Home / Labor Law / Employment / Employment contract

Back

Published: 07/18/2016

Reading time: 7 min

0

1299

When hiring, one of the most important documents is the employment contract drawn up between the employer and employee.

This type of document can be indefinite in duration, i.e. without a specific end date or urgent, indicating the end date of cooperation between the parties.

- Legislation

- What is a fixed-term employment contract and when is it concluded?

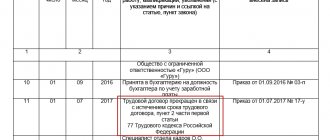

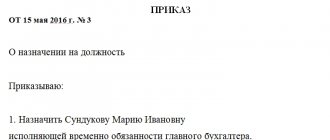

- Features of concluding an employment contract with the chief accountant

Employment contract with the chief accountant

An employment contract is concluded with the applicant at the very beginning of the employment relationship; cooperation begins with its signing, and before the document is drawn up, it is impossible to begin duties and talk about material or other responsibility. It is the employment contract that contains information about the rights, obligations, level of responsibility of the parties to the contract and confirmation in the form of signatures that the employer and employee agree with everything stated.

The same requirements apply to drawing up an employment agreement with the chief accountant as with other subordinates. Mandatory sections and paragraphs of the document are discussed in Art. 57 Labor Code.

Since the chief accountant is one of the key figures of the enterprise, the employment contract with him usually includes a clause on full financial responsibility. This point protects the employer from possible negligence, theft and any manipulation on the part of the new employee.

Working as an accountant in an organization can be the main job for an employee, or the chief accountant can work part-time if he successfully copes with all the responsibilities assigned to him. In this case, a note is made in the contract that the accountant has been hired for the position on a part-time basis.

conclusions

An employment contract is concluded with the chief accountant, as with all other specialists, when formalizing their professional activities. It indicates standard data, and also reflects the topic of financial liability, the duration of the probationary period, and the type of contract to be concluded.

When preparing the relevant document, the chief accountant can act as a part-time employee and a remote employee. The Labor Legislation of the Russian Federation allows both options for conducting labor activities.

What is a fixed-term employment contract, and is it possible to conclude such an agreement with the chief accountant?

If the validity period of an employment contract is not specified in its text, it is automatically recognized as unlimited.

If the employer and the hired employee agree that their employment relationship will only last for a certain time, a fixed-term employment contract can be concluded between them. Its validity period is limited by the expiration date of the document specified in the document.

If the period of validity of a fixed-term contract has expired, but the employer does not dismiss the employee, the employment agreement becomes open-ended, and it is not possible to dismiss the employee on the basis of termination of its validity period.

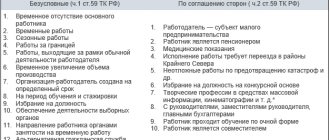

Article 59 of the Labor Code allows the chief accountant to sign a fixed-term employment agreement. Its maximum validity period is 5 years. The law does not define any minimum terms of employment relations, which means that, if necessary, you can hire a chief accountant for 1-2 weeks in order to entrust him with any short-term work.

Rules for calculating vacation pay

Annual leave paid by management is a standard right for such employees. Maintaining a job and salary is typical. Such rest in general cannot be less than 28 days.

When drawing up fixed-term employment contracts, it is assumed that calculations are carried out using other formulas and indicators. With fixed-term agreements, the general terms are determined by how many days are actually worked.

Two working days for each month of work are the rest periods for those whose agreements are for 2 months or less. The same rule applies to those performing seasonal work.

But to use vacation is a right that appears after at least six months have passed with the same employer.

The specific figure for compensation in a given case depends on the average salary. Article 139 of the Labor Code of the Russian Federation specifies in detail the rules for carrying out calculations in such situations. It is also necessary to rely on the Regulations on the specifics of the procedure for calculating wages.

The standard procedure assumes that the actual amount of remuneration for work that was transferred over the previous 12 months is always taken as a basis. Calendar month is the period from the 1st to the 30th.

To calculate the average earnings, the remuneration per day is multiplied by the number of days for which the payment is applied. They rely on general principles to apply for leave at their own expense, after drawing up the appropriate application.

Fixed-term employment contract with the chief accountant: period of labor relations

It is permissible to conclude an employment contract with the chief accountant exclusively for those periods of time established by the Labor Code, namely:

- For a period of indefinite duration (indefinite employment contract).

- For a certain period of time - the period cannot exceed 5 years (unless the case is considered exceptional according to the Labor Code).

- For a limited period of time (fixed-term employment contract). The conclusion of such an agreement is allowed only in certain cases, subject to certain conditions.

Legislation

In the Labor Code of the Russian Federation, the third section is devoted to the employment contract; the terms of such documents can be read in the fifty-eighth and fifty-ninth articles of the Labor Code of the Russian Federation.

It is also worth considering that, taking into account legislative practice, a fixed-term employment contract signed for more than five years of cooperation is de facto considered indefinite. By a court decision, any fixed-term employment contract may be recognized as having no expiration date if the cooperation is ongoing.

Common mistakes

Error: The employer forgot about the dismissal of the chief accountant after the expiration of the fixed-term contract, and then fired him on this basis 6 months later.

Comment: If the employer does not promptly initiate the dismissal of an employee hired under a fixed-term employment contract, the agreement becomes indefinite, and therefore in the future it is possible to dismiss the employee only on a general basis.

Error: The chief accountant, who wanted to get a part-time job, was denied a fixed-term employment contract, based on the belief that the law prohibits such an approach.

Comment: Part-time work is a sufficient basis for employment of a chief accountant under the terms of a fixed-term employment contract.

Terms of payment

When applying for a chief accountant to work in a state or municipal institution, a state extra-budgetary fund, a state or municipal unitary enterprise or a legal entity, more than 50% of the shares (shares) in the authorized capital of which are in state or municipal ownership, then the conditions for remuneration of the chief accountant are determined by special regulations (for example, the Regulations on the conditions of remuneration for heads of federal state unitary enterprises, approved by Decree of the Government of the Russian Federation of January 2, 2015 No. 2).

The remuneration of chief accountants and accountants of other organizations is not regulated by law (but in any case cannot be lower than the minimum wage, subject to the period of time worked and when established labor standards are met).

Answers to common questions about a fixed-term employment contract with a chief accountant

Question No. 1: The chief accountant, employed under a fixed-term employment contract, wrote a letter of resignation of his own free will, without having worked the entire term. Is it possible to force an employee to work for some time?

Answer: The law allows the chief accountant to be detained after writing a letter of resignation on his own initiative for up to 30 days, unlike other subordinates who are required to work for 14 days.

Question No. 2: Is it possible to conclude a fixed-term employment contract with the chief accountant in case he does not meet all the employer’s requirements?

Answer: To check whether the hired employee suits you, you are allowed to hire a chief accountant on a probationary period.

But it is also permitted to conclude a fixed-term contract if there are legal grounds for doing so. Rate the quality of the article. Your opinion is important to us:

Severance pay and compensation

This section will also apply to chief accountants, who, by virtue of the norms of the Labor Code of the Russian Federation, have the right to receive compensation upon termination of an employment contract. Severance pay, compensation and other payments in connection with the termination of an employment contract are limited for chief accountants of certain legal entities, which are expressly specified in Art. 349.3 Labor Code of the Russian Federation.

When establishing the amount of compensation for chief accountants of other companies, it should be taken into account that if the amount of payments is set at 25 percent or more of the book value of the company’s assets, then there is a risk that this clause of the employment contract will be declared invalid if this payment is not agreed upon according to the established procedure for approving large transactions . Approval must take place in accordance with the terms of Art. 79 of the Federal Law of December 26, 1995 No. 208-FZ or Art. 46 of the Federal Law of 02/08/1998 No. 14-FZ.

Home > CATEGORIES OF DISPUTES > SAMPLES OF AGREEMENTS > EMPLOYMENT AGREEMENT with an accountant (fixed-term; subject to a probationary period)

EMPLOYMENT CONTRACT

with an accountant

(urgent; subject to a probationary period)

___________________ "__"__________ _____

_______________________________________________, hereinafter referred to as__

(name of company)

“Employer”, represented by ___________________________________________________,

(position, full name)

acting ___ on the basis of ____________________________, on the one hand, and

______________________________________, hereinafter referred to as___ “Employee”,

(FULL NAME.)

on the other hand, have entered into this agreement as follows:

1. THE SUBJECT OF THE AGREEMENT

1.1. The Employer instructs, and the Employee accepts, the performance of labor duties as an accountant in ____________ (name of the structural unit of the organization).

1.2. The work under this agreement is the main one for the Employee.

1.3. The Employee’s place of work is ________________________________ at the address: ________________________________.

1.4. In order to verify the compliance of the Employee’s qualifications with the position held and his attitude to the work entrusted to the Employee, a probationary period of ______ (______________) months is established from the date of commencement of work specified in clause 2.1 of this agreement.

1.5. The employee reports directly to ____________________________.

1.6. The Employee’s work under this agreement is carried out under normal conditions. The Employee’s labor duties are not related to performing heavy work, work in areas with special climatic conditions, work with harmful, dangerous and other special working conditions.

2. DURATION OF THE AGREEMENT

2.1. The employee must begin performing his job duties from “___”____________ ____.

2.2. This agreement is a fixed-term agreement and is valid until “___”_____ ____.

2.3. The basis for concluding a fixed-term employment contract is ____________________.

3. CONDITIONS OF PAYMENT FOR THE EMPLOYEE

3.1. For the performance of labor duties, the Employee is paid a salary in the amount of ___ (_______________) rubles per month.

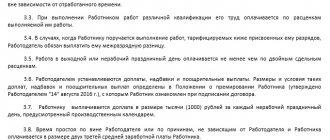

3.2. The employer establishes incentives and compensation payments (additional payments, allowances, bonuses, etc.). The amounts and conditions of such payments are determined in the Regulations on bonus payments to employees “______________”, which the Employee was familiarized with when signing this agreement.

3.3. If the Employee, along with his main job, performs additional work in another position or performs the duties of a temporarily absent employee without being released from his main job, the Employee is paid an additional payment in the amount of __% of the salary for the combined position.

3.4. Overtime work is paid for the first two hours of work at time and a half, for subsequent hours - at double rate. At the Employee's request, overtime work, instead of increased pay, may be compensated by providing additional rest time, but not less than the time worked overtime.

3.5. Work on a day off or a non-working holiday is paid in the amount of a single part of the official salary per day or hour of work in excess of the official salary, if work on a day off or a non-working holiday was carried out within the monthly standard working time, and in the amount of a double part of the official salary per day or hour work in excess of the official salary, if the work was performed in excess of the monthly working hours. At the request of an Employee who worked on a day off or a non-working holiday, he may be given another day of rest. In this case, work on a weekend or a non-working holiday is paid in a single amount, and a day of rest is not subject to payment.

3.6. The Employee's wages are paid by issuing cash at the Employer's cash desk (by transferring to the Employee's bank account) every six months on the day established by the Internal Labor Regulations.

3.7. Deductions may be made from the Employee's salary in cases provided for by the legislation of the Russian Federation.

4. WORKING AND REST TIME REGIME

4.1. The employee has a five-day work week with two days off - ________________.

4.2. Start time: _________________________________

Closing time: _____________________

4.3. During the working day, the Employee is given a break for rest and food from ___ to ____ hour, which is not included in working hours.

4.4. The employee is granted annual paid leave of ___ (at least 28) calendar days.

The right to use vacation for the first year of work arises for the Employee after six months of his continuous work with this Employer. By agreement of the parties, paid leave may be provided to the Employee before the expiration of six months. Vacation for the second and subsequent years of work can be granted at any time of the working year in accordance with the vacation schedule.

4.5. For family reasons and other valid reasons, the Employee, on the basis of his written application, may be granted leave without pay for the duration established by the labor legislation of the Russian Federation and the Internal Labor Regulations “_____________________”.

5. RIGHTS AND OBLIGATIONS OF AN EMPLOYEE

5.1. The employee is obliged:

5.1.1. Conscientiously perform the following duties:

- carry out work on maintaining accounting records of property, liabilities and business operations (accounting for fixed assets, inventory, production costs, sales of products, results of economic and financial activities, settlements with suppliers and customers, as well as for services provided, etc.) P.);

— participate in the development and implementation of measures aimed at maintaining financial discipline and rational use of resources;

— receive and control primary documentation for the relevant areas of accounting and prepare them for accounting processing;

— reflect on the accounting accounts transactions related to the movement of fixed assets, inventory and cash;

— compile reporting calculations of the cost of products (works, services), identify sources of losses and unproductive costs, prepare proposals for their prevention;

— accrue and transfer taxes and fees to the federal, regional and local budgets, insurance contributions to state extra-budgetary social funds, payments to banking institutions, funds to finance capital investments, wages of workers and employees, other payments and payments, as well as deductions of funds for material incentives for employees of the organization;

— provide managers, creditors, investors, auditors and other users of financial statements with comparable and reliable accounting information in the relevant areas (areas) of accounting;

— develop a working chart of accounts, forms of primary documents used for registration of business transactions for which standard forms are not provided, as well as forms of documents for internal accounting reporting, participate in determining the content of basic techniques and methods of accounting and technology for processing accounting information;

— participate in the economic analysis of the economic and financial activities of the organization based on accounting and reporting data in order to identify intra-economic reserves, implement savings regimes and measures to improve document flow, in the development and implementation of progressive forms and methods of accounting based on the use of modern computer technology, in conducting inventories of funds and inventory items;

— prepare data on the relevant areas of accounting for reporting, monitor the safety of accounting documents, draw them up in accordance with the established procedure for transfer to the archive;

— perform work on the formation, maintenance and storage of a database of accounting information, make changes to reference and regulatory information used in data processing;

— participate in the formation of the economic formulation of problems or their individual stages, solved with the help of computer technology, determine the possibility of using ready-made projects, algorithms, application software packages that allow the creation of economically sound systems for processing economic information.

5.1.2. Comply with the Internal Labor Regulations “____________” and other local regulations of the Employer.

5.1.3. Maintain labor discipline.

5.1.4. Comply with labor protection and occupational safety requirements.

5.1.5. Treat the property of the Employer and other employees with care.

5.1.6. Immediately inform the Employer or immediate supervisor about the occurrence of a situation that poses a threat to the life and health of people, the safety of the Employer’s property.

5.1.7. Do not give interviews, conduct meetings or negotiations regarding the activities of the Employer without prior permission from management.

5.1.8. Do not disclose information that constitutes a trade secret of the Employer. Information that is a trade secret of the Employer is defined in the Regulations on Trade Secrets “____________________”.

5.1.9. By order of the Employer, go on business trips in Russia and abroad.

5.2. The employee has the right to:

5.2.1. Providing him with the work stipulated by this agreement.

5.2.2. Timely and full payment of wages in accordance with your qualifications, complexity of work, quantity and quality of work performed.

5.2.3. Rest, including paid annual leave, weekly days off, non-working holidays.

5.2.4. Compulsory social insurance in cases provided for by federal laws.

5.2.5. Other rights established by the current legislation of the Russian Federation.

6. RIGHTS AND OBLIGATIONS OF AN EMPLOYER

6.1. The employer is obliged:

6.1.1. Comply with laws and other regulations, local regulations, and the terms of this agreement.

6.1.2. Provide the Employee with work stipulated by this agreement.

6.1.3. Provide the Employee with equipment, documentation and other means necessary to perform his job duties.

6.1.4. Pay the full amount of wages due to the Employee within the time limits established by the Internal Labor Regulations.

6.1.5. Provide for the Employee’s everyday needs related to the performance of his job duties.

6.1.6. Carry out compulsory social insurance for the Employee in the manner established by federal laws.

6.1.7. Perform other duties established by the current legislation of the Russian Federation.

6.2. The employer has the right:

6.2.1. Encourage the Employee for conscientious, effective work.

6.2.2. Require the Employee to fulfill his job duties as defined in this agreement, to take care of the property of the Employer and other employees, and to comply with the internal labor regulations.

6.2.3. Bring the Employee to disciplinary and financial liability in the manner established by the current legislation of the Russian Federation.

6.2.4. Adopt local regulations.

6.2.5. Exercise other rights provided for by the current legislation of the Russian Federation and local regulations.

7. EMPLOYEE SOCIAL INSURANCE

7.1. The employee is subject to social insurance in the manner and under the conditions established by the current legislation of the Russian Federation.

8. WARRANTY AND COMPENSATION

8.1. During the period of validity of this agreement, the Employee is subject to all guarantees and compensations provided for by the labor legislation of the Russian Federation, local acts of the Employer and this agreement.

9. RESPONSIBILITY OF THE PARTIES

9.1. In case of failure or improper performance by the Employee of his duties specified in this agreement, violation of labor legislation, the Employer’s internal labor regulations, other local regulations of the Employer, as well as causing material damage to the Employer, he bears disciplinary, material and other liability in accordance with the labor legislation of the Russian Federation.

9.2. The Employee is obliged to compensate the Employer for direct actual damage caused to him; lost income (lost profits) cannot be recovered from the Employee.

9.3. The Employer bears financial and other liability to the Employee in accordance with the current legislation of the Russian Federation.

9.4. In cases provided for by law, the Employer is obliged to compensate the Employee for moral damage caused by unlawful actions and (or) inaction of the Employer.

10. TERMINATION OF THE AGREEMENT

10.1. This employment contract may be terminated on the grounds provided for by the current legislation of the Russian Federation.

10.2. The day of termination of the employment contract in all cases is the Employee’s last day of work, with the exception of cases where the Employee did not actually work, but retained his place of work (position).

11. FINAL PROVISIONS

11.1. The terms of this employment contract are confidential and are not subject to disclosure.

11.2. The terms of this employment contract are legally binding on the parties from the moment it is signed by the parties. All changes and additions to this employment contract are formalized by a bilateral written agreement.

11.3. Disputes between the parties arising during the execution of an employment contract are considered in the manner established by the current legislation of the Russian Federation.

11.4. In all other respects that are not provided for in this employment contract, the parties are guided by the legislation of the Russian Federation governing labor relations.

11.5. The agreement is drawn up in two copies having equal legal force, one of which is kept by the Employer and the other by the Employee.

12. DETAILS OF THE PARTIES

Employer: ________________________________________________________,

address: ___________________________________________________________________,

Taxpayer Identification Number __________________________, Checkpoint ________________________________________,

settlement account ___________________________ in ________________________________________,

BIC __________________________.

Worker: ____________________________________________________________,

passport: series _______, N _______, issued by __________________________________

_________________________________________________ "___"__________ _____ G.,

department code _____, registered at the address: ____________________

__________________________________________________________________________.

13. SIGNATURES OF THE PARTIES

Employer: Employee:

______________/_______________ _____________/______________

M.P.

For questions regarding the drafting and examination of contracts, additional agreements, statements of claim, and other documents, we recommend that you contact our lawyers by phone. 8 (919) 722-05-32

Legal services for organizations and individuals – www. mashenkof. ru

Share on social networks:

Powers and Responsibilities

As mentioned above, the Federal Law “On Accounting” in force today does not contain the functional responsibilities and powers of the chief accountant. Therefore, it is necessary to establish the terms of reference directly in the employment contract, either in the job description, or in a separate internal regulatory document (the employee must be familiar with them upon signature). This also applies to the powers of an ordinary accountant. When determining the functionality, you can take as a basis the Qualification Directory of Positions of Managers, Specialists and Other Employees, approved by Resolution of the Ministry of Labor of the Russian Federation of August 21, 1998 No. 37.

If an accountant (both chief and ordinary) is given the authority to sign financial and settlement documents, then it is also advisable to indicate this right in the employment contract. When the organization has relations with banks, the latter will require confirmation of the authority of the accountant if his signature is included in the card with sample signatures and seal imprints.

Previously, the form of this card contained two types of signatures - a person vested with the right of the first signature, and a person vested with the right of a second signature - this was always the chief accountant. With changes in legislation, a card can now contain several signatures, but their combination on payment documents is determined by the organization and the bank in a separate document - an agreement. In this case, the bank must confirm that the person whose signature is included on the card has the appropriate authority. They may also be specified in the employment contract.

It should be remembered that there are categories of legal entities where chief accountants are subject to special requirements reflected in the legislation. For example:

- the candidacy of the chief accountant of a state or municipal unitary enterprise is agreed upon with the owner of the enterprise’s property (clause 8, paragraph 1, article 20 of the Federal Law of November 14, 2002 No. 161-FZ “On State and Municipal Unitary Enterprises”);

- The Bank of Russia has special requirements for the business reputation of the chief accountant of a credit organization (Regulation of the Central Bank of the Russian Federation dated October 25, 2013 No. 408-P);

- qualification and other requirements are presented to the chief accountant in an insurance organization (clause 2 of article 32.1 of the Law of the Russian Federation of November 27, 1992 No. 4015-1 “On the organization of insurance business in the Russian Federation”).

Thus, hiring an employee, on whom not only the company’s financial risks, but also its success largely depends, is an important step. Their well-coordinated cooperation for the benefit of the company will depend on how fully and competently the interaction between the employer and the accounting employee is spelled out.

Dear readers, if you see an error or typo, help us fix it! To do this, highlight the error and press the “Ctrl” and “Enter” keys simultaneously. We will learn about the inaccuracy and correct it.