Contributing authorized capital (AC) when creating an LLC is not a very difficult task. Of course, this is possible if the founders have investment resources (or the founder, when he is alone). But without this it is impossible to carry out real business activity. Therefore, we take it for granted that the founders have the opportunity to contribute authorized capital.

But it needs to be done correctly. Our article will tell you about the procedure, rules and terms for paying the authorized capital. Additional questions can be asked to a personal consultant.

How much money should be contributed to the authorized capital of the LLC?

There is often no connection between the actual volume of required investments and the size of the company's authorized capital. You can still find large construction projects that are being built by companies with minimal authorized capital. In this case, the amount needed for the business is raised from third-party investors or through a bank loan. Sometimes an organization receives an interest-free loan from its founder, i.e. He just uses the owner’s money for a period of time. Such raised funds do not constitute authorized capital.

However, the law determines that each founder must contribute his share in the authorized capital. What this amount will be depends on the scope of the company's activities. In general, the authorized capital of an LLC for all founders must be at least 10,000 rubles.

But for insurers, alcohol producers, banks, gambling organizers, employment agencies providing personnel, and some other areas, the minimum Criminal Code is much higher. For example, to create a private security organization you need to contribute at least 250,000 rubles. And to produce ethyl alcohol it will take 10 million rubles.

As for the upper limit, i.e. the maximum size of the authorized capital, it is not established by law. But the founders need to know that when receiving dividends from their share in the management company, they will have to pay a tax at a rate of 13% (depending on the status of a tax resident of the Russian Federation).

Free tax consultation

Tax consequences of depositing money to form a management company

Receiving contributions to the management company does not form a tax base for profits on the basis of subclause. 3 p. 1 art. 251 Tax Code of the Russian Federation. This article states that the contribution of any property (which, in accordance with paragraph 2 of Article 130 of the Civil Code of the Russian Federation, includes funds) as contributions to the Criminal Code does not increase the taxable base.

Contributions to the management company are not subject to VAT, since in accordance with subparagraph. 4 p. 3 art. 39 of the Tax Code of the Russian Federation they are not implementation.

Exchange differences in this case also do not affect the profit tax (clause 1 of Article 277 of the Tax Code of the Russian Federation). This article states that receiving payment for placed shares or shares does not lead to the issuer's profit (loss).

Consequently, making money as a contribution to the management company does not have any impact on the taxation of a legal entity.

Failure to fulfill a participant’s obligation to pay for a share in the authorized capital often brings the founders to court. ConsultantPlus experts have collected the latest judicial practice on this issue into a single review. Explore the analytical selection for free by getting trial access to K+.

Is it possible to limit ourselves to only the minimum size of the charter capital?

If the authorized capital of an LLC is contributed in the minimum possible amount, then the founders comply with the requirements of the law. However, in practice such organizations are at risk to a certain extent.

- Banks may refuse to open a current account. Credit institutions are not required to explain their refusal to provide cash settlement services, but for them, companies with such modest assets are not the most desirable clients. But without a current account, an organization cannot transfer payments to the budget, and working with counterparties becomes much more complicated.

- For the Federal Tax Service, the minimum capital is one of the signs of a fly-by-night company. Of course, this criterion alone is not enough to recognize an organization as an unscrupulous counterparty, but if other signs are present, the minimum wage can play a negative role.

- Lenders and investors evaluate the attractiveness and economic stability of an organization, including by the size of its authorized capital. This means that the LLC may lose profitable investments, because the interests of creditors are almost not protected in any way. The minimum size of the charter capital can also become an unspoken obstacle to participation in tenders and trades or prevent you from winning a competition.

Thus, the size of the authorized capital of an LLC when created must correspond to the scale of the business and type of activity, and not just formally fit into the requirements of the law.

Results

The authorized capital is one of the most important funds of an enterprise formed during its creation. It performs 3 main functions - distribution, logistics and guarantee. The management company, in terms of its minimum size, must necessarily be formed by depositing money. To account for the replenishment of the capital account, accounts 75, 80, as well as accounts for accounting for cash flows (50, 51, 52) are used. Replenishing capital assets with cash does not have any impact on the tax base.

Sources: Law “On Currency Regulation” dated December 10, 2003 No. 173-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What property can be contributed to the authorized capital of an LLC?

The most liquid asset is money, so payment of the authorized capital of an LLC most often occurs in cash. Moreover, the minimum amount of the authorized capital cannot be contributed by anything other than money. Although not so long ago, until 2014, the first asset of an LLC could be contributed by inexpensive office property (usually a table, chairs, office equipment).

