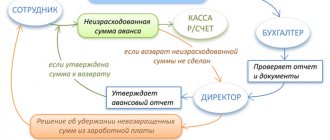

Upon receipt of money for reporting, the employee of the enterprise undertakes to provide documents confirming the fact of spending the money and to return unused amounts. 3 working days are allotted for drawing up the report and submitting it to the accounting department after returning from a business trip or the end of the period of using accountable funds. If the responsible person did not report on time using an advance report or did not return the balance of the advance funds, the employer can recover the money issued in several ways.

Question: How is the deduction from an employee’s salary of the balance of the accountable amount issued to pay for travel expenses not returned in a timely manner reflected in accounting? The employee returned from a business trip and submitted an advance report on time, according to which the balance of the unspent accountable amount (advance), previously issued to the employee in cash from the cash register, amounted to 5,500 rubles. The final payment for the advance report was not made by the employee within the prescribed period. Based on the order of the manager and with the written consent of the employee, the unreturned accountable amount is withheld from the employee’s accrued wages. Income and expenses are accounted for tax purposes using the accrual method. Operations related to the calculation and payment of wages to the employee, from which the deduction is made, are not considered in this consultation. View answer

Is the employee’s consent required to withhold an accountable amount?

An employee can return unspent funds in cash and deposit them into the company’s cash desk. But if he does not have the opportunity to repay the debt on time, then several options are allowed for deducting it from his salary.

Labor Code in Art. 137 provides for the employer’s right to return unspent accountable amounts. Refunds are available in several options:

- At the request of the employee . In this case, the employee writes a free-form application addressed to the employer, where he asks to withhold accountable amounts from his income.

- By decision of the employer through the issuance of an order to withhold accountable amounts from the employee.

It is impossible to obtain accountable amounts by order without the prior consent of the employee. The employee’s consent to withholding must be obtained in writing so that regulatory authorities do not have a reason to hold the employer liable.

Expert opinion

Gusev Vladislav Semenovich

Lawyer with 10 years of experience. Specializes in criminal law. Member of the Bar Association.

Consent may take the form of a statement from the employee, or he may sign the order to withhold the accountable amount and indicate there that he does not dispute the grounds for the withholding and the amount of the debt.

The employer can also provide the employee with a preliminary written notice of the amount of the upcoming deduction, where he must sign.

Also in practice, the following scenarios are possible:

- If there is a disagreement between the employer and the employee regarding the amount of debt, or the employee refuses to return the money voluntarily, then the employer must go to court . In this case, the limitation period for debt collection is three years.

- Company management may decide to write off debt by recognizing it as employee income . It is important to consider that this amount will become taxable income and personal income tax must be transferred from it from unused accountable amounts. Forgiveness of debt to an employee is formalized through the issuance of an appropriate order.

Documents grounds for retention

The basis for issuing an order may be an application received from an employee to withhold a certain amount.

But if such an application has not been previously received, then a form such as an advance report is used to collect the debt from the employee. The accountable person fills it out independently. It must contain the following information:

- Employer name.

- Full name of the accountable person , place of work.

- Dates of expenditure according to primary documentation.

- Name of the primary document.

- Expense amount.

As appendices to the expense report are primary documents that confirm the amount of expenses: checks, cash orders, etc. If the expense report writes off daily expenses that do not have primary documentation, then it simply states the amount of daily allowance that is approved by the enterprise in internal documentation.

In the final line of the expense report, the accountable person indicates the amount spent by him, and the accountant checks how much it corresponds to the amount he received.

When the amount of funds written off according to the advance report is less than what was issued to the employee, then he develops a debt to the employer. It is from the advance report that the amount of debt for the withholding order is taken.

The employee is given 3 working days to prepare an advance report and submit it to the accounting department after returning from a business trip or the end of the period for using funds for the report. If the advance report has not been submitted, then the entire accountable amount becomes the employee's debt to the employer.

