers to fixed assets.

Containers arrive at enterprises along with inventory from suppliers and are accounted for on the basis of accompanying documents (waybills, invoices), in which they are highlighted as a separate line. Acceptance of containers is carried out on the basis of accompanying documents regarding quantity and quality. The release of empty containers (without goods) is documented in separate waybills, invoices and other expense documents.

Fight, damage, scrap of containers are documented in an act. The damage caused is recovered from the perpetrators in accordance with the established procedure.

Accounting for containers is carried out at storage locations by materially responsible persons in the commodity book or in warehouse accounting cards, entries in which are made on the basis of primary documents for the receipt or disposal of inventory. At certain times, financially responsible persons submit a material (commodity) report to the accounting department, which shows the receipt and disposal of containers for each document as separate items.

The container is taken into account:

— together with goods in wholesale and retail trade on account 1330 “Goods”;

— separately on account 1334 “Containers under goods and empty”;

- separately on account 2415 “Other fixed assets” if the reusable packaging corresponds to the characteristics of fixed assets.

Upon receipt of containers in accordance with accompanying documents from suppliers and other organizations, capitalization is made using the following entry:

Debit 1334 “Containers under goods and empty”

Loan 3310 “Short-term accounts payable to suppliers and contractors.”

If the container has the characteristics of fixed assets, then it is capitalized using the following entry:

Debit 2415 “Other fixed assets”

Loan 3310 “Short-term accounts payable to suppliers and contractors.”

Trading organizations for commodity transactions may have expenses, income and losses.

Packaging costs are costs associated with transportation, loading, unloading, repairs, etc.

Losses arise as a result of the mismanagement of materially responsible persons, resulting in damage, damage, scrap, and a decrease in the quality of the container.

An entity can receive income from containers, if the containers were received from suppliers free of charge, from the excess of the cost of the containers at delivery prices over the cost of the containers at discount prices.

Expenses for packaging are recorded on account 7110 “Expenses from the sale of products and provision of services”, and income - on account 6280 “Other income”.

Analytical accounting of containers is carried out by materially responsible persons, name, quantity, price.

Trade enterprises that sell inventory using reusable packaging that has deposit prices, which are set based on the actual cost of acquisition or procurement, are not subject to value added tax. The only exception is the shipment of returnable packaging, since, according to the Tax Code of the Republic of Kazakhstan, returnable packaging is packaging, the cost of which is not included in the cost of sales of the products sold in it and which is subject to return to the supplier on the terms and within the terms established by the contract for the supply of these products. If the container is not returned within the prescribed period, then such container is included in the sales turnover.

If the goods arrived in disposable packaging, which is included in the price of the goods or must be paid in addition to the cost of the goods, then this packaging, according to the Tax Code, is subject to VAT.

For reusable containers, a deposit is usually charged, allocated in the payment documents as a separate line, returned after the container is returned to the supplier, which is reflected in the supplier’s accounting records with the following entry:

Debit 1210 “Short-term receivables from buyers and customers”

Credit 1334 “Containers under goods and empty.”

The receipt of funds for containers at the deposit price is reflected by the entry:

Debit 1040 “Money in current bank accounts in tenge”

Loan 1210 “Short-term receivables from buyers and customers”

In the buyer’s accounting records are kept at the collateral value:

Debit 1334 “Containers under goods and empty”

Loan 3310 “Short-term accounts payable to suppliers and contractors.”

After transferring the deposit for the packaging to the supplier:

Debit 3310 “Short-term accounts payable to suppliers and contractors.”

Loan 1040 “Money in current bank accounts in tenge.”

If the container is returned to the supplier in good condition, the deposit is returned to the buyer in full:

Debit 1040 “Money in current bank accounts in tenge”

Credit 1334 “Containers under goods and empty.”

If the recipient of the package pays the seller at a price lower than the contract price, then the seller applies the difference to expenses:

Debit 7110 “Expenses for sales of products and provision of services”

Credit 1334 “Containers under goods and empty.”

