A fine is a monetary penalty from an organization for violating the rules established by current legislation or contracts concluded by the organization with its suppliers and customers.

Compliance with current legislation is verified by regulatory authorities, which are authorized to impose penalties in case of identified violations.

The tax inspectorate carries out its control function most frequently, imposing sanctions for various violations of tax legislation, including:

- for late submission of reports;

- for errors in reporting;

- for accepting cash without a cash register;

- for gross violation of the rules for accounting for income and expenses, and others.

If the organization owns vehicles, it will have to periodically pay traffic police fines for violating traffic rules.

Other control bodies that may impose sanctions during an inspection include:

- Rospotrebnadzor;

- Fire Inspectorate (EMERCOM);

- Sanitary inspection;

- Rostechnadzor;

- Labour Inspectorate;

- Federal Migration Service and others.

When an organization pays fines, the accounting entries depend on what the penalties were imposed for: for violation of tax laws or for other reasons.

In what cases may administrative sanctions be imposed on a company?

The Administrative Code contains dozens of articles, according to which a legal entity may be subject to penalties.

We list a number of the most common cases:

- In case of violation of traffic rules by drivers driving vehicles owned by the organization.

- In case of violations of labor legislation identified by Rostrud specialists.

- In case of violations of legislation on the protection of consumer rights by trade organizations.

- In case of violations of certain requirements of tax legislation that are not directly related to the payment of taxes (for example, deadlines for submitting declarations).

Deduction from contract security amounts

Correspondence in a government agency.

- Receipt of funds at temporary disposal (security under the contract):

D-t (KIF) 3. 201.11 (510) K-t (KBC) 3. 304.01 (730) - Transfer of penalties from a personal account to account for funds in temporary disposal to budget revenue:

D-t (KBC) 3. 304.01 (830) K-t (KIF) 3. 201.11 (610) - Receipt of penalty amounts to the administrator's personal account:

D-t (KDB) 1. 210.02 (140) K-t (KDB) 1. 209.40. (560) or (KDB) 1. 205.41. (560)

Correspondence in a budgetary (autonomous) institution.

Writing off in accounting the amounts of penalties from funds in temporary disposal and reflecting them as income:

D-t (KBC) 3. 304.01 (830)

Kit (KIF) 3. 201.11 (610)

D-t (KIF) 2. 201.11. (510) / D-t 17.01 (KOSGU 140)

Kit (KDB) 2. 209.40. (560) or

(KDB) 2. 205.41.

(560) The basis for transactions are documents confirming that the security remains with the institution:

- notification of clarification of client operations (f. 0531852) sent to OFC

- accounting certificate (f.0503833)

Administrative fine - accounting entries

The general principles for reflecting expenses in accounting are given in PBU 10/99 “Expenses of an organization.”

Because fines cannot be attributed to expenses directly related to the main activities of the company, they can be classified as other expenses in accordance with clause PBU 10/99. The list given in this paragraph is open, therefore, on its basis, penalties can also be recognized as expenses.

In accordance with the Chart of Accounts, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, account 91 is used to account for other expenses.

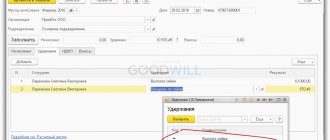

Thus, if the company is assessed fines, the accounting entries will be associated with this account. Regardless of the type of fine - traffic violation or labor inspection fine - the accounting entries will be the same:

DT 91.2 – CT 76 – charging a fine;

DT 76 – CT 51 – the fine is transferred to the budget.

If the company challenged the fines in court, but lost the case, the bailiffs can carry out the collection. In this case, the postings on the writ of execution will be similar to those discussed above.

Unlike accounting, tax accounting provisions contain a direct prohibition on including penalties transferred to the budget into expenses (clause 2 of Article 270 of the Tax Code of the Russian Federation).

In this case, there is a constant difference between the two types of accounting in the amount of accrued penalties.

Therefore, if an organization has accrued a fine, the entries must be supplemented with transactions to reflect tax differences in accordance with PBU 18/02. In this case, a permanent tax liability (PNO) arises. To determine its value, you need to multiply the permanent difference by the current income tax rate.

DT 99 – KT 68.4 – reflected PNO

Thus, if an organization has been assessed a fine, the entries relate not only to settlements with the budget, but also to the resulting tax differences.

Penalty when purchasing services

In addition to the Civil Code of the Russian Federation, the concept of a penalty, the procedures for its calculation and collection when purchasing services for state (municipal) needs are defined in Art. 34 “Contract” of Federal Law No. 44-FZ (hereinafter referred to as the Law). According to clause 4, securing the responsibility of the customer and supplier (contractor, performer) for non-fulfillment or improper fulfillment of obligations under the contract is a mandatory condition of the contract. Clause 6 contains requirements for the payment of penalties in case of delay in fulfilling obligations and in other cases of non-fulfillment (improper fulfillment) of obligations.

