An employment contract with an accountant is a contract in which it is necessary to take into account the specifics of hiring such a specialist: pay special attention to the “Responsibility” section, the probationary period and the conditions for its termination.

The position of chief accountant is one of the key positions in almost every organization. Such a specialist is traditionally the second person after the director and belongs to the management team. When drawing up an employment contract with him, it is necessary not only to fulfill the requirements of Article 57 of the Labor Code of the Russian Federation, which provides general features for such contracts, but also to provide for important points that are inherent in this position.

Employment contract with an accountant or chief accountant: when is it needed?

Almost all relationships in business are built on the basis of contracts. A contract is a written agreement about mutual obligations. The hiring of a person for any position must also be marked by the signing of an employment contract, which usually indicates:

- place of work;

- position and functions assigned to the employee;

- the first day of work, and, if necessary, the last or the period of validity of the contract and performance of work duties;

- the amount of salary or tariff rate, the volume of incentive and compensation payments, the basic rules for their payment;

- work schedule;

- other conditions.

Find out what rights, duties and responsibilities of the chief accountant are provided for by law here.

It is also important to indicate the place, date of conclusion of the contract and information about both parties.

The position of chief accountant (or accountant who fully maintains records of an economic entity) is no exception. In addition, it must be taken into account that this position is one of the most significant, since the chief accountant bears enormous responsibility for the preparation of tax, accounting and other reporting, for the accuracy of the information reflected in it. Therefore, the employment contract with the chief accountant must reflect additional key points regarding the performance of labor functions. Which? More on this later.

Download in word a sample employment contract with an accountant 2018

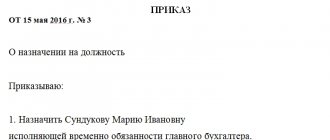

EMPLOYMENT CONTRACT

with an accountant

| G. ____________ | "___"________ ___ G. |

____________________________________________________________ (name of the employer), hereinafter referred to as "Employer", represented by _________________________________________ (position, full name), acting on the basis of ________________________________________ (documents confirming authority), on the one hand, and ___________________________ (full name . employee), hereinafter referred to as ____ "Employee", on the other hand, collectively referred to as the "Parties", have entered into this agreement as follows:

1. SUBJECT OF THE EMPLOYMENT CONTRACT

1.1. The Organization undertakes to provide the Employee with work as an accountant, provide working conditions provided for by labor legislation and other regulatory legal acts containing labor law norms, a collective agreement (if any), agreements, local regulations and this agreement, pay timely and in full The Employee receives a salary, and the Employee undertakes to personally perform the functions of a broker and comply with the internal labor regulations in force at the Employer.

1.2. The work under this agreement is the main one for the Employee.

Option. 1.2. Work under this employment contract is a part-time job for the Employee.

1.3. The Employee's place of work is _____________________________________________ <2>.

1.4. The employee reports directly to _____________________.

1.5. The employee is subject to the following working conditions at the workplace:

— ___________________________________________ <3>.

(specify class, subclass of working conditions)

1.6. The Employee’s labor duties are not related to the performance of work in areas with special climatic conditions.

1.7. The employee is subject to compulsory social insurance against accidents at work and occupational diseases.

1.8. Working conditions in the workplace comply with the requirements of the current legislation of the Russian Federation in the field of labor protection, taking into account the specifics of the Employee’s labor functions.

1.9. The Employee undertakes not to disclose legally protected secrets (official, commercial, other) and confidential information owned by the Employer and its counterparties.

2. DURATION OF THE AGREEMENT

2.1. The Agreement comes into force on the date of its conclusion by the Employee and the Employer (or from the day the Employee is actually admitted to work with the knowledge or on behalf of the Employer or his representative).

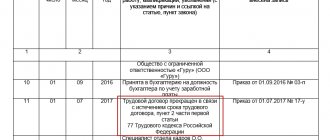

2.2. Start date: "__"__________ ____

2.3. The contract is concluded for an indefinite period.

Option. 2.3. The contract was concluded for a period of ____________ in connection with ___________________________ (circumstances (reasons) that led to the conclusion of a fixed-term contract) <4>.

Option. 2.4. In order to verify the compliance of the Employee’s qualifications with the position held and his attitude to the work assigned to him, a probationary period of ____ (_________) months <5> is established from the date of commencement of work.

If during the probationary period the Employee comes to the conclusion that the work offered to him is not suitable for him, then he has the right to terminate this employment contract at his own request by notifying the Employer in writing three days in advance.

