Detailed turnover sheets for synthetic and analytical accounts serve for the purpose of summarizing accounting information for a separate period for accounting accounts. Summary tables of incoming/outgoing balances and turnovers are necessary for an accountant when drawing up a balance sheet and other forms of reporting, control and analysis of information. It is important to remember that the turnover sheet for synthetic accounts and the turnover sheet for analytical accounts are each formed in their own way and have differences. Let's look at the features of filling each in typical situations.

Classification of turnover sheets

The turnover (turnover balance sheet) shows due to what amounts of debit and credit turnover on an account (or accounts, or certain analytics allocated in a specific account) for a certain period, the value of the final balance was formed from the amount of the initial balance.

That is, a document such as a turnover sheet can be created in three main versions:

- SALT for the total set of synthetic accounts;

- turnover statement for a separate synthetic account or for several synthetic accounts;

- turnover sheet for a specific analytics allocated on a synthetic account, or for several such analytics.

Despite the availability of options, the structure of the turnover sheets will be the same. It will contain:

- balance at the beginning of the period;

- debit turnover;

- loan turnover;

- balance at the end of period.

It is more convenient to consider the algorithm for compiling the turnover sheet using the example of a separate synthetic account. Let this be account 71, which reflects transactions with accountable persons.

To learn about what other accounts can be used in accounting, read the article.

What does the balance sheet show?

Greetings, dear blog readers. Recently, one of my subscribers suggested that I review the balance sheet in an article for people who are not accountants, but who need to understand the basic information from this register. The article will also be useful for novice accountants and those studying this profession.

In this article we will look at the turnover sheet itself, what it consists of (its structure), briefly examine the basic concepts of accounting, without which it is difficult to understand the turnover sheet, we will understand how to draw up a turnover sheet, and also consider the most common accounts: account 10, account 20, count 41, count 43, count 60, count 62 and count 70.

What is a turnover sheet and what does it consist of?

Let's start with a definition. The balance sheet, also called the turnover sheet or turnover, is an accounting register that reflects the balances and turnovers (transactions) of all accounting accounts.

Previously, the balance sheet was compiled using the turnover sheet. If you studied to become an accountant, economist, or other professions where accounting is studied, you probably know the so-called end-to-end tasks, when you need to make entries, calculate account balances, draw up a balance sheet, and draw up a balance sheet based on it.

Nowadays, most often, the balance sheet is drawn up in the program and the turnover sheet is needed to see the turnover and account balances, and to reconcile the amounts if something does not add up in the balance sheet.

Here is an example of a balance sheet from the 1C Accounting 8 program.

It has the following columns. Account number, account name (sometimes the account name is skipped and only its number is given), then the balance (balance) at the beginning of the period (if the turnover is compiled for a month, then the balance is at the beginning of the month), turnover for the month and the balance (balance) at the end of the period .

Now, I think it’s clear where the name of this register comes from. Because it contains balances, in accounting language - balances and turnover for the period.

The columns with balances and turnovers, in turn, are divided into two parts: debit and credit.

These are two parts of the ledger account.

Please note that the debit and credit amounts for balances must be equal to each other, the same for turnover.

Active and passive accounting accounts

Accounts are the basis of accounting. With their help, all operations of the enterprise are reflected. The numbers and names of accounts can be viewed in the chart of accounts; all commercial organizations use the chart of accounts dated October 31, 2000, which has been in effect since 2001.

All accounts can be divided into two groups: active and passive.

Active accounts are accounts that record the organization’s property, that is, fixed assets, materials, goods, cash, etc.

In schematic form, an account can be represented as a table consisting of two parts, a debit on the left and a credit on the right. Debit is abbreviated as Dt , and credit is Kt .

The account balance at the beginning or end of the period is called the “balance.”

The amount of transactions during the reporting period is called account turnover. An account can have two turnovers - debit turnover (Obd) and credit turnover (Obk).

Active account scheme

| D-t | Kit |

| Сн – balance or balance at the beginning of the period | |

| Operations that increase the account | Operations that reduce the account |

| Obd—total amount of debit transactions | Obk—total amount of loan transactions |

| Sk (balance or balance at the end of the period) = Sn + Obd - Obk |

In an active account, the balance at the beginning and at the end of the period can only be in debit.

Example:

The balance on account 51 “Current accounts” at the beginning of the month is 20,000 rubles. Within a month, money was received into the current account in the amounts of 60,000 and 70,000 rubles and was transferred from the current account in the amounts of 40,000 and 50,000 rubles. Determine the balance of account 51 at the end of the month.