However, the Law also provides for a number of exceptions when the above requirements may not apply (Clause 15, Article 34). Exceptions include purchases from a single source, for example, for an amount not exceeding 100,000 rubles, or goods, works or services related to the scope of activity of natural monopolies.

According to the Law, in certain cases, in the manner prescribed by the Government of the Russian Federation, it is possible to grant a deferment in the payment of accrued amounts of penalties or to write them off. One of the criteria required for write-off is the size of the total amount of unpaid penalties. It should not exceed 5% of the contract price.

Compensation for traffic police fines at the expense of the guilty party

In accordance with Art. 238 of the Labor Code of the Russian Federation, the organization has the right to recover the paid fine from the guilty person. In this case, the driver may be found guilty.

If the organization that owns the vehicle was assessed a traffic police fine, the damage compensation transactions will be as follows:

DT 73 – CT 91.1 – the amount of the fine is allocated to settlements with the guilty person;

DT 70 – CT 73 – amount withheld from salary, or

DT 50 – CT 73 – the amount was voluntarily deposited into the cash desk of the enterprise.

Example

Driver Smirnov A.V. in a car owned by Alpha LLC, he exceeded the speed limit and was fined 1 thousand rubles. To reflect this fine for traffic violations in accounting, the accounting entries will be as follows:

DT 91.2 – CT 76 (1000 rub.) – fine charged

DT 76 – CT 51 (1000 rubles) – the amount of the fine is transferred to the budget

DT 99 – CT 68.4 (1000 x 20% = 200 rubles) – permanent tax liability reflected

DT 73 – CT 91.1 (1000 rubles) – the fine is assigned to the guilty person

DT 50 - CT 73 (1000 rubles) - the driver deposited the amount into the cash register.

To pay under the contract

In the case under consideration, the resulting counterclaim (penalty) presented to the supplier (contractor) is counted towards payment of the institution’s obligations under the contract.

When choosing this calculation method, a government institution must take into account several factors:

- It is advisable to include in the contract a condition that the fulfillment of obligations to transfer the penalty to budget revenue is assigned to the state customer;

- transfer the penalty yourself to budget revenue (the name of the counterparty for whom the penalty is transferred should be indicated in the payment document);

- make changes to the indicators of the budget obligation taken into account by the FC body.

It should be noted that the Budget Code of the Russian Federation does not provide for the execution of the budget by income by offsetting expenditure obligations (Article 218 of the Budget Code of the Russian Federation).

Correspondence in a government agency

- Reflection of amounts of obligations under the contract:

D-t (KRB) 1. 401.20 (ХХХ) or1.106.ХХ (310) Kit (KRB) 1. 302.ХХ (730)

- Reducing the amount of obligations by the amount of the penalty:

D-t (KRB) 1. 302.ХХ (830) K-t (KDB) 1. 209.40. (560) or(KDB)1. 205.41. (560)

- Transfer of withheld amounts of penalties to budget revenue:

D-t (KDB) 1. 210.02 (140) or(KDB) 1.303.05 (830) K-t (KRB) 1.304.05 (ХХХ) – code according to which execution is provided.

Correspondence in a budgetary (autonomous) institution

Let's consider a separate case when the contract is executed at the expense of subsidies allocated for other purposes (capital investments) and located in a separate personal account of the institution.

- Transfer of funds under the contract (minus the amount of the penalty):

D-t (KRB) 5 (6). 302.ХХ (830) Kt (KIF) 5 (6). 201.11 (610) / 18 (code KOSGU XXX) - Termination of counterclaim:

D-t (KRB) 5 (6). 302.ХХ (830) Kt (KRB) 5 (6). 304.06 (730) - Termination of counterclaim in the amount of the fulfilled claim under sanctions:

D-t (KRB) 2. 304.06 (830) K-t (KDB) 2. 209.40. (560) or(KDB) 2. 205.41. (560)

- Transfer of the amount of the penalty from a separate personal account to an account for accounting for transactions with institutional funds:

Dt (KRB) 5(6). 304.06 (830) K-t (KIF) 5(6). 201.11 (610) / 18 (KOSGU code XXX expenses) – disposal of funds from a separate personal account 21 (31).D-t (KDB) 2. 201.11 (510) / 17 (KOSGU code 140) – receipt of funds to the funds transactions account 20 (30). Kit (KRB) 2. 304.06 (730)

Correspondence regarding the termination of the counterclaim is reflected (based on certificate f. 0504833).

General provisions

Filing tax reports is the main responsibility of every taxpayer.