3. OBLIGATIONS OF THE PARTIES

3.1. The employee reports directly to _____________________.

3.2. The employee is obliged:

3.2.1. Perform the following job responsibilities:

- carry out work on maintaining accounting records of property, liabilities and business operations (accounting for fixed assets, inventory, production costs, sales of products, results of economic and financial activities, settlements with suppliers and customers, as well as for services provided, etc.) P.);

— participate in the development and implementation of measures aimed at maintaining financial discipline and rational use of resources;

— receive and control primary documentation for the relevant areas of accounting and prepare them for accounting processing;

— reflect on the accounting accounts transactions related to the movement of fixed assets, inventory and cash;

— compile reporting calculations of the cost of products (works, services), identify sources of losses and unproductive costs, prepare proposals for their prevention;

— accrue and transfer taxes and fees to the federal, regional and local budgets, insurance contributions to state extra-budgetary social funds, payments to banking institutions, funds to finance capital investments, wages of workers and employees, other payments and payments, as well as deductions of funds for material incentives for employees of the organization;

— provide managers, creditors, investors, auditors and other users of financial statements with comparable and reliable accounting information in the relevant areas (areas) of accounting;

— develop a working chart of accounts, forms of primary documents used for registration of business transactions for which standard forms are not provided, as well as forms of documents for internal accounting reporting, participate in determining the content of basic techniques and methods of accounting and technology for processing accounting information;

— participate in the economic analysis of the economic and financial activities of the organization based on accounting and reporting data in order to identify intra-economic reserves, implement savings regimes and measures to improve document flow, in the development and implementation of progressive forms and methods of accounting based on the use of modern computer technology, in conducting inventories of funds and inventory items;

— prepare data on the relevant areas of accounting for reporting, monitor the safety of accounting documents, draw them up in accordance with the established procedure for transfer to the archive;

— perform work on the formation, maintenance and storage of a database of accounting information, make changes to reference and regulatory information used in data processing;

— participate in the formation of the economic formulation of problems or their individual stages, solved with the help of computer technology, determine the possibility of using ready-made projects, algorithms, application software packages that allow the creation of economically sound systems for processing economic information.

3.2.2. Comply with the internal labor regulations established by the Employer, production and financial discipline, and conscientiously perform your job duties specified in paragraphs. 3.2.1 of this employment contract.

3.2.3. Take care of the Employer's property and not disclose information and information that is a trade secret of the Employer.

3.2.4. Do not give interviews, conduct meetings or negotiations regarding the activities of the Employer without the permission of its management.

3.2.5. Comply with labor protection, safety and industrial sanitation requirements.

3.3. The employee has the right:

- to provide him with the work specified in this employment contract;

— for timely and full payment of wages;

— for rest in accordance with the terms of this employment contract and the requirements of the legislation of the Russian Federation;

— other rights granted to employees by the Labor Code of the Russian Federation.

3.4. The employer undertakes:

3.4.1. Provide the Employee with work in accordance with the terms of this employment contract. The Employer has the right to require the Employee to perform duties (work) not stipulated by this employment contract only in cases provided for by the labor legislation of the Russian Federation.

3.4.2. Ensure safe working conditions in accordance with the requirements of safety regulations and labor legislation of the Russian Federation.

3.4.3. Pay bonuses and remuneration in the manner and on the terms established by the Employer, provide financial assistance taking into account the assessment of the Employee’s personal labor participation in work and in the manner established by the Regulations on Remuneration and other local acts of the Employer.

3.4.4. Carry out compulsory social insurance for the Employee in accordance with the current legislation of the Russian Federation.

3.4.5. Pay for training, if necessary, in order to improve the Employee’s qualifications.

3.4.6. Familiarize the Employee with labor protection requirements, Internal Labor Regulations and other local regulations related to the Employee’s professional activities.

3.5. The employer has the right:

— encourage the Employee in the manner and amount provided for by this employment contract, the collective agreement, as well as the terms of the current labor legislation of the Russian Federation;

— bring the Employee to disciplinary and financial liability in cases provided for by the current labor legislation of the Russian Federation;

— carry out certification of the Employee in accordance with the Certification Regulations in order to identify the real level of professional competence of the Employee;

— conduct an assessment of the Employee’s performance in accordance with the Regulations on Labor Performance Assessment;

— with the consent of the Employee, involve him in the performance of certain tasks that are not part of the Employee’s job responsibilities;

— with the consent of the Employee, involve him in performing additional work in a different or the same profession (position) for an additional fee;

— exercise other rights granted by the Labor Code of the Russian Federation.

4. CONDITIONS OF PAYMENT FOR THE EMPLOYEE

4.1. For the performance of labor duties, the Employee is set a salary according to the staffing table in the amount of _____ (__________) rubles per month.