Let's draw a diagram of count 51:

| D-t | Kit |

| Sn – 20,000 rub. | |

| 60 000 | 40 000 |

| 70 000 | 50 000 |

| Obd— 130,000 | Obk— 90,000 |

| Sk = 20000+130000 – 90000=60 000 |

Passive accounts are accounts of the sources of property, that is, how this property is acquired. Sources can be own or borrowed.

Own - this is the authorized capital, retained earnings, etc. Borrowed – loans and borrowings.

Passive account scheme

| D-t | Kit |

| Сн – balance or balance at the beginning of the period | |

| Operations that reduce the account | Operations that increase the account |

| Obd—total amount of debit transactions | Obk—total amount of loan transactions |

| Sk (balance or balance at the end of the period) = Сн + Obk – Obd |

In a passive account, the balance at the beginning and at the end of the period can only be on the loan

Example:

The balance in account 80 “Authorized capital” at the beginning of the month is 10,000 rubles. Within a month, the founders made deposits in the amounts of 40,000 and 60,000 rubles and the capital was reduced in connection with the withdrawal of the founders in the amounts of 20,000 and 30,000 rubles. Determine the balance of account 80 at the end of the month.

Let's draw a diagram of the count 80:

| D-t | Kit |

| Sn – 10,000 rub. | |

| 20 000 | 40 000 |

| 30 000 | 60 000 |

| Obd—50,000 | Obk— 100,000 |

| Sk = 10000+100000 – 50000=60 000 |

How to prepare a balance sheet?

Data comes into circulation from accounting accounts. Let's create a register using the example of 51 and 80 accounts discussed above.

We will write the balance at the beginning of the month for account 51 in the column Balance at the beginning for Dt. We record the turnover in the “Turnover” column by debit and credit. Balance at the end in the column Balance at the end according to Dt.

For a count of 80 it will be a little opposite. The balance at the beginning of the month is recorded in the column Balance at the beginning by Kt. We record the turnover in the “Turnover” column by debit and credit. Balance at the end in the column Balance at the end according to Kt.

Please note that account turnover is recorded in both the debit and credit columns. But balances can be either debit or credit.

Balance sheet for account 10 “Materials”

This account is active, and it reflects all the materials that the company has. For example, a furniture manufacturing enterprise will have boards, fabric for upholstery, etc. as materials. A clothing company has: fabric, buttons, threads.

Other materials include stationery, gasoline and others.

Since this account is active, the opening balance will be in debit. It means how many materials are in stock at the beginning of the period. Debit turnover shows how many materials were received by the enterprise during the period. And for the loan - how much materials were written off. This account will always have a debit balance at the end of the period.

If suddenly the balance is on the loan (if you keep records in the program, there this amount is shown in debit, but in red and with a minus) - this means an error. That is, more materials were written off than actually existed.

Balance sheet for accounts 41 “Goods” and 43 “Finished products”

These accounts, like account 10, are active and they will have a similar structure in turnover.

Products are what a business buys or resells.

Finished products are what the company produces. For example, furniture, clothes, etc.

The balance at the beginning of the period is always in debit and means how many goods or finished products are in the warehouse at the beginning of the period. Debit turnover shows how many goods were received by the enterprise during the period or how many finished products were manufactured. And for the loan - how many goods and finished products were sold. This account will always have a debit balance at the end of the period. A balance with a minus sign means an error.

Balance sheet for account 20 “Main production”

This account collects the cost of finished products or services at the enterprise. For example, if a company is engaged in tailoring, this account reflects all the costs associated with it. Materials (fabric, buttons, threads, etc.), seamstresses’ salaries and deductions from it, depreciation of sewing equipment, rent and utilities and other expenses.

Account 20 is active. The balance at the beginning of the period is always in debit and means the balance of work in progress at the beginning of the period. For example, for a sewing enterprise, these will be unfinished and unfinished items.

Debit turnover shows the enterprise's expenses associated with the manufacture of products or provision of services. And under the loan, expenses are written off when products arrive at the warehouse or services are provided. This account will always have a debit balance at the end of the period. A balance with a minus sign means an error. This is exactly the option shown in the picture. On credit, expenses are written off, but on debit there is nothing. Therefore, the balance is shown in red and signals an error.

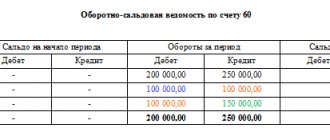

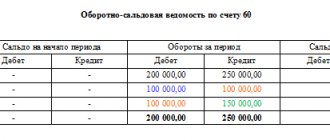

Balance sheet for account 60 “Settlements with suppliers and contractors”

This account is intended to record settlements with suppliers who supply the company with materials, goods or services.

And here we will encounter another type of account - active-passive. The difference between these accounts is that they can have a balance of both debit and credit.