What an accountant needs to remember when issuing money for reporting

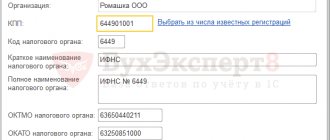

The issuance of money on account is regulated by the instruction of the Bank of the Russian Federation dated March 11, 2014 No. 3210-U, which establishes the procedure for conducting cash transactions (hereinafter referred to as procedure No. 3210-U). Based on its provisions, there are 3 main points that every accountant needs to remember when issuing money for reporting:

- Accountable funds are issued on the basis of a written application from the person receiving the funds or an order from the manager. The required details of such an application include (except for the full name, position and signature of the applicant): the amount of accountable funds, the period for which the money is issued, the date and signature of the manager who authorized the release of funds into account (clause 6.3 of order No. 3210- U). A sample application can be viewed on our website.

ATTENTION! From November 30, 2020, an administrative document can be drawn up for several cash payments to one or more employees. In this case, you need to indicate the name, amount and period for which the money is issued for each employee.

What other innovations in the procedure for recording cash transactions have come into effect, ConsultantPlus experts told. Get trial access to the K+ system and go to the review material for free.

2. The deadlines for issuing money for reporting may be established by accounting policies or a separate order. This will make it easier for accountable persons to write statements, and for an accountant to check the timing of refunds. Legislatively, there are no established boundaries for the periods for which money is issued for reporting purposes. Each enterprise resolves this issue independently.

IMPORTANT! The enterprise must have an order stating who has the right to receive money on account. We have a sample of such an order on our website.

- The accountable person is obliged to report the accountable amount or return unused funds to the enterprise's cash desk within the number of days established by the employer after the end of the period for which he was given the money. If the money was issued for a business trip, the accountable person is obliged to report within the period established by the employer after returning.

Another important nuance is the maximum possible amount that can be reported. This has its limitations.

We recommend that you look at the material “What amount can be issued for reporting in 2021 - 2021?”

Rules for drawing up an order

The employer is obliged to issue an order to deduct from the salary within a month after it becomes aware of the employee’s debt. If the specified deadlines are missed, then you will have to go to court to collect the amount of the debt, or the employee will first have to write an application for withholding.

The employee draws up an application to withhold accountable amounts in a free format.

The order should include the following information:

- Employer company name.

- Title of the document.

- Full name of the accountable person and his position.

- Date of issue of the order and place (city).

- Circumstances of issuing the accountable amount : when it was issued and for what purposes (for example, in connection with a business trip).

- Amount of funds subject to withholding.

- List of attachments (this may be a notice of withholding, an advance report, or a written statement from the employee).

In the order, the head of the company can appoint a person responsible for withholding money from wages. Usually this is an accounting employee who is responsible for payroll.

The deduction is made on the next day of payment of wages. It can be made from both an advance payment and a final payment.

It is worth considering that even if there is a correctly executed order to withhold and the employee’s consent has been obtained, the employer is not always able to withhold the accountable amount that has not been returned to him at a time. This is due to the fact that the provisions of labor legislation limit the amount of deductions from the employee’s income.

Results

When issuing imprest amounts, the enterprise accountant is obliged to keep records of the timing of their return. If the accountable does not timely report for the amounts issued (or does not return them), it is possible to deduct them from the salary. The procedure for such retention can be initiated by both the employee and the employer.

More information about how to collect a report from the director of an enterprise can be found in the article “Five effective ways to reset the accumulated report of a director.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Deduction amount

Thus, the employer has the right to withhold from wages an accountable amount that was not spent by the employee. The deduction is made through an application by the employee or by order by order of the employer.

In any case, you must obtain consent from the employee to withhold, otherwise the debt can only be recovered through legal proceedings. A debt on accountable amounts is incurred by an employee if he does not provide an advance report within 3 days after starting work or the amount on the report is less than what was issued to him.

How to write a consent text?

Consent is drawn up in writing in a free style. The standard structure of the application is taken as an example, including the following details:

- addressee details - head of the organization;

- details of the applicant - accountable person;

- title and title of the document;

- text;

- applicant's signature;

- day of writing the application.

The text deciphers the essence of consent. The phrase may begin with the words “I agree to be deducted from my salary...” or “I ask to be deducted from my salary...”.