Option for part-time work. 4.1. The Employee's remuneration is made _____________________________ (in proportion to the time worked/depending on output/on other conditions). When setting standard assignments for persons working part-time with time-based wages, wages are paid based on the final results for the amount of work actually completed.

4.2. The employer establishes incentives and compensation payments (additional payments, allowances, bonuses, etc.). The amounts and conditions of such payments are determined in the Regulations on bonus payments to employees “_____________”, which the Employee was familiarized with when signing this agreement.

4.3. If the Employee, along with his main job, performs additional work in another position or performs the duties of a temporarily absent employee without being released from his main job, the Employee is paid an additional payment in the amount established by agreement of the parties.

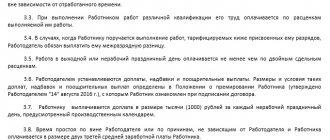

4.4. Overtime work is paid for the first two hours of work at time and a half, for subsequent hours - at double rate. At the Employee's request, overtime work, instead of increased pay, may be compensated by providing additional rest time, but not less than the time worked overtime.

4.5. Work on a day off or a non-working holiday is paid in the amount of a single part of the official salary per day or hour of work in excess of the official salary, if work on a day off or a non-working holiday was carried out within the monthly standard working time, and in the amount of a double part of the official salary per day or hour work in excess of the official salary, if the work was performed in excess of the monthly working hours. At the request of an Employee who worked on a day off or a non-working holiday, he may be given another day of rest. In this case, work on a weekend or a non-working holiday is paid in a single amount, and a day of rest is not subject to payment.

4.6. The Employee's wages are paid by issuing cash at the Employer's cash desk (by transferring to the Employee's bank account) every six months on the day established by the Internal Labor Regulations.

4.7. Deductions may be made from the Employee's salary in cases provided for by the legislation of the Russian Federation.

5. VACATION. WORKING AND REST TIME MODE <6>

5.1. The employee has a five-day work week with two days off - _____________________.

5.2. Start time: _________________.

Finish time: _________________.

5.3. During the working day, the Employee is given a break for rest and food from ____ hour to ____ hour, which is not included in working hours.

5.4. The employee is granted annual paid leave of ____ (at least 28) calendar days.

The right to use vacation for the first year of work arises for the Employee after six months of his continuous work with the Employer. By agreement of the parties, paid leave may be provided to the Employee before the expiration of six months. Vacation for the second and subsequent years of work can be granted at any time of the working year in accordance with the vacation schedule.

5.5. For family reasons and other valid reasons, the Employee, on the basis of his written application, may be granted leave without pay for the duration established by the labor legislation of the Russian Federation and the Internal Labor Regulations of the Employer.

6. EMPLOYEE SOCIAL INSURANCE

6.1. The employee is subject to compulsory social insurance against industrial accidents and occupational diseases in the manner and under the conditions established by the current legislation of the Russian Federation.

7. WARRANTY AND COMPENSATION

7.1. During the period of validity of this agreement, the Employee is subject to all guarantees and compensations provided for by the labor legislation of the Russian Federation, local acts of the Employer and this agreement.

8. RESPONSIBILITY OF THE PARTIES

8.1. A party to a contract guilty of violating labor legislation and other regulatory legal acts containing labor law norms is liable in cases and in the manner established by the Labor Code of the Russian Federation and other federal laws.

8.2. The financial liability of a party to a contract arises for damage caused by it to the other party to the contract as a result of its culpable unlawful behavior.

8.3. In cases provided for by law, the Employer is obliged to compensate the Employee for moral damage caused by unlawful actions and/or inaction of the Employer.

8.4. Each party is required to prove the amount of damage caused.

9. TERMINATION OF THE AGREEMENT

9.1. The grounds for termination of this employment contract are:

9.1.1. Agreement of the parties.

9.1.2. Termination of an employment contract at the initiative of the Employee. In this case, the Employee is obliged to notify the Employer no later than two weeks before the expected date of termination of this agreement. The specified period begins the next day after the Employer receives the Employee’s resignation letter.

9.1.3. Termination of an employment contract at the initiative of the Employer.

9.1.4. Expiration of the contract period specified in clause 2.3 of this contract. The Employee must be notified in writing of the termination of the employment contract due to its expiration at least three calendar days before dismissal.

9.1.5. Other grounds provided for by the labor legislation of the Russian Federation.

9.2. The day of termination of the employment contract in all cases is the Employee’s last day of work, with the exception of cases where the Employee did not actually work, but retained his place of work (position).