Otherwise, they retain the structure either an active structure (transactions that increase the account are shown as a debit, and those that decrease as a credit) or passive (on the contrary, transactions that decrease the account are shown as a debit, and those that increase as a credit).

Account 60 refers to active-passive accounts with a passive structure. This means that the debit will show a decrease in our debt to the supplier, and the credit will show an increase. The account credit balance shows that we owe the supplier a certain amount.

And if the balance turns out to be a debit, this means that the supplier owes our company. This may happen if we have transferred an advance to the supplier, but the supplier has not yet provided materials, goods or services.

Balance sheet for account 62 “Settlements with buyers and customers”

Settlements with customers are carried out on this account. It is also active-passive, but with an active structure. That is, the debit of the account shows an increase in the debt of customers to our company, and the credit shows its decrease.

The debit balance of the account shows that the buyer owes our company a certain amount.

And if the balance is on the loan, this means that our company owes the buyer. This may happen if we received an advance from him, but have not yet provided goods, finished products or services.

Balance sheet for account 70 “Settlements with personnel for wages”

And finally, the account is 70. Settlements with the organization’s personnel are taken into account on this account.

Account 70 refers to active-passive accounts with a passive structure. The debit shows a decrease in our debt to staff, and the credit shows an increase. The account credit balance shows that we owe the employees a certain amount.

And if the balance turns out to be a debit, this means that the employees owe our company. This may happen if the company, for example, transfers advances to employees.

I hope the article helped you understand what the balance sheet shows. The material turned out to be very voluminous, so if something is not clear or you have other questions, for example, about other accounts, ask them in the comments.

Share the article on social networks, ask questions in the comments and subscribe to my Instagram

Visit my second blog

All courses on accounting and 1C

If you need individual training, consultations and other services for working with 1C, take a look at the “Consultations” section

Start working in 1C cloud

For more information about what the balance sheet shows, watch the video:

Did you like the article? Share on social media networks

Turnover sheet for synthetic account 71: formation features

Let’s assume that an employee of an organization, Ivanov, received cash from his employer in the amount of 10,000 rubles. for household needs, and his colleague Petrov - travel allowances in the amount of 20,000 rubles.

A week later, Ivanov reported on the use of funds, providing an advance report with supporting documents in the amount of 9,000 rubles. Petrov brought the employer a similar set worth 19,000 rubles.

Read about the features of preparing an advance report here.

What will the turnover sheet look like for account 71, reflecting these business transactions?

The turnover sheet is a table, the columns of which have the following names:

| Account (sub-account) / Analytical characteristics of a sub-account | Balance at the beginning of the period | Period transactions | balance at the end of period | |||

| Debit | Credit | Debit | Credit | Debit | Credit | |

In the first column of the turnover sheet, the following is recorded:

- synthetic account;

- the subaccount in which transactions are recorded, if it is entered into the applicable chart of accounts (in our case, it is entered and has the designation 71.01);

- analytical characteristics of this subaccount (can be anything; for 71 accounts these are the names of the employees to whom cash is issued).

Filling out the columns of the turnover sheet occurs on the basis of data from primary accounting documents according to the accounting entries corresponding to these documents. If accounting is carried out manually, then each of the transactions recorded in accounting is entered into the turnover sheet in chronological order. In accounting programs, this register is generated automatically.

ConsultantPlus experts explained which accounts should be used in accounting and how to properly conduct analytical accounting:

If you do not have access to the K+ system, get a trial online access for free.

Statement as a register

Accounting registers are used to register, systematize and accumulate information from primary documents (Article 10 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ). Their forms of organization are developed independently and approved as part of their accounting policies for accounting purposes. But it is important that such accounting registers have the mandatory details required by law.

Registers can be maintained using both synthetic accounting accounts and analytical data. Accordingly, they are called synthetic and analytical registers. And one of the most popular is the turnover sheet for synthetic accounting accounts.

SALT for account 71: sample filling with postings

For our example, the fact of issuing funds to Ivanov and Petrov in the amount of 10,000 and 20,000 rubles, respectively, is first recorded. These transactions correspond to the following transactions:

- Dt 71.01 Kt 50 - in the amount of 10,000 rubles;

- Dt 71.01 Kt 50 - in the amount of 20,000 rubles.

Let's reflect them on the turnover sheet:

- enter the amounts 10,000 and 20,000 rubles. in the “Debit” column opposite the corresponding analytical characteristics of the subaccount (these are the names of employees Ivanov and Petrov);

- we add up the 2 available figures that form the debit of subaccount 71.01, and indicate in the turnover sheet the resulting total amount of 30,000 rubles. in the “Debit” column opposite this subaccount;

- if no other operations were carried out on synthetic account 71 (let’s agree that this is the case), we duplicate the amount of 30,000 rubles. in the “Debit” column opposite account 71.