The main thing is that it should be clear from the text that the employee is not against the fact that money will be collected from him.

Example of a statement text:

Is it possible to deduct an account from your salary?

Art. 137 of the Labor Code of the Russian Federation gives the employer the right to collect debt for unused accountable amounts.

However, for this he must perform a series of sequential manipulations:

The company can deduct the debt from wages.

True, it is not always possible to do this peacefully, so the matter may end in forced collection.

How to collect funds from an employee’s earnings?

The employer sets for its personnel the period for which accountable amounts are issued.

Within 3 days after its end, employees must submit an advance report to the accounting department confirming the actual expenditure of funds for their intended purpose.

If the employee was on sick leave, on vacation or a business trip at that time, he has the right to make an advance report and return the remaining funds upon returning to his place of work.

If an employee has unspent money, he simply deposits it into the company’s cash desk. However, things don't always work out so smoothly.

Sometimes the employee is simply unable to make a return.

Expert opinion

Gusev Vladislav Semenovich

Lawyer with 10 years of experience. Specializes in criminal law. Member of the Bar Association.

Then, based on the consent of the employee and the issued deduction order, the accountant can withhold the accountable amount from the salary in an amount not exceeding 20% of the monthly salary. This limitation is established by Art. 138 Labor Code of the Russian Federation.

The specified maximum withholding amount is calculated from income minus personal income tax.

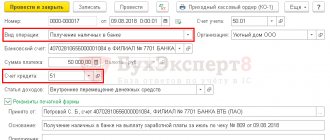

Let's look at what this looks like using a specific example.

Example

Kuzin Ivan Petrovich went on a business trip, he was given 10 thousand rubles for his account.

He returned earlier and reported using an advance report only for the amount of 2 thousand rubles.

The employee did not have the opportunity to return the money to the cashier. But he agreed in writing to monthly deductions from his salary in the amount of 20%.

The employee's accrued monthly salary is 25 thousand rubles.

To retain the debt, the accountant must perform the following manipulations:

It turns out that in 2 months with such a salary, the accountant will collect the entire debt.

Foundation documents

The primary document by which the employee’s debt for accountable amounts to the enterprise is revealed is the advance report of form No. AO - 1, approved by the employer.

It reflects the amounts issued to the employee and documented expenses.

However, it is impossible to collect a debt from an employee only on the basis of an advance report.

For this purpose, based on the written consent of the employee, an order is issued to withhold unspent accountable amounts from the salary.

This will be the basis for collecting the amount of the debt.

If the employee does not give consent and no agreement is reached, then the employer needs to file a lawsuit.

Then the document - the basis will be an executive document: a court order or a writ of execution.

However, at least a month and a half will pass before such a document is received, during which time the employee may have time to resign.

Then the collection will no longer be handled by the employer, but by the bailiff - the procedure for withholding is by order of the bailiffs.

Is the employee's consent required?

According to Article 137 of the Labor Code of the Russian Federation, the employer can make deductions from the employee’s salary if the latter does not dispute the grounds and amounts of deductions. Therefore, in order to avoid problems in the future, it is recommended to obtain the written consent of the employee.

Only if there is an application from the employee can an order be issued and a penalty imposed.

The legislation does not provide for a special form of written consent; it is drawn up in free form, but must contain all relevant information.

If the employee does not give consent, the employer will have to apply to the court with a demand to collect the debt forcibly.

statements of consent to collect the accountable amount from wages - word.

Order to withhold accountable amounts

The employer's decision is formalized in the form of an order or instruction.

The specific form of the order has not been approved at the legislative level, but it is recommended to include the following mandatory points in the document:

- Company name;

- name of the form, in connection with which it was compiled;

- Document Number;

- Date of preparation;

- a demand for debt collection for an accountable amount indicating the amount of withholding and personal information of the debtor;

- from what date and in what amount should deductions be made from wages;

- who is responsible for monitoring the execution of the order;

- signature of the manager and employee from whom deductions will be made;

- the document indicates the basis for issuing the order: the employee’s consent.