In addition to the fact that officials have developed and approved individual forms for each fiscal obligation, each type of reporting has its own deadline. If a company or entrepreneur delays a report, for example, forgets to send it to the Federal Tax Service, then he will be fined for failure to submit a declaration. Note that the deadlines for most of the fiscal obligations are approved in the Tax Code of the Russian Federation. However, exceptional rules apply for regional and local taxes. Thus, the authorities of a subject or municipal entity have the right to regulate individual deadlines for the provision of fiscal reporting, which will be valid only in the territory of a given region or municipal entity. For example, corporate property tax, transport or land tax.

Let us remind you that each tax, fee or other payment has its own forms and reporting forms, as well as deadlines by which information must be provided to the Federal Tax Service. If this is not done, the taxpayer will be punished - a fine will be issued for failure to submit a declaration or calculation. The reason for failure does not matter; punishment can be avoided only in exceptional cases.

Rules for accounting for fines on taxes and agreements

The company may be fined by the tax authorities, for example, for late submission of reports. Counterparties may impose fines for violating the terms of contracts. The opposite may also happen - the organization itself will receive monetary compensation from a supplier who did not ship the goods on time. Accounting for sanctions in each specific case has its own characteristics. Let's look at them in more detail.

Regulatory regulation

The traffic police fine is taken into account for accounting purposes in other expenses (clause 12 of PBU 10/99) and is reflected in account 91.02 (Chart of Accounts 1C).

Fines for violating traffic rules cannot be taken into account in tax expenses as they are not economically justified (Article 252 of the Tax Code of the Russian Federation). In addition, they are directly listed as expenses not taken into account for tax purposes (clause 2 of Article 270 of the Tax Code of the Russian Federation).

The amount of compensation for damage in the event of withholding it from the guilty person is included in income for income tax purposes (STS) on the date of recognition by the debtor or the date of entry into force of the court decision (clause 3 of Article 250 of the Tax Code of the Russian Federation, clause 1 of Article 346.15 of the Tax Code of the Russian Federation , paragraph 4, paragraph 4, article 271 of the Tax Code of the Russian Federation).

Labor legislation

In settlements with the employee, two options are possible:

- withhold the amount of the fine (Article 238 of the Labor Code of the Russian Federation),

- do not withhold the amount of the fine (Article 240 of the Labor Code of the Russian Federation).

Recovery of damages from the guilty person is carried out by order of the employer, which he must issue no later than a month from the date the amount of damage is established (Article 248 of the Labor Code of the Russian Federation).

Debt can only be collected through legal proceedings if:

- the month period has expired;

- the employee does not agree to voluntarily compensate for the damage caused to the employer;

- the amount of damage caused to be recovered from the employee exceeds his average monthly earnings;

- the employee undertook to compensate the damage voluntarily, but quit before the debt was fully repaid and refused to pay the debt.

The employee must provide written consent to reimburse the amount of the fine to the organization.

Personal income tax and insurance premiums

The organization may decide to forgive the employee for the damage, in which case the question arises about the need to impose personal income tax on the amount of damage.

There are two opposing opinions of regulatory agencies regarding the withholding of personal income tax from an employee in the event that the organization forgives the damage caused to it:

- The employee receives an economic benefit (income in kind) in the form of exemption from the obligation to compensate for direct actual damage in the amount of the undeducted fine (Article 41 of the Tax Code of the Russian Federation). Income is subject to personal income tax (Letters of the Ministry of Finance of the Russian Federation N 03-04-05/1660 dated 01/20/2016, dated 08/22/2014 N 03-04-06/42105, dated 04/12/2013 N 03-04-06/12341, dated 10.04. 2013 N 03-04-06/1183, dated 08.11.2012 N 03-04-06/10-310).

- The employee does not have any income, since the organization is held liable as the owner of the vehicle (Letter of the Federal Tax Service of the Russian Federation dated April 18, 2013 N ED-4-3 / [email protected] ).

If you decide to withhold tax, then for personal income tax accounting purposes:

- date of receipt of income - the day of forgiveness of the damage (date of the order, order for forgiveness) (clause 2, clause 1, article 223 of the Tax Code of the Russian Federation);

- date of personal income tax withholding - the date of the first cash payment in favor of the employee (clause 4 of article 226 of the Tax Code of the Russian Federation);

- the deadline for transferring personal income tax is the day following the day of payment to the employee (clause 6 of article 226 of the Tax Code of the Russian Federation).

The forgiven fine is not subject to insurance contributions, since no payments were made in favor of the employee (Article 420 of the Tax Code of the Russian Federation).

shtraf.jpg

Related publications

When it comes to fines for a company, the first thing that comes to mind is tax sanctions. Indeed, this is the most common situation in which a company incurs such costs. But in some cases, an organization also has to pay fines that are not related to tax violations. Let's consider in what cases this may happen and how to reflect fines in accounting.