For the return of containers to suppliers or packaging organizations, accounting entries must be made:

a) for the amount of income excluding VAT:

Debit 1210 “Short-term receivables from buyers and customers”

Credit 6280 “Other income”;

b) for the amount of VAT submitted:

Debit 1210 “Short-term receivables from buyers and customers”

Credit 3130 “Value added tax”;

c) writing off the cost of returned packaging:

Debit 7110 “Expenses for the sale of products and provision of services” Credit 1334 “Containers under the goods and empty”;

d) for writing off shortages, losses from damage to containers (scrap, broken, etc.): Debit 1630 “Other short-term assets”

Credit 1334 “Containers under goods and empty”;

e) for the posting of previously unaccounted for packaging and packaging received from suppliers without payment, as well as its surplus identified as a result of the inventory:

Debit 1334 “Containers under goods and empty”

Credit 6280 “Other income”;

f) for the costs of repairing containers carried out by a third party, according to the invoice presented for payment:

Debit 7110 “Expenses for sales of products and provision of services”

Debit 1420 “Value added tax”

Loan 3310 “Short-term accounts payable to suppliers and contractors”;

g) during internal movement of containers from one financially responsible person to another:

Debit 1334 “Containers under goods and empty” (warehouse 1) Credit 1334 “Containers under goods and empty” (warehouse 2).

1.6. Accounting for returned goods

Returning previously sold goods is a common phenomenon in the practice of many organizations. The return of goods by the buyer, like any business transaction carried out by an organization, must be properly documented and reflected in the accounting accounts.

If the goods previously transferred to the buyer are returned to the supplier on the grounds provided for by the Civil Code of the Republic of Kazakhstan or the contract, the buyer, in essence, reasonably refuses to fulfill the purchase and sale (supply) agreement, since, having transferred the goods to the buyer in violation of the requirements for quality and assortment , completeness, packaging, etc., the supplier did not properly fulfill its obligations under the contract. In this regard, the entries previously reflected in the accounting accounts for the sale of goods to the buyer must be clarified by making corrective entries.

All this will be reflected in the accounting accounts as follows:

Products shipped to customers:

a) the cost of shipped products is written off:

Debit 7010 “Cost of products sold and services provided”

Credit 1330 “Goods”

b) an invoice is presented to the buyer (for the agreed value) or income from the sale of products is accrued:

Debit 1210 “Short-term receivables from buyers and customers”

Loan 6010 “Income from the sale of finished products and services provided” - 684,300;

c) for the amount of value added tax on the contract value:

Debit 1210 “Short-term receivables from buyers and customers”

Credit 3130 “Value added tax”

d) for the amount of shipping costs:

Debit 7110 “Expenses for the sale of finished products and

services provided"

Credit 1040 “Money in current bank accounts in tenge”, e) payments received from the buyer for shipped products: Debit 1040 “Money in current bank accounts in tenge” Credit 1210 “Short-term receivables from buyers and customers”

If the buyer discovers a violation of quality requirements, an insufficient range of goods, the completeness or packaging is damaged, or a hidden defect is discovered, then the commission draws up a report and, if necessary, calls a representative of the supplier. Based on the act, a complaint is sent to the supplier, which is reflected on the invoices as follows:

Debit 1630 “Other short-term assets”

Loan 3310 “Short-term accounts payable

suppliers and contractors."

The supplier adjusts the volume of sales

goods reflected in accounting, on the basis of the invoice for the return of goods and the corresponding act.

If the goods have been accepted and capitalized, then after drawing up the act, all previous entries are reversed.

Previously made records on the shipment of products are reversed (using the “red reversal” method):

a) cost of shipped products:

Debit 7010 “Cost of products sold and services provided”

Credit 1330 “Goods”

b) contractual cost of shipped products: Debit 1210 “Short-term receivables from buyers and customers”

Loan 6010 “Income from the sale of finished products and services provided”

c) the amount of value added tax on the contract value: Debit 1210 “Short-term receivables from buyers and customers” Credit 3130 “Value added tax”

d) for the amount of shipping costs:

Debit 7110 “Expenses for sales of products and services provided”

Loan 1040 “Money in current bank accounts in tenge”

New products were shipped to replace the returned ones:

a) the cost of shipped products is written off:

Debit 7010 “Cost of products sold and services provided”

Credit 1330 "Products"

b) an invoice is presented to the buyer (for the agreed value) or income from the sale of products is accrued:

Debit 1210 “Short-term receivables from buyers and customers”

Loan 6010 “Income from sales of products and provision of services”

c) for the amount of value added tax on the contract value:

Debit 1210 “Short-term receivables from buyers and customers”

Credit 3130 “Value added tax”

d) for the amount of shipping costs:

Debit 7110 “Expenses for sales of products and provision of services”

Loan 1040 “Money in current bank accounts in tenge”

e) payments were received from the buyer for the shipped products: Debit 1040 “Money in current bank accounts in tenge” Credit 1210 “Short-term receivables from buyers and customers”

To confirm that the return of goods sold by the supplier was carried out in connection with justified claims related to improper fulfillment of its obligations, the supplier must have supporting documents. If the procedure for acceptance and documentation of goods by the buyer is established by the contract, documents confirming the identified discrepancies in quantity, quality, etc. must comply with the requirements of the contract. If the terms of the contract do not establish requirements for documenting acceptance, then acts are drawn up that are the legal basis for making claims to the supplier.