The order is drawn up on a sheet of A-4 format without errors. If the document contains false information, the employer risks being held liable for penalties without reason.

sample order to withhold an accountable amount from a salary - word.

Accounting and tax accounting

The employee's debt for accountable funds is his obligation to the employer. The amount may be transferred to the income category if the company’s management decides to forgive the debt. After the period of pre-trial settlement of the problem (1 month), insurance premiums are charged on the amount of debt. The amount of contributions can be offset or refunded if one of the conditions is met:

- the employee voluntarily returned the funds;

- the amount of debt was counted as expenses on the basis of an advance report and documents confirming the targeted nature of the expenses.

There are two ways to write off debt from dismissed employees:

- through spending part of the reserve for doubtful debts;

- through attributing the amount of debt to financial results.

In the first case, a posting is made between the debit of 63 and the credit of 71 accounts, in the second, the debit turnover is recorded for 91 accounts, and the credit entry is recorded for 71 accounts. Simultaneously with these correspondences, the amount is reflected in off-balance sheet accounting in account 007. In off-balance sheet accounting data, information about written off bad debts of this type must be displayed for 5 years from the date of closure of the debt.

Nuances of tax accounting

The fact of issuing monetary resources to an employee for reporting purposes is not the basis for the occurrence of an expense transaction in accounting. The balance of unused funds returned by the employee cannot be attributed to the income of the enterprise. The amount of accountable amounts is not taken into account when calculating income tax; it must be shown as part of accounts receivable.

Debts recognized as bad are written off in tax accounting as non-operating expenses. To transfer a debt to the category of bad debt, it is necessary to document the fact that the statute of limitations has expired. When applying the simplified tax system (with any type of taxable object) or UTII, written off bad receivables cannot reduce the tax base.

Accounts, postings

Accounting for accountable amounts is maintained in 71 accounts. If the balance of funds given to the employee in advance is not returned in a timely manner, the amount of the debt is considered a deficiency in the accounting records. Deductions of accountable amounts are carried out as a reduction in the amount of the shortfall attributed to a specific responsible person. Typical correspondence in this accounting segment is as follows:

- D71 – K50 or 51 – the issuance of money for reporting is reflected;

- D94 - K71 - unspent accountable amount not paid into the cash register on time is classified as a shortage;

- D70 - K94 - the balance of accountable funds was withheld from wages (with the written consent of the debtor);

- D73 - K94 - indicates a debt on accountable funds that cannot be repaid from the monthly earnings of an individual;

- D50 or 51 - K73 - a record is drawn up in situations where the employee voluntarily closes the debt and when the required amount is forcibly repaid by a court decision;

- D91 – K73 – recording the fact of debt forgiveness;

- D70 – K68 – income tax was calculated on the forgiven amount of debt;

- D91 - K69 - shows the accrual of insurance premiums on accountable amounts that moved from the group of debts to the category of employee income.

Upon dismissal

Sometimes, at the time of dismissal, an employee has an outstanding amount of accountable amounts.

If the employee’s consent to withhold has already been taken, and an order for the enterprise has been issued, a recovery of no more than 20% is also made from the calculated amounts.

The employee can voluntarily deposit the balance of the debt into the company's cash desk upon receipt of the payment upon dismissal.

To do this, the accountant prints outgoing and incoming cash orders at the same time.

When the amount of debt is revealed immediately at the time of dismissal, the employer must follow the same course of action as with a working employee.

If an employee does not want to pay the outstanding amount, the employer does not have the right to delay his dismissal.

He can collect the amount of the debt after it has been settled.

To do this, you must first submit a statement of claim to the court, then with a court order to the bailiffs.

conclusions

On the topic of deducting unspent accountable amounts from salaries, we will draw several main conclusions:

- An employee can deposit the amount of debt voluntarily through the enterprise's cash desk using a cash receipt order.

- You can deduct a debt of no more than 20% of your monthly salary. A percentage is withheld from accrued wages minus personal income tax.

- To maintain accountability, it is necessary to obtain the employee’s consent and issue an appropriate order.

- If there is no desire to pay the debt, the employer has the right to collect it through a judicial authority. Then deductions will be made on the basis of the writ of execution.