As soon as Ivanov and Petrov bring their advance reports and checks, we draw up the postings:

- Dt 10 Kt 71.01 - in the amount of 9,000 rubles;

- Dt 26 Kt 71.01 - in the amount of 19,000 rubles.

On the turnover sheet:

- enter 9,000 and 19,000 rubles. in the “Credit” column opposite the employees’ names;

- we add up the figures for credit transactions, and the resulting value is 28,000 rubles. We enter in the “Credit” column opposite the subaccount 71.01, as well as the main synthetic account 71.

If the opening balance is zero, then in order to determine the balance at the end of the period and indicate it in the turnover sheet, you need to subtract the smaller ones from the larger values indicated in the columns under the cell “Turnover at the end of the period”. If 1st is recorded in the Debit column and 2nd is recorded in the Credit column (as in our scenario), the results are recorded in the Debit column under the Ending Balance cell. In this case it consists of:

- from 1,000 rub. according to Ivanov’s reports (enter this amount next to Ivanov’s last name);

- 1,000 rub. according to Petrov’s reports (we record opposite the name Petrov).

In turn, in the “Debit” column under the “Balance at the end of the period” cell opposite subaccount 71.01, the indicators of all analytical characteristics of the subaccount are summarized. That is, in our case, we will fix here the amount of 2,000 rubles. We duplicate this value in the “Debit” column under the “Balance at the end of the period” cell opposite the synthetic account 71.

Thus, based on the results of transactions, a debit balance for account 71 is recorded in the turnover sheet. Its total amount is 2,000 rubles.

A finished sample of the turnover sheet reflecting the above operations will look like this:

| Account (sub-account) / Analytical characteristics of a sub-account | Balance at the beginning of the period | Period transactions | balance at the end of period | |||

| Debit | Credit | Debit | Credit | Debit | Credit | |

| 71 | 30 000,00 | 28 000,00 | 2 000,00 | |||

| 71.01 | 30 000,00 | 28 000,00 | 2 000,00 | |||

| Ivanov | 10 000,00 | 9 000,00 | 1 000,00 | |||

| Petrov | 20 000,00 | 19 000,00 | 1 000,00 | |||

For other nuances of filling out the SALT, read the material “How can you check the balance sheet” .

Synthetic and analytical accounts, their purpose and relationship

In order to obtain different, according to the level of generalization, information in accounting, two groups of accounts are used: synthetic and analytical.

Synthetic account – designed for consolidated grouping and accounting of homogeneous accounting objects.

Analytical account - designed for detailed characteristics of objects.

Example:

43 “Finished products” is a synthetic account.

Analytical accounts - at an agricultural enterprise - grain, at an industrial enterprise - cement, at a food industry enterprise - ready-made meals, etc.

Entering accounting objects into synthetic accounts is called synthetic accounting, and entering analytical accounts is called analytical accounting. Synthetic accounting is carried out in monetary terms, analytical accounting in quantitative and total terms (for example, “Finished products” in synthetic accounting is carried out in monetary terms, in analytical accounting in centners, tons, etc.).

The connection between analytical and synthetic accounts is manifested in the following:

- Synthetic accounts are detailed using analytical accounts.

- A business transaction reflected in a synthetic account must be taken into account in the corresponding analytical account.

- On a synthetic account, the operation is recorded as a total amount, and on an analytical account in partial amounts, resulting in the (same) total amount.

- The initial and final balances, debit and credit turnovers of the synthetic account must be equal to the sums of the corresponding balances and turnovers of the analytical accounts.

Concept and characteristics of subaccounts

Some accounts do not require further detail, so analytical accounts are not opened (For example: cash register, current account). An intermediate link between synthetic and analytical accounts are subaccounts.

Subaccounts are a way of grouping analytical account data.

| Synthetic account | Subaccount | Analytical account |

| 10 "Materials" | 1. Raw materials | Salt, sugar, preservation |

| 2. Purchased semi-finished products and components, structures and parts | Semi-finished sour cream | |

| 3.Fuel | Dis. fuel, coal, gas, firewood, peat, gasoline. | |

| 4.Containers and packaging materials | Boxes, bags | |

| 5.Spare parts | Tires, battery | |

| 6.Other materials | ||

| 7.Materials transferred for processing to third parties | ||

| 8.Building materials | Boards, bricks, cement | |

| 9.Inventory and household supplies | Rakes, shovels | |

| 10.Special equipment and special clothing in stock | Specialist. clothes in warehouse | |

| 11.Special equipment and special clothing in operation | Specialist. clothes in use |