In the case of concluding an agreement for the purchase and sale of goods on credit, the buyer’s failure to fulfill the obligation to pay for the goods received gives the supplier grounds to demand the buyer return the goods or, in accordance with the agreement, pay fines (penalties, penalties).

Moreover, if, under the terms of the supply agreement, penalties are provided for violation of the terms of production, then the following accounting entry is made for the amount of fines (penalties, penalties) recognized by the supplier:

Debit 1630 “Other short-term assets” Credit 6280 “Other income”. Upon receipt of funds in compensation for penalties: Debit 1040 “Money in current bank accounts in tenge” Credit 1630 “Other short-term assets”

After the corresponding transactions for the return of goods are reflected in the accounting for the amount of the adjustment to the taxable turnover of VAT, the supplier issues an additional invoice in which the amount of the adjustment is indicated with a minus sign.

Reflection of goods return operations from suppliers:

- The actual cost of goods sold is written off:

Debit 7010 “Cost of products sold and services provided”

Credit 1330 “Goods”

- At the agreed price (excluding VAT);

Debit 1210 "Short-term receivables from buyers and customers"

Loan 6010 “Income from sales of products

and provision of services"

- For the amount of VAT on goods sold: Debit 1210 "Short-term receivables from buyers and customers"

Credit 3130 “Value added tax”

- For the contract price (excluding VAT) of returned goods of inadequate quality:

Debit 6020 “Return of sold products”

Credit 1210 "Short-term receivables from buyers and customers"

- For the amount of VAT on returned goods: Debit 3130 “Value added tax”

Credit 1210 "Short-term receivables from buyers and customers"

- For the actual cost of returned goods of inadequate quality:

Debit 7010 “Cost of products sold and services provided”

Credit 1330 “Goods”

- For the negotiated cost (excluding VAT) of transport services for the return of goods:

Debit 7210 “Administrative expenses”

Loan 3310 “Short-term accounts payable to suppliers and contractors.”

- For the amount of VAT according to the invoice of the trucking company for the return of goods:

Debit 1420 “Value added tax”

Loan 3310 “Short-term accounts payable to suppliers and contractors.”

If the buyer returns the goods to the supplier for other reasons, for example, due to the impossibility of selling them profitably, due to the lack of consumer demand, then the operation to return the goods is qualified by the supplier as the acquisition of this product and, accordingly, by the buyer - as a sale and is reflected in the accounting accounting of the original supplier in the manner prescribed for the acquisition of these goods. In this case, the original supplier duly fulfilled its obligations under the purchase and sale (supply) agreement, ownership of the goods transferred to the buyer, which entails recognition of the fact of sale for tax purposes.

1.7. Accounting for commodity losses and revaluation of goods

Transportation, storage and sale of goods in trade is accompanied in some cases by the formation of commodity losses. In trade practice, loss of goods can occur for both objective and subjective reasons. In this regard, it is customary to divide commodity losses into standardized and non-standardized. This division is important when writing off damage as a result of losses incurred.

Standardized losses are related to the physical and chemical properties of goods (natural loss, losses from broken goods in glassware, etc.), i.e. those that are objective in nature and therefore limit sizes (standards) are established on them. The norms for commodity losses are established by the state and published in the relevant regulatory documents. Losses of goods within the established norms are written off as the entity's expenses for the sale of goods.

Non-standardized losses arise, as a rule, as a result of mismanagement (breakage, scrap, damage to goods) or natural disasters. Writing off these losses requires identifying the causes and perpetrators of the losses.

Reducing commodity losses due to objective factors and the complete elimination of losses from mismanagement is one of the important problems, since these losses lead to a loss of turnover of an equivalent amount, respectively, and the income of the subject. If normalized commodity losses increase the subject’s expenses, then losses of goods due to the fault of specific persons are the immobilization of the subject’s assets until compensation for material damage is made. Therefore, in the conditions of market relations, the occurrence and write-off of such losses is unacceptable.