9.3. The Employer has the right to decide to make a compensation payment to the Employee in the amount of _________ in the case of _____________________.

10. FINAL PROVISIONS

10.1. The terms of this employment contract are confidential and are not subject to disclosure.

10.2. The terms of this employment contract are legally binding on the parties from the moment it is signed by the parties. All changes and additions to this employment contract are formalized by a bilateral written agreement.

10.3. Disputes between the parties arising during the execution of an employment contract are considered in the manner established by the current legislation of the Russian Federation.

10.4. In all other respects that are not provided for in this employment contract, the parties are guided by the legislation of the Russian Federation governing labor relations.

10.5. Before signing the employment contract, the Employee is familiar with the following documents:

_________________________

_________________________

_________________________

10.6. The agreement is drawn up in two copies having equal legal force, one of which is kept by the Employer and the other by the Employee.

11. ADDRESSES AND DETAILS OF THE PARTIES

Employer: ________________________________________________________,

address: ___________________________________________________________________,

TIN ___________________________________, checkpoint ___________________________________,

r/s _____________________________________ in ________________________________,

BIC ___________________________________.

Worker: ____________________________________________________________,

passport: series _________ N __________, issued ______________________________

____________________ “___”________ ___ city, department code _____________,

registered at the address: _____________________________________________________.

SIGNATURES OF THE PARTIES

Employer: Employee:

______________/_____________/ ______________/_____________/

(signature) (full name) (signature) (full name)

(M.P.)

A copy was received and signed by Employee “___”________ ___.

Employee's signature: ____________________

———————————

Information for your information:

<1> Requirements for qualifications, practical experience, education and training in this specialty, see: Qualification reference book for positions of managers, specialists and other employees, section. I “Industry-wide qualification characteristics of positions of workers employed in enterprises, institutions and organizations”, subsection 2 “Positions of specialists”, “Accountant” (approved by Resolution of the Ministry of Labor of Russia dated August 21, 1998 N 37).

<2> According to paragraph. 2 hours 2 tbsp. 57 of the Labor Code of the Russian Federation, in the case where an employee is hired to work in a branch, representative office or other separate structural unit of an organization located in another area, the separate structural unit and its location are indicated.

<3> In accordance with paragraph. 9 hours 2 tbsp. 57 of the Labor Code of the Russian Federation, information about working conditions in the workplace is mandatory for inclusion in the employment contract.

According to Part 2 of Art. 3 of the Federal Law of December 28, 2013 N 426-FZ “On a special assessment of working conditions”, based on the results of a special assessment of working conditions, classes (subclasses) of working conditions in the workplace are established.

In accordance with Part 1 of Art. 14 of the Federal Law of December 28, 2013 N 426-FZ “On special assessment of working conditions”, working conditions according to the degree of harmfulness and (or) danger are divided into four classes - optimal, acceptable, harmful and dangerous working conditions.

<4> A fixed-term employment contract is concluded in the cases provided for in Art. 59 of the Labor Code of the Russian Federation.

In accordance with paragraph. 8 hours 2 tbsp. 59 of the Labor Code of the Russian Federation, by agreement of the parties, a fixed-term employment contract can be concluded with managers, deputy managers and chief accountants of organizations, regardless of their organizational, legal forms and forms of ownership.

<5> A probationary period is not assigned if a fixed-term employment contract is concluded for a period of up to two months (paragraph 8, part 4, article 70 of the Labor Code of the Russian Federation) and cannot exceed three months (part 5, article 70 of the Labor Code of the Russian Federation) , and in the case of concluding an employment contract for a period of two to six months, the trial cannot exceed two weeks (Part 6 of Article 70 of the Labor Code of the Russian Federation).

<6> According to paragraph. 6 hours 2 tbsp. 57 of the Labor Code of the Russian Federation, provisions on working time and rest time are included if for a given employee the working and rest time regime differs from the general rules in force for a given employer.

<7> From 04/07/2015, business companies are not required to have a seal (Federal Law dated 04/06/2015 N 82-FZ “On amendments to certain legislative acts of the Russian Federation regarding the abolition of the mandatory seal of business companies”).

What conditions must be included in the chief accountant’s employment contract?

When hiring a chief accountant, the employer should especially carefully consider the following points:

- Full financial responsibility (Article 243 of the Labor Code of the Russian Federation) - the decision to assign it to the chief accountant is made by the employer himself. In most cases, the position includes such responsibility.

If the employment contract or the agreement to it does not contain a clause on financial responsibility, then a separate agreement on full financial responsibility has no legal force. Read more in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

- Probationary period (Article 70 of the Labor Code of the Russian Federation) - for the chief accountant it can be extended up to 6 months. Here again, the employer has the right to set any period at his discretion.