But now the method of contributing the minimum amount of authorized capital is fixed in Article 66.2 of the Civil Code of the Russian Federation: “When paying for the authorized capital of a business company, funds must be contributed in an amount not lower than the minimum amount of authorized capital.”

In addition to the minimum amount, payment of the authorized capital of an LLC can be made with any amount of money or property. This could be real estate, equipment, transport, intangible assets, shares and shares in other companies, government and municipal bonds.

The founders may establish a ban on the contribution of certain property, for example, non-core equipment, as payment for shares of the management company. The general meeting of participants must approve the amount of the property contribution. And if the value of the property exceeds 20,000 rubles, then an independent expert must be hired to evaluate it.

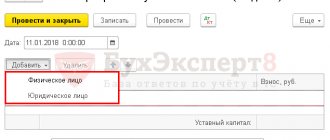

Accounting entries when depositing money to form a management company

Accounting for settlements for the formation of the Criminal Code is kept on the account. 80 “Authorized capital”. In this case, he corresponds with the account. 75 “Settlements with founders” and (depending on the chosen option) with cash accounts (50, 51, 52).

Posting Dt 75.1 - Kt 80 forms the debt of the founders for contributions to the management company.

Further, various methods of paying for the management company in cash are possible.

The founder can first deposit money into the cash register: Dt 50 - Kt 75.1.

Then they are deposited into the bank account: Dt 51 - Kt 50.

Also, the founder can immediately transfer money to the current account: Dt 51 - Kt 75.1.

For a practical example of postings for contributing authorized capital with money and property, see here.

If the founder is a non-resident, then he has the right to make a contribution in foreign currency. This follows from the legislation on currency control (Article 6 of the Law “On Currency Regulation” dated December 10, 2003 No. 173-FZ): Dt 52 - Kt 75.1.

In this case, exchange rate differences appear. In accordance with clause 14 of PBU 3/2006, these differences should be attributed to additional capital (account 83):

- Dt 75.1 - Kt 83 - if the exchange rate has increased and the resulting differences are positive;

- Dt 83 - Kt 75.1 - in the event of a fall in the exchange rate and the occurrence of negative differences.

This shows that exchange rate differences that arose when the exchange rate fell in this case must be compensated for by additional capital. But a newly created organization, as a rule, has not yet formed additional capital. Therefore, before replenishing additional capital, the enterprise may develop a negative account balance. 83.

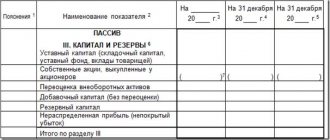

Read about where to find the authorized capital on the balance sheet here.

Procedure for contribution of authorized capital

The deadlines for contributing the authorized capital are established by Article 16 of the Law “On LLC” - no more than four months from the date of registration of the company. However, an earlier date may be specified in the agreement on establishment or in the decision of the sole founder.

There is no special administrative sanction for violating the deadline for contributing the authorized capital of an LLC upon creation. But when this period exceeds a year, the organization may be forcibly liquidated at the initiative of the Federal Tax Service.

If only some of the founders have not contributed their share to the authorized capital, then their unpaid shares pass to the company. It is also possible to provide in the establishment agreement for the collection of penalties in the form of a fine or penalty in relation to such debtors.

Participants can deposit funds to pay their share in cash or transfer them by bank transfer. If money is deposited into the cash register, then confirmation of payment will be a cash receipt order. But the organization does not always have a cash register, then you need to make a non-cash payment.

How to deposit the authorized capital into the LLC current account? There is nothing complicated about this procedure. A transfer to an organization's account can be made from your individual account or deposited in cash through a bank. The main thing is that any document confirming the contribution of a share to the capital company should indicate its purpose. For example, “Payment by the founder of a share in the authorized capital” or “Contribution of a participant to the authorized capital.” The payment order, PKO or payment receipt must be kept by the participant.

If the share in the company is contributed by property, then the registration procedure will be different. After receiving an independent assessment and approving it at the general meeting, an act of acceptance and transfer of property is drawn up.

The act must indicate:

- data of the parties (the company itself and the participant);

- information about the size and nominal value of the paid share;

- description of the property and its estimated value.

- confirmation that the property belongs to the participant by right of ownership and is transferred to pay for his share in the authorized capital.

In addition, if property is transferred, the ownership of which requires state registration (real estate, transport, shares, etc.), then additional documents must be drawn up. We recommend that you obtain a free consultation on this issue.

Free registration consultation

Decrease in capital

A change in the size of the capital company downward is made either by decision of the owners or as required by law. In both cases, this operation is formalized by a decision of the general meeting of founders with the subsequent submission of documents to the registration authority.

The law requires a reduction in the size of the capital in the event of:

- late payment by the founders;

- if the value of net assets is lower than the authorized capital, that is, in case of unprofitable activities.

If part of the capital is not paid on time, accounting entry Dt 80 Kt 81 “Own shares (shares)” arises for part of the unpaid contribution of the founders. The posting date is the next day after the expiration of the 4-month period from the date of registration of the LLC.

In case of unprofitable activities, part of the capital is directed to repay the loss: Dt 80 Kt 84 “Retained earnings”. The posting date corresponds to the date of the decision to reduce capital to the amount of net assets.

The owners decide to reduce the size of the management company:

- upon withdrawal of a participant from the LLC and payment of his share of participation - Dt 80 Kt 75 “Calculations for contributions to the authorized capital”;

- when the Company redeems part of the capital shares into ownership - Dt 81 “Own shares (shares)” Kt 75.01 “Settlements on contributions to the authorized capital” - with subsequent cancellation of the purchased shares - Dt 80 Kt 81 “Own shares (shares)”;

- with a proportional decrease in the share of participants or the par value of shares. The resulting difference may become the Company’s income - Dt 80 Kt 91.01 “Other income” or paid to participants - Dt 80 Kt 75.01 “Settlements on contributions to the authorized capital”.

The posting dates for capital reductions correspond to the date the registration changes are recorded.

conclusions

Let us repeat once again the most important points regarding the contribution of the authorized capital of an LLC:

- The minimum size of the capital of a limited liability company is 10,000 rubles. The exception is some types of activities for which much larger amounts must be deposited.

- Each LLC participant must contribute their share of the authorized capital. The contribution can be in monetary or property form, but the minimum amount of the management company is made only in money. If the value of the property contribution exceeds 20,000 rubles, it must be assessed by an independent expert.

- The deadline for entering the capital is four months after the registration of the company, unless the founders themselves set an earlier deadline. The share of a participant who does not pay his share on time passes to the company.

- Payment for a share of the authorized capital can be made in cash or by transfer to the company's current account. The property contribution is transferred under an acceptance certificate and, if necessary, accompanied by documents on state registration of the transfer of ownership to the LLC.

Increase in capital

An increase in the amount of share capital can be made both by the decision of the founders and by legal requirements.

The company considers the issue and makes a decision to increase capital in the following cases:

- lack of working capital;

- accepting new participants;

- additional issue of shares (for joint-stock companies, joint-stock companies);

- acquisition of licenses for activities that require a larger capital amount.

The source of increase in share capital will be either the LLC’s own property, or contributions from new founders, or additional contributions from existing members of the company.

Increase in authorized capital, posting:

| Due to net profit | Dt 84 Kt 80 |

| Due to the contributions of new LLC participants | Dt 75.01 Kt 80 |

| By increasing the contributions of existing participants of the Company | Dt 75.01 Kt 80 |

Provide free financial assistance

The owner can donate money to his company without registering a contribution to the property. To do this, he enters into an agreement with the organization on the provision of free financial assistance, also known as a gift agreement (Article 572 of the Civil Code of the Russian Federation).

A gift is reflected in the same way as a contribution to property:

| Dt 51 (50) | Kt 83 |

| Current accounts (cash) | Extra capital |

If the owner provides gratuitous financial assistance to the company, the company does not generate tax income. Another plus is that you don’t have to involve a notary. The downside is that the owner will not be able to demand the company return the transferred money.

Get demo access to the Standard and resolve controversial issues together with experts

Issue a loan

The owner can invest money in the company for a while if he issues a loan without interest or at an interest rate lower than bank interest. To do this, the owner and the LLC enter into a loan agreement and specify in it the size of the loan, the repayment period, the interest rate or its absence (Article 809 of the Civil Code of the Russian Federation).

The receipt of a loan is reflected by the following entry:

| Dt 51 (50) | Kt 66 (67) |

| Current accounts (cash) | Calculations for short-term loans and borrowings (Settlements for long-term loans and borrowings) |

Account 66 is suitable for loans for a period of less than a year. For the rest, use count 67.

Loan without interest

When applying for an interest-free loan, the organization does not receive material benefits and taxable income, so the company does not pay additional taxes (letter of the Ministry of Finance of Russia dated March 23, 2017 No. 03-03-RZ/16846).