Of course, the responsibilities of the chief accountant often have a wider range of tasks. Including: collection and generation of data necessary for the preparation of management reporting, exercising a leadership function in the process of implementing a corporate information system.

Based on this, an applicant for the position of chief accountant of a holding must have extensive experience in the field of accounting and tax accounting, have up-to-date professional knowledge and be a competent manager.

Requirements for hiring a chief accountant:

- Completed higher education in economics . This requirement does not exclude the possibility of hiring a chief accountant with a different education. However, it is the economic direction that makes it easier for the applicant to further expand existing skills in accounting (AC) and taxation, and gain knowledge in related areas such as banking, financial analysis, budgeting, and organizational economics.

- Professional experience 3–5 years . This may be the performance of the duties of the chief accountant (deputy), head of the tax department. In addition, the applicant for the position may have experience working with audit organizations and outsourcing firms.

- The correlation of one or more of the candidate's previous jobs with the current one . An applicant who was previously the chief financier of a small organization of 50 people may not be able to cope with the functions of the chief accountant of a large holding company whose accounting department has more than 100 employees. An undeniable advantage is experience in the same field in which the employer specializes.

Additional clauses to be included in the employment contract with the chief accountant

Since this position involves access to information that is confidential and classified, it is worth including a clause in the employment contract obliging him to observe trade secrets. Law No. 129-FZ uses the concept of “trade secret” for information contained in accounting registers and internal accounting reports. Persons authorized to have access to such information must be responsible for its disclosure.

In addition, the specifics of the work of a chief accountant require a busy schedule. Therefore, irregular working hours can be included in an employment contract as one of the main conditions. Of course, this mode of work, specified in the contract, gives the employee the right to the guarantees specified in Part 1 of Art. 119 of the Labor Code of the Russian Federation, including for additional paid days to the main vacation.

The law determines the minimum amount of additional leave for an irregular working day at three days. However, internal labor regulations or a collective agreement may increase the number of days of additional leave if additional features of work with irregular working hours are provided.

Due to the nature of the work performed, the chief accountant is not entrusted with any material assets. This position is not on the list of positions with which it is necessary to conclude agreements on full individual financial responsibility. The job responsibilities of the chief accountant do not include receiving funds and material assets. Consequently, the agreement on full liability with him has no legal force and will be declared invalid in any court .

The employer has the opportunity to protect itself from fraud when concluding an employment contract with the chief accountant by adding to the document a clause on the employee’s full financial liability in the event of damage to the organization, in accordance with Art. 243 Labor Code of the Russian Federation.

Material damage can be caused by careless actions of the chief accountant, as well as improper performance of his duties. Only untimely taxes transferred to the budget can result in large fines. In accordance with Art. 243 of the Labor Code of the Russian Federation, a clause on full financial liability is prescribed in the employment contract; in this case, the employer has the right to withhold the entire amount of damage caused from the chief accountant. Otherwise, the deduction from the chief accountant can be made once within the limits of the average monthly salary.

But it should be noted that in judicial practice there are cases when they refuse to recover damages even if there is a provision for compensation for damages in the employment contract. For example, if, through the fault of the chief accountant, a fine was imposed on the organization for not submitting reports on time (Appeal ruling of the Moscow City Court dated December 18, 2015 N 33-45565/15).

Requirements for an accountant when applying for a job in government agencies

In addition to the basic conditions imposed, government agencies may also impose additional ones:

- first of all, this is compliance with the requirements of Federal Law 79 and professional standards;

- knowledge of the Constitution of the Russian Federation and the norms and acts that determine the specifics of this particular enterprise;

- compliance with the intricacies of accounting and reporting;

- taking into account class ranks and length of service of employees of ministries and departments when calculating wages;

- understanding the procedure for forming a budget and spending its funds, reporting on the results.

Labor function of an accountant

After the HR department employee indicates all the mandatory conditions and information in the employment contract, it is necessary to spell out in detail all the responsibilities of the future chief accountant of the enterprise. The employee needs to clearly understand what duties he will perform and what he is responsible for.

The labor function can be specified in the employment contract, but I recommend that it is better to consolidate the responsibilities in the job description. The instructions themselves can be issued as a separate document or as an annex to the employment contract. Please note that the responsibilities of the chief accountant depend directly on the organization’s application of the professional standard . If the qualification requirements do not apply to an accountant, indicate the approximate functionality of the employee.

In the “Employee Rights and Responsibilities” section, indicate:

- rights and obligations that are provided for by law and are mandatory for all employees. You can take the professional standard “Accountant” as a basis;

- rights and responsibilities provided in the organization for a specific position.

The question is often asked whether it is legal to enter into an employment contract with the chief accountant without the right to sign. If such a condition is necessary, then the contract states that the right to sign is assigned to the director (Order No. 0 dated 00.00.00).

Job description of the chief accountant. The organization does not apply professional standards.

Qualification requirements for chief accountants are established by the professional standard “Accountant” (Order of the Ministry of Labor of Russia dated February 21, 2019 N 103n). If these requirements apply to the chief accountant, then describe the employee’s labor functions based on the order of the Ministry of Labor.

According to the new requirements of the professional standard, depending on the category of the position, the chief accountant must have certain qualification requirements. He must have at least seven years of experience in this position, with secondary specialized education. If he has a higher specialized education, then five years of experience is enough to be employed as a chief accountant.

An additional advantage when hiring will be the availability of certificates of completion of professional retraining programs for accountants, as well as advanced training courses.

Job description of the chief accountant taking into account the requirements of the professional standard.

The employer has the right to establish other requirements for the candidate if they relate to business qualities, are related to the specifics of the enterprise's production activities and are not related to discrimination.

When compiling the section “Rights and Obligations of the Employer”, rely on Art. 22 of the Labor Code of the Russian Federation. If necessary, you can indicate additional rights and obligations of the employer that are not expressly provided for by law. For example, the employer’s obligation to provide an employee with a voluntary health insurance policy.

Instructions for filling out an order for the appointment of a chief accountant

The first thing that needs to be indicated in this document is the date the order was generated and its number according to internal document flow. The date of creation of the order will be considered the date the new chief accountant takes office, unless otherwise specified in a separate paragraph in the order.

Then you should enter the last name, first name and patronymic (without abbreviations) of the person who is appointed chief accountant. Just below you need to specify on what basis the employee is hired: temporary or permanent.

Filling out the nature of the job

In small enterprises, chief accountants are often forced to travel to the bank, tax office, Pension Fund, Social Insurance Fund and other government agencies. In this case, the question arises: how to organize a trip of this type?

There is no clear answer to this question. Therefore, if the chief accountant will have to frequently travel to other organizations, it is recommended that he be assigned a traveling nature of work with compensation for the corresponding expenses, and the employee’s job description can indicate how often and where he will travel.

Notify the Social Insurance Fund about hiring your first employee

This needs to be done in two cases:

- The employee is hired under an employment contract.

- The employee is hired under a civil contract, which provides for contributions for injuries.

You must register with the Social Insurance Fund within 30 calendar days after signing the contract. If you don’t make it in time, you face a fine: 5,000 rubles up to 90 days of delay, longer - 10,000 rubles. The procedure for registering with the FSS is approved by regulations. To register you will need:

- statement;

- a copy of your passport;

- workers' work books;

- civil contracts with employees, if they provide for contributions for injuries.

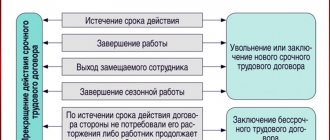

Termination of an employment contract with the chief accountant

In the “Change and termination of the employment contract” section, indicate the procedure for changing the contract and its termination. The chief accountant may be dismissed for additional reasons:

- when the owner of the enterprise changes (Article 81 of the Labor Code of the Russian Federation);

- for an unreasonable decision, due to which the company’s property was not preserved, was used for other purposes, or when damage was caused to the employer (Clause 9, Part 1, Article 81 of the Labor Code of the Russian Federation).

We will pay special attention to the termination of employment relations when the owner of the organization changes. This is an additional basis for termination established by clause 4 of Art. 81 of the Labor Code of the Russian Federation, is regulated in detail by other norms of the Labor Code of the Russian Federation. The new owner has three months if he wants to fire the chief accountant (Part 1 of Article 75 of the Labor Code of the Russian Federation). In this case, no evidence of dishonesty or insufficient qualifications of the chief accountant is required; the only necessary condition is a change of owner.

If the new owner signed an additional agreement with the chief accountant. agreement to the employment contract (changes in wages, duties, other conditions), then after this it is impossible to formalize dismissal, since this is unlawful, even within a three-month period.

The signing of the agreement is documentary confirmation that the new owner has decided to work with the chief accountant on new terms. After all, the legislation gives the new employer the right to choose - to continue working with the chief accountant or to fire him. If a decision is made to part with an employee, compensation must be paid, and the law defines a minimum amount - no less than three times the average monthly salary (Article 181 of the Labor Code of the Russian Federation).

In the “Final Provisions” section, describe the procedure for resolving possible disputes and disagreements between the employer and employee.

Features of the appointment of a chief accountant

When appointing a new chief accountant of an organization, a procedure is always carried out to transfer authority from the employee who previously held this position. At the same time, the new chief accountant himself determines the period for which he is ready to accept accounting documents (according to the law, accounting documents must be stored in the archives of the enterprise for at least five years). In cases where a deep detailed verification of documents for a five-year period is impossible, especially close attention should be paid to the reporting for recent months, as well as to those documents that will be needed in the near future.

Thus, by the time he leaves office, the previous chief accountant is required to submit tax and accounting reports for the last period.

If cases are accepted at the beginning of the next reporting period, then he is obliged to present to the new employee all primary documentation in full, accounting journals and notebooks and a ready balance of working capital for the past period. That is, a new accountant, before taking over the management of affairs, is obliged to check:

- primary reporting documents (receipt and expense orders, payment orders, payslips);

- accounting documents for working with cash register equipment, cash book;

- books of purchases and sales;

- securities registration journal;

- log of powers of attorney;

- invoice register;

- availability and registers of check books of banking organizations;

- other documents.

In fact, the transfer of affairs from one chief accountant to another is somewhat similar to an on-site tax audit.

Requirements for chief accountants of individual organizations

The professional standard sets special (increased) requirements for chief accountants of individual organizations. Such organizations include, in particular:

- joint stock companies;

- insurance organizations and non-state pension funds;

- joint stock investment funds;

- management companies of mutual investment funds.

The chief accountants of such organizations are obliged to:

- have higher education;

- have work experience related to accounting, preparation of accounting (financial) statements or auditing activities for at least 3 years out of the last 5 calendar years;

- in the absence of higher education in the field of accounting and auditing, the work experience of the chief accountant must be at least 5 years out of the last 7 calendar years;

- not have an unexpunged or outstanding conviction for crimes in the economic sphere.

Chief accountants of credit and financial organizations must meet the following special requirements:

- have a higher legal or economic education;

- experience in managing a department or other division of a credit institution whose activities are related to banking operations, at least 1 year;

- If the candidate has another higher education, relevant work experience must be at least 2 years.

Results

A job description is a fairly important document that defines the specific functions of an employee. Since the chief accountant is one of the serious figures in any organization, his job description should be given special attention.

Sources:

- Resolution of the Ministry of Labor of the Russian Federation dated August 21, 1998 No. 37

- Law “On Accounting” dated December 6, 2011 N 402-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Why do you need a job description?

This document is of great importance both for the management of the enterprise and for the accountants themselves. It allows the first to competently coordinate and manage the work of subordinates, and the second to clearly understand work functionality and responsibility. In addition, in the event of controversial situations that require resolution in court, the job description can serve as evidence of the presence or absence of guilt on the part of the employee or employer. The more carefully and accurately the requirements for the employee are spelled out, as well as his rights, responsibilities and other points of the job description, the better.