- Urgency of an employment contract (Article 59 of the Labor Code of the Russian Federation) - a fixed-term employment contract with the chief accountant is concluded at the discretion of the employer, i.e. the latter draws up the contract on these terms, and the applicant for the position has the right to express his consent by signing the contract or disagreement by refusing to sign .

IMPORTANT! Any additional terms of the contract should not contradict current legislation in the field of labor and employment and worsen the situation of the employee.

See also “How to register a chief accountant without the right to sign?”

Design nuances

The document does not have a unified form (form) - this is not provided for by labor legislation.

Therefore, in each individual case, contracts are drawn up taking into account the specifics of the employee’s work functions, that is, in free form. However, there are still certain requirements for the information entered into the document form . The agreement must include certain clauses (sections). But it may also include additional conditions regarding the employee’s responsibility for material assets.

According to the Resolution of the Ministry of Labor No. 85, accountants may be held fully responsible - the employee is obliged to compensate for damage in full, regardless of the size of his own salary.

This clause can either be included in the contract or placed in a separate agreement - both options are absolutely legal according to current labor legislation.

When a civil law contract is concluded with the chief accountant

If a company or individual entrepreneur has a small number of transactions per year, then the constant presence of a chief accountant (or simply an accountant) in the workplace is not necessary. In such cases, you can settle on concluding a civil law agreement. It must indicate the amount of work that the contractor must complete in a certain period of time. This could be, for example, submitting reports (quarterly, annual) by a certain deadline.

It is very important to draw up a GPC agreement in such a way that, during an inspection, the regulatory authorities do not reclassify it as a labor contract. This often happens with regular payments to the contractor - here the option of dividing the contract period into intermediate stages, for example quarterly, is suitable. With this division, regular payment for services can be justified as an advance payment for individual stages - submission of quarterly reports, and not wages.

The standard conditions discussed in the GPC agreement are usually the following:

- complete information about the parties to the contract - the customer and the contractor;

- the total amount of work that must be completed and the time frame allocated for this;

- payment amount.

The agreement is certified by the signatures of both parties and sealed, if available.

Is it legal to conclude a fixed-term employment contract with a chief accountant? Read the answer to this question in ConsultantPlus. Study the material by getting trial access to the K+ system for free.

Features of accounting in an organization

Both the accounting service and one person can carry out accounting in an organization. There are several options for implementing accounting in an organization:

- The accounting service can be separated into a separate division, headed by the chief accountant;

- Accounting in an organization can be carried out by third parties, for example, a specialized service or an individual specialist working as an individual entrepreneur;

- The manager can carry out accounting independently;

- Add the position of accountant to the staffing table.

If the organization’s staffing table provides for only one accountant position, then he can be either a “chief accountant” or simply an “accountant” (

Results

The execution of an employment contract concluded with an applicant for the position of chief accountant must be approached with full responsibility. This document reflects not only such standard items as the employee’s work responsibilities, wages and working conditions, but also special conditions, for example, full financial responsibility, an extended probationary period or the urgency of the employment contract. All these points were taken into account by our experts when compiling the sample presented in the article.

If a company or individual entrepreneur does not need a permanent accountant, then they have the opportunity to hire an executor to keep records and submit reports under a civil contract.

In this case, it is important that controllers have no reason to reclassify such a contract as an employment contract. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Features of the document

Labor legislation states that chief accountants have a special status.

Only the head of an organization or enterprise can dismiss a person from this position.

Contracts can be either fixed-term (limited in time) or indefinite. And in budgetary organizations that receive funding from the state treasury, personnel department employees must be guided by special Recommendations when drawing up this document.

Such recommendations in most points duplicate the provisions of articles of the Labor Code. But at the same time they have a more clear interpretation of individual conditions. For example, it is the Recommendations that indicate that the second copy of the signed agreement is stored in the archives of the personnel department. There is no explanation for this in the Labor Code (a general recommendation is given for storage with the employer).

It should be remembered that without a document drawn up correctly and in the proper manner, the start of an employment relationship is considered illegal (no contract has been concluded).

It is the responsibility of employers to complete the document within three days from the moment the employee begins to perform his official duties.

The main functions of the document, as mentioned above, are to legitimize the relationship between the employee and the employer. The employee receives social guarantees (insurance, timely payment, vacation days, sick leave), and the employer has the right to demand from the employee conscientious and proper performance of work, compliance with internal regulations and discipline.

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Employment contract with the chief accountant